Professional Documents

Culture Documents

Peachtree Securities, Inc (B-2)

Uploaded by

Rufino Gerard MorenoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Peachtree Securities, Inc (B-2)

Uploaded by

Rufino Gerard MorenoCopyright:

Available Formats

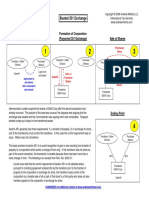

Bond and Stock Valuation

Peachtree Securities,

Inc. (B-2)

What we need to know

Common Stock

A security that represents ownership in a corporation.

Holders exercise control by electing a board of directors

Common stockholders are on the bottom of the priority ladder for

ownership structure

Preferred Stock

A class of ownership in a corporation that has a higher claim on its assets

and earnings than common stock.

Shares do not usually carry voting rights

Dividends are paid to preferred stock before dividends are paid to common

stock

Combines features on debt

Constant Growth Model

Used to find the value of a constant growth stock

Also known as the Gordon Growth Model

What we need to know

Expected Rate of Return

The rate of return expected to be realized from an investment; the

weighted average of the probability distribution of the possible results

Effective Annual Return

The annual rate of interest actually being earned

The rate that would produce the same ending (future)

value if annual compounding had been used.

What we need to know

Expected Rate of Return, k s

The rate of return on a common stock that a shareholder

expects to receive in the future

Dividend Yield, D1/P0

The expected dividend divided by the current price of a share

of stock

Dividend Growth Rate, g

The expected rate of growth in dividends per share

Capital Gains Yield,

The expected rate of growth in dividends per share

6. TECO has $54,956,000 of

preferred stock outstanding

a. Supposed its Series A, which has a $100 par

value and pays a $4.32 percent cumulative

dividend currently sells for $48.00 per share.

What is its nominal expected rate of return? Its

effective annual rate of return?

(Hint: Remember that dividends are paid quarterly. Also, assume

that Expected

this issueRate

is perpetual.

Nominal

of Return

Effective Rate of Return

= (Par Value*Cumulative

Div/Current Price

= (100*4.32%)/$48

= 0.09 or 9.0%

= 1.09308 1

= 0.09308 or 9.31%

6. TECO has $54,956,000 of

preferred stock outstanding

b. Supposed its Series F, with a $100 par value and a $9.75

percent cumulative dividend has a mandatory sinking fund

provision. 60,000 of the 300,000 total shares outstanding

must be redeemed annually at par beginning at the end of

1993. If the nominal required rate of return is 8%, what is the

current (January 1, 1993) value per share?

Sinking Fund Provision

A provision in a bond contract that requires the issuer to retire a

portion of the bond issue each year.

Used to buy back a certain percentage of the bond issue each year

6. TECO has $54,956,000 of

preferred stock outstanding

b. Supposed its Series F, with a $100 par value and a $9.75

percent cumulative dividend has a mandatory sinking fund

provision. 60,000 of the 300,000 total shares outstanding

must be redeemed annually at par beginning at the end of

1993. If the nominal required rate of return is 8%, what is the

current (January 1, 1993) value per share?

What we need to know

Expected Total Return, ks = D1/P0 + [(P1-P0)/P0]

The sum of expected dividend yield and the expected capital

gains yield

For a constant growth firm, expected capital gains yield and

expected dividend yield are constant

Expected Rate of Return, ks = D1/P0 + g

The expected rate of return on a constant growth stock

7. Now consider TECOs common stock. Value Line

estimates TECOs 5-year dividend growth rate to be

6.0% (See Figure 1 in Case 2). Assume that TECOs

stock traded on January 1, 1992 for $22.26. Assume for

now that the 6.0% growth rate is expected to continue

indefinitely.

a. What was TECOs expected rate of return at the

beginning of 1992?

(Hint: Value Line estimated D1 to be $1.80 at the start of 1992. See

Figure 1 in Case 2).

Given:

D1 = $1.80

g = 6%

t = 5 yrs (1992-1997)

Expected Rate of Return

ks = Dividend Yield + Growth

Rate

= D1/P0 + g

= $1.80/$22.26 + 0.06

= 0.08086 + 0.06

= 0.14086 or 14.09%

7. Now consider TECOs common stock. Value Line

estimates TECOs 5-year dividend growth rate to be

6.0% (See Figure 1 in Case 2). Assume that TECOs

stock traded on January 1, 1992 for $22.26. Assume for

now that the 6.0% growth rate is expected to continue

indefinitely.

b. What was the expected dividend yield and

expected capital gains yield on January 1, 1992?

Expected Dividend Yield

= D1/P0

= $1.80/$22.26

= 0.08086 or 8.09%

Given:

Expected Capital Gains Yield

= (P1-P0)/P0

= ($22.26*1.06 + $22.26)/

$22.26

= 0.06 or 6%

The expected capital gains

yield is 6.00% same as the

growth

rate

since

the

company is assumed to have

6% dividend growth rate

indefinitely.

D1 = $1.80

g = 6%

t = 5 yrs (1992-1997)

7. Now consider TECOs common stock. Value Line

estimates TECOs 5-year dividend growth rate to be

6.0% (See Figure 1 in Case 2). Assume that TECOs

stock traded on January 1, 1992 for $22.26. Assume for

now that the 6.0% growth rate is expected to continue

indefinitely.

c. What is the relationship between dividend yield

and capital gains yield over time under constant

growth assumptions?

Year, t

Growth

rate, g

Stock

Price, Pt

0

1

2

3

4

5

6.00%

6.00%

6.00%

6.00%

6.00%

6.00%

$ 21.00

$ 22.26

$ 23.60

$ 25.01

$ 26.51

$ 28.10

Dividend, Dividend

Dt

Yield

$

$

$

$

$

$

1.70

1.80

1.91

2.02

2.14

2.27

8.09%

8.09%

8.09%

8.09%

8.09%

8.09%

Capital

Gains

Yield

6.00%

6.00%

6.00%

6.00%

6.00%

6.00%

Dt

(P1-P0)

Notes:

Pt

P0

Dividend yield and capital gains yield are directly

correlated

and remains constant under the constant growth

assumptions.

= Previous stock = Previous div

price * (1+g)

amount * (1+g)

7. Now consider TECOs common stock. Value Line

estimates TECOs 5-year dividend growth rate to be

6.0% (See Figure 1 in Case 2). Assume that TECOs

stock traded on January 1, 1992 for $22.26. Assume for

now that the 6.0% growth rate is expected to continue

indefinitely.

d. What conditions must hold to use the constant

growth (Gordon) model? Do many real world

stocks satisfy the constant growth assumptions?

The dividend is expected to grow forever at a constant rate, g

The stock price is expected to grow at this same rate

The expected dividend yield is a constant

The expected capital gains yield is also a constant, and it equal to g

The expected total rate of return, k s, is equal to the expected dividend

yield plus the expected growth rate: k s = dividend yield + g

Earnings growth results from a number of factors including (1) inflation, (2) the

amount of earnings the company retains and reinvests and the (3) rate of return the

company earns on its equity (ROE). Inflation might vary during different periods,

regulations and economic policies might affect the direction and profitability of

businesses and organizational strategy and corporate events might affect investors

perception of the company affecting its price value. The Gordon Constant growth

model is effective for companies with mature and stable history of growth.

What we need to know

Total Company (Corporate Value) Model

A valuation model used as an alternative to the dividend growth model to

determine the value of a firm, especially one that does not pay dividends or is

privately held.

Discounts a firms free cash flows at the WACC to determine its value.

Vcompany = PV of expected future free cash flows

=

FCF1

+

FCF1

++

FCF

.

(1 + WACC)1 (1 + WACC)2

(1 + WACC)

Free Cash Flows

Cash generated before making any payments to common or preferred

stockholders or to bond holders; Cash flow available to all investors

Discounted at the companys weighted average cost of debt, preferred

stock and common stock (WACC)

FCF = NOPAT Net new investment in operating capital

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

a. What was the value of TECO stock on January 1,

1992, if the required rate of return is 13.5%?

Given:

g (yr 1-5) = 6% t = 10

g (6 onwards) = 7.5%

What we need to know

Equilibrium

The condition under which the expected return on a security is just equal to

its required return

price is stable

Conditions:

1. A stocks expected rate of return as seen by the marginal investor must

equal its required rate of return; k hat = k

2. The actual market prices of the stock must equal its intrinsic value as

estimated by the marginal investor; P 0 hat = P0

Free Cash Flows

Cash generated before making any payments to common or preferred

stockholders or to bond holders; Cash flow available to all investors

Discounted at the companys weighted average cost of debt, preferred

stock and common stock (WACC)

FCF = NOPAT Net new investment in operating capital

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

b. What is the expected stock price at the end of

1992 assuming that the stock is in equilibrium?

If the stock is in equilibrium, the required rate of return must

equal the expected rate of return.

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

c. What is the expected dividend yield, capital

gains yield, and total return for 1992?

Capital Gains Yield

Expected Dividend

= (P1 -P0)/P0

Yield

= ($30.62 - $28.56)/

= D1/P0

$28.56

= $1.80/28.56

= 0.07198 or 7.20%

= 0.06303 or 6.30%

Total Rate of Return

= EDY + ECGY

= 6.30% + 7.20%

= 13.50%

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

d. Suppose TECOs dividend was expected to remain

constant at $1.80 for the next 5 years and then grow at

a constant 6% rate. If the required rate of return is

13.5%, would TECOs stock value be higher or lower

than your answer in Part A? if you are using the Lotus

model for the case, calculate the dividend yield, capital

gains yield, and total yield from 1992 through 1996.

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

The value of

share became

$19.76 which

is lower than

the $28.56

provided in A.

If the dividend remain constant at $1.8 per share,

TECOs expected stock value will fall by $8.8 per

share. Comparing to the initial trading price of

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

e. TECOs stock price was $22.26 at the beginning of 1992.

Using the growth rates given in the introduction to this

question, what is the stocks expected rate of return?

8. Suppose you believe that TECOs 6.0% dividend

growth rate will only hold for 5 years. After that, the

growth rate will return to TECOs historical 10-year

average of 7.5%. Note that D6 = D5 x 0.075 (again, see

Figure 1 in Case 2).

f. Refer back to Figure 1 in Case 2. Look at the % Earned

Common Equity estimated for 1995 through 1997 and at

the projected earnings and dividends per share for the same

period. Could those figures be used to develop an estimated

long-run sustainable growth rate? Does this figure support

the 7.5% growth rate given in the problem? (Hint: Think of the

formula g = br = (retention ratio)(ROE).)

9. Common stocks are usually valued assuming annual

dividends even though dividend are actually paid

quarterly. This is because stream is so uncertain that

the use of a quarterly model is not warranted.

The quarterly constant growth valuation model is:

Where P0 is the stocks value and Dqi is the dividend in

Quarter i. Note that this model assumes that dividend

growth occurs once every year rather than at every quarter.

Assume that TECOs next four quarterly dividends are

$1.80/4 = $0.45 each; that k, the annual required rate of

return, is 13.5% and that g is a constant 6.0%. What is

TECOs value according to the quarterly model

9. Common stocks are usually valued assuming annual

dividends even though dividend are actually paid

quarterly. This is because stream is so uncertain that

the use of a quarterly model is not warranted.

The quarterly constant growth valuation model is:

Given:

D1 = $1.80;

Dqi = $0.45

k = 13.5%

g = 6%

Quarte

r

1

2

3

4

Divq

$

$

0.45

0.75

$

$

0.45

0.50

$

$

0.45

0.25

$

$

0.45

Total Annual

CF

k-g

=

PVs

Dqi(1+k)i

13.50%

$ 0.4948

13.50%

$ 0.4794

13.50%

$ 0.4645

13.50%

$ 0.4500

$ 1.8887

13.5% - 6%

7.5%

You might also like

- PeachTree Securities (B-2) FINALDocument45 pagesPeachTree Securities (B-2) FINALish june100% (1)

- Peachtree Securities Inc.Document24 pagesPeachtree Securities Inc.Rufino Gerard Moreno83% (6)

- Peachtree Securities (B)Document26 pagesPeachtree Securities (B)Rufino Gerard MorenoNo ratings yet

- Peachtree SecuritiesDocument55 pagesPeachtree SecuritiesLouredaine MalingNo ratings yet

- Peachtree A Complete AnswersDocument5 pagesPeachtree A Complete AnswersPhilip JosephNo ratings yet

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Document16 pagesAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiNo ratings yet

- Robert Montoya Case LearningsDocument4 pagesRobert Montoya Case Learningsish juneNo ratings yet

- Case #84 Risk and Rates of Return - Filmore EnterprisesDocument9 pagesCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Mark XDocument10 pagesMark XJennifer Ayers0% (2)

- Peachtree Securities Inc. (A) Answers - Irish JuneDocument8 pagesPeachtree Securities Inc. (A) Answers - Irish Juneish juneNo ratings yet

- Mini Case 29Document3 pagesMini Case 29Avon Jade RamosNo ratings yet

- 08 Corporate BondsDocument4 pages08 Corporate Bondspriandhita asmoro75% (4)

- RMontoya SolutaDocument21 pagesRMontoya SolutaTy Best CoonNo ratings yet

- Asignacion Unidad 2Document6 pagesAsignacion Unidad 2Angel L Rolon TorresNo ratings yet

- Online Quiz 3 Duration Q&ADocument3 pagesOnline Quiz 3 Duration Q&AjonNo ratings yet

- Case 1 - Financial Analysis and Planning Fall 2010Document9 pagesCase 1 - Financial Analysis and Planning Fall 2010AmnaMohamedNo ratings yet

- Modigliani & Miller Capital Structure TheoryDocument2 pagesModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosNo ratings yet

- Case 1Document6 pagesCase 1Mitul M Rathod100% (4)

- 07 Time Value of Money - BE ExercisesDocument26 pages07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNo ratings yet

- Finance Chapter 16Document42 pagesFinance Chapter 16courtdubs67% (3)

- Chap 5Document52 pagesChap 5jacks ocNo ratings yet

- Can One Size Fit All?Document21 pagesCan One Size Fit All?Abhimanyu ChoudharyNo ratings yet

- The Dilemma at Day Pro-CaseDocument7 pagesThe Dilemma at Day Pro-CaseTheknower Ofitall50% (2)

- Ch05 Bond Valuation SoluationsDocument6 pagesCh05 Bond Valuation SoluationsSeema Kiran50% (2)

- IFM PresentsiDocument4 pagesIFM PresentsiRezky Pratama Putra0% (1)

- Case StudyDocument6 pagesCase StudyWelshfyn ConstantinoNo ratings yet

- Bond ValuationDocument15 pagesBond ValuationZahid Usman100% (1)

- Answers To Problem Sets: Net Present Value and Other Investment CriteriaDocument9 pagesAnswers To Problem Sets: Net Present Value and Other Investment CriteriaTracywongNo ratings yet

- TB Chapter08Document79 pagesTB Chapter08CGNo ratings yet

- Bonds and Stocks SolutionsDocument3 pagesBonds and Stocks SolutionsLucas AbudNo ratings yet

- Case 11Document10 pagesCase 11Trương Quốc VũNo ratings yet

- Finance Chapter 18Document35 pagesFinance Chapter 18courtdubs100% (1)

- 08 LasherIM Ch08Document20 pages08 LasherIM Ch08Ed Donaldy100% (2)

- Stocks ValuationDocument102 pagesStocks ValuationKatherine Cabading InocandoNo ratings yet

- Self-Test Problems Problem 1: Bond ValuationDocument5 pagesSelf-Test Problems Problem 1: Bond ValuationSeulgi MoonNo ratings yet

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocument8 pagesAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNo ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital Problemsshikha_asr2273No ratings yet

- Chap 3 SolutionsDocument70 pagesChap 3 SolutionsHoàng Huy80% (10)

- Chapter 3 Time Value of MoneyDocument17 pagesChapter 3 Time Value of MoneywubeNo ratings yet

- Ch04 P35 Build A ModelDocument17 pagesCh04 P35 Build A ModelAbhishek Surana100% (2)

- Market-Based Valuation: Price MultiplesDocument28 pagesMarket-Based Valuation: Price MultiplesShaikh Saifullah KhalidNo ratings yet

- Time Value of MoneyDocument52 pagesTime Value of MoneyJasmine Lailani ChulipaNo ratings yet

- Finance Chapter 17Document30 pagesFinance Chapter 17courtdubs75% (4)

- HOMEWORKDocument7 pagesHOMEWORKReinaldo RoseroNo ratings yet

- Answer:: Stock ValuationDocument3 pagesAnswer:: Stock Valuationmuhammad hasanNo ratings yet

- Tutorial 1 AnswersDocument3 pagesTutorial 1 AnswersAmeer FulatNo ratings yet

- CH 5 Security Market IndexesDocument12 pagesCH 5 Security Market IndexesMoin khanNo ratings yet

- Case 04 (Old) - Can One Size Fit All - SolutiondsfsdDocument4 pagesCase 04 (Old) - Can One Size Fit All - SolutiondsfsdFitria Hasanah100% (4)

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Ss 2Document6 pagesSs 2Lim Kuan YiouNo ratings yet

- Bond ValuationDocument2 pagesBond ValuationIkram Ul Haq0% (1)

- Valuation of Stocks & Bonds: Bfinma2: Financial Management P-2Document47 pagesValuation of Stocks & Bonds: Bfinma2: Financial Management P-2Dufuxwerr WerrNo ratings yet

- Chapter 10 MishkinDocument22 pagesChapter 10 MishkinLejla HodzicNo ratings yet

- Chapter 05 Risk and Return Past and PrologueDocument30 pagesChapter 05 Risk and Return Past and PrologueThanh Lê0% (1)

- FRA Level 2 Question BankDocument244 pagesFRA Level 2 Question Bankamaresh gautam50% (2)

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- 04 The Value of Common StocksDocument5 pages04 The Value of Common StocksMộng Nghi TôNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- Basic Stock ValuationDocument9 pagesBasic Stock Valuationdalila123a50% (2)

- Chapter 4 Valuation of Bonds and Cost of CspitalDocument24 pagesChapter 4 Valuation of Bonds and Cost of Cspitalanteneh hailie100% (7)

- MBADocument10 pagesMBARufino Gerard MorenoNo ratings yet

- Is The Philippines Ready For Federalism?Document27 pagesIs The Philippines Ready For Federalism?Rufino Gerard MorenoNo ratings yet

- Quantitative Methods: Time-Series ForecastingDocument9 pagesQuantitative Methods: Time-Series ForecastingRufino Gerard MorenoNo ratings yet

- Samsung Electronics Co As of Feb9 - 10AMDocument34 pagesSamsung Electronics Co As of Feb9 - 10AMRufino Gerard MorenoNo ratings yet

- RMSE Computation in ExcelDocument2 pagesRMSE Computation in ExcelRufino Gerard MorenoNo ratings yet

- SEC Corporate Governance Blueprint Oct 29 2015 PDFDocument80 pagesSEC Corporate Governance Blueprint Oct 29 2015 PDFRufino Gerard MorenoNo ratings yet

- 2016 Pcso Manual of Corporate GovernanceDocument167 pages2016 Pcso Manual of Corporate GovernanceRufino Gerard Moreno100% (1)

- The Inequitable Appeal OriginalDocument19 pagesThe Inequitable Appeal OriginalRufino Gerard MorenoNo ratings yet

- PCSO Performance Scorecard 2013 2014Document12 pagesPCSO Performance Scorecard 2013 2014Rufino Gerard MorenoNo ratings yet

- Dilg Joincircular 201534 Eb60b107faDocument33 pagesDilg Joincircular 201534 Eb60b107faRufino Gerard MorenoNo ratings yet

- Audit Committee 1Document4 pagesAudit Committee 1Rufino Gerard MorenoNo ratings yet

- Compen and Remu CommDocument2 pagesCompen and Remu CommRufino Gerard MorenoNo ratings yet

- Lnterim: Annex Philippine Charity Sweepstakes Office PerformanceDocument6 pagesLnterim: Annex Philippine Charity Sweepstakes Office PerformanceRufino Gerard MorenoNo ratings yet

- Coverage: 2016 PCSO Manual of Corporate GovernanceDocument1 pageCoverage: 2016 PCSO Manual of Corporate GovernanceRufino Gerard MorenoNo ratings yet

- StramaCaseNo 2 PDFDocument13 pagesStramaCaseNo 2 PDFRufino Gerard Moreno100% (2)

- The Unenforceable Contracts) 1Document19 pagesThe Unenforceable Contracts) 1Rufino Gerard MorenoNo ratings yet

- I Obligations: Articles 1156 To 1304 of The Civil Code of The PhilippinesDocument17 pagesI Obligations: Articles 1156 To 1304 of The Civil Code of The PhilippinesRufino Gerard MorenoNo ratings yet

- Intermountain LumberDocument1 pageIntermountain LumberRufino Gerard MorenoNo ratings yet

- The Assessment of Commitment Advantages 20160304-23824-Lv3730Document17 pagesThe Assessment of Commitment Advantages 20160304-23824-Lv3730Rufino Gerard MorenoNo ratings yet

- Tinio OpermanmidtermsDocument5 pagesTinio OpermanmidtermsRufino Gerard MorenoNo ratings yet

- FIN630 Short Notes For Lecture 23-45 by Humaira PDFDocument45 pagesFIN630 Short Notes For Lecture 23-45 by Humaira PDFsohaib shahidNo ratings yet

- Fabozzi Bmas7 Ch23 ImDocument37 pagesFabozzi Bmas7 Ch23 ImSandeep SidanaNo ratings yet

- Chapter Five: Interest Rate Determination and Bond ValuationDocument38 pagesChapter Five: Interest Rate Determination and Bond ValuationMikias DegwaleNo ratings yet

- Ram Jethmalani's Letter To P. Chidambaram in NDTV Money Laundering MatterDocument33 pagesRam Jethmalani's Letter To P. Chidambaram in NDTV Money Laundering Matterpcwedsndtv100% (14)

- CapSim Quiz Sample QuestionsDocument2 pagesCapSim Quiz Sample QuestionsDanieNo ratings yet

- MKT81752HL 02Document40 pagesMKT81752HL 020idmey4dNo ratings yet

- Testbank Financial Management Finance 301Document60 pagesTestbank Financial Management Finance 301منیر ساداتNo ratings yet

- Chapter 10a - Long Term Finance - BondsDocument6 pagesChapter 10a - Long Term Finance - BondsTAN YUN YUNNo ratings yet

- Drivers of Liquidity in Corp BondsDocument38 pagesDrivers of Liquidity in Corp BondssoumensahilNo ratings yet

- Christensen 12e Chap08 EffectiveInterest 2019Document72 pagesChristensen 12e Chap08 EffectiveInterest 2019Difa100% (1)

- The Math of Intrinsic ValueDocument33 pagesThe Math of Intrinsic ValuelogeshmechNo ratings yet

- Review of Bond & StockDocument3 pagesReview of Bond & StockbalachmalikNo ratings yet

- Chapter 13Document30 pagesChapter 13REEMA BNo ratings yet

- Fixed Income Valuation (SAPM)Document26 pagesFixed Income Valuation (SAPM)sairaj bhatkarNo ratings yet

- PDF Chapter 05 Answer - CompressDocument5 pagesPDF Chapter 05 Answer - CompressChryshelle LontokNo ratings yet

- BUS328 Lê-Th Y-Tiên 1632300120 HW W4Document6 pagesBUS328 Lê-Th Y-Tiên 1632300120 HW W4GuruBaluLeoKing0% (1)

- Dividend Assignment ReportDocument20 pagesDividend Assignment ReportSadia Afroz LeezaNo ratings yet

- Financial Markets and Institutions 6th Edition Saunders Solutions Manual 1Document9 pagesFinancial Markets and Institutions 6th Edition Saunders Solutions Manual 1jess100% (32)

- Cost of CapitalDocument16 pagesCost of CapitalSirshajit SanfuiNo ratings yet

- Rec LTD: 2. P/E 5.11 3. Book Value (RS) 209Document4 pagesRec LTD: 2. P/E 5.11 3. Book Value (RS) 209Srini VasanNo ratings yet

- Course No. Course Title Instructor-In-ChargeDocument4 pagesCourse No. Course Title Instructor-In-ChargeAryan JainNo ratings yet

- International Bond MarketDocument15 pagesInternational Bond MarketHarvinton LiNo ratings yet

- A Study On Financial Performance Analysis: Profitability RatiosDocument24 pagesA Study On Financial Performance Analysis: Profitability RatiosEprinthousespNo ratings yet

- Prop Af223025a99kjen2 PDFDocument8 pagesProp Af223025a99kjen2 PDFCKhae SumaitNo ratings yet

- Chap 3 Bonds and Their ValuationDocument42 pagesChap 3 Bonds and Their ValuationShahzad C7No ratings yet

- F9 ACCA - Notes You Will Not ForgetDocument19 pagesF9 ACCA - Notes You Will Not Forgetadnan79100% (3)

- Asx24 Contract SpecificationsDocument42 pagesAsx24 Contract SpecificationsJohn SalazarNo ratings yet

- DRM CompDocument4 pagesDRM CompHarsh JaiswalNo ratings yet

- Determinants of Dividend Policies in Pharmaceutical Industry 71Document49 pagesDeterminants of Dividend Policies in Pharmaceutical Industry 71Raghuram Seshabhattar100% (1)

- Unit6 2-ValuationofPreferredandCommonStockDocument77 pagesUnit6 2-ValuationofPreferredandCommonStockHay JirenyaaNo ratings yet