Professional Documents

Culture Documents

Morning View 20jan2010

Uploaded by

AndysTechnicalsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning View 20jan2010

Uploaded by

AndysTechnicalsCopyright:

Available Formats

Canadian Dollar (Daily)

.9780

.9798

Someday I’ll have to do another wave count on the Can$. As it

stands, it’s the most loved foreign currency among speculators and it’s

now getting repelled into a potential double top.

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 (90 minute) 5

1

1130

4?

“a”

1113

2

“b”

This market could not take out key support at 1,130. Instead it ricocheted higher from key support.

Until this market can decisively take out 1,130, we’ll have to assume higher prices. This is getting

very difficult because we continue to deal with very “odd shapes.” The waves 1&3 are “corrective”

patterns, thus the continued belief in some sort of “terminal/diagonal” conclusion. The issue for the

bears is that waves 1&3 were very similar in size, so an extended wave-5 is a distinct possibility. I’ll

readily admit, though, that all of the price action is puzzling. If you’ve been a bear, the best strategy

has clearly been to “wait” for a true reversal pattern, something we haven’t seen in several months.

How can you be bearish when we can’t even take out a previous low?

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z)

“c”

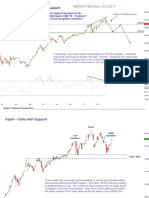

S&P 500 (180 min.) ~ A “c” Wave Ends? 5

1150

3

Reprinted from 1/16/2010

1

1130

4 ( 1 )?

“a” b alt: 4 of “c”

d

5

1113

2

3

1094

e

1086 “b”

4 a c

1

On the 1/2/10 report we were looking for a completed Elliott Wave up from the 1033. There is now some

good evidence that we have completed a move. This final “c” wave definitely has the look of a “terminal”

pattern in that the various legs higher are “corrective” in nature, not impulsive. The move down from 1150

was the sharpest break we’ve seen since in a few weeks. 1130 and 1113 are clear technical support

points for bulls. If these levels start giving way in a convincing way, then we’ll have to conclude that

2 we’re in the beginning stages of a major market turn.

1033

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

a or w Dollar Index (60 minute)

-c-

(5)

78.45

Yesterday it was suggested that 78.14 was a more likely target given the pace of the bounce. The DXY

is already “knocking on that door.” I can see a case where the Dollar gets some short term resistance

today into this zone.

-b- (c)

-d-

[5]?

[3]?

[4]

[1]

(a)

[2]

-a-

-c-

(b)

76.67

-e-

x

Andy’s Technical Commentary__________________________________________________________________________________________________

a or w Dollar Index (60 minute)

-c-

(5) This morning’s powerful burst suggests even more upside for the DXY. The

78.45

(a)=(c) target is 77.68. The 161.8% of (a)=(c) is 78.14, a more likely target

given the pace of the recent bounce.

-b- -d-

(c)/(3)

(a)/(1)

-a-

-c-

(b)/(2)

Reprinted from 1/19/2010

76.67

-e-

x

Andy’s Technical Commentary__________________________________________________________________________________________________

Ten Year Note Futures (Daily)

Sometimes, it’s just easier to do analysis without a count. It’s pretty easy to see that this is

an uptrend channel that has not been broken. So, why bet against it? Key support remains

at 116’27 while the market looks headed for 118’05.

118’05

116’27

Andy’s Technical Commentary__________________________________________________________________________________________________

Ten Year Note Futures (Daily)

The 10 Yr. Note took out a nice resistance level last week, which now becomes important

short term support. Despite the fact the longer term picture is bearish, this market is clearly

in an uptrend for now. Bulls seem to be OK as long as they can keep it above 116’27. The

next test for bulls would come at the 118’05 level.

118’05

116’27

Reprinted from 1/19/2010

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical

commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s interpretation of technical analysis. The

author may or may not trade in the markets discussed. The author may hold positions opposite of

what may by inferred by this report. The information contained in this commentary is taken from

sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy

or completeness thereof and is sent to you for information purposes only. Commodity trading

involves risk and is not for everyone.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading:

Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or options contracts, you should

consider your financial experience, goals and financial resources, and know how much you can

afford to lose above and beyond your initial payment to a broker. You should understand commodity

futures and options contracts and your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk

disclosure documents your broker is required to give you.

You might also like

- S&P 500 Update 16 Jan 10Document8 pagesS&P 500 Update 16 Jan 10AndysTechnicalsNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Morning View 26jan2010Document8 pagesMorning View 26jan2010AndysTechnicalsNo ratings yet

- S&P 500 Update 30 Nov 09Document8 pagesS&P 500 Update 30 Nov 09AndysTechnicalsNo ratings yet

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- SP500 Update 24apr11Document7 pagesSP500 Update 24apr11AndysTechnicalsNo ratings yet

- Gold Report 20 Dec 2009Document9 pagesGold Report 20 Dec 2009AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- Market Discussion 23 Jan 11Document10 pagesMarket Discussion 23 Jan 11AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Morning View 3feb2010 - S&P GoldDocument6 pagesMorning View 3feb2010 - S&P GoldAndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Morning View 28jan2010Document7 pagesMorning View 28jan2010AndysTechnicalsNo ratings yet

- S&P 500 Update 18 Apr 10Document10 pagesS&P 500 Update 18 Apr 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- S& P 500 Update 2 May 10Document9 pagesS& P 500 Update 2 May 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Pmo 2009Document11 pagesPmo 2009Karl Henry DahaoNo ratings yet

- (Comp.) 292. RFI of Steel Bars Adjustment On U-Duct Type 2 ManholeDocument6 pages(Comp.) 292. RFI of Steel Bars Adjustment On U-Duct Type 2 ManholeJohan JasmadiNo ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- Construction of Water Supply System, GujratDocument56 pagesConstruction of Water Supply System, GujratM ShahidNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Baidu (BIDU) Daily Linear ScaleDocument6 pagesBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- Q Stat 3Document24 pagesQ Stat 3tihato8838No ratings yet

- Middle Primary Division Competition Paper: ThursdayDocument10 pagesMiddle Primary Division Competition Paper: ThursdayOlga Rudenko BradfordNo ratings yet

- S&P 500 Update 1 Nov 09Document7 pagesS&P 500 Update 1 Nov 09AndysTechnicalsNo ratings yet

- Week 1 Friday HWDocument3 pagesWeek 1 Friday HWAndre AlvaradoNo ratings yet

- Tout Pour Letoeic Test CompletDocument43 pagesTout Pour Letoeic Test CompletLaurine DumouchelNo ratings yet

- National Auto Lock Service, NC: ChevroletDocument36 pagesNational Auto Lock Service, NC: ChevroletAlejandro Ponton TrabajosNo ratings yet

- A-A - 55487 - Nov 1994 Pin Lock Hitch PinDocument4 pagesA-A - 55487 - Nov 1994 Pin Lock Hitch Pinevan.huchon.proNo ratings yet

- حيدر - تنافسيDocument4 pagesحيدر - تنافسيHayder HassibNo ratings yet

- Revista AudioDocument68 pagesRevista AudioadirsomNo ratings yet

- A. Dimension Inspection of Support Saddle Orientation and AnchoringDocument7 pagesA. Dimension Inspection of Support Saddle Orientation and Anchoringwdavid81No ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- 4.5 External Pressure Design For Flat Bottom Cone Roof (RBCR) TanksDocument7 pages4.5 External Pressure Design For Flat Bottom Cone Roof (RBCR) TanksMiguel Martinez GuerreroNo ratings yet

- Gold Update 2 Nov 09Document4 pagesGold Update 2 Nov 09AndysTechnicalsNo ratings yet

- Middle Primary Division: Questions 1 To 10, 3 Marks Each 1Document8 pagesMiddle Primary Division: Questions 1 To 10, 3 Marks Each 1Le Huu HaiNo ratings yet

- Lazy EyeDocument6 pagesLazy EyeFrédéric TotaNo ratings yet

- FH SSDocument7 pagesFH SSMONA KUMARINo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Financial Accounting: A: How To Study AccountingDocument29 pagesFinancial Accounting: A: How To Study Accountingrishi_positive1195No ratings yet

- Quiz Ia Quiz IaDocument2 pagesQuiz Ia Quiz IaMili Dit0% (1)

- Equinix - Initiation ReportDocument27 pagesEquinix - Initiation ReportkasipetNo ratings yet

- Valuation of SecuritiesDocument31 pagesValuation of Securitiesmansi sainiNo ratings yet

- CH3 Derivatives PPDocument61 pagesCH3 Derivatives PPvincenzo21010No ratings yet

- Company Accounts Issue of Shares Par Premium DiscountDocument20 pagesCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Regulatory Notice 16 24Document13 pagesRegulatory Notice 16 24Kris SzczerbinskiNo ratings yet

- Ordinary Old - Accounting Paper 2 NSSCODocument20 pagesOrdinary Old - Accounting Paper 2 NSSCOTangeniNo ratings yet

- Quiz 2 Version 2Document6 pagesQuiz 2 Version 2testusername123salds50% (2)

- Module 2 Capital Budgeting Net Present Value and Other Investment CriteriaDocument70 pagesModule 2 Capital Budgeting Net Present Value and Other Investment CriteriaJoyal jose100% (1)

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Analysis of Stock Portfolio Performance With SharpeDocument4 pagesAnalysis of Stock Portfolio Performance With SharpeFatimah AzzahraNo ratings yet

- Chapter 9 Project Cash FlowsDocument28 pagesChapter 9 Project Cash FlowsGovinda AgrawalNo ratings yet

- Gakpo 18Document2 pagesGakpo 18denekew lesemiNo ratings yet

- Ethics AssignmentDocument16 pagesEthics AssignmentNghĩaTrầnNo ratings yet

- Rectification of ErrorDocument2 pagesRectification of ErrorHARDIK SINGHVINo ratings yet

- FMGT 1013 - Week 4Document6 pagesFMGT 1013 - Week 4Rizafe BaccayNo ratings yet

- Merger Acquisition-Sun Pharma RanbaxyDocument20 pagesMerger Acquisition-Sun Pharma Ranbaxyarjunnarang18No ratings yet

- Managerial Accounting Hansen Mowen 8th Editions CH 13Document28 pagesManagerial Accounting Hansen Mowen 8th Editions CH 13Ari Surya MiharjaNo ratings yet

- Introduction To SHE and Issuance of SharesDocument1 pageIntroduction To SHE and Issuance of Shareslei dcNo ratings yet

- MACR Course Outline 2019 IIMU - Subject To RevisionDocument5 pagesMACR Course Outline 2019 IIMU - Subject To RevisionVinay KumarNo ratings yet

- MKT MixDocument18 pagesMKT MixRezki PerdanaNo ratings yet

- Day 1 - Overview of The SAP FI-CO Module PDFDocument13 pagesDay 1 - Overview of The SAP FI-CO Module PDFkyushineNo ratings yet

- Accounting Info+Financial StatementsDocument31 pagesAccounting Info+Financial StatementsSage WilliamsNo ratings yet

- DFHIDocument4 pagesDFHIJignesh TogadiyaNo ratings yet

- Commerce Syllabus FullDocument8 pagesCommerce Syllabus FullSatyabrata roulNo ratings yet

- Mid CORFINDocument16 pagesMid CORFINRichard LazaroNo ratings yet

- Corporate Finance European Edition David Hillier Full ChapterDocument51 pagesCorporate Finance European Edition David Hillier Full Chapterwm.baker518100% (9)

- Entrepreneurship: Quarter 2 - Module 8 Computation of Gross ProfitDocument23 pagesEntrepreneurship: Quarter 2 - Module 8 Computation of Gross ProfitBergonsolutions Aingel83% (18)

- Principles & Practices of BankingDocument63 pagesPrinciples & Practices of BankingP SwapnaNo ratings yet