Professional Documents

Culture Documents

Yng Rinb 050711

Uploaded by

mevrick_guyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yng Rinb 050711

Uploaded by

mevrick_guyCopyright:

Available Formats

State Bank of India

RETAIL

INTERNET BANKING

State Bank of India

Why Net Banking?

Any where banking

Any Time Banking (24 X 7)

Real Time

Value Added Services

Convenience

New Age Banking

Minimize risk

Reduce queues

Improve customer

satisfaction

State Bank of India

Policy Guidelines 2011-12

Internet Banking

Increase in number of users through

sustained campaigns.

Tie-up with educational institutions/companies

offering tailor made online solutions for their

employees.

Conducting workshops for Corporates to

increase usage of Internet Banking.

Popularizing and marketing of the product ICollect .

Target as on Mar-12 -50% of transactions

through alternate channels

State Bank of India

New Projects launched during the year

Retail :

i-collect: A generic e-payment module for online collection

e-TDR/e-STDR/e-RD: Online opening, enquiry and closure

facility.

Currency Future: Online trading

Tax collection using SBI ATM Card on INB platform.

Online Gift Card request and Top up

Stop payment of Cheques online

Online Multicity Cheque book request

Commercial Tax for AP, UP, Maharashtra, Karnataka(22 States/

UT)

Consolidated view of balance in account summary page

UPSC/SSC fee collection

Introduction of new user role : Limited transaction rights

AS 26: Integration with NSDL for Online Tax Statement

Internet Banking Transaction Growth

State Bank of India

Internet Banking - Daily Average Retail & CorporateTransactions

450

Daily Avg. FY 10-11

Daily Average Transactions (in '000s)

400

Total

393.68

350

300

Retail

268.59

250

200

Daily Avg. FY 09-10

188.59

150

131.69

Daily Avg.FY 08-09

100

50

Daily Avg.FY 07-08

Daily Avg.FY 06-07

9.08

4.55

4.53

2006-2007

39.32

24.91

Corporate

125.09

99.21

52.61

56.90

46.60

14.41

2007-2008

2008-2009

2009-2010

2010-2011

State Bank of India

Internet Banking

www.onlinesbi.com is SBIs initiative to provide

convenience of Internet Banking

Launched on 1st July 2001.

Its is a 24X7, 365 days service channel,

anywhere, anytime

Provides for various banking activities through

Internet

Minimum cost of transaction

Better time management

State Bank of India

Internet Banking - two variants

Retail Internet Banking

( For Personal Segment Customers)

Corporate Internet Banking

(For Non-Personal Segment

Customers)

State Bank of India

Security Features :INB

Customers interest safe and secured

Verisign certified

256-bit SSL encryption technology

Defining of Third party as beneficiary : Secured &

Unique

Multilevel password

Transaction in pre-defined accounts

Transfer up to defined limits

High Security option

Auto expiry of session

Virtual Key Board Facility

State Bank of India

Security Features

Last failed login attempt displayed to Retail

customer

Last five login passwords cannot be repeated

both retail and corporate

State Bank of India

Security Feature - Virtual Key Board

State Bank of India

Security Feature - Encryption

Data from your PC to INB Server goes encrypted,

A complex and compressed form of data packets

Worlds highest level of encryption : 256-bit

Do you know,

which bank

Offers you the highest

Secured Internet Banking ?

State Bank of India

Security Feature Login Password

Pass word is a form of authentication

The customer will be prompted by the system

for change of User ID and PW on the first

login.

The new User ID can be alpha numeric

Minimum 3 and maximum 20 characters

The PW should be alpha numeric with at

least one special character , one alphabet

and one numeric e.g. uop#4716

Min 8 and Max 20 characters.

State Bank of India

Security Feature Profile Password

It is an added Security feature provided in

INB

Profile password is used to manage

beneficiary, change passwords, etc.

It is defined by the customer and not

provided by the bank

If forgotten, it can be reset at the branch

State Bank of India

Retail INB - Features

Account Enquiry

Statement of Account

Money Transfer

Demand Draft & Cheque Book Issue

Stop payment of cheque

E-Tax & also viewing Tax credit statement (Form

26AS)

TDS Enquiry

New Account Opening like e-TDR, e-STDR, RD, CA

Standing Instruction

Scheduling of Payment

Issue of Gift Card

State Bank of India

Value Added Service

Bills Payment e.g. LIC,SBI Card etc

Rail Ticket Booking

Airline ticket Booking

Tax Payment

VISA Money Transfer

Online fee collection facility

State Bank of India

New Features

1. Housing Loan - Notional Interest : New link now available

Enquiries -->Housing Loan Interest

2. Bill payment history now available for the entire period

Bill Payment -->Payment History

3. Last failed attempt to login displayed in the landing page

4. SMS for autopay/scheduled bill pay transactions will be

sent to customer a day in advance to enable customer to

maintain funds in accounts for the transaction

5.For transactions done through internet banking, narration

will include the indicator 'INB' - will be reflected in passbook

too

6. The link to 'View Income Tax Statement' is now placed

in the landing page - ie., in Accounts Summary page

State Bank of India

FORM 26AS

Income Tax Department facilitates a PAN holder to view his

Tax Credit Statement (Form 26AS) online.

Form 26AS contains:

Details of tax deducted on behalf of the taxpayer by

deductors.

Details of tax collected on behalf of the taxpayer by collectors

Advance tax/self assessment tax/regular assessment tax, etc.

deposited by the taxpayers (PAN holders)

Details of tax refunds received during the financial year

Details of the High value Transactions in respect of shares,

mutual fund etc.

The Tax Credit Statement (Form 26AS) are generated wherein

valid PAN has been reported in the TDS statements.

State Bank of India

FORM 26AS

Taxpayers who are registered at the portal

https://incometaxindiaefiling.gov.in can view 26AS by clicking on

'View Tax Credit Statement (Form 26AS)' in "My Account". The

facility is available free of cost.

The facility is available to PANs that are registered with Tax

Information Network for view of 26AS statement. The PAN holder

has to fill up an online Registration form for such purpose.

Thereafter, verification of PAN holder's identity is done by the TINFacilitation Centre personnel either at PAN holder's address or at

the TIN-facilitation center that has been chosen by the PAN

holder. The verification involves a cost at prescribed rates. Once

authorised, the PAN holder can view Tax Credit Statement online.

The facility is available to a PAN holder having net banking

account with any authorized bank. View of Tax Credit

Statement (Form 26AS) is available only if the PAN is mapped

to that particular account. The facility is available for free of

cost

State Bank of India

State Bank of India

State Bank of India

State Bank of India

State Bank of India

State Bank of India

State Bank of India

FIRST LOGIN STEPS - https://www.onlinesbi.com

State Bank of India

State Bank of India

Login screen..

State Bank of India

As given in

PPK

State Bank of India

NEW FEATURE

State Bank of India

State Bank of India

State Bank of India

State Bank of India

FOR CHANGING PASSWORD

iINTERNET BANKING

State Bank of India

MOBILE BANKING

State Bank of India

Account Enquiry

State Bank of India

Account Statement

State Bank of India

Account Statement

State Bank of India

Limits on Transactions

Menu Navigation - Profile :Set limits:

SBI has set a limit of Rs.1,00,000- per IOI

transaction and Rs.5,00,000- per Third party

transactions.

The customer has to set his own limits.

A customer who desires to request for IOI or

make Third party transfers needs to set these

limits under Profile section.

State Bank of India

..

Set limits for transactions

State Bank of India

MANAGE BENEFICIARY

For making third party transfers, an user needs

to define a third party under Profile section.

Details of the TP include Name, account

number, branch and the transaction limit for that

third party

The transaction limit set by the customer for

third party has to be less than or equal to the

limit set for third party transfers.

State Bank of India

MANAGE BENEFICIARY

State Bank of India

MANAGE THIRD PARTY

State Bank of India

Third Party Payment

State Bank of India

Enable High Security Option available to customer

State Bank of India

Enable High Security

Addition of Mobile No. in Customers Profile

Mandatory for Third Party Creation, Third

Party Funds Transfer, for adding biller.

Optional for High Security Password during

transaction

New addition or Change in Mobile No.

requires Branch approval

OTP optional upto Rs.10,000.

State Bank of India

Add / or change Mobile no. at the provided space

State Bank of India

One Reference No. e.g. EHS0012345

will be generated at Customers end

INB officer having the rights to approve

Mobile No. either through this reference

no. or from User Id Of the customer

State Bank of India

INB Officer will approve Mobile No. based on customers written request

State Bank of India

On approval Customer will get High

Security Password on his Mobile No. each

time, whenever he adds Third Party or

during funds transfer

State Bank of India

Add Third Party/ Inter Bank Payee/

Visa Beneficiary/ Group Beneficiary

Customer can add Beneficiary to his profile only if:

His Mobile no. has been approved by the branch in Enable High

Security

Or each time Home Branch of customer will approve the

Beneficiary

Third Party- Any account within SBI Max Rs.5 lacs

Inter Bank Payee- Account in any Commercial Bank other than SBI.

Max Rs.5 lacs

VISA Beneficiary- Visa Card holder of any Bank. Max amt per

transaction 25000. Max amt per day per user 50000.

State Bank of India

Add Beneficiary

State Bank of India

Fill the details

State Bank of India

REFERENCE NUMBER

State Bank of India

After filling all the details if customers

mobile no. is registered in high security

then he will get high security password

through SMS on his mobile and can

approve this beneficiary

State Bank of India

Key in High Security Password

State Bank of India

Successful Approval

State Bank of India

If Mobile no. is not registered then

reference no. e.g. IBT000062082 will be

generated

INB Officer at Branch will approve this

reference no.

State Bank of India

INB officer will go to

Request-> Approve Beneficiary

Reference No. IBT000062082

State Bank of India

Approve Beneficiary without reference no.

If reference no. not known then select All

State Bank of India

Select Approve to approve beneficiary

State Bank of India

Successful Approval of Beneficiary

State Bank of India

After approval Customer can Transfer funds

to this Beneficiary from the next day

State Bank of India

Inter Bank Transfer through RTGS/ NEFT

State Bank of India

Inter Bank Transfer through RTGS/ NEFT

State Bank of India

Inter Bank Transfer through RTGS/

NEFT

State Bank of India

Asking for Confirmation

State Bank of India

Successful Fund Transfer

State Bank of India

E-Pay

Users of Onlinesbi.com can make online bill payments. Biller include Electricity

Companies, Telephone, Mobile Phone Companies, SBI Cards, LIC and many

others. Max Rs.5 lacs

Add Biller:

Before making payments, users will have to add Billers.

Billers are listed city-wise.

State Bank of India

E-Pay

View/Pay Bills: The customer can see all his bills here and pay anytime

before Pay by date.

Auto payment option available

View Expired Bills: Expired Bills- Unpaid bills that have

expired will be displayed here. Users are also given an

option to delete the expired bills from this link.

Payment History : All the paid bills will be available for

enquiry

State Bank of India

Add Biller

State Bank of India

Add Biller (cont.)

State Bank of India

Billers Acknowledgement

State Bank of India

Bill Payment

State Bank of India

Payment History

State Bank of India

and Acknowledgement

State Bank of India

REQUEST FOR E-TDR, RD, IOI,SB,CA

INTERNET BANKING

State Bank of India

To pay Direct Tax through the internet:

1. Click the Direct Taxes (OLTAS) link.

2. You are displayed Tax Information Network webpage of Income Tax

Department.

3. Click the challan No. applicable. Enter the PAN, name, address,

assessment year, major head, minor head, type of payment etc.

4. Select State Bank of India from the Bank name list

5. You will be redirected to the Online SBI login page.

6. Enter your Internet Banking user ID and password. Proceed to select

the account from which you wish to pay tax.

7. Enter the tax amount and submit the page.

8. You are displayed a confirmation page indicating the status of the

transaction.

9. Retail customers are also provided with a link to print the e-receipt for

this payment, if the transaction is successful. You can also generate ereceipt subsequently from 'Status Enquiry' link under 'Enquiries' tab.

10. On completion of successful transaction, the challan will be available in

the 'Query by Account' or 'Query by Echeque' link under 'Reports' tab.

INTERNET BANKING

State Bank of India

INTERNET BANKING

State Bank of India

DEMAT ACCOUNT STATMENT

INTERNET BANKING

State Bank of India

MOBILE BANKING

State Bank of India

MOBILE BANKING

State Bank of India

MOBILE BANKING

State Bank of India

MOBILE BANKING

State Bank of India

MOBILE BANKING

State Bank of India

You might also like

- Latest In: Internet BankingDocument9 pagesLatest In: Internet Bankingmevrick_guyNo ratings yet

- Rinb & Cinb SbiDocument48 pagesRinb & Cinb SbiAnand VSNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentMashum AliNo ratings yet

- Self Study TopicDocument13 pagesSelf Study TopicRohit SoniNo ratings yet

- HDFC Bank provides nationwide banking services with 2000+ branchesDocument16 pagesHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaNo ratings yet

- Faq RetailDocument3 pagesFaq Retailshiv2108No ratings yet

- DD-Digital ProductsDocument58 pagesDD-Digital ProductsFaded JadedNo ratings yet

- Digital Products Latest Changes SummaryDocument5 pagesDigital Products Latest Changes Summaryjyzdmk2p8gNo ratings yet

- System Requirement Specification of Online Banking System: 1.1 PurposeDocument8 pagesSystem Requirement Specification of Online Banking System: 1.1 PurposesiddharthNo ratings yet

- STP Analysis of ICICI BANK vs SBI for Savings AccountsDocument28 pagesSTP Analysis of ICICI BANK vs SBI for Savings AccountsUmang Jain0% (1)

- Essay # 1. Meaning of Internet Banking:: ContentsDocument8 pagesEssay # 1. Meaning of Internet Banking:: ContentsdfgsgfywNo ratings yet

- Role of It in BankingDocument5 pagesRole of It in BankingSamaira SheikhNo ratings yet

- Report On Digital Banking NewDocument79 pagesReport On Digital Banking NewmanasutharNo ratings yet

- Satisfaction Towards Services Provided by The Bank Through E-BANKING in IndiaDocument8 pagesSatisfaction Towards Services Provided by The Bank Through E-BANKING in IndiaBaljit kaurNo ratings yet

- Services 432Document22 pagesServices 432Bhisham Pal RajoraNo ratings yet

- HomeDocument3 pagesHomeAishwarya Sharma DawarNo ratings yet

- Digital Banking Booklet Ver 1Document32 pagesDigital Banking Booklet Ver 1Anugat JenaNo ratings yet

- FAQ For RAK Bank CorporateDocument9 pagesFAQ For RAK Bank CorporatesrinandhniNo ratings yet

- E-banking services and features offered by banksDocument11 pagesE-banking services and features offered by banksvivek kumarNo ratings yet

- Features of All Types of AccountsDocument113 pagesFeatures of All Types of AccountsNahid HossainNo ratings yet

- Retail Products and Services of State Bank of IndiaDocument81 pagesRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- MAN Micro ProjectDocument11 pagesMAN Micro ProjectAbhijit chavanNo ratings yet

- 06 GRP Assignment 2Document6 pages06 GRP Assignment 2Ashish BnNo ratings yet

- Customer Perception Towards Internet Banking PDFDocument17 pagesCustomer Perception Towards Internet Banking PDFarpita waruleNo ratings yet

- Current Scenario in IndiaDocument24 pagesCurrent Scenario in IndiaMeenuNo ratings yet

- History of BankDocument12 pagesHistory of BankvanpariyabhumikaNo ratings yet

- STP Analysis For ICICI BankDocument27 pagesSTP Analysis For ICICI BankRohit Jain100% (1)

- Shubham Kumar Chachan CIA - 1Document12 pagesShubham Kumar Chachan CIA - 1AYUSH TREHAN 20215023No ratings yet

- Digital ProductsDocument3 pagesDigital Productsamit cNo ratings yet

- HBL IPG FAQs PDFDocument5 pagesHBL IPG FAQs PDFAbbas HussainNo ratings yet

- Kotak Mahindra Bank Account TypesDocument16 pagesKotak Mahindra Bank Account Typessanju kumarNo ratings yet

- Report On HDFC BANK NewDocument19 pagesReport On HDFC BANK NewakashNo ratings yet

- Online Banking Report on Janata BankDocument5 pagesOnline Banking Report on Janata Bankফারজান স্মৃতিNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- Icici BankDocument56 pagesIcici BankvishwanathvrNo ratings yet

- Internet Banking in India:) Information Only SystemDocument6 pagesInternet Banking in India:) Information Only SystemSwati SharmaNo ratings yet

- Final E-Banking Concept PaperDocument9 pagesFinal E-Banking Concept PaperGerlie Ann MendozaNo ratings yet

- E-Banking HDFC BankDocument24 pagesE-Banking HDFC BankAmit JangirNo ratings yet

- Citizens Charter Cbi19Document20 pagesCitizens Charter Cbi19Movies BlogNo ratings yet

- MCB Internet Banking Faqs: View OnlyDocument19 pagesMCB Internet Banking Faqs: View OnlyMuhammad AsifNo ratings yet

- RBI E-Mandate Guidelines FAQsDocument3 pagesRBI E-Mandate Guidelines FAQsDjxjfdu fjedjNo ratings yet

- E-Banking in India: Services Provided by The Bank ThroughDocument21 pagesE-Banking in India: Services Provided by The Bank ThroughKomal SahuNo ratings yet

- Internet Banking AbstractDocument3 pagesInternet Banking AbstractTelika Ramu100% (5)

- Commerce Project 3rd YearDocument31 pagesCommerce Project 3rd YearJatin Arora72% (122)

- Innovation in Indian Banking SectorDocument3 pagesInnovation in Indian Banking SectorSandeep MishraNo ratings yet

- Bank Management System Project ReportDocument19 pagesBank Management System Project ReportKharoudNo ratings yet

- E-Payment of Central Excise and Service TaxDocument3 pagesE-Payment of Central Excise and Service TaxkhajuriaonlineNo ratings yet

- 88643200593Document2 pages88643200593infoNo ratings yet

- Get SBI bank statement online or offlineDocument2 pagesGet SBI bank statement online or offlineKxkdkksNo ratings yet

- CA Focused AttachmentsDocument8 pagesCA Focused AttachmentssatishNo ratings yet

- IOB19258SelfRegistration UserManualDocument1 pageIOB19258SelfRegistration UserManualsiva RNo ratings yet

- Ib Guidelines-Fcdb12.0 Customer FaqDocument7 pagesIb Guidelines-Fcdb12.0 Customer FaqNikita NamaNo ratings yet

- Bank Terms and ConditionDocument5 pagesBank Terms and ConditionLibin VargheseNo ratings yet

- Setting Up Payment Gateway in IndiaDocument16 pagesSetting Up Payment Gateway in Indiaps100% (1)

- Bob Internet BankingDocument12 pagesBob Internet BankingSweta PandeyNo ratings yet

- Arvind 190101010048 State Bank of India. What Is Online SBI ?Document2 pagesArvind 190101010048 State Bank of India. What Is Online SBI ?arvind singhalNo ratings yet

- Presented By-Ranjeet Kumar YadavDocument23 pagesPresented By-Ranjeet Kumar YadavSaify Shaik100% (1)

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Banking Glossary 2011Document27 pagesBanking Glossary 2011Praneeth Kumar NaganNo ratings yet

- NIOS Culture NotesDocument71 pagesNIOS Culture Notesmevrick_guy0% (1)

- IBPS Interview PrepDocument33 pagesIBPS Interview Prepmevrick_guyNo ratings yet

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- Yuva Savings Bank AccountDocument1 pageYuva Savings Bank Accountmevrick_guyNo ratings yet

- A StudyDocument12 pagesA Studymevrick_guyNo ratings yet

- State Bank Learning Centre e-gyan Vol 1 Key HighlightsDocument13 pagesState Bank Learning Centre e-gyan Vol 1 Key Highlightsmevrick_guyNo ratings yet

- Top 10 Economic Challenges for Modi GovtDocument17 pagesTop 10 Economic Challenges for Modi Govtmevrick_guyNo ratings yet

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- 2nd Issue E-Gyan, October-2013Document28 pages2nd Issue E-Gyan, October-2013mevrick_guyNo ratings yet

- 01 21-RBIremittanceDocument11 pages01 21-RBIremittancemevrick_guyNo ratings yet

- 01.13 ClearingDocument38 pages01.13 Clearingmevrick_guy0% (1)

- 01.19 Safe CustodyDocument9 pages01.19 Safe Custodymevrick_guyNo ratings yet

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyNo ratings yet

- 01.03-Deposit Accounts OpeningDocument38 pages01.03-Deposit Accounts Openingmevrick_guy0% (1)

- 8 To 8 Functionality: Section Section DescriptionDocument7 pages8 To 8 Functionality: Section Section Descriptionmevrick_guyNo ratings yet

- Currency Chest Operations GuideDocument10 pagesCurrency Chest Operations Guidemevrick_guyNo ratings yet

- Transaction Processing: Cash, Cheques, TransfersDocument23 pagesTransaction Processing: Cash, Cheques, Transfersmevrick_guyNo ratings yet

- 01.14 Maker Checker FunctionalitiesDocument19 pages01.14 Maker Checker Functionalitiesmevrick_guyNo ratings yet

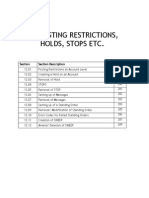

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- Generate Multiple Demand Drafts from Deposit AccountDocument40 pagesGenerate Multiple Demand Drafts from Deposit Accountmevrick_guyNo ratings yet

- Manage cash workflow and transactionsDocument21 pagesManage cash workflow and transactionsmevrick_guyNo ratings yet

- 01.09-User System ManagementDocument12 pages01.09-User System Managementmevrick_guyNo ratings yet

- 01 02-CifDocument25 pages01 02-Cifmevrick_guyNo ratings yet

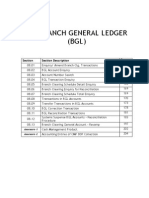

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- 01.01 IntroductionDocument16 pages01.01 Introductionmevrick_guyNo ratings yet

- Deposit Accounts - Joint Accounts and NomineesDocument30 pagesDeposit Accounts - Joint Accounts and Nomineesmevrick_guyNo ratings yet

- 00.01 PrefaceDocument1 page00.01 Prefacemevrick_guyNo ratings yet