Professional Documents

Culture Documents

Introduction To Capital Markets: Group 4

Uploaded by

Varun Baxi0 ratings0% found this document useful (0 votes)

30 views10 pagescapital markets

Original Title

Capital Markets

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcapital markets

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views10 pagesIntroduction To Capital Markets: Group 4

Uploaded by

Varun Baxicapital markets

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 10

Introduction to Capital

Markets

Group 4

Abhishek Bhatnagar

Aniruddha

Deshpande

Rajiv Singhai

Surbhi Jain

Varun Baxi

Vishal Tulsiyan

15P003

15P005

15P040

15P053

15P055

15P059

What are capital markets?

Capital markets are a sub-part of the financial system

The primal role of this market is to make investment

from investors who have surplus funds to the ones

who are running a deficit

Structure of capital markets

Significance of Capital markets

Mobilization of the wealth of savers to those who can put it to long-term

productive use, such as companies or governments making long-term

investments

Efficient allocation of investment resources arranging investment funds to

those units of the organization which are in need of the same

Speed up economic growth and development unfettered flow of surplus

funds to deficit units (ensures growth of investment & employment)

Entrepreneurship Growth makes the necessary financial resources available

Stock indices are barometers of the economy

Functions of a capital market

Disseminate information efficiently

Enable quick valuation of financial instruments both equity and

debt

Enable wider participation

Provide operational efficiency through

simplified transaction procedure

lowering settlement timings and

Lowering transaction costs

Types of Capital Markets

Primary Market

Secondary Market

It is that market in which shares,

debentures and other securities are

sold for the first time for collecting

long-term capital.

This market is concerned with new

issues. Therefore, the primary

market is also called NEW ISSUE

MARKET.

In this market, the flow of funds is

from savers to borrowers

(industries), hence, it helps directly

in the capital formation of the

country.

The money collected from this

market is generally used by the

companies to modernize the plant,

machinery and buildings, for

extending business, and for setting

up new business unit.

The secondary market is that

market in which the buying and

selling of the previously issued

securities is done.

The transactions of the secondary

market are generally done

through the medium of stock

exchange

The chief purpose of the

secondary market is to create

liquidity in securities.

If an individual has bought some

security and he now wants to sell

it, he can do so through the

medium of stock exchange to sell

or purchase through the medium

of stock exchange requires the

services of the broker presently

Common Capital Market

Instruments

Stocks:

A security that represents ownership in a corporation. Holders of

common stock exercise control by electing a board of directors and voting on

corporate policy. Common stockholders are on the bottom of the priority

ladder for ownership structure. In the event of liquidation, common

shareholders have rights to a company's assets only after bondholders,

preferred shareholders and other debt-holders have been paid in full.

Preference Shares:

A class of ownership in a corporation that has

a higher claim on its assets and earnings than common stock. Preferred

shares generally have a dividend that must be paid out before dividends to

common shareholders, and the shares usually do not carry voting rights.

Preferred stock combines features of debt, in that it pays fixed dividends,

and equity, in that it has the potential to appreciate in price. The details of

each preferred stock depend on the issue

Major Capital Market Instruments

Bonds:

Bonds refer to debt instruments bearing interest on maturity. In simple

terms, organizations may borrow funds by issuing debt securities

named bonds, having a fixed maturity period (more than one year) and

pay a specified rate of interest (coupon rate) on the principal amount to

the holders. Thus a bond is like a loan: the issuer is the borrower

(debtor), the holder is the lender (creditor), and the coupon is the

interest.

Debentures:

Debentures are the debt instruments similar to Bonds. In India Debentures

and Bonds are used interchangeably. However in some countries like

USA Debentures are the debt instruments issued in order to raise the

capital for some specific purpose, i.e. to raise the capital for short term

or for expansion thus debenture is also like a loan.

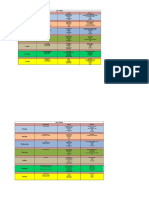

Scenario of Indian Capital

Market

Resource Mobilised in Primary Markets

80000

70000

Amount(Cr)

60000

50000

40000

30000

20000

10000

0

2009-10

2010-11

2011-12

2012-13

2013-14

Year

Source: Indiastat database

The Data of the Primary market is the reflection of the

state of the economy

Due to the declining state of Indian Economy when the

investments started phasing out there was the decline in

the amount of capital raised

Decisions about the

capital structure of the

company

largely

depends on the cost of

capital

Thus the division of

capital raising through

IPO and bonds is

largely depended on

the cost of Debt and

Cost of Equity.

Source PRIME Database, World bank data

Secondary Market in India

Secondary Market is the market where the securities are resold

Secondary markets performance is the function of fundamental

factors as well as sentiments

Secondary markets are also used as the barometer of the health of

the economy and investors confidence

Thank You

You might also like

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- A Project Report On NSEDocument64 pagesA Project Report On NSEMukesh ChhotalaNo ratings yet

- National Stock ExchangeDocument63 pagesNational Stock ExchangePrashantChauhanNo ratings yet

- Capital MarketDocument58 pagesCapital MarketJasmandeep brar100% (6)

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesFrom EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- What Do You Mean by Security Market?Document16 pagesWhat Do You Mean by Security Market?Chiku SinghNo ratings yet

- Capital Market-Part IDocument9 pagesCapital Market-Part ISiya ShuklaNo ratings yet

- ProjectDocument25 pagesProjectDeana PhillipsNo ratings yet

- MB II Unit Final StudentsDocument70 pagesMB II Unit Final StudentsHema vijay sNo ratings yet

- Capital Market: Group MembersDocument17 pagesCapital Market: Group MembersSushil MirguleNo ratings yet

- Basic Terms of Capital MarketDocument44 pagesBasic Terms of Capital Marketdhanabalu87No ratings yet

- Unit V Meaning of Stock ExchangeDocument17 pagesUnit V Meaning of Stock ExchangeManojkumar MohanasundramNo ratings yet

- Meaning and Concept of Capital MarketDocument11 pagesMeaning and Concept of Capital Marketmanyasingh100% (1)

- Bachelor of Business Administration-BBA: Semester 5 BB0022 Capital and Money Market - 4 Credits Assignment (60 Marks)Document8 pagesBachelor of Business Administration-BBA: Semester 5 BB0022 Capital and Money Market - 4 Credits Assignment (60 Marks)Devlean Bhowal100% (1)

- The Capital MarketDocument5 pagesThe Capital MarketJasleen kaurNo ratings yet

- Stock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoDocument4 pagesStock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoAli JumaniNo ratings yet

- BAP 4 Capital Market L1-3Document17 pagesBAP 4 Capital Market L1-3Mabel Jean RambunayNo ratings yet

- ED VR20 UNIT 4 MaterialDocument11 pagesED VR20 UNIT 4 Materialvikas 5G9No ratings yet

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- It Comprises of The Stock Exchanges Which Provide A Platform For The Purchase and Sale of SecuritiesDocument12 pagesIt Comprises of The Stock Exchanges Which Provide A Platform For The Purchase and Sale of SecuritiesnishaNo ratings yet

- Some What Solved QB-Financial Mnagement-MBM633Document7 pagesSome What Solved QB-Financial Mnagement-MBM633Amit KumarNo ratings yet

- Indian Financial SystemDocument72 pagesIndian Financial SystemVivek KumarNo ratings yet

- A Project Report On NSEDocument49 pagesA Project Report On NSEViren SehgalNo ratings yet

- S A A I M: Ecurity Nalysis ND Nvestment AnagementDocument38 pagesS A A I M: Ecurity Nalysis ND Nvestment AnagementghanshyamvarshneyjiNo ratings yet

- Interview QuestionsDocument7 pagesInterview QuestionsGaurav TripathiNo ratings yet

- Financial Markets & ServicesDocument29 pagesFinancial Markets & ServicesShashhwat SrivastavNo ratings yet

- Fundamentals of Capital MarketDocument37 pagesFundamentals of Capital MarketBharat TailorNo ratings yet

- SEBI WriteUpDocument4 pagesSEBI WriteUpTeja ChilukotiNo ratings yet

- 04 & 05. The Stock Market Participants - Corporations & InvestorsDocument6 pages04 & 05. The Stock Market Participants - Corporations & InvestorsasfaarsafiNo ratings yet

- STOCK Market: Secondary Market Is A Market in Which ExistingDocument26 pagesSTOCK Market: Secondary Market Is A Market in Which Existingpankaj vermaNo ratings yet

- Project Report - Capital MarketDocument33 pagesProject Report - Capital MarketPragati DixitNo ratings yet

- An Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIIIDocument43 pagesAn Insight Into Indian Capital Market: Presented By: Rajesh Kumar MBA (Finance), ACS, AIIIAmrut KaurNo ratings yet

- Financial MarketsDocument31 pagesFinancial MarketsCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- A Project Report On NSEDocument8 pagesA Project Report On NSEGagan GoyalNo ratings yet

- Capital Market1Document68 pagesCapital Market1Sandeep BargajeNo ratings yet

- Capital Market: Subject: Indian Financial System (Ifs)Document8 pagesCapital Market: Subject: Indian Financial System (Ifs)Nayana hyNo ratings yet

- Capital Market OverviewDocument36 pagesCapital Market OverviewUpadhyay JiNo ratings yet

- Financial Management (MBA 2nd Sem) - Unit 5Document18 pagesFinancial Management (MBA 2nd Sem) - Unit 5Dev StatusNo ratings yet

- Capital Market16Document298 pagesCapital Market16Nadeem khanNo ratings yet

- Financial Institution and MarketsDocument57 pagesFinancial Institution and MarketsTushar GaurNo ratings yet

- BusinessStudies12 Finance MarketDocument24 pagesBusinessStudies12 Finance MarketRam VermaNo ratings yet

- Sources of FundsDocument13 pagesSources of FundsSenelwa Anaya0% (1)

- Sapm PPT 1Document21 pagesSapm PPT 1Gitanjali SubbaraajNo ratings yet

- Capital MarketDocument38 pagesCapital Marketapi-3798892No ratings yet

- Financial Institutions and Markets - Answers (Sem-IV)Document8 pagesFinancial Institutions and Markets - Answers (Sem-IV)Udit JoshiNo ratings yet

- NotesDocument49 pagesNotesMatthew MullalyNo ratings yet

- Capital Market:: What Does Capital Markets Mean?Document5 pagesCapital Market:: What Does Capital Markets Mean?Nadeem AhmadNo ratings yet

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- Capital Market Capital Markets Are: Financial Markets Debt Equity SecuritiesDocument10 pagesCapital Market Capital Markets Are: Financial Markets Debt Equity SecuritiesAnand ChavanNo ratings yet

- Innovative Financial Instruments in IndiaDocument31 pagesInnovative Financial Instruments in Indiariyasacademic50% (4)

- My PartDocument6 pagesMy Partkdoshi23No ratings yet

- Security Analysis AND Portfolio Management: DR N.N.SenguptaDocument51 pagesSecurity Analysis AND Portfolio Management: DR N.N.SenguptaApril BakerNo ratings yet

- Some of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowDocument3 pagesSome of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowNadir ShahNo ratings yet

- Treasury Bills, Commercial Papers, Bankers Acceptance, Certificates of Deposits, EtcDocument6 pagesTreasury Bills, Commercial Papers, Bankers Acceptance, Certificates of Deposits, Etc'Jinal Thummar'No ratings yet

- Capital Markets PromotionDocument8 pagesCapital Markets Promotionkumeshk1983No ratings yet

- Capital Market:: Primary Market Secondary MarketDocument63 pagesCapital Market:: Primary Market Secondary MarketvishalhiroleNo ratings yet

- Equity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term FinancialDocument10 pagesEquity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term Financialfrancis dungcaNo ratings yet

- Capital Market OperationsDocument120 pagesCapital Market OperationsmanjapcNo ratings yet

- Slide Design User Help GuideDocument7 pagesSlide Design User Help GuideVarun BaxiNo ratings yet

- Tata Steel Application FormDocument6 pagesTata Steel Application FormVarun BaxiNo ratings yet

- Welcome at Commercial Establishment Mikro-Met ® Grzegorz KłosowskiDocument25 pagesWelcome at Commercial Establishment Mikro-Met ® Grzegorz KłosowskiVarun BaxiNo ratings yet

- India: Equity ResearchDocument9 pagesIndia: Equity ResearchVarun BaxiNo ratings yet

- Projectprofile Raw&BoiledriceDocument6 pagesProjectprofile Raw&BoiledriceVarun BaxiNo ratings yet

- Amara Raja Vs ExideDocument50 pagesAmara Raja Vs ExideVarun BaxiNo ratings yet

- Notes O&tDocument6 pagesNotes O&tVarun BaxiNo ratings yet

- Atul Auto - Auto and Ancillary - Mahim DwivediDocument2 pagesAtul Auto - Auto and Ancillary - Mahim DwivediVarun BaxiNo ratings yet

- Conversion GuideDocument134 pagesConversion GuideVarun Baxi100% (1)

- % Growth: Sales 43% 84% Expenses 18% 24% OPM Other Income Interest 5% 5% 4% Depreciation 5% 6% 6% Tax EPS (Unadj)Document12 pages% Growth: Sales 43% 84% Expenses 18% 24% OPM Other Income Interest 5% 5% 4% Depreciation 5% 6% 6% Tax EPS (Unadj)Varun BaxiNo ratings yet

- Trading Assignment: Group 4 - Section A 18 July, 2016Document10 pagesTrading Assignment: Group 4 - Section A 18 July, 2016Varun BaxiNo ratings yet

- Derivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsDocument9 pagesDerivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsVarun BaxiNo ratings yet

- Sampa VideDocument9 pagesSampa VideVarun BaxiNo ratings yet

- Cooper HalfDocument5 pagesCooper HalfVarun BaxiNo ratings yet

- Hero Motocorp Ltd-Audited Financial Results: Classification: INTERNALDocument3 pagesHero Motocorp Ltd-Audited Financial Results: Classification: INTERNALVarun BaxiNo ratings yet

- July Menu Breakfast Lunch DinnerDocument2 pagesJuly Menu Breakfast Lunch DinnerVarun BaxiNo ratings yet

- Investment StrategyDocument5 pagesInvestment StrategyVarun BaxiNo ratings yet

- Derivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsDocument13 pagesDerivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsVarun BaxiNo ratings yet

- Swan Diagram NotesDocument3 pagesSwan Diagram NotesGizri AlishaNo ratings yet

- Inflation AccountingDocument23 pagesInflation AccountingthejojoseNo ratings yet

- What Is An Eclectic Paradigm?: An Economic and Business ModelDocument2 pagesWhat Is An Eclectic Paradigm?: An Economic and Business ModelMD Abdur RahmanNo ratings yet

- Funds Transfer Pricing: Cracking The Code On Deposit ValuationDocument4 pagesFunds Transfer Pricing: Cracking The Code On Deposit ValuationHoàng Trần HữuNo ratings yet

- Monopoly Market StructureDocument9 pagesMonopoly Market StructurefitsumNo ratings yet

- Cost-Benefit Analysis and Environmental Impact AssessmentDocument14 pagesCost-Benefit Analysis and Environmental Impact AssessmentMznalqadiNo ratings yet

- Marsha Mellow Doesn T Care Whether She Consumes in Period 1Document1 pageMarsha Mellow Doesn T Care Whether She Consumes in Period 1trilocksp SinghNo ratings yet

- Operations Management Handbook With Questions & AnswersDocument289 pagesOperations Management Handbook With Questions & AnswersxamzaNo ratings yet

- Aumann - 1962 - Utility Theory Without The Completeness AxiomDocument6 pagesAumann - 1962 - Utility Theory Without The Completeness Axiomapi-256525507No ratings yet

- Module 1Document28 pagesModule 1jeandela088No ratings yet

- IEPDocument50 pagesIEPK.muniNo ratings yet

- 12Document3 pages12itachi uchihaNo ratings yet

- 3350469Document361 pages3350469Ana Luz OspinoNo ratings yet

- Dwnload Full Economics Today The Micro View 18th Edition Miller Solutions Manual PDFDocument35 pagesDwnload Full Economics Today The Micro View 18th Edition Miller Solutions Manual PDFirisybarrous100% (7)

- DerivaGem 2Document10 pagesDerivaGem 2Vicky RajoraNo ratings yet

- Lecture Notes Unit 1 2014Document8 pagesLecture Notes Unit 1 2014Peter Jean-jacquesNo ratings yet

- Problem Set1 KeyDocument6 pagesProblem Set1 Keygorski29No ratings yet

- Micro Economics Related To Architecture and EngineDocument5 pagesMicro Economics Related To Architecture and EngineMahitha RaaviNo ratings yet

- Inflation PresentationDocument12 pagesInflation PresentationVivek SinghNo ratings yet

- Lecture 1 Productivity MeasurementDocument15 pagesLecture 1 Productivity MeasurementIbrar ShahNo ratings yet

- Materials Management AND Economic Order QuantityDocument46 pagesMaterials Management AND Economic Order QuantitySubhashini KJNo ratings yet

- The Influence of Coastal Tourism Destination On Community Participation With Transformational Leadership ModerationDocument9 pagesThe Influence of Coastal Tourism Destination On Community Participation With Transformational Leadership ModerationAnonymous izrFWiQNo ratings yet

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocument21 pagesManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreIsmail WardhanaNo ratings yet

- Notes On Economic EnvironmentDocument9 pagesNotes On Economic EnvironmentJahid HasanNo ratings yet

- FisherDocument15 pagesFishersakshi chaurasiaNo ratings yet

- Money in The Modern Economy An Introduction PDFDocument10 pagesMoney in The Modern Economy An Introduction PDFTharindu Dissanayake100% (1)

- Brics EconomyDocument36 pagesBrics EconomyTushar PatilNo ratings yet

- DerivativeDocument47 pagesDerivativeMuhammad AshfaqNo ratings yet

- An Empirical Study On The Performance Evaluation of Public Sector Banks in IndiaDocument16 pagesAn Empirical Study On The Performance Evaluation of Public Sector Banks in Indiapratik053No ratings yet

- Solution Manual For Microeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom BarbieroDocument34 pagesSolution Manual For Microeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom Barbierowisardspoliate.ybjnr100% (47)