Professional Documents

Culture Documents

Basel I and Basel II

Uploaded by

Hunny Pal0 ratings0% found this document useful (0 votes)

17 views18 pagesppt

Original Title

11921_Basel I and Basel II

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views18 pagesBasel I and Basel II

Uploaded by

Hunny Palppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 18

Basel I and Basel II

Why BASEL II

Basel II much more risk sensitive, as it is aligning capital

requirements to risks of loss. Better risk management in a bank

means bank may be able to allocate less regulatory capital.

The objective of Basel II is to modernise existing capital

requirements framework to make it more comprehensive and

risk sensitive.

The Basel II framework therefore designed to be more sensitive

to the real risks that firms face than Basel I.

Apart from looking at financial figures, it also considers

operational risks, such as risk of systems breaking down or

people doing the wrong things, and also market risk.

FINAL OBJECTIVE Basel II

Ensuring that capital allocation is more

risk sensitive

Separating operational risk from credit

risk, and quantifying both

Attempting to align economic and

regulatory capital more closely to reduce

scope for regulatory arbitrage

Three Pillars of Basel II Framework

Pillar 1 sets out the minimum capital requirements firms will be

required to meet to cover credit, market and operational risk.

Pillar 2 sets out a new supervisory review process. Requires

financial institutions to have their own internal processes to assess

their overall capital adequacy in relation to their risk profile.

Pillar 3 cements Pillars 1 and 2 and is designed to improve market

discipline by requiring firms to publish certain details of their risks,

capital and risk management as to how senior management and the

Board assess and will manage the institution's risks.

Pillar 1 : Minimum capital requirements

Institution's total regulatory capital must be at

least 8% (ratio same as in Basel I) of its risk

weighted assets, based on measures of THREE

RISKS

Pillar 2 : Supervisory Review

Covers Supervisory Review Process, describing principles for

effective supervision.

Supervisors obliged to evaluate activities, corporate governance,

risk management and risk profiles of banks to determine whether

they have to change or to allocate more capital for their risks

(called Pillar 2 capital)

Deals with regulatory response to the first pillar, giving regulators

much improved 'tools' over those available to them under Basel I

Also provides framework for dealing with all the other risks a

bank may face, such as Systemic risk, pension risk, concentration

risk, strategic risk, reputation risk, liquidity risk and legal risk,

which the accord combines under the title of residual risk

It gives banks a power to review their risk management system.

Pillar 3 : Market Discipline

Covers transparency and the obligation

of banks to disclose meaningful

information to all stakeholders

Clients and shareholders should have

sufficient understanding of activities of

banks, and the way they manage their

risks

THANK YOU

11

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Ippf CSR PDFDocument22 pagesIppf CSR PDFkaligelisNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LEG 500 - Law, Ethics, and Corporate Governance: Course DescriptionDocument19 pagesLEG 500 - Law, Ethics, and Corporate Governance: Course Descriptionsurnj1No ratings yet

- مدى توافق النظام المحاسبي المالي (SCF) مع المعايير المحاسبية الدولية (IAS - IFRS) (دراسة تحليلية تقييمية)Document20 pagesمدى توافق النظام المحاسبي المالي (SCF) مع المعايير المحاسبية الدولية (IAS - IFRS) (دراسة تحليلية تقييمية)عادل عمرانيNo ratings yet

- List of Members For Healthcare Service - 2353Document27 pagesList of Members For Healthcare Service - 2353Samish ChoudharyNo ratings yet

- Abstract:: Keyword:-Technological Innovation, Retail Banking, Time Element For Delivery of ServicesDocument1 pageAbstract:: Keyword:-Technological Innovation, Retail Banking, Time Element For Delivery of ServicesHunny PalNo ratings yet

- Test 1 MGN646Document1 pageTest 1 MGN646Hunny PalNo ratings yet

- 1 Capstone ReportDocument1 page1 Capstone ReportHunny PalNo ratings yet

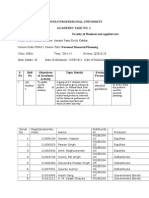

- Department of ManagementDocument1 pageDepartment of ManagementHunny PalNo ratings yet

- Total Assets (I) Advances (I) Deposits (I) Borrowing (I)Document4 pagesTotal Assets (I) Advances (I) Deposits (I) Borrowing (I)Hunny PalNo ratings yet

- Mkt620:Green Marketing: Course ObjectivesDocument2 pagesMkt620:Green Marketing: Course ObjectivesHunny PalNo ratings yet

- January Work According To Mentor: 1) Feedback of Capstone I ExamDocument1 pageJanuary Work According To Mentor: 1) Feedback of Capstone I ExamHunny PalNo ratings yet

- DDB11theditionDocument21 pagesDDB11theditionHunny PalNo ratings yet

- 1 HCL Preparatory Schedule StudentsDocument15 pages1 HCL Preparatory Schedule StudentsHunny PalNo ratings yet

- Lovely Professional University Academic Task No. 1Document1 pageLovely Professional University Academic Task No. 1Hunny PalNo ratings yet

- Research Paper On BankingDocument7 pagesResearch Paper On BankingHunny Pal100% (1)

- Fin615hw1Document5 pagesFin615hw1Hunny PalNo ratings yet

- IFRS 9 WebinarDocument18 pagesIFRS 9 WebinarMovie MovieNo ratings yet

- Coporate Model of JapanDocument21 pagesCoporate Model of JapanJini BasnetNo ratings yet

- Separation of Ownership and ControlDocument11 pagesSeparation of Ownership and ControlSorin GabrielNo ratings yet

- Crescent JuteDocument60 pagesCrescent JuteMuhammad SajidNo ratings yet

- Ya Dut Iya Sir: Compount InterestDocument6 pagesYa Dut Iya Sir: Compount InterestadiNo ratings yet

- Insurance TermsDocument11 pagesInsurance TermsRenu SyamNo ratings yet

- KODA LTD 2010 Annual ReportDocument120 pagesKODA LTD 2010 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- Directors Summary (Sanidhya Saraf)Document40 pagesDirectors Summary (Sanidhya Saraf)Chirag JainNo ratings yet

- 4Document180 pages4NindasurnilaPramestiCahyaniNo ratings yet

- Objection Handling: 1 No NeedDocument11 pagesObjection Handling: 1 No NeedManish LohiaNo ratings yet

- 2020 Corporate Governance ReviewDocument43 pages2020 Corporate Governance ReviewAbiodun MorenikejiNo ratings yet

- Corporate Governance and Financial Performance ofDocument7 pagesCorporate Governance and Financial Performance ofadegokeoladayo0106No ratings yet

- Chapter 1 Garrison 13eDocument66 pagesChapter 1 Garrison 13efarhan MomenNo ratings yet

- Course Book CSR 2011-2012Document21 pagesCourse Book CSR 2011-2012Yaqut Ar-RumiNo ratings yet

- Dampak Penerapan IfrsDocument6 pagesDampak Penerapan IfrsMarsheila Choirunnisa NurizkyNo ratings yet

- FIN448 Class 01Document43 pagesFIN448 Class 01Adam StylesNo ratings yet

- Beyond Gender Diversity How Specific Attributes of Fe 2017 The British AccoDocument20 pagesBeyond Gender Diversity How Specific Attributes of Fe 2017 The British AccojanaNo ratings yet

- Annual Report (Attock Cement)Document85 pagesAnnual Report (Attock Cement)rizingpassionNo ratings yet

- Expenditure Process, Conversion Processes, and Administrative Processes. These Broader Processes Contain Sub-Processes. For Example, TheDocument46 pagesExpenditure Process, Conversion Processes, and Administrative Processes. These Broader Processes Contain Sub-Processes. For Example, TherikanshaNo ratings yet

- ZTE CorpDocument387 pagesZTE CorpHoàng Nam LêNo ratings yet

- Annual Report 2016 Janata BankDocument313 pagesAnnual Report 2016 Janata BankMahzabeen Nahid50% (2)

- Original 1489564193 Chapter 1 Principles of ReinsuranceDocument20 pagesOriginal 1489564193 Chapter 1 Principles of ReinsurancemakeshwaranNo ratings yet

- IAS 8 - Accounting Policies Estimates and ErrorsDocument12 pagesIAS 8 - Accounting Policies Estimates and ErrorsThuỷ TiênnNo ratings yet

- Securitas Code of ConductDocument3 pagesSecuritas Code of ConductJulio Brenda Cruz100% (1)

- Ars R 2018Document478 pagesArs R 2018Hakenewerth QuentinNo ratings yet

- International Financial Management 8th Edition Eun Test BankDocument38 pagesInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)