Professional Documents

Culture Documents

Chapter 1 - Controllership

Uploaded by

JakeSimmonsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Controllership

Uploaded by

JakeSimmonsCopyright:

Available Formats

SHORT-TERM

FINANCIAL

MANAGEMENT

Chapter 1 - The Role of Working Capital

Prepared by Patricia R. Robertson

Kennesaw State University

Textbook Outline

Part I Introduction to Liquidity

Part II Management of Working Capital

Part III Corporate Cash Management

Part IV Forecasting & Planning

Part V Short-Term Investing &

Financing

Part VI Special Topics

2

Part I - Introduction to Liquidity

Chapters

Covered

Chapter 1

The Role of Working Capital

Chapter 2

Analysis of the Working Capital Cycle

Chapter 3

Cash Holdings

3

Identify the cash flows associated with short-term

financing decisions.

understand how working capital flows and

depreciation charges create a disparity between

profit and operating cash flow.

identify the basic issues involved in managing

working capital.

After studying this chapter, you should be

able to:

4

THE ROLE OF WORKING CAPITAL

Chapter 1 Agenda

5

Identify the cash flows associated

with short-term financing decisions,

understand how working capital flows

and depreciation charges create a

disparity between profit and

operating cash flow, and identify the

basic issues involved in managing

working capital.

Working Capital Management

6

Short-Term Financial Management (aka Working

Capital Management) is the day-to-day management

of the operating needs of a firm through its current

assets and current liabilities.

It involves managing cash, accounts receivable, inventory,

accounts payable, and accruals.

The goal is to ensure a firm has the ability to satisfy

both upcoming operational expenses and maturing

short-term debt.

The Importance of Cash

Cash flow is the lifeblood of a firm.

The firm must design a cost structure to operate

profitably or it will fail.

Similarly, profitable companies, if cash-strapped, can

also fail.

Profits and cash flow are highly correlated in short-

term decision-making.

Therefore, firms must manage cash flows and profits.

7

Financial Statements

8

Financial statements report the performance of a firm, and

include the:

Balance sheet

Income statement

Statement of retained earnings

Statement of cash flows

These interrelated statements show where money came

from, where it went, and where it is now.

We need to understand if and where the firm generated cash,

and where it was used.

While this course focuses on short-term financial management,

we will review long-term sources and uses of cash, too.

Understanding the sources and uses of cash historically allows

for the accurate prediction of future cash flows.

Financial Analysis

9

Financial analysis is used to understand a firms historical

and present financial position, as well as its prospects.

The objective of financial statement analysis depends on the

perspective of the user:

Management

Creditors

Investors

Suppliers

Analysts

Regulators

The Balance Sheet

10

The balance sheet is a snapshot of the financial accounts of a

firm as of a particular date.

Assets

11

Assets are categorized as current (CA) or fixed

(FA).

Assets are listed on the balance

sheet in order of liquidity.

Frequently, more than one

timeframe is presented for

comparison.

Current assets are expected to be

converted to cash within a year.

Fixed assets have a relatively long

life, and can be tangible (e.g.

building) or intangible (e.g.

patent).

Liabilities & Owners Equity

12

Liabilities are categorized as current (CL) or long-term

(LTD).

Liabilities are also listed in order

of liquidity.

Current liabilities are expected to

be paid within a year, and will

require cash.

Long-term liabilities have

maturities longer than one year.

The difference between assets

and liabilities is owners equity

(E).

The Current Accounts

13

The relationship between current assets and current

liabilities is critical to the ongoing operations of the

firm.

Current Assets

14

Cash & equivalents

Cash and highly-liquid investments.

Short-term investments

Investments to be liquidated within the

year.

Accounts receivable

Sales made to customers on credit.

Displayed net of doubtful accounts.

Inventory

Some combination of raw materials,

W-I-P, and finished goods.

Affected by valuation method/inflation.

Other

Generally, Prepaid Expenses.

Cash Position refers to cash

on hand and in the bank, as

well as access to bank loans and

short-term investments.

Current Liabilities

15

Accounts payable

Amounts owed to suppliers

for purchases.

Accruals

Expenses incurred but not

yet paid (e.g. salaries, rent,

insurance, taxes, etc.).

Short-term debt

Short-term debt and/or the

principal portion of long-

term debt due within the

year.

The term of debt should

match the type of asset

financed.

Working Capital

16

(Net) working capital = current assets current liabilities

Working capital is the operating liquidity available to a company

and is positive in a healthy firm and varies by industry.

If a firm has negative working capital, it might have to sell assets at

fire sale prices to raise cash.

Long-Term Assets & Liabilities

17

Long-term assets represent the investments made by the

firm.

Long-term liabilities (LTD) represent the long-term financing

sources for those investments.

The residual interest in assets after deducting

liabilities.

Includes Common Stock (at par), Additional Paid-In-

Capital, Retained Earnings, and Treasury Stock.

Retained Earnings is not idle cash; rather reinvested

earnings.

Stockholders Equity

18

Sources & Uses of Cash

Buy inventory on credit

Sell inventory for cash

Collect receivables

Borrow short-term debt

Borrow long-term debt

Sell fixed assets

Sell common stock

Liquidate investments

Buy inventory with cash

Make sales on credit

Pay suppliers (A/P)

Repay short-term loan

Retire long-term debt

Buy fixed assets

Repurchase stock

Pay dividends / taxes

Make new investments

19

Sources (Inflows) Uses (Outflows)

On the balance sheet, there are both short and long-term sources

and uses of cash; they are the opposite of each other.

The Income Statement

20

The income statement measures financial performance over

a period of time.

Income,

earnings, and

profit are used

interchangeably.

The Income Statement

21

Revenue is recognized when

earned, not collected

(accrual accounting).

Expenses are booked to

match the timing of

revenue recognition.

The income statement does

not reflect cash flows.

We are concerned with cash

flows.

Earnings Quality

22

Earnings quality is

affected by:

Accounting choices,

methods, and

assumptions.

Discretionary

expenditures.

Non-recurring

transactions.

Non-operating gains and

losses.

Profits vs. Cash

Net income is not the same

as cash flow (economic

earnings).

The firm earned $5,642

million, yet cash decreased

by $65 million.

We look to the balance

sheet to reconcile

changes in cash.

23

Cash Flow Timeline Example

24

A brand new

firm is

created.

The owner

puts in half

the money

and borrows

the other

half.

Cash 1,000 $ Debt 500 $

Stock 500 $

Total 1,000 $ Total 1,000 $

Balance Sheet - Day 1

Assets Liabilities & Net Worth

Cash Flow Timeline Example

25

The next day,

the firm buys

a building and

an initial

supply of

inventory.

They pay cash

for the

building and

the inventory

is bought on

45-day credit

from the

firms

suppliers.

Cash 1,000 $ Debt 500 $

Stock 500 $

Total 1,000 $ Total 1,000 $

Cash 400 $ Accounts Payable 300 $

Inventory 300 $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

Total 1,300 $ Total 1,300 $

Balance Sheet - Day 1

Balance Sheet - Day 2

Assets Liabilities & Net Worth

Assets Liabilities & Net Worth

Cash Flow Timeline Example

26

Buying the

inventory on

credit creates

the liability,

accounts

payable.

The size of

the firm

increases by

$300.

Cash 1,000 $ Debt 500 $

Stock 500 $

Total 1,000 $ Total 1,000 $

Cash 400 $ Accounts Payable 300 $

Inventory 300 $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

Total 1,300 $ Total 1,300 $

Balance Sheet - Day 1

Balance Sheet - Day 2

Assets Liabilities & Net Worth

Assets Liabilities & Net Worth

Cash Flow Timeline Example

27

Heres where

we are at

month-end.

The firm

offers credit

sales to

customers,

creating a

receivable

and depleting

inventory.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Sales 700 $

Cost of Goods Sold 300 $

Gross Profit 400 $

Operating Expenses

Salaries, Advertising, Etc. 200 $

Depreciation 100 $

Operating Profit 100 $

Interest 50 $

Taxes 25 $

Net Profit 25 $

Income Statement - End of Month

Cash Flow Timeline Example

28

As the firm

operates, it

incurs

expenses

(salaries,

utilities, rent,

etc.), which

are accrued

until paid.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Sales 700 $

Cost of Goods Sold 300 $

Gross Profit 400 $

Operating Expenses

Salaries, Advertising, Etc. 200 $

Depreciation 100 $

Operating Profit 100 $

Interest 50 $

Taxes 25 $

Net Profit 25 $

Income Statement - End of Month

Cash Flow Timeline Example

29

Depreciation,

a non-cash

charge, is

expensed.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Sales 700 $

Cost of Goods Sold 300 $

Gross Profit 400 $

Operating Expenses

Salaries, Advertising, Etc. 200 $

Depreciation 100 $

Operating Profit 100 $

Interest 50 $

Taxes 25 $

Net Profit 25 $

Income Statement - End of Month

Cash Flow Timeline Example

30

Cash is used

to pay

interest and

taxes.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Sales 700 $

Cost of Goods Sold 300 $

Gross Profit 400 $

Operating Expenses

Salaries, Advertising, Etc. 200 $

Depreciation 100 $

Operating Profit 100 $

Interest 50 $

Taxes 25 $

Net Profit 25 $

Income Statement - End of Month

Cash Flow Timeline Example

31

Profits are

added to the

balance sheet

as retained

earnings.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Sales 700 $

Cost of Goods Sold 300 $

Gross Profit 400 $

Operating Expenses

Salaries, Advertising, Etc. 200 $

Depreciation 100 $

Operating Profit 100 $

Interest 50 $

Taxes 25 $

Net Profit 25 $

Income Statement - End of Month

Cash Flow Timeline Example

32

At the

beginning of

the next

month, the

bills for the

accruals are

paid with

cash.

The balance

sheet

decreases in

size.

Cash 325 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals 200 $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,525 $ Total 1,525 $

Cash 125 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,325 $ Total 1,325 $

Assets Liabilities & Net Worth

Balance Sheet - Beginning of Next Month

Assets Liabilities & Net Worth

Balance Sheet - End of Month

Cash Flow Timeline Example

33

Cash is used

to pay the

accounts

payable once

due.

The firm made

$25 but has

spent cash it

does not have.

THE FIRM

HAS PAID

CASH FOR

EXPENSES

BUT HAS

COLLECTED

NO MONEY

FOR SALES.

Cash 125 $ Accounts Payable 300 $

Accounts Receivable 700 $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,325 $ Total 1,325 $

Cash (175) $ Accounts Payable - $

Accounts Receivable 700 $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,025 $ Total 1,025 $

Balance Sheet - Middle of Next Month

Assets Liabilities & Net Worth

Balance Sheet - Beginning of Next Month

Assets Liabilities & Net Worth

Cash Flow Timeline Example

34

In the final

view, the A/R

are collected.

The firm still

has $25 in

profit, but has

$125 more in

cash than it

had after

buying the

building.

During the

cycle, the cash

ranged from a

high of $525

to a low of

($175).

Cash (175) $ Accounts Payable - $

Accounts Receivable 700 $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,025 $ Total 1,025 $

Cash 525 $ Accounts Payable - $

Accounts Receivable - $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,025 $ Total 1,025 $

Balance Sheet - Middle of Next Month

Assets Liabilities & Net Worth

Balance Sheet - Final View

Assets Liabilities & Net Worth

Cash Flow Timeline Example

35

Despite being profitable, why did the firm run out of cash

during the operating cycle?

This is explained by differences in the timing of cash

disbursements and cash receipts.

Firms must establish policies to manage working capital

accounts so that an adequate amount of liquidity is available

to run the business.

The Cash Cycle

36

We are concerned with the amount of cash flow, as well as

the timing.

We have to build and sell products before we can generate cash

inflows.

In the meantime, we incur cash outflows for supplies and labor.

We are concerned with the success of operations, or cash

generated internally.

Externally generated cash comes from investing and financing

activities.

Temporary operating shortfalls can be satisfied with borrowing,

but ultimately a firm must generate cash.

The Cash Cycle

Inventory, if purchased on credit,

creates an accounts payable.

Inventory, if sold on credit, generates an

accounts receivable.

Receivables are collected in cash.

Payables are paid out of cash from

sales, by drawing down liquid reserves,

or by borrowing.

37

Cash flows in a cycle into, around, and out of a businessit

is the lifeblood of the firm.

If the firm were to stop its operating activities, most (if

not all) of the cash tied up in working capital would be

released; the operating cycle affects the timing of

cash flow.

Cash Flow Timeline

38

The cash

conversion

period is the

time between

when cash is

received versus

paid.

The shorter the

cash conversion

period, the

more efficient

the firms

working capital

and more cash

is generated.

The firm is a system of cash flows.

These cash flows are unsynchronized and uncertain.

Operating Versus Cash Cycle

39

The Operating Cycle is the length of time from buying

inventory to collecting cash.

Say, we buy inventory on credit and pay the bill 30 days later.

We sell the inventory 30 days after that, and get paid after 45

days.

The Operating Cycle is 105 days.

The Cash Cycle (Cash Conversion Period) is the elapsed

time between the firms payment to suppliers and receipt of

customer payments.

Here, the Cash Cycle is 75 days (105 30).

40

The Cash Cycle

Firms must manage cash flows

and profits to ensure it has the

necessary cash for daily

operations.

Any gaps must be filled by short-

term borrowing or using cash

reserves.

Alternatively, the firms can alter

the cycle by changing the timing

of the cash flows.

41

We need to isolate the cash component of the accrual-based

income statement entries:

Operating Cash Flows, together with other sources and uses

of cash, explain the change in cash on the balance sheet.

Analysis also includes adjustments for non-recurring items.

Operating Cash Flows

42

Cash Collected From Customers

- Cash Paid To Suppliers

- Cash Paid For Operations

- Cash Paid To Creditors

- Cash Paid For Taxes

= Cash Flow From Operations

Operating Cash Flows

43

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

We look to the income statement and changes on the

balance sheet to reconcile changes in cash at a single

point in time.

Converting I/S to Cash Flows

44

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

Assets

= Use

= Source

Liabilities

= Use

=Source

Converting I/S to Cash Flows

45

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

If A/R increased,

then not all of the

sales recorded

during the period

have been

collected; less cash

was collected than

recorded on the

accrual-based

income statement.

If A/R decreased,

cash from prior

period sales was

collected.

Converting I/S to Cash Flows

46

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

If A/P increased,

then not all of the

inventory expensed

in CGS has been

paid for; less cash

was paid to suppliers

than reflected on

the income

statement.

If A/P decreased, we

paid for items this

period expensed in a

prior period.

Converting I/S to Cash Flows

47

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

If inventory increased,

it represents an

additional use of cash

to purchase inventory

not yet sold and not

included in CGS.

If inventory decreased,

the firm did not

replenish inventory

sold, freeing up cash

previously held in the

working capital cycle.

Converting I/S to Cash Flows

48

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

An increase in

accrued expenses

indicates we

expensed items for

which cash has not

yet been paid.

A decrease in

accruals mean we

paid for items

expensed in a prior

period.

Accruals can be recorded as assets or liabilities. In either case, it is simply a matter of

timing; the transaction has occurred but money has not changed hands. An example

is interest. For investments, interest income is an accrued asset. For a loan, interest

expense is an accrued liability.

Converting I/S to Cash Flows

49

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

Similarly (and not

included on the

chart), an increase

in Prepaid Expenses

is a cash outflow

for items not yet

expensed, so is

added to Operating

Expenses.

Accrued expenses are the opposite of prepaid expenses.

Converting I/S to Cash Flows

50

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

We are interested in current period depreciation. If using the income statement,

simply use the depreciation expensed during the year. If getting this information

from the balance sheet, use the change in accumulated depreciation. Note that the

latter could (and likely does) have noise from the sale of fixed assets during the

period that affected accumulated depreciation.

The income

statement includes

the non-cash

charge,

depreciation.

Adjust operating

expenses to

include current

period

depreciation, a

non-cash expense.

Converting I/S to Cash Flows

51

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

Deferred taxes

result from timing

(temporary)

differences.

Accrued taxes are

permanent

differences

between tax

returns and

financial

statements (e.g.:

depreciation

methods on fixed

assets).

A deferred expense has been incurred but not yet paid; an accrued expense has not yet

been incurred.

Converting I/S to Cash Flows

52

Cash Flow Statement

Income Statement Adjustment Cash Flow Account

Sales - A/R = Cash Collected

- A/P

+ Inv

- Op Accr

- Dep

Interest - Acc Int = Cash Paid to Creditors

- Accrued Txs

- Deferred Txs

Net Profit Operating Cash Flow

CGS

Operating Expenses

Taxes

= Cash Paid to Suppliers

= Cash Paid for Op Exps

= Cash Paid for Taxes

A firm must be

able to translate

earnings (profits)

into cash.

If a firm has

negative operating

cash flow, it did

not generate cash

from its primary

operations and

must liquidate

investments or

borrow.

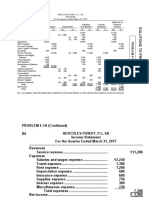

Back To This Example

53

Presented are

two points in

timeDay 1

and the final

view.

Lets

reconcile the

change in

cash from

$1,000 to

$525.

Cash 1,000 $ Debt 500 $

Stock 500 $

Total 1,000 $ Total 1,000 $

Cash 525 $ Accounts Payable - $

Accounts Receivable - $ Accruals - $

Inventory - $ Debt 500 $

Fixed Assets 600 $ Stock 500 $

(Accumulated Depreciation) (100) $ Retained Earnings 25 $

Total 1,025 $ Total 1,025 $

Balance Sheet - Final View

Assets Liabilities & Net Worth

Balance Sheet - Day 1

Assets Liabilities & Net Worth

54

Reconciliation of Cash

We will do a more complex

example in a minutefor

now, become acquainted with

the format.

Cash Flow Statement

Inccome Statement 2009 Adjustment Change Cash Flow LT Sources/Uses Change

Sales 700 $ - A/R - $ 700 $ - Fixed Assets 500 $

CGS 300 $ - A/P - $ - Depreciation 100 $

+ Inv - $ + Short-Term Debt - $

Operating Expenses 300 $ - Op Accr - $ + Long-Term Debt - $

- Dep 100 $ + Other Liabilities - $

Interest 50 $ - Acc Int - $ 50 $ - Dividends Paid - $

Taxes 25 $ - Def Txs - $ 25 $ LT Change in Cash (600) $

Net Profit 25 $ Operating Cash Flow 125 $

125 $

-$600

(475) $

1,000 $

(475) $

525 $

Beginning Cash

Total Change in Cash

Ending Cash

Cash Reconciliation

300 $

200 $

Operating Cash Flow

LT Change in Cash

Total Change in Cash

Cash Flow Statement

Inccome Statement 2009 Adjustment Change Cash Flow LT Sources/Uses Change

Sales 700 $ - A/R - $ 700 $ - Fixed Assets 500 $

CGS 300 $ - A/P - $ - Depreciation 100 $

+ Inv - $ + Short-Term Debt - $

Operating Expenses 300 $ - Op Accr - $ + Long-Term Debt - $

- Dep 100 $ + Other Liabilities - $

Interest 50 $ - Acc Int - $ 50 $ - Dividends Paid - $

Taxes 25 $ - Def Txs - $ 25 $ LT Change in Cash (600) $

Net Profit 25 $ Operating Cash Flow 125 $

125 $

-$600

(475) $

1,000 $

(475) $

525 $

Beginning Cash

Total Change in Cash

Ending Cash

Cash Reconciliation

300 $

200 $

Operating Cash Flow

LT Change in Cash

Total Change in Cash

55

Reconciliation of Cash

IMPORTANT:

1) EVERY line item on the balance sheet must

be accounted for somewhere in the analysis.

2) Dont double-count depreciation. Use

EITHER the change in net fixed assets and

add back change in accumulated

depreciation OR use change in gross fixed

assets.

2

The analyst should be concerned with:

The success (or failure) of firm in generating cash

from operations.

The underlying causes of (and magnitude of)

positive or negative operating cash flow.

Fluctuations in operating cash flows over time.

Operating Cash Flows

56

Managing the Cash Cycle

57

Managing The Cash Cycle

58

Managing the cash cycle includes:

Reducing idle inventory

Stretching payables

Aggressively managing receivables

Receivables and inventory

absorb cash; payables supply

cash.

Working Capital Management

59

The cheapest and best source of cash exists as

working capital within the business:

Managing The Cash Cycle

60

The cash flow cycle refers to the continual flow of

resources through the working capital accounts.

This results in periods of cash surpluses and deficits.

The faster a firm is growing, the more cash it needs.

While a firm can operate with negative cash flow for short

periods of time, it must generate positive cash flow long-

term.

Some firms try to manage working capital to zero.

Zero investment in working capital increases cash.

Zero investment in working capital is a permanent increase

in earnings.

Shareholder Value Creation

61

Value can be created from many short-term financial

management activities.

Inventory Cash Management

Level Amount & Timing of Collections

Mix Amount & Timing of Disbursements

Timing Amount & Timing of Concentration

Customer Integration Receivables Banking System

Supply Chain Integration Quality Information System Integration

Information System Integration Quantity

Collection Short-Term Investing & Borrowing

Payables Timing Vendors

Utilization Customer Integration Maturity

Timing Information System Integration Hedging

Supplier Negotiation Yield

Purchasing Integration Diversification

Information System Integration Liquidity

Information System Integration

Managing Inventory

62

Inventory levels should be adequate to meet uncertain

client demand without investing cash in too much

inventory.

There is a trade-off between:

Stock-out costs

Cost of excess inventory (holding costs)

Ordering costs

More in Chapter 4.

Managing Receivables

63

The Financial Manager decides:

Which customers may buy on credit.

How much credit is offered and on what terms.

e.g.: Net 30, 2/10; Net 30

The process for monitoring collections.

The procedures for processing remittances to minimize float.

Float is time it takes to convert the remittance to cash.

More in Chapters 5, 6 & 9.

Managing Payables

64

Payables can be viewed as interest-free financing.

The financial manager wants:

The longest and/or most favorable credit terms available from its

suppliers.

Terms can include cash discounts.

The timing of the payment to be on the due date and not before

depending on the benefit to the firm from the discount versus the

foregone cash.

More in Chapters 7 & 11.

A Few Introductory

Thoughts

65

Short-Term Planning

66

The ultimate goal of short-term planning is to

make sure there is enough cash on hand to

operate.

Over the six-month planning period, this firm has ample

cash. Yet, DURING the six-months, it ran out of cash.

How Much WC Is Enough?

67

Approximately 40%-50% of assets in U.S. firms

are invested in working capital accounts.

The firm must decide how much in resources to

commit to working capital and, specifically, cash

and liquid assets.

In typical economic times, 3.3% 4.1% of the

balance sheet would be in cash (10% in times of

economic distress).

Early Warning Signs

68

Early warning signs of insufficient working capital

include:

Pressure on existing cash reserves.

Unusual cash generating activities (e.g. offering big cash

discounts).

Bank overdrafts.

Emergency bank loans.

Partial payments to suppliers and creditors.

You might also like

- Rosemarie O. Nombrefia: Subject InstructorDocument43 pagesRosemarie O. Nombrefia: Subject InstructorRosemarie Oliva Nombrefia100% (3)

- Elements of Finance Mariano Chapter5Document38 pagesElements of Finance Mariano Chapter5Loi Bermundo100% (1)

- Financial ControllershipDocument27 pagesFinancial Controllershipmarife75% (4)

- Financial Ratio AnalysisDocument25 pagesFinancial Ratio AnalysisSimran SinghNo ratings yet

- FM - 3A - Group 3 - Interest RatesDocument46 pagesFM - 3A - Group 3 - Interest RatesNherwin OstiaNo ratings yet

- FinMan 306 SyllabusDocument8 pagesFinMan 306 Syllabuscarl fuerzasNo ratings yet

- ACCA P1 Governance, Risk, and Ethics - Revision QuestionsDocument2 pagesACCA P1 Governance, Risk, and Ethics - Revision QuestionsChan Tsu ChongNo ratings yet

- Chapter 1: Introduction To Accounting (FAR By: Millan)Document28 pagesChapter 1: Introduction To Accounting (FAR By: Millan)Ella MontefalcoNo ratings yet

- Chapter 4 - Problems - Non-Current Assets Held For Sale and Discontinued OperationsDocument17 pagesChapter 4 - Problems - Non-Current Assets Held For Sale and Discontinued OperationsVictor TucoNo ratings yet

- Hercules Poirpt PDFDocument4 pagesHercules Poirpt PDFsy yusuf75% (12)

- Financial Controller ShipDocument11 pagesFinancial Controller ShipJaimee VelchezNo ratings yet

- 1 Controllership IntroductionDocument33 pages1 Controllership IntroductionPerlyn Tayog100% (1)

- Murray - Lindo ControllershipDocument27 pagesMurray - Lindo ControllershipMichella ManlapigNo ratings yet

- Financial ControllershipDocument4 pagesFinancial ControllershipjheL garciaNo ratings yet

- Questionnaire ControllershipDocument8 pagesQuestionnaire ControllershipDavid Dave FuaNo ratings yet

- FinMan 306 SyllabusDocument9 pagesFinMan 306 SyllabusglennNo ratings yet

- Management ScienceDocument53 pagesManagement Sciencesanthilatha100% (1)

- Global Finance With Electronic BankingDocument53 pagesGlobal Finance With Electronic BankingMissy Acoy100% (1)

- Capital BudgetingDocument20 pagesCapital BudgetingiptrcrmlNo ratings yet

- MBA Managerial Accounting SummaryDocument31 pagesMBA Managerial Accounting Summarycamirpo100% (1)

- Chapter 2Document31 pagesChapter 2Roseanne Yumang100% (1)

- Management ReportingDocument6 pagesManagement ReportingSol Dela PenaNo ratings yet

- Global Finance and Electronic Banking - DiscussionDocument1 pageGlobal Finance and Electronic Banking - DiscussionBenjamen KamzaNo ratings yet

- Cash Management SystemDocument65 pagesCash Management SystemmsdNo ratings yet

- Financial ManagementDocument33 pagesFinancial ManagementSandeep Ghatuary100% (1)

- Management Science: Course Code: 13HM1102 L TPC 4 0 0 3Document2 pagesManagement Science: Course Code: 13HM1102 L TPC 4 0 0 3Praveen PvsmNo ratings yet

- Strategic MAnagment and Strategic CompetitivenessDocument20 pagesStrategic MAnagment and Strategic Competitivenessrohan_jangid8No ratings yet

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationNo ratings yet

- CHAPTER 2.1 Strategic Financial ManagementDocument23 pagesCHAPTER 2.1 Strategic Financial ManagementKarl BarnuevoNo ratings yet

- Competitiveness, Strategy, and ProductivityDocument27 pagesCompetitiveness, Strategy, and ProductivityMuhammad USMAN100% (2)

- Accounts Receivable ManagementDocument14 pagesAccounts Receivable ManagementJay-ar Castillo Watin Jr.No ratings yet

- Financial Analysis and ReportingDocument5 pagesFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- Financial ManagementDocument9 pagesFinancial ManagementGansukh ZolbooNo ratings yet

- Ratio Analysis - Holly FashionDocument6 pagesRatio Analysis - Holly FashionCarmen Popescu-DutaNo ratings yet

- Financial Statements For A Sole Proprietorship: Accounting Chapter 7Document22 pagesFinancial Statements For A Sole Proprietorship: Accounting Chapter 7Nur SiaNo ratings yet

- Syllabus ACCO 20073 Cost Accounting and ControlDocument7 pagesSyllabus ACCO 20073 Cost Accounting and ControlCaia VelazquezNo ratings yet

- Cash ManagementDocument51 pagesCash ManagementDebasmita SahaNo ratings yet

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- Accounting Information System A Complete Guide - 2020 EditionFrom EverandAccounting Information System A Complete Guide - 2020 EditionRating: 1 out of 5 stars1/5 (1)

- Financial Reporting and Management Reporting SystemsDocument44 pagesFinancial Reporting and Management Reporting SystemsMichael ReedNo ratings yet

- Capital BudgetingDocument59 pagesCapital BudgetingDavid Abbam Adjei67% (3)

- Financial Statement AnalysisDocument55 pagesFinancial Statement AnalysisPravin UntooNo ratings yet

- AAA FDNMARK 01 - Introduction To Marketing ManagementDocument49 pagesAAA FDNMARK 01 - Introduction To Marketing ManagementMarco Vicente SanvictoresNo ratings yet

- Qualitiesofahighperformance Finance Executive:: An Aggregation of SkillsDocument9 pagesQualitiesofahighperformance Finance Executive:: An Aggregation of Skillsvinni_30No ratings yet

- Conceptual FrameworkDocument33 pagesConceptual FrameworkzillxsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- Fraud and ErrorsDocument65 pagesFraud and ErrorsJoshua PedrocheNo ratings yet

- Managerial Accounting Chapter 1 The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocument9 pagesManagerial Accounting Chapter 1 The Changing Role of Managerial Accounting in A Dynamic Business Environmenttravelling100% (4)

- Advance Marketing ManagementDocument6 pagesAdvance Marketing ManagementJeevendra Pratap SinghNo ratings yet

- (OBLICON) Reviewer - Obligations General ProvisionsDocument8 pages(OBLICON) Reviewer - Obligations General ProvisionsMaggie MalonzoNo ratings yet

- Chapter 1 The Role and Environment of Managerial FinanceDocument27 pagesChapter 1 The Role and Environment of Managerial FinanceSteph BorinagaNo ratings yet

- Cangque A Bapf 106 Ba Module 1 For CheckingDocument27 pagesCangque A Bapf 106 Ba Module 1 For CheckingArmalyn Cangque100% (1)

- Capital BudgetingDocument30 pagesCapital BudgetingPrabath Suranaga Morawakage100% (1)

- Short Term & Long Term FinancesDocument22 pagesShort Term & Long Term Financesjaydee_atc5814100% (3)

- Chapter 9 - BudgetingDocument27 pagesChapter 9 - BudgetingPria JakartaNo ratings yet

- Accounting Research and Methods OrientationDocument40 pagesAccounting Research and Methods OrientationPang Siulien100% (1)

- Horizontal and Vertical Ratio AnalysisDocument21 pagesHorizontal and Vertical Ratio AnalysismrnttdpnchngNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisRenz BrionesNo ratings yet

- MBA in Financial ManagementDocument14 pagesMBA in Financial Managementedmosdigitex1485No ratings yet

- Conceptual Framework (Finacc-TOA)Document55 pagesConceptual Framework (Finacc-TOA)YenNo ratings yet

- Financial System & BSPDocument46 pagesFinancial System & BSPZenedel De JesusNo ratings yet

- Building Your SkillsDocument46 pagesBuilding Your SkillsCharlie Magne G. SantiaguelNo ratings yet

- Hilton7e PrefaceDocument37 pagesHilton7e PrefaceErma WulandariNo ratings yet

- 1 Research in Management Accounting Innovations An Overview of Its Recent DevelopmentDocument58 pages1 Research in Management Accounting Innovations An Overview of Its Recent DevelopmentEdiSukarmantoNo ratings yet

- Fundamentals of Accounting 1Document70 pagesFundamentals of Accounting 1Xia AlliaNo ratings yet

- De George, E. T., Li, X., - Shivakumar, L. (2016)Document115 pagesDe George, E. T., Li, X., - Shivakumar, L. (2016)Ikhsan Al IzyraNo ratings yet

- Accounts ReceivableDocument54 pagesAccounts ReceivableFrancine Thea M. LantayaNo ratings yet

- EBOOK Etextbook PDF For Auditing A Risk Based Approach 11Th Edition by Karla M Johnstone Download Full Chapter PDF Docx KindleDocument61 pagesEBOOK Etextbook PDF For Auditing A Risk Based Approach 11Th Edition by Karla M Johnstone Download Full Chapter PDF Docx Kindlecharles.martinez668100% (38)

- 5 Major Accounts of AccountingDocument2 pages5 Major Accounts of AccountingAnonymous P1iMibNo ratings yet

- Module BookDocument160 pagesModule BookKarthik RNo ratings yet

- Corporate Governance: An Analysis by Team BournvitaDocument15 pagesCorporate Governance: An Analysis by Team BournvitaDeepanshu VarshneyNo ratings yet

- Afar 2 Quizzes Acgsbdjxjcudhdh - CompressDocument26 pagesAfar 2 Quizzes Acgsbdjxjcudhdh - CompressWishNo ratings yet

- Lcci Finance Quantative Qualification BrochureDocument38 pagesLcci Finance Quantative Qualification BrochureLuckygo GohappyNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Flow Valuation, Case #KEL778Document20 pagesFlow Valuation, Case #KEL778SreeHarshaKazaNo ratings yet

- Diploma in International Financial Reporting: Thursday 6 December 2007Document9 pagesDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNo ratings yet

- Statement of Account: Jamisolamin, Margie Joan MiquiabasDocument1 pageStatement of Account: Jamisolamin, Margie Joan MiquiabasAnn JamisolaminNo ratings yet

- CH 13Document22 pagesCH 13Waseem AhmedNo ratings yet

- Far110 Quiz 1 Inventory & Suspense Ac January 2022 QDocument2 pagesFar110 Quiz 1 Inventory & Suspense Ac January 2022 QINTAN NOOR AMIRA ROSDINo ratings yet

- Name Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDDocument28 pagesName Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDraja farhanNo ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- A Study On Factors Governing Computerized Accounting in Selected SMEs' of GujaratDocument23 pagesA Study On Factors Governing Computerized Accounting in Selected SMEs' of GujaratrajNo ratings yet

- MCT & ActDocument30 pagesMCT & Actmablekos13No ratings yet

- AT04 Understanding The Entity and Its Environment (PSA 330)Document7 pagesAT04 Understanding The Entity and Its Environment (PSA 330)John Paul SiodacalNo ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- Module 1 - Cost Concept and Terminology - With AnswersDocument21 pagesModule 1 - Cost Concept and Terminology - With AnswersKelvin CulajaráNo ratings yet

- DDT - Chapter 1Document47 pagesDDT - Chapter 1Suba ChaluNo ratings yet