Professional Documents

Culture Documents

ACG 6305 Chapter 1

Uploaded by

Rudy Joseph Michaud IICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACG 6305 Chapter 1

Uploaded by

Rudy Joseph Michaud IICopyright:

Available Formats

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

1

Chapter 1:

Managerial

Accounting:

An Overview

Modified Slides

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

2

Financial and Managerial Accounting:

Seven Key Differences

Financial Accounting Managerial Accounting

1. Users External persons who Managers who plan for

make financial decisions and control an organization

2. Time focus Historical perspective Future emphasis

3. Verifiability Emphasis on Emphasis on

versus relevance objectivity and verifiability relevance

4. Precision versus Emphasis on Emphasis on

timeliness precision timeliness

5. Subject Primary focus is on Focus on

companywide reports segment reports

6. Rules Must follow GAAP / IFRS Not bound by GAAP / IFRS

and prescribed formats or any prescribed format

7. Requirement Mandatory for Not

external reports Mandatory

Like Exhibit 1-1, page 2

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

3

The Work of Management and the Need for

Management Accounting Information

Decision Making in:

Planning (including Strategy formulation

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

4

Strategy: Customer Value Propositions

Understand and respond to

individual customer needs.

Customer

Intimacy

Strategy

Operational

Excellence

Strategy

Deliver products and services

faster, more conveniently,

and at lower prices.

Product

Leadership

Strategy

Offer higher quality products.

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

5

The Work of Management and the Need for

Management Accounting Information

Decision Making in:

Planning (including Strategy formulation),

Controlling:

By Directing & Motivating to implement plans

(e.g., by allocation & extrinsic incentives; p. 17)

By gathering, evaluating, and responding to

feedback on actual results versus plans (e.g.,

budgets) reported to managers in performance

reports

Control decisions necessary

Financial & nonfinancial information required.

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

6

The Planning and Control Cycle

Decision

Making

Formulating long-

and short-term plans

(Planning)

Measuring

performance

(Controlling)

Implementing

plans: Directing

and Motivating

(Controlling)

Comparing actual

to planned

performance

(Controlling)

Begin

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

7

Cost Management

The approaches and activities of managers to

use resources to increase value to customers

and to achieve organizational goals (e.g., lower

the costs of products and services.)

(From: Horngren, Datar, & Rajan, Cost

Accounting, 14

th

Edition, Pearson Prentice Hall,

Upper Saddle River, NJ, 2012, page 848).

Cost management should be across the internal

value chain*; e.g., see Exhibit 1-6 page 16:

Business functions making up the value chain

Product Customer

R&D Design Manufacturing Marketing Distribution Service

*Also, across the supply chain.

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

8

Corporate Organization Chart

Purchasing Personnel Vice President

Operations

Treasurer Controller

Chief Financial

Officer

President

Board of Directors

Management Accountants in the

Organizational Structure

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

9

Line and Staff Relationships

Line positions are directly

related to achievement of

the basic objectives of an

organization.

Example: Production

supervisors in a

manufacturing plant.

Staff positions support and

assist line positions.

Examples: Cost accountant

in a manufacturing plant and

Controller/Chief Accounting

Officer, who is primarily

responsible for management

accounting and financial

accounting.

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

10

Business Environment: Process Management

Managers need to continually improve the business

processes across business functions in the value chain;

for example (management accounting supportive

response examples in brackets):

Lean Thinking; e.g., Lean Production such as just-in-

time, pull versus just-in-case, push (e.g., Lean Accounting

(page 489) and Backflush costing (not in textbook))

Theory of Constraints: a lean model that is designed to

effectively manage constraints; (Throughput accounting or

super variable costing, pages 279-282; e.g.: John B.

MacArthur, From Activity-Based Costing to Throughput

Accounting, posted in Blackboard)

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

11

A constraint (also called a bottleneck) is anything that

prevents you from getting more of what you want.

The constraint in a system is determined

by the step that has the smallest capacity.

Theory of Constraints (continued)

http://www.thermofab.com/drum_buffer_rope.html

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

12

Theory of Constraints (continued)

A sequential process of identifying and

removing constraints/bottlenecks in a system:

1. Identify the systems constraints.

2. Decide how to exploit the systems constraints.

3. Subordinate everything else to the above

decision.

4. Elevate/relax the systems constraints (see

pages 550-551).

5. If in the previous steps a constraint has been

broken, go back to step 1

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

13

Business Environment: Other Factors

Strategic Management: e.g., combat increased

international competition (strategic cost management

models; e.g., ABC (Ch 7) & Target Costing (Appendix A))

Enterprise Risk Management: a process used by

organizations to proactively identify and manage risk; e.g.,

by sharing the risk, accepting the risk, or reducing the risk

by implementing specific controls (e.g., measure the

benefits and costs of alternative enterprise risk

management approaches)

Corporate Social Responsibility: a concept whereby

organizations consider the needs of all stakeholders when

making decisions that extend beyond legal compliance to

include voluntary actions to satisfy stakeholder

expectations (e.g., environmental cost management)

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

14

Ethics: Code of Conduct for

Management Accountants

The Institute of Management Accountant (IMA) Statement

of Ethical Professional Practice has the following three

major parts (for more detail, see Exhibit 1-9, page 16):

1. Ethical Principles (honesty, fairness, objectivity, and

responsibility)

2. Standards of ethical behavior (competence,

confidentiality, integrity, and credibility)

3. Resolution of Ethical Conflict (discuss with immediate

superior &/or successive management levels, clarify

ethical issues with an IMA Ethics Counselor or other

impartial advisor, and consult your own attorney)

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

15

Ethics (continued)

Ethical Codes of Conduct at the International Level:

The IFACs International Ethics Standards Board for

Accountants (IESBA) develops ethical standards and

guidance for use by professional accountants. It

encourages member bodies to adopt high standards of

ethics for their members and promotes good ethical

practices globally. The IESBA also fosters international

debate on ethical issues faced by accountants.

(http://www.ifac.org/Ethics/index.php)

The Foreign Corrupt Practices Act of 1977.

ACFE Occupational Fraud & Abuse Reports:

http://www.acfe.com/fraud/report.asp; Most occupational fraud

(26.3%) committed in accounting department - 2012 Report, 53

Appendix 1A: Corporate Governance

Sarbanes-Oxley Act 0f 2002.

Internal Control: preventative control and detective control.

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

16

Certified Management Accountant

A management accountant

who has the necessary qualifications and

who passes a rigorous professional exam earns

the right to be known as a Certified

Management Accountant (CMA).

Copyright 2015 McGraw-Hill Education McGraw-Hill/Irwin

17

CMA Exam Content: Exhibit 1-4, page 8

Information about becoming a CMA and the CMA program can be accessed

on the IMAs website at www.imanet.org or by calling 1-800-638-4427.

Part 1 Financial Planning, Performance and Control

Planning, budgeting, and forecasting

Performance management

Cost management

Internal controls

Professional ethics

Part 2 Financial Decision Making

Financial statement analysis

Corporate finance

Decision analysis and risk management

Investment decisions

Professional ethics

You might also like

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- MBA Managerial Accounting SummaryDocument31 pagesMBA Managerial Accounting Summarycamirpo100% (1)

- Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions ManualDocument25 pagesHorngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions ManualChristinaSmithteydp100% (52)

- Cost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelFrom EverandCost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelNo ratings yet

- IC Restaurant Balanced Scorecard ExampleDocument1 pageIC Restaurant Balanced Scorecard Examplemuscdalife100% (1)

- 2.1. Perfect CompetitionDocument73 pages2.1. Perfect Competitionapi-3696178100% (5)

- BSC Powerpoint PresentationDocument26 pagesBSC Powerpoint PresentationRavi GajjarNo ratings yet

- Lean Analytics: The Ultimate Guide to Improve Your Company. Learn Profitable Strategies to Use Data and Optimize Your Business.From EverandLean Analytics: The Ultimate Guide to Improve Your Company. Learn Profitable Strategies to Use Data and Optimize Your Business.No ratings yet

- Module Study Pack (Stretigic Management Accounting)Document328 pagesModule Study Pack (Stretigic Management Accounting)Rimon BD100% (3)

- Chapter 1 Solutions Horngren Cost AccountingDocument14 pagesChapter 1 Solutions Horngren Cost AccountingAnik Kumar MallickNo ratings yet

- Managing Operations: Your guide to getting it rightFrom EverandManaging Operations: Your guide to getting it rightNo ratings yet

- 1 - Introduction To AccountingDocument27 pages1 - Introduction To AccountingIra monick codillaNo ratings yet

- How to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationFrom EverandHow to Enhance Productivity Under Cost Control, Quality Control as Well as Time, in a Private or Public OrganizationNo ratings yet

- Question # 1 (A) Define Scope and Significance of Operation ManagementDocument11 pagesQuestion # 1 (A) Define Scope and Significance of Operation ManagementHuzaifa KhalilNo ratings yet

- Ch01 Horngren IsmDocument19 pagesCh01 Horngren IsmKiều Thảo AnhNo ratings yet

- Management Accounting: Retrospect and ProspectFrom EverandManagement Accounting: Retrospect and ProspectRating: 4.5 out of 5 stars4.5/5 (5)

- Management Accounting Chapter 1Document4 pagesManagement Accounting Chapter 1Ieda ShaharNo ratings yet

- Chapter 01Document31 pagesChapter 01Ahmad N. AlawiNo ratings yet

- Solution Manual - Chapter 1Document5 pagesSolution Manual - Chapter 1psrikanthmbaNo ratings yet

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (10)

- The Changing Role of Managerial Accounting in A Global Business EnvironmentDocument31 pagesThe Changing Role of Managerial Accounting in A Global Business EnvironmentFlorensia RestianNo ratings yet

- Chapter 1 SolutionsDocument14 pagesChapter 1 SolutionschloeNo ratings yet

- Chapter 1 Solutions - Questions Ed15Document3 pagesChapter 1 Solutions - Questions Ed15camd1290No ratings yet

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocument27 pagesThe Changing Role of Managerial Accounting in A Dynamic Business EnvironmentAndrea RobinsonNo ratings yet

- Dwnload Full Cost Accounting A Managerial Emphasis 2nd Edition Horngren Solutions Manual PDFDocument19 pagesDwnload Full Cost Accounting A Managerial Emphasis 2nd Edition Horngren Solutions Manual PDFcurguulusul100% (13)

- Solucionario Contabilidad de Costos Horn (001-004) PDFDocument4 pagesSolucionario Contabilidad de Costos Horn (001-004) PDFMaryIngalsNo ratings yet

- MGT388 Lecture 10 NotesDocument4 pagesMGT388 Lecture 10 Noteschris.a.baberNo ratings yet

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis Canadian 8th Edition Datar Solutions Manual PDFDocument18 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis Canadian 8th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (8)

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (7)

- Managerial Accounting - Chapter4Document15 pagesManagerial Accounting - Chapter4Nazia AdeelNo ratings yet

- World University of Bangladesh: Md. Atiqur Rahman KhanDocument23 pagesWorld University of Bangladesh: Md. Atiqur Rahman KhanFuadNo ratings yet

- Chapter 01 - AnswerDocument19 pagesChapter 01 - AnswerOscar Antonio100% (2)

- Chapter 1Document3 pagesChapter 1Andrea QuetzalNo ratings yet

- MB0052Document8 pagesMB0052Rajni KumariNo ratings yet

- 11 Edition: Mcgraw-Hill/IrwinDocument34 pages11 Edition: Mcgraw-Hill/IrwinMuhammad SajidNo ratings yet

- Master of Business Administration-MBA Semester 3 ' Supply Chain" Specialization SC0009-Supply Chain Cost Management - 4 Credits Assignment (60 Marks)Document8 pagesMaster of Business Administration-MBA Semester 3 ' Supply Chain" Specialization SC0009-Supply Chain Cost Management - 4 Credits Assignment (60 Marks)mreenal kalitaNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerTJ NgNo ratings yet

- Cost Accounting 1Document30 pagesCost Accounting 1Rut LumbantobingNo ratings yet

- Chapter 1 ObjectivesDocument9 pagesChapter 1 ObjectivesMuhammad NadeemNo ratings yet

- Chapter 1 Answer Cost Accounting PDFDocument5 pagesChapter 1 Answer Cost Accounting PDFCris VillarNo ratings yet

- OM013Document13 pagesOM013Bsnl BareillyNo ratings yet

- 2019 Six - Practices - For - Effective - Portfolio - MGMT - 385064Document13 pages2019 Six - Practices - For - Effective - Portfolio - MGMT - 385064LauraNo ratings yet

- Chapter 01 - AnswerDocument18 pagesChapter 01 - AnswerJoy Angelique JavierNo ratings yet

- Assignment 1 - Darshan BhavsarDocument5 pagesAssignment 1 - Darshan BhavsarDarshan BhavsarNo ratings yet

- Managerial Accounting and The Business Environment: Chapter OneDocument50 pagesManagerial Accounting and The Business Environment: Chapter OneAdeyemi Fatimah AdebukolaNo ratings yet

- Introduction Management AccountingDocument26 pagesIntroduction Management AccountingIsmail Mat NoordinNo ratings yet

- PRODUCTIONS AND OPERATIONS MANAGEMENT QnA AnsDocument14 pagesPRODUCTIONS AND OPERATIONS MANAGEMENT QnA AnsAbhishek MandalNo ratings yet

- Managerial Accounting Assignment Help: Planning and ControlDocument7 pagesManagerial Accounting Assignment Help: Planning and ControlNabeel Ismail/GDT/BCR/SG4No ratings yet

- ACE 212 Tutorial 1 Suggested SolutionDocument3 pagesACE 212 Tutorial 1 Suggested SolutionJoyce PamendaNo ratings yet

- Garrison12ce SM Ch01 FINALDocument14 pagesGarrison12ce SM Ch01 FINALKitchen UselessNo ratings yet

- Chapter One: Cost Management and StrategyDocument34 pagesChapter One: Cost Management and StrategySyafira Nida IsyaraniNo ratings yet

- The Manager and Management AccountingDocument24 pagesThe Manager and Management AccountingBakarNo ratings yet

- MB501 Assignment 2 - Manish ShekharDocument7 pagesMB501 Assignment 2 - Manish Shekharmanish.shekhar17No ratings yet

- Pom Theory Notes 2017-18 (Du-Sscbs-Bms-Sem-Iv)Document22 pagesPom Theory Notes 2017-18 (Du-Sscbs-Bms-Sem-Iv)Vinayak ChawlaNo ratings yet

- Business Management Short Notes (PBP)Document110 pagesBusiness Management Short Notes (PBP)Amir Ali100% (1)

- Blocher 9e Chap001Document34 pagesBlocher 9e Chap001adamagha703No ratings yet

- Chapter 4Document6 pagesChapter 4Kibrom EmbzaNo ratings yet

- Current Focus On Management AccountingDocument3 pagesCurrent Focus On Management AccountingGêmTürÏngånÖ0% (2)

- Cost Reduction and Control Best Practices: The Best Ways for a Financial Manager to Save MoneyFrom EverandCost Reduction and Control Best Practices: The Best Ways for a Financial Manager to Save MoneyNo ratings yet

- Reaching Sustainable: Implement and drive sustainability transformation in your organizationFrom EverandReaching Sustainable: Implement and drive sustainability transformation in your organizationNo ratings yet

- The Business Savvy Project Manager: Indispensable Knowledge and Skills for SuccessFrom EverandThe Business Savvy Project Manager: Indispensable Knowledge and Skills for SuccessRating: 5 out of 5 stars5/5 (1)

- Summary of CH-8 Innovation and New Product StrategyDocument3 pagesSummary of CH-8 Innovation and New Product StrategyNahid Hasan Tushar100% (1)

- Economic Analysis of CadburyDocument27 pagesEconomic Analysis of CadburyFawad Shah100% (2)

- Service GuranteeDocument2 pagesService GuranteeKevo KarisNo ratings yet

- The Value Chain and Cost Analysis 6Document5 pagesThe Value Chain and Cost Analysis 6Md.Yousuf AkashNo ratings yet

- Value Chain Slides Powerpoint TemplateDocument20 pagesValue Chain Slides Powerpoint TemplateWidjaya HarahapNo ratings yet

- Consumer & Trade Oriented Sales Promotions Technique: Rakib Zahoor Wani Maheen Anem Misbah Khan Mohsin FayazDocument6 pagesConsumer & Trade Oriented Sales Promotions Technique: Rakib Zahoor Wani Maheen Anem Misbah Khan Mohsin FayazRakibZWaniNo ratings yet

- October 2022 RFBT Preweek Handout Number 1 With Answer Final VersionDocument16 pagesOctober 2022 RFBT Preweek Handout Number 1 With Answer Final VersionNot ConradNo ratings yet

- Apple SWOTDocument12 pagesApple SWOTElly TanNo ratings yet

- History of Mutual Fund IndustryDocument5 pagesHistory of Mutual Fund IndustryB.S KumarNo ratings yet

- Introduction To Audit and Audit Standard Setting ProcessDocument8 pagesIntroduction To Audit and Audit Standard Setting ProcessIrish SanchezNo ratings yet

- KPL RevisedDocument17 pagesKPL RevisedEmezi ObisikeNo ratings yet

- Acc106 - Test 1 - May 2018 - SSDocument5 pagesAcc106 - Test 1 - May 2018 - SSsyahiir syauqiiNo ratings yet

- Accounting For Materials - 1Document2 pagesAccounting For Materials - 1Charles Tuazon50% (2)

- M07A-CK-HƯỚNG DẪN VIẾT BÁO CÁO-001197-KSDNDocument9 pagesM07A-CK-HƯỚNG DẪN VIẾT BÁO CÁO-001197-KSDNNgô Vĩnh HyNo ratings yet

- Typewriting Instution Business Plan: Typing Service Executive SummaryDocument17 pagesTypewriting Instution Business Plan: Typing Service Executive SummaryMadhavan RMNo ratings yet

- Assignment TopicsDocument2 pagesAssignment Topicsswarna lathaNo ratings yet

- 2023 MQP 2327 Business StudiesDocument4 pages2023 MQP 2327 Business StudiesChirag NaiduNo ratings yet

- Marketing MyopiaDocument2 pagesMarketing MyopiaToivino JuniorNo ratings yet

- Visions July 11 Katz LDocument8 pagesVisions July 11 Katz LAnonymous Rv4CpUfIENo ratings yet

- ERS 3.0 - Product SheetDocument2 pagesERS 3.0 - Product SheetTonilleNo ratings yet

- Competing For Advantage 2nd Edition by Hoskisson Hitt Ireland and Harrison ISBN Solution ManualDocument18 pagesCompeting For Advantage 2nd Edition by Hoskisson Hitt Ireland and Harrison ISBN Solution Manualsook100% (25)

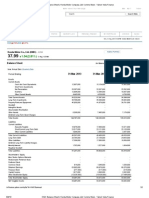

- HMC Balance Sheet - Honda Motor Company, LTD PDFDocument2 pagesHMC Balance Sheet - Honda Motor Company, LTD PDFPoorvi JainNo ratings yet

- Transmittal To COADocument47 pagesTransmittal To COARONIL APAOPEDROTESNo ratings yet

- Marginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDocument34 pagesMarginal Costing and Absorption Costing: Department OF Accounting ACC322 - Advanced Cost AccountingDavid ONo ratings yet

- Organization Structure - Azerbaijan 2022 UpdatedDocument1 pageOrganization Structure - Azerbaijan 2022 UpdatedGunel BadalovaNo ratings yet

- BKM, Chap 16Document16 pagesBKM, Chap 16rob_jiangNo ratings yet

- Self Practice Cost AccountingDocument17 pagesSelf Practice Cost AccountingLara Alyssa GarboNo ratings yet