Professional Documents

Culture Documents

Bank Reconciliation Bank Reconciliation

Uploaded by

mustafa_330 ratings0% found this document useful (0 votes)

253 views9 pagesBank Reconciliation Explains all differences between general ledger cash account and bank statement cash balance. Deposits in transit - Outstanding checks - bank or book errors - EFT's - service charges - NSF checks.

Original Description:

Original Title

Bank Reconcilation

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBank Reconciliation Explains all differences between general ledger cash account and bank statement cash balance. Deposits in transit - Outstanding checks - bank or book errors - EFT's - service charges - NSF checks.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

253 views9 pagesBank Reconciliation Bank Reconciliation

Uploaded by

mustafa_33Bank Reconciliation Explains all differences between general ledger cash account and bank statement cash balance. Deposits in transit - Outstanding checks - bank or book errors - EFT's - service charges - NSF checks.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 9

Bank Reconciliation

• Explains all differences between general

ledger cash account and bank statement

cash balance

– Deposits in transit

– Outstanding checks

– Bank or book errors

– EFT’s

– Service charges

– NSF checks

Copyright © 2007 Prentice-Hall. All rights reserved 1

Any increase (decrease) to

Any increase (decrease) to

cash that has been recorded

Bank Reconciliation

cash that has been recorded

by the bank, but has not

in the books, but does not

appear on the bank

been recorded in the books

statement

yet

Bank Statement Book Balance

Add: Add:

Deduct: Deduct:

Adjusted bank balance Adjusted book balance

Copyright © 2007 Prentice-Hall. All rights reserved 2

Reconciling Items

Bank Statement

Add: Deposits in transit.

Deduct: Outstanding checks

Add or Deduct: Bank errors

Book Balance

Add: Interest revenue

Add: Bank collections

Deduct: Nonsufficient funds check (NSF)

Deduct: Service charges

Add or Deduct: Book errors, EFT transfers

Copyright © 2007 Prentice-Hall. All rights reserved 3

The company has recorded the cash

S8-6

receipts, but the bank does not show

the deposit yet

Bank balance $3,800

Add: Deposits in transit 200

$4,000

Deduct: Outstanding checks 900

Reconciled bank balance $3,100

The company has recorded the cash

disbursements, but the checks have

not yet cleared the bank

Copyright © 2007 Prentice-Hall. All rights reserved 4

These items appear on the bank

S8-6

statement, but the company has not

yet recorded them

Book balance $2,480

Add: Bank collection from customer 630

Interest revenue 10

Subtotal $3,120

Deduct: Bank service charge 20

Reconciled book balance $3,100

Copyright © 2007 Prentice-Hall. All rights reserved 5

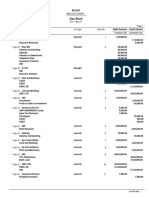

S8-6

Ranger Security Systems

Bank Reconciliation

May 31, 2007

Bank balance $3,800 Book balance

Add: Collection

$2,480

Add: Deposits in transit 200 from customer 630

Interest revenue 10

$4,000 Subtotal $3,120

Deduct: Service charge 20

Deduct: Outstanding Reconciled book balance $3,100

checks 900

Reconciled bank

balance $3,100

Copyright © 2007 Prentice-Hall. All rights reserved 6

Remember, you only need to prepare

Adjusting the Books

entries for any adjustment to the

Book Balance

Book balance $2,480

Add: Bank collection from customer 630

Interest revenue 10

Subtotal $3,120

Deduct: Bank service charge 20

Reconciled book balance $3,100

Any reconciling item under “Book Balance”

requires a journal entry to adjust the Cash account

Copyright © 2007 Prentice-Hall. All rights reserved 7

S8-7

GENERAL JOURNAL

DATE DESCRIPTION REF DEBIT CREDIT

May 31 Cash 630

Accounts Receivable-

K. Brooks 630

Bank collection from customer

31 Cash 10

Interest Revenue 10

Interest earned on bank

balance

Copyright © 2007 Prentice-Hall. All rights reserved 8

S8-7

GENERAL JOURNAL

DATE DESCRIPTION REF DEBIT CREDIT

May 31 Miscellaneous Expense 20

Cash 20

Bank service charge

Copyright © 2007 Prentice-Hall. All rights reserved 9

You might also like

- Welcome: Click To Edit Master Title StyleDocument29 pagesWelcome: Click To Edit Master Title StyleMingxNo ratings yet

- College Accounting 12th Edition Slater Solutions Manual DownloadDocument35 pagesCollege Accounting 12th Edition Slater Solutions Manual DownloadRicardo Rivera100% (27)

- Accounting 7th Edition Horngren Solutions ManualDocument25 pagesAccounting 7th Edition Horngren Solutions Manualnicholassmithyrmkajxiet100% (20)

- Accounting 7th Edition Horngren Solutions Manual Full Chapter PDFDocument46 pagesAccounting 7th Edition Horngren Solutions Manual Full Chapter PDFadelaideoanhnqr1v100% (12)

- Bank ReconciliationDocument35 pagesBank ReconciliationGurmeet SinghNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- What Is Bank Reconciliation?Document7 pagesWhat Is Bank Reconciliation?Yassi CurtisNo ratings yet

- Week 5 Topic Tutorial Solutions CB2100 - 1920ADocument6 pagesWeek 5 Topic Tutorial Solutions CB2100 - 1920ALily TsengNo ratings yet

- Bank Reconciliation ExampleDocument3 pagesBank Reconciliation ExampleAmsaluNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Topic 5 Bank ReconciliationDocument13 pagesTopic 5 Bank Reconciliationqbf28kbgc4No ratings yet

- ACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts ReceivableDocument7 pagesACCT 1005 - Suggested Solutions - BBC Lecture Questions - Cash - Accounts ReceivableKenya LevyNo ratings yet

- Bank Reconciliation Statement PreparationDocument5 pagesBank Reconciliation Statement PreparationsteveNo ratings yet

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- Bank reconciliation report analysisDocument6 pagesBank reconciliation report analysisAgha TamourNo ratings yet

- What Is A Bank Reconciliation?Document4 pagesWhat Is A Bank Reconciliation?Mustaeen DarNo ratings yet

- Horngrens Financial Accounting 8Th Edition Nobles Solutions Manual Full Chapter PDFDocument50 pagesHorngrens Financial Accounting 8Th Edition Nobles Solutions Manual Full Chapter PDFaddorsedmeazel1exjvs100% (8)

- Basic AccountingDocument11 pagesBasic AccountingFarshad IslamNo ratings yet

- BX2011 Topic01 Workshop Qns & Sols 2021Document9 pagesBX2011 Topic01 Workshop Qns & Sols 2021Shi Pyeit Sone KyawNo ratings yet

- Solution Manual For Accounting 28th Edition Carl Warren Christine Jonick Jennifer SchneiderDocument45 pagesSolution Manual For Accounting 28th Edition Carl Warren Christine Jonick Jennifer SchneiderToddNovakmekfw98% (43)

- Acc Topic 6 PDFDocument7 pagesAcc Topic 6 PDFBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Example 2:: Adjustments To The Bank BalanceDocument8 pagesExample 2:: Adjustments To The Bank BalanceTERRIUS AceNo ratings yet

- Financial StatementDocument197 pagesFinancial StatementShouvik NagNo ratings yet

- Af As Chapter 8Document18 pagesAf As Chapter 8FarrukhsgNo ratings yet

- Bank Reconciliation Statement: Strictly ConfidentialDocument3 pagesBank Reconciliation Statement: Strictly Confidentialnegussie biruNo ratings yet

- Acc CH 8Document9 pagesAcc CH 8Trickster TwelveNo ratings yet

- Construct Ten-Column Worksheets: Key To Resources 2 3 Inventory Control Methods 3 Feedback To Activities 18Document20 pagesConstruct Ten-Column Worksheets: Key To Resources 2 3 Inventory Control Methods 3 Feedback To Activities 18hemacrcNo ratings yet

- Sr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)Document11 pagesSr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)muhammad zainNo ratings yet

- Dwnload Full Corporate Financial Accounting 14th Edition Warren Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Accounting 14th Edition Warren Solutions Manual PDFhofstadgypsyus100% (16)

- Full Download Corporate Financial Accounting 14th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 14th Edition Warren Solutions Manualmasonh7dswebb100% (38)

- Corporate Financial Accounting 12th Edition Warren Solutions ManualDocument25 pagesCorporate Financial Accounting 12th Edition Warren Solutions ManualDavidHicksarzb100% (63)

- Financial and Managerial Accounting 14th Edition Warren Solutions ManualDocument25 pagesFinancial and Managerial Accounting 14th Edition Warren Solutions ManualAngelaMartinezpxjd100% (48)

- Accounting Chapter 8 Warren AnswerDocument16 pagesAccounting Chapter 8 Warren AnswerFadhly Azzuhry0% (1)

- Full Download Corporate Financial Accounting 12th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 12th Edition Warren Solutions Manualmasonh7dswebb100% (37)

- Dwnload Full Corporate Financial Accounting 12th Edition Warren Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Accounting 12th Edition Warren Solutions Manual PDFhofstadgypsyus100% (10)

- Simulation 1 - Financial Accounting - March 4Document4 pagesSimulation 1 - Financial Accounting - March 4Ednalyn PascualNo ratings yet

- Bank Reconciliation StetementsDocument5 pagesBank Reconciliation StetementsSheikh RakinNo ratings yet

- Corporate Financial Accounting 13th Edition Warren Solutions ManualDocument17 pagesCorporate Financial Accounting 13th Edition Warren Solutions ManualDavidHicksarzb100% (54)

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- 04 Bank Reconciliation StatementsDocument10 pages04 Bank Reconciliation StatementsBabamu Kalmoni JaatoNo ratings yet

- Exercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Document12 pagesExercise 7.1: S.O. Heater Installations: Bank Reconciliation Statement As at 31 July 2015Doan Chan PhongNo ratings yet

- Bank Reconciliations - 1Document9 pagesBank Reconciliations - 1ZAKAYO NJONYNo ratings yet

- ch07 SM Carlon 5eDocument39 pagesch07 SM Carlon 5eKyle100% (1)

- Dwnload Full Corporate Financial Accounting 13th Edition Warren Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Accounting 13th Edition Warren Solutions Manual PDFhofstadgypsyus100% (12)

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (36)

- Patnership TwoDocument8 pagesPatnership TwoTapz IbrahimNo ratings yet

- Cash - CRDocument14 pagesCash - CRpingu patwhoNo ratings yet

- Solutions To More SAC 1 Revision 2021Document5 pagesSolutions To More SAC 1 Revision 2021anshsinghsoniNo ratings yet

- Reconcile Bank AccountsDocument8 pagesReconcile Bank AccountsGeorge MockNo ratings yet

- FA - Preparing A Trial BalanceDocument19 pagesFA - Preparing A Trial BalanceOwen GradyNo ratings yet

- Practice Problem in Cash ReceivableDocument5 pagesPractice Problem in Cash ReceivableJernalynne AvellanaNo ratings yet

- Solution Manual For Corporate Financial Accounting 13th Edition by Warren ISBN 1285868781 9781285868783Document36 pagesSolution Manual For Corporate Financial Accounting 13th Edition by Warren ISBN 1285868781 9781285868783stephanievargasogimkdbxwn100% (23)

- Bank ReconciliationDocument6 pagesBank ReconciliationXienaNo ratings yet

- Petty Cash and Bank Reconciliation ControlsDocument24 pagesPetty Cash and Bank Reconciliation Controlsقتيبة الجدايةNo ratings yet

- 05 Quiz 1 - ARG - ZarateDocument2 pages05 Quiz 1 - ARG - ZarateYvan ZarateNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Financial Accounting: Naveed AnjumDocument15 pagesFinancial Accounting: Naveed Anjummustafa_33No ratings yet

- PartnershipDocument63 pagesPartnershipmustafa_33100% (1)

- Plant Assets & Intangibles Plant Assets & IntangiblesDocument70 pagesPlant Assets & Intangibles Plant Assets & Intangiblesmustafa_33100% (1)

- Thinking About Communication: Chapter#1Document20 pagesThinking About Communication: Chapter#1mustafa_33No ratings yet

- Corporations: Retained Earnings and The Income StatementDocument40 pagesCorporations: Retained Earnings and The Income Statementmustafa_33No ratings yet

- Day Book 2Document2 pagesDay Book 2The ShiningNo ratings yet

- Introduction To "Services Export From India Scheme" (SEIS)Document6 pagesIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- Work Order: Department: Hapag-Lloyd Guatemala S.A. Phone: +0 Order To: Interlogic Service DistributionDocument2 pagesWork Order: Department: Hapag-Lloyd Guatemala S.A. Phone: +0 Order To: Interlogic Service DistributionAlex MarroquinNo ratings yet

- The Marketer's Guide To Travel Content: by Aaron TaubeDocument18 pagesThe Marketer's Guide To Travel Content: by Aaron TaubeSike ThedeviantNo ratings yet

- AnuragDocument2 pagesAnuragGaurav SachanNo ratings yet

- Approval Sheet: Internship Report On NBP, Karak BranchDocument3 pagesApproval Sheet: Internship Report On NBP, Karak BranchwaqarNo ratings yet

- Banking Industry KYIDocument199 pagesBanking Industry KYIYasmeen MahammadNo ratings yet

- SMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTDocument7 pagesSMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTVaghela RavisinhNo ratings yet

- Cola CaseDocument40 pagesCola Case01dynamic100% (1)

- Master Data Online Trustworthy, Reliable Data: DatasheetDocument2 pagesMaster Data Online Trustworthy, Reliable Data: DatasheetSahilNo ratings yet

- Newspapers Are Transforming Not Disappearing: iMAT Conference 2006Document1 pageNewspapers Are Transforming Not Disappearing: iMAT Conference 2006Justin ReedNo ratings yet

- Water ManagementDocument2 pagesWater ManagementIwan PangestuNo ratings yet

- TPM Essay - 1st PartDocument4 pagesTPM Essay - 1st PartFernanda MarquesNo ratings yet

- CHED New Policies On Tuiton and Other School FeesDocument13 pagesCHED New Policies On Tuiton and Other School FeesBlogWatch100% (2)

- SAP TM Course GuideDocument5 pagesSAP TM Course GuideP raju100% (1)

- Temu 4Document8 pagesTemu 4leddy teresaNo ratings yet

- LpoDocument4 pagesLpoNoushad N HamsaNo ratings yet

- Ahrend Sen 2012Document12 pagesAhrend Sen 2012sajid bhattiNo ratings yet

- 1.1 Purpose: Intended Audience and Reading SuggestionsDocument11 pages1.1 Purpose: Intended Audience and Reading SuggestionsSwapneel JadhavNo ratings yet

- Mountain DewDocument8 pagesMountain DewSasquatch0% (1)

- Everest Group Exela Your Complete Guide To Accounts Payable Transformation PDFDocument19 pagesEverest Group Exela Your Complete Guide To Accounts Payable Transformation PDFlaks_maniNo ratings yet

- Training On APQPDocument38 pagesTraining On APQPSachin Chauhan100% (1)

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Brics EconomyDocument36 pagesBrics EconomyTushar PatilNo ratings yet

- Advertisment and MediaDocument21 pagesAdvertisment and MediaMohit YadavNo ratings yet

- Jurnal Yaa TSMDocument12 pagesJurnal Yaa TSMhd capitalNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Blue Ribbon NovemberDocument32 pagesBlue Ribbon NovemberDavid PenticuffNo ratings yet

- Umang UG Fest Brochure PDFDocument8 pagesUmang UG Fest Brochure PDFDebarshee MukherjeeNo ratings yet

- Government of Maharashtra: State Health Society, MaharashtraDocument4 pagesGovernment of Maharashtra: State Health Society, MaharashtraVenkatesh ChNo ratings yet