Professional Documents

Culture Documents

Break Even Analysis

Uploaded by

Prabha KaranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Break Even Analysis

Uploaded by

Prabha KaranCopyright:

Available Formats

BREAK EVEN ANALYSIS

MEANING OF COSTS

Costs refer to the expenditure

incurred to produce a particular

product or service.

All costs involve a sacrifice of some

kind or the other to acquire a benefit.

The cost of production includes the

cost of raw materials, labour & other

expenses.

Cost concepts:

Fixed costs:

These costs that do not

vary with output.

Before a Firm starts

producing, it needs to

spent on plant, M/C,

fittings, equipments,

In fact, the firm has to

bear these costs even if

there is no output.

Cost Concepts:

Variable Costs:

The costs that vary with

volume of output and the

costs are incurred in

getting more &more inputs.

Eg: cost of Raw materials,

wages etc.,

It is otherwise called as

primary cost of production.

Cost concepts

Marginal Costs:

The addition made to the total cost

by the production of one additional

unit of output.

This means marginal cost is the

addition to the total cost of

producing n units instead of n-1

units where n is any given number.

Revenue concept

Total Revenue:

Total Revenue is the total

amount of money received

by a firm from goods sold

during a certain time

period.

TR=Q.P

Where Q is the quantity sold

and P is the price per unit.

BREAK EVEN ANALYSIS

An important application of cost

analysis used frequently in businesses

is Break even analysis.

It examines the relation between total

revenue, total costs and total profits of

a firm at different levels of output.

It is determining profit at various

projected levels of sales, identifying

the breakeven point.

BEA

Break-even analysis refers to analysis of the

break even point (BEP)

The BEP is defined as a no-profit or no-loss

point.

It is necessary to determine the BEP,

because it denotes the minimum volume of

production to be undertaken to avoid

losses.

In other words, how much minimum is to be

produced to see the profits.

BEA

Break-even analysis is defined as of

costs and their possible impact on

revenues and volume of the firm.

It is also cost-volume-profit analysis.

A firm is said to attain the BEP when

its total revenue is equal to Total

cost.(TR=TC).

TC=FC+VC

From the diagram we understand:

TC=Total Variable cost (TVC)+ Total Fixed

cost (TFC)

The variable cost line is drawn first. It

varies proportionately with volume of

production and sales.

The total cost line is derived by adding

total fixed costs line to the total variable

cost line.

The total revenue line starts from 0 point

and increases along with volume of sales

intersecting total cost line at point BEP

From the Diagram.

The zone below BEP is loss zone and

the zone above BEP is profit zone.

The point (E) where the revenue line

crosses the total cost line is the

break even point.

Assumptions underlying BreakEven Analysis

Costs can perfectly be classified into fixed

and variable costs.

Selling price does not change with volume

changes. It remains fixed. It does not

consider the price discounts or cash

discounts.

All the goods produced are sold. There is no

closing stock.

There is only one product available for sale.

Significance of BEA

To ascertain the profit on a particular

level of sales volume or a given capacity

of production.

To calculate the sales required to earn a

particular desired level of profit

to compare the efficiency of different

firms

To compare the product lines, sales area,

methods of sale for individual company.

BEA

It is significance for economic research,

business decision making, company

management, investment analysis and

public policy.

It is an important technique to trace the

relationship between costs, revenue and

profits at the varying levels of output or

sales.

It provides an important bridge between

business behaviour and economic theory

of the firm.

Limitations of BEA

BEP is based on fixed cost, variable

cost & total revenue. A change in one

variable is going to affect the BEP.

Where the business conditions are

volatile, BEP cannot give stable

results.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Effective Leadership Skills in The 21ST CenturyDocument67 pagesEffective Leadership Skills in The 21ST CenturySam ONi100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Return To The Source Selected Speeches of Amilcar CabralDocument112 pagesReturn To The Source Selected Speeches of Amilcar Cabraldjazzy456No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Open Data Driving Growth Ingenuity and InnovationDocument36 pagesOpen Data Driving Growth Ingenuity and InnovationAnonymous EBlYNQbiMyNo ratings yet

- GUBAnt BanwnaDocument36 pagesGUBAnt BanwnaMarc Philip100% (1)

- The Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Document297 pagesThe Works of Samuel Johnson, Volume 04 The Adventurer The Idler by Johnson, Samuel, 1709-1784Gutenberg.orgNo ratings yet

- Importance of Economics in EngineeringDocument8 pagesImportance of Economics in EngineeringPrabha Karan100% (4)

- Second Assessment - Unknown - LakesDocument448 pagesSecond Assessment - Unknown - LakesCarlos Sánchez LópezNo ratings yet

- LeadershipDocument28 pagesLeadershipPrabha KaranNo ratings yet

- Managerial CommunicationDocument35 pagesManagerial CommunicationPrabha KaranNo ratings yet

- HRM IntroDocument11 pagesHRM IntroPrabha KaranNo ratings yet

- Time ManagementDocument19 pagesTime ManagementPrabha KaranNo ratings yet

- Choosing A Career: Rule#1: Rule#2: Rule#3Document25 pagesChoosing A Career: Rule#1: Rule#2: Rule#3Prabha KaranNo ratings yet

- Pricing: Pricing Objectives Pricing Methods Pricing StrategiesDocument17 pagesPricing: Pricing Objectives Pricing Methods Pricing Strategiesjoann121887No ratings yet

- Organisation StructuresDocument13 pagesOrganisation StructuresPrabha KaranNo ratings yet

- Principles of ManagementDocument22 pagesPrinciples of ManagementPrabha KaranNo ratings yet

- Pricing SystemDocument43 pagesPricing SystemPrabha KaranNo ratings yet

- HRM and Motivation TheoriesDocument28 pagesHRM and Motivation TheoriesPrabha KaranNo ratings yet

- Adam Smith's Division of Labor Theory & Scientific Management PrinciplesDocument14 pagesAdam Smith's Division of Labor Theory & Scientific Management PrinciplesPrabha KaranNo ratings yet

- Forms of BusinessDocument32 pagesForms of BusinessPrabha KaranNo ratings yet

- Cost Concepts in Economics Explained: Opportunity, Fixed, VariableDocument19 pagesCost Concepts in Economics Explained: Opportunity, Fixed, VariablePrabha Karan100% (1)

- Scope of EconomicsDocument33 pagesScope of EconomicsPrabha KaranNo ratings yet

- Scarcity and ChoiceDocument40 pagesScarcity and ChoicePrabha KaranNo ratings yet

- Scarcity and ChoiceDocument40 pagesScarcity and ChoicePrabha KaranNo ratings yet

- DEMAND DETERMINANTS AND SUPPLY CURVESDocument22 pagesDEMAND DETERMINANTS AND SUPPLY CURVESPrabha KaranNo ratings yet

- BepDocument14 pagesBepPrabha KaranNo ratings yet

- Economics OverviewDocument23 pagesEconomics OverviewPrabha KaranNo ratings yet

- Elasticity of DemandDocument23 pagesElasticity of DemandPrabha KaranNo ratings yet

- Demand, DeterminentsDocument43 pagesDemand, DeterminentsPrabha KaranNo ratings yet

- Demand, Supply, and Market EquilibriumDocument48 pagesDemand, Supply, and Market EquilibriumPrabha KaranNo ratings yet

- Elasticity of DemandDocument23 pagesElasticity of DemandPrabha KaranNo ratings yet

- Economic OptimisationDocument11 pagesEconomic OptimisationPrabha KaranNo ratings yet

- DemandforcastingDocument17 pagesDemandforcastingPrabha KaranNo ratings yet

- Economic OptimisationDocument11 pagesEconomic OptimisationPrabha KaranNo ratings yet

- Basic economic concepts like scarcity, choice and opportunity costDocument28 pagesBasic economic concepts like scarcity, choice and opportunity costPrabha KaranNo ratings yet

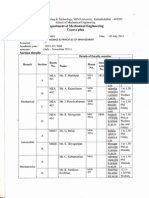

- Engineering Economics and Principles of Management Course PlanDocument6 pagesEngineering Economics and Principles of Management Course PlanPrabha KaranNo ratings yet

- InvoiceDocument1 pageInvoiceDp PandeyNo ratings yet

- Definition, Nature, Scope, Subject MatterDocument7 pagesDefinition, Nature, Scope, Subject MatterNikon SonuNo ratings yet

- Women in Indian CinemaDocument16 pagesWomen in Indian CinemaahmerkhateebNo ratings yet

- Castells Information AgeDocument6 pagesCastells Information Agemaswing@yahoo.comNo ratings yet

- KPK Progress in PTI's Government (Badar Chaudhry)Document16 pagesKPK Progress in PTI's Government (Badar Chaudhry)badarNo ratings yet

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM1)Document9 pagesFundamentals of Accountancy, Business and Management 1 (FABM1)A.No ratings yet

- Project On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesDocument9 pagesProject On-Law of Torts Topic - Judicial and Quasi Judicial AuthoritiesSoumya Shefali ChandrakarNo ratings yet

- Satyam PPT FinalDocument16 pagesSatyam PPT FinalBhumika ThakkarNo ratings yet

- MBC and SAP Safe Management Measures, Caa 2020-05-28Document9 pagesMBC and SAP Safe Management Measures, Caa 2020-05-28Axel KruseNo ratings yet

- The Impact of E-Commerce in BangladeshDocument12 pagesThe Impact of E-Commerce in BangladeshMd Ruhul AminNo ratings yet

- ___Document2 pages___kikuomahdi123No ratings yet

- AutoCompute SF2Document84 pagesAutoCompute SF2Ronan SibbalucaNo ratings yet

- Appendix F - Property ValueDocument11 pagesAppendix F - Property ValueTown of Colonie LandfillNo ratings yet

- Ethics in Social Science ResearchDocument33 pagesEthics in Social Science ResearchRV DuenasNo ratings yet

- KEY TO THE SWIMMING POOL TIMETABLE AND PROGRAMMEDocument2 pagesKEY TO THE SWIMMING POOL TIMETABLE AND PROGRAMMEthomas homerNo ratings yet

- English FinalDocument6 pagesEnglish FinalAPRIL LYN D. GETI-AYONNo ratings yet

- RGPV Enrollment FormDocument2 pagesRGPV Enrollment Formg mokalpurNo ratings yet

- Types of Majority 1. Simple MajorityDocument1 pageTypes of Majority 1. Simple MajorityAbhishekNo ratings yet

- Silent Night (2015) ProgramDocument88 pagesSilent Night (2015) ProgramLyric Opera of Kansas CityNo ratings yet

- Prospects For The Development of Culture in UzbekistanDocument3 pagesProspects For The Development of Culture in UzbekistanresearchparksNo ratings yet

- CW Module 4Document10 pagesCW Module 4Rodney Warren MaldanNo ratings yet

- 2015 Scholarship ApplicationDocument3 pages2015 Scholarship Applicationapi-280767644No ratings yet

- In - Gov.uidai ADHARDocument1 pageIn - Gov.uidai ADHARvamsiNo ratings yet