Professional Documents

Culture Documents

The Foreign Exchange Market

Uploaded by

Charles MK ChanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Foreign Exchange Market

Uploaded by

Charles MK ChanCopyright:

Available Formats

Chapter 13

The Foreign

Exchange

Market

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-2

Chapter Preview

We develop a modern view of exchange

rate determination that explains recent

behavior in the foreign exchange market.

Topics include:

Foreign Exchange Market

Exchange Rates in the ong Run

Exchange Rates in the !hort Run

Explaining "hanges in Exchange Rates

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-3

Foreign Exchange Market

Most countries of the world have their own

currencies: the #.!.$ France$ %ra&il$ and

'ndia$ (ust to name a few.

The trading of currencies and banks

deposits is what makes up the foreign

exchange market.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-4

Foreign Exchange Market

The next slide shows exchange rates for

four currencies from )**+,-++..

/ote the difference in rate fluctuations

during the period. Which appears most

volatile0 The least0

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-5

Foreign Exchange Market:

Historical Exchange Rates

"urrent foreign exchange rates

http:11www.federalreserve.gov1releases12)+1hist

Figure 13.1: Exchange Rates$ )**+3-++.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-6

The Foreign Exchange Market

4efinitions

). !pot exchange rate

-. Forward exchange rate

5. 6ppreciation

.. 4epreciation

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-7

Foreign Exchange Market:

h! "re Exchange Rates #$portant%

When the currenc7 of 7our countr7

appreciates relative to another countr7$

7our countr78s goods prices abroad and

foreign goods prices in 7our countr7.

). Makes domestic businesses less competitive

-. %enefits domestic consumers 97ou:

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-

Foreign Exchange Market:

How is Foreign Exchange Tra&e&%

F; traded in over,the,counter market

). Most trades involve bu7ing and selling bank

deposits denominated in different currencies.

-. Trades in the foreign exchange market

involve transactions in excess of <) million.

5. T7pical consumers bu7 foreign currencies

from retail dealers$ such as 6merican

Express.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-!

Exchange Rates in the 'ong Run

Exchange rates are determined in markets

b7 the interaction of suppl7 and demand.

6n important concept that drives the

forces of suppl7 and demand is the aw

of =ne >rice.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-10

Exchange Rates in the 'ong Run:

'aw o( )ne Price

The aw of =ne >rice states that the price

of an identical good will be the same

throughout the world$ regardless of which

countr7 produces it.

Example: 6merican steel <)++ per ton$

?apanese steel )+$+++ 7en per ton

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-11

"# $ % 50 yen&' then pri(e are)

American Steel Japanese Steel

"n *.+. '100 '200

"n ,apan 5000 yen 10-000 yen

Exchange Rates in the 'ong Run:

'aw o( )ne Price

aw of one price E @ )++ 7en1<

"# $ % 100 yen&' then pri(e are)

American Steel Japanese Steel

"n *.+. '100 '100

"n ,apan 10-000 yen 10-000 yen

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-12

Exchange Rates in the 'ong Run: Theor!

o( Purchasing Power Parit! *PPP+

The theor7 of >>> states that exchange

rates between two currencies will ad(ust to

reflect changes in price levels.

>>> 4omestic price level )+A$

domestic currenc7 )+A

6pplication of law of one price to price levels

Works in long run$ not short run

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-13

Exchange Rates in the 'ong Run: Theor!

o( Purchasing Power Parit! *PPP+

>roblems with >>>

). 6ll goods are not identical in both countries

9i.e.$ To7ota versus "hev7:

-. Man7 goods and services are not traded

9e.g.$ haircuts$ land$ etc.:

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-14

Exchange Rates in the 'ong Run:

PPP

Figure 13., >urchasing >ower >arit7$

#nited !tates1#nited Bingdom$ )*C53-++. 9'ndex: March )*C5 @ )++:

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-15

Exchange Rates in the 'ong Run: Factors

"((ecting Exchange Rates in 'ong Run

%asic >rinciple: 'f a factor increases

demand for domestic goods relative to

foreign goods$ the exchange rate

The four ma(or factors are relative price

levels$ tariffs and Duotas$ preferences for

domestic v. foreign goods$ and productivit7.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-16

Exchange Rates in the 'ong Run: Factors

"((ecting Exchange Rates in 'ong Run

Relative price levels: a rise in relative

price levels cause a countr7Es currenc7

to depreciate.

Tariffs and Duotas: increasing trade barriers

causes a countr7Es currenc7 to appreciate.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-17

Exchange Rates in the 'ong Run: Factors

"((ecting Exchange Rates in 'ong Run

>references for domestic v. foreign goods:

increased demand for a countr7Es good

causes its currenc7 to appreciateF

increased demand for imports causes the

domestic currenc7 to depreciate.

>roductivit7: if a countr7 is more productive

relative to another$ its currenc7

appreciates.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-1

Exchange Rates in the 'ong Run: Factors

"((ecting Exchange Rates in 'ong Run

The following table summari&es these

relationships. %7 convention$ we are

Duoting$ for example$ the exchange rate$ E$

as units of foreign currenc7 1 ) #! dollar.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-1!

Exchange Rates in the 'ong Run: Factors

"((ecting Exchange Rates in 'ong Run

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-20

Exchange Rates in the -hort Run

'n the short run$ it is ke7 to recogni&e that

an exchange rate is nothing more than the

price of domestic bank deposits in terms of

foreign bank deposits.

%ecause of this$ we will rel7 on the tools

developed in "hapter . for the

determinants of asset demand.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-21

Exchange Rates in the -hort Run: Expecte&

Returns on .o$estic an& Foreign .eposits

We will illustrate this with a simple example

Francois the Foreigner can deposit excess

euros locall7$ or he can convert them to

#.!. dollars and deposit them in a #.!.

bank. The difference in expected returns

depends on two things: local interest rates

and expected future exchange rates.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-22

Exchange Rates in the -hort Run:

Expecte& Returns an& #nterest Parit!

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-23

i

D

= i

F

E

t +1

e

E

t

E

t

E

t +1

e

E

t

E

t

= 5%i

F

= 15%

Example: if i

D

@ )+A and expected appreciation of <$

Exchange Rates in the -hort Run:

Expecte& Returns an& #nterest Parit!

'nterest >arit7 "ondition

< and F deposits perfect substitutes

9-:

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-24

Exchange Rates in the -hort Run:

Expecte& Returns an& #nterest Parit!

To determine the eDuilibrium condition$ we

must first determine the expected return in

terms of dollars on foreign deposits$ RF.

/ext$ we must determine the expected

return in terms of dollars on dollar

deposits$ R4.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-25

Exchange Rates in the -hort Run:

.eriving R

F

Curve

R

F

curve connects these points and is upward sloping

because when E

t

is higher$ expected appreciation

of F higher$ R

F

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-26

Exchange Rates in the -hort Run:

.eriving R

D

Curve

4eriving R

D

"urve

>oints %$ 4$ E$ R

D

@ )+A$ so curve

is vertical

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-27

Exchange Rates in the -hort Run:

E/uili0riu$

EDuilibrium

R

D

@ R

F

at EG

'f E

t

H EG$ R

F

H R

D

$ sell <$ E

t

'f E

t

I EG$ R

F

I R

D

$ bu7 <$ E

t

The following figure illustrates this.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-2

Figure 13.3 EDuilibrium in the Foreign Exchange Market

Exchange Rates in the -hort Run:

E/uili0riu$

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-2!

Explaining Changes

in Exchange Rates

To understand how exchange rates shift in

time$ we need to understand the factors

that shift expected returns for domestic and

foreign deposits.

We will examine these separatel7$ as well

as changes in the mone7 suppl7 and

exchange rate overshooting.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-30

Figure 13.1 !hifts in the !chedule

for the Expected Return on Foreign 4eposits RF

Explaining Changes in Exchange

Rates: -hi(ts in R

F

1. R

F

curve shifts right

when

i

F

: because R

F

at

each E

t

E

e

t+1

: because

expected appreciation

of F at each E

t

and R

F

-. =ccurs: ). 4omestic P

F -. Restrictions on

trade F 5. 'mports F

.. Exports F

J. >roductivit7

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-31

Figure 13.2 !hifts in the !chedule

for the Expected Return on 4omestic 4eposits R4

Explaining Changes in Exchange

Rates: -hi(ts in R

D

1. R

D

shifts right when

i

D

$ because R

D

at each E

t

6ssumes that

domestic

e

unchanged$ so

domestic real

rate

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-32

Explaining Changes in Exchange

Rates: Factors that -hi(t R

F

an& R

D

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-33

Explaining Changes in Exchange Rates:

Factors that -hi(t R

F

an& R

D

*cont.+

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-34

Figure 13.3 Effect of a Rise in the 4omestic

/ominal 'nterest Rate as a Result of an 'ncrease in Expected 'nflation

Explaining Changes in Exchange

Rates: Response to i 4ecause

e

1.

e

$ E

e

tK)

$ expected

appreciation of F $

R

F

shifts out to right

2. i

D

$ R

D

shifts to right

5. 2owever because

e

H i

D

$ real rate $

E

e

tK)

more than i

D

R

F

shifts out H R

D

shifts out and E

t

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-35

Figure 13.5 Effect of a Rise in the Mone7 !uppl7

Explaining Changes in Exchange

Rates: Changes in the Mone! -uppl!

1. M

s

$ P $ E

e

tK)

$

expected appreciation

of F $ R

F

shifts right

2. M

s

$ i

D

$ R

D

shifts

leftLgo to point -

and E

t

5. 'n long run$ i

D

returns

to old level$ R

D

shifts

back$ go to point 5

and get exchange

rate overshooting

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-36

Case: h! are Exchange Rates

-o 6olatile

Expectations of E

e

tK)

fluctuate

Exchange rate overshooting

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-37

Figure 13.7 Malue of the 4ollar

and 'nterest Rates$ )*C53-++.

4ail7 foreign exchange rate

http:11Duotes.ino.com1exchanges10e@F=RE;

The .ollar an& #nterest Rates

). Malue of < and real

rates rise and fall

together$ as

theor7 predicts

-. /o association

between < and

nominal rates:

< falls in late

)*C+s as nominal

rate rises

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-3

The Practicing Manger:

Pro(iting (ro$ F8 Forecasts

Forecasters look at factors discussed here

F; forecasts affect financial institutions

managers8 decisions

'f forecast 7en appreciate$ 7en depreciate$

!ell 7en assets$ bu7 euro assets

Make more euros loans$ less 7en loans

F; traders sell 7en$ bu7 euros

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-3!

Chapter -u$$ar!

Foreign Exchange Market: the market for

deposits in one currenc7 versus deposits

in another.

Exchange Rates in the ong Run: driven

primaril7 b7 the law of one price as it

affects the four factors discussed.

Copyright 2006 Pearson Addison-Wesley. All

rights reserved.

13-40

Chapter -u$$ar! *cont.+

Exchange Rates in the !hort Run: short,

run rates are determined b7 the demand

for assets denominated in both domestic

and foreign currencies.

Explaining "hanges in Exchange Rates:

factors leading to shifts in the RF and R4

schedules were explored.

You might also like

- If Jeff Medora CHP 07Document25 pagesIf Jeff Medora CHP 07Naoman ChNo ratings yet

- Short-Run Exchange Rate Determination Using CIP ModelDocument12 pagesShort-Run Exchange Rate Determination Using CIP ModeldrooldudeabhiNo ratings yet

- Mishkin PPT Ch17Document22 pagesMishkin PPT Ch17atulkirarNo ratings yet

- Fixed Exchange Rates and Foreign Exchange Intervention: Slides Prepared by Thomas BishopDocument54 pagesFixed Exchange Rates and Foreign Exchange Intervention: Slides Prepared by Thomas BishopShehroze MoeenNo ratings yet

- Suggested End of Chapter 5 SolutionsDocument8 pagesSuggested End of Chapter 5 SolutionsgoodwynjNo ratings yet

- The Foreign Exchange MarketDocument29 pagesThe Foreign Exchange Marketshahidul0No ratings yet

- Chapter 19 Foreign Exchange Risk: 1. ObjectivesDocument32 pagesChapter 19 Foreign Exchange Risk: 1. Objectivessamuel_dwumfourNo ratings yet

- Multinational Business Finance Eiteman 12th Edition Solutions ManualDocument5 pagesMultinational Business Finance Eiteman 12th Edition Solutions ManualGeorgePalmerkqgd100% (29)

- Chapter 4: Factors That Influence Exchange RatesDocument11 pagesChapter 4: Factors That Influence Exchange RatesGall AnonimNo ratings yet

- 10 Krugman PPT c13Document48 pages10 Krugman PPT c13Shehroze MoeenNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Exchange Rates and The Foreign Exchange Market: An Asset ApproachDocument24 pagesExchange Rates and The Foreign Exchange Market: An Asset Approachsiddus1No ratings yet

- International Parity ConditionsDocument39 pagesInternational Parity ConditionsDiegoNo ratings yet

- CH 13Document12 pagesCH 13Simona NicolaeNo ratings yet

- Exchange Rates and The Foreign Exchange Market: An Asset ApproachDocument44 pagesExchange Rates and The Foreign Exchange Market: An Asset ApproachJohanne Rhielle OpridoNo ratings yet

- IFM Notes Full Rudramurthy SirDocument94 pagesIFM Notes Full Rudramurthy SirSachin PatilNo ratings yet

- CH 7Document25 pagesCH 7Zuhaib SultanNo ratings yet

- International Parity Relationship: Topic 4Document32 pagesInternational Parity Relationship: Topic 4sittmoNo ratings yet

- International Financial Markets: International Parity Conditions: Interest Rate and The Fisher ParitiesDocument13 pagesInternational Financial Markets: International Parity Conditions: Interest Rate and The Fisher Parities1klornaNo ratings yet

- INTERNATIONAL BANK MANAGEMENT MID-TERMDocument6 pagesINTERNATIONAL BANK MANAGEMENT MID-TERMaklank_218105No ratings yet

- International Financial Management Canadian Canadian 3rd Edition Brean Solutions ManualDocument16 pagesInternational Financial Management Canadian Canadian 3rd Edition Brean Solutions ManualAmberFranklinegrn100% (41)

- A M2 EFI 01marchedeschangesDocument28 pagesA M2 EFI 01marchedeschangesAzemour MohamedNo ratings yet

- Ch18 FinancialRisksDocument37 pagesCh18 FinancialRiskssamuel_dwumfourNo ratings yet

- Answers For Chapter 4Document3 pagesAnswers For Chapter 4Wan MP WilliamNo ratings yet

- Relationships Among Inflation, Interest Rates, and Exchange RatesDocument29 pagesRelationships Among Inflation, Interest Rates, and Exchange RatesClaudia ChavarriaNo ratings yet

- Chapter 2 - World Trade - An OverviewDocument36 pagesChapter 2 - World Trade - An Overviewvintosh_pNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2ePaul Sau HutaNo ratings yet

- 3.1 International Parity ConditionsDocument41 pages3.1 International Parity ConditionsSanaFatimaNo ratings yet

- Fin 444 - Chapter 7 SlidesDocument28 pagesFin 444 - Chapter 7 SlidesBappi MahiNo ratings yet

- Interest Rate ParityDocument5 pagesInterest Rate ParitypranavbhallaNo ratings yet

- ECS1601 Chapter 16 Narrated Slides Foreign Sector Exchange RatesDocument31 pagesECS1601 Chapter 16 Narrated Slides Foreign Sector Exchange RatesConnor Van der MerweNo ratings yet

- Int'l Finance, HW#1-7,2011Document81 pagesInt'l Finance, HW#1-7,2011Cody SimonNo ratings yet

- International Financial MarketsDocument10 pagesInternational Financial MarketsFurqan AhmedNo ratings yet

- International Parity Relations ExplainedDocument34 pagesInternational Parity Relations ExplainedMotiram paudelNo ratings yet

- Currency Exchange Rates: Understanding Equilibrium Value: 2. Foreign Exchange Market ConceptsDocument8 pagesCurrency Exchange Rates: Understanding Equilibrium Value: 2. Foreign Exchange Market ConceptsFaizan UllahNo ratings yet

- 5 ForexDocument50 pages5 Forexcharlie simoNo ratings yet

- Eun 9e International Financial Management PPT CH06 AccessibleDocument31 pagesEun 9e International Financial Management PPT CH06 AccessibleDao Dang Khoa FUG CTNo ratings yet

- International FinanceDocument20 pagesInternational FinancecoffeedanceNo ratings yet

- International Parity Conditions 2Document30 pagesInternational Parity Conditions 2Monika BahlNo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamNo ratings yet

- Measuring Economic Exposure and Foreign Exchange Risk for Rolls-RoyceDocument4 pagesMeasuring Economic Exposure and Foreign Exchange Risk for Rolls-RoyceneetamoniNo ratings yet

- ECON Chapter 7Document8 pagesECON Chapter 7Mushaisano MudauNo ratings yet

- Exchange RatesDocument12 pagesExchange RatesHeoHamHốNo ratings yet

- Causes and Effect of Free Fall of Rupee Against DollarDocument2 pagesCauses and Effect of Free Fall of Rupee Against Dollarsaharan49No ratings yet

- MS&E 247s International Investments Summer 2005 Instructor: Yee-Tien Fu Friday 7/29/05 2:45-4:25pm (100 Mins) Midterm ExaminationDocument14 pagesMS&E 247s International Investments Summer 2005 Instructor: Yee-Tien Fu Friday 7/29/05 2:45-4:25pm (100 Mins) Midterm ExaminationThị Diệu Hương NguyễnNo ratings yet

- International Financial Management PgapteDocument31 pagesInternational Financial Management PgapterameshmbaNo ratings yet

- 08 Interest Rates Exchange Rates and InflationDocument39 pages08 Interest Rates Exchange Rates and InflationEneida HaskoNo ratings yet

- Foreign Exchange Market and Management of Foreign Exchange RiskDocument56 pagesForeign Exchange Market and Management of Foreign Exchange RiskCedric ZvinavasheNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- Bond Spreads - Leading Indicator For CurrenciesDocument6 pagesBond Spreads - Leading Indicator For CurrenciesanandNo ratings yet

- Bombay Stock ExchangeDocument25 pagesBombay Stock Exchangemadhav5544No ratings yet

- Linear Programming Aplication: Foreign Exchange ManagementDocument2 pagesLinear Programming Aplication: Foreign Exchange ManagementHernan DarioNo ratings yet

- Exchange Rates and The Foreign Exchange Market: An Asset ApproachDocument49 pagesExchange Rates and The Foreign Exchange Market: An Asset ApproachTariqul IslamNo ratings yet

- MPP8-512-L16E-Lua Chon Mot Che Do Ty Gia - James Riedel-2015-11-18-09251061Document21 pagesMPP8-512-L16E-Lua Chon Mot Che Do Ty Gia - James Riedel-2015-11-18-09251061nguyennauy25042003No ratings yet

- 3 - Foreign Exchange DeterminationDocument53 pages3 - Foreign Exchange Determinationmanonmani_mktg8423No ratings yet

- Automated Forex Trading System Guide PDFDocument16 pagesAutomated Forex Trading System Guide PDFaqua4u53430% (1)

- Why Do Interest Rates Change?Document41 pagesWhy Do Interest Rates Change?YSLHKHKHKNo ratings yet

- A Note On Parity Conditions.: Derivatives & Risk Management Professor Michel A. RobeDocument5 pagesA Note On Parity Conditions.: Derivatives & Risk Management Professor Michel A. RobesalmakdaNo ratings yet

- Kotler Pom15 Im 04Document27 pagesKotler Pom15 Im 04Charles MK ChanNo ratings yet

- Kotler Pom15 Im 05Document28 pagesKotler Pom15 Im 05Charles MK ChanNo ratings yet

- Chapter Eight - Planning, Materiality and Risk Assessment - Part 4Document6 pagesChapter Eight - Planning, Materiality and Risk Assessment - Part 4Charles MK ChanNo ratings yet

- 9602 in Fin SolveDocument86 pages9602 in Fin SolveCharles MK Chan0% (1)

- Interaction Between StakeholderDocument12 pagesInteraction Between StakeholderCharles MK ChanNo ratings yet

- Bba 211 Business Law AssignmentsDocument2 pagesBba 211 Business Law AssignmentsCharles MK ChanNo ratings yet

- Kotler Pom15 Im 03Document26 pagesKotler Pom15 Im 03Charles MK ChanNo ratings yet

- Chap 017Document24 pagesChap 017Charles MK ChanNo ratings yet

- MKT 02Document21 pagesMKT 02Charles MK ChanNo ratings yet

- Kotler-Ch 1Document34 pagesKotler-Ch 1Charles MK Chan0% (1)

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- Conso Ex PDFDocument16 pagesConso Ex PDFCharles MK ChanNo ratings yet

- Department of Business AdministrationDocument3 pagesDepartment of Business AdministrationCharles MK ChanNo ratings yet

- FNE306-01 International Finance Course DocumentDocument6 pagesFNE306-01 International Finance Course DocumentCharles MK ChanNo ratings yet

- Homework Ch5Document32 pagesHomework Ch5Charles MK ChanNo ratings yet

- Relevant Costs and Decision MakingDocument18 pagesRelevant Costs and Decision MakingCharles MK ChanNo ratings yet

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNo ratings yet

- L3 Additional Specimen Questions and Answers - Topic 10Document6 pagesL3 Additional Specimen Questions and Answers - Topic 10ladyreveurNo ratings yet

- ABA 202A Answer of Problems of Chapter 2, 3, & 9.odtDocument3 pagesABA 202A Answer of Problems of Chapter 2, 3, & 9.odtCharles MK ChanNo ratings yet

- Asset Replacement Decision for Chemical CompanyDocument1 pageAsset Replacement Decision for Chemical CompanyCharles MK ChanNo ratings yet

- Level 3 Certificate in Accounting: SyllabusDocument16 pagesLevel 3 Certificate in Accounting: SyllabusCharles MK ChanNo ratings yet

- Passport To Success Errata - Level 3 AccountingDocument9 pagesPassport To Success Errata - Level 3 AccountingCharles MK ChanNo ratings yet

- L3 Passport To Success - Solutions BookletDocument52 pagesL3 Passport To Success - Solutions BookletCharles MK ChanNo ratings yet

- Relevant Costs and Decision MakingDocument18 pagesRelevant Costs and Decision MakingCharles MK ChanNo ratings yet

- LO.1-LO.3 (Relevant Costs Sunk Costs) Prior To The 2009 Super Bowl, A Phoenixarea Retailer OrderedDocument1 pageLO.1-LO.3 (Relevant Costs Sunk Costs) Prior To The 2009 Super Bowl, A Phoenixarea Retailer OrderedCharles MK ChanNo ratings yet

- Mapping Table LCCI Vs BAFSDocument3 pagesMapping Table LCCI Vs BAFSCharles MK ChanNo ratings yet

- 003 Specimen Paper 2008 - AnswersDocument8 pages003 Specimen Paper 2008 - AnswersCharles MK ChanNo ratings yet

- 002 Specimen Paper 2008 - QuestionsDocument8 pages002 Specimen Paper 2008 - QuestionsCharles MK ChanNo ratings yet

- Mapping Table LCCI Vs BAFSDocument3 pagesMapping Table LCCI Vs BAFSCharles MK ChanNo ratings yet

- L3 Additional Specimen Questions and Answers - Topic 10Document6 pagesL3 Additional Specimen Questions and Answers - Topic 10ladyreveurNo ratings yet

- PR Amundi Results 2020Document15 pagesPR Amundi Results 2020dorgNo ratings yet

- Negotiable InstrumentsDocument7 pagesNegotiable InstrumentsLDNo ratings yet

- LIC's Jeevan Dhara IIDocument21 pagesLIC's Jeevan Dhara IIpratikwagh112002No ratings yet

- Predstavitev NLBDocument101 pagesPredstavitev NLBFinanceNo ratings yet

- Chapter 7 Audit Procedures & Techniques (NSA 520)Document24 pagesChapter 7 Audit Procedures & Techniques (NSA 520)Moksha HunterNo ratings yet

- Tamilnadu Mercantile BankDocument3 pagesTamilnadu Mercantile BankPraveen SelvarajNo ratings yet

- NEW Takaful Hospital and Surgical Claim Form - Sun Life Malaysia Takaful PDFDocument4 pagesNEW Takaful Hospital and Surgical Claim Form - Sun Life Malaysia Takaful PDFamadkacakNo ratings yet

- Viking Insurance Endorsement Confirmation for Added 1994 CorvetteDocument10 pagesViking Insurance Endorsement Confirmation for Added 1994 Corvettemesa1965No ratings yet

- Factor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertDocument16 pagesFactor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertJuan Manuel VeronNo ratings yet

- Fortune TellerDocument3 pagesFortune TellerbharatNo ratings yet

- Quiz Section 5 Cia Part 1 Governance, Risk Management, and ControlDocument15 pagesQuiz Section 5 Cia Part 1 Governance, Risk Management, and ControlMitch MinglanaNo ratings yet

- CFAS Chapter 4 Q&ADocument1 pageCFAS Chapter 4 Q&ACINDY BALANONNo ratings yet

- Swan Dry Cleaners Is Owned and Operated by Peyton Keyes PDFDocument1 pageSwan Dry Cleaners Is Owned and Operated by Peyton Keyes PDFAnbu jaromiaNo ratings yet

- Asset Liability Management in YES Bank: A Final Project ReportDocument68 pagesAsset Liability Management in YES Bank: A Final Project ReportUjwal JaiswalNo ratings yet

- Pib Limits PredesDocument1 pagePib Limits PredeskrishkpeNo ratings yet

- Personal and Household Finance WorksheetDocument4 pagesPersonal and Household Finance WorksheetZeeshan AhmedNo ratings yet

- Chap 02-Analyzing TransactionsDocument51 pagesChap 02-Analyzing TransactionsJean Coul100% (1)

- ACCO 20063 instructional materials on accounting standardsDocument6 pagesACCO 20063 instructional materials on accounting standardsAubrey CatalanNo ratings yet

- Legend - Docx 1Document101 pagesLegend - Docx 1Juberlina CerbitoNo ratings yet

- Jose Espinoza water bill detailsDocument1 pageJose Espinoza water bill detailsJose EspinozaNo ratings yet

- Unit 4 Personal AccountsDocument12 pagesUnit 4 Personal Accountsprisca pebriyaniNo ratings yet

- Vbak FPLTC: Links Between Different Tables That We UseDocument5 pagesVbak FPLTC: Links Between Different Tables That We UseSandeep KethepalliNo ratings yet

- Excel Solutions To CasesDocument32 pagesExcel Solutions To Cases박지훈No ratings yet

- Porto Free Powerpoint TemplateDocument9 pagesPorto Free Powerpoint TemplateTeneswari RadhaNo ratings yet

- Bài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmDocument13 pagesBài kiểm tra trắc nghiệm chủ đề - Thanh toán bằng cổ phiếu - - Xem lại bài làmAh TuanNo ratings yet

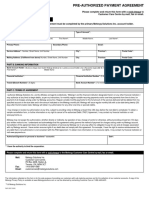

- Please Complete and Return This Form With A Void Cheque To Customer Care Centre by Mail, Fax or EmailDocument1 pagePlease Complete and Return This Form With A Void Cheque To Customer Care Centre by Mail, Fax or EmailAmirhoosein MeshginiNo ratings yet

- Module 3 - FARDocument20 pagesModule 3 - FARGaGa's TVNo ratings yet

- Auditing TheoDocument27 pagesAuditing TheoSherri BonquinNo ratings yet

- Chapter 02 - CONCEPTUAL FRAMEWORK: Objective of Financial ReportingDocument6 pagesChapter 02 - CONCEPTUAL FRAMEWORK: Objective of Financial ReportingKimberly Claire AtienzaNo ratings yet

- UPAS L/C: An Innovative Payment Scheme For International TradeDocument2 pagesUPAS L/C: An Innovative Payment Scheme For International TradesomsemNo ratings yet