Professional Documents

Culture Documents

Electronic Payment System

Uploaded by

Aanchal GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Electronic Payment System

Uploaded by

Aanchal GuptaCopyright:

Available Formats

ELECTRONIC PAYMENT

SYSTEM

REQUIREMENTS FOR E-PAYMENTS

The various factors that have lead the financial institutions to make use of e-payments are:

Decreasing technology cost- The technology used in the networks is decreasing day by day.

Reduced operational and processing cost- Due to reduced technology cost, the processing cost

of various commerce activities becomes very less. A very simple reason to prove this is the fact

that in electronic transactions we save both paper and time.

Increasing online commerce

SECURITY FOR E-PAYMENTS

Authentication

Authenticity of business

Confidentiality

Information privacy

Data Integrity

Data must not be altered

Audit Trail

Data should be trailed

SECURITY FOR E-PAYMENTS

Standards for E-payments

It is a must to have a generally accepted protocol for securing e-payments such as SSL

Implemented protocols

SSL (Secure Sockets Layer)

Security protocol used by web browser and web server to transmit sensitive information over the

internet

Uses private key to encrypt data

SET (Secure Electronic Transaction)

Built with SSL

Uses digital wallet that holds

customers certificates

TYPES OF ELECTRONIC PAYMENT

SYSTEMS

EPSs enable a customer to pay for the goods and services online by using integrated hardware and

software systems. The main objectives of EPS are to increase efficiency, improve security, and

enhance customer convenience and ease of use.

Online buyers may use one of the following EPSs to pay for products/services:

Electronic funds transfer (EFT): EFT involves electronic transfer of money by financial institutions.

Payment cards : They contain stored financial value that can be transferred from the customer's computer to the

businessman's computer.

Credit cards : They are the most popular method used in EPSs and are used by charging against the customer

credit.

Smart cards: They include stored financial value and other important personal and financial information used for

online payments.

Electronic money (e-money/e-cash): This is standard money converted into an electronic format to pay for online

purchases.

Online payment: This can be used for monthly payment for Internet, phone bills, etc.

Electronic wallets (e-wallets) : They are similar to smart cards as they include stored financial value for online

payments.

Micro-payment systems : They are similar to e-wallets in that they include stored financial value for online payments;

on the other hand, they are used for small payments, such as kurus in Turkey .

Electronic gifts : They are one way of sending electronic currency or gift certificates from one individual to another.

The receiver can spend these gifts in their favorite online stores provided they accept this type of

currency.

ELECTRONC FUNDS TRANSFER (EFT)

Electronic funds transfer is one of the oldest electronic payment systems.

EFT is the groundwork of the cash-less and check-less culture where and paper bills, checks, envelopes, stamps are

eliminated.

EFT is used for transferring money from one bank account directly to another without any paper money changing hands.

The most popular application of EFT is that instead of getting a paycheck and putting it into a bank account, the money is

deposited to an account electronically.

The advantages of EFT contain the following:

Simplified accounting

Improved efficiency

Reduced administrative costs

Improved security

PAYMENT CARDS

Credit cards, debit cards, charge cards, smart cards are payment cards. They are the most popular tool for electronic payment

transactions.

Credit Cards

There are two types of credit cards on the market today:

Credit cards issued by credit card companies (e.g., MasterCard, Visa) and major banks.

Credit cards are issued based on the customer's income level, credit history, and total wealth.

The customer is supposed to pay his or her debts during the payment period; otherwise interest will accumulate.

Credit cards issued by department stores (e.g Boyner), oil companies (e.g. Shell)

Limitations of credit cards are their unsuitability for very small or very large payments.

Debit Cards

Debit cards checks in that the charges will be taken from the customer's checking account.

The benefit for the customer is the easiness of use and convenience.

These cards also keep the customer under his or her budget because they do not allow the customer

to go beyond his or her resources.

The advantage to the merchant is the speed at which the merchant collects these charges.

Magnetic strip cards

Cannot send or receive information

Cannot increment or decrement value of cash stored on the card

Processing must be done on a device into which the card is inserted

Charge Cards

Charge cards are similar to credit cards except they have no revolving credit line, so the balance must be paid off every month.

Credit, debit, and charge card methods of payments have been successfully utilized in the pre-Internet period, and they are

often used in the e-commerce world as well.

Some of the reasons for their popularity in the e-commerce world are their availability (most customers own one of these

cards), ease of use, and acceptance.

To use these cards as an online payment system, a well-defined process is followed.

Stored Value Cards

Stored-value cards can be an elaborate smart card with a microchip that records currency balance.

Common stored-value cards include: Prepaid phone, copy, subway, and bus cards.

Smart Cards

A smart card is about the size of a credit card, made of a plastic with an embedded microprocessor chip that holds important

financial and personal information.

The microprocessor chip is loaded with the relevant information and periodically recharged.

In addition to these pieces of information, systems have been developed to store cash onto the chip.

The money on the card is saved in an encrypted form and is protected by a password to ensure the security of the smart card

solution.

In order to pay via smart card it is necessary to introduce the card into a hardware terminal.

The device requires a special key from the issuing bank to start a money transfer in either direction.

Smart cards can be disposable or rechargeable.

A popular example of a disposable smart card is the one issued by telephone companies.

After using the pre-specified amount, the card can be discarded.

ELECTRONIC CASH (E-CASH)

Similar to regular cash, e-cash enables transactions between customers without the need for banks or other

third parties.

When used, e-cash is transferred directly and immediately to the participating merchants and vending

machines.

Electronic cash is a secure and convenient alternative to bills and coins.

This payment system complements credit, debit, and charge cards and adds additional convenience and control

to everyday customer cash transactions.

E-cash usually operates on a smart card, which includes an embedded microprocessor chip.

The microprocessor chip stores cash value and the security features that make electronic transactions secure.

Mondex, a subsidiary of MasterCard (Mondex Canada Association) is a good example of e-cash.

E-cash is transferred directly from the customer's desktop to the merchant's site.

Therefore, e-cash transactions usually require no remote authorization or personal identification number (PIN)

codes at the point of sale.

E-cash can be transferred over a telephone line or over the Web.

The microprocessor chip embedded onto the card keeps track of the e-cash transactions.

Using e-cash the customer has two options: a stand-alone card containing e-cash or a combination card that

incorporates both e-cash and debit .

ELECTRONC CHEQUES (E-CHEQUES)

E-check is the result of cooperation among several banks, government entities, technology companies, and e-commerce

organizations.

An e-check uses the same legal and business protocols associated with traditional paper checks.

It is a new payment instrument that combines high-security, speed, convenience, and processing efficiencies for online

transactions.

It shares the speed and processing efficiencies of all-electronic payments.

An e-check can be used by large and small organizations, even where other electronic payment solutions are too risky or

not appropriate.

The key advantages of e-checks are as follows:

Secure and quick settlement of financial obligations

Fast check processing

Very low transaction cost

ELECTRONIC WALLETS (E-WALLETS)

Electronic wallets being very useful for frequent online shoppers are commercially available for pocket, palm-sized,

handheld, and desktop PCs.

They offer a secure, convenient, and portable tool for online shopping.

They store personal and financial information such as credit cards, passwords, PINs, and much more.

To facilitate the credit-card order process, many companies are introducing electronic wallet services.

E-wallets allow you to keep track of your billing and shipping information so that it can be entered with one click at

participating merchants' sites.

E-wallets can also store e- checks, e-cash and your credit-card information for multiple cards.

A popular example of an e-wallet on the market is Microsoft Wallet; to obtain Microsoft Wallet, one needs to set up a

Microsoft Passport.

MCRO-PAYMENT

Merchants must pay a fee for each credit-card transaction that they process; this can become costly when customers purchase

inexpensive items. The cost of some items could actually be lower than the standard transaction fees, causing merchants to incur

losses.

Micro-payments are used for small payments on the Web.

The process is similar to e-wallet technology where the customer transfers some money into the wallet on his or her desktop

and then pays for digital products by using this wallet.

Using micro-payment one will be able to pay for one article from a professional journal, a chapter from a scientific book, or one

song from a CD on the Web.

IBM offers micro- payment wallets and servers. IBM micro-payment systems allow vendors and merchants to sell content,

information, and services over the Web.

It provides universal acceptance and offers comprehensive security.

This micro-payment system can be used for billing by banks and financial institutions, Internet service providers (ISPs), content

providers (offering games, entertainment, archives, etc.), telecommunications, service providers (offering fax, e-mail, or phone

services over the Web), and by premium search engines and specialized databases.

PEER-TO-PEER PAYMENTS

A peer-to-peer payment service allows the transfer of digital cash (e-Cash) via e-mail between two people who

have accounts at e-Cash-enabled banks.

Peer-to- peer transactions allow online financial transfers between consumers.

One example of peer-to-peer payment service is PayPal . Transactions through PayPal are immediate, the

service is free for individuals sending money to one another and the payee is not required to enter any credit-card

information.

PayPal allows a user to send money to anyone with an e-mail address, regardless of what bank either person

uses, or whether or not the recipient is pre-registered with the service.

People wishing to send money to others can log on to PayPal at www.x.com open an account and register the

amount to be sent. That amount is hilled to the person's credit card, Payment notification is sent to the recipient,

and an account is established in the recipient's name.

When the person to whom the payment is sent receives the e-mail notification, he or she simply registers with

PayPal and has access to an account containing the payment. The funds in this account can he transferred to the

recipient's bank account by direct deposit or mailed by check from PayPal.

The Paypal system can also be used to enable credit-card payment for auction items in real time.

Credit card information is checked before a transaction is initiated.

This means that the transaction begins processing immediately after it is initiated, reducing the risk of fraud or

overdrawn accounts.

B2B AND B2C TRANSACTONS

The fastest grossing sector of e-commerce payments is business-to-business (B2B) transactions. These

payments are often much larger than business-to- customer (B2C) transactions and involve complex business

accounting systems .

For example, Paymentech is one of the largest payment solutions providers for point-of-sale transactions on the

Internet.

The service provides reporting and processing tools and services to help manage a merchant account and

electronic check processing.

Paymentech supports all types of credit and debit cards and conducts all transactions in a secure environment.

Merchants using Paymentech can customize their payment- processing plans.

PaymentNet allows merchants to track their expenses in a secure environment on a 24-by-7 basis.

Its features include custom reporting, e-billing and cross-compatibility with other third-party expense reporting

tools.

B2C market transactions are less complicated than B2B transactions.

Using Electronic Bill Presentment and Payment (EBPP) a company can display a bill on multiple platforms online

and offer actual payment processes.

Payments are generally electronic transfers from consumer checking accounts.

This is conducted through the ACH (Automated Clearing House), the current method for processing electronic

monetary transfers.

You might also like

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- Chapter 03: Electronic Payment System: By: Diwakar UpadhyayaDocument67 pagesChapter 03: Electronic Payment System: By: Diwakar UpadhyayaBibek karnaNo ratings yet

- Electronic Payment SystemDocument21 pagesElectronic Payment SystemHaidarNo ratings yet

- Electronic Payment SystemsDocument8 pagesElectronic Payment SystemsAbhishek NayakNo ratings yet

- Ecomerce NotesDocument28 pagesEcomerce NotesManageITafricaNo ratings yet

- L5 Electronic Payment SystemsDocument28 pagesL5 Electronic Payment SystemsKenneth Kibet NgenoNo ratings yet

- E-COMMERCE - Unit-2Document19 pagesE-COMMERCE - Unit-2Kalyan KumarNo ratings yet

- Unit-III: Types of Electronic Payment SystemsDocument8 pagesUnit-III: Types of Electronic Payment SystemsUmam AfzalNo ratings yet

- Electronic Payment System - IDocument12 pagesElectronic Payment System - ITejasvee Tandon Jaipuria JaipurNo ratings yet

- IDM - E-Commerce - Payment Systems & SEODocument33 pagesIDM - E-Commerce - Payment Systems & SEOBhaswati PandaNo ratings yet

- Week 2Document36 pagesWeek 2FARYAL FATIMANo ratings yet

- E Comm - Unit 3Document8 pagesE Comm - Unit 3prashanttendolkarNo ratings yet

- Topic 7Document31 pagesTopic 7LucyChanNo ratings yet

- E Payment 120927112113 Phpapp02Document38 pagesE Payment 120927112113 Phpapp02sagarg94gmailcomNo ratings yet

- Electronic Payment System: Presented byDocument43 pagesElectronic Payment System: Presented bysheetal28svNo ratings yet

- Electronic Payment Systems (Eps)Document16 pagesElectronic Payment Systems (Eps)Navneet VishnoiNo ratings yet

- Online Payment SystemDocument30 pagesOnline Payment SystemDjks YobNo ratings yet

- Unit-5 E-Commerce Electronic Payment System SRGDocument33 pagesUnit-5 E-Commerce Electronic Payment System SRGLuitel ShaneNo ratings yet

- Electronic Payment SystemsDocument36 pagesElectronic Payment SystemsSaurabh G82% (11)

- Cse - 18cs013 Lm15 - Bit WikiDocument3 pagesCse - 18cs013 Lm15 - Bit WikiFor My YouTubeNo ratings yet

- Payment System: Refer Chapter - 11 From Book Gary P. Schneider SoftDocument37 pagesPayment System: Refer Chapter - 11 From Book Gary P. Schneider Softpranay639No ratings yet

- E Payments Modes and MethodsDocument52 pagesE Payments Modes and MethodsHarshithNo ratings yet

- Lecture 5Document19 pagesLecture 5Muhammad Mubshar NazirNo ratings yet

- E. Comm Unit 3Document34 pagesE. Comm Unit 3Himanshu SahdevNo ratings yet

- Web Payment SystemsDocument39 pagesWeb Payment SystemsBrightkofi OtchereNo ratings yet

- Electronic Payment System: Amit Kumar Nayak Roll No:29401 Regd No:1005105001Document17 pagesElectronic Payment System: Amit Kumar Nayak Roll No:29401 Regd No:1005105001Amit Kumar NayakNo ratings yet

- E Payment SystemDocument56 pagesE Payment SystemAnkiTwilightedNo ratings yet

- Chap 5 Note Roy SirDocument70 pagesChap 5 Note Roy SirJannatul FardusNo ratings yet

- Unit - 2 - Electronic Payment SystemDocument67 pagesUnit - 2 - Electronic Payment Systemvisdag100% (2)

- CH - 7 E-MarketingDocument44 pagesCH - 7 E-MarketingleteslassieNo ratings yet

- CH-6 E MarketingDocument17 pagesCH-6 E Marketingabdelamuzemil8No ratings yet

- Electronic Payment SystemDocument23 pagesElectronic Payment System741Mohd Saif AnsariNo ratings yet

- Chapter-6 Electronic Payment PDFDocument40 pagesChapter-6 Electronic Payment PDFSuman BhandariNo ratings yet

- Week7 SCM IntegrationTechnologiesEDI WS CloudDocument130 pagesWeek7 SCM IntegrationTechnologiesEDI WS CloudAyush K SaxenaNo ratings yet

- System Integration and Architecture - P4Document24 pagesSystem Integration and Architecture - P4percival fernandezNo ratings yet

- Unit3e PaymentsDocument53 pagesUnit3e PaymentsKavitha PalaniNo ratings yet

- E-Payment System: By: Dr. Anubha, Dept. of CommerceDocument18 pagesE-Payment System: By: Dr. Anubha, Dept. of Commerceathulnsunil39No ratings yet

- Electronic PaymentDocument81 pagesElectronic Paymentarya manchandaNo ratings yet

- Cyber Unit 2 Lecture 4Document21 pagesCyber Unit 2 Lecture 4VijayNo ratings yet

- ECOM Unit 3Document29 pagesECOM Unit 3kunchala_veniNo ratings yet

- E PaymentDocument11 pagesE PaymentGurpreet BansalNo ratings yet

- Electronic Payment SystemDocument47 pagesElectronic Payment SystemMilan Jain100% (1)

- Payment SystemDocument26 pagesPayment SystemAlice Johnson100% (1)

- 4 Electronic Payment SystemsDocument39 pages4 Electronic Payment SystemsYashasweeNo ratings yet

- Group 2 - Various Forms of E - BankingDocument12 pagesGroup 2 - Various Forms of E - BankingTrinidad, Ma. AngelicaNo ratings yet

- Unit-3 Electronic Payment SystemDocument12 pagesUnit-3 Electronic Payment SystemNezuko KamadoNo ratings yet

- E-Commerce Payment Systems: Dr. Abhinita Daiya DY Patil International UniversityDocument6 pagesE-Commerce Payment Systems: Dr. Abhinita Daiya DY Patil International UniversityFoodie GramNo ratings yet

- E Marketing Unit 2 e ComDocument18 pagesE Marketing Unit 2 e ComjayNo ratings yet

- Unit 5 Electronic Payment SystemDocument17 pagesUnit 5 Electronic Payment SystemSatyam RajNo ratings yet

- The E-Payment SystemsDocument35 pagesThe E-Payment Systemsabbu03No ratings yet

- Electronic Payment SystemsDocument20 pagesElectronic Payment SystemsLakshay TyagiNo ratings yet

- E Commerce PresentationDocument30 pagesE Commerce PresentationRajiv Ranjan100% (1)

- Unit-V Indian PerspectiveDocument105 pagesUnit-V Indian PerspectiveSachin gollapalliNo ratings yet

- Im Mini ProjectDocument10 pagesIm Mini Projectsrividya balajiNo ratings yet

- E COMMERCE FINAL COVERAGE MODULE 1 and 2Document9 pagesE COMMERCE FINAL COVERAGE MODULE 1 and 2BRIAN CORPUZ INCOGNITONo ratings yet

- E Commerce Notes Chapter 5-10Document5 pagesE Commerce Notes Chapter 5-10Taniya Bhalla100% (1)

- E - Business Unit-III, 2020Document15 pagesE - Business Unit-III, 2020Sourabh SoniNo ratings yet

- Electronic Payment SystemsDocument36 pagesElectronic Payment Systemsjoe_inba100% (1)

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Leadership Issues in Globalization: Submitted By: Shivani (082) NameeshaDocument11 pagesLeadership Issues in Globalization: Submitted By: Shivani (082) NameeshaAanchal GuptaNo ratings yet

- Customer Expectations of ServicesDocument21 pagesCustomer Expectations of ServicesAanchal Gupta100% (1)

- Ethical Issues in IbDocument14 pagesEthical Issues in IbAanchal GuptaNo ratings yet

- Industrial Relations and Technological ChangeDocument11 pagesIndustrial Relations and Technological ChangeAanchal Gupta94% (18)

- Advertising Appeal FinalDocument26 pagesAdvertising Appeal FinalAanchal Gupta0% (1)

- Role of Marketing in A Developing EconomyDocument23 pagesRole of Marketing in A Developing EconomyAanchal GuptaNo ratings yet

- Process InnovationDocument29 pagesProcess InnovationAanchal Gupta100% (8)

- Process InnovationDocument29 pagesProcess InnovationAanchal GuptaNo ratings yet

- Innovation ModelsDocument32 pagesInnovation ModelsAanchal GuptaNo ratings yet

- Business ResearchDocument15 pagesBusiness ResearchAanchal GuptaNo ratings yet

- Questionnaire For The Analysis of Employee EngagementDocument1 pageQuestionnaire For The Analysis of Employee EngagementAanchal GuptaNo ratings yet

- Penyata Akaun / Statement of Account: Dilindungi Oleh PIDM Setakat RM250,000.00 Bagi Setiap PendepositDocument2 pagesPenyata Akaun / Statement of Account: Dilindungi Oleh PIDM Setakat RM250,000.00 Bagi Setiap PendepositSame HaszroyNo ratings yet

- Website:www - Mahadiscom.in: MSEDCL Call Center: 18002333435 18001023435 1912Document3 pagesWebsite:www - Mahadiscom.in: MSEDCL Call Center: 18002333435 18001023435 1912Chetan RamtekeNo ratings yet

- Mr. Rajat Khandelwal A 25 Dev Nagar A 25 Dev Nagarmurlipura JAIPUR - 302039 Rajasthan, IndiaDocument10 pagesMr. Rajat Khandelwal A 25 Dev Nagar A 25 Dev Nagarmurlipura JAIPUR - 302039 Rajasthan, Indiak.rajatNo ratings yet

- Transactions 650 344366000 20200827 200640 PDFDocument15 pagesTransactions 650 344366000 20200827 200640 PDFKiran AdhikariNo ratings yet

- Mitc CCDocument16 pagesMitc CCmohang.mysoreNo ratings yet

- CP Que New 11Document3 pagesCP Que New 11Jignasa VankarNo ratings yet

- FeeHiveChallan 999107201014768 PDFDocument1 pageFeeHiveChallan 999107201014768 PDFK.DURGA PAVAN SANTHOSH,IT18 Vel Tech, ChennaiNo ratings yet

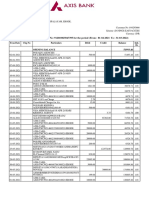

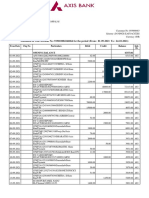

- Statement of Axis Account No:912010025047395 For The Period (From: 01-04-2021 To: 31-03-2022)Document5 pagesStatement of Axis Account No:912010025047395 For The Period (From: 01-04-2021 To: 31-03-2022)Naghul MxNo ratings yet

- PT Hensel Davest Indonesia, TBK: The (Hidden) Ecommerce & Fintech Gem From East IndonesiaDocument10 pagesPT Hensel Davest Indonesia, TBK: The (Hidden) Ecommerce & Fintech Gem From East Indonesiazainuddin spiritusNo ratings yet

- Format Laporan Petty CashDocument8 pagesFormat Laporan Petty CashIchalz NtsNo ratings yet

- Cryptocurrency Training - Ba Training MaterialsDocument38 pagesCryptocurrency Training - Ba Training MaterialsAbdullah TemitopeNo ratings yet

- 'PPT EcomDocument16 pages'PPT EcomAYUSHI CHADHANo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- Pertimbangan Dan Sikap Milenial Terhadap Minat Menggunakan E-Wallet: Pada Masa PSBB Di Kota TangerangDocument18 pagesPertimbangan Dan Sikap Milenial Terhadap Minat Menggunakan E-Wallet: Pada Masa PSBB Di Kota Tangerang14Muhammad Abdur RakhmanNo ratings yet

- VFRTDocument1 pageVFRTsalim driaiNo ratings yet

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact UsSAM50% (2)

- 127 SL Date Time ATM Booth Name Customer Mobile NumberDocument8 pages127 SL Date Time ATM Booth Name Customer Mobile NumberDrinkwell AccountsNo ratings yet

- EssayDocument2 pagesEssayMariecon MonteroNo ratings yet

- Latest Cash App Carding Method LuciferDocument7 pagesLatest Cash App Carding Method LuciferCharles Ovens67% (6)

- Faith Il SepDocument4 pagesFaith Il SephittaNo ratings yet

- GST Challan PDFDocument2 pagesGST Challan PDFNishi GuptaNo ratings yet

- Acct Statement XX2182 29082021Document28 pagesAcct Statement XX2182 29082021Sunil VishwakarmaNo ratings yet

- SuperCard SOCDocument1 pageSuperCard SOCManish BhagatNo ratings yet

- Web VulnDocument3 pagesWeb VulnwarnoNo ratings yet

- Questionnaire On Consumer Awareness and Perception About Credit Cards in IndiaDocument6 pagesQuestionnaire On Consumer Awareness and Perception About Credit Cards in IndiaSARATH KUMAR DNo ratings yet

- ArticleforPaymentsSystemsMagazine-13 11 05Document14 pagesArticleforPaymentsSystemsMagazine-13 11 05Syed RazviNo ratings yet

- Ch3 Cryptography and Public Key InfrastructureDocument10 pagesCh3 Cryptography and Public Key InfrastructureGetachew ShambelNo ratings yet

- AdvanceReceipt2021 10 24 22 12 41Document5 pagesAdvanceReceipt2021 10 24 22 12 41AbNo ratings yet

- Electricity Bill PDFDocument1 pageElectricity Bill PDFAMULYA RANJAN PAULNo ratings yet

- Domestic: Soumitra Roy & Tusi RoyDocument2 pagesDomestic: Soumitra Roy & Tusi RoyAnonymous t5MrKaXDNo ratings yet