Professional Documents

Culture Documents

Chap 01

Uploaded by

Indra SelvarathinamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 01

Uploaded by

Indra SelvarathinamCopyright:

Available Formats

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc.

, 1999

Overview

I. Introduction

II. The Economics of Effective Management

Identify Goals and Constraints

Recognize the Role of Profits

Understand Incentives

Understand Markets

Recognize the Time Value of Money

Use Marginal Analysis

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Managerial Economics

Manager

A person who directs resources to achieve a stated goal.

Economics

The science of making decisions in the presence of

scare resources.

Managerial Economics

The study of how to direct scarce resources in the way

that most efficiently achieves a managerial goal.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Economic vs. Accounting

Profits

Accounting Profits

Total revenue (sales) minus dollar cost of producing

goods or services

Reported on the firms income statement

Economic Profits

Total revenue minus total opportunity cost

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Opportunity Cost

Accounting Costs

The explicit costs of the resources needed to produce

produce goods or services

Reported on the firms income statement

Opportunity Cost

The cost of the explicit and implicit resources that are

foregone when a decision is made

Economic Profits

Total revenue minus total opportunity cost

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Market Interactions

Consumer-Producer Rivalry

Consumers attempt to locate low prices, while producers

attempt to charge high prices

Consumer-Consumer Rivalry

Scarcity of goods reduces the negotiating power of

consumers as they compete for the right to those goods

Producer-Producer Rivalry

Scarcity of consumers causes producers to compete with

one another for the right to service customers

The Role of Government

Disciplines the market process

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

The Time Value of Money

Present value (PV) of an amount (FV) to be

received at the end of n periods when the

per-period interest rate is i:

PV

FV

i

n

1

Examples?

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Present Value of a Series

Present value of a stream of future amounts

(FV

t

) received at the end of each period for

n periods:

PV

FV

i

FV

i

FV

i

n

n

1

1

2

2

1 1 1

...

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Net Present Value

Suppose a manager can purchase a stream of

future receipts (FV

t

) by spending C

0

dollars

today. The NPV of such a decision is

NPV C

FV

i

FV

i

FV

i

n

n

0

1

1

2

2

1 1 1

...

NPV < 0: Reject

NPV > 0: Accept

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Firm Valuation

The value of a firm equals the present value

of all its future profits

PV = S

p

t

/ (1 + i)

t

If profits grow at a constant rate, g < i, then:

PV = p

o

1i) / ( i - g), p

o

current profit level.

Maximizing Short-Term Profits

If the growth rate in profits < interest rate and both

remain constant, maximizing the present value of all

future profits is the same as maximizing current profits.

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Control Variables

Output

Price

Product Quality

Advertising

R&D

Basic Managerial Question: How much of

the control variable should be used to

maximize net benefits?

Marginal (Incremental)

Analysis

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Net Benefits

Net Benefits = Total Benefits - Total Costs

Profits = Revenue - Costs

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Marginal Benefit (MB)

Change in total benefits arising from a

change in the control variable, Q:

MB = DB / DQ

Slope (calculus derivative) of the total

benefit curve

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Marginal Cost (MC)

Change in total costs arising from a change

in the control variable, Q:

MC = DC / DQ

Slope (calculus derivative) of the total cost

curve

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Marginal Principle

To maximize net benefits, the managerial

control variable should be increased up to

the point where MB = MC

MB > MC means the last unit of the control

variable increased benefits more than it

increased costs

MB < MC means the last unit of the control

variable increased costs more than it

increased benefits

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

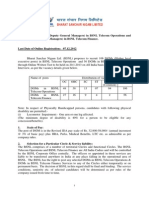

The Geometry of Optimization

Q

Benefits & Costs

Benefits

Costs

Q*

B

C

Slope = MC

Slope =MB

Michael R. Baye, Managerial Economics and Business Strategy, 3e. The McGraw-Hill Companies, Inc. , 1999

Summary

Make sure you include all costs and benefits

when making decisions (opportunity cost)

When decisions span time, make sure you

are comparing apples to apples (PV

analysis)

Optimal economic decisions are made at the

margin (marginal analysis)

You might also like

- Theory PDFDocument33 pagesTheory PDFStan Smith100% (2)

- What, Why, How: Jen Linkova Aka Furry Openwall, IncDocument61 pagesWhat, Why, How: Jen Linkova Aka Furry Openwall, IncBilal LatifNo ratings yet

- Help Font Installation PDFDocument4 pagesHelp Font Installation PDFsandotcomNo ratings yet

- CMD 230415Document4 pagesCMD 230415Indra SelvarathinamNo ratings yet

- 100 Amazing FactsDocument5 pages100 Amazing FactsAnup DashNo ratings yet

- B 904 Bdea: Áßö Õ Ò Gßóõà Gßú? - Õßs Euõ N (Pøí GêxDocument4 pagesB 904 Bdea: Áßö Õ Ò Gßóõà Gßú? - Õßs Euõ N (Pøí GêxIndra SelvarathinamNo ratings yet

- Ntea SupportDocument2 pagesNtea SupportIndra SelvarathinamNo ratings yet

- FBZRDocument3 pagesFBZRIndra SelvarathinamNo ratings yet

- FibreChannel Maria LunaDocument20 pagesFibreChannel Maria LunaIndra SelvarathinamNo ratings yet

- Chellotranz RatesDocument12 pagesChellotranz RatesIndra SelvarathinamNo ratings yet

- Tejas End of SalesDocument3 pagesTejas End of SalesIndra SelvarathinamNo ratings yet

- 4 EMS Installation ProcedureDocument9 pages4 EMS Installation ProcedureIndra SelvarathinamNo ratings yet

- Syllabus PDFDocument9 pagesSyllabus PDFevsgoud_goudNo ratings yet

- Tejas End of SalesDocument3 pagesTejas End of SalesIndra SelvarathinamNo ratings yet

- Time - Table: B.Ed Degree Examination (NON-SEMESTER), MAY/JUNE - 2013Document3 pagesTime - Table: B.Ed Degree Examination (NON-SEMESTER), MAY/JUNE - 2013Indra SelvarathinamNo ratings yet

- SyllabusDocument61 pagesSyllabusIndra SelvarathinamNo ratings yet

- BSNL DGMDocument6 pagesBSNL DGMnareshjangra397No ratings yet

- 3012 1nepp Ne RTDDocument3 pages3012 1nepp Ne RTDIndra SelvarathinamNo ratings yet

- Per UserDocument24 pagesPer UserIndra SelvarathinamNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingAyaz AkhtarNo ratings yet

- Application Form EnglishDocument1 pageApplication Form EnglishsreevarshaNo ratings yet

- B 1004 Udea: - Mi Gßóõà Gßú?Document4 pagesB 1004 Udea: - Mi Gßóõà Gßú?Indra SelvarathinamNo ratings yet

- Acquaint Yourself BookletDocument8 pagesAcquaint Yourself BookletAkshay AdigaNo ratings yet

- Doc037 PdfnoticicationDocument5 pagesDoc037 PdfnoticicationIndra SelvarathinamNo ratings yet

- Ext BluettoothDocument26 pagesExt BluettoothIndra SelvarathinamNo ratings yet

- CP1 7A NoteDocument21 pagesCP1 7A NoteIndra SelvarathinamNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CHAPTER ONE Principles IDocument26 pagesCHAPTER ONE Principles IMathewos Woldemariam BirruNo ratings yet

- Audit Module 1 - Trial Balance Account MappingDocument6 pagesAudit Module 1 - Trial Balance Account MappingGaurav KumarNo ratings yet

- Quiz in Module 8 Key AnswerDocument6 pagesQuiz in Module 8 Key AnswerfabyunaaaNo ratings yet

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- Managing The Finance FunctionDocument8 pagesManaging The Finance FunctionIcy IzzyNo ratings yet

- Asuncion Escala Ngina Applied Auditing 1 2015Document219 pagesAsuncion Escala Ngina Applied Auditing 1 2015Jacel ManaloNo ratings yet

- Intermediate Accounting 1 WeekDocument32 pagesIntermediate Accounting 1 Weekimsana minatozakiNo ratings yet

- PM - LearnsignalDocument70 pagesPM - LearnsignalEbtisam HanifNo ratings yet

- Paper11 Syl22 Dec23 Set2 SolDocument16 pagesPaper11 Syl22 Dec23 Set2 Solajithsm39No ratings yet

- Examining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaDocument20 pagesExamining Business Potential and Growth in Textile and Apparel Industry: A Case Study in MalaysiaAhmad Hirzi AzniNo ratings yet

- Handout #2 Gov Act Entries-1Document5 pagesHandout #2 Gov Act Entries-1Idh skyNo ratings yet

- 2ndlecture-Corporate LiquidationDocument6 pages2ndlecture-Corporate LiquidationRechelle DalusungNo ratings yet

- 1-Conceptual Framework SummaryDocument11 pages1-Conceptual Framework Summaryyen yenNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- 001 ASSIGNMENT Financial Statement AnalysisDocument4 pages001 ASSIGNMENT Financial Statement AnalysisMarilou Arcillas PanisalesNo ratings yet

- CPWA Code BriefDocument301 pagesCPWA Code BriefSamrat MukherjeeNo ratings yet

- Pencil Factory. How To Start Polymer Pencil Manufacturing Business.-889953 PDFDocument67 pagesPencil Factory. How To Start Polymer Pencil Manufacturing Business.-889953 PDFMuhammad SulmanNo ratings yet

- FFC vs. EngroDocument36 pagesFFC vs. EngroAnsaria100% (1)

- General Review Solutions PDFDocument20 pagesGeneral Review Solutions PDFJerry PinongpongNo ratings yet

- FinMan Chapter 11 Edited by RCVDocument31 pagesFinMan Chapter 11 Edited by RCVBruna Rahd MarianoNo ratings yet

- Worksheet To PostClosing Trial BalanceDocument11 pagesWorksheet To PostClosing Trial BalanceLemuel DioquinoNo ratings yet

- Department of Business AdministrationDocument9 pagesDepartment of Business AdministrationKannan NagaNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- Financial Management in Sick UnitsDocument29 pagesFinancial Management in Sick Unitsagarwalatish100% (1)

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsDocument125 pagesAssignment Classification Table: Topics Brief Exercises Exercises ProblemsYang LeksNo ratings yet

- Project of DemonetizationDocument18 pagesProject of DemonetizationSURAJ KUMAR PRASADNo ratings yet

- Information Sheet Financial StatementsDocument6 pagesInformation Sheet Financial StatementsSitti SadalaoNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1LyricVideoNo ratings yet

- M18-101 - As IndAS by CA Rajesh MakkarDocument451 pagesM18-101 - As IndAS by CA Rajesh MakkarAANo ratings yet

- Erp Revenue RecognizationDocument14 pagesErp Revenue RecognizationsureshNo ratings yet