Professional Documents

Culture Documents

Credit Rating Agency in India

Uploaded by

Aditya50%(2)50% found this document useful (2 votes)

3K views24 pagesIFCI holds 26% of the share capital &74% is contributed by UTI, LIC,GIC,PNB,CBI, Bank of Baroda,UCO Bank and HDFC Ltd. CARE LTD.(CREDIT ANALYSIS and RESEARCH in EQUITY) is a credit rating and information services company promoted by IDBI jointly with investment institutions, banks and financial companies. DUFF and PHELPS CREDIT RATING DCR Is the result of joint

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIFCI holds 26% of the share capital &74% is contributed by UTI, LIC,GIC,PNB,CBI, Bank of Baroda,UCO Bank and HDFC Ltd. CARE LTD.(CREDIT ANALYSIS and RESEARCH in EQUITY) is a credit rating and information services company promoted by IDBI jointly with investment institutions, banks and financial companies. DUFF and PHELPS CREDIT RATING DCR Is the result of joint

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

50%(2)50% found this document useful (2 votes)

3K views24 pagesCredit Rating Agency in India

Uploaded by

AdityaIFCI holds 26% of the share capital &74% is contributed by UTI, LIC,GIC,PNB,CBI, Bank of Baroda,UCO Bank and HDFC Ltd. CARE LTD.(CREDIT ANALYSIS and RESEARCH in EQUITY) is a credit rating and information services company promoted by IDBI jointly with investment institutions, banks and financial companies. DUFF and PHELPS CREDIT RATING DCR Is the result of joint

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

Presentation On

Credit Rating Agencies In India

ICRA Ltd.(Investment Information &

Credit Rating Agency)

The ICRA Ltd. Has been promoted by IFCI at

New Delhi. It is an independent company Ltd

by shares with an authorised share capital of

Rs.10 crore against 5 crore is paid up. IFCI

holds 26%of the share capital &74% is

contributed by UTI, LIC,GIC,PNB,CBI, Bank

of Baroda,UCO Bank & HDFC Ltd.

Objectives Of ICRA

To provide information & guidance to

institutional & individual investor.

To enhance the ability of the borrower/issuers

to access the money market & the capital

market for large volume of resources from

investing public

To assist the regulators in promoting the

transparency in the financial market.

Range Of Service Offered.

Rating Services

Information services

Advisory Services

Rating Services Includes.

The other Services in the area of credit rating

include following………..

Credit Assessment

General Assessment

Bank Lines of Credit Rating

Credit Assessment For Small Scale & Medium

Scale Industries.

Insurance Company Paying Rating.

Information Services Includes;

Equity Grading

Equity Assessment

Corporate Review

Money & Finance

Investment Information Publications

Corporate Reports

ICRA’S Rating Symbols

Long Term Instruments, including

debentures/bonds/preference shares

Medium Term Instruments Comprising

Certificate Of deposit

Short Term Instruments Including Commercial

Papers

Equity

CARE LTD.(CREDIT ANALYSIS &

RESEARCH IN EQUITY)

CARE Ltd. Is a credit rating & information

services company promoted by IDBI jointly

with investment institutions, banks & financial

companies. The company started is operation in

October 1993 & announced its Ist rating in

1993.

CARE Range Of Services

Credit Rating

Information Services

Equity Research

Other Services Includes…..

• CARE Loan Rating

• Credit Analysis Rating

• Interest Rate Structure Model

DUFF & PHELPS CREDIT RATING

DCR Is the result of joint venture between the

international credit rating agency Duff &

Phelps & JM Financial & Alliance Group.

DCR Symbols

• Long term & Medium term debt/instruments.

• Short term debt/instruments.

ONICRA(ONIDA INDIVIDUAL

CREDIT RATING AGENCY)

ONICRA is the first individual credit agency in

India promoted by famous ONIDA group.

ONIDA covers approximately 75 million

households owning three popular items colour

TVs, refrigerators & washing machines.

ONICRA RATING SCALE

ONICRA has been pioneer introduce the

concept of individual credit rating. It has

develop a rating system for various types of

credit extension by conducting in debt study of

all aspect the behaviour of credit seekers.

The creditworthiness of the individual is

measured on various Parameters such as age,

qualification, occupation, savings, stability of

works and history of repayment etc.

ONICRA Rating Process

ONICRA takes up the credit rating for

individuals at the request of lending institution.

A lending institution writes to the ONICRA

whenever a potential customers visit the firm

for customers credit.

The customers is required to fill in a prescribed

form.

ONICRA uses 100 point scale to rate the

individual on various parameters

MOODY’S INVESTOR SERVICES

Moody has stated following

instruments:

• Corporate bonds

• Municipal bonds

• Commercial papers

• Short term Municipal note

• Preferred stock

Performance of credit Rating Agency

Reforms in the financial sector have greatly

enhanced the role of credit rating agencies.

CRISIL,ICRA & CARE, the three major rating

agencies are handling 90%-95%of the business of

credit rating. All of them are promoted by financial

institutions. Financial institutions while advancing

loans take the help of credit rating agencies to get

the company rated. All these agencies have

continued to expand their activities.

Conti…

This has raised a big question mark as to procedure

or the methodology that these rating agencies follow

for rating. It has also been observed that companies

not satisfied with rating of one agency approach

another rating agency for better rating. Rating

process followed for rating has been found to be

defective. Rating agencies take in to consideration

only past & present performance & the projected

future performance is ignored.

SEBI REGULATIONS

A credit rating agency shall make all efforts to

protect the interest of investors.

A credit rating in the conduct of its business ,

shall observed high degree of integrity,

dignity & fairness in the conduct of its

business.

A credit rating agency shall fulfill its obligation

in a prompt, ethical & professional manner.

Cont…

A credit rating agency shall at all times exercise

due diligence ensure proper care & exercise

independent professional judgment in order to

achieve & maintain objectivity.

A credit rating agency shall have a reasonable &

adequate basis for performing rating evaluations,

with the support of appropriate & in depth rating

researches.

Cont…

A credit rating agency shall have in place a

rating process that reflects consistent &

international rating standards.

A credit rating agency shall not indulge in any

unfair competition nor shall it wean away the

clients of any other rating agency on

assurance of high rating.

A credit rating agency shall disclose its rating

methodology to clients, users & the public.

Cont…

A credit rating agency shall, wherever necessary,

disclose to the clients, possible sources of conflict of

duties & interest, which could impair its ability to

make fair, objectives & unbiased ratings.

A credit rating agency shall not make any

exaggerated statement, whether oral or written, to

the client either about its qualification or its capability

to render certain services or its achievement with

regard to the services rendered to other clients.

Cont…

A credit rating agency shall not make any untrue

statement, suppress any material fact or make any

misrepresentations in any documents, reports,

papers or information furnished to the board, stock

exchange or public at large.

A credit rating agency shall ensure that the board is

promptly informed about any action, legal proceeding

etc.initiated against it alleging any material breach or

noncompliance by it, of any law, rules, regulations &

directions of the board or of any other regulatory

body.

Cont…

A credit rating agency shall ensure that there

is no misuse of any privileged information

including prior knowledge of rating decision

or changes.

(a) a credit rating agency or any of his

employees shall not render, directly or

indirectly any investment advice about any

security in the publicly accessible media.

Cont…

(b)a credit rating agency shall not offer fee-

based services to the rated entities, beyond

credit ratings & research.

You might also like

- TEST Inter. U.1 Name: - : Grammar 1 Underline The Correct FormDocument4 pagesTEST Inter. U.1 Name: - : Grammar 1 Underline The Correct FormKrisztofer Török100% (1)

- Security Awareness TrainingDocument95 pagesSecurity Awareness TrainingChandra RaoNo ratings yet

- Lupin CaseDocument15 pagesLupin CaseSanjit Sinha0% (1)

- Black Book Project On Marketing in Banking Sector and Recent Trends - 257238756Document67 pagesBlack Book Project On Marketing in Banking Sector and Recent Trends - 257238756riyajainNo ratings yet

- Kotak Mahindra Bank What Makes Kotak Different From Others - A Comparative Story KotakDocument68 pagesKotak Mahindra Bank What Makes Kotak Different From Others - A Comparative Story KotakshiprapathaniaNo ratings yet

- Sip Hotel IndustryDocument25 pagesSip Hotel IndustryParas WaliaNo ratings yet

- International Credit RatingDocument17 pagesInternational Credit RatingDrx Mehazabeen KachchawalaNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument58 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentAnonymous 01pQbZUMMNo ratings yet

- Gabriel Marcel - Sketch of A Phenomenology and A Metaphysic of HopeDocument6 pagesGabriel Marcel - Sketch of A Phenomenology and A Metaphysic of HopeHazel Dawn PaticaNo ratings yet

- Fmbo Short AnswersDocument6 pagesFmbo Short Answersvenkatesh telangNo ratings yet

- Fanancial Analysis F Icici BankDocument78 pagesFanancial Analysis F Icici BankPaul DiazNo ratings yet

- Dissertation Project ReportDocument83 pagesDissertation Project ReportSneha ShekarNo ratings yet

- A Report On: Technical & Fundamental Analysis in Foreign Currency ExchangeDocument54 pagesA Report On: Technical & Fundamental Analysis in Foreign Currency ExchangeManju ReddyNo ratings yet

- Mugilan HDFC CSR Assignment-1Document30 pagesMugilan HDFC CSR Assignment-16038 Mugilan k100% (1)

- Project On Retail BankingDocument44 pagesProject On Retail BankingabhinaykasareNo ratings yet

- Case - TI Cycles - MMDocument17 pagesCase - TI Cycles - MMChayan SenNo ratings yet

- Wavin PlasticsDocument18 pagesWavin PlasticsAndreas Vinther PoulsenNo ratings yet

- Summer Internship ReportDocument73 pagesSummer Internship Reportsunny nasaNo ratings yet

- Project Report HDFCDocument58 pagesProject Report HDFCKr Ish NaNo ratings yet

- Systematic Risk of Select Banking Scripts Traded in NSE MBA ProjectDocument83 pagesSystematic Risk of Select Banking Scripts Traded in NSE MBA ProjectSuresh Raghav100% (2)

- Perfetti Final ReportDocument26 pagesPerfetti Final ReportPankaj DhamapurkarNo ratings yet

- BB Advisory ReportDocument36 pagesBB Advisory ReportLoknathNo ratings yet

- A Study On Customer Satisfaction On Lic Insured ServicesDocument69 pagesA Study On Customer Satisfaction On Lic Insured ServicesdineshshaNo ratings yet

- Merchant Banking SynopsisDocument6 pagesMerchant Banking SynopsisAnonymous iVVlOINo ratings yet

- Issue ManagementDocument30 pagesIssue Managementmohanbkp100% (2)

- Risk Management in SharekhanDocument60 pagesRisk Management in SharekhanSilvi Khurana0% (1)

- 10.methods of Cost VariabilityDocument14 pages10.methods of Cost VariabilityNeel Gupta100% (1)

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- MRPDocument52 pagesMRPJAI SINGHNo ratings yet

- Axis Bank Marketing StrategyDocument10 pagesAxis Bank Marketing StrategyVishal KambleNo ratings yet

- Aditya Birla MoneyDocument15 pagesAditya Birla MoneyVishal AryaNo ratings yet

- Project CertificateDocument79 pagesProject CertificatemahenderNo ratings yet

- Internship SandeepDocument25 pagesInternship Sandeeprahul vijuNo ratings yet

- Credit Risk Management in BanksDocument50 pagesCredit Risk Management in BanksDivyaNo ratings yet

- A Multidisciplinary Action Project Report OnDocument62 pagesA Multidisciplinary Action Project Report OnRiddhi ThankiNo ratings yet

- Customer Satisfaction - HDFC LifeDocument49 pagesCustomer Satisfaction - HDFC Liferaj0% (1)

- Fundamental Analysis of ICICI Bank Through Ratio AnalysisDocument9 pagesFundamental Analysis of ICICI Bank Through Ratio Analysiskgn78692No ratings yet

- Internship Program 2021 We Believe That The Key To Success Can Be Found Among The YouthDocument4 pagesInternship Program 2021 We Believe That The Key To Success Can Be Found Among The YouthMidhun ThomasNo ratings yet

- LIC Brand Loyalty PDFDocument16 pagesLIC Brand Loyalty PDFRasika Pawar-Haldankar0% (1)

- Globalization and Cooperative Sector in IndiaDocument8 pagesGlobalization and Cooperative Sector in IndiaRAKESH SHARMANo ratings yet

- IciciDocument14 pagesIcicimercyNo ratings yet

- Corporate Identificatio and Competition Analysis: A Project Report ONDocument77 pagesCorporate Identificatio and Competition Analysis: A Project Report ONmustkeem_qureshi7089No ratings yet

- Roll No.15, Tybbi 2010-11Document101 pagesRoll No.15, Tybbi 2010-11Amey Kolhe67% (3)

- Credit Rating in India - A Case For AccountabilityDocument66 pagesCredit Rating in India - A Case For AccountabilityArun Mishra100% (3)

- Financial RiskDocument68 pagesFinancial RiskGouravNo ratings yet

- Ratio Analysis of It Companies Five Infosys Wipro Tcs MahindraDocument14 pagesRatio Analysis of It Companies Five Infosys Wipro Tcs MahindrakharemixNo ratings yet

- Comparative Analysis of Broking FirmsDocument12 pagesComparative Analysis of Broking FirmsJames RamirezNo ratings yet

- Comparative Analysis of Business Environment and Risks in Briics CountriesDocument40 pagesComparative Analysis of Business Environment and Risks in Briics Countriesqqvids100% (2)

- Rajkot People's Co-Op - Bank Ltd.Document72 pagesRajkot People's Co-Op - Bank Ltd.Kishan Gokani100% (1)

- UNIT-4 Mergers, Diversification and Performance EvaluationDocument13 pagesUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiNo ratings yet

- MARWADI FINANCE MBA Porject Report Prince DudhatraDocument89 pagesMARWADI FINANCE MBA Porject Report Prince DudhatrapRiNcE DuDhAtRa100% (1)

- Reforms and Recent Changes in Derivatives MarketsDocument19 pagesReforms and Recent Changes in Derivatives MarketsprathibakbNo ratings yet

- A Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., PalamanerDocument7 pagesA Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., Palamanersree anugraphicsNo ratings yet

- Retail Banking (With Special Reference To Icici Bank)Document32 pagesRetail Banking (With Special Reference To Icici Bank)Varun PuriNo ratings yet

- Icici BankDocument37 pagesIcici BankNitinAgnihotriNo ratings yet

- CRISILDocument40 pagesCRISILvasugarg102531No ratings yet

- Credit RatingDocument15 pagesCredit RatingNamrata Bhanot100% (3)

- Credit Rating Agencies: Submitted To: Prof Meghana PatilDocument57 pagesCredit Rating Agencies: Submitted To: Prof Meghana PatiladitieducationNo ratings yet

- Credit Rating Agencies in IndiaDocument12 pagesCredit Rating Agencies in IndiaAnand DhawanNo ratings yet

- Credit Rating ProcessDocument36 pagesCredit Rating ProcessBhuvi SharmaNo ratings yet

- Credit RatingDocument15 pagesCredit RatingKrishna Chandran PallippuramNo ratings yet

- Credit Rating ReportDocument12 pagesCredit Rating ReportKunal HansdaNo ratings yet

- Credit RatingDocument56 pagesCredit RatingRaman Gupta100% (1)

- Forecasting Cash FlowsDocument4 pagesForecasting Cash FlowsAdityaNo ratings yet

- Hedging Cash Balance UncertaintiesDocument11 pagesHedging Cash Balance UncertaintiesAditya100% (1)

- Inventory ManagementDocument29 pagesInventory ManagementAditya80% (5)

- Forecasting Cash FlowsDocument4 pagesForecasting Cash FlowsAdityaNo ratings yet

- Disbursement SystemsDocument12 pagesDisbursement SystemsAdityaNo ratings yet

- Disbursement SystemsDocument12 pagesDisbursement SystemsAdityaNo ratings yet

- Disbursement SystemsDocument12 pagesDisbursement SystemsAdityaNo ratings yet

- Currency Option (FINAL)Document12 pagesCurrency Option (FINAL)AdityaNo ratings yet

- The Payment of Gratuity Act 1972Document12 pagesThe Payment of Gratuity Act 1972AdityaNo ratings yet

- Financial. Institution & IFCIDocument18 pagesFinancial. Institution & IFCIAditya100% (1)

- Risk Management in BanksDocument16 pagesRisk Management in BanksAdityaNo ratings yet

- Capital Adequacy & Capital PlanningDocument21 pagesCapital Adequacy & Capital PlanningAdityaNo ratings yet

- Cash Concentration StrategiesDocument11 pagesCash Concentration StrategiesAditya100% (1)

- Financial ForcesDocument25 pagesFinancial ForcesAdityaNo ratings yet

- DerivativesDocument5 pagesDerivativesAdityaNo ratings yet

- Factory Act 1948Document13 pagesFactory Act 1948reetesh88% (8)

- Currency OptionDocument15 pagesCurrency OptionAdityaNo ratings yet

- The Payment of Bonus ACT, 1965Document20 pagesThe Payment of Bonus ACT, 1965anandi_meenaNo ratings yet

- Gratuity Act (Vikram)Document23 pagesGratuity Act (Vikram)AdityaNo ratings yet

- Lecture 15Document17 pagesLecture 15AdityaNo ratings yet

- The Employees' State Insurance Act, 1948Document20 pagesThe Employees' State Insurance Act, 1948AdityaNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNo ratings yet

- Workmen Compensation ActDocument17 pagesWorkmen Compensation ActAdityaNo ratings yet

- Inventory ControlDocument24 pagesInventory ControlAdityaNo ratings yet

- The Indian Retail SectorDocument17 pagesThe Indian Retail SectorAdityaNo ratings yet

- Int. Product Policy and Marketing MixDocument17 pagesInt. Product Policy and Marketing MixsujeetleopardNo ratings yet

- CapmDocument26 pagesCapmapi-3814557100% (1)

- Marketing Ch. 15Document31 pagesMarketing Ch. 15Vijay MalikNo ratings yet

- Aggregate PlanningDocument3 pagesAggregate PlanningAdityaNo ratings yet

- Industrial MarketingDocument9 pagesIndustrial MarketingAditya0% (1)

- Online Learning Can Replace Classroom TeachingsDocument7 pagesOnline Learning Can Replace Classroom TeachingsSonam TobgayNo ratings yet

- Gps DVR FlierDocument2 pagesGps DVR FlierShankar PandaNo ratings yet

- EPS For OPAPRU Executives - Ao24jan2024Document3 pagesEPS For OPAPRU Executives - Ao24jan2024rinafenellere.opapruNo ratings yet

- Dentapdf-Free1 1-524 1-200Document200 pagesDentapdf-Free1 1-524 1-200Shivam SNo ratings yet

- FINAL Haiti Electricity Report March 2018Document44 pagesFINAL Haiti Electricity Report March 2018Djorkaeff FrancoisNo ratings yet

- Terminal Injustice - Ambush AttackDocument2 pagesTerminal Injustice - Ambush AttackAllen Carlton Jr.No ratings yet

- Meritor DownloadDocument68 pagesMeritor DownloadShubham BhatiaNo ratings yet

- ColaDocument4 pagesColaAkhil ChauhanNo ratings yet

- The Hidden Opportunity in Container Shipping: Travel, Transport & LogisticsDocument8 pagesThe Hidden Opportunity in Container Shipping: Travel, Transport & LogisticseyaoNo ratings yet

- MCQ Chapter 1Document9 pagesMCQ Chapter 1K57 TRAN THI MINH NGOCNo ratings yet

- Learning CompetenciesDocument44 pagesLearning CompetenciesJeson GalgoNo ratings yet

- Sample DLL Catch Up FridayDocument11 pagesSample DLL Catch Up Fridayalice mapanaoNo ratings yet

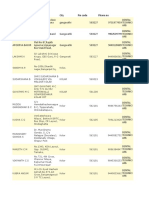

- Disbursement Register FY2010Document381 pagesDisbursement Register FY2010Stephenie TurnerNo ratings yet

- Glossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Document4 pagesGlossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Chetna Shetty DikkarNo ratings yet

- Critical Analysis of The Payment of Wages ActDocument2 pagesCritical Analysis of The Payment of Wages ActVishwesh SinghNo ratings yet

- B16. Project Employment - Bajaro vs. Metro Stonerich Corp.Document5 pagesB16. Project Employment - Bajaro vs. Metro Stonerich Corp.Lojo PiloNo ratings yet

- Scraper SiteDocument3 pagesScraper Sitelinda976No ratings yet

- Outline 2018: Cultivating Professionals With Knowledge and Humanity, Thereby Contributing To People S Well-BeingDocument34 pagesOutline 2018: Cultivating Professionals With Knowledge and Humanity, Thereby Contributing To People S Well-BeingDd KNo ratings yet

- Seryu Cargo Coret CoreDocument30 pagesSeryu Cargo Coret CoreMusicer EditingNo ratings yet

- PMP Mock Exams 1, 200 Q&ADocument29 pagesPMP Mock Exams 1, 200 Q&Asfdfdf dfdfdf100% (1)

- How To Be Baptized in The Holy SpiritDocument2 pagesHow To Be Baptized in The Holy SpiritFelipe SabinoNo ratings yet

- EGYPTIAN LITERA-WPS OfficeDocument14 pagesEGYPTIAN LITERA-WPS OfficeLemoj CombiNo ratings yet

- Bible Who Am I AdvancedDocument3 pagesBible Who Am I AdvancedLeticia FerreiraNo ratings yet

- HBL IPG FAQs PDFDocument5 pagesHBL IPG FAQs PDFAbbas HussainNo ratings yet

- Outpatient ClaimDocument1 pageOutpatient Claimtajuddin8No ratings yet

- Xeridt2n cbn9637661Document7 pagesXeridt2n cbn9637661Naila AshrafNo ratings yet