Professional Documents

Culture Documents

The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and Revenues

Uploaded by

EricKHLeawOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and Revenues

Uploaded by

EricKHLeawCopyright:

Available Formats

Slide 4.

Chapter 4

The effect of profit or loss on

capital and the double entry

system for expenses and

revenues

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.2

Learning objectives

After you have studied this chapter, you

should be able to:

Calculate profit by comparing revenue with

expenses

Explain how the accounting equation is

used to show the effects of changes in

assets and liabilities upon capital after

goods or services have been traded

Explain why separate accounts are used for

each type of expense and revenue

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.3

Learning objectives (Continued)

Explain

why an expense is entered as a

debit in the appropriate expense account

Explain why an item of revenue is entered

as a credit in the appropriate revenue

account

Enter a series of expense and revenue

transactions into the appropriate T-accounts

Explain how the use of business cash and

business goods for the owners own

purposes are dealt with in the accounting

records

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.4

The nature of profit or loss

Profit

means the amount by which

revenue is greater than expenses for a set

of transactions, where:

Revenue means the sales value of goods

and services that have been supplied to

customers.

Expenses means the cost value of all the

assets that have been used up to obtain

these revenues.

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.5

The Nature of Profit & Loss

Profit

= Revenue Expenses

Profit = the amount by which revenues are

greater than expenses for a set of

transactions

Revenue = the sales value of goods and

services that have been supplied to

customers

Expenses = the cost value of all the assets

that have been used up to obtain those

revenues

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.6

Calculating profit

If we supplied goods and services valued for

sale at 100,000 to customers, and the

expenses incurred by us in order to supply

those goods and services amounted to

70,000, the result would be a profit of

30,000:

Revenue

100,000

Less expenses

(70,000)

Profit

30,000

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.7

The effect of profit and loss on

capital

The

accounting equation we have used is:

Capital = Assets Liabilities

When

profit has been earned, this

increases capital:

Old capital + Profit = New capital

Or

when a loss has been earned, the

capital figure decreases:

Old capital Loss = New capital

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.8

Recording expenses

In order to calculate profit, expenses must

be entered into appropriate accounts. A

separate account is opened for each type

of expense:

Bank interest account

Subscriptions account

Rent account

Overdraft interest

account

Motor expenses

account

Postages

account

Audit fees account

Telephone account

Stationery

account

Insurance account

General expenses

account

Wages account

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.9

Debit or credit

Assets

and expenses involve expenditure

by the business and are shown as debit

entries because they must ultimately be

paid for.

Revenue

is the opposite of expenses and

therefore revenue entries appear on the

credit side of the revenue accounts.

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

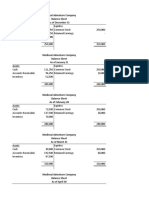

Slide 4.10

Debit or credit (Continued)

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.11

Double entries for expenses

and revenues

Rent of 200 is paid in cash:

Debit the rent account with 200

Credit the cash account with 200

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.12

Double entries for expenses

and revenues (Continued)

Motor expenses of 355 are paid by cheque:

Debit the motor expenses account with 355

Credit the bank account with 355

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.13

Double entries for expenses

and revenues (Continued)

60 cash is received for commission

earned by the business:

Debit the cash account with 60

Credit the commissions received account with

60

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.14

Activity

June 1 Paid for postage stamps by cash

50

June 2 Paid for electricity by cheque 229

June 3 Received rent in cash 138

June 4 Paid insurance by cheque 142

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.15

Activity (Continued)

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.16

Drawings

Money

that the owner takes from the

business for private use is called

drawings.

Drawings reduces capital they are

never an expense of the business.

An increase in drawings is a debit entry

in the drawings account.

The credit entry is against cash or bank

if money was taken from the business,

or purchases if stock was taken.

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.17

Drawings

Drawings

Expenses of a business

Drawings = cash and physical goods

taken out from the business for the

owners private

Drawing =

Capital

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.18

Accounting Entries

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.19

Recording drawings

On 25 August, the owner takes 50 cash

out of the business for his own use:

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.20

Recording drawings (Continued)

On 28 August, the owner takes 400 of

goods out of the business for his own use:

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.21

Learning outcomes

You should have now learnt:

1.How to calculate profit by comparing

revenue with expenses

2.That the accounting equation is central to

any explanation of the effect of trading

upon capital

3.Why every different type of expense is

shown in a separate expense account

4.Why every different type of revenue is

shown in a separate revenue account

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.22

Learning outcomes (Continued)

5. Why

an expense is shown as a debit entry

in the appropriate expense account

6. Why revenue is shown as a credit entry in

the appropriate revenue account

7. How to enter a series of expense and

revenue transactions into the appropriate

T-accounts

8. What is meant by the term drawings

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

Slide 4.23

Learning outcomes (Continued)

That drawings are always a reduction in

capital and never an expense of a

business

10. How to record drawings of cash in the

accounting books

11. How to record drawings of goods in the

accounting books

9.

Frank Wood and Alan Sangster, Frank Woods Business Accounting 1, 12th Edition, Pearson Education Limited 2012

You might also like

- The Double Entry System For Assets, Liabilities and CapitalDocument25 pagesThe Double Entry System For Assets, Liabilities and CapitalEricKHLeawNo ratings yet

- Chapter 7Document26 pagesChapter 7EricKHLeawNo ratings yet

- CH 6Document14 pagesCH 6EffeNo ratings yet

- Assessment and Teaching of 21st Century SkillsDocument62 pagesAssessment and Teaching of 21st Century SkillscripamontiNo ratings yet

- Example of Business PlanDocument22 pagesExample of Business PlanIustin VoineaNo ratings yet

- 3 Subject Content: 1 The Fundamentals of Accounting 1.1 The Purpose of AccountingDocument7 pages3 Subject Content: 1 The Fundamentals of Accounting 1.1 The Purpose of AccountingLeow Zi LiangNo ratings yet

- Igcse Accounting Sole Trader Question OnlyDocument10 pagesIgcse Accounting Sole Trader Question OnlySara HassanNo ratings yet

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingAhrian BenaNo ratings yet

- ACC 202 Financial Reporting UpdatesDocument25 pagesACC 202 Financial Reporting UpdatesherueuxNo ratings yet

- Pom NotesDocument16 pagesPom NotesYash MakhijaNo ratings yet

- 10 Igcse - Accounting - Partnerships - F.unlocked PDFDocument55 pages10 Igcse - Accounting - Partnerships - F.unlocked PDFshivom talrejaNo ratings yet

- 11 Igcse - Accounting - Prepayments - Accruals - Unlocked PDFDocument13 pages11 Igcse - Accounting - Prepayments - Accruals - Unlocked PDFshivom talrejaNo ratings yet

- 10 Key Policies Procedures Every Organization Needs 1681624451Document11 pages10 Key Policies Procedures Every Organization Needs 1681624451Gladys Kong100% (1)

- The Data Collection Survey For The Development of Yangon Port in Republic of The Union of MyanmarDocument270 pagesThe Data Collection Survey For The Development of Yangon Port in Republic of The Union of MyanmarHtoo WaiNo ratings yet

- ALL COMBINED PDF'S - Compressed PDFDocument489 pagesALL COMBINED PDF'S - Compressed PDFshivom talrejaNo ratings yet

- Cambridge Primary Science 2nd WB 2 (S.A.files?)Document90 pagesCambridge Primary Science 2nd WB 2 (S.A.files?)SARAH SIDDIQUINo ratings yet

- Chapter 1 Introduction To POMDocument24 pagesChapter 1 Introduction To POMvasanirinkalNo ratings yet

- 0 - 136904 - 17may2018104716 - CGBT-HSE-010-M - PIRP JDC OCT16Document7 pages0 - 136904 - 17may2018104716 - CGBT-HSE-010-M - PIRP JDC OCT16yeNo ratings yet

- IGCSE Accounting Trial BalanceDocument2 pagesIGCSE Accounting Trial BalanceHiNo ratings yet

- OPM PII protection policyDocument15 pagesOPM PII protection policyMark SpeakmanNo ratings yet

- Project-Based Learning As 21st Century Teaching APDocument12 pagesProject-Based Learning As 21st Century Teaching APsalie29296No ratings yet

- Myanmar - Scoping Paper Myanmar Coastal Zone Management 211113 96dpiDocument76 pagesMyanmar - Scoping Paper Myanmar Coastal Zone Management 211113 96dpiMin Moe100% (1)

- Reactivating WHSmith: Applying Operations Management Principles in a Case StudyDocument9 pagesReactivating WHSmith: Applying Operations Management Principles in a Case StudySheikh Muhammad ShabbirNo ratings yet

- Secure Coding EmbeddedDocument32 pagesSecure Coding EmbeddedMohammed Irfan100% (1)

- Myanmar's Offshore Oil & Gas ArenaDocument17 pagesMyanmar's Offshore Oil & Gas ArenaRyanLinNo ratings yet

- Apptega's Anti-Virus PolicyDocument6 pagesApptega's Anti-Virus Policysfdvsfdv100% (1)

- Frank Wood's Business Accounting 1 Twelfth EditionDocument29 pagesFrank Wood's Business Accounting 1 Twelfth EditionEricKHLeaw100% (2)

- Lecture 2 - The Double Entry System For - Assets, Liabilities and CapitalDocument27 pagesLecture 2 - The Double Entry System For - Assets, Liabilities and CapitalIsaacNo ratings yet

- Returns Day BooksDocument26 pagesReturns Day BooksIsaacNo ratings yet

- Receipts and PaymentsDocument23 pagesReceipts and Payments강준구No ratings yet

- Goodwill For Sole Proprietors and Partnerships: Frank Wood's Business Accounting 1, 12Document30 pagesGoodwill For Sole Proprietors and Partnerships: Frank Wood's Business Accounting 1, 12F2070 CHOO KEN HWANo ratings yet

- Chap22 - Accruals - PrepaymentsDocument24 pagesChap22 - Accruals - PrepaymentsLinh Le Thi ThuyNo ratings yet

- Topic 1 BA100 IntroDocument14 pagesTopic 1 BA100 IntroEricKHLeawNo ratings yet

- Chap21 - Capital Vs Revenue ExpenditureDocument7 pagesChap21 - Capital Vs Revenue ExpenditureLinh Le Thi ThuyNo ratings yet

- Financial AccountingDocument17 pagesFinancial Accountingashibhallau100% (1)

- The Journal: Frank Wood's Business Accounting 1, 12Document25 pagesThe Journal: Frank Wood's Business Accounting 1, 12Kofi AsaaseNo ratings yet

- A Level AccountingDocument5 pagesA Level AccountingMichal DomanskiNo ratings yet

- CH 1Document22 pagesCH 1Nabeel AliNo ratings yet

- Financial Management AssignmentDocument53 pagesFinancial Management Assignmentmuleta100% (1)

- CH 13Document22 pagesCH 13Waseem AhmedNo ratings yet

- Chapter 5Document17 pagesChapter 5EricKHLeawNo ratings yet

- Frank Wood's Business Accounting 1, 12Document22 pagesFrank Wood's Business Accounting 1, 12Zain Wahab GmNo ratings yet

- BFM205 Week 1Document33 pagesBFM205 Week 1Nishant ShahNo ratings yet

- Unit 10 Financial Accounting and ReportingDocument11 pagesUnit 10 Financial Accounting and ReportingMohammadAhmad0% (2)

- CH 13Document22 pagesCH 13Waseem AhmedNo ratings yet

- Chap04 Expenses RevenueDocument17 pagesChap04 Expenses RevenueLinh Le Thi ThuyNo ratings yet

- Manufacturing AccountsDocument16 pagesManufacturing AccountsKen IrokNo ratings yet

- Lecture 1 - Seminar QuestionsDocument5 pagesLecture 1 - Seminar Questionsbehzadji7No ratings yet

- Chapter 3Document31 pagesChapter 3EricKHLeawNo ratings yet

- Statements of Profit or Loss and Statements of Financial Position: Further ConsiderationsDocument17 pagesStatements of Profit or Loss and Statements of Financial Position: Further ConsiderationsRoxana AntociNo ratings yet

- The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenuesDocument20 pagesThe Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenueszainNo ratings yet

- CH 04Document61 pagesCH 04Sagar NairNo ratings yet

- Assignment Front Sheet: BusinessDocument13 pagesAssignment Front Sheet: BusinessHassan AsgharNo ratings yet

- Kimmel, Weygandt, Kieso: Tools For Business Decision Making, 2nd EdDocument50 pagesKimmel, Weygandt, Kieso: Tools For Business Decision Making, 2nd EdShoib RahmanNo ratings yet

- Fa Mod1 Ont 0910Document511 pagesFa Mod1 Ont 0910subash1111@gmail.comNo ratings yet

- Chap 004Document66 pagesChap 004poiriejsNo ratings yet

- Tutorial 5Document165 pagesTutorial 5Irene WongNo ratings yet

- Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFDocument6 pagesLecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFjasminetsoNo ratings yet

- Financial Accounting BasicsDocument24 pagesFinancial Accounting BasicsMonirHRNo ratings yet

- Revision MidtermDocument1 pageRevision MidtermEricKHLeawNo ratings yet

- Vistana Hotel: - Elaine Leaw - Choo Teck Cheng - Khaw Chuan Xuan - Tan Huey WenDocument13 pagesVistana Hotel: - Elaine Leaw - Choo Teck Cheng - Khaw Chuan Xuan - Tan Huey WenEricKHLeawNo ratings yet

- Strategic Management RevisionDocument4 pagesStrategic Management RevisionEricKHLeawNo ratings yet

- Common Module ListssssDocument2 pagesCommon Module ListssssJeffrey ButlerNo ratings yet

- Strategic Management RevisionDocument4 pagesStrategic Management RevisionEricKHLeawNo ratings yet

- Marketing Strategy and Competitive Positioning PDFDocument647 pagesMarketing Strategy and Competitive Positioning PDFEricKHLeawNo ratings yet

- Marketing Strategy and Competitive Positioning PDFDocument647 pagesMarketing Strategy and Competitive Positioning PDFEricKHLeawNo ratings yet

- Creative IMC Message StrategiesDocument36 pagesCreative IMC Message StrategiesEricKHLeawNo ratings yet

- Chapter 5Document17 pagesChapter 5EricKHLeawNo ratings yet

- Chapter 5Document17 pagesChapter 5EricKHLeawNo ratings yet

- Chapter 3Document31 pagesChapter 3EricKHLeawNo ratings yet

- Frank Wood's Business Accounting 1 Twelfth EditionDocument29 pagesFrank Wood's Business Accounting 1 Twelfth EditionEricKHLeaw100% (2)

- Groupon Final PDFDocument57 pagesGroupon Final PDFEricKHLeawNo ratings yet

- Brand Impact On Purchasing Intention. An Approach in Virtual SocialDocument9 pagesBrand Impact On Purchasing Intention. An Approach in Virtual SocialEricKHLeawNo ratings yet

- Chapter 1 - PersistDocument19 pagesChapter 1 - PersistEricKHLeawNo ratings yet

- Trends: 1. Mobile commerce/M-Commerce 2. Loyalty Programs Key Threats: 1. Intense Competition 2. Waning Customers Activity/less Customers ActivityDocument1 pageTrends: 1. Mobile commerce/M-Commerce 2. Loyalty Programs Key Threats: 1. Intense Competition 2. Waning Customers Activity/less Customers ActivityEricKHLeawNo ratings yet

- MH370: Lost Malaysia Airlines Flight to BeijingDocument1 pageMH370: Lost Malaysia Airlines Flight to BeijingEricKHLeawNo ratings yet

- Planning and Creating A Value Proposition: The Offer: Inc. Publishing As Prentice HallDocument31 pagesPlanning and Creating A Value Proposition: The Offer: Inc. Publishing As Prentice HallEricKHLeawNo ratings yet

- Topic 1 BA100 IntroDocument14 pagesTopic 1 BA100 IntroEricKHLeawNo ratings yet

- Corporate Social Responsibility in Commercial BankingDocument3 pagesCorporate Social Responsibility in Commercial BankingEricKHLeawNo ratings yet

- BB202 Business Math Group AssignmentDocument2 pagesBB202 Business Math Group AssignmentEricKHLeaw100% (1)

- Corporate Social Responsibility in CommercialDocument21 pagesCorporate Social Responsibility in CommercialEricKHLeaw100% (1)

- Company Overview - Davis IndustriesDocument4 pagesCompany Overview - Davis IndustriesdeepikaNo ratings yet

- Marginal CostingDocument17 pagesMarginal CostingGarima Singh ChandelNo ratings yet

- REED FileDocument4 pagesREED FileJake VargasNo ratings yet

- Accounting Principles Question Paper, Answers and Examiners CommentsDocument24 pagesAccounting Principles Question Paper, Answers and Examiners CommentsRyanNo ratings yet

- Balance Sheet: As at 31st March, 2015Document2 pagesBalance Sheet: As at 31st March, 2015Dhairyaa BhardwajNo ratings yet

- Tan, Ma. Cecilia ADocument20 pagesTan, Ma. Cecilia ACecilia TanNo ratings yet

- Cost Concepts and Behavior ChapterDocument3 pagesCost Concepts and Behavior ChapterPattraniteNo ratings yet

- Partnership Operation Practice Problems PDFDocument11 pagesPartnership Operation Practice Problems PDFMeleen TadenaNo ratings yet

- Reporting and Analyzing Receivables: QuestionsDocument25 pagesReporting and Analyzing Receivables: QuestionsAstrid LimónNo ratings yet

- Differential Cost AnalysisDocument7 pagesDifferential Cost AnalysisSalman AzeemNo ratings yet

- Amalgamation of Companies and External Reconstruction QuestionsDocument12 pagesAmalgamation of Companies and External Reconstruction Questionskashish mehtaNo ratings yet

- Project Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Document20 pagesProject Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Arun OusephNo ratings yet

- Business MathDocument4 pagesBusiness MathShekinah HuertaNo ratings yet

- Business FInance Week 3 and 4Document68 pagesBusiness FInance Week 3 and 4Jonathan De villa100% (1)

- 5_6338931490453195887Document11 pages5_6338931490453195887martinfaith958No ratings yet

- Vendor Application Form SummaryDocument2 pagesVendor Application Form Summarykiki adamNo ratings yet

- Annual Report Non-Profit making Organizations (AR NPODocument15 pagesAnnual Report Non-Profit making Organizations (AR NPOSibaprasad DashNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- Assessment Questions on Business Finance ConceptsDocument18 pagesAssessment Questions on Business Finance ConceptsadbscorpioNo ratings yet

- 2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214Document27 pages2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214FelipeWeissNo ratings yet

- Module 3 - Overview of NPODocument19 pagesModule 3 - Overview of NPOJebong CaguitlaNo ratings yet

- AS-1 Accounting Standard for Disclosure of Accounting PoliciesDocument8 pagesAS-1 Accounting Standard for Disclosure of Accounting PoliciesMadhusudan PoddarNo ratings yet

- Assumptions: DCF ModelDocument3 pagesAssumptions: DCF Modelniraj kumarNo ratings yet

- Qdoc - Tips Accounting McqsDocument6 pagesQdoc - Tips Accounting McqsMeh NanoNo ratings yet

- PT Adaro Energy Indonesia TBK (ADRO)Document15 pagesPT Adaro Energy Indonesia TBK (ADRO)Arief RahmatullahNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- HO & Branch AccountingDocument6 pagesHO & Branch AccountingMaria BeatriceNo ratings yet

- Chapter 8Document66 pagesChapter 8Jamaica Rose Salazar0% (1)

- Definition of Standard CostingDocument18 pagesDefinition of Standard CostingHimanshu PachoriNo ratings yet

- Business Combination Problems SolvedDocument2 pagesBusiness Combination Problems SolvedcpacpacpaNo ratings yet