Professional Documents

Culture Documents

Budgeting

Uploaded by

KomlavathiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting

Uploaded by

KomlavathiCopyright:

Available Formats

Financial Management

and Budgeting

SHOW ME THE MONEY!

What is a budget?

A budget can be a helpful method of keeping

track of group funds.

It is a tool for planning and controlling

organizational funds.

It is a formal written guideline describing your

organizations future goals expressed in financial

terms within a set period of time.

A detailed statement of estimated income and

expenses.

A historical record of the organizations activities

during a given period.

What can a budget

accomplish?

It can help refine goals based on realistic

resources.

It can compel members of the organizations to

use funds efficiently.

It can provide accurate information to adjust,

analyze, and evaluate programs and activities.

It can provide a historical reference to be used

for future planning.

It can be an aid in decision making.

Steps to Develop a budget

Step 1: Begin preparations a month or

more prior to the close of the current year

(end of spring semester).

This will allow for the new administration to

easily transition without worrying about

approving their budget for the next year.

Steps to Develop a budget, contd

Step 2: Prepare an outline of the organizations planned

activities for the upcoming year.

This allows your organization to determine what plans you wish

to do for the upcoming year (take a trip, have a dinner, publish

a newsletter, show movies, etc.)

Many times committee chairs, executive officers, and sometimes

group members will make proposals for the activities might be

considered during the organizations fiscal year.

These proposals are presented to the budget committee, which

might be a separate group chaired by the treasurer or other

organization member in the case of a larger group, or the executive

committee in the case of a smaller group.

This step is very important since programs require money, and

to a great extent they drive the budget.

Steps to Develop a budget, contd

Step 3: Determine available funds (carry over balance

from previous years, cash on hand and funds in the

bank, interest, etc.)

Step 4: Do careful studies of funding sources, costs,

estimated and probable fundraisers.

Step 5: Estimate expected income and when it is

expected to be available (dues, t-shirts, sales, etc.)

Step 6: Define needed expenses (advertising/printing,

supplies, etc.)

Step 7: Get price quotations on certain expenditures,

delegate certain responsibilities to members.

Steps to Develop a budget, contd

Step 8: Rank the order of expenditures by their importance.

When doing this step the organization needs to consider which activities

are the wisest expenditure of funds.

Step 9: Negotiate, as necessary, eliminate less essential

expenditures or limit expenditures.

Step 10: Revise, review, coordinate, cross-reference, and then

assemble into a final budget; the budget must be flexible to

anticipate conditions which might have been overlooked during the

planning process.

This allows the organization to project their revenues and expenditures

for the next fiscal year.

Many times once the revenues and expenditures are projected they are

presented to the executive group for initial review.

Changes to the budget can be made based on recommendations of the

officers.

Assuming that the revised budget is approved, it is then presented to the

organizations members for adoption.

Keys to managing a budget

Once approved, adopted and prepared, it should

be closely managed.

The budget is the organizations financial road map

for the year.

It can be changed if circumstances dictate, but it

would require a vote according to the process

prescribed in the organizations constitution or by-

laws.

Set and maintain a minimum cash balance.

Formulate general policies and procedures

needed to achieve objectives.

Keys to managing a budget, contd

Keep an accurate log of financial transactions

(income and expenses): maintain your

organization record book (check and balance

records periodically).

Contemplate on having the treasurer preparing

periodic reports related to the budget and presents

them to the executive officers and members.

Keys to managing a budget, contd

The treasurer should produce monthly operating

statements.

In the report all transactions that have occurred since the

previous statement should be included.

At the end of each statement a balance should be reported by

the treasurer.

The monthly statement should be reconciled with the year-

to-date activity of the organization so that a clear picture of

the organizations financial position can be established.

A review of the statement will provide the income of the

organization, its expenses, and the organizations cash balance.

Keys to managing a budget, contd

Control cost allow only approved expenditures.

Assess budget at any given point of time during

the budgeted period.

After the budget period has elapsed, determine

the outcome of each expense and revenue.

Judge and review actual cost in order to

establish priorities for the next budget period.

Were In the Money

Managing the budget and being successful

in balancing the spending will allow your

organization to transition easily.

Having a correct budget and knowing how

much monies your organization is able to

work with will allow for your organization

to have less stress and more fun.

Example Budget

Previous Year Current Year

Revenue

Dues and activity fees ____________ ____________

Student government allocation ____________ ____________

Services rendered ____________ ____________

Commissions from machines ____________ ____________

Sales ____________ ____________

Fundraisers ____________ ____________

Program receipts ____________ ____________

Other receipts ____________ ____________

Prior year carried forward ____________ ____________

TOTAL REVENUE ____________ ____________

Expenses

Personnel services ____________ ____________

Salaries ____________ ____________

Hourly wages ____________ ____________

Fringe benefits ____________ ____________

Workers compensation ____________ ____________

Social Security ____________ ____________

Insurance ____________ ____________

Operating expenses ____________ ____________

Telephone line charge ____________ ____________

Long distance ____________ ____________

Other communications ____________ ____________

Office supplies ____________ ____________

Printing ____________ ____________

Postage ____________ ____________

Equipment rental ____________ ____________

Equipment repair ____________ ____________

Program expenses (Develop budget for each program)

Newsletter ____________ ____________

Speakers ____________ ____________

Travel ____________ ____________

Outstanding debt ____________ ____________

Miscellaneous expenses ____________ ____________

Capital

List by item ____________ ____________

Contingency ____________ ____________

TOTAL EXPENSES ____________ ____________

BALANCE ____________ ____________

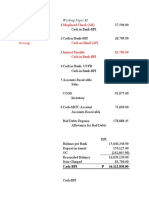

Sample Balance Sheet

Date: ___________________

Amount

Assets

Cash on hand ____________

Accounts receivable ____________

Savings accounts (by number) ________ ____________

________ ____________

Equipment (fair market value) ____________

_______________________________ ____________

_______________________________ ____________

Other property ____________

_______________________________ ____________

_______________________________ ____________

TOTAL ASSETS

Liabilities

Accounts Payable ____________

Long-term debts ____________

_________________________________ ____________

_________________________________ ____________

TOTAL LIABILITIES ____________

NET Value of Organization ____________

You might also like

- SBIapplicationformDocument5 pagesSBIapplicationformSufi DarweshNo ratings yet

- Economic Feasibility AnalysisDocument24 pagesEconomic Feasibility AnalysisMohamed SururrNo ratings yet

- TIPS Document Request FormDocument4 pagesTIPS Document Request FormAndrewNo ratings yet

- Handouts CVP AnalysisDocument6 pagesHandouts CVP AnalysisAissa OrbitaNo ratings yet

- Economic Survey: (Name of Cooperative)Document4 pagesEconomic Survey: (Name of Cooperative)이신지No ratings yet

- Budgeting BasicsDocument14 pagesBudgeting BasicsKimi LanticanNo ratings yet

- Business Plan Formats (1) 12Document9 pagesBusiness Plan Formats (1) 12Osman OsmanNo ratings yet

- Economic SurveyDocument4 pagesEconomic SurveyPAPAGRAND MOVERS CORP.No ratings yet

- 1 Sitxfin004 Wa V92020Document8 pages1 Sitxfin004 Wa V92020Kamal Saini100% (1)

- 2 Actual Income and Expenditure For Past YearDocument2 pages2 Actual Income and Expenditure For Past YearDILG NBOONo ratings yet

- BSA1B Activity 1Document2 pagesBSA1B Activity 1ShorinNo ratings yet

- Economic SurveyDocument4 pagesEconomic SurveyPAPAGRAND MOVERS CORP.No ratings yet

- HRDF-0007Document1 pageHRDF-0007PrincessAntonetteDeCastroNo ratings yet

- ANNEX Y - Template For Individual Project Proposal Business PlanDocument3 pagesANNEX Y - Template For Individual Project Proposal Business PlanShin MelodyNo ratings yet

- Finance Policies and Procedures Manual - TEMPLATE PDFDocument60 pagesFinance Policies and Procedures Manual - TEMPLATE PDFIPFC CochinNo ratings yet

- Nagasuresh Nanduri: Technical SkillsDocument3 pagesNagasuresh Nanduri: Technical Skillsnagasuresh nNo ratings yet

- 2cp Ce 23Document12 pages2cp Ce 23rodrigoNo ratings yet

- CPA Firm TransactionsDocument4 pagesCPA Firm TransactionsBigAsianPapiNo ratings yet

- Plantilla Kakebo PDFDocument2 pagesPlantilla Kakebo PDFTania SerranoNo ratings yet

- Healthcare FinancingDocument3 pagesHealthcare FinancingZhij ConstanteNo ratings yet

- Activity. Business PlanDocument2 pagesActivity. Business PlanDanica HerealwaysNo ratings yet

- CORPORATE PLANNING STRATEGIESDocument64 pagesCORPORATE PLANNING STRATEGIESJanadine Grace De LeonNo ratings yet

- BSBA-OM 1st Year BLK 1Document2 pagesBSBA-OM 1st Year BLK 1Villanueva AyumiNo ratings yet

- Business Plan Booklet 1Document3 pagesBusiness Plan Booklet 1Amr AbdelMoneimNo ratings yet

- BMCE Business Loan Application Form - EmmaDocument4 pagesBMCE Business Loan Application Form - EmmaJulius YawsonNo ratings yet

- Mobile Service AgreementDocument4 pagesMobile Service AgreementawxcareNo ratings yet

- SL Projects or Programs ApplicationDocument3 pagesSL Projects or Programs Applicationapi-229699088No ratings yet

- Sample Program Budget TemplateDocument1 pageSample Program Budget TemplateValerie F. LeonardNo ratings yet

- Finance Policies and Procedures Manual - TEMPLATEDocument60 pagesFinance Policies and Procedures Manual - TEMPLATEHassan Liquat100% (2)

- Clearance FormDocument1 pageClearance FormNaveen KumarNo ratings yet

- Franchise Application (Starbucks)Document9 pagesFranchise Application (Starbucks)annyeongchinguNo ratings yet

- Clearance Form: Department /project Clearing Officer Remarks DateDocument1 pageClearance Form: Department /project Clearing Officer Remarks DateElence CorpNo ratings yet

- 05 Creating BudgetDocument9 pages05 Creating BudgetNguyen Khanh LinhNo ratings yet

- 2019 CIA P3 SIV 2A 1 BudgetingDocument133 pages2019 CIA P3 SIV 2A 1 BudgetingMarieJoiaNo ratings yet

- Annual Report and Financial Statement 07Document1 pageAnnual Report and Financial Statement 07Tom Lui EstrellaNo ratings yet

- Financial Planning Cash BudgetDocument55 pagesFinancial Planning Cash BudgetG sonataNo ratings yet

- Activity Sheet in Business Enterprise SimulationDocument7 pagesActivity Sheet in Business Enterprise SimulationAimee LasacaNo ratings yet

- 10K Case Study - Understanding 10K Case StudyDocument5 pages10K Case Study - Understanding 10K Case StudyÄurora YangNo ratings yet

- L-7 The Business Plan 1japuraDocument12 pagesL-7 The Business Plan 1japuranuwan184No ratings yet

- Matriculation NoDocument12 pagesMatriculation NokerttanaNo ratings yet

- Spredsheet format.docxDocument1 pageSpredsheet format.docxphungvcungNo ratings yet

- Business Plan Format324Document4 pagesBusiness Plan Format324rizabasasNo ratings yet

- Financial Management and Event BudgetingDocument1 pageFinancial Management and Event BudgetingLeonards JoanNo ratings yet

- SuwushwuudjwijdDocument1 pageSuwushwuudjwijdSyvone HeinichNo ratings yet

- IiwjxiiwjxiwjxiwxDocument1 pageIiwjxiiwjxiwjxiwxSyvone HeinichNo ratings yet

- Assignment PDFDocument3 pagesAssignment PDFkaori katoNo ratings yet

- Matriculation NoDocument13 pagesMatriculation NoKetz NKNo ratings yet

- SLIDE HANDOUTS - Chapter 1Document15 pagesSLIDE HANDOUTS - Chapter 1Zawana JjangNo ratings yet

- Financial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileDocument7 pagesFinancial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileIdrees HafeezNo ratings yet

- Common Grant Application FormDocument8 pagesCommon Grant Application FormChina BrownNo ratings yet

- DOCUMENTS FOR SUPPLIER ACCREDITATION FinalDocument6 pagesDOCUMENTS FOR SUPPLIER ACCREDITATION FinalAnna HasNo ratings yet

- Economic SurveyDocument6 pagesEconomic SurveygregbaccayNo ratings yet

- Profit Planning by AriefDocument49 pagesProfit Planning by AriefariefNo ratings yet

- Economic Survey of Malaueg Jeepney Operators CooperativeDocument10 pagesEconomic Survey of Malaueg Jeepney Operators CooperativeElwin NarcisoNo ratings yet

- Philippine Science High School System CAMPUS: - Financial Report FormDocument1 pagePhilippine Science High School System CAMPUS: - Financial Report FormHannah Elizabeth GarridoNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- PRAN-RFL Financial Performance AnalysisDocument46 pagesPRAN-RFL Financial Performance Analysismorshedul hasan88% (41)

- Barth Etal The Relevance of The Value Relevance AnotherviewDocument28 pagesBarth Etal The Relevance of The Value Relevance AnotherviewMaz ShuliztNo ratings yet

- The Gaap and IfrsDocument2 pagesThe Gaap and IfrsAlan Cheng100% (1)

- Yusingco, Rhealene A. ABM 12 - St. Paul: Fundamentals of Accounting 2 Unit Test For Statement of Financial PositionDocument13 pagesYusingco, Rhealene A. ABM 12 - St. Paul: Fundamentals of Accounting 2 Unit Test For Statement of Financial PositionRaymond Roco100% (1)

- Kertas Kerja - UTSDocument10 pagesKertas Kerja - UTSAlviana RenoNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- Financial MGT ADocument390 pagesFinancial MGT ADeogratias ManyamaNo ratings yet

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- MC2022 - 24-Chart of Accounts.Document45 pagesMC2022 - 24-Chart of Accounts.donde salazarNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap015 PDFDocument54 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap015 PDFYopie ChandraNo ratings yet

- Ladies Shoes Manufacturing Unit Rs. 9.93 Million Sep 2014Document22 pagesLadies Shoes Manufacturing Unit Rs. 9.93 Million Sep 2014Iftekharul IslamNo ratings yet

- Prosper Chapter6v2 PDFDocument28 pagesProsper Chapter6v2 PDFAdam Taggart100% (2)

- EITF Abs00-19Document38 pagesEITF Abs00-19Alycia SkousenNo ratings yet

- Cpa MockexambrochureDocument16 pagesCpa Mockexambrochureqwertypoiuy19No ratings yet

- Multi Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesMulti Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- Working Paper AnalysisDocument10 pagesWorking Paper AnalysisHannaniah PabicoNo ratings yet

- The Impact of A New Accounting Standard To An EntityDocument4 pagesThe Impact of A New Accounting Standard To An EntityDhenzel AntonioNo ratings yet

- Intellectual Property RightsDocument34 pagesIntellectual Property RightsLaksha ChibberNo ratings yet

- KEDC 2019 Financial StatementsDocument18 pagesKEDC 2019 Financial StatementsPhạm Thảo Vân100% (1)

- Financial Management: Dr. Saurabh Pratap Iiit DM JabalpurDocument40 pagesFinancial Management: Dr. Saurabh Pratap Iiit DM JabalpurPrince SinghNo ratings yet

- Amazing Pie ChartsDocument13 pagesAmazing Pie ChartsAna Laura ArredondoNo ratings yet

- Tally 9 NotesDocument17 pagesTally 9 NotesAnjali HemadeNo ratings yet

- F7.1 Chap 11 - Financial Instruments 2Document35 pagesF7.1 Chap 11 - Financial Instruments 2NapolnzoNo ratings yet

- Merrill Lynch - How To Read Financial ReportDocument52 pagesMerrill Lynch - How To Read Financial ReportDrei TorresNo ratings yet

- Chapter 21 Cryptocurrency Article (ACCA + IFRS Box)Document8 pagesChapter 21 Cryptocurrency Article (ACCA + IFRS Box)Kelvin Chu JYNo ratings yet

- Problem Quizzes 3 4 5Document9 pagesProblem Quizzes 3 4 5Marjorie Palma0% (1)

- (In Philippine Pesos) : Se Detendre La Plage IncDocument5 pages(In Philippine Pesos) : Se Detendre La Plage IncJheza Mae PitogoNo ratings yet

- Business Plan For Quad Bike Industry Bus PDFDocument44 pagesBusiness Plan For Quad Bike Industry Bus PDFRajesh IndukuriNo ratings yet

- DepreciationDocument3 pagesDepreciationkrisha milloNo ratings yet

- Buying an Existing Business GuideDocument24 pagesBuying an Existing Business GuideberkNo ratings yet