Professional Documents

Culture Documents

Managerial Accounting Basics: Garrisson cp3

Uploaded by

GlenPalmerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting Basics: Garrisson cp3

Uploaded by

GlenPalmerCopyright:

Available Formats

Systems Design:

Job-Order Costing

Chapter Three

3-2

Learning Objective 1

Distinguish between

process costing and

job-order costing and

identify companies that

would use each costing

method.

3-3

Types of Product Costing Systems

Process

Costing

Job-order

Costing

A company

company produces

produces many

many units

units of

of aa single

single

product.

product.

One

One unit

unit of

of product

product is

is indistinguishable

indistinguishable from

from other

other

units

units of

of product.

product.

The

The identical

identical nature

nature of

of each

each unit

unit of

of product

product enables

enables

assigning

assigning the

the same

same average

average cost

cost per

per unit.

unit.

3-4

Types of Product Costing Systems

Process

Costing

Job-order

Costing

Many

Many different

different products

products are

are produced

produced each

each period.

period.

Products

Products are

are manufactured

manufactured to

to order.

order.

The

The unique

unique nature

nature of

of each

each order

order requires

requires tracing

tracing or

or

allocating

allocating costs

costs to

to each

each job,

job, and

and maintaining

maintaining cost

cost

records

records for

for each

each job.

job.

3-5

Comparing Process and Job-Order Costing

3-6

Quick Check

Which

Which of

of the

the following

following companies

companies would

would be

be

likely

likely to

to use

use job-order

job-order costing

costing rather

rather than

than

process

process costing?

costing?

a.

a. Scott

Scott Paper

Paper Company

Company for

for Kleenex.

Kleenex.

b.

b. Architects.

Architects.

c.

c. Heinz

Heinz for

for ketchup.

ketchup.

d.

d. Caterer

Caterer for

for aa wedding

wedding reception.

reception.

e.

e. Builder

Builder of

of commercial

commercial fishing

fishing vessels.

vessels.

3-7

Quick Check

Which

Which of

of the

the following

following companies

companies would

would be

be

likely

likely to

to use

use job-order

job-order costing

costing rather

rather than

than

process

process costing?

costing?

a.

a. Scott

Scott Paper

Paper Company

Company for

for Kleenex.

Kleenex.

b.

b. Architects.

Architects.

c.

c. Heinz

Heinz for

for ketchup.

ketchup.

d.

d. Caterer

Caterer for

for aa wedding

wedding reception.

reception.

e.

e. Builder

Builder of

of commercial

commercial fishing

fishing vessels.

vessels.

3-8

Learning Objective 2

Identify the documents

used in a job-order

costing system.

3-9

Job-Order Costing An Overview

Direct

Direct Materials

Materials

Direct

Direct Labor

Labor

Manufacturing

Manufacturing

Overhead

Overhead

Job

Job No.

No. 11

Job

Job No.

No. 22

Job

Job No.

No. 33

Charge

Charge

direct

direct

material

material

and

and direct

direct

labor

labor costs

costs

to

to each

each job

job

as

as work

work is

is

performed.

performed.

3-10

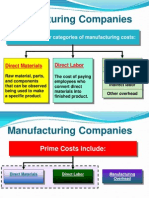

Direct Manufacturing Costs

Direct

Direct Materials

Materials

Direct

Direct Labor

Labor

Manufacturing

Manufacturing

Overhead

Overhead

Job

Job No.

No. 11

Job

Job No.

No. 22

Job

Job No.

No. 33

Manufacturing

Manufacturing

Overhead,

Overhead,

including

including

indirect

indirect

materials

materials and

and

indirect

indirect labor

labor,,

are

are allocated

allocated

to

to all

all jobs

jobs

rather

rather than

than

directly

directly traced

traced

to

to each

each job.

job.

3-11

The Job Cost Sheet

PearCo Job Cost Sheet

Job Number A - 143

Department B3

Item Wooden cargo crate

Direct Materials

Req. No. Amount

Date Initiated 3-4-05

Date Completed

Units Completed

Direct Labor

Manufacturing Overhead

Ticket Hours Amount Hours

Rate

Amount

Cost Summary

Direct Materials

Direct Labor

Manufacturing Overhead

Total Cost

Unit Product Cost

Units Shipped

Date Number Balance

3-12

Measuring Direct Materials Cost

Will E. Delite

3-13

Measuring Direct Materials Cost

3-14

Measuring Direct Labor Costs

3-15

Job-Order Cost Accounting

3-16

Learning Objective 3

Compute predetermined

overhead rates and

explain why estimated

overhead costs (rather

than actual overhead

costs) are used in the

costing process.

3-17

Why Use an Allocation Base?

Manufacturing overhead is applied to jobs that

are in process. An allocation base, such as direct

labor hours, direct labor dollars, or machine

hours, is used to assign manufacturing overhead

to individual jobs.

We use an allocation base because:

1.

It is impossible or difficult to trace overhead costs to particular

jobs.

2.

Manufacturing overhead consists of many different items ranging

from the grease used in machines to production managers

salary.

3.

Many types of manufacturing overhead costs are fixed even

though output fluctuates during the period.

3-18

Manufacturing Overhead Application

The predetermined overhead rate (POHR) used to

apply overhead to jobs is determined before the

period begins.

POHR =

Estimated total manufacturing

overhead cost for the coming period

Estimated total units in the

allocation base for the coming period

Ideally,

Ideally, the

the allocation

allocation base

base

is

is aa cost

cost driver

driver that

that causes

causes

overhead.

overhead.

3-19

The Need for a POHR

Using a predetermined rate makes it

possible to estimate total job costs sooner.

Actual overhead for the period is not

known until the end of the period.

3-20

Application of Manufacturing Overhead

Based

Based on

on estimates,

estimates,

and

and determined

determined before

before

the

the period

period begins.

begins.

Overhead applied = POHR

Actual

Actual amount

amount of

of the

the allocation

allocation

based

based upon

upon the

the actual

actual level

level of

of

activity.

activity.

Actual activity

3-21

Overhead Application Rate

POHR =

POHR =

Estimated total manufacturing

overhead cost for the coming period

Estimated total units in the

allocation base for the coming period

$640,000

160,000 direct labor hours (DLH)

POHR = $4.00 per DLH

For

For each

each direct

direct labor

labor hour

hour worked

worked on

on aa

particular

particular job,

job, $4.00

$4.00 of

of factory

factory overhead

overhead

will

will be

be applied

applied to

to that

that job.

job.

3-22

Job-Order Cost Accounting

3-23

Job-Order Cost Accounting

PearCo Job Cost Sheet

Job Number A - 143

Department B3

Item Wooden cargo crate

Date Initiated 3-4-05

Date Completed 3-5-05

Units Completed

2

Direct Materials

Direct Labor

Manufacturing Overhead

Req. No. Amount Ticket Hours Amount Hours

Rate

Amount

X7-6890 $ 116

36

8

$

88

8

$

4 $

32

Cost Summary

Direct Materials

Direct Labor

Manufacturing Overhead

Total Cost

Unit Product Cost

$

$

$

$

$

116

88

32

236

118

Units Shipped

Date Number Balance

3-24

Interpreting the Average Unit Cost

The average unit cost should not be interpreted

as the costs that would actually be incurred if an

additional unit were produced.

Fixed overhead would not change if another unit

were produced, so the incremental cost of

another unit may be somewhat less than $118.

3-25

Quick Check

Job

Job WR53

WR53 at

at NW

NW Fab,

Fab, Inc.

Inc. required

required $200

$200 of

of direct

direct

materials

materials and

and 10

10 direct

direct labor

labor hours

hours at

at $15

$15 per

per hour.

hour.

Estimated

Estimated total

total overhead

overhead for

for the

the year

year was

was $760,000

$760,000

and

and estimated

estimated direct

direct labor

labor hours

hours were

were 20,000.

20,000. What

What

would

would be

be recorded

recorded as

as the

the cost

cost of

of job

job WR53?

WR53?

a.

a. $200.

$200.

b.

b. $350.

$350.

c.

c. $380.

$380.

d.

d. $730.

$730.

3-26

Quick Check

Job

Job WR53

WR53 at

at NW

NW Fab,

Fab, Inc.

Inc. required

required $200

$200 of

of direct

direct

materials

materials and

and 10

10 direct

direct labor

labor hours

hours at

at $15

$15 per

per hour.

hour.

Estimated

Estimated total

total overhead

overhead for

for the

the year

year was

was $760,000

$760,000

and

and estimated

estimated direct

direct labor

labor hours

hours were

were 20,000.

20,000. What

What

would

would be

be recorded

recorded as

as the

the cost

cost of

of job

job WR53?

WR53?

a.

a. $200.

$200.

b.

b. $350.

$350.

c.

c. $380.

$380.

d.

d. $730.

$730.

3-27

Learning Objective 4

Understand the flow of

costs in a job-order

costing system and

prepare appropriate

journal entries to

record costs.

3-28

Job-Order Costing

Document Flow Summary

A

A sales

sales order

order is

is the

the

basis

basis of

of issuing

issuing aa

production

production order.

order.

A

A production

production

order

order initiates

initiates

work

work on

on aa job.

job.

3-29

Job-Order Costing

Document Flow Summary

Materials

Materials used

used

may

may be

be either

either

direct

direct or

or

indirect.

indirect.

Direct

materials

Job

Job Cost

Cost

Sheets

Sheets

Materials

Materials

Requisition

Requisition

Indirect

materials

Manufacturing

Manufacturing

Overhead

Overhead

Account

Account

3-30

Job-Order Costing

Document Flow Summary

An

An employees

employees

time

time may

may be

be either

either

direct

direct or

or indirect.

indirect.

Direct

Labor

Job

Job Cost

Cost

Sheets

Sheets

Employee

Employee

Time

Time Ticket

Ticket

Indirect

Labor

Manufacturing

Manufacturing

Overhead

Overhead

Account

Account

3-31

Job-Order Costing

Document Flow Summary

Employee

Employee Indirect

Time

Time Ticket

Ticket Labor

Other

Other

Actual

Actual OH

OH

Charges

Charges

Materials

Materials

Requisition

Requisition

Manufacturing

Manufacturing Applied Job Cost

Job Cost

Overhead

Overhead

Overhead Sheets

Sheets

Account

Account

Indirect

Material

3-32

Learning Objectives 4 & 7

Understand the flow of costs

in a job-order costing system

and prepare appropriate

journal entries to record costs.

Use T-accounts to show the

flow of costs in a job-order

costing system.

3-33

Job-Order Costing: The Flow of Costs

The transactions (in Taccount and journal

entry form) that capture

the flow of costs in a

job-order costing

system are illustrated

on the following slides.

3-34

The Purchase and Issue of Raw Materials

Raw Materials

Material Direct

Purchases Materials

Indirect

Materials

Mfg. Overhead

Actual Applied

Indirect

Materials

Work in Process

(Job Cost Sheet)

Direct

Materials

3-35

Cost Flows Material Purchases

Raw material purchases are recorded in an

inventory account.

3-36

Cost Flows Material Usage

Direct materials issued to a job increase Work in Process and

decrease Raw Materials. Indirect materials used are charged to

Manufacturing Overhead and also decrease Raw Materials.

3-37

The Recording of Labor Costs

Salaries and

Wages Payable

Direct

Labor

Indirect

Labor

Mfg. Overhead

Actual Applied

Indirect

Materials

Indirect

Labor

Work in Process

(Job Cost Sheet)

Direct

Direct

Materials

Labor

3-38

The Recording of Labor Costs

The cost of direct labor incurred increases Work in Process and

the cost of indirect labor increases Manufacturing Overhead.

3-39

Recording Actual Manufacturing Overhead

Salaries and

Wages Payable

Direct

Labor

Indirect

Labor

Mfg. Overhead

Actual Applied

Indirect

Materials

Indirect

Labor

Other

Overhead

Work in Process

(Job Cost Sheet)

Direct

Direct

Materials

Labor

3-40

Recording Actual Manufacturing Overhead

In addition to indirect materials and indirect labor, other

manufacturing overhead costs are charged to the

Manufacturing Overhead account as they are incurred.

3-41

Learning Objective 5

Apply overhead cost to

Work in Process using

a predetermined

overhead rate.

3-42

Applying Manufacturing Overhead

Salaries and

Wages Payable

Direct

Labor

Indirect

Labor

Mfg. Overhead

Actual Applied

Indirect

Materials Overhead

Indirect

Applied to

Labor

Work in

Other

Process

Overhead

Work in Process

(Job Cost Sheet)

Direct

Direct

Materials

Labor

Overhead

Applied

IfIf actual

actual and

and applied

applied

manufacturing

manufacturing overhead

overhead

are

are not

not equal,

equal, aa year-end

year-end

adjustment

adjustment is

is required.

required.

3-43

Applying Manufacturing Overhead

Work in Process is increased when Manufacturing

Overhead is applied to jobs.

3-44

Accounting for Nonmanufacturing Cost

Nonmanufacturing costs are not assigned to individual

jobs; rather they are expensed in the period incurred.

Examples:

Examples:

1.

1.

2.

2.

Salary

Salary expense

expense of

of employees

employees

who

who work

work in

in aa marketing,

marketing, selling,

selling,

or

or administrative

administrative capacity.

capacity.

Advertising

Advertising expenses

expenses are

are expensed

expensed

in

in the

the period

period incurred.

incurred.

3-45

Accounting for Nonmanufacturing Cost

Nonmanufacturing costs (period expenses) are charged to

expense as they are incurred.

3-46

Learning Objective 6

Prepare schedules of

cost of goods

manufactured and cost

of goods sold.

3-47

Transferring Completed Units

Work in Process

(Job Cost Sheet)

Direct

Direct

Materials

Labor

Overhead

Applied

Finished Goods

Cost of

Goods

Mfd.

Cost of

Goods

Mfd.

3-48

Transferring Completed Units

As jobs are completed, the Cost of Goods Manufactured is

transferred to Finished Goods from Work in Process.

3-49

Transferring Units Sold

Work in Process

(Job Cost Sheet)

Direct

Direct

Materials

Labor

Overhead

Applied

Finished Goods

Cost of

Goods

Mfd.

Cost of

Goods

Mfd.

Cost of Goods Sold

Cost of

Goods

Sold

Cost of

Goods

Sold

3-50

Transferring Units Sold

When finished goods are sold, two entries are required:

(1) to record the sale, and (2) to record COGS and reduce

Finished Goods.

3-51

Learning Objective 8

Compute underapplied

or overapplied

overhead cost and

prepare the journal

entry to close the

balance in

Manufacturing

Overhead to the

appropriate accounts.

3-52

Problems of Overhead Application

The difference between the overhead cost applied to

Work in Process and the actual overhead costs of a

period is referred to as either underapplied or

overapplied overhead.

Underapplied overhead

exists when the amount of

overhead applied to jobs

during the period using the

predetermined overhead

rate is less than the total

amount of overhead

actually incurred during

the period.

Overapplied overhead

exists when the amount of

overhead applied to jobs

during the period using the

predetermined overhead

rate is greater than the

total amount of overhead

actually incurred during

the period.

3-53

Overhead Application Example

PearCos

PearCos actual

actual overhead

overhead for

for the

the year

year was

was $650,000

$650,000

with

with aa total

total of

of 170,000

170,000 direct

direct labor

labor hours

hours worked

worked on

on

jobs.

jobs.

How

How much

much total

total overhead

overhead was

was applied

applied to

to PearCos

PearCos jobs

jobs

during

during the

the year?

year? Use

Use PearCos

PearCos predetermined

predetermined

overhead

overhead rate

rate of

of $4.00

$4.00 per

per direct

direct labor

labor hour.

hour.

Overhead Applied During the Period

Applied Overhead = POHR Actual Direct Labor Hours

Applied Overhead = $4.00 per DLH 170,000 DLH = $680,000

3-54

Overhead Application Example

PearCos

PearCosactual

actual overhead

overhead for

for the

the year

year was

was $650,000

$650,000

with

with aa total

total of

of 170,000

170,000 direct

direct labor

labor hours

hours worked

worked on

on

jobs.

jobs.

How

total

overhead

PearCo

has

overapplied

How much

much

total

overhead was

was applied

applied to

to PearCos

PearCosjobs

jobs

during

Use

overhead

for

the

year

during the

the year?

year?

Use PearCos

PearCospredetermined

predetermined

overhead

rate

$4.00

by $30,000.

overheadWhat

rate of

ofwill

$4.00 per

per direct

direct labor

labor hour.

hour.

PearCo do?

Overhead Applied During the Period

Applied Overhead = POHR Actual Direct Labor Hours

Applied Overhead = $4.00 per DLH 170,000 DLH = $680,000

3-55

Disposition of Under- or Overapplied Overhead

PearCos

PearCos Method

Method

$30,000

may be allocated

to these accounts.

$30,000 may be

closed directly to

cost of goods sold.

OR

Work

Work in

in

Process

Process

Finished

Finished

Goods

Goods

Cost

Cost of

of

Goods

Goods Sold

Sold

Cost

Cost of

of

Goods

Goods Sold

Sold

3-56

Disposition of Under- or Overapplied Overhead

PearCos Cost

of Goods Sold

Unadjusted

Balance

Actual Overhead

overhead applied

costs

to jobs

$30,000

Adjusted

Balance

PearCos

Mfg. Overhead

$650,000

$30,000

$680,000

$30,000

overapplied

3-57

Quick Check

Tiger,

Tiger,Inc.

Inc. had

had actual

actual manufacturing

manufacturing overhead

overhead costs

costs of

of

$1,210,000

$1,210,000 and

and aa predetermined

predetermined overhead

overhead rate

rate of

of

$4.00

$4.00 per

per machine

machine hour.

hour. Tiger,

Tiger,Inc.

Inc. worked

worked 290,000

290,000

machine

machine hours

hours during

during the

the period.

period. Tigers

Tigers

manufacturing

manufacturing overhead

overhead is

is

a.

a. $50,000

$50,000 overapplied.

overapplied.

b.

b. $50,000

$50,000 underapplied.

underapplied.

c.

c. $60,000

$60,000 overapplied.

overapplied.

d.

d. $60,000

$60,000 underapplied.

underapplied.

3-58

Quick Check

Tiger,

overhead

costs

of

Tiger,Inc.

Inc. had

had actual

actual manufacturing

manufacturing

overhead

costs

of

Overhead

Applied

Overhead

Applied

$1,210,000

overhead

rate

$1,210,000 and

and aa predetermined

predetermined

overhead

rate of

of

$4.00

hour

hours

$4.00per

per

hour290,000

290,000

hours

=

$1,160,000

$4.00

Inc.

= $1,160,000

$4.00 per

per machine

machine hour.

hour. Tiger,

Tiger,

Inc. worked

worked 290,000

290,000

machine

period.

Underapplied

Overhead

machine hours

hours during

during the

the

period. Tigers

Tigers

Underapplied

Overhead

$1,210,000 --$1,160,000

manufacturing

$1,160,000

manufacturing overhead

overhead is

is =$1,210,000

$50,000

=

a.

a. $50,000

$50,000 overapplied.

overapplied.

b.

b. $50,000

$50,000 underapplied.

underapplied.

c.

c. $60,000

$60,000 overapplied.

overapplied.

d.

d. $60,000

$60,000 underapplied.

underapplied.

$50,000

3-59

Allocating Under- or Overapplied Overhead Between

Accounts

Assume the overhead applied in ending Work in

Process Inventory, ending Finished Goods

Inventory, and Cost of Goods Sold is shown below:

3-60

Allocating Under- or Overapplied Overhead Between

Accounts

We would complete the following allocation of

$30,000 overapplied overhead:

3-61

Allocating Under- or Overapplied Overhead Between

Accounts

3-62

Overapplied and Underapplied Manufacturing Overhead Summary

PearCos

Method

3-63

Multiple Predetermined Overhead Rates

To this point, we have assumed that there is a single

predetermined overhead rate called a plantwide overhead

rate.

Large companies

often use multiple

predetermined

overhead rates.

May be more complex

but . . .

May be more accurate because

it reflects differences across

departments.

3-64

Job-Order Costing in Service Companies

Job-order costing is used in many different types

of service companies.

3-65

The Use of Information Technology

Technology plays an important part in many job-order

cost systems. When combined with Electronic Data

Interchange (EDI) or a web-based programming

language called Extensible Markup Language (XML), bar

coding eliminates the inefficiencies and inaccuracies

associated with manual clerical processes.

3-66

End of Chapter 3

You might also like

- ACT 202 - Chapter 3 - UpdatedDocument53 pagesACT 202 - Chapter 3 - UpdatedJahidHassanNo ratings yet

- Systems Design: Job-Order CostingDocument46 pagesSystems Design: Job-Order CostingRafay Salman MazharNo ratings yet

- CostingDocument86 pagesCostingHardik BadgujarNo ratings yet

- Job CostingDocument30 pagesJob Costingzahid_mahmood3811100% (1)

- Job-Order Costing: Pearco Materials Requisition FormDocument4 pagesJob-Order Costing: Pearco Materials Requisition FormannadNo ratings yet

- Cost Accounting Lecture 3Document78 pagesCost Accounting Lecture 3Fariya MemonNo ratings yet

- CH 03Document7 pagesCH 03Kanbiro Orkaido50% (2)

- Week TwoDocument209 pagesWeek TwodratdratNo ratings yet

- 107-W4-Job order-chp08-STDocument77 pages107-W4-Job order-chp08-STmargaret mariaNo ratings yet

- Systems Design: Job-Order CostingDocument19 pagesSystems Design: Job-Order CostingMd Delowar Hossain MithuNo ratings yet

- Chapter 03Document68 pagesChapter 03Naimul HasanNo ratings yet

- Act202 Chapter 3Document68 pagesAct202 Chapter 3yared debebeNo ratings yet

- Chap 003Document19 pagesChap 003Hafsa JawedNo ratings yet

- Sol ch03Document8 pagesSol ch03Wirachai PhongPhanNo ratings yet

- Produce Job Costing InformationDocument18 pagesProduce Job Costing InformationAshenafi AbdurkadirNo ratings yet

- A WK3 Chp2Document83 pagesA WK3 Chp2Jocelyn LimNo ratings yet

- Chapter 3 AccountingDocument3 pagesChapter 3 Accountingmirzaaish112233No ratings yet

- Chapter - 02 Job Order CostingDocument69 pagesChapter - 02 Job Order CostingGonzalo Jr. RualesNo ratings yet

- Chapter 3 System Design Job Order Costing SystemDocument76 pagesChapter 3 System Design Job Order Costing SystemMulugeta GirmaNo ratings yet

- Ch.4 Job CostingDocument39 pagesCh.4 Job Costingvinn albatraozNo ratings yet

- Job Order CostingDocument43 pagesJob Order CostingNefvi Desqi AndrianiNo ratings yet

- Asiment SolutionDocument4 pagesAsiment Solutionmansoor1307100% (1)

- Management Accounting Session 3 Job Order Costing: Indian Institute of Management RohtakDocument52 pagesManagement Accounting Session 3 Job Order Costing: Indian Institute of Management RohtakSiddharthNo ratings yet

- Job Order Costing System Is Also Extensively Used in Service Industries. Hospitals, Law Firms, Movie StudiosDocument32 pagesJob Order Costing System Is Also Extensively Used in Service Industries. Hospitals, Law Firms, Movie StudiosShafana HamidNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingJomar Teneza100% (1)

- Systems Design: Job-Order CostingDocument67 pagesSystems Design: Job-Order CostingJellene GarciaNo ratings yet

- Job CostingDocument46 pagesJob Costingnicero555No ratings yet

- Analisis Biaya: Semester Gasal TA 2013 - 2014 Lec 4 - Job Order CostingDocument42 pagesAnalisis Biaya: Semester Gasal TA 2013 - 2014 Lec 4 - Job Order CostingMaulana HasanNo ratings yet

- Overheads AbsorbtionDocument29 pagesOverheads AbsorbtionGaurav AgarwalNo ratings yet

- GRC Job Order Costing ModuleDocument14 pagesGRC Job Order Costing ModuleKirk EscanillaNo ratings yet

- Job Order Costing Lecture NotesDocument6 pagesJob Order Costing Lecture NotesRenz LorenzNo ratings yet

- Activity Based CostingDocument70 pagesActivity Based CostingAnkur VermaNo ratings yet

- Lecture-8.2 Job Order Costing (Theory With Problem)Document13 pagesLecture-8.2 Job Order Costing (Theory With Problem)Nazmul-Hassan Sumon100% (2)

- Job Costing Vs Process CostingDocument20 pagesJob Costing Vs Process CostingappleandmangoNo ratings yet

- Chap 004Document50 pagesChap 004Mohamed ElmahgoubNo ratings yet

- S2 CMA c03 Job CostingDocument13 pagesS2 CMA c03 Job Costingdiasjoy67No ratings yet

- Chap 003Document72 pagesChap 003Hà PhươngNo ratings yet

- Ronald Hilton Chapter 3Document25 pagesRonald Hilton Chapter 3Swati67% (3)

- Chapter 3 NotesDocument23 pagesChapter 3 NotesEin LuckyNo ratings yet

- Man Acc Garrison CH 3Document71 pagesMan Acc Garrison CH 3Cha DumpyNo ratings yet

- Job Order Costing Syste1 PDFDocument19 pagesJob Order Costing Syste1 PDFgosaye desalegn100% (2)

- Introduction To Managerial Accounting and Job Order Cost SystemsDocument57 pagesIntroduction To Managerial Accounting and Job Order Cost Systemsshailyrastogi100% (1)

- Topic 6: Job Order CostingDocument51 pagesTopic 6: Job Order CostingNa RaunaNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- Lesson 10 Costing SystemsDocument8 pagesLesson 10 Costing SystemsSuhanna DavisNo ratings yet

- Definition of Job Order CostingDocument8 pagesDefinition of Job Order CostingWondwosen AlemuNo ratings yet

- Assignment Pertemuan 4-Kode DosenDocument4 pagesAssignment Pertemuan 4-Kode DosenIyang RohaciNo ratings yet

- CH.3 COMM 305 Managerial AccountingDocument19 pagesCH.3 COMM 305 Managerial Accountingryry1616No ratings yet

- Job Order Cost Accounting: Study ObjectivesDocument39 pagesJob Order Cost Accounting: Study ObjectivesNanik DeniaNo ratings yet

- Job Order CostingDocument81 pagesJob Order CostingmohsinNo ratings yet

- Module For Managerial Accounting-Job Order CostingDocument17 pagesModule For Managerial Accounting-Job Order CostingMary De JesusNo ratings yet

- Job, Batch and Service Costing Process Costing - F2Document24 pagesJob, Batch and Service Costing Process Costing - F2yikesNo ratings yet

- Hca14 SM Ch04Document45 pagesHca14 SM Ch04DrellyNo ratings yet

- Principles of Accounting Chapter 17Document42 pagesPrinciples of Accounting Chapter 17myrentistoodamnhighNo ratings yet

- Job CostingDocument18 pagesJob CostingmonuagarNo ratings yet

- Job Order Costing Accounting 2Document86 pagesJob Order Costing Accounting 2Faizan TafzilNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Takt Time: A Guide to the Very Basic Lean CalculationFrom EverandTakt Time: A Guide to the Very Basic Lean CalculationRating: 5 out of 5 stars5/5 (2)

- Takt Time - Understanding the Core Principle of Lean Manufacturing: Toyota Production System ConceptsFrom EverandTakt Time - Understanding the Core Principle of Lean Manufacturing: Toyota Production System ConceptsRating: 5 out of 5 stars5/5 (1)

- AssignmentDocument23 pagesAssignmentGlenPalmerNo ratings yet

- R K ConsultantsDocument10 pagesR K ConsultantsGlenPalmerNo ratings yet

- Cases FinalDocument15 pagesCases FinalGlenPalmer100% (1)

- Plot 2: Rejecting MR Perfect: Rej Ect Ing MR Per Fec TDocument5 pagesPlot 2: Rejecting MR Perfect: Rej Ect Ing MR Per Fec TGlenPalmerNo ratings yet

- Bangladesh's Knitwear - BKMEADocument18 pagesBangladesh's Knitwear - BKMEAGlenPalmerNo ratings yet

- T Hub CasestudyDocument13 pagesT Hub CasestudyAnonymous BROdLNNo ratings yet

- Case DetailsDocument2 pagesCase DetailsGlenPalmerNo ratings yet

- Central Market Case Solution-FitzimmonsDocument8 pagesCentral Market Case Solution-FitzimmonsGlenPalmerNo ratings yet

- Central Market Case Study-New PerspectiveDocument8 pagesCentral Market Case Study-New PerspectiveGlenPalmerNo ratings yet

- Quality Function DeploymentDocument12 pagesQuality Function DeploymentGlenPalmerNo ratings yet

- New Product DevelopmentDocument25 pagesNew Product DevelopmentGlenPalmerNo ratings yet

- Zappos Case StudyDocument10 pagesZappos Case StudyGlenPalmer0% (1)

- Lead To Revenue GuideDocument57 pagesLead To Revenue GuideGlenPalmer100% (1)

- Why Location Is The New Currency of MarketingDocument9 pagesWhy Location Is The New Currency of MarketingGlenPalmerNo ratings yet

- Infy PDFDocument8 pagesInfy PDFGlenPalmerNo ratings yet

- Xpresso Lube Case SolutionDocument8 pagesXpresso Lube Case SolutionGlenPalmer100% (2)

- Case Study: RetailDocument2 pagesCase Study: RetailGlenPalmerNo ratings yet

- Articles On Organic Agriculture Act of 2010Document6 pagesArticles On Organic Agriculture Act of 2010APRIL ROSE YOSORESNo ratings yet

- Architectural, Museology, Urban DesignDocument201 pagesArchitectural, Museology, Urban DesignAbby VernonNo ratings yet

- ACC Flow Chart (Whole Plan) - Rev00Document20 pagesACC Flow Chart (Whole Plan) - Rev00amandeep12345No ratings yet

- Data0305 KX18DCDocument3 pagesData0305 KX18DCAbdelhamid SammoudiNo ratings yet

- CATALO VetivDocument240 pagesCATALO VetivHữu CôngNo ratings yet

- TemplateDocument17 pagesTemplatedaveNo ratings yet

- Mitac 6120N ManualDocument141 pagesMitac 6120N ManualLiviu LiviuNo ratings yet

- Top Links October 2018Document122 pagesTop Links October 2018Andrew Richard ThompsonNo ratings yet

- Guidelines For Xii Plan: Ther Backward Classes (Obc)Document15 pagesGuidelines For Xii Plan: Ther Backward Classes (Obc)SACHCHIDANAND PRASADNo ratings yet

- Customers at SurveyDocument10 pagesCustomers at Surveynaren000No ratings yet

- Luyện tâp Liên từ Online 1Document5 pagesLuyện tâp Liên từ Online 1Sơn KhắcNo ratings yet

- Trasdata HelpDocument4,852 pagesTrasdata HelpPaul Galwez75% (4)

- 2006 AcrotechDocument32 pages2006 Acrotechkaniappan sakthivelNo ratings yet

- EMT Tooth Saver Data SheetDocument5 pagesEMT Tooth Saver Data SheetTerry FarmakisNo ratings yet

- Application of Pinnipedvibrissae To AeropropulsionDocument31 pagesApplication of Pinnipedvibrissae To AeropropulsionShahzadNo ratings yet

- Marantz Product Catalogue 2010 2011Document31 pagesMarantz Product Catalogue 2010 2011O M Gee100% (1)

- Template Extended-AbstractDocument3 pagesTemplate Extended-AbstractGraita PurwitasariNo ratings yet

- Faqs and User Manual - Returns Offline Tool: Goods and Services Tax NetworkDocument161 pagesFaqs and User Manual - Returns Offline Tool: Goods and Services Tax NetworklathaNo ratings yet

- Darcy Friction Loss Calculator For Pipes, Fittings & Valves: Given DataDocument2 pagesDarcy Friction Loss Calculator For Pipes, Fittings & Valves: Given DataMSNo ratings yet

- Heavy Industry Taxila ReportDocument25 pagesHeavy Industry Taxila ReportMuhammad UmairNo ratings yet

- Spam DetectionDocument142 pagesSpam DetectionRahul GantaNo ratings yet

- Tolerance RingsDocument13 pagesTolerance Ringspai mjrNo ratings yet

- Tracer-AN Series: MPPT Solar Charge ControllerDocument4 pagesTracer-AN Series: MPPT Solar Charge ControllerNkosilozwelo SibandaNo ratings yet

- Sensus WP Dynamic Cold Water Meter (DN40-300)Document4 pagesSensus WP Dynamic Cold Water Meter (DN40-300)Roderikus Rendy MNo ratings yet

- Technical Manual Operator'S and Unit Maintenance Manual FOR Firing Device, Demolition. M122 (NSN 1375-01-021-0606) (EIC: 2NA)Document7 pagesTechnical Manual Operator'S and Unit Maintenance Manual FOR Firing Device, Demolition. M122 (NSN 1375-01-021-0606) (EIC: 2NA)Михаил НаумовNo ratings yet

- 1213-23-Si-Og RR GecDocument8 pages1213-23-Si-Og RR Gecvkj5824No ratings yet

- Ship-Like Target Design For Underwater Explosion Experiments PDFDocument92 pagesShip-Like Target Design For Underwater Explosion Experiments PDFFernando Raúl LADINONo ratings yet

- Answers For SummariesDocument6 pagesAnswers For SummariesDaphneNo ratings yet

- DOE Cooling Catalogue 2017Document164 pagesDOE Cooling Catalogue 2017Rashaad SheikNo ratings yet

- Thrust Bearing Design GuideDocument56 pagesThrust Bearing Design Guidebladimir moraNo ratings yet