Professional Documents

Culture Documents

QDFA

Uploaded by

Atul MittalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QDFA

Uploaded by

Atul MittalCopyright:

Available Formats

CHAPTER 26

Mergers, LBOs, Divestitures,

and Holding Companies

26-2

Topics in Chapter

Types of mergers

Merger analysis

Role of investment bankers

LBOs, divestitures, and holding

companies

26-3

Economic Justifications for

Mergers

Synergy = Value of the whole exceeds

sum of the parts

Operating economies

Financial economies

Differential management efficiency

Taxes (use accumulated losses)

Break-up value = Assets more valuable

broken up and sold

26-4

Questionable

Reasons for Mergers

Diversification

Purchase of assets below replacement

cost

Acquire other firms to increase size,

thus making it more difficult to be

acquired

26-5

Merger Types

Horizontal

Vertical

Congeneric

Related but not same industry

Conglomerate

Unrelated enterprises

26-6

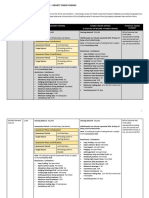

Five Largest Completed Mergers

(as of December, 2007)

TABLE 26-1

26-7

Friendly & Hostile Mergers

Friendly merger:

Supported by management of both firms

Hostile merger:

Target firms management resists the merger

Acquirer must go directly to the target firms

stockholders tender offer - try to get 51% to

tender their shares.

Often, mergers that start out hostile end up as

friendly, when offer price is raised

26-8

Merger Analysis

DCF Analysis

Corporate Valuation (Ch 11)

Adjusted Present Value Method (Ch 26.7)

Equity Residual Model (Ch 26.8)

= Free Cash Flow to Equity Method

Market Multiples Analysis

Provides a benchmark

26-9

The APV Model

Value of firm if it had no debt

+ Value of tax savings due to debt

= Value of operations

First term = unlevered value of the firm

Second term = value of the interest tax shield

26-10

The APV Model

TD V V

U L

(15-7)

(16-4)

(26-1)

1 t

t

sU

t

U OP

) R 1 (

FCF

V V

1 t

t

sU

t

TS

) r 1 (

TS

V

(15-1)

(26-2)

(26-3)

26-11

APV Model

V

U

= Unlevered value of firm

= PV of FCFs discounted at unlevered cost of

equity, r

sU

V

TS

= Value of interest tax shield

= PV of interest tax savings discounted at

unlevered cost of equity, r

sU

Interest tax savings = Interest * (tax rate) = TS

t

26-12

APV vs. Corporate Valuation

Best model when capital structure is changing

Merger often causes capital structure changes

over the first several years

Causes WACC to change from year to year

Hard to incorporate year-to-year WACC changes in

the corporate valuation model

Corporate Valuation (i.e., discount FCF at

WACC) = easier than APV when capital

structure is constant

26-13

Steps in APV Valuation

1. Calculate unlevered cost of equity, r

sU

2. Project FCF

t

,TS

t

until company is at its

target capital structure for one year and

is expected to grow at a constant rate

thereafter.

d d sL s sU

d sU sU sL

r w r w r

)

S

D

)( T 1 )( r r ( r r

(16-6)

(26-4)

(26-5)

26-14

Steps in APV Valuation

3. Project horizon growth rate, g

Calculate horizon value of unlevered firm

using constant growth formula and FCF

N

Calculate horizon value of tax shields using

constant growth formula and TS

N

g r

) g 1 ( FCF

g r

FCF

HV

sU sU

1 N

N , U

g r

) g 1 ( TS

g r

TS

HV

sU sU

1 N

N , TS

(26-7)

(26-8)

26-15

Steps in APV Valuation

4. Calculate Value of Operations

Calculate unlevered value of firm as PV of

unlevered horizon value and FCF

t

Calculate value of tax shields as PV of tax

shield horizon value and TS

t

N

1 t

N

sU

N , U

t

U , s

t

U

) r 1 (

HV

) r 1 (

FCF

V

N

1 t

N

sU

N , TS

t

U , s

t

TS

) r 1 (

HV

) r 1 (

TS

V

(26-9)

(26-10)

26-16

Steps in APV Valuation

4. Calculate Value of Operations

Calculate V

op

as sum of unlevered value and tax

shield value

5. Find total value of the firm

TS U OP

V V V

(26-11)

shares #

S

P

debt of Value

assets operating - non of Value

F

F op

op TS U

V S

V V

V V V

26-17

The FCFE Approach

FCFE = Free Cash Flow to Equity

Cash flow available for distribution to common

shareholders

debt issued newly payments principal

- expense interest tax - After

FCF FCFE

debt in change net shield tax interest

capital operating in investment Net

NI FCFE

(26-12)

26-18

FCFE Approach

Value of Equity =

Assuming constant growth:

1 t

t

sL

t

FCFE

) r 1 (

FCFE

V

g r

) g 1 ( FCFE

g r

FCFE

HV

sL sL

1 N

N , FCFE

N

1 t

N

sL

N , FCFE

t

sL

t

FCFE

) r 1 (

HV

) r 1 (

FCFE

V

(26-13)

(26-14)

(26-15)

assets operating - Non

FCFE

V S

(26-16)

26-19

TABLE 26-2

26-20

Valuation Examples

Caldwell Incs acquisition of Tutwiler

Tutwiler

Market value of equity = $62.5 m

Debt = $27 m

Total market value = $89.5 m

% Debt = 30.17%

Cost of debt, r

d

= 9%

10 million shares outstanding

26-21

Tutwiler Acquisition

Tutwilers pre-merger beta = 1.20

Risk-free rate = 7%

Market risk premium = 5%

CAPM r

sL

= 13%

% 707 . 10 WACC

%) 13 ( 6983 . 0 %) 9 )( 60 . 0 ( 3017 . 0 WACC

r w r ) T 1 ( w WACC

sL s d d

26-22

Tutwiler Acquisition

Both firms = 40% tax rate

Post-horizon g= 6%

Caldwell will issue debt to maintain

constant capital structure:

$6.2 m debt increase at merger

26-23

Projecting Post-Merger CFs

01/01/10 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14

Panel A: Selected Items

1 Net Sales $105.0 $126.0 $151.0 $174.0 $191.0

2 Cost of goods sold 80.0 94.0 113.0 129.3 142.0

3 Selling & Admin expenses 10.0 12.0 13.0 15.0 16.0

4 Depreciation 8.0 8.0 9.0 9.0 10.0

5 EBIT 7.0 12.0 16.0 20.7 23.0

6 Interest Expense 3.0 3.2 3.5 3.7 3.9

7 Debt 33.2 35.8 38.7 41.1 43.6 46.2

8 Total Net Operating Capital 116.0 117.0 121.0 125.0 131.0 138.0

26-24

Post-Merger CF Projections

01/01/10 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14

Panel B Corporate Valuation CFs

9 NOPAT=EBIT(1-T) (T=40%) $4.2 $7.2 $9.6 $12.4 $13.8

10 Less net invest. In op cap 1.0 4.0 4.0 6.0 7.0

11 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

Panel C: APV Model Cash Flows

12 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

13 Interst tax savings = INT(T) 1.2 1.28 1.4 1.48 1.56

Panel D: FCFE Model Cash Flows

14 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

15 Less A-T Interest=INT(1-T) 1.8 1.9 2.1 2.2 2.4

16 Plus debt 6.2 2.6 2.9 2.5 2.5 2.6

17 FCFE $6.2 $4.0 $4.1 $6.0 $6.7 $7.1

26-25

Tutwiler Corporate Valuation

m 1 . 83 $ 27 $ 1 . 110 $

1 . 110 $ V

m 1 . 153 $

06 . 0 1070 / 0

) 06 . 1 ( 800 . 6 $

HV

g WACC

) g 1 ( FCF

g WACC

FCF

HV

Operation

2014 , OP

2014 2015

2014 , OP

Equity of Value

(26-7)

26-26

Tutwiler: Corporate Valuation

Panel B Corporate Valuation CFs

9 NOPAT=EBIT(1-T) (T=40%) $4.2 $7.2 $9.6 $12.4 $13.8

10 Less net invest. In op cap 1.0 4.0 4.0 6.0 7.0

11 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

Horizon value $153.1

FCF $3.2 $3.2 $5.6 $6.4 $159.9

Present Value of FCF $110.1

Minus Value of current debt $27.0

Value of Equity $83.1

26-27

Tutwiler APV Approach

% 793 . 11 r

%) 9 ( 3017 . 0 %) 13 ( 6983 . 0 r

r w r w r

sU

sU

d d sL s sU

5) - (26

Estimate Tutwilers Unlevered Cost of Equity:

26-28

Tutwiler APV Approach

Panel C: APV Model Cash Flows

12 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

Horizon Value of FCF $124.4

Total FCF $3.2 $3.2 $5.6 $6.4 $131.2

Value (Unlevered) $88.7

13 Interest tax savings = INT(T) 1.2 1.28 1.4 1.48 1.56

Horizon Value of tax savings $28.7

Total Tax Shield $1.2 $1.3 $1.4 $1.5 $30.3

Value(Tax Shield) $21.4

Total Value of Firm $110.1

Minus Value of current debt $27.0 r(sU) 11.793%

Value of Equity $83.1 g = 6%

26-29

Tutwiler FCFE Model

m 9 . 106 $

06 . 0 13 . 0

) 06 . 1 ( 06 . 7 $

HV

g r

) g 1 ( FCFE

g r

FCFE

HV

N , FCFE

sL sL

2015

2014 , FCFE

(26-14)

26-30

Panel D: FCFE Model Cash Flows

14 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

15 Less A-T Interest=INT(1-T) 1.8 1.9 2.1 2.2 2.4

16 Plus debt 6.2 2.6 2.9 2.5 2.5 2.6

17 FCFE $6.2 $4.0 $4.1 $6.0 $6.7 $7.1

Horizon value of FCFE 106.9

Total FCFE $6.2 $4.0 $4.1 $6.0 $6.7 $114.0

Value of FCFE $83.1

r(sL) 13.0%

g = 6%

Tutwiler FCFE Model

26-31

Tutwiler Value Recap

Tutwiler is worth more as part of

Caldwell than stand-alone

Current Value of Equity $62.5

Corporate Valuation $83.1

APV Approach $83.1

FCFE Model $83.1

TUTWILER Equity

26-32

The Bid Price

Caldwells Bid for Tutwiler

Caldwell will assume Tutwilers debt

Added short-term debt for acquisition

Analysis shows Tutwiler worth $83.1m

to Caldwell

If Caldwell pays more Caldwell value

diluted

How much should Caldwell offer?

26-33

Caldwells Bid for Tutwiler

Targets Estimated value = $83.1 million

Targets current value = $62.5 million

Merger premium = $20.6 million

Synergistic Benefits = $20.6 million

Realizing synergies has been problematic

in many mergers

26-34

Caldwells Bid

Offer range = $62.5m to $83.1m

$62.5m merger benefits would

go to the acquiring firms

shareholders

$83.1m all value added would go

to the target firms shareholders

26-35

Bid Strategy Issues

High preemptive bid to ward off other

bidders

Low bid and then plan to go up

Do targets managers have 51% of

stock and want to remain in control?

What kind of personal deal will targets

managers get?

26-36

Do mergers really create value?

According to empirical evidence,

acquisitions do create value as a result of

economies of scale, other synergies, and/or

better management.

Target firm shareholders reap most of the

benefits

Final price close to full value

Target management can always say no

Competing bidders often push up prices

26-37

Acquisition with Permanent

Change in Capital Structure

Tutwiler currently:

$62.5m value of equity

$27m debt = 30.17% debt

Caldwells plan

Increase debt to 50%

Maintain level from 2012 on

New rate on debt = 9.5%

Tax shield, WACC and bid price will change

26-38

Change in Tax Shield

This last debt level is consistent with the assumed

long-term capital structure

The last interest payment is consistent with the long-term capital

structure

9. Debt 52.63 63.16 73.68 78.95 87.33

10. Interest

a

5.000 6.000 7.000 7.500 8.296

11. Interest tax savings 2.000 2.400 2.800 3.000 3.319

26-39

Effect on the Bid Price

New Horizon Value Calculation

First, calculate Tutwiler's horizon value if it were unlevered.

HV

U

= FCF

2014

* (1 + g) (r

U

- g)

HV

U

= 6.8 * 1.060 0.1179 - 0.06

HV

U

= $124.42

Second, calculate the horizon value of Tutwiler's tax shields under new financing plan:

HV

TS

= TS

2014

* (1 + g) (r

U

- g)

HV

TS

= 3.319 * 1.060 0.1179 - 0.06

HV

TS

= $60.72

Horizon value of Tax Shields is larger due to increased debt level.

26-40

Revised Value of Tutwiler

12 Free Cash Flow $3.2 $3.2 $5.6 $6.4 $6.8

Horizon Value of FCF $124.4

Total FCF $3.2 $3.2 $5.6 $6.4 $131.2

Value (Unlevered) $88.7

13 Interest tax savings = INT(T) 2.0 2.4 2.8 3.0 3.3

Horizon Value of tax savings $60.7

Total Tax Shield $2.0 $2.4 $2.8 $3.0 $64.0

Value(Tax Shield) $44.3

Total Value of Firm $133.0

Minus Value of current debt $27.0 r(sU) 11.793%

Revised Value of Equity $106.0 g = 6%

Panel C: APV Model Cash Flows with Increased Debt

26-41

Recap: Value of Tutwiler Equity

Total Per Sh

Current Value of Equity $62.5 $6.25

Original Merger Value $83.1 $8.31

APV Approach Revised $106.0 $10.60

TUTWILER Equity

26-42

Merger Payment

Cash

Shares in acquiring firm

Debt of the acquiring firm

Combination

26-43

Bid Structure Effects

Capital structure of post-merger firm

Tax treatment of shareholders

Ability of target shareholders to

benefit from post merger gains

Federal & state regulations applied to

acquiring firm

26-44

Tax Consequences

Shareholders

Taxable Offer

Payment = primarily cash or bonds

IRS views as a sale

Target shareholders taxed on gain

Original purchase price vs. Offer price

Taxed in year of merger

26-45

Non-taxable Offer

Payment = primarily stock

IRS views as an exchange

Target shareholder pay no taxes at

time of merger

Taxed at time of stock sale

Preferred by shareholders

Tax Consequences

Shareholders

26-46

Tax Consequences

Firms

Non-taxable offer

Simple merger of balance sheets

Continue depreciating targets assets as

previously

Taxable offer depends on offer type

Offer for targets assets

Offer for targets stock

26-47

Taxable Offer for Targets assets

Acquirer pays gain on offer asset value

Acquirer records targets assets at

appraised value

Depreciation based on new valuation

Goodwill = offer new valuation

Amortized over 15 years/straight line

Tax Consequences

Firms

26-48

Taxable Offer for Targets Stock

2 Choices of tax treatment

1. Record acquired assets at book value

and continue depreciating on current

schedule

2. Record acquired assets at appraised

value and generate goodwill

Tax Consequences

Firms

26-49

Figure

26-1

26-50

Purchase Accounting

Purchase:

Assets of acquired firm are written up or

down to reflect purchase price relative to

net asset value

Goodwill often created

An asset on the balance sheet

Common equity account increased to

balance assets and claims

26-51

Table 26-4

26-52

Income Statement Effects

Table 26-5

26-53

Goodwill Amortization

Goodwill amortization:

No longer amortized over time for

shareholder reporting

Still amortized for Federal Tax purposes

Goodwill subject to annual impairment

test

If fair market value has declined, then

goodwill is reduced

26-54

The Role of Investment Bankers

Arranging mergers

Identifying targets

Developing defensive tactics

Establishing a fair value

Financing mergers

Arbitrage operations

26-55

Defensive Tactics

Super Majority

1/3 of Directors elected each year

75% approval for merger versus simple majority

Convince target price is too low

Raising anti-trust issues

Open market repurchase of stock to push price up

Finding a White Knight

Finding a White Squire

Taking a Poison Pill

ESOP plans

26-56

Poison Pills

Any technique used to discourage

hostile takeovers

Borrowing on terms that require

immediate repayment if acquired

Selling desirable assets at low prices

Granting lucrative golden parachutes

Allowing current shareholders to buy

shares at reduced prices

26-57

Risk Arbitrage

Arbitrageurs or arbs

Speculation in likely takeover

targets

Insider trading scandals

Ivan Boesky

26-58

Who Wins?

Takeovers increase the wealth of

target firm shareholders

Benefit to acquiring firm debatable

Event Studies Target stock price

30% for hostile tender offers

20% for friendly mergers

26-59

Alliances versus Acquisitions

Access to new markets and technologies

Multiple parties share risks and expenses

Rivals can often work together

harmoniously

Antitrust laws can shelter cooperative

R&D activities

26-60

Leveraged Buyout (LB0)

Small group of investors buys all

publicly held stock

Takes the firm private

Group usually includes management

Purchase often financed with large

amounts of high-yield debt

Investors take firm public to cash out

26-61

Advantages and Disadvantages of

Going Private

Advantages:

Administrative cost savings

Increased managerial incentives

Increased managerial flexibility

Increased shareholder participation

Disadvantages:

Limited access to equity capital

No way to capture return on investment

26-62

Types of Divestitures

Sale of entire subsidiary to another firm

Spin-off

Spinning off a corporate subsidiary by

giving the stock to existing shareholders

Carve-out

Selling a minority interest in a subsidiary

Outright liquidation of assets

26-63

Motivation for Divestitures

Subsidiary worth more to buyer than

when operated by current owner

Settle antitrust issues

Subsidiarys value increased operated

independently

Change strategic direction

Shed money losers

Get needed cash when distressed

26-64

Holding Companies

Corporation formed for sole purpose of

owning the stocks of other companies

Typically, subsidiary companies:

Issue their own debt

Equity held by the holding company

Holding company sells stock to individual

investors

26-65

Advantages and Disadvantages of

Holding Companies

Advantages:

Control with fractional ownership

Isolation of risks

Disadvantages:

Partial multiple taxation

Ease of enforced dissolution

You might also like

- Capital BudgettingDocument31 pagesCapital Budgettingkataruka123No ratings yet

- 15 Min Guide To GMATDocument13 pages15 Min Guide To GMATAaron CampbellNo ratings yet

- Alsha YaDocument1 pageAlsha YaAtul MittalNo ratings yet

- Quotation: Vat/Tin: 29471119182 CST No: 29471119182 PannoDocument1 pageQuotation: Vat/Tin: 29471119182 CST No: 29471119182 PannoAtul MittalNo ratings yet

- Transfer Pricing: Optimal Product Mix and Divisional ProfitsDocument69 pagesTransfer Pricing: Optimal Product Mix and Divisional ProfitsAtul Mittal100% (1)

- National Institute of Research CentreDocument66 pagesNational Institute of Research CentreAtul MittalNo ratings yet

- Problem Set 2 International Finance SolutionsDocument9 pagesProblem Set 2 International Finance SolutionsSourav NandyNo ratings yet

- Suncoast Office, A Goal Programming Problem, Solution, Analysis, Sensitivity Analysis, and ReportDocument8 pagesSuncoast Office, A Goal Programming Problem, Solution, Analysis, Sensitivity Analysis, and ReportArka ChakrabortyNo ratings yet

- Syllabus: Faculty of Management Studies, University of DelhiDocument7 pagesSyllabus: Faculty of Management Studies, University of DelhiAtul MittalNo ratings yet

- Online GroceryDocument6 pagesOnline GroceryAtul Mittal100% (1)

- Johnson RuleDocument2 pagesJohnson RuleKaran MadaanNo ratings yet

- Exposure Norms - RBI CircularDocument38 pagesExposure Norms - RBI CircularAtul MittalNo ratings yet

- 2013 Course CatalogDocument12 pages2013 Course CatalogAtul MittalNo ratings yet

- Intel Capital PortfolioDocument95 pagesIntel Capital PortfolioAtul MittalNo ratings yet

- 9HRRWGR101012 CDRDocument10 pages9HRRWGR101012 CDRAtul MittalNo ratings yet

- CDR Master Circular 2012Document72 pagesCDR Master Circular 2012Gaurav KukrejaNo ratings yet

- Previous Year GD & Extempore Topic1Document5 pagesPrevious Year GD & Extempore Topic1Raj KumarNo ratings yet

- Products of Large CorporatesDocument3 pagesProducts of Large CorporatesAtul MittalNo ratings yet

- UniversitiesDocument1 pageUniversitiesAtul MittalNo ratings yet

- FMS Admission Brochure 2012Document44 pagesFMS Admission Brochure 2012pisthuNo ratings yet

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Document3 pagesBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Interest Rate Parity: 1. A Covered Interest ArbitrageDocument4 pagesInterest Rate Parity: 1. A Covered Interest ArbitrageRockyLagishettyNo ratings yet

- International Financial Management 13th Edition Madura Test BankDocument30 pagesInternational Financial Management 13th Edition Madura Test Bankaprilhillwoijndycsf100% (27)

- Commodities Daily: Focus: SHFE-LME Zinc - Arbitrage Opportunities?Document5 pagesCommodities Daily: Focus: SHFE-LME Zinc - Arbitrage Opportunities?Mahmudul Hasan MahimNo ratings yet

- H 17 DecoursetextDocument629 pagesH 17 Decoursetextcanela.dNo ratings yet

- Nism 8 - Equity Derivatives - Practice Test 2Document19 pagesNism 8 - Equity Derivatives - Practice Test 2complaints.tradeNo ratings yet

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- Chapter 17 International Business Finance: Foundations of Finance, 7e (Keown/Martin/Petty)Document26 pagesChapter 17 International Business Finance: Foundations of Finance, 7e (Keown/Martin/Petty)Vivian ChullamonNo ratings yet

- Derivatives: Analysis and ValuationDocument34 pagesDerivatives: Analysis and ValuationVanessa DavisNo ratings yet

- MGT 112 Global Business StrategyDocument39 pagesMGT 112 Global Business StrategyOmar RiberiaNo ratings yet

- Hedge Funds AustraliaDocument9 pagesHedge Funds Australiae_mike2003No ratings yet

- Forex - Problems in Exchange RateDocument26 pagesForex - Problems in Exchange Rateyawehnew23No ratings yet

- ASB4403 International Financial MarketsDocument4 pagesASB4403 International Financial MarketsIbidzleNo ratings yet

- Question Pool Chapter03Document35 pagesQuestion Pool Chapter03Petar N NeychevNo ratings yet

- Schedule of Assessment Programs Fees Infinity Forex Funds V5Document14 pagesSchedule of Assessment Programs Fees Infinity Forex Funds V5newalbertblkyanNo ratings yet

- Nism Series Xvi Commodity Derivative Exam Workbook PDFDocument30 pagesNism Series Xvi Commodity Derivative Exam Workbook PDFDwaipayan MojumderNo ratings yet

- CH-6-Efficient Capital MarketsDocument9 pagesCH-6-Efficient Capital MarketsMoin khanNo ratings yet

- FM AssignmentDocument10 pagesFM Assignmentshingirai kasaeraNo ratings yet

- Hedge Fund Strategies and StylesDocument28 pagesHedge Fund Strategies and StylesPriya JagasiaNo ratings yet

- Euromktscan PlattsDocument16 pagesEuromktscan PlattschrisofomaNo ratings yet

- Investor Perception Study Towards Equity Derivatives TradingDocument13 pagesInvestor Perception Study Towards Equity Derivatives TradingBEPF 13 Parth LanghnejaNo ratings yet

- Energy Trading and Risk Management: Tadahiro Nakajima Shigeyuki HamoriDocument145 pagesEnergy Trading and Risk Management: Tadahiro Nakajima Shigeyuki HamoriefqdswdgvcrggfNo ratings yet

- CÂU HỎI TRẮC NGHIỆM IRP 1Document4 pagesCÂU HỎI TRẮC NGHIỆM IRP 1Nhi PhanNo ratings yet

- FINA3203 Solution 2Document6 pagesFINA3203 Solution 2simonsin6a30No ratings yet

- Bear Stearns Annual Report 2006Document117 pagesBear Stearns Annual Report 2006highfinance100% (1)

- Capital Structure and Firm ValueDocument33 pagesCapital Structure and Firm Valuemanish9890No ratings yet

- 2018 FRM Practice Exam Part IDocument136 pages2018 FRM Practice Exam Part Ideepti100% (2)

- RiskDocument4 pagesRiskUtkarsh ChoudharyNo ratings yet

- Banking GlossaryDocument178 pagesBanking GlossaryasadullahqureshiNo ratings yet

- LB - Abs Cdo PrimerDocument28 pagesLB - Abs Cdo PrimerJonRLaiNo ratings yet

- Solution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultDocument15 pagesSolution Manual For International Business Competing in The Global Marketplace 12th Edition Charles W L Hill G Tomas M HultBrianWelchxqdm100% (35)