Professional Documents

Culture Documents

ECON Managerial Accounting

Uploaded by

michellevngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECON Managerial Accounting

Uploaded by

michellevngCopyright:

Available Formats

McGraw-Hill/Irwin Copyright 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

CHAPTER 1

The Fundamentals of

Managerial Economics

Introduction

The manager

Economics

Managerial economics defined

Economics of Effective Management

Identifying goals and constraints

Recognize the nature and importance of profits

Understand incentives

Understand markets

Recognize the time value of money

Use marginal analysis

Learning managerial economics

1-2

Chapter Overview

Chapter One

Introduction

Chapter 1 focuses on defining managerial

economics, and illustrating how it is a valuable

tool for analyzing many business situations.

This chapter provides an overview of managerial

economics.

How do accounting profits and economic profits

differ?

Why is the difference important?

How do managers account for time gaps between

costs and revenues?

What guiding principle can managers use to maximize

profits?

1-3

Chapter Overview

The Manager

A person who directs resources to achieve a

stated goal.

Directs the efforts of others.

Purchases inputs used in the production of the

firms output.

Directs the product price or quality decisions.

1-4

Introduction

Economics

The science of making decisions in the

presence of scarce resources.

Resources are anything used to produce

a good or service, or achieve a goal.

Decisions are important because scarcity

implies trade-offs.

1-5

Introduction

The study of how to direct scarce resources in the

way that most efficiently achieves a managerial

goal.

Should a firm purchase components like disk

drives and chips from other manufacturers or

produce them within the firm?

Should the firm specialize in making one type of

computer or produce several different types?

How many computers should the firm produce,

and at what price should you sell them?

1-6

Introduction

Managerial Economics Defined

Basic principles comprising effective

management:

Identify goals and constraints.

Recognize the nature and importance of

profits.

Understand incentives.

Understand markets.

Recognize the time value of money.

Use marginal analysis.

1-7

Economics of Effective Management

Economics of Effective Management

The Nature and Importance of Profits

A typical firms objective is to maximize

profits.

Accounting profit

Total amount of money taken in from sales (total

revenue) minus the dollar cost of producing goods

or services.

Economic profit

The difference between total revenue and cost

opportunity cost.

Opportunity cost

The explicit cost of a resource plus the implicit cost of

giving up its best alternative.

1-8

Economics of Effective Management

The Role of Profits

Profit Principle:

Profits are a signal to resource holders

where resources are most highly

valued by society.

1-9

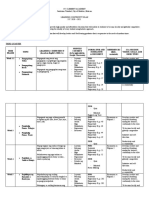

Economics of Effective Management

1-10

Power of

Input Suppliers

Supplier Concentration

Price/Productivity of

Alternative Inputs

Relationship-Specific

Investments

Supplier Switching Costs

Government Restraints

Power of

Buyers

Buyer Concentration

Price/Value of Substitute

Products or Services

Relationship-Specific

Investments

Customer Switching Costs

Government Restraints

Entry

Substitutes & Complements

Industry Rivalry

Concentration

Price, Quantity, Quality,

or Service Competition

Degree of Differentiation

Level, Growth,

and Sustainability

of Industry Profits

Entry Costs

Speed of Adjustment

Sunk Costs

Economies of Scale

Network Effects

Reputation

Switching Costs

Government Restraints

Price/Value of Surrogate Products

or Services

Price/Value of Complementary

Products or Services

Network Effects

Government

Restraints

Switching Costs

Timing of Decisions

Information

Government

Restraints

Economics of Effective Management

Five Forces and Industry Profitability

Understand Incentives

Changes in profits provide an incentive to

how resource holders use their resources.

Within a firm, incentives impact how

resources are used and how hard workers

work.

One role of a manager is to construct

incentives to induce maximal effort from

employees.

1-11

Economics of Effective Management

Two sides to every market transaction:

Buyer.

Seller.

Bargaining position of consumers and producers

is limited by three rivalries in economic

transactions:

Consumer-producer rivalry.

Consumer-consumer rivalry.

Producer-producer rivalry.

Government and the market.

1-12

Economics of Effective Management

Understand Markets

The Time Value of Money

Often a gap exists between the time

when costs are borne and benefits

received.

Managers can use present value

analysis to properly account for the

timing of receipts and expenditures.

1-13

Economics of Effective Management

Present Value Analysis 1

Present value of a single future value

The amount that would have to be invested

today at the prevailing interest rate to

generate the given future value:

=

1 +

Present value reflects the difference between

the future value and the opportunity cost of

waiting:

=

1-14

Economics of Effective Management

Present Value Analysis II

Present value of a stream of future values

=

1

1 +

1

+

2

1 +

2

++

1 +

or,

=

1 +

=1

1-15

Economics of Effective Management

Consider a project that returns the following

income stream:

Year 1, $10,000; Year 2, $50,000; and Year 3,

$100,000.

At an annual interest rate of 3 percent, what

is the present value of this income stream?

=

$10,000

1 +0.03

1

+

$50,000

1 +0.03

2

+

$100,000

1 +0.03

3

= $148,352.70

1-16

Economics of Effective Management

The Time Value of Money in Action

Net Present Value

The present value of the income stream

generated by a project minus the

current cost of the project:

=

1

1 +

1

+

2

1 +

2

++

1 +

0

1-17

Economics of Effective Management

Present value of decisions that indefinitely

generate cash flows:

=

0

+

1

1 +

1

+

2

1 +

2

+

3

1 +

3

+

Present value of this perpetual income stream

when the same cash flow is generated (

1

=

2

= = ):

1-18

Economics of Effective Management

Present Value of Indefinitely Lived Assets

Profit maximization principle

Maximizing profits means maximizing

the value of the firm, which is the

present value of current and future

profits.

1-19

Economics of Effective Management

Present Value and Profit Maximization

Present Value and Estimating Values of Firms I

The value of a firm with current profits

0

, with

no dividends paid out and expected, constant

profit growth rate of (assuming < ) is:

=

0

+

0

1 +

1 +

1

+

0

1 +

2

1 +

2

+

0

1 +

3

1 +

3

+

=

0

1 +

1-20

Economics of Effective Management

When dividends are immediately paid out of

current profits, the present value of the firm is

(at ex-dividend date):

0

=

0

1 +

1-21

Economics of Effective Management

Present Value and Estimating Values of Firms II

Short-term and long-term profits principle

If the growth rate in profits is less than

the interest rate and both are constant,

maximizing current (short-term) profits

is the same as maximizing long-term

profits.

1-22

Economics of Effective Management

Short-Term versus Long-term Profits

Given a control variable, , of a

managerial objective, denote the

total benefit as .

total cost as .

Managers objective is to maximize net

benefits:

=

1-23

Economics of Effective Management

Marginal Analysis

How can the manager maximize net benefits?

Use marginal analysis

Marginal benefit:

The change in total benefits arising from a

change in the managerial control variable, .

Marginal cost:

The change in the total costs arising from a

change in the managerial control variable, .

Marginal net benefits:

=

1-24

Economics of Effective Management

Using Marginal Analysis

Marginal principle

To maximize net benefits, the manager

should increase the managerial control

variable up to the point where marginal

benefits equal marginal costs. This level of

the managerial control variable corresponds

to the level at which marginal net benefits

are zero; nothing more can be gained by

further changes in that variable.

1-25

Economics of Effective Management

Marginal Analysis Principle I

Marginal Principle II

Marginal principle (calculus alternative)

Slope of a continuous function is the

derivative /marginal value of that function:

=

1-26

Economics of Effective Management

Marginal Analysis In Action

It is estimated that the benefit and cost

structure of a firm is:

= 250 4

2

=

2

Find the and functions.

= 250 8

= 2

What value of makes zero?

250 8 = 2 = 25

1-27

Economics of Effective Management

1-28

Quantity

(Control Variable)

Total benefits

Total costs

0

Maximum total benefits

Maximum net

benefits

Economics of Effective Management

Determining the Optimal Level of a Control Variable

1-29

Quantity

(Control Variable)

Net benefits

0

Maximum

net benefits

Slope =()

= = 0

Economics of Effective Management

Determining the Optimal Level of a Control Variable II

1-30

Quantity

(Control Variable)

Marginal

benefits, costs

and net benefits

0

Maximum net

benefits

Economics of Effective Management

Determining the Optimal Level of a Control Variable III

Incremental revenues

The additional revenues that stem from a yes-or-

no decision.

Incremental costs

The additional costs that stem from a yes-or-no

decision.

Thumbs up decision

> .

Thumbs down decision

< .

1-31

Economics of Effective Management

Incremental Decisions

Learning Managerial Economics

Practice, practice, practice

Learn terminology

Break down complex issues into

manageable components.

Helps economics practitioners

communicate efficiently.

1-32

Learning Managerial Economics

Conclusion

Make sure you include all costs and

benefits when making decisions

(opportunity costs).

When decisions span time, make sure you

are comparing apples to apples (present

value analysis).

Optimal economic decisions are made at

the margin (marginal analysis).

1-33

Conclusion

You might also like

- ME Chapter 1 FundamentalsDocument33 pagesME Chapter 1 FundamentalsSivasakti MarimuthuNo ratings yet

- The Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinDocument33 pagesThe Fundamentals of Managerial Economics: Mcgraw-Hill/IrwinRanyDAmandaNo ratings yet

- Fundamentals of ManagementDocument25 pagesFundamentals of ManagementCC CCNo ratings yet

- Managerial Economics & Business StrategyDocument23 pagesManagerial Economics & Business StrategySuryadyDarsonoNo ratings yet

- Managerial Economics & Business StrategyDocument12 pagesManagerial Economics & Business StrategyInanda Shinta AnugrahaniNo ratings yet

- Innovation in The Ghanaian Financial MarketDocument30 pagesInnovation in The Ghanaian Financial MarketNYAMEKYE ADOMAKONo ratings yet

- Chapter 1 Fundamentals of Managerial Economics PDFDocument25 pagesChapter 1 Fundamentals of Managerial Economics PDFNeni BangunNo ratings yet

- Manajerial 01Document33 pagesManajerial 01DiditNo ratings yet

- The Manager: - A Person Who Directs Resources To Achieve A Stated GoalDocument17 pagesThe Manager: - A Person Who Directs Resources To Achieve A Stated GoalKentaro Panergo NumasawaNo ratings yet

- IPPTChap 001Document42 pagesIPPTChap 001Aaron JangNo ratings yet

- Chapter2 Managerial-Economics P1Document15 pagesChapter2 Managerial-Economics P1Yve LuelleNo ratings yet

- Managerial Economics For ManagersDocument30 pagesManagerial Economics For ManagersGautam BindlishNo ratings yet

- Chapter One Introduction To Managerial EconomicsDocument20 pagesChapter One Introduction To Managerial EconomicsAmar EliasNo ratings yet

- Chapter 1 Introduction To Engineering EconomyDocument55 pagesChapter 1 Introduction To Engineering EconomyNadia IsmailNo ratings yet

- Lesson 01b, BB Managerial Econ & Goals of The FirmDocument68 pagesLesson 01b, BB Managerial Econ & Goals of The FirmAbdiweli mohamedNo ratings yet

- Scope of Managerial Economics CH 1Document13 pagesScope of Managerial Economics CH 1hajra khanNo ratings yet

- Managerial Eco1Document190 pagesManagerial Eco1ManojNo ratings yet

- Roles and Responsibilities, Concepts of EconomicsDocument22 pagesRoles and Responsibilities, Concepts of EconomicsUmamaheswari RajanNo ratings yet

- Introduction MBA I (13 15) FDocument17 pagesIntroduction MBA I (13 15) Fmanishkhandal88No ratings yet

- Performance MeasurementDocument6 pagesPerformance Measurementcherrymia canomayNo ratings yet

- Session 2.1Document120 pagesSession 2.1anuhya_katariNo ratings yet

- ACCA P5 PresentationDocument51 pagesACCA P5 PresentationDobu KolobingoNo ratings yet

- 01 Managerial EconomicsDocument24 pages01 Managerial EconomicsscribdwithyouNo ratings yet

- ch01 Accounting ManagerialDocument43 pagesch01 Accounting ManagerialNasyrah KautsarahNo ratings yet

- Business-Economics SamenvattingDocument41 pagesBusiness-Economics SamenvattingAlexander BoshraNo ratings yet

- Balance Scorecard and Strategic Analysis of Operating IncomeDocument47 pagesBalance Scorecard and Strategic Analysis of Operating IncomeMelody Anne Duero PabelloNo ratings yet

- The Managerial Finance FunctionDocument42 pagesThe Managerial Finance FunctionSherif ElkadyNo ratings yet

- Chapter 1: Managers, Profits, and Markets: Ninth EditionDocument55 pagesChapter 1: Managers, Profits, and Markets: Ninth EditionMirza Golam Abbas ShahneelNo ratings yet

- Nature and Scope of Managerial EconomicsDocument70 pagesNature and Scope of Managerial Economicsnatalie clyde matesNo ratings yet

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidNo ratings yet

- An Electronic Presentation by Douglas Cloud: Pepperdine UniversityDocument42 pagesAn Electronic Presentation by Douglas Cloud: Pepperdine UniversityburningmotivationNo ratings yet

- Mangerial EconomicsDocument37 pagesMangerial EconomicsevelynNo ratings yet

- EconomicsDocument16 pagesEconomicsShahab AhmedNo ratings yet

- Nature and Scope PDFDocument6 pagesNature and Scope PDFSanchit MiglaniNo ratings yet

- Nature and Scope of Managerial EconomicsDocument26 pagesNature and Scope of Managerial EconomicsPawan KumarNo ratings yet

- Management Control System - Revenue & Expense CenterDocument23 pagesManagement Control System - Revenue & Expense CenterCitra Dewi Wulansari0% (1)

- Module 2 Evaluating Decentralized OperationsDocument36 pagesModule 2 Evaluating Decentralized Operationscurly030125No ratings yet

- Module 1 - Nature and Scope of Managerial EconomicsDocument30 pagesModule 1 - Nature and Scope of Managerial Economicswrongthing9025100% (1)

- Theory of The FirmDocument15 pagesTheory of The FirmDaud SulaimanNo ratings yet

- Unit-4 Valuations BasicsDocument7 pagesUnit-4 Valuations BasicsPrà ShâñtNo ratings yet

- Topic 3 - Responsibility Acctg TPDocument51 pagesTopic 3 - Responsibility Acctg TPFunyoungNo ratings yet

- Financial Accounting: Section 3Document54 pagesFinancial Accounting: Section 3LOINI IIPUMBUNo ratings yet

- 3 Semester IMBA: Principles of EconomicsDocument30 pages3 Semester IMBA: Principles of EconomicsjakikhanNo ratings yet

- Unit 1Document101 pagesUnit 1atulkumar.rise1No ratings yet

- GJDocument58 pagesGJKishore ChakravarthyNo ratings yet

- Blocher8e EOC SM Ch18 Final StudentDocument50 pagesBlocher8e EOC SM Ch18 Final StudentKatelynNo ratings yet

- Business Economics: Dr. Ashaq HussainDocument27 pagesBusiness Economics: Dr. Ashaq HussainMaanvi RockzzNo ratings yet

- MCS Paper Solution FinalDocument207 pagesMCS Paper Solution FinalSuhana SharmaNo ratings yet

- Financial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsiDocument18 pagesFinancial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsifitriEmpiiNo ratings yet

- Financial Management: Key Concepts and SkillsDocument70 pagesFinancial Management: Key Concepts and SkillsAakash KamthaneNo ratings yet

- The Role, History, and Direction of Management AccountingDocument38 pagesThe Role, History, and Direction of Management AccountingAlmira Muthia IslamiNo ratings yet

- Strategy Execution - DiscussionDocument22 pagesStrategy Execution - DiscussionAayushya ChaturvediNo ratings yet

- Tools of MEDocument24 pagesTools of MEHaritha IduriNo ratings yet

- Quick RecapDocument20 pagesQuick RecapHoàngAnhNo ratings yet

- CHAPTER 1 Financial Management FunctionDocument21 pagesCHAPTER 1 Financial Management Functionhisham ashrafNo ratings yet

- The Manager and Management AccountingDocument25 pagesThe Manager and Management AccountingNCTNo ratings yet

- Introduction To Accounting and Business Decision Making: ©2020 John Wiley & Sons Australia LTDDocument44 pagesIntroduction To Accounting and Business Decision Making: ©2020 John Wiley & Sons Australia LTDHasan FiqihNo ratings yet

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- TestDocument4 pagesTestAlina DushachenkoNo ratings yet

- Business Plan Work ImmersionDocument24 pagesBusiness Plan Work ImmersionAvrylle Maneja67% (3)

- Atomic Physics Exam Qs StudentDocument7 pagesAtomic Physics Exam Qs StudentfitzttNo ratings yet

- Air ConditionerDocument131 pagesAir ConditionerRahul AnsariNo ratings yet

- 2014-05-13-VGT Press Release - Swiss SigningDocument1 page2014-05-13-VGT Press Release - Swiss SigningSwissmissionEUNo ratings yet

- Implementing (7, 4) Hamming Code Using CPLD On VHDLDocument6 pagesImplementing (7, 4) Hamming Code Using CPLD On VHDLmohanNo ratings yet

- My Beamer TalkDocument85 pagesMy Beamer TalkOtmane El ouardiNo ratings yet

- ReadingDocument3 pagesReadingMuhamad IbrohimNo ratings yet

- BryophytesDocument18 pagesBryophytesDiego Andres Moreno GaonaNo ratings yet

- FILIPINO 2 LEARNING PLAN 3rd QuarterDocument4 pagesFILIPINO 2 LEARNING PLAN 3rd QuarterMary Kryss DG SangleNo ratings yet

- Geography Chapter 2 - Land, Soil, Water, Natural Vegetation & Wildlife ResourcesDocument3 pagesGeography Chapter 2 - Land, Soil, Water, Natural Vegetation & Wildlife ResourcesGarvit BilewalNo ratings yet

- Youth Protection WaiverDocument1 pageYouth Protection WaiverKatie McCarthyNo ratings yet

- 曼昆《经济学原理第三版》宏观分册原版中英文双语PPT课件Chap 25Document76 pages曼昆《经济学原理第三版》宏观分册原版中英文双语PPT课件Chap 25Jia Wei MiaoNo ratings yet

- Lec04 - Types of RegistersDocument17 pagesLec04 - Types of RegistersBilal ImranNo ratings yet

- Everyday Conversation 3CDocument10 pagesEveryday Conversation 3Cjiyoon KimNo ratings yet

- Spinel GemstoneDocument34 pagesSpinel GemstoneKen LamNo ratings yet

- Tutorial Collection SimpleDocument11 pagesTutorial Collection SimplerallupymeyraldoNo ratings yet

- Exxonmobil Interview Questions and AnswersDocument60 pagesExxonmobil Interview Questions and Answersrajkamal eshwar100% (3)

- 3 - Cellular Respiration NotesDocument22 pages3 - Cellular Respiration Notesapi-375285021No ratings yet

- Full Download Test Bank For Chemistry Principles and Reactions 8th Edition by Masterton PDF Full ChapterDocument34 pagesFull Download Test Bank For Chemistry Principles and Reactions 8th Edition by Masterton PDF Full Chapteryen.resiege.ffrq100% (15)

- Neurohealth Properties of Hericium Erinaceus MycelDocument11 pagesNeurohealth Properties of Hericium Erinaceus Myceldokan42No ratings yet

- Transient Torque Rise of A Modern Light Duty Diesel Engine With Variable Valve ActuationDocument12 pagesTransient Torque Rise of A Modern Light Duty Diesel Engine With Variable Valve ActuationdheepanasNo ratings yet

- Bayesian Cost Effectiveness Analysis With The R Package BCEA PDFDocument181 pagesBayesian Cost Effectiveness Analysis With The R Package BCEA PDFNelson Carvas JrNo ratings yet

- Restful ApiDocument27 pagesRestful ApiBlank UserNo ratings yet

- Guard Rail Cataloge PDFDocument28 pagesGuard Rail Cataloge PDFreza acbariNo ratings yet

- Unit 8 Technical Analysis: ObjectivesDocument13 pagesUnit 8 Technical Analysis: Objectivesveggi expressNo ratings yet

- You Are The ReasonDocument7 pagesYou Are The ReasonSindi Ghassani SabilaNo ratings yet

- Tomorrow Is WaitingDocument8 pagesTomorrow Is WaitingsrplsmskNo ratings yet

- Esp32-Wroom-32se Datasheet enDocument26 pagesEsp32-Wroom-32se Datasheet enWesllen Dias SouzaNo ratings yet

- EPR in Waste ManagementDocument11 pagesEPR in Waste Managementdorexp17No ratings yet