Professional Documents

Culture Documents

Understanding Interest Rate Risk

Uploaded by

Arjun SainiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding Interest Rate Risk

Uploaded by

Arjun SainiCopyright:

Available Formats

Interest Rate Risk-3

Objective

The objective of the session is to comprehend

the following variants of interest rate risk.

Price Risk.

Reinvestment risk

Price Risk

The values of investments change inversely to

interest rates.

If the interest rate in the market increase,

investment suffer depreciation.

If the interest rate decline, investments in the

banks portfolio gain in value.

The price change in investments are on account

of the present values of the cash flows in the

bond being altered when discounted by the new

interest rate.

Price Risk

Thus all bonds are subject to price risk which

is the potential loss in value on account of

changes in interest rates.

This concept can be generalized and can be

extended to all items of assets and liabilities in

a banks balance sheet which conceptually

constitutes series of expected cash flows.

As such ,have present values (market values

)which vary with market interest rates.

Price Risk

Thus all items of assets and liabilities are

exposed to price risk.

Price risk will impact the values of assets and

liabilities of bank .

In turn impact market value of net worth

which is the difference between the market

value of assets and liabilities.

Reinvestment risk

The expected yield on investments, generally

indicated by yield to maturity.

It is based on the important assumption that the

bond will be held till maturity

It is also assumed that during the life of the bond,

the periodic coupons received will be reinvested

at an interest rate equal to the YTM.

This assumption can go wrong in which case

income from investments by way of coupons gets

reinvested at lower rates in case the interest rates

decline.

Reinvestment Risk

Uncertainty with regard to interest rate at which the future

cash flows can be reinvested is called reinvestment risk.

The bond pricing formula assumes that all coupon

payments are reinvested at the bonds Yield to

Maturity.(YTM).

However in reality the interest rates can never be static in

the market.

Nevertheless as the coupon payments are to be reinvested

for shorter maturity than the original tenure of the bond

(to synchronize with the maturity of the Bond ),the interest

rates for such remaining tenure would be naturally

different from the interest rates (YTM) originally estimated.

Reinvestment Risk

If the interest rate goes up in the market during the life of a bond ,interest

flows will be reinvested at higher yields thereby increasing the

reinvestment income. The increase in reinvestment income will increase

the realized yield of the bond which would be more than the YTM

expected at the time of purchase of the Bond.

On the other hand, when the interest rate declines during the life of the

Bond, the coupons will be reinvested at lower yields which reduce the

reinvestment income. This would result in reduction in realized yield of

the Bond which would be less than the YTM originally estimated at the

time of purchase.

However as the Price of the Bond is inversely proportion to the interest

rates, the bond price would depreciate in the rising interest rate scenario

and bond price would appreciate in the falling interest rate scenario. This

depreciation or appreciation in bond price would result in a capital loss

gain thereby partially setting off the increased reinvestment income or

reduced reinvestment income in the respective scenarios.

Thus price risk and reinvestment risk partially off set one another.

You might also like

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Valuation of Securities-3Document54 pagesValuation of Securities-3anupan92No ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document3 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Alessandra PilatNo ratings yet

- BF330 FPD 8 2020 1Document49 pagesBF330 FPD 8 2020 1richard kapimpaNo ratings yet

- Bond ImmunisationDocument29 pagesBond ImmunisationVaidyanathan RavichandranNo ratings yet

- Chapter 2 - Risks Associated With Investing in Bonds: - Major Learning OutcomesDocument53 pagesChapter 2 - Risks Associated With Investing in Bonds: - Major Learning OutcomesAsadNo ratings yet

- BRM Session 8 Interest Rate RiskDocument31 pagesBRM Session 8 Interest Rate RiskSrinita MishraNo ratings yet

- UntitledDocument29 pagesUntitledDEEPIKA S R BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Bond ManagementDocument29 pagesBond ManagementNigus AberaNo ratings yet

- Chapter 5Document29 pagesChapter 5Aimes AliNo ratings yet

- Intermediate Finance Session 9 Chapter 18 Key ConceptsDocument56 pagesIntermediate Finance Session 9 Chapter 18 Key ConceptsrizaunNo ratings yet

- BondsDocument14 pagesBondssonal100% (1)

- Classes of Financial Assets (Fixed Income Securities) : Dr. Himanshu Joshi FORE School of ManagementDocument27 pagesClasses of Financial Assets (Fixed Income Securities) : Dr. Himanshu Joshi FORE School of Managementazim.akhtarNo ratings yet

- Risks of Investing in Bonds TitleDocument54 pagesRisks of Investing in Bonds TitlemohammedNo ratings yet

- Overview of Fixed-Income Portfolio ManagementDocument11 pagesOverview of Fixed-Income Portfolio ManagementkypvikasNo ratings yet

- BOND VALUATION Week 4Document43 pagesBOND VALUATION Week 4desblahNo ratings yet

- Measuring Bond Duration and Price VolatilityDocument2 pagesMeasuring Bond Duration and Price VolatilityFreimond07No ratings yet

- Bond Valuation: - A Technique For Determining The Fair Value of A Particular BondDocument11 pagesBond Valuation: - A Technique For Determining The Fair Value of A Particular BondmayuumayurNo ratings yet

- Risks of Bond Investing Interest Rate RiskDocument23 pagesRisks of Bond Investing Interest Rate RiskArun KumarNo ratings yet

- Bond Pricing and Bond Yield New - 1Document66 pagesBond Pricing and Bond Yield New - 1Sarang Gupta100% (1)

- Tangkapan Layar 2023-10-26 Pada 10.34.06Document19 pagesTangkapan Layar 2023-10-26 Pada 10.34.06Fairuz akmalNo ratings yet

- Bond Valuation 000000001Document41 pagesBond Valuation 000000001Subrata BagNo ratings yet

- Lecture 4 (Interest Rate and Bond Valuation)Document54 pagesLecture 4 (Interest Rate and Bond Valuation)Christy Ho100% (1)

- March 22 ChapDocument31 pagesMarch 22 ChapÁrni Davíð SkúlasonNo ratings yet

- Interest RatesDocument12 pagesInterest RatesRTushar BeeshmNo ratings yet

- Bond and Equity ValuationDocument18 pagesBond and Equity Valuationclassmate0% (1)

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- Session 10Document41 pagesSession 10Hammad KamranNo ratings yet

- Interest Rates and Bond Valuation QDocument6 pagesInterest Rates and Bond Valuation QJoana Ann ImpelidoNo ratings yet

- Chapter 2 Fixed Income SecuritiesDocument18 pagesChapter 2 Fixed Income SecuritiesGeremew MetadelNo ratings yet

- Bond Pricing and Bond Yield SRPM2012Document57 pagesBond Pricing and Bond Yield SRPM2012ashishbansal85No ratings yet

- Understanding Yield SpreadDocument15 pagesUnderstanding Yield SpreadShubham KumarNo ratings yet

- Bonds - Prices and Yields Presentation 10112021Document36 pagesBonds - Prices and Yields Presentation 10112021Onur YamukNo ratings yet

- Benefits and Risks PDFDocument2 pagesBenefits and Risks PDFkirti gNo ratings yet

- Valuation of Bonds and SharesDocument9 pagesValuation of Bonds and Sharessangee_it100% (1)

- ch09 PPT Kidwell 4e Bond-Markets-And-ValuationDocument35 pagesch09 PPT Kidwell 4e Bond-Markets-And-ValuationAlexa Daphne M. EquisabalNo ratings yet

- Interest Rate Risk I (CH 8)Document13 pagesInterest Rate Risk I (CH 8)Mahbub TalukderNo ratings yet

- Valuation of Fixed Income SecuritiesDocument37 pagesValuation of Fixed Income Securitiesaksh02007No ratings yet

- Understanding the Yield CurveDocument14 pagesUnderstanding the Yield CurveAmirNo ratings yet

- 05 Bonds Valuation and IRDocument28 pages05 Bonds Valuation and IRselcen sarıkayaNo ratings yet

- Chapter 7a - Bonds ValuationDocument22 pagesChapter 7a - Bonds ValuationAian CortezNo ratings yet

- Portfolio Management: Dr. Himanshu Joshi FORE School of Management New DelhiDocument25 pagesPortfolio Management: Dr. Himanshu Joshi FORE School of Management New Delhiashishbansal85No ratings yet

- Bond valuation and yield analysisDocument35 pagesBond valuation and yield analysisTanmay MehtaNo ratings yet

- Bond v Stocks: Key DifferencesDocument133 pagesBond v Stocks: Key DifferencesPartha Protim SahaNo ratings yet

- Valuation of Fixed Income SecuritiesDocument41 pagesValuation of Fixed Income SecuritiesVikrant Verma100% (1)

- Lecture-4 Bonds and Bond ValuationDocument36 pagesLecture-4 Bonds and Bond ValuationZamir StanekzaiNo ratings yet

- Bond ValuationDocument49 pagesBond Valuationmehnaz kNo ratings yet

- Valuation of BondsDocument25 pagesValuation of BondsSUDIPTA SHIBNo ratings yet

- Bond ValuationDocument18 pagesBond Valuationshrutisirsa1No ratings yet

- Bonds and The Term Structure of Interest RatesDocument59 pagesBonds and The Term Structure of Interest RatesZUNERAKHALIDNo ratings yet

- Reinvestment Risk and Zero-Coupon BondsDocument2 pagesReinvestment Risk and Zero-Coupon BondsMuneeba RustamNo ratings yet

- Midterm FM ReviewerDocument11 pagesMidterm FM ReviewerKristine MartinezNo ratings yet

- Debt Fund FeaturesDocument18 pagesDebt Fund FeaturesAmit ShahNo ratings yet

- Bond Valuation and Interest Rates ExplainedDocument14 pagesBond Valuation and Interest Rates ExplainedLinda Mohammad FarajNo ratings yet

- Duration & ConvexityDocument18 pagesDuration & ConvexityHrishikesh Malu100% (3)

- Fundamentals of Investment - Unit 2Document30 pagesFundamentals of Investment - Unit 2Abhishek MukherjeeNo ratings yet

- Bond Valuation: Risks in BondsDocument17 pagesBond Valuation: Risks in BondsruchisinghnovNo ratings yet

- Bond Valuation FundamentalsDocument61 pagesBond Valuation FundamentalsDaniel HakimNo ratings yet

- Chapter 10Document8 pagesChapter 10Hareem Zoya WarsiNo ratings yet

- Lec 10Document26 pagesLec 10danphamm226No ratings yet

- Banking Awareness QuestionsDocument31 pagesBanking Awareness QuestionsArjun SainiNo ratings yet

- All MCQ of DBDocument16 pagesAll MCQ of DBArjun SainiNo ratings yet

- Pre ClassPPT 2Document15 pagesPre ClassPPT 2Arjun SainiNo ratings yet

- Sensex at 100,000 by 2020!: by Varun Goel, Head PMS, KarvyDocument4 pagesSensex at 100,000 by 2020!: by Varun Goel, Head PMS, KarvyArjun SainiNo ratings yet

- Pre ClassPPT 6Document7 pagesPre ClassPPT 6Arjun SainiNo ratings yet

- Accounting Fundamentals ExplainedDocument14 pagesAccounting Fundamentals ExplainedArjun SainiNo ratings yet

- Pre Class PPT 4Document11 pagesPre Class PPT 4Arjun SainiNo ratings yet

- Pre ClassPPT 6Document7 pagesPre ClassPPT 6Arjun SainiNo ratings yet

- Pre ClassPPT 5Document6 pagesPre ClassPPT 5Arjun SainiNo ratings yet

- Credit Risk: Credit Risk Is Defined As "The Inability orDocument10 pagesCredit Risk: Credit Risk Is Defined As "The Inability orArjun SainiNo ratings yet

- National Electronic Funds TransferDocument3 pagesNational Electronic Funds TransferArjun SainiNo ratings yet

- Pre ClassPPT 1Document16 pagesPre ClassPPT 1Arjun SainiNo ratings yet

- Rights & Duties of BOs & DPsDocument4 pagesRights & Duties of BOs & DPsddNo ratings yet

- Rights & Duties of BOs & DPsDocument4 pagesRights & Duties of BOs & DPsddNo ratings yet

- Full Page PhotoDocument1 pageFull Page PhotoArjun SainiNo ratings yet

- Revised Depository Service ChargesDocument1 pageRevised Depository Service ChargesArjun SainiNo ratings yet

- Sbi Assistant Clerk Notification 2014Document5 pagesSbi Assistant Clerk Notification 2014Telugu VaahiniNo ratings yet

- Governmentsponsored Industrial Growththe Jaipur Industrial Estate A Case StudyDocument8 pagesGovernmentsponsored Industrial Growththe Jaipur Industrial Estate A Case StudyArjun SainiNo ratings yet

- Sbi Assistant Clerk Notification 2014Document5 pagesSbi Assistant Clerk Notification 2014Telugu VaahiniNo ratings yet

- Economics MGMTDocument1 pageEconomics MGMTArjun SainiNo ratings yet

- For India? The Solution For Our Economic ProblemsDocument1 pageFor India? The Solution For Our Economic ProblemsArjun SainiNo ratings yet

- Full Page PhotoDocument1 pageFull Page PhotoArjun SainiNo ratings yet

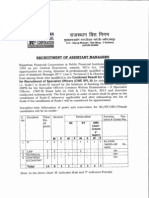

- Assistant Manager Recuitement 08082013 PDFDocument3 pagesAssistant Manager Recuitement 08082013 PDFMalik MalikNo ratings yet

- SI&CIDocument4 pagesSI&CIArjun SainiNo ratings yet

- For India? The Solution For Our Economic ProblemsDocument1 pageFor India? The Solution For Our Economic ProblemsArjun SainiNo ratings yet

- Business PresentationDocument8 pagesBusiness PresentationArjun SainiNo ratings yet

- Dictionary of BusinessDocument9 pagesDictionary of BusinessArjun SainiNo ratings yet

- Dictionary of BusinessDocument9 pagesDictionary of BusinessArjun SainiNo ratings yet

- Andhra Bank PO Exam-Oct 06Document6 pagesAndhra Bank PO Exam-Oct 06Banks_QNo ratings yet

- Small Business Loan Application Form For Individual - Sole - BDODocument2 pagesSmall Business Loan Application Form For Individual - Sole - BDOjunco111222No ratings yet

- FRM 2015 Part 1 Practice ExamDocument47 pagesFRM 2015 Part 1 Practice ExamVitor SalgadoNo ratings yet

- Model ByeLaws of Housing Cooperative SocietiesDocument65 pagesModel ByeLaws of Housing Cooperative SocietiesbluedremzNo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- C A N S L I MDocument7 pagesC A N S L I MIndi KinantiNo ratings yet

- Cooperative ManualDocument35 pagesCooperative ManualPratik MogheNo ratings yet

- GST India IntroductionDocument274 pagesGST India IntroductionChandana RajasriNo ratings yet

- Home Activity 3Document6 pagesHome Activity 3Don LopezNo ratings yet

- Information Collection Survey For The Mega Manila Subway Project in The Republic of The PhilippinesDocument226 pagesInformation Collection Survey For The Mega Manila Subway Project in The Republic of The PhilippinesLian Las Pinas100% (2)

- Lembar Jawaban 1 UPK (Kevin J)Document12 pagesLembar Jawaban 1 UPK (Kevin J)kevin jonathanNo ratings yet

- Rentberry Whitepaper enDocument59 pagesRentberry Whitepaper enKen Sidharta0% (1)

- Annual Report 2019Document228 pagesAnnual Report 2019Rohit PatelNo ratings yet

- Comair AnnualReportDocument76 pagesComair AnnualReportJanus CoetzeeNo ratings yet

- Essentials of a Contract - Formation, Validity, Performance & DischargeDocument25 pagesEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- Nava Bharat-2013-2014Document180 pagesNava Bharat-2013-2014SUKHSAGAR1969No ratings yet

- Securitization of Financial AssetsDocument7 pagesSecuritization of Financial Assetsnaglaa alyNo ratings yet

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorNo ratings yet

- Construction Budget: Project InformationDocument2 pagesConstruction Budget: Project InformationAlexandruDanielNo ratings yet

- Hair Salon Business Plan ExampleDocument20 pagesHair Salon Business Plan ExampleJamesnjiruNo ratings yet

- Major Assignment #3Document17 pagesMajor Assignment #3Elijah GeniesseNo ratings yet

- Scotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedDocument2 pagesScotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedChrisNo ratings yet

- Fin 444 CHP 4 SlidesDocument24 pagesFin 444 CHP 4 SlidesBappi MahiNo ratings yet

- Earnings Management in India: Managers' Fixation On Operating ProfitsDocument27 pagesEarnings Management in India: Managers' Fixation On Operating ProfitsVaibhav KaushikNo ratings yet

- SAS® Financial Management 5.5 Formula GuideDocument202 pagesSAS® Financial Management 5.5 Formula Guidejohannadiaz87No ratings yet

- CDP Revised Toolkit Jun 09Document100 pagesCDP Revised Toolkit Jun 09kittu1216No ratings yet

- HTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFDocument99 pagesHTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFДмитрий ЮхановNo ratings yet

- Joint Venture Master AgreementDocument176 pagesJoint Venture Master AgreementHaYoung KimNo ratings yet

- Chapter 12 Solutions ManualDocument82 pagesChapter 12 Solutions ManualbearfoodNo ratings yet

- 41 and 42 Tolentino Vs Secretary of FinanceDocument2 pages41 and 42 Tolentino Vs Secretary of FinanceYvon Baguio100% (1)

- Tracking Market GammaDocument11 pagesTracking Market Gammadeepak777100% (1)