Professional Documents

Culture Documents

Chap 10

Uploaded by

Maricar Salvador PenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 10

Uploaded by

Maricar Salvador PenaCopyright:

Available Formats

Chapter 10

Introduction

Capital budgeting was introduced in Chapter

9. The estimation of a projects cash flows

was covered, including both the net

investment and net cash flows.

The focus of this chapter is the analysis of a

projects cash flows in order to make a project

acceptance or rejection decision.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-1

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Organization of Chapter 10

Capital budgeting decision methods:

Payback period

Discounted payback period

Net present value

Profitability index

Internal rate of return

Modified internal rate of return

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-2

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Organization of Chapter 10

Capital budgeting decisions with:

Independent projects

Mutually exclusive projects

Projects with cash flows that are not normal

The advantages and disadvantages of each of

the capital budgeting decision methods

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-3

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Project Cash Flows

The capital budgeting decision is essentially

based upon a cost/benefit analysis.

We call the cost of a project the net

investment.

The benefits from a project are the future cash

flows generated. We call these the net cash

flows.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-4

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Decision Methods

Capital budgeting decision methods essentially

compare a projects net investment with its net

cash flows. Project acceptance or rejection is

based upon this comparison.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-5

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

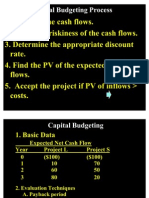

Payback Period

A projects payback period is the number of

years its takes for a projects net cash flows to

pay back the net investment. Shorter paybacks

are better than longer paybacks.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-6

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Payback Period

Suppose a project has a $200,000 net

investment and net cash flows (NCFs) of

$70,000 annually for 7 years. What is the

payback?

In 3 years, the project will generate a total of

$210,000 from net cash flows. Therefore, the

payback must be a little less than 3 years. It is

more precisely:

$200,000

Payback Period

2.86 Years

$70,000

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-7

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Payback Period

The payback period is useful as a measure of a

projects liquidity risk, but it has several

weaknesses:

Does not account for the time value of money

No objective criterion for what is an acceptable

payback period

Cash flows occurring after the payback period have

no impact upon the payback computation.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-8

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Discounted Payback Period

This improves upon the payback period by

taking into account the time value of money.

A projects discounted payback period is the

number of years it takes for the net cash flows

present values to pay back the net investment.

Again, shorter paybacks are better than longer

paybacks.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-9

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Discounted Payback Period

We will compute the discounted payback period

(DPP) using the same example. We will need a

required rate of return for the computation.

Lets use 10%.

The following table is used to compute the

projects DPP.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-10

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Discounted Payback Period

Year

0

1

2

3

4

5

Cash Flow

PV of Cash Flow

-$200,000

$70,000

$70,000

$70,000

$70,000

$70,000

-$200,000

$63,636

$57,851

$52,592

$47,811

$43,464

Cumulative

-$200,000

-$236,364

-$78,513

-$25,921

After 3 years there is still $25,921 that has not

been paid back by the present value of the net

cash flows.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-11

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Discounted Payback Period

The DPP will be 3 years plus whatever

proportion of year 4 is needed to pay back the

final $25,921.

$25,921

DPP 3

3.54

$47,811

The discounted payback is 3.54 years. This

project recovers its net investment in 3.54 years

when considering the time value of money.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-12

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Discounted Payback Period

The DPP is an improvement upon the payback

period in 2 ways:

The DPP takes into account the time value of

money.

There is an objective criterion for an acceptable

DPP if a project has normal cash flows. Under

these circumstances a project is acceptable if

the DPP is less than the economic life of the

project.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-13

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Net Present Value

A projects net present value (NPV) is the most

straightforward application of cost-benefit analysis.

The cost is the net investment.

The benefit is the sum of the present values.

NPV is the sum of the present values of the net cash

flows minus the net investment. The cash flows are

discounted at a projects required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-14

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Net Present Value

Using the same example, the NPV with a 10%

required rate of return is:

1

1

1 + 10% 5

$200,000 = $65,355

NPV = $70,000 x

10%

A positive NPV indicates a project is acceptable.

A negative NPV indicates a project is not

acceptable.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-15

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Net Present Value

A projects NPV is also an estimate of the

change in a firms value caused by investment

in a project.

In the example, the firms value is expected to

increase by $65,355 if the project is accepted.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-16

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Profitability Index

A projects profitability index (PI) also

compares a projects costs to its benefits.

Cost and benefits for the PI are measured the same

as for the NPV.

The comparison of costs and benefits is different for

the PI than for the NPV. It is the ratio of a projects

benefit to its cost.

A projects PI is the sum of the present values of

the net cash flows divided by the net investment.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-17

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Profitability Index

Using the same example and a 10% required

rate of return, the projects PI is

1 - 1 + 10% 5

$70,000 x

10%

$265,355

PI =

=

= 1.33

$200,000

$200,000

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-18

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Profitability Index

The PI can also be computed as follows:

NPV

$65,355

PI 1

1

1.33

Net Investment

$200,000

A PI of 1.33 indicates a project is expected to

generate $0.33 of NPV for every $1.00 invested

in the project. Keep in mind, NPV is a measure

of value over and above the projects net

investment.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-19

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Profitability Index

A PI greater than 1.0 indicates a project is

acceptable.

A PI less than 1.0 indicates a project is not

acceptable.

The PI is most useful when a firm is facing

capital rationing. The PI indicates which

projects generate the greatest NPV per dollar

invested.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-20

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Internal Rate of Return

An internal rate of return (IRR) is a projects

true annual percentage rate of return based

upon the estimated cash flows.

IRR can also be defined as the interest rate

causing a projects NPV to be equal to zero.

Therefore, the IRR equation is adapted from the

NPV equation.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-21

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Internal Rate of Return

Using the same example, the IRR equation is:

1

1

1 + IRR 5

$200,000 = 0

$70,000 x

IRR

IRR equals 22.11%.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-22

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Internal Rate of Return

The IRR equation can also be expressed as:

1

1

1 + IRR 5

= $200,000

$70,000 x

IRR

And of course the IRR still equals 22.11%.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-23

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Internal Rate of Return

A project is:

Acceptable if the IRR > required rate of return.

Unacceptable if the IRR < required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-24

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Internal Rate of Return

Notice we did not use the 10% required rate of

return to compute the IRR in our example. But

we do determine project acceptability by

comparing the IRR to the required rate of

return.

In our example, the project is acceptable since

the 22.11% IRR is greater than the 10%

required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-25

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

A projects modified internal rate of return

(MIRR) is the interest rate equating a projects

investment costs with the terminal value of the

projects net cash flows.

The present value of a projects investment

costs is called the beginning value.

The future value of a projects net cash flows is

called the terminal value.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-26

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

A projects beginning value is the sum of the

present values of all investment cash outflows

for a project.

If all investment cash outflows occur at the very

beginning (time = 0), then the beginning value

equals the net investment.

If investment outlays occur over several years,

the discount rate used to compute present

values is usually the required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-27

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

A projects terminal value is the sum of the

future values of the net cash flows at the end of

the projects economic life.

The interest rate used to compute the future

values is usually the required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-28

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

Using the same example, the projects

beginning value is just the net investment of

$200,000. The projects terminal value (TV) is:

1 + 10% 5 1

TV = $70,000 x

= $427,357

10%

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-29

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

The projects MIRR equates the PV of the

beginning value with the FV of the terminal

value:

$427,357

$200,000 =

5

1 + MIRR

The MIRR equals 16.40%.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-30

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Modified Internal Rate of Return

A project is:

Acceptable if the MIRR > required rate of return.

Unacceptable if the MIRR < required rate of

return.

In our example, the project is acceptable since

the 16.40% MIRR is greater than the 10%

required rate of return.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-31

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Independent Projects and Decision Making

An independent capital budget project presents

a standalone decision. A single project is

simply evaluated to determine if it is expected to

increase firm value or decrease firm value.

If a project has normal cash flows and is

independent, then any of the methods besides

payback period can be used to determine

acceptability.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-32

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Independent Projects and Decision Making

An independent, normal project is

acceptable if

Discounted payback period < economic life

Net present value > 0

Profitability index > 1.0

Internal rate of return > required rate of return

Modified IRR > required rate of return

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-33

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Mutually Exclusive Projects and Decision Making

Mutually exclusive capital budgeting decisions

require the evaluation of several projects to

determine the one project that maximizes firm

value.

All the mutually exclusive projects need to be

ranked with only the best project accepted.

The project with the highest NPV is by definition

the project expected to maximize firm value.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-34

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Mutually Exclusive Projects and Decision Making

Other methods besides NPV may not rank

projects correctly if:

Projects have scale differencesnet

investments are different sizes.

Projects have cash flow timing differences.

Cash flows are not normalone or more future

net cash flows are negative.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-35

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Mutually Exclusive Projects and Decision Making

When projects have scale differences:

Only the NPV will definitely rank projects

correctly.

The payback period, DPP, PI, IRR, and MIRR

may not rank projects correctly.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-36

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Mutually Exclusive Projects and Decision Making

When projects have cash flow timing

differences:

The NPV, PI, and MIRR will rank projects

correctly.

The payback period, DPP, and IRR may not rank

projects correctly.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-37

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Mutually Exclusive Projects and Decision Making

When a projects cash flows are not normal:

The NPV, PI, and MIRR will rank projects

correctly.

The payback period, DPP, and IRR may not rank

projects correctly.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-38

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Payback Period

A measure of liquidity and risk

Does not take into account the time value of

money

No information on project profitability

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-39

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Discounted Payback

A better measure of liquidity and risk than the

ordinary payback period

Does take into account the time value of

money

Provides an objective criterion for normal

projects: DPP < economic life

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-40

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Net Present Value

Best measure of project profitability.

Does not provide much information about

project risk.

Is consistent with maximizing firm value.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-41

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Profitability Index

A relative measure of profitability

Provides some information about project risk

May not rank mutually exclusive projects

correctly

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-42

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Internal Rate of Return

A relative measure of profitability

Provides some information about project risk

May not rank mutually exclusive projects

correctly

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-43

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Capital Budgeting Methods Pros and Cons

Modified Internal Rate of Return

A relative measure of profitability

Provides some information about project risk

May not rank mutually exclusive projects

correctly if scale differences exist between

projects

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-44

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Summary of Chapter 10 Topics

The NPV is the single best measure of a

projects profitability.

The PI, IRR, and MIRR provide a measure of a

projects margin of safety.

The payback period and DPP provide a

measure of liquidity risk.

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-45

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

Summary of Chapter 10 Topics

We have covered the following in this chapter:

Computation of 6 capital budgeting decision

methods and their pros and cons

Making decisions with independent projects

Making decisions with mutually exclusive

projects

Hospitality Financial Management

By Robert E. Chatfield and Michael C. Dalbor

10-46

2005 Pearson Education, Inc.

Pearson Prentice Hall

Upper Saddle River, NJ 07458

You might also like

- Philippine Constitution - Civil Service Exam ReviewerDocument41 pagesPhilippine Constitution - Civil Service Exam ReviewerYzza Veah Esquivel50% (2)

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_No ratings yet

- Model Internal Audit Activity CharterDocument4 pagesModel Internal Audit Activity CharterMae Ann Jeaneth TariaoNo ratings yet

- Oracle Treasury Br100Document60 pagesOracle Treasury Br100Rajendran Suresh0% (1)

- Capital BudgetingDocument37 pagesCapital BudgetingJErome DeGuzman100% (3)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- The Importance of Book ValueDocument4 pagesThe Importance of Book ValuelowbankNo ratings yet

- Lecture 4Document64 pagesLecture 4James1331No ratings yet

- Albrecht 4e Ch11 SolutionsDocument21 pagesAlbrecht 4e Ch11 SolutionsDesy Margaret0% (1)

- Why NPV Is Better Than Irr (40 Points)Document2 pagesWhy NPV Is Better Than Irr (40 Points)Dong Rosello100% (1)

- Atoms To Bits: 26 Annual Wealth Creation Study (2016-2021)Document64 pagesAtoms To Bits: 26 Annual Wealth Creation Study (2016-2021)his19 1142No ratings yet

- Sales Reviewer PDFDocument25 pagesSales Reviewer PDFShaireen Prisco Rojas100% (2)

- Brand Value Measurement of DoveDocument15 pagesBrand Value Measurement of DoveSujit100% (1)

- Dawson Stores Inc.Document3 pagesDawson Stores Inc.Juris PasionNo ratings yet

- Capital Budgeting Analysis TechniquesDocument63 pagesCapital Budgeting Analysis TechniquesSonali JagathNo ratings yet

- Investor Protection Measures by SEBIDocument3 pagesInvestor Protection Measures by SEBIAnonymous J53erBT30QNo ratings yet

- Lacuesta Vs Ateneo de ManilaDocument1 pageLacuesta Vs Ateneo de Manilapja_14100% (1)

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityFrom EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityRating: 4 out of 5 stars4/5 (2)

- Ch12 HW SolutionsDocument16 pagesCh12 HW Solutionsgilli1tr100% (1)

- Gitman Capital BudgetingDocument51 pagesGitman Capital BudgetingjaneNo ratings yet

- Capital Budgeting MethodsDocument39 pagesCapital Budgeting Methodsafsdasdf3qf4341f4asDNo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMilad AkbariNo ratings yet

- Industrial Management and Process Economics Assignment: University of The PunjabDocument14 pagesIndustrial Management and Process Economics Assignment: University of The PunjabAbubakr KhanNo ratings yet

- Project Management Assignment: Analyzing Software ProjectsDocument9 pagesProject Management Assignment: Analyzing Software ProjectssizzlacalunjiNo ratings yet

- Capital Investment Decision - DUDocument50 pagesCapital Investment Decision - DUAsif Abdullah KhanNo ratings yet

- PM Introduction PDFDocument39 pagesPM Introduction PDFbhaskkarNo ratings yet

- P A G e Initial Outlay CF in Year 1 CF I PDFDocument12 pagesP A G e Initial Outlay CF in Year 1 CF I PDFsharlinsdgmailcomNo ratings yet

- 279 - Fin Management 8 NPV and InvestmentDocument17 pages279 - Fin Management 8 NPV and Investmentirma makharoblidzeNo ratings yet

- Fundamentals of Electric CircuitsDocument32 pagesFundamentals of Electric CircuitsmustafaNo ratings yet

- Please help John Shell to evaluate these two projects using payback period method. Which project should he chooseDocument42 pagesPlease help John Shell to evaluate these two projects using payback period method. Which project should he chooseLoureine Patricia SumualNo ratings yet

- Strategic Investment Decisions: Measuring, Monitoring, and Motivating PerformanceDocument36 pagesStrategic Investment Decisions: Measuring, Monitoring, and Motivating Performancechitu1992No ratings yet

- Project EvaluationDocument34 pagesProject EvaluationKavitha ReddyNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- DSM 9 Capital Budgeting TechniquesDocument5 pagesDSM 9 Capital Budgeting TechniquesSoahNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument25 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- Module 2Document9 pagesModule 2vinitaggarwal08072002No ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Capital BudgetingDocument12 pagesCapital Budgetingola nasserNo ratings yet

- Investment Decision RulesDocument14 pagesInvestment Decision RulesprashantgoruleNo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesSafaet Rahman SiyamNo ratings yet

- Bab 5 Pengurusan Kewangan 2 (Payback Period, NPV, IRR)Document27 pagesBab 5 Pengurusan Kewangan 2 (Payback Period, NPV, IRR)emma lenaNo ratings yet

- Capital Budgeting Techniques: All Rights ReservedDocument22 pagesCapital Budgeting Techniques: All Rights ReservedImran Ahamed 1731135No ratings yet

- Capital Investment DecisionDocument26 pagesCapital Investment Decisionliyjb2No ratings yet

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDocument27 pagesRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNo ratings yet

- Capital Budgeting: Corporate Finance, Dr. Hemendra GuptaDocument42 pagesCapital Budgeting: Corporate Finance, Dr. Hemendra GuptaRiya PandeyNo ratings yet

- ch10 - The Basics of Capital BudgetingDocument14 pagesch10 - The Basics of Capital Budgetinganower.hosen61No ratings yet

- Capital RationingDocument24 pagesCapital RationingKhalid MahmoodNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Introduction to Capital Budgeting TechniquesDocument3 pagesIntroduction to Capital Budgeting TechniquesDeneree Joi EscotoNo ratings yet

- Planning and Evaluationl English 5Document34 pagesPlanning and Evaluationl English 5Absa TraderNo ratings yet

- Capital Budgeting Techniques: All Rights ReservedDocument43 pagesCapital Budgeting Techniques: All Rights Reservedred8blue8No ratings yet

- Egret Case StudyDocument35 pagesEgret Case StudyHimalaya BanNo ratings yet

- Corporate Finance 4Document8 pagesCorporate Finance 4Zahid HasanNo ratings yet

- Multiple Choice Questions: This Activity Contains 21 QuestionsDocument7 pagesMultiple Choice Questions: This Activity Contains 21 Questionsbewoketu maruNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingRuchika AgarwalNo ratings yet

- Financial Concepts: February 2010Document27 pagesFinancial Concepts: February 2010esbede_408128813No ratings yet

- The Use of Modern Capital Budgeting TechniquesDocument4 pagesThe Use of Modern Capital Budgeting TechniquesPrachi SharmaNo ratings yet

- CH04 The Capital Budgeting DecisionDocument31 pagesCH04 The Capital Budgeting DecisionJamaNo ratings yet

- Lesson 7 Net Present Value and Other Investment CriteriaDocument55 pagesLesson 7 Net Present Value and Other Investment CriteriaMon NazareaNo ratings yet

- Investment Appraisal Methods GuideDocument42 pagesInvestment Appraisal Methods GuideAnslem TayNo ratings yet

- Chapter 6 - Capital BudgetingDocument40 pagesChapter 6 - Capital Budgetingsymtgywsq8No ratings yet

- Weygandt, Kieso, & Kimmel: Managerial AccountingDocument54 pagesWeygandt, Kieso, & Kimmel: Managerial AccountingGiulia TabaraNo ratings yet

- Present-Worth Analysis: Chapter Learning ObjectivesDocument30 pagesPresent-Worth Analysis: Chapter Learning ObjectivesRoman AliNo ratings yet

- Net Present Value and Other Investment Criteria: Principles of Corporate FinanceDocument36 pagesNet Present Value and Other Investment Criteria: Principles of Corporate FinanceSAKSHI SHARMANo ratings yet

- Net Present Value and Other Investment Criteria: Ross, Essentials of Corporate Finance, 5eDocument34 pagesNet Present Value and Other Investment Criteria: Ross, Essentials of Corporate Finance, 5e2023014091No ratings yet

- Corporate Finance ToolsDocument39 pagesCorporate Finance ToolsSeth BrakoNo ratings yet

- Payback Period Cash Outlay (Investment) / Annual Cash InflowDocument4 pagesPayback Period Cash Outlay (Investment) / Annual Cash InflowKyla BarbosaNo ratings yet

- A Crash Course On Measuring ROIDocument2 pagesA Crash Course On Measuring ROICharly BskzNo ratings yet

- Fraud CaseDocument6 pagesFraud CaseMaricar Salvador PenaNo ratings yet

- Lecture 6 - IRR (N)Document24 pagesLecture 6 - IRR (N)Maricar Salvador PenaNo ratings yet

- Affidavit of TrainingDocument2 pagesAffidavit of TrainingMaricar Salvador PenaNo ratings yet

- LawDocument4 pagesLawMaricar Salvador PenaNo ratings yet

- Chapter 11Document28 pagesChapter 11Ajmal KhanNo ratings yet

- Fraud CaseDocument5 pagesFraud CaseMaricar Salvador PenaNo ratings yet

- Multiple Choice Practice Questions for Payroll, Accounts Receivable, Purchasing & Internal ControlsDocument7 pagesMultiple Choice Practice Questions for Payroll, Accounts Receivable, Purchasing & Internal ControlsbajujuNo ratings yet

- 157 37315 EA312 2013 1 2 1 Chap008Document70 pages157 37315 EA312 2013 1 2 1 Chap008Melissa MoodyNo ratings yet

- Organizational ChartDocument1 pageOrganizational ChartMaricar Salvador PenaNo ratings yet

- San Miguel's Ang Sues GMA7's Gozon, Other Shareholders For EstafaDocument2 pagesSan Miguel's Ang Sues GMA7's Gozon, Other Shareholders For EstafaMaricar Salvador PenaNo ratings yet

- Fraud CaseDocument5 pagesFraud CaseMaricar Salvador PenaNo ratings yet

- Relationship Status and Terms of EndearmentDocument3 pagesRelationship Status and Terms of EndearmentMaricar Salvador PenaNo ratings yet

- Lecture 6 - IRR (N)Document24 pagesLecture 6 - IRR (N)Maricar Salvador PenaNo ratings yet

- Marital CommunicationDocument25 pagesMarital CommunicationMaricar Salvador PenaNo ratings yet

- Rais12 SM CH12Document46 pagesRais12 SM CH12Chris Search100% (1)

- San Miguel's Ang Sues GMA7's Gozon, Other Shareholders For EstafaDocument2 pagesSan Miguel's Ang Sues GMA7's Gozon, Other Shareholders For EstafaMaricar Salvador PenaNo ratings yet

- 3air Im09Document34 pages3air Im09Maricar Salvador PenaNo ratings yet

- 3air Im09Document34 pages3air Im09Maricar Salvador PenaNo ratings yet

- Marital CommunicationDocument25 pagesMarital CommunicationMaricar Salvador PenaNo ratings yet

- Philippines Code of ConductDocument31 pagesPhilippines Code of Conductjadestopa100% (1)

- Study TYBCom Accountancy Auditing-IIDocument396 pagesStudy TYBCom Accountancy Auditing-IIRani Naik Dhuri100% (2)

- IncomeDocument99 pagesIncomeMaricar Salvador PenaNo ratings yet

- Assignment - LAWDocument1 pageAssignment - LAWMaricar Salvador PenaNo ratings yet

- Solution Chapter 5Document22 pagesSolution Chapter 5Teresa GonzalesNo ratings yet

- SM ch22Document19 pagesSM ch22Maricar Salvador PenaNo ratings yet

- Msci KLD 400 Social IndexDocument2 pagesMsci KLD 400 Social IndexJose Pinto de AbreuNo ratings yet

- HDFC Bank Introduction: India's Leading Private BankDocument14 pagesHDFC Bank Introduction: India's Leading Private Banksameer_kiniNo ratings yet

- Updated ResumeDocument1 pageUpdated Resumeapi-480331932No ratings yet

- Lesson 1 Financial Objectves of The Different Types of OrganizationsDocument41 pagesLesson 1 Financial Objectves of The Different Types of OrganizationsKissel Jade Barsalote SarnoNo ratings yet

- Acca f4 Chapter 10 Formation of ComapnyDocument30 pagesAcca f4 Chapter 10 Formation of ComapnyOmer UddinNo ratings yet

- MF QuestionnaireDocument5 pagesMF QuestionnaireVINEETA KAPOORNo ratings yet

- FCCB in IndiaDocument24 pagesFCCB in IndiaSana Riyaz KhalifeNo ratings yet

- Bus 316 - Week2Document40 pagesBus 316 - Week2winblacklist1507No ratings yet

- Power Finance CorporationDocument32 pagesPower Finance Corporationangshu0020100% (2)

- Section 5 Registration PDFDocument2 pagesSection 5 Registration PDFAnonymous YBBpXPb7VNo ratings yet

- LIBOR Manipulation ImplicationsDocument6 pagesLIBOR Manipulation ImplicationsGirish ChandraNo ratings yet

- Stock Exchange CharacteristicsDocument2 pagesStock Exchange CharacteristicsMaher AliNo ratings yet

- Ra 6957Document15 pagesRa 6957Shalena Salazar-SangalangNo ratings yet

- SWIFT's CLS ® Third Party ServiceDocument2 pagesSWIFT's CLS ® Third Party Serviceashok_rambhiaNo ratings yet

- COCONDocument48 pagesCOCONMNo ratings yet

- Case Flow:: Philippine Stock Exchange, Inc., PetitionerDocument2 pagesCase Flow:: Philippine Stock Exchange, Inc., Petitionerrhod leysonNo ratings yet

- Full download book Corporate Finance 6Th Global Edition Pdf pdfDocument41 pagesFull download book Corporate Finance 6Th Global Edition Pdf pdflarry.thurman516100% (10)

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- CA CPT Accounts Summary NotesDocument17 pagesCA CPT Accounts Summary NotesAjay Banna ShekhawatNo ratings yet

- GOVERNING SECTIONS & RULES FOR BUY BACK OF SHARESDocument18 pagesGOVERNING SECTIONS & RULES FOR BUY BACK OF SHARESPramod Kumar SaxenaNo ratings yet

- Chapter 10 Quiz AnswersDocument12 pagesChapter 10 Quiz AnswersDevanshi PatelNo ratings yet

- Admission Certificate Children Army PersonnelDocument3 pagesAdmission Certificate Children Army Personnelसुधाकर त्यागीNo ratings yet