Professional Documents

Culture Documents

Basics of Accounting: Overview of Hedge Funds

Uploaded by

Aditya ShuklaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics of Accounting: Overview of Hedge Funds

Uploaded by

Aditya ShuklaCopyright:

Available Formats

CONFIDENTI

AL

Basics of Accounting

Overview of Hedge Funds

August 2010

Mar-2010

Basics of Accounting

Definition of Accounting

Page 2

CONFIDENTI

AL

Accounting has been defined by the American Institute of Certified

Public Accountants, as The art of recording, classifying and

summarizing in a significant manner and in terms of money,

transactions and events which are, in part at least, of a financial

character, and interpreting the results thereof

Basics of Accounting

Page 3

CONFIDENTI

AL

Groups of Accounts

Liabilities

Assets

Income

Expenditure

Owners Capital

Each of the groups has several sub-groups and every such sub-group

either has accounts or sub-groups as its sub-units, forming a tree

structure.

Basics of Accounting

Page 4

CONFIDENTI

AL

Debits and Credits

All amounts recorded in the books of account are placed either to the

debit or credit of an account. For any transaction, which account(s)

should be debited and which should be credited is determined by the

following Golden rules:

DEBIT what comes in, CREDIT what goes out

DEBIT the receiver of benefit, CREDIT the giver of benefit

DEBIT all expenses and losses, CREDIT all incomes and gains

Basics of Accounting

Page 5

CONFIDENTI

AL

Other Topics

Capital and Revenue Expenditure - Capital Expenditure is that expenditure

which results in the acquisition of an asset. Items of expenditure whose benefit

expires within the year or expenditure incurred for maintaining the business or

keeping the assets in good working condition are referred to as Revenue

Expenditure.

Financial Statements - At the end of the reporting period which is generally

one year the accounting transactions for the entire period are summarised

into a few statements. The major Financial Statements are:

1. Balance Sheet: Statement of Assets and Liabilities as on a particular date,

indicating the financial position of an entity at a given point of time.

2. Profit and Loss Account: Statement of Income and Expenditure for the

reporting period, indicating the financial performance of the entity during

the reporting period.

Users of Financial Statements: Management, Shareholders, Investors,

Lenders, Government

Basics of Accounting

Concepts of Accounting

Page 6

CONFIDENTI

AL

To ensure uniformity in preparation of accounts across entities, the following

concepts are applied when recording accounting transactions:

1)Business Entity Concept: The business for which accounts are

maintained is treated as an entity distinct from its owners and managers.

2)Money Measurement Concept: All transactions affecting the business

are stated in money terms and recorded in the Books of Account.

3)Dual Aspect Concept: Every transaction has two aspects a debit and

a credit and the sum of all debits will equal the sum of all credits.

4)Cost Concept: Transactions are recorded at the actual cost.

5)Going Concern Concept: At the time of recording the transactions, it is

assumed that the entity will continue to remain in business for as long as

can be foreseen.

Basics of Accounting

Concepts of Accounting (contd..)

Page 7

CONFIDENTI

AL

6)Accrual Concept: Income is recorded when goods are supplied or a

service is rendered, even though the money may be received later;

expenditure is recorded when goods are procured or a service is

availed, even though the money may be paid later.

7)Realisation Concept: Transactions are recorded only when they

occur and not in anticipation of their occurrence.

8)Matching Concept: Income and expenses for a period are

correlated to ensure that the accounts project an accurate picture.

Basics of Accounting

Conventions of Accounting

Page 8

CONFIDENTI

AL

To make the information contained in financial statements clear and

meaningful, they are drawn up according to the following

conventions:

1)Consistency: Accounting practices should remain the same from

year to year.

2)Disclosure: All information which is essential for fully

understanding the financial statements should be disclosed in

addition to the information required to be disclosed by law.

3)Conservatism: Financial statements should be drawn up on a

conservative basis i.e. anticipated income should not be recorded

whereas likely losses should be provided for.

Basics of Accounting

Process of Accounting

Page 9

CONFIDENTI

AL

After each transaction is done, the process to account for this

transaction can be depicted with the help of the below steps:

1.Post the transaction in the ledger (The Journal Entry)

2.Generate the Trial Balance (List of balances in all the accounts as of

the end of the specified period)

3.Compilation of Profit & Loss Account

4.Preparation of Balance Sheet

Basics of Accounting

Page 10

CONFIDENTI

AL

Screenshots Income Statement

Basics of Accounting

Page 11

CONFIDENTI

AL

Screenshots Balance Sheet

Basics of Accounting

Page 12

CONFIDENTI

AL

Thanks!

You might also like

- Game Audio - Tales of A Technical Sound Designer Volume 02Document154 pagesGame Audio - Tales of A Technical Sound Designer Volume 02Joshua HuNo ratings yet

- 2018 International Swimming Pool and Spa CodeDocument104 pages2018 International Swimming Pool and Spa CodeEngFaisal Alrai100% (3)

- Accounting NotesDocument22 pagesAccounting NotesSrikanth Vasantada50% (2)

- TRS PresentationviewableDocument17 pagesTRS PresentationviewableAditya ShuklaNo ratings yet

- Accounts BasicsDocument144 pagesAccounts Basicsjdon100% (1)

- Surge Protection Devices GuidesDocument167 pagesSurge Protection Devices GuidessultanprinceNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 033 - Flight Planning Monitoring - QuestionsDocument126 pages033 - Flight Planning Monitoring - QuestionsEASA ATPL Question Bank100% (4)

- Checklist Code ReviewDocument2 pagesChecklist Code ReviewTrang Đỗ Thu100% (1)

- Concepts: Introduction To Financial AccountingDocument30 pagesConcepts: Introduction To Financial Accountingbmurali37No ratings yet

- Basics of Business AccountingDocument34 pagesBasics of Business AccountingMadhusmita MishraNo ratings yet

- Introduction To AccountingDocument54 pagesIntroduction To AccountingDanny KdNo ratings yet

- FINANCIAL ACCOUNTING Notes PDFDocument134 pagesFINANCIAL ACCOUNTING Notes PDFMix Mixture67% (3)

- Financial, Cost and Management AccountingDocument82 pagesFinancial, Cost and Management Accountingmkpatidar100% (1)

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Accounting BasicsDocument144 pagesAccounting BasicsSabyasachi Srimany100% (1)

- Rubber DamDocument78 pagesRubber DamDevanshi Sharma100% (1)

- Financial Accounting-Short Answers Revision NotesDocument26 pagesFinancial Accounting-Short Answers Revision Notesfathimathabasum100% (7)

- Fallas Compresor Copeland-DesbloqueadoDocument16 pagesFallas Compresor Copeland-DesbloqueadoMabo MabotecnicaNo ratings yet

- Starbucks PDFDocument14 pagesStarbucks PDFanimegod100% (1)

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- Accounting Concepts and Conventions: Unit - IDocument30 pagesAccounting Concepts and Conventions: Unit - IGopal KrishnanNo ratings yet

- AFM Short NotesDocument56 pagesAFM Short NotesthamiztNo ratings yet

- BasicsDocument11 pagesBasicsRathan SettyNo ratings yet

- Accounting ConceptsDocument6 pagesAccounting Conceptsbalaje99No ratings yet

- Definition of AccountingDocument2 pagesDefinition of AccountingAndrés AvilésNo ratings yet

- Accounts and Book Keeping in Primary Level Cooperatives10920Document40 pagesAccounts and Book Keeping in Primary Level Cooperatives10920Palek Koang DiawNo ratings yet

- Accounting NotesDocument71 pagesAccounting Noteswaseem ahsanNo ratings yet

- Financial Accounting - MBA - 01 PDFDocument107 pagesFinancial Accounting - MBA - 01 PDFAnanda SahuNo ratings yet

- Double Entry SystemDocument11 pagesDouble Entry SystemPraveenNo ratings yet

- Accounting ConceptsDocument5 pagesAccounting ConceptsAakanksha ThodupunooriNo ratings yet

- Accounting NotesDocument23 pagesAccounting NotesboiroyNo ratings yet

- MEAUNIT3pdf RemovedDocument29 pagesMEAUNIT3pdf Removedb20cs099No ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesManjulaNo ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Bba 1sem Financial Accounting Important NotesDocument38 pagesBba 1sem Financial Accounting Important Notestyagiujjwal59No ratings yet

- Unit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingDocument5 pagesUnit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingShradha KapseNo ratings yet

- MCA-Account - Pandit (New) - Sem - IIDocument339 pagesMCA-Account - Pandit (New) - Sem - IIdeepshrm100% (1)

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Majid 12 3762 1 Accounting Principles and ConceptsDocument5 pagesMajid 12 3762 1 Accounting Principles and ConceptsHasnain BhuttoNo ratings yet

- Principles of Accounts Syllabus Section 2Document5 pagesPrinciples of Accounts Syllabus Section 2Herve CharlemagneNo ratings yet

- Business Accounting - BBA-IT 2Document8 pagesBusiness Accounting - BBA-IT 2Ishika SrivastavaNo ratings yet

- Accounting Concepts and ConventionsDocument13 pagesAccounting Concepts and Conventionssunsign100% (1)

- Financial Accounting - IntroDocument16 pagesFinancial Accounting - Introaiswarya sNo ratings yet

- The Financial Statements: Chapter OutlineDocument15 pagesThe Financial Statements: Chapter OutlineBhagaban DasNo ratings yet

- Accounting System Short Notes Du Bcom Hons Chapter 1Document7 pagesAccounting System Short Notes Du Bcom Hons Chapter 1ishubhy111No ratings yet

- Chapter 1Document6 pagesChapter 1Nlt20bca027 Mesak HmingthanmawiaNo ratings yet

- Fundamentels of Accounting Lect 1Document9 pagesFundamentels of Accounting Lect 1Jahanzaib ButtNo ratings yet

- Basic AccountsDocument31 pagesBasic AccountspoornapavanNo ratings yet

- Financial Accounting TheoryDocument14 pagesFinancial Accounting TheoryNimalanNo ratings yet

- Financial AccountancyDocument25 pagesFinancial AccountancyRAVI SHEKARNo ratings yet

- Short Notes On FinanceDocument41 pagesShort Notes On FinanceVeeramani ArumugamNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesMahmud Abdullahi SarkiNo ratings yet

- Chapter 3 NotesDocument30 pagesChapter 3 NotesnoxoloNo ratings yet

- Accounting Concepts and ConventionsDocument26 pagesAccounting Concepts and ConventionsIshaan PaliwalNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document20 pagesGenerally Accepted Accounting Principles (GAAP)Vijayanta PawaseNo ratings yet

- Mea Unit 3Document43 pagesMea Unit 3b21ai008No ratings yet

- Unit - Ii Introduction To Financial AccountingDocument37 pagesUnit - Ii Introduction To Financial AccountingdownloaderNo ratings yet

- DocumentDocument8 pagesDocumentDivyansh SinghNo ratings yet

- BBA Accounting For Business 01Document11 pagesBBA Accounting For Business 01naldo nestoNo ratings yet

- Local Media5374970280966884062Document23 pagesLocal Media5374970280966884062Cristine Joy Petallana100% (1)

- Information Processing and Accounting CycleDocument60 pagesInformation Processing and Accounting Cyclemiadjafar463No ratings yet

- Fa Unit 1 - Notes - 20200718004241Document21 pagesFa Unit 1 - Notes - 20200718004241Vignesh CNo ratings yet

- Accounting Concepts and Principles - 2020 Online ClassDocument40 pagesAccounting Concepts and Principles - 2020 Online ClassGhillian Mae GuiangNo ratings yet

- GAAPDocument14 pagesGAAPMr SuTtUNo ratings yet

- Accounts 2 MarksDocument14 pagesAccounts 2 MarkssaranNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

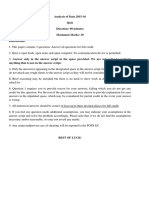

- 2015 Quiz PaperDocument4 pages2015 Quiz PaperAditya ShuklaNo ratings yet

- Corpostrat: First Round - Screening StageDocument1 pageCorpostrat: First Round - Screening StageAditya ShuklaNo ratings yet

- Day 6Document44 pagesDay 6Aditya ShuklaNo ratings yet

- Fin Club InterestDocument1 pageFin Club InterestAditya ShuklaNo ratings yet

- 3M AAAAdityaDocument1 page3M AAAAdityaAditya ShuklaNo ratings yet

- Domd - GNBBDocument3 pagesDomd - GNBBAditya ShuklaNo ratings yet

- StarbucksDocument44 pagesStarbucksJatin KohliNo ratings yet

- FAM Notes Monopoly Onwards PDFDocument19 pagesFAM Notes Monopoly Onwards PDFAditya ShuklaNo ratings yet

- Fin Club InterestDocument1 pageFin Club InterestAditya ShuklaNo ratings yet

- FAM Last Two ClassesDocument6 pagesFAM Last Two ClassesAditya ShuklaNo ratings yet

- Global Security Solutionsfinal2aaaaDocument2 pagesGlobal Security Solutionsfinal2aaaaAditya ShuklaNo ratings yet

- Statement of Cash Flows - Three Examples - Blank FormatDocument3 pagesStatement of Cash Flows - Three Examples - Blank FormatAditya ShuklaNo ratings yet

- TATCHA: Marketing The Beauty Secrets of Japanese GeishaDocument1 pageTATCHA: Marketing The Beauty Secrets of Japanese GeishaAditya ShuklaNo ratings yet

- TedPAD WhiteDocument1 pageTedPAD WhiteDewita SoeharjonoNo ratings yet

- Basics of Accounting: Overview of Hedge FundsDocument12 pagesBasics of Accounting: Overview of Hedge FundsAditya ShuklaNo ratings yet

- Class Action Claims: The D. E. Shaw GroupDocument10 pagesClass Action Claims: The D. E. Shaw GroupAditya ShuklaNo ratings yet

- Chapter 1-Answer KeyDocument1 pageChapter 1-Answer KeyAditya ShuklaNo ratings yet

- Bonds ShawDocument19 pagesBonds ShawAditya ShuklaNo ratings yet

- Spark Program AnnouncementDocument12 pagesSpark Program AnnouncementAditya ShuklaNo ratings yet

- TedPAD WhiteDocument1 pageTedPAD WhiteDewita SoeharjonoNo ratings yet

- Global Security Solutionsfinal2aaaaDocument2 pagesGlobal Security Solutionsfinal2aaaaAditya ShuklaNo ratings yet

- Modeling For Decisions: Sachin Jayaswal Indian Institute of Management Ahmedabad Sachin@iimahd - Ernet.inDocument17 pagesModeling For Decisions: Sachin Jayaswal Indian Institute of Management Ahmedabad Sachin@iimahd - Ernet.inAditya ShuklaNo ratings yet

- Chapter 1-Answer KeyDocument1 pageChapter 1-Answer KeyAditya ShuklaNo ratings yet

- Immunization StrategiesDocument20 pagesImmunization StrategiesnehasoninsNo ratings yet

- ITC Cigarettes WordDocument33 pagesITC Cigarettes WordAditya ShuklaNo ratings yet

- Guide Rail Bracket AssemblyDocument1 pageGuide Rail Bracket AssemblyPrasanth VarrierNo ratings yet

- VERITAS NetBackup 4 (1) .5 On UnixDocument136 pagesVERITAS NetBackup 4 (1) .5 On UnixamsreekuNo ratings yet

- Lesson Plan Cot1Document9 pagesLesson Plan Cot1Paglinawan Al KimNo ratings yet

- Steinecker Boreas: Wort Stripping of The New GenerationDocument16 pagesSteinecker Boreas: Wort Stripping of The New GenerationAlejandro Javier Delgado AraujoNo ratings yet

- Where Business Happens Where Happens: SupportDocument19 pagesWhere Business Happens Where Happens: SupportRahul RamtekkarNo ratings yet

- Acc 13 Februari 23 PagiDocument19 pagesAcc 13 Februari 23 PagisimbahNo ratings yet

- Flyweis Services Pvt. LTDDocument11 pagesFlyweis Services Pvt. LTDFlyweis TechnologyNo ratings yet

- Syllabus 9701 Chemistry AS: AS or A2 UnitsDocument4 pagesSyllabus 9701 Chemistry AS: AS or A2 UnitsHubbak KhanNo ratings yet

- Defence QuestionnaireDocument2 pagesDefence QuestionnaireSumitt SinghNo ratings yet

- Engineering Economics1Document64 pagesEngineering Economics1bala saiNo ratings yet

- Ingredients EnsaymadaDocument3 pagesIngredients Ensaymadajessie OcsNo ratings yet

- PhysioEx Exercise 1 Activity 1Document3 pagesPhysioEx Exercise 1 Activity 1edvin merida proNo ratings yet

- HOWO SERVICE AND MAINTENANCE SCHEDULE SinotruckDocument3 pagesHOWO SERVICE AND MAINTENANCE SCHEDULE SinotruckRPaivaNo ratings yet

- MSC 200Document18 pagesMSC 200Amit KumarNo ratings yet

- SoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDDocument19 pagesSoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDArpit SharmaNo ratings yet

- 1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyDocument1 page1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyMCarmen López CastroNo ratings yet

- Strategy Guide To Twilight Imperium Third EditionDocument74 pagesStrategy Guide To Twilight Imperium Third Editioninquartata100% (1)

- Journal of Power Sources: Binyu Xiong, Jiyun Zhao, Zhongbao Wei, Maria Skyllas-KazacosDocument12 pagesJournal of Power Sources: Binyu Xiong, Jiyun Zhao, Zhongbao Wei, Maria Skyllas-KazacosjayashreeNo ratings yet

- English Literature Coursework Aqa GcseDocument6 pagesEnglish Literature Coursework Aqa Gcsef5d17e05100% (2)

- Oracle® Secure Backup: Installation and Configuration Guide Release 10.4Document178 pagesOracle® Secure Backup: Installation and Configuration Guide Release 10.4andrelmacedoNo ratings yet

- Copy - of - Commonlit - Meet The Fearless Cook Who Secretly Fed and Funded The Civil Rights Movement - StudentDocument6 pagesCopy - of - Commonlit - Meet The Fearless Cook Who Secretly Fed and Funded The Civil Rights Movement - Studentlilywright08No ratings yet

- First Certificate Star SB PDFDocument239 pagesFirst Certificate Star SB PDFPatricia Gallego GálvezNo ratings yet

- Segmentation of Qarshi Industries Private Limited PakistanDocument6 pagesSegmentation of Qarshi Industries Private Limited PakistanReader100% (1)