Professional Documents

Culture Documents

Canada Automobile Industry

Uploaded by

RajanikantJadhavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Canada Automobile Industry

Uploaded by

RajanikantJadhavCopyright:

Available Formats

2010

Canadian Automotive Sector

Overview

The Automotive Industry is a crucial economic driver

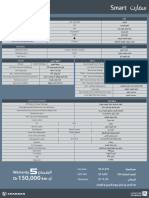

Level

(2009)

Share of Total

Manufacturing

Share of

Total

Economy

GDP

$ 14.6 B

10%

1.2 %

Manufacturing

Shipments

$ 56.8 B

12%

n/a

Investment

$ 2.9 B

18%

1%

Exports

$ 39.2 B

17 %

11 %

Manufacturing

Employment

109 111

7%

1%

Auto industry is a key driver of Canadas

economy:

The largest manufacturing sector in

Canada, contributing to 10% of

manufacturing GDP and 11% of total

merchandise exports.

109,111 direct employment in auto

sector manufacturing; a further 332,975

in aftermarket, and dealerships.

Produced 1.4 million units vehicles;

domestic sales were 1.5 million units.

Passenger

Vehicle

Assembly

Automotive sector also creates

significant demand for other industries:

37% of steel foundry production

17% of rubber production

14% of processed aluminum

13% of wire goods

9% of carpeting and fabric

8% of glass

Employment

Number of

Establishments

Production (Units)

Heavy

Duty

Vehicle

Assembly

35 615

Motor

Vehicle

Parts

Production

Truck Body &

Trailer

Production

61 193

12 304

55

41

944

237

1 479 161

11 321

na

na

$19.1

$2.6

Shipments ($

Billions)

$35.1

Exports ($ billions)

$26.7

$1.4

$10.2

$0.9

Export Ratio (% of

shipments)

81%

72%

53%

35%

Canada has five major light vehicle assemblers

Assembly plants:

Toyota

2 plants in Cambridge

1 plant in Woodstock

Honda

2 plants in Aliston

Canadian light vehicle production shares by

manufacturer

45.0%

40.0%

35.0%

General Motors

2 plants in Oshawa

1 plant in Ingersoll

GM

30.0%

Toyota

25.0%

20.0%

Chrysler

1 plant in Brampton

1 plant in Windsor

Honda

15.0%

Chrysler

10.0%

Ford

5.0%

Ford

1 plant in Oakville

1 plant in St. Thomas

0.0%

2000 2002 2004 2006 2008 2010(f)2012(f)2014(f)2016(f)

Source: WardsAuto, CSM Forecasting

Exceptional Canadian Quality

Canadian assembly plants have won

about one-third (30%) of all J.D. Power

plant quality awards for North America,

which is about double the Canadian

share of regional production (16%)

since 1996.

The only Toyota plant outside Japan to

produce Lexus vehicles is in Canada.

J.D. Power Plant Quality Awards

1991

Toyota Cambridge (Gold)

1992

Toyota Cambridge (Silver)

1993

Toyota Cambridge (Bronze)

1994

Ford St. Thomas (Silver)

1995

Toyota Cambridge (Gold)

1996

Toyota Cambridge (Gold), Honda Alliston

(Silver)

1998

Ford St. Thomas (Gold)

1999

GM Oshawa 1 (Bronze)

2000

Toyota Cambridge (Bronze)

2001

Toyota Cambridge (Gold)

2002

GM Oshawa 2 (Gold)

2003

GM Oshawa 1 (Gold)

2005

GM Oshawa 2 (Gold), GM Oshawa 1 (Silver)

2006

GM Oshawa 2 (Gold), Chrysler Windsor (Silver)

2007

GM Oshawa 2 (Silver)

2009

GM Oshawa Car (Silver)

Canadian auto supply chain - a national industry

In 2009, the Canadian auto parts sector:

Had shipments $19 billion and almost

61,000 workers.

Over 1000 establishments, 78% with

less than 200 employees

Representation throughout Canada,

including:

Metal stamping and electronic

equipment manufacturers in

Western Canada.

Seats and interior trim

manufacturers in Eastern Canada.

Transmission and power train parts

manufacturers in Central Canada.

For every assembly plant opened in N.A.,

19 direct suppliers open up within 60 miles of

the plant.

Each auto assembly job creates 4.9 indirect

jobs e.g. rubber, plastics, fabricated metals

and steel products.

Dealers and aftermarket collectively employ

more than 333,000 people.

Canadas automotive sector is fully integrated in N.A.

The Canadian market represents

only 12% (1.5 million) of N.A.

vehicle sales but is responsible for

17% (1.4 million) of N.A.

production in 2009.

Canada exports 81% of vehicle

production and 53% of parts in

2009:

Integration of Canada U.S. Supply Chain:

Rear Suspension Assembly by Martinrea

- Of these exports 99% of vehicles

and 94% of parts destined for the

U.S.

Assembly plants and major parts

companies are clustered in

southern Ontario to allow an easy

and efficient integration of supply

chains.

Vehicle demand varies in different markets

Vehicle demand in global market

varies due to consumer preference,

regulatory requirement,

commodity/oil prices, and market

structure.

Global Production by Segment

(1997-2015)

Millions 30

25

20

15

Relatively high demand in

broad-based C- and D-segment in

North America, while emerging

markets like China, Central and

Eastern Europe focus on smaller

size vehicles like B- and Csegment.

Global production growth on B,C

and D-segment is expected to be

high in the future.

10

1997

2002

2007

2009

2011

2015

Global Production Growth by Segment

(2009-2015)

FF

A

E

7%

12%

6%

B

18%

D

22%

C

35%

6

Source: CSM Worldwide Global Outlook, 2009

North America is expected to be an attractive market in the long run

U.S. has a unique demand on vehicles

due to its geographic remote, safety

and fuel regulations, and sophisticated

market structure:

NA Vehicle Demand by Segment, 2011-2015

According to recent survey, value and

safety are the most important

considerations to final purchase

decision for US consumers.

Due to the new fuel efficiency

regulations, high energy prices, and

shifting consumer preference, OEMs

are expected to adjust production:

Small-sized vehicle (A-segment)

sourcing to low-cost jurisdictions

Small to Medium-sized (B-segment)

volume surges next decade

Medium-sized to luxury vehicles (C,

D-segments) reach critical mass

Large to full-frame vehicle (E, Fsegment) production is expected to

drop

Data Source: CSM Worldwide

Canadian Automotive R&D Centres

Chrysler Canada Inc.

Automotive Research & Development Centre (Windsor ON)

Ford Motor Company of Canada Ltd.

Ford Manitoba Extreme Cold Weather Test Facility (Thompson MB)

Ford Powertrain Engineering Research & Development Centre (Windsor ON)

Ford Centre for Excellence in Manufacturing (Windsor ON)

General Motors of Canada Ltd.

GM Canadian Regional Engineering Centre (Oshawa ON)

GM Cold Weather Development Centre (Kapuskasing ON)

UOIT Automotive Centre of Excellence (Oshawa ON)

Honda R&D Americas Inc. (Canada)

Environmental testing laboratory (Dartmouth NS)

Navistar / International Truck and Engine Corporation

ITEC Center for Innovation (Windsor ON)

Toyota Canada Inc.

Toyota Canada Cold Research Centre (Timmins ON)

Vehicles Made in Canada 2010

Acura CSX

Chevrolet Impala

Dodge Grand Caravan

Honda Civic Coupe

Lincoln Town Car

Acura MDX

Chrysler 300

Ford Crown Victoria

Honda Civic Sedan

Mercury Grand Marquis

Acura ZDX

Chevrolet Camaro

Chrysler Town & Country

Dodge Charger

Ford Edge

Ford Flex

Lexus RX 350

Lincoln MKT

Toyota Corolla

Toyota Matrix

Toyota RAV4

Chevrolet Equinox

Dodge Challenger

GMC Terrain

Lincoln MKX

VW Routan

10

You might also like

- AbbasDocument7 pagesAbbasMathan KumarNo ratings yet

- Automotive Industry in CanadaDocument13 pagesAutomotive Industry in Canadacoolaks30No ratings yet

- Auto Components IndustryDocument6 pagesAuto Components Industryyankee_akhil4554No ratings yet

- C2311 Motor Vehicle Manufacturing in Australia Industry ReportDocument40 pagesC2311 Motor Vehicle Manufacturing in Australia Industry ReportmenonmoonNo ratings yet

- Automobile IndustryDocument7 pagesAutomobile IndustryPavansut MishraNo ratings yet

- Lucintel GlobalCompositeMarketAnalysis 2012Document38 pagesLucintel GlobalCompositeMarketAnalysis 2012Sumit BhartiaNo ratings yet

- Supermini Car Market Project: Chelsea Hans Richard GarinDocument16 pagesSupermini Car Market Project: Chelsea Hans Richard Garinb_bose123No ratings yet

- Motor Industry of Japan 2011Document67 pagesMotor Industry of Japan 2011aryangcNo ratings yet

- Tata Motors LTDDocument13 pagesTata Motors LTDOluwaseun OduolaNo ratings yet

- General Motors Internal Initiation (Buy-Side) ReportDocument62 pagesGeneral Motors Internal Initiation (Buy-Side) ReportZee Maqsood100% (1)

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Global Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuDocument200 pagesGlobal Auto Industry: Franklin Guo Dat Hong Rex Liu Reya LuPankaj VyasNo ratings yet

- Agi ProDocument4 pagesAgi ProSyed SultanNo ratings yet

- AutoDocument2 pagesAutoNguyễn DuyNo ratings yet

- Automotive: Iksc Knowledge Bridge Pvt. LTDDocument3 pagesAutomotive: Iksc Knowledge Bridge Pvt. LTDPratik PatilNo ratings yet

- US Automotive Parts Industry Annual Assessment - 2009Document80 pagesUS Automotive Parts Industry Annual Assessment - 2009Sandra MillerNo ratings yet

- Auto Survey Report-12!1!10lDocument77 pagesAuto Survey Report-12!1!10lyudhie_7No ratings yet

- The Effects of The 2007-2009 Economic Crisis OnDocument12 pagesThe Effects of The 2007-2009 Economic Crisis OnKuldeepSinghNo ratings yet

- Honest Insights Autumn 2013Document8 pagesHonest Insights Autumn 2013John SlavinNo ratings yet

- Status of The Auto Industry and A: Strategy To Make Canada A Product Development HubDocument40 pagesStatus of The Auto Industry and A: Strategy To Make Canada A Product Development Hubravikiran1955No ratings yet

- L1 - Introduction To AlcoaDocument58 pagesL1 - Introduction To AlcoaCraigUnderwoodNo ratings yet

- General MotorsDocument18 pagesGeneral MotorsDushyant ShahNo ratings yet

- A Presentation On "Landscape of Automobile Industry Sector": Consulting ClubDocument22 pagesA Presentation On "Landscape of Automobile Industry Sector": Consulting ClubaddyamitNo ratings yet

- Bharat Forge PresentationDocument18 pagesBharat Forge PresentationSachin GandhiNo ratings yet

- TS Automotive Report September 2019Document54 pagesTS Automotive Report September 2019Ftu Đinh Kiều AnhNo ratings yet

- Team 5 Industry PaperDocument23 pagesTeam 5 Industry Paperapi-315687330No ratings yet

- Auto Industry AnalysisDocument2 pagesAuto Industry AnalysismihirdoshiNo ratings yet

- Final GMDocument26 pagesFinal GMapi-341483048No ratings yet

- Group 7-AutoDocument25 pagesGroup 7-AutosuchzNo ratings yet

- Automotive Companies in Canada by Gagan MokhaDocument8 pagesAutomotive Companies in Canada by Gagan MokhagaganNo ratings yet

- Automobile Industry IndiaDocument32 pagesAutomobile Industry IndiaNeha BhayaniNo ratings yet

- A Presentation ON: Management Research Project - IDocument25 pagesA Presentation ON: Management Research Project - Isrp188No ratings yet

- GM and Electric Car Final PDFDocument16 pagesGM and Electric Car Final PDFnazmiNo ratings yet

- 1.1: Overview of Automobile Industry in India: Chapter 1: Industrial ProfileDocument93 pages1.1: Overview of Automobile Industry in India: Chapter 1: Industrial Profiletamal mukherjeeNo ratings yet

- Logic CostDocument11 pagesLogic CostSaurabh Krishna SinghNo ratings yet

- Auto Industry ProfileDocument5 pagesAuto Industry ProfileMurali Dharan RaghavendiranNo ratings yet

- Automotive Industry Crisis of 2008-2010: Team MembersDocument8 pagesAutomotive Industry Crisis of 2008-2010: Team MembersMaged M.W.No ratings yet

- Automobile Industry in IndiaDocument7 pagesAutomobile Industry in IndiaRakesh SinghNo ratings yet

- Automobiles Industry ReportDocument5 pagesAutomobiles Industry ReportvaasurastogiNo ratings yet

- India Auto Supplychains-IyerDocument35 pagesIndia Auto Supplychains-IyerVenkateshwar Rao. RokandlaNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Global Paint & Coating Market ReportDocument7 pagesGlobal Paint & Coating Market ReportNitin Nagpal100% (2)

- EICDocument10 pagesEICDeepak VishwakarmaNo ratings yet

- Strategic Analysis On Ford MotorDocument20 pagesStrategic Analysis On Ford Motormahithegr8No ratings yet

- Auto Ancillary ReportsDocument20 pagesAuto Ancillary Reportsruchi_abhiNo ratings yet

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- Motor Industry Facts 2011Document44 pagesMotor Industry Facts 2011Varun RastogiNo ratings yet

- Auto Industry: India in The Changing World OrderDocument16 pagesAuto Industry: India in The Changing World Orderbindya2211No ratings yet

- Industrial Analysis Automotive IndustryDocument71 pagesIndustrial Analysis Automotive Industrytaghavi1347No ratings yet

- Report HoldenDocument14 pagesReport HoldenNaimul BariNo ratings yet

- Financial Analysis of Honda Motors & Hyundai MotorsDocument17 pagesFinancial Analysis of Honda Motors & Hyundai MotorsshashankNo ratings yet

- Porter's Five Forces Analysis - Indian Automobile Industry 2Document60 pagesPorter's Five Forces Analysis - Indian Automobile Industry 2Ashish Mendiratta50% (2)

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- The Tire IndustryDocument6 pagesThe Tire IndustryKavish BarapatreNo ratings yet

- Automotive Industry OverviewDocument7 pagesAutomotive Industry OverviewAshim DuttaNo ratings yet

- Comprehensive Project-I ON Automobile Industry (Four Wheelers)Document20 pagesComprehensive Project-I ON Automobile Industry (Four Wheelers)Ghpibm SpuNo ratings yet

- Global Automobile IndustryDocument4 pagesGlobal Automobile IndustryPranav BehkiNo ratings yet

- Sukhoi Su 30MKIDocument19 pagesSukhoi Su 30MKIRajanikantJadhav0% (1)

- Dell Inc. (Stylized As DELL) Is An American Privately Owned: Fortune 500Document1 pageDell Inc. (Stylized As DELL) Is An American Privately Owned: Fortune 500RajanikantJadhavNo ratings yet

- Contents - The Power of SilenceDocument5 pagesContents - The Power of SilenceRajanikantJadhavNo ratings yet

- History of BugattiDocument9 pagesHistory of BugattiRajanikantJadhavNo ratings yet

- Back Ground and History of WheelchairDocument2 pagesBack Ground and History of WheelchairRajanikantJadhavNo ratings yet

- History of SaabDocument23 pagesHistory of SaabRajanikantJadhavNo ratings yet

- History of RenaultDocument25 pagesHistory of RenaultRajanikantJadhavNo ratings yet

- History of Tata MotorsDocument12 pagesHistory of Tata MotorsRajanikantJadhavNo ratings yet

- History of Sterling TrucksDocument3 pagesHistory of Sterling TrucksRajanikantJadhav0% (1)

- History of Rolls RoyceDocument5 pagesHistory of Rolls RoyceRajanikantJadhavNo ratings yet

- Volvo Car CorporationDocument22 pagesVolvo Car CorporationRajanikantJadhavNo ratings yet

- History of ToyotaDocument3 pagesHistory of ToyotaRajanikantJadhavNo ratings yet

- Bourdon's Tube Pressure GaugeDocument32 pagesBourdon's Tube Pressure GaugeRajanikantJadhav100% (1)

- Automatic TransmissionDocument14 pagesAutomatic TransmissionRajanikantJadhav100% (4)

- Tata Group of CompaniesDocument14 pagesTata Group of CompaniesrexkingdomNo ratings yet

- Tata Group of CompaniesDocument14 pagesTata Group of CompaniesrexkingdomNo ratings yet

- GATE Mathematics Solved 2011 PDFDocument16 pagesGATE Mathematics Solved 2011 PDFRajanikantJadhavNo ratings yet

- Properties of Iron and SteelsDocument25 pagesProperties of Iron and SteelsRajanikantJadhavNo ratings yet

- Indian Armed ForcesDocument14 pagesIndian Armed ForcesRajanikantJadhavNo ratings yet

- Logan CaseDocument15 pagesLogan Casegautham2189No ratings yet

- Torque Specification Guide: Front and Rear Axle Nut Torque Specifications For FWD and RWD VehiclesDocument24 pagesTorque Specification Guide: Front and Rear Axle Nut Torque Specifications For FWD and RWD VehiclesRafael RicoNo ratings yet

- Pass Thru Pro II - Car ECU Programming - Snap-On DiagnosticsDocument2 pagesPass Thru Pro II - Car ECU Programming - Snap-On DiagnosticsPepenauta InternautaNo ratings yet

- Pasta 1Document4 pagesPasta 1CHECKLIST ITNEROLNo ratings yet

- River Valley News Shopper, May 24, 2010Document44 pagesRiver Valley News Shopper, May 24, 2010Pioneer GroupNo ratings yet

- Mustang Monthly - July 2019 PDFDocument78 pagesMustang Monthly - July 2019 PDFebt555No ratings yet

- D ValveDocument12 pagesD Valvela020576No ratings yet

- 77 290 Ducatomca 603.85.375 en 02 04.21 L LGDocument368 pages77 290 Ducatomca 603.85.375 en 02 04.21 L LGBadita EusebiuNo ratings yet

- Catalogo Reparo Bomba e Dir Hidr Seg LeveDocument6 pagesCatalogo Reparo Bomba e Dir Hidr Seg LeverafwebNo ratings yet

- GM 4L60E ID Codes 2.1Document17 pagesGM 4L60E ID Codes 2.1damian berduscoNo ratings yet

- Mini Project TeslaDocument9 pagesMini Project TeslaRimsha KhanNo ratings yet

- Hyundai PresentationDocument9 pagesHyundai Presentationbkzvf8wnh5No ratings yet

- CS35 Plus Spec Sheet 2024 UpdatedDocument1 pageCS35 Plus Spec Sheet 2024 Updatedpathan_riyazkhanNo ratings yet

- Ic RegulatorDocument19 pagesIc RegulatorFatah FatanNo ratings yet

- Buy Me A Coffee / Postaw Mi Kawę Buycoffee - To/piotrtesterDocument168 pagesBuy Me A Coffee / Postaw Mi Kawę Buycoffee - To/piotrtesterWardana Herna AksaniNo ratings yet

- Holden VT-VX-VY-VU Commodore Workshop ManualDocument490 pagesHolden VT-VX-VY-VU Commodore Workshop ManualB Brereton71% (7)

- Company ProfileDocument12 pagesCompany ProfileLingesh LingeshNo ratings yet

- Literature Review of Hyundai MotorsDocument5 pagesLiterature Review of Hyundai Motorsafduadaza100% (1)

- 2016 Chevy Colorado Owners ManualDocument396 pages2016 Chevy Colorado Owners Manualsteve heerNo ratings yet

- Audi A1 2012Document6 pagesAudi A1 2012carlosNo ratings yet

- Jamna Auto Industries - Wikipedia PDFDocument8 pagesJamna Auto Industries - Wikipedia PDFPriya TwinkieNo ratings yet

- 12 TransmissionDocument3 pages12 TransmissionKuba SwkNo ratings yet

- Volvo Apps PDFDocument1 pageVolvo Apps PDFEmersonLavandierNo ratings yet

- Expo Roundup: Published byDocument36 pagesExpo Roundup: Published bySamarth PatilNo ratings yet

- Bugatti Veyron InstructionsDocument19 pagesBugatti Veyron InstructionsMARIA PATRICIA HUERTA VALENTIN0% (1)

- Are These The 23 Ugliest Cars Ever MadeDocument1 pageAre These The 23 Ugliest Cars Ever MadeMiss BaorapetseNo ratings yet

- GAC TOYOTA BZ4X Specification Uniland Motors Lovisa L 2023.1.9Document18 pagesGAC TOYOTA BZ4X Specification Uniland Motors Lovisa L 2023.1.9Jorge DuranNo ratings yet

- Mini Cooper Led DRL InstalationDocument12 pagesMini Cooper Led DRL InstalationJavier Zamora0% (1)

- General Motors 10-K 2008Document480 pagesGeneral Motors 10-K 2008earl100% (2)

- Aggiornamento Truck 39 en GB WebDocument10 pagesAggiornamento Truck 39 en GB WebvimagapiNo ratings yet

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerFrom EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerRating: 4.5 out of 5 stars4.5/5 (54)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet

- What Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessFrom EverandWhat Customers Hate: Drive Fast and Scalable Growth by Eliminating the Things that Drive Away BusinessRating: 5 out of 5 stars5/5 (1)

- The World's Most Dangerous Geek: And More True Hacking StoriesFrom EverandThe World's Most Dangerous Geek: And More True Hacking StoriesRating: 4 out of 5 stars4/5 (49)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Pit Bull: Lessons from Wall Street's Champion TraderFrom EverandPit Bull: Lessons from Wall Street's Champion TraderRating: 4 out of 5 stars4/5 (17)

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsFrom EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsRating: 4.5 out of 5 stars4.5/5 (10)