Professional Documents

Culture Documents

Ch1 Foundations - Engineering Economic Exercise

Uploaded by

Lei Yin0 ratings0% found this document useful (0 votes)

123 views39 pagesEngineering Economy covers time value of money, economic equivalence, and cost estimation. Engineers must be able to incorporate economic analysis into their creative efforts. A proper economic analysis for selection and execution is a fundamental task of engineering.

Original Description:

Original Title

Ch1 Foundations_Engineering Economic Exercise

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEngineering Economy covers time value of money, economic equivalence, and cost estimation. Engineers must be able to incorporate economic analysis into their creative efforts. A proper economic analysis for selection and execution is a fundamental task of engineering.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

123 views39 pagesCh1 Foundations - Engineering Economic Exercise

Uploaded by

Lei YinEngineering Economy covers time value of money, economic equivalence, and cost estimation. Engineers must be able to incorporate economic analysis into their creative efforts. A proper economic analysis for selection and execution is a fundamental task of engineering.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 39

2012 by McGraw-Hill, New York, N.

Y All Rights Reserved

1-1

Lecture slides to accompany

Engineering Economy

7

th

edition

Leland Blank

Anthony Tarquin

Chapter 1

Foundations Of

Engineering

Economy

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-2

TOPIC OUTCOMES

1. Role in decision

making

2. Study approach

3. Ethics and economics

4. Interest rate

5. Terms and symbols

6. Cash flows

7. Economic equivalence

8. Simple and compound

interest

9. Minimum attractive

rate of return

10. Spreadsheet

functions

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-3

Why Engineering Economy is Important to

Engineers

Engineers design and create

Designing involves economic decisions

Engineers must be able to incorporate economic

analysis into their creative efforts

Often engineers must select and implement from

multiple alternatives

Understanding and applying time value of money,

economic equivalence, and cost estimation are vital

for engineers

A proper economic analysis for selection and

execution is a fundamental task of engineering

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-4

Time Value of Money (TVM)

Description: TVM explains the change in the

amount of money over time for funds owed by

or owned by a corporation (or individual)

Corporate investments are expected to earn a return

Investment involves money

Money has a time value

The time value of money is the most

important concept in engineering

economy

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-5

Engineering Economy

Engineering Economy involves

Formulating

Estimating, and

Evaluating

expected economic outcomes of alternatives

designed to accomplish a defined purpose

Easy-to-use math techniques simplify the

evaluation

Estimates of economic outcomes can be

deterministic or stochastic in nature

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-6

General Steps for Decision Making Processes

1. Understand the problem define objectives

2. Collect relevant information

3. Define the set of feasible alternatives

4. Identify the criteria for decision making

5. Evaluate the alternatives and apply

sensitivity analysis

6. Select the best alternative

7. Implement the alternative and monitor

results

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-7

Steps in an Engineering Economy Study

Ethics Different Levels

Universal morals or ethics Fundamental

beliefs: stealing, lying, harming or murdering

another are wrong

Personal morals or ethics Beliefs that an

individual has and maintains over time; how a

universal moral is interpreted and used by

each person

Professional or engineering ethics Formal

standard or code that guides a person in work

activities and decision making

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-8

Code of Ethics for Engineers

All disciplines have a formal code of ethics. National Society of

Professional Engineers (NSPE) maintains a code specifically for

engineers; many engineering professional societies have their own code

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-9

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-10

Interest and Interest Rate

Interest the manifestation of the time value of money

Fee that one pays to use someone elses money

Difference between an ending amount of money and

a beginning amount of money

Interest = amount owed now principal

Interest rate Interest paid over a time period expressed

as a percentage of principal

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-11

Rate of Return

Interest earned over a period of time is expressed as a

percentage of the original amount (principal)

interest accrued per time unit

Rate of return (%) = x 100%

original amount

Borrowers perspective interest rate paid

Lenders or investors perspective rate of return earned

Interest paid Interest earned

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-12

Interest rate Rate of return

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-13

Commonly used Symbols

t = time, usually in periods such as years or months

P = value or amount of money at a time t

designated as present or time 0

F = value or amount of money at some future

time, such as at t = n periods in the future

A = series of consecutive, equal, end-of-period

amounts of money

n = number of interest periods; years, months

i = interest rate or rate of return per time period;

percent per year or month

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-14

Cash Flows: Terms

Cash Inflows Revenues (R), receipts,

incomes, savings generated by projects and

activities that flow in. Plus sign used

Cash Outflows Disbursements (D), costs,

expenses, taxes caused by projects and

activities that flow out. Minus sign used

Net Cash Flow (NCF) for each time period:

NCF = cash inflows cash outflows = R D

End-of-period assumption:

Funds flow at the end of a given interest period

Cash Flows: Estimating

Point estimate A single-value estimate of a

cash flow element of an alternative

Cash inflow: Income = $150,000 per month

Range estimate Min and max values that

estimate the cash flow

Cash outflow: Cost is between $2.5 M and $3.2 M

Point estimates are commonly used; however, range estimates

with probabilities attached provide a better understanding of

variability of economic parameters used to make decisions

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-15

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-16

Cash Flow Diagrams

What a typical cash flow diagram might look like

0 1 2 n - 1 n

Draw a time line

One time

period

0 1 2 n-1 n

Show the cash flows (to approximate scale)

Cash flows are shown as directed arrows: + (up) for inflow

- (down) for outflow

Always assume end-of-period cash flows

Time

F = $100

P = $-80

Cash Flow Diagram Example

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-17

Plot observed cash flows over last 8 years and estimated sale next

year for $150. Show present worth (P) arrow at present time, t = 0

Economic Equivalence

Definition: Combination of interest rate (rate of

return) and time value of money to determine

different amounts of money at different points

in time that are economically equivalent

How it works: Use rate i and time t in upcoming

relations to move money (values of P, F and A)

between time points t = 0, 1, , n to make

them equivalent (not equal) at the rate i

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-18

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-19

Example of Equivalence

Different sums of money at different times may

be equal in economic value at a given rate

0 1

$100 now

$110

Rate of return = 10% per year

$100 now is economically equivalent to $110 one year from

now, if the $100 is invested at a rate of 10% per year.

Year

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-20

Simple and Compound Interest

Simple Interest

Interest is calculated using principal only

Interest = (principal)(number of periods)(interest rate)

I = Pni

Example: $100,000 lent for 3 years at simple i = 10%

per year. What is repayment after 3 years?

Interest = 100,000(3)(0.10) = $30,000

Total due = 100,000 + 30,000 = $130,000

Simple and Compound Interest

Compound Interest

Interest is based on principal plus all accrued interest

That is, interest compounds over time

Interest = (principal + all accrued interest) (interest rate)

Interest for time period t is

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-21

Compound Interest Example

Example: $100,000 lent for 3 years at i = 10% per

year compounded. What is repayment after 3

years?

Interest, year 1: I

1

= 100,000(0.10) = $10,000

Total due, year 1: T

1

= 100,000 + 10,000 = $110,000

Interest, year 2: I

2

= 110,000(0.10) = $11,000

Total due, year 2: T

2

= 110,000 + 11,000 = $121,000

Interest, year 3: I

3

= 121,000(0.10) = $12,100

Total due, year 3: T

3

= 121,000 + 12,100 = $133,100

Compounded: $133,100 Simple: $130,000

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-22

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-23

Minimum Attractive Rate of Return

MARR is a reasonable rate

of return (percent)

established for evaluating

and selecting alternatives

An investment is justified

economically if it is

expected to return at least

the MARR

Also termed hurdle rate,

benchmark rate and cutoff

rate

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-24

MARR Characteristics

MARR is established by the financial

managers of the firm

MARR is fundamentally connected to the cost

of capital

Both types of capital financing are used to

determine the weighted average cost of capital

(WACC) and the MARR

MARR usually considers the risk inherent to a

project

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-25

Types of Financing

Equity Financing Funds either from retained

earnings, new stock issues, or owners

infusion of money.

Debt Financing Borrowed funds from outside

sources loans, bonds, mortgages, venture

capital pools, etc. Interest is paid to the lender

on these funds

For an economically justified project

ROR MARR > WACC

EXAMPLE of WACC

If you wish to buy a car by paying 40% using

your savings that earns 10% per year and

another 60% by using credit card at 18% per

year. What is your weighted average cost of

capital (WACC)? If your MARR=15% and your

ROR=18%, would you proceed with the

purchase?

WACC=0.4 (10) + 0.6(18) = 14.8% per year

Since WACC<MARR so proceed with the

purchase

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-26

Opportunity Cost

Definition: Largest rate of return of all projects not

accepted (forgone) due to a lack of capital funds

If no MARR is set, the ROR of the first project not undertaken

establishes the opportunity cost

Example: Assume MARR = 10%. Project A, not

funded due to lack of funds, is projected to

have ROR

A

= 13%. Project B has ROR

B

= 15%

and is funded because it costs less than A

Opportunity cost is 13%, i.e., the opportunity to

make an additional 13% is forgone by not

funding project A

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-27

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-28

Introduction to Spreadsheet Functions

Excel financial functions

Present Value, P: = PV(i%,n,A,F)

Future Value, F: = FV(i%,n,A,P)

Equal, periodic value, A: = PMT(i%,n,P,F)

Number of periods, n: = NPER((i%,A,P,F)

Compound interest rate, i: = RATE(n,A,P,F)

Compound interest rate, i: = IRR(first_cell:last_cell)

Present value, any series, P: = NPV(i%,second_cell:last_cell) + first_cell

Example: Estimates are P = $5000 n = 5 years i = 5% per year

Find A in $ per year

Function and display: = PMT(5%, 5, 5000) displays A = $1154.87

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-29

Chapter Summary

Engineering Economy fundamentals

Time value of money

Economic equivalence

Introduction to capital funding and MARR

Spreadsheet functions

Interest rate and rate of return

Simple and compound interest

Cash flow estimation

Cash flow diagrams

End-of-period assumption

Net cash flow

Perspectives taken for cash flow estimation

Ethics

Universal morals and personal morals

Professional and engineering ethics (Code of Ethics)

REVIEW QUESTIONS

1.The concept that different sums of money at

different points in time can be said to be equal

to each other is known as:

A. Evaluation criterion

B. Equivalence

C. Cash flow

D. Intangible factors

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-30

REVIEW QUESTIONS

2.The evaluation criterion that is usually used

in an economic analysis is:

A. Time to completion

B. Technical feasibility

C. Sustainability

D. Financial units (dollars or other currency)

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-31

REVIEW QUESTIONS

3. All of the following are examples of each

cash flows, except:

A. Asset salvage value

B. Income taxes

C. Operating cost of assets

D. First cost of asset

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-32

REVIEW QUESTIONS

4. In most engineering economy studies, the

best alternative is the one that:

A. Will last the longest time

B. Is most politically correct

C. Is easiest to implement

D. Has the lowest cost

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-33

REVIEW QUESTIONS

5.All of the following are examples of equity

financing, except:

A. Mortgage

B. Money from savings

C. Cash on hand

D. Retained earnings

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-34

REVIEW QUESTIONS

6.At an interest rate of 10% per year, the

equivalent amount of $10,000 one year ago is

closest to:

A. $8264

B.$9091

C.$11,000

D.$12,000

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-35

REVIEW QUESTIONS

7.Assume that you and your best friend each have $1000 to

invest. You invest your money in a fund that pays 10% per year

compound interest. Your friend invests her money at a bank that

pays 10% per year simple interest. At the end of 1 year, the

difference in the total amount for each of you is:

A. You have $10 more than she does

B. You have $100 more than she does

C. You both have the same amount of money

C. She has $10 more than you do

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-36

REVIEW QUESTIONS

8.The time it would take for a given sum of

money to double at 4% per year simple

interest is closest to:

A. 30 years

B. 25 years

C. 20 years

D. 10 years

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-37

REVIEW QUESTIONS

9.To finance a new project costing $30 million,

a company borrowed $21 million at 16% per

year interest and used retained earnings

valued at 12% per year for the remainder of the

investment. The companys weighted average

cost of capital for the project was closest to:

A.12.5% B.13.6% C.14.8% D.15.6%

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-38

REVIEW QUESTIONS

10.Amounts of $1000 1 year ago and $1345.60

1 year hence are equivalent at what compound

interest per year?

A.12.5% per year

B.14.8% per year

C.17.2% per year

D. None of the above

2012 by McGraw-Hill, New York, N.Y All Rights Reserved

1-39

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cot2 DLPDocument5 pagesCot2 DLPLowie D GacetaNo ratings yet

- Plant Design Costing RevisionDocument78 pagesPlant Design Costing RevisionLei YinNo ratings yet

- Ch6 AnnualWorthAnalysisDocument15 pagesCh6 AnnualWorthAnalysisLei YinNo ratings yet

- Assignment #1 (Engineering Economy)Document2 pagesAssignment #1 (Engineering Economy)Lei YinNo ratings yet

- 04 Script Examples Solid Liquid ExtractionDocument11 pages04 Script Examples Solid Liquid ExtractionLei YinNo ratings yet

- 2.1 Data AnalysisDocument8 pages2.1 Data AnalysisLei YinNo ratings yet

- Simulia Isight Brochure PDFDocument6 pagesSimulia Isight Brochure PDFlingesh1892No ratings yet

- Dumas 1998Document48 pagesDumas 1998Yuming MaNo ratings yet

- Einstein's Theory of Specific Heats: Classical Concept Review 23Document2 pagesEinstein's Theory of Specific Heats: Classical Concept Review 23Agres KrismantonaNo ratings yet

- DFT Scan Cells Network DesignDocument3 pagesDFT Scan Cells Network Designrahul m sNo ratings yet

- Introduction To Signal Flow Graph (SFG) : Samuel Jefferson MasonDocument30 pagesIntroduction To Signal Flow Graph (SFG) : Samuel Jefferson MasonSirshenduNo ratings yet

- Mini ProjectDocument12 pagesMini ProjectParth PethkarNo ratings yet

- Short-Term Electricity Demand Forecasting With MARS, SVR and ARIMADocument16 pagesShort-Term Electricity Demand Forecasting With MARS, SVR and ARIMAharri8026No ratings yet

- Fea Module 1Document56 pagesFea Module 1NAVADE SATISHNo ratings yet

- Tess ElationDocument7 pagesTess ElationBoy ShahNo ratings yet

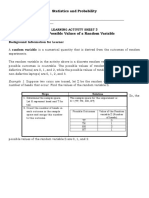

- Statistics and Probability 12 LAS 3Document3 pagesStatistics and Probability 12 LAS 3Cfourr SteelWorksNo ratings yet

- U1 Classical CryptographyDocument13 pagesU1 Classical CryptographyDjsjsbNo ratings yet

- Brain Tumor MriDocument23 pagesBrain Tumor MrisekharraoNo ratings yet

- Problems and Exercises Assigned For ELEC4502 - Week 0Document7 pagesProblems and Exercises Assigned For ELEC4502 - Week 0voonmingchooNo ratings yet

- 1 s2.0 S0020722506000942 MainDocument13 pages1 s2.0 S0020722506000942 MainAyushmanSrivastavaNo ratings yet

- 8509-Production & Operations ManagementDocument6 pages8509-Production & Operations ManagementHassan Malik100% (1)

- Assignment 3 (Measurable Functions)Document2 pagesAssignment 3 (Measurable Functions)EDU CIPANANo ratings yet

- Chapter 3-Linear Functions of Random VariablesDocument25 pagesChapter 3-Linear Functions of Random VariablesStr.EngNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument40 pagesCost Volume Profit (CVP) AnalysisAnne PrestosaNo ratings yet

- Research Methods, 9Th Edition: Theresa L. White and Donald H. McburneyDocument145 pagesResearch Methods, 9Th Edition: Theresa L. White and Donald H. McburneyKassandra MartinezNo ratings yet

- Como Baixar o ForgeDocument3 pagesComo Baixar o ForgejohncenaatuttutuNo ratings yet

- Lesson 1 MMWDocument12 pagesLesson 1 MMWAuria Graceil AlabasoNo ratings yet

- Finite Mixture Modelling Model Specification, Estimation & ApplicationDocument11 pagesFinite Mixture Modelling Model Specification, Estimation & ApplicationPepe Garcia EstebezNo ratings yet

- Extrusion Process: 6.3.1 Direct Extrusion (Also Called Forward Extrusion) Is Illustrated in Figure (6.1) - ADocument6 pagesExtrusion Process: 6.3.1 Direct Extrusion (Also Called Forward Extrusion) Is Illustrated in Figure (6.1) - AchandanNo ratings yet

- A Genetic Algorithm-Based Classification Approach For Multicriteria ABC Analysis.Document32 pagesA Genetic Algorithm-Based Classification Approach For Multicriteria ABC Analysis.Fernando GómezNo ratings yet

- Variable Speed Drives Altivar Machine ATV320: Catalog MarchDocument48 pagesVariable Speed Drives Altivar Machine ATV320: Catalog MarchDoug SantosNo ratings yet

- Milano LecturesDocument60 pagesMilano LecturesSkiptippNo ratings yet

- Lesson Plan in Mathematics II: I. ObjectivesDocument4 pagesLesson Plan in Mathematics II: I. ObjectivesLim TorresNo ratings yet

- Calculating Missing AnglesDocument18 pagesCalculating Missing AnglesDairo AbiodunNo ratings yet

- Bolted Busbar Connections With Longitudinal Slots: July 2010Document6 pagesBolted Busbar Connections With Longitudinal Slots: July 2010wy6279No ratings yet