Professional Documents

Culture Documents

Ethical Issues in Financial Reporting

Uploaded by

khan_ss0 ratings0% found this document useful (0 votes)

30 views10 pagesincome tax, ifrs, ias

Original Title

Ias 12 Income tax

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentincome tax, ifrs, ias

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views10 pagesEthical Issues in Financial Reporting

Uploaded by

khan_ssincome tax, ifrs, ias

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

12

Ethical Issues in Financial

Reporting

Ethical Issues in Financial Reporting

Ethics in accounting are concerned with how to make

good and moral choices in regard to the preparation,

presentation and disclosure of financial information.

Financial reporting is a straightforward task that comes

with a variety of tricky ethical issues.

Breaches in ethics can result in major scandals for

companies and lead to loss of investor and consumer

confidence.

Understanding some of the more common ethical issues

that can arise in financial reporting can help those in the

field avoid potential landmines that could bring not only

their employers, but also their careers, to their knees.

Ethical Issues in Financial

Reporting

Fraudulent Financial Reporting

Most accounting scandals over the last two decades

have centered on fraudulent financial reporting.

Fraudulent financial reporting is the misstatement of

the financial statements by company management.

Usually, this is carried out with the intent of misleading

investors and maintaining the company's share price.

While the effects of misleading financial reporting may

boost the company's stock price in the short-term,

there are almost always ill effects in the long run.

This short-term focus on company finances is

sometimes known as "myopic management."

Ethical Issues in Financial

Reporting

Misappropriation of Assets

On an individual employee level, the most common ethical

issue in accounting is the misappropriation of assets.

Misappropriation of assets is the use of company assets for

any other purpose than company interests.

Otherwise known as stealing or embezzlement,

misappropriation of assets can occur at nearly any level of

the company and to nearly any degree. For example, a

senior level executive may charge a family dinner to the

company as a business expense.

At the same time, a line-level production employee may

take home office supplies for personal use. In both cases,

misappropriation of assets has occurred.

Ethical Issues in Financial

Reporting

Disclosure

As a subtopic of fraudulent financial reporting, disclosure

violations are errors of ethical omission.

While intentionally recording transactions in a manner that is

not in accordance with generally accepted accounting

principles is considered fraudulent financial reporting, the

failure to disclose information to investors that could change

their decisions about investing in the company could be

considered fraudulent financial reporting, as well.

Company executives must walk a fine line; it is important for

management to protect the company's proprietary information.

However, if this information relates to a significant event, it

may not be ethical to keep this information from the investors.

Ethical Issues in Financial

Reporting

Penalties

This legislation allows for harsh penalties

for manipulating financial records,

destroying information, interfering with

an investigation and provides legal

protection for whistle-blowers.

In addition, chief executives can be held

criminally liable for the misreporting of

their company.

Ethical Issues in Financial

Reporting

Cooking the Books

Financial reporters may be asked to "cook the books" when poor

documentation has been kept of expenditures and asset value.

This practice involves making up figures that may or may not be

good estimates of actual numbers.

While pressure to do this may come from the very top of a

company, the practice is not only unethical, but also outright

fraudulent.

Cooking the books also includes manipulation of accounting

records in preparing financial statements, as well as the

intentional omission of important asset of liability information

from financial reports.

A company might overstate how much it made in profits to

attract investors, for instance, or understate its liabilities to avoid

creating investor panic.

Ethical Issues in Financial

Reporting

Cute Accounting

This term describes the practice of stretching or

bending standards set by the accountancy

profession to the limit.

An example of this might include structuring lease

agreements so that any leased assets, along with

any liabilities that come with those leases, can be

kept off their books.

Some financial experts argue that this is

unethical, because companies that do this are

essentially misrepresenting their assets and

liabilities.

Ethical Issues in Financial

Reporting

Conflicts of Interest

A conflict of interest can result when an employee

receives an inappropriate personal benefit as the result

of any actions performed in his official role as a

financial reporter.

As an example, consider a financial reporter who

overstates a company's income as a way to ensure a

larger bonus for himself.

This is a direct conflict of interest because the financial

reporter is reaping a gain from his unethical activities.

It also flies in the face of the accounting profession's

code of ethics, which requires absolute objectivity.

Ethical Issues in Financial

Reporting

Breach of Confidentiality

Insider trading is an easy example of breach of

confidentiality in financial reporting.

A breach of confidentiality refers to any

disclosure of confidential or proprietary

information that an employee acquires as the

result of her employment as a financial reporter.

When that information is used for personal gain

or for the gain of some third party, the financial

reporter has broken her implicit oath of

confidentiality to her employer.

You might also like

- Ethical Behaviour and Implications For AccountantsDocument24 pagesEthical Behaviour and Implications For AccountantsKeoikantseNo ratings yet

- Audit Forensik UAJY - 4Document54 pagesAudit Forensik UAJY - 4eugeniaNo ratings yet

- Accounting Unit 3Document10 pagesAccounting Unit 3SergioNo ratings yet

- Creative AccountingDocument13 pagesCreative AccountingMira CE100% (1)

- CSEC Principles of Accounts - Introduction To Accounting & EthicsDocument5 pagesCSEC Principles of Accounts - Introduction To Accounting & EthicsRhea Lee RossNo ratings yet

- Q1 (A) Why Are Unethical Practices Observed in Accounting?Document5 pagesQ1 (A) Why Are Unethical Practices Observed in Accounting?Aagya RaiNo ratings yet

- Rangkuman Buat UTSDocument8 pagesRangkuman Buat UTSanggiNo ratings yet

- CH1 - Financial ManagementDocument10 pagesCH1 - Financial ManagementJohn LiamNo ratings yet

- Financial-Management - Lesson 1-What Is FinanceDocument10 pagesFinancial-Management - Lesson 1-What Is FinanceMargie RosetNo ratings yet

- AccountingDocument4 pagesAccountingErma AlferezNo ratings yet

- Acc201 Su3Document9 pagesAcc201 Su3Gwyneth LimNo ratings yet

- What Is Accounting?: Philippines Reporting Standards (PFRS)Document3 pagesWhat Is Accounting?: Philippines Reporting Standards (PFRS)Anonymous yvHbTK4XoNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chapter 1 - InesDocument5 pagesChapter 1 - InesDardan BalajNo ratings yet

- FM SummaryDocument11 pagesFM Summaryannemijn kraaijkampNo ratings yet

- Managerial Finance Chapter 1 (An Overview)Document23 pagesManagerial Finance Chapter 1 (An Overview)Opie OmNo ratings yet

- Financial Statement Frauds 1. Financial Statement Reporting 1.1. BasisDocument11 pagesFinancial Statement Frauds 1. Financial Statement Reporting 1.1. BasisJessica NguyenNo ratings yet

- Creative Accounting Full EditDocument11 pagesCreative Accounting Full EditHabib MohdNo ratings yet

- Financial Reporting & AuditingDocument24 pagesFinancial Reporting & AuditingAssad RafaqNo ratings yet

- Uses of Accounting Information and The Financial StatementsDocument65 pagesUses of Accounting Information and The Financial StatementsElwin Michaelraj VictorNo ratings yet

- Business Finance NotesDocument42 pagesBusiness Finance Noteskaiephrahim663No ratings yet

- Creative Accounting Tutor Master PDFDocument12 pagesCreative Accounting Tutor Master PDFJojo Josepha MariaNo ratings yet

- ACF1200 Notes (Topic 1 - 11)Document18 pagesACF1200 Notes (Topic 1 - 11)caden wrayNo ratings yet

- Camouflage AccountingDocument28 pagesCamouflage AccountingKishore AgarwalNo ratings yet

- Chapter 1Document7 pagesChapter 1Abd El-Rahman El-syeoufyNo ratings yet

- Auditing: Concept of MaterialityDocument43 pagesAuditing: Concept of MaterialityZead MahmoodNo ratings yet

- Ethics in Finance and AccountingDocument17 pagesEthics in Finance and AccountingSurangana gargNo ratings yet

- Accounting TheoryDocument32 pagesAccounting TheoryVicky VijayvargiyaNo ratings yet

- M1. Professional BehaviourDocument12 pagesM1. Professional BehaviourZHI KANG KONGNo ratings yet

- Patterns of Earnings ManagementDocument6 pagesPatterns of Earnings ManagementAnis SofiaNo ratings yet

- FINMANDocument10 pagesFINMANMine MineNo ratings yet

- Creative AccountingDocument7 pagesCreative Accountingeugeniastefania raduNo ratings yet

- Accounting Quality AnalysisDocument4 pagesAccounting Quality AnalysisBurhan Al MessiNo ratings yet

- Theories in Accounting: ©2018 John Wiley & Sons Australia LTDDocument57 pagesTheories in Accounting: ©2018 John Wiley & Sons Australia LTDdickzcaNo ratings yet

- Significance and Limitations of Financial StatementsDocument14 pagesSignificance and Limitations of Financial StatementsabbyplexxNo ratings yet

- Accounting For Lawyers by Solicitor KatuDocument45 pagesAccounting For Lawyers by Solicitor KatuFrancisco Hagai GeorgeNo ratings yet

- Accounting - Saad Imran..Document26 pagesAccounting - Saad Imran..Saad ImranNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Characteristics of The Creative Accounting ConceptDocument5 pagesCharacteristics of The Creative Accounting ConceptCata Roxana StelianaNo ratings yet

- Earnings Management: Instructor: M.Jibran Sheikh E-Mail: Jibransheikh@comsats - Edu.pkDocument46 pagesEarnings Management: Instructor: M.Jibran Sheikh E-Mail: Jibransheikh@comsats - Edu.pkMah Zeb SyyedNo ratings yet

- Acc 2214 Topic 2Document6 pagesAcc 2214 Topic 2Sunday OcheNo ratings yet

- Accounting Assignment - Saad Imran LO4Document38 pagesAccounting Assignment - Saad Imran LO4Saad ImranNo ratings yet

- Topic: Ethical Issues in Corporate GovernanceDocument13 pagesTopic: Ethical Issues in Corporate GovernanceNitin AggarwalNo ratings yet

- Topic: Ethical Issues in Corporate GovernanceDocument13 pagesTopic: Ethical Issues in Corporate GovernanceNitin AggarwalNo ratings yet

- 601 NewDocument28 pages601 Newmuhammad saqib jabbarNo ratings yet

- Business EthicsDocument21 pagesBusiness EthicsMark IlanoNo ratings yet

- Our WorkDocument16 pagesOur Workroro522011No ratings yet

- Questions Mba - MidtermDocument6 pagesQuestions Mba - Midtermاماني محمدNo ratings yet

- 01 The Accounting Environment and Accounting FrameworkDocument39 pages01 The Accounting Environment and Accounting Frameworkapostol ignacio100% (1)

- Objective of An Audit (Narasi)Document4 pagesObjective of An Audit (Narasi)ayu dwinyNo ratings yet

- ReviewerDocument5 pagesReviewerJeline E LansanganNo ratings yet

- Auditing 1Document9 pagesAuditing 1Vanessa BatallaNo ratings yet

- Reviewer FinanceDocument9 pagesReviewer FinanceChristine Marie RamirezNo ratings yet

- Chapter 1-FMDocument20 pagesChapter 1-FMbereket nigussieNo ratings yet

- Creative AccountingDocument5 pagesCreative Accountingvikas_nair_2No ratings yet

- ch09 - PPT - Rankin - 2e RevDocument37 pagesch09 - PPT - Rankin - 2e Revmichele hazelNo ratings yet

- Financial Accounting (F3/FFA) : July 2012 SessionDocument148 pagesFinancial Accounting (F3/FFA) : July 2012 SessionxxxtrememohsinNo ratings yet

- 02 ECorp AR 2014 Full PDFDocument129 pages02 ECorp AR 2014 Full PDFkhan_ssNo ratings yet

- Brief On Ducati Case StudyDocument1 pageBrief On Ducati Case Studykhan_ssNo ratings yet

- Samsung Brief: OpinionDocument1 pageSamsung Brief: Opinionkhan_ssNo ratings yet

- IAS 38 CasesDocument4 pagesIAS 38 CasesRonit AhujaNo ratings yet

- Ias 38Document43 pagesIas 38khan_ssNo ratings yet

- IAS 18 - Revenue RecognitionDocument3 pagesIAS 18 - Revenue Recognitionkhan_ssNo ratings yet

- Ias 16Document14 pagesIas 16khan_ssNo ratings yet

- Most Useful Business Books For Managers - Comprehensive ListDocument2 pagesMost Useful Business Books For Managers - Comprehensive ListAdrian MihalceaNo ratings yet

- Risk N ReturnDocument59 pagesRisk N ReturnSardar Faisal Bin RaziqNo ratings yet

- IFRSDocument26 pagesIFRSkhan_ssNo ratings yet

- 2nd Semester 1.5Document3 pages2nd Semester 1.5khan_ssNo ratings yet

- Apple: by 6764-Fms/mba/f14 Sheeraz KhanDocument3 pagesApple: by 6764-Fms/mba/f14 Sheeraz Khankhan_ssNo ratings yet

- Financial Reporting & StatementsDocument6 pagesFinancial Reporting & Statementskhan_ssNo ratings yet

- Theories of Interest RatesDocument31 pagesTheories of Interest Rateskhan_ssNo ratings yet

- CertifiedDocument1 pageCertifiedkhan_ssNo ratings yet

- Financial DerivativesDocument29 pagesFinancial DerivativesnandukyNo ratings yet

- Risk N ReturnDocument59 pagesRisk N ReturnSardar Faisal Bin RaziqNo ratings yet

- Creating Excel ReportsDocument7 pagesCreating Excel Reportskhan_ssNo ratings yet

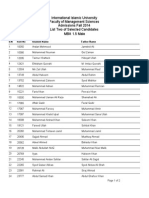

- 2 MBA 1.5 MaleDocument2 pages2 MBA 1.5 Malekhan_ssNo ratings yet

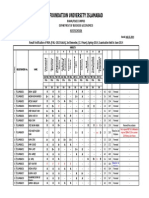

- 2nd Merit List BSEE (FALL-2014 Admission) - Morning: Ref No. NameDocument2 pages2nd Merit List BSEE (FALL-2014 Admission) - Morning: Ref No. Namekhan_ssNo ratings yet

- Excel2007 Ess QRGDocument1 pageExcel2007 Ess QRGJames WoodsNo ratings yet

- French OnlineDocument5 pagesFrench Onlinekhan_ssNo ratings yet

- Latex Hints and TricksDocument24 pagesLatex Hints and TricksbilzinetNo ratings yet

- Account Statement From 27 Dec 2017 To 27 Jun 2018Document4 pagesAccount Statement From 27 Dec 2017 To 27 Jun 2018mrcopy xeroxNo ratings yet

- Release Notes Csi Bridge V 2020Document9 pagesRelease Notes Csi Bridge V 2020Abdul KadirNo ratings yet

- GNDDocument16 pagesGNDDEAN TENDEKAI CHIKOWONo ratings yet

- Quote Generator DocumentDocument47 pagesQuote Generator DocumentPrajwal KumbarNo ratings yet

- Ats1811 MLDocument16 pagesAts1811 MLWathNo ratings yet

- Lab Manual: Department of Computer EngineeringDocument65 pagesLab Manual: Department of Computer EngineeringRohitNo ratings yet

- The Effect of Bicarbonate Additive On Corrosion ResistanceDocument11 pagesThe Effect of Bicarbonate Additive On Corrosion ResistancebexigaobrotherNo ratings yet

- ProEXR ManualDocument44 pagesProEXR ManualSabine BNo ratings yet

- Meeting Request LetterDocument2 pagesMeeting Request LetterRagni Tayal100% (1)

- Top Notch 1, 3° Edicion Workbook Answer KeyDocument14 pagesTop Notch 1, 3° Edicion Workbook Answer KeyLuis Lopez90% (61)

- Arbitrage Calculator 3Document4 pagesArbitrage Calculator 3Eduardo MontanhaNo ratings yet

- Psar Techspec Autologicsoftwaretechspecfor Psarvehicles en PF v2.0Document183 pagesPsar Techspec Autologicsoftwaretechspecfor Psarvehicles en PF v2.0PhatNo ratings yet

- Union of India v. Mohit Minerals Pvt. LTD.-GST Validity AnalysisDocument4 pagesUnion of India v. Mohit Minerals Pvt. LTD.-GST Validity Analysissandhya parimalaNo ratings yet

- 7 Hive NotesDocument36 pages7 Hive NotesSandeep BoyinaNo ratings yet

- BS en Iso 11114-4-2005 (2007)Document30 pagesBS en Iso 11114-4-2005 (2007)DanielVegaNeira100% (1)

- Nagpur Company List 2Document10 pagesNagpur Company List 2Kaushik BachanNo ratings yet

- IT 118 - SIA - Module 1Document9 pagesIT 118 - SIA - Module 1Kim Zyrene DominoNo ratings yet

- Techniques Tips For Polishing PDFDocument6 pagesTechniques Tips For Polishing PDFrobin parmarNo ratings yet

- OCES 1001 - Final Exam Instructions (Please Read BEFORE The Exam)Document16 pagesOCES 1001 - Final Exam Instructions (Please Read BEFORE The Exam)Heihei ChengNo ratings yet

- NCAA Safety Bulletin 23-4 - AprilDocument21 pagesNCAA Safety Bulletin 23-4 - AprilANo ratings yet

- GR No. 188213 - January 11, 2016 FACTS: Herein Petitioner, Natividad Cruz, Was The Punong Barangay or Chairperson of BarangayDocument6 pagesGR No. 188213 - January 11, 2016 FACTS: Herein Petitioner, Natividad Cruz, Was The Punong Barangay or Chairperson of BarangayAilyn GaluraNo ratings yet

- NHW Beg 4E Unit Tests - 3a PDFDocument2 pagesNHW Beg 4E Unit Tests - 3a PDFabeer24No ratings yet

- Solution For Databases Reference Architecture For Oracle Rac Database 12c With Gad Using HdidDocument48 pagesSolution For Databases Reference Architecture For Oracle Rac Database 12c With Gad Using HdidClaudio Osvaldo Vargas FarfanNo ratings yet

- " My Heart Will Go On ": Vocal: Celine DionDocument8 pages" My Heart Will Go On ": Vocal: Celine DionLail Nugraha PratamaNo ratings yet

- Beer Distribution Game - Wikipedia, The Free EncyclopediaDocument3 pagesBeer Distribution Game - Wikipedia, The Free EncyclopediaSana BhittaniNo ratings yet

- How To Write The Introduction of An Action Research PaperDocument8 pagesHow To Write The Introduction of An Action Research Papergw1qjewwNo ratings yet

- Mass Effect 5e - The HomebreweryDocument253 pagesMass Effect 5e - The HomebreweryRony Do CarmoNo ratings yet

- A Case Study On Mahindra's Blue Sense Application Project by RohitDocument43 pagesA Case Study On Mahindra's Blue Sense Application Project by RohitrohitNo ratings yet

- India's Information Technology Sector: What Contribution To Broader Economic Development?Document32 pagesIndia's Information Technology Sector: What Contribution To Broader Economic Development?Raj KumarNo ratings yet