Professional Documents

Culture Documents

Public Sector Econ Lecture 3 - State and Local

Uploaded by

JessOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Sector Econ Lecture 3 - State and Local

Uploaded by

JessCopyright:

Available Formats

Public Sector Economics: Lecture 3

Prof. Alexander Gelber

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

1 of 35

10

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Fiscal Federalism

The United States has a federal system,

dividing activity between a national

government and state and local

governments.

Education, for example, is often provided by

state and local governments.

Optimal fiscal federalism: The question

of which activities should take place at

which level of government.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

2 of 35

10.1

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Fiscal Federalism in the United States and Abroad

Much state and local spending is supported

by intergovernmental grants.

o Intergovernmental grants: Payments

from one level of government to another.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

3 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Application:EffectofFiscalStimulus

ARRA (stimulus bill) increased the percentage of Medicaid

expenditures that the federal government pays for all states by 6.2

percentage points and increased the match rate by more for states

that experienced especially large increases in unemployment.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

4 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Application:EffectofFiscalStimulus

Overall conclusion: $100,000 in stimulus was associated

with 3.8 additional job-years (3.2 job-years outside the

government, health, and education sectors).

The big picture: was stimulus in the form of transfers to

states worth it? Should there be further stimulus now?

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

5 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

The Tiebout Model

What determines how much and how

efficiently public goods local governments

provide?

The market provides the optimal amount of

private goods.

Why does the market do so well for private

goods but not public goods?

Tiebouts insight: shopping and

competition.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

6 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

The Tiebout Model: Shopping and Competition

There is little shopping or competition for a

national government.

But when public goods are provided at the

local level by cities and towns, competition

arises.

o Individuals can vote with their feet.

This threat of exit can induce efficiency in

local public goods production.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

7 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

The Formal Model

Competition across towns can lead to the

optimal provision of public goods.

Towns determine public good levels and tax

rates.

People move freely across towns, picking

their preferred locality.

People with similar tastes end up together,

paying the same amount in taxes and

receiving the same public goods.

There is no free riding because everyone

pays the same amount in each town.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

8 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

ProblemswithTieboutmodel?

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

9 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Problems with Tiebout Model

The Tiebout model requires a number of

assumptions that may not hold in reality,

including:

People are actually be able to move.

People have full information on taxes and

benefits.

People must be able to choose among a

range of towns that might match their

taste for public goods.

No externalities from one jurisdictions

policy to another.

Means that one jurisdictions policy has

no effect on well-being of other

jurisdictions.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

10 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Capitalization of Fiscal Differences into House

Prices

Fiscal differences across jurisdictions are also

reflected in house prices.

House price capitalization: Incorporation

into the price of a house the costs

(including local property taxes) and benefits

(including local public goods) of living in the

house.

Areas with relatively generous public goods

(given taxes) should have higher house

prices.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

11 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

EVIDENCE: Evidence for Capitalization from

Californias Proposition 13

Californias Proposition 13 became law in

1978.

o Set the maximum amount of any tax on

property at 1% of the full cash value.

o Note: actual property tax rate can be

higher due to voter-approved debt,

Mello-Roos taxes, and other taxes

o Full cash value: Value as of 1976, with

annual increases of 2% at most.

Reduced property taxes immensely in some

areas (with high property taxes before Prop

13), little change in others (with low property

taxes before Prop 13).

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

12 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

EVIDENCE: Evidence for Capitalization from

Californias Proposition 13

Each $1 of property tax reduction increased

house values by about $7, about equal to

the PDV of a permanent $1 tax cut.

In principle, the fall in property taxes would

result in a future reduction in public goods

and services, which would lower home

values.

The fact that house prices rose by almost

the present discounted value of the taxes

suggests that Californians did not think that

they would lose many valuable public

goods and services when taxes fell.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

13 of 35

10.2

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Optimal Fiscal Federalism

Tiebout model implies that the extent to which public

goods should be chosen locally depends on three

factors:

1. Tax-benefit linkages: The relationship between the

taxes people pay and the government goods and

services they get in return. Goods with strong taxbenefit linkages should (all else equal) tend to be

provided locally.

If residents can directly enjoy benefits of

property taxes, they are willing to pay local

taxes. If not, they leave.

Example: local welfare policy.

2. Cross-municipality spillovers in public goods.

3. Economy of scale (if any) in public good provision.

If taxes and benefits are linked, and there are no

Public

Finance and Public

Jonathan Gruber of

Fourth

Edition Copyright

2012 Worth

Publishers good14 of 35

spillovers

orPolicy

economies

scale,

then local

public

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Application:StateandLocalIncentivesforBusiness

Location

http://www.nytimes.com/2012/12/02/us/how-local-taxpayers-bankrollcorporations.html

States, counties and cities giving over $80b/year to companies. Is this socially

efficient? What, if anything, should the federal government do?

Example: $22 million + payroll tax break to Twitter and other companies

(e.g. Yammer) for locating in San Francisco (rather than the Peninsula).

Other companies (e.g. Uber, Square) now in that general area

Exempts companies that move to or remain in theMarket and Tenderloin

districts from paying the payroll tax on new employees for six years.

San Francisco companies with payrolls higher than $250,000 are

charged a 1.5 percent business tax on employee compensation.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

15 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Redistribution across Communities

Enormous inequality in revenue across

municipalities.

Berkeley raises $12,802/student while

Bolinas-Stinson raises $28,928.

Should we care?

o If Tiebout is right, then this reflects optimal

sorting and financing.

o But if not, redistribution might be called for.

o Note: may prefer to redistribute by

income, not location.

o The main tool of redistribution is

intergovernmental grants, cash transfers

from one level of government to another.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

16 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Matching Grants

Grants come in multiple forms, with different

implications.

Block grant: A grant of some amount with

no mandate as to how it is spent.

Conditional block grant: A grant of

some amount with a mandate as to how it

is spent.

Matching grant: A grant, the amount of

which is tied to the amount of spending by

the local community.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

17 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

10.3

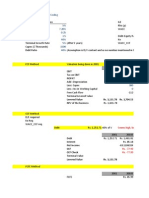

Tools of Redistribution: Grants

Other

spending

(thousands

)

$1,000

500

500

IC1

B

$1,000

Education

spending

(thousands)

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

18 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

10.3

Matching Grants

Education spending matched one-for-one

with grants from a higher level of

government

Other

spending

(thousands

)

$1,000

625

500

IC2

IC1

B

500 750 1,000

C

$2,000

Education

spending

(thousands)

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

19 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

10.3

Block Grant

Other

spending

(thousands

) D

$1,375

1,000

A

Z

800

625

500

Y

X

IC3

IC1

500575750 1,000

1,375

Income effect

Substitution effect

C

$2,000

Education

spending

(thousands)

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

20 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

10.3

Conditional Block Grant

Other

spending

(thousands

) D

$1,375

1,000

F

Z

800

625

500

Y

X

IC3

IC1

B

0

375500575750 1,000

Income effect

Substitution effect

E

1,375

C

$2,000

Education

spending

(thousands)

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

21 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Implications of Different Grant Types

Different grant types affect incentives in

different ways.

Matching grants rotate out the budget

constraint, acting like a subsidy.

o Help with externalities, since they are

targeted.

Block grants shift out the entire budget

constraint, raising spending on all goods.

o Good if redistribution is the goal.

Conditional block grants may differ from

block grants if the amount of the grant is

greater than the initial educational

spending.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

22 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Application:IncentivesforMedicaidExpansion

Affordable Care Act authorizes states to expand

Medicaid to adults under age 65 with income up to 138

percent of federal poverty level (FPL).

Federal government pays 100 percent of the cost of

newly eligible adult Medicaid beneficiaries through

2016.

Phases down to a 90 percent matching rate by 2020

and remains at 90 percent permanently.

As originally written, ACA compelled states to include

in Medicaid expansion all non-disabled adults up to

138% of FPL or risk losing all Medicaid funding

John Roberts decision in NFIB vs. Sebelius: this was

a gun to the head and unconstitutional coercion of

states

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

23 of 35

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

StatesexpandingMedicaidunderACA

https://www.you

tube.com/watch

?

v=SvwN6oJiuTY

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

24 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Redistribution in Action: School Finance Equalization

A very important local redistribution is

school finance equalization.

School finance equalization laws: Laws

that mandate redistribution of funds across

communities in a state to ensure more

equal financing of schools.

o Example: New Jersey redistributes most

revenue from towns with per capita

revenue above the 85th percentile.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

25 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Redistribution in Action: School Finance Equalization

Different structures result in different tax

prices.

Tax price: For school equalization schemes,

the amount of revenue a local district would

have to raise in order to gain $1 more of

spending.

If half of revenue is redistributed, tax price

is $2.

If all revenue is redistributed, tax price is

infinite.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

26 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

APPLICATION: School Finance Equalization and

Property Tax Limitations in California

School finance equalization in California

meant tax price became very high

Note that spending differences across

localities remain.

Taxes no longer financed local school

spending; largely just taxes, rather than

prices.

Proposition 13 sometimes said to have been

a response to school finance equalization in

California.

i.e. voters were happy to limit property

taxes once those taxes brought them

little benefit.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

27 of 35

10.3

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

EVIDENCE: The Flypaper Effect

The simple model implies that conditional

grants largely crowd out local spending.

In our example, conditional block grant

of $375 raised local spending on

education by only $75 (from $500 to

$575).

Implied crowdout of local spending

on education: $300 (=$375-$75).

Looking at how states spend grant money,

some empirical literature has found that the

flypaper effect matters: The money sticks

where it hits.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

28 of 35

10.4

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Conclusion

Central governments collect only part of

total tax revenues and spend only part of

total public spending.

The Tiebout model suggests that the

spending should be done locally when:

o Strong tax-benefit linkages.

o Little cross-municipality spillovers.

o No economies of scale in public good

provision.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

29 of 35

10.4

C H AP T E R 1 0 S T AT E AN D LO C AL G O V E R N M E N T E X P E N D I T U R E S

Conclusion

Higher levels of government may still want

to redistribute across lower levels of

government.

o If the higher-level government decides

that it wants to redistribute across lower

levels, it can do so through several

different types of grants.

o Appropriate choice of grants depends on

goal of government financing.

Public Finance and Public Policy Jonathan Gruber Fourth Edition Copyright 2012 Worth Publishers

30 of 35

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Syllabus Eurpubchopubeco 20152016 Cesi 2016 02 17 16 27 15Document6 pagesSyllabus Eurpubchopubeco 20152016 Cesi 2016 02 17 16 27 15Estella ManeaNo ratings yet

- Das Kapital ContentsDocument2 pagesDas Kapital Contentsmanirup_tceNo ratings yet

- 6 3 - Types of EconomiesDocument26 pages6 3 - Types of Economiesapi-235395204No ratings yet

- Republic Act 10633 General Appropriation Act of 2014Document3 pagesRepublic Act 10633 General Appropriation Act of 2014Marc Eric Redondo0% (1)

- (PFM) WK 3 CapitalismDocument16 pages(PFM) WK 3 CapitalismAngel BNo ratings yet

- BUSINESS AND TRANSFER TAXATION CHAPTER 1Document2 pagesBUSINESS AND TRANSFER TAXATION CHAPTER 1NeLson ALcanarNo ratings yet

- Externalities, Public Goods, Imperfect Information, and Social ChoiceDocument35 pagesExternalities, Public Goods, Imperfect Information, and Social ChoiceLukas PrawiraNo ratings yet

- Chapter 1Document29 pagesChapter 1Yusuf Hussein100% (2)

- Rental ReceiptDocument1 pageRental ReceiptGuru KrishNo ratings yet

- How Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyDocument12 pagesHow Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyCenter for American ProgressNo ratings yet

- Direct vs Indirect Tax GuideDocument3 pagesDirect vs Indirect Tax GuidekashanircNo ratings yet

- McDonald's Argentina currency crisis issuesDocument4 pagesMcDonald's Argentina currency crisis issuesSuhas KiniNo ratings yet

- Economicshelp Org Capitalism V SocialismDocument6 pagesEconomicshelp Org Capitalism V SocialismJan Wyndell LopezNo ratings yet

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanNo ratings yet

- P. Tax ChallanDocument2 pagesP. Tax ChallanJulie SpearsNo ratings yet

- Public ExpenditureDocument4 pagesPublic ExpenditureadityatnnlsNo ratings yet

- Bir Form 2306Document3 pagesBir Form 2306Rebecca McdowellNo ratings yet

- Ecuatorial Guinea - Government Ministry InformationDocument9 pagesEcuatorial Guinea - Government Ministry InformationRoshankumar BalasubramanianNo ratings yet

- Economic Systems QuizDocument3 pagesEconomic Systems Quizapi-256560022No ratings yet

- DepEd clearance and reports submission for DNTVHS principalDocument1 pageDepEd clearance and reports submission for DNTVHS principalpatrickkayeNo ratings yet

- Chapter OneDocument16 pagesChapter OneHaile GirmaNo ratings yet

- The Payment of Bonus Act Annual ReturnDocument4 pagesThe Payment of Bonus Act Annual ReturnNasir AhmedNo ratings yet

- Money Growth Inflation GuideDocument2 pagesMoney Growth Inflation GuideQuy Nguyen QuangNo ratings yet

- Myob - Chart of AccountsDocument4 pagesMyob - Chart of AccountsAr RaziNo ratings yet

- Capitalism, Socialism, and DemocracyDocument36 pagesCapitalism, Socialism, and DemocracyKavita SharmaNo ratings yet

- BHM 749 Introdution To Public ServiceDocument177 pagesBHM 749 Introdution To Public ServiceMuhammad Jamil100% (1)

- Minutes 17 Public Economics B.A. H Eco. 5th Sem.Document3 pagesMinutes 17 Public Economics B.A. H Eco. 5th Sem.Teddy Jain0% (1)

- Economic SystemDocument7 pagesEconomic Systemrisma ramadhanNo ratings yet

- Balance Sheet Tutorial Effects TransactionsDocument3 pagesBalance Sheet Tutorial Effects TransactionsAlin LuchianNo ratings yet

- EMI CalculatorDocument12 pagesEMI CalculatorMariappan SarawananNo ratings yet