Professional Documents

Culture Documents

Common-Size Financial Statements and Multiple Ratios

Uploaded by

roxetteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Common-Size Financial Statements and Multiple Ratios

Uploaded by

roxetteCopyright:

Available Formats

Financial Statement Analysis

Common-Size Financial Statements

and Multiple Ratios

Financial Statement Analysis

Horizontal Common-size Analysis

focuses on changes in operating results and financial position

during two or more accounting periods

The changes are expressed in terms of percentages of

corresponding amounts in a base period

Vertical Common-size Analysis

concerns the relationships among financial statement items of a

single accounting period expressed in terms of a percentage

relationship to a base item (the base is 100%)

Financial Statement Analysis

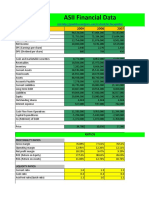

EXAMPLE -- Statement of Financial Position

Current

Prior

Current

Prior

CURRENT ASSETS:

Year End

Year End

CURRENT LIABILITIES:

Year End

Year End

Cash and equivalents

325,000

275,000

Accounts payable

200,000

125,000

Available-for-sale securities 165,000

145,000

Accrued interest on note

5,000

5,000

Accounts receivable (net)

120,000

115,000

Current portion of L.T. debt

100,000

100,000

Notes receivable

55,000

40,000

Accrued salaries and wages

15,000

10,000

Inventories

85,000

55,000

Income

taxes

payable

70,000

35,000

Prepaid

expenses

10,000

5,000

Total current assets

275,000

760,000

635,000

Total current liabilities

NONCURRENT ASSETS:

NONCURRENT LIABILITIES:

Equity-method investments 120,000

115,000

Bonds payable

600,000

PPE

1,000,000 900,000

Long-term

notes

payable

60,000

Minus: Accum. Dep.

(85,000)

(55,000)

Employee-related obligations

10,000

Goodwill

5,000

Deferred income taxes

5,000

5,000

Total noncurrent assets 1,040,000 965,000

Total noncurrent liabilities

675,000

Total

liabilities

950,000

EQUITY:

Ordinary shares, US $1 par

390,000

500,000

90,000

15,000

5,000

610,000

1,000,000

500,000

Financial Statement Analysis

EXAMPLE of an Income Statement

Net

sales

Cost of goods sold

Gross profit

SG&A

expenses

Current Year

Prior Year

1,800,000

1,400,000

(1,450,000)

(1,170,000)

350,000

230,000

(200,000)

(160,000)

Operating income

150,000

Other income and expenses

(65,000)

Income before interest and taxes

85,000

Interest expense

(15,000)

Income before taxes

70,000

Income taxes (40%)

(28,000)

Net income

42,000

70,000

(25,000)

45,000

(10,000)

35,000

(14,000)

21,000

Financial Statement Analysis

Liquidity Ratios

Liquidity Ratios

Liquidity is an entitys ability to pay its current obligations as

they come due and remain in business in the short run.

Liquidity depends on the ease with which current assets can

be converted to cash. Liquidity ratios measure this ability by

relating an entitys liquid assets to its current liabilities at a

moment in time.

Financial Statement Analysis

Activity Ratios

Activity Ratios

Reflect how quickly major noncash assets are converted to

cash.

Measure results for an accounting period

Relate information from the statement of financial position to

information from the income statement.

Activity Ratios

Financial Statement Analysis

Solvency Ratios and Leverage

Activity Ratios

An entitys ability to pay its noncurrent obligations as they

come due and remain in business in the long run

The key ingredients of solvency are the entitys capital

structure and degree of leverage

Financial Statement Analysis

Return on Investments and Profitability

Return on Investments and Profitability

You might also like

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- A BUSINESS PROPOSAL ON THE Palm OilDocument21 pagesA BUSINESS PROPOSAL ON THE Palm OilEbuka Ekedum88% (134)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Financial Statement AnalysisDocument72 pagesFinancial Statement AnalysisPadyala SriramNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument115 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownKatrina Vianca Decapia100% (1)

- Investment: Dr. Kumail Rizvi, CFA, FRMDocument113 pagesInvestment: Dr. Kumail Rizvi, CFA, FRMsarakhan0622100% (1)

- Section 800 of Ra 10863Document35 pagesSection 800 of Ra 10863roxette78% (18)

- Accounting and Financial Reporting FundamentalsDocument19 pagesAccounting and Financial Reporting FundamentalstundsandyNo ratings yet

- MBA Financial Management Chapter 1 OverviewDocument80 pagesMBA Financial Management Chapter 1 Overviewadiba10mkt67% (3)

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisMylene CandidoNo ratings yet

- Analysis of Financial Statements - FinalDocument25 pagesAnalysis of Financial Statements - FinalAnonymous y3E7iaNo ratings yet

- ACCA MOCK FINANCIAL REPORTING MARCH 21 ANSWERSDocument15 pagesACCA MOCK FINANCIAL REPORTING MARCH 21 ANSWERSnoor ul anumNo ratings yet

- Balance Sheet PPT 183Document38 pagesBalance Sheet PPT 183Rita SinghNo ratings yet

- Until I Found YouDocument7 pagesUntil I Found YoulakkiNo ratings yet

- RATIO ANALYSIS MEANING AND TYPESDocument51 pagesRATIO ANALYSIS MEANING AND TYPESSatwik100% (1)

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument113 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- Problems: Problem 6-1Document122 pagesProblems: Problem 6-1Vip BigbangNo ratings yet

- Auditing Problems: Problem 1Document4 pagesAuditing Problems: Problem 1Krizelle Jo MarquezNo ratings yet

- Chapter 10Document85 pagesChapter 10sherrybanoNo ratings yet

- Chapter 1Document43 pagesChapter 1Shah NidaNo ratings yet

- Basic Accounting Principles: The Financial StatementsDocument51 pagesBasic Accounting Principles: The Financial StatementsRahul BammiNo ratings yet

- Chapter 1 - Introduction To Financial Statement Analysis - SVDocument34 pagesChapter 1 - Introduction To Financial Statement Analysis - SVk60.2112343080No ratings yet

- Unit: Iii: Financial Statement AnalysisDocument29 pagesUnit: Iii: Financial Statement AnalysisnivethapraveenNo ratings yet

- FS Services PDFDocument38 pagesFS Services PDFwajihu9618No ratings yet

- FS Analysis Tools for Assessing Financial HealthDocument21 pagesFS Analysis Tools for Assessing Financial HealthLouise BattungNo ratings yet

- Financial Statement Analysis: by Aditi RodeDocument36 pagesFinancial Statement Analysis: by Aditi RodegrshneheteNo ratings yet

- How To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCDocument70 pagesHow To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCTurner McKayNo ratings yet

- Chapter 6 Financial Statement AnalysisDocument72 pagesChapter 6 Financial Statement Analysissharktale2828No ratings yet

- Intro to Financial Statements and Reporting TopicsDocument26 pagesIntro to Financial Statements and Reporting TopicsAlee HulioNo ratings yet

- MUST Business School lecture on analysis of financial statementsDocument116 pagesMUST Business School lecture on analysis of financial statementsSadia Khan100% (2)

- Financial Management: Chapter 2 - Financial Statement AnalysisDocument35 pagesFinancial Management: Chapter 2 - Financial Statement Analysisgeachew mihiretuNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisNivetha PraveenNo ratings yet

- Financial Statement PreparationDocument9 pagesFinancial Statement PreparationDELFIN, LORENA D.No ratings yet

- Balance Sheet: Current AssetsDocument32 pagesBalance Sheet: Current AssetsGiri ReddyNo ratings yet

- Financial StatementsDocument34 pagesFinancial StatementsRadha GanesanNo ratings yet

- Financial Statement Analysis: S Ravi ShankarDocument18 pagesFinancial Statement Analysis: S Ravi ShankarSushil BhavsarNo ratings yet

- Financial Statement AnalysisDocument55 pagesFinancial Statement Analysismukul3087_305865623No ratings yet

- Module 1-Review of Accounting ProcessDocument49 pagesModule 1-Review of Accounting ProcessJenny Flor PeterosNo ratings yet

- Financial Statement Analysis - UpdatedDocument58 pagesFinancial Statement Analysis - UpdatedJoyce Ann Agdippa BarcelonaNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument58 pagesAnalysis and Interpretation of Financial StatementsNiña Gloria Acuin ZaspaNo ratings yet

- Basic Accounting Principles: The Financial StatementsDocument51 pagesBasic Accounting Principles: The Financial StatementsUtsav AaryaNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisRahul DewakarNo ratings yet

- Basic Accounting Principles: The Financial StatementsDocument55 pagesBasic Accounting Principles: The Financial Statementsthella deva prasadNo ratings yet

- Accounting ProcessDocument17 pagesAccounting ProcessDurga Prasad100% (1)

- Chapter-5: Statement of Cash FlowDocument43 pagesChapter-5: Statement of Cash FlowBAM ZAHARDNo ratings yet

- Steve Pollard: Associate Lecturer Business InstituteDocument91 pagesSteve Pollard: Associate Lecturer Business InstituteMadhushree Gavaskar100% (1)

- Creating A Successful Financial PlanDocument29 pagesCreating A Successful Financial PlanSherry MalikNo ratings yet

- 06 Evaluating Financial PerformanceDocument25 pages06 Evaluating Financial PerformanceTrần ThiNo ratings yet

- AttachmentDocument17 pagesAttachmentMarjorie Dag-omNo ratings yet

- Chapter 1Document52 pagesChapter 1tiffanysosa1223No ratings yet

- Analyzing Financial Data: Ratio AnalysisDocument12 pagesAnalyzing Financial Data: Ratio AnalysiscpdNo ratings yet

- Statement of Cash Flows ExplainedDocument53 pagesStatement of Cash Flows ExplainedKaushik DwivediNo ratings yet

- Financial ManagementDocument34 pagesFinancial ManagementAbisellyNo ratings yet

- FM 2Document22 pagesFM 2Kajal singhNo ratings yet

- Analysis and Interpretation of Financial Statements 1Document61 pagesAnalysis and Interpretation of Financial Statements 1Jeon Cyrone CuachonNo ratings yet

- Financial Management: Session - 2: Financial Statement AnalysisDocument22 pagesFinancial Management: Session - 2: Financial Statement AnalysisShantanu SinhaNo ratings yet

- Finance Primer - 2016Document26 pagesFinance Primer - 2016Gurram Sarath KumarNo ratings yet

- Financial Reporting and Analysis: Inam-Ul-HaqueDocument36 pagesFinancial Reporting and Analysis: Inam-Ul-HaqueinamNo ratings yet

- FRA-NewDocument31 pagesFRA-NewAbhishek DograNo ratings yet

- Finspire 105 - FSA Cash Flow StatementDocument8 pagesFinspire 105 - FSA Cash Flow StatementHarshvardhan PatilNo ratings yet

- Financial Performance Measures by Venture Life Cycle StageDocument31 pagesFinancial Performance Measures by Venture Life Cycle StageMiguel Gonzalez LondoñoNo ratings yet

- Financial Accounting FundamentalsDocument25 pagesFinancial Accounting FundamentalsEunice MuñozNo ratings yet

- Flow Accounting for Improved PerformanceDocument52 pagesFlow Accounting for Improved Performancedimidimi1100% (1)

- Budgetring ControlDocument16 pagesBudgetring ControlNamrata NeopaneyNo ratings yet

- SPC SlidesDocument39 pagesSPC SlidesAkshay Singh kushwahNo ratings yet

- Reflection Paper: Plant DesignDocument3 pagesReflection Paper: Plant DesignroxetteNo ratings yet

- QA-PR-035 FM007 - Rev.00 - Problem Investigation and Countermeasure ReportDocument1 pageQA-PR-035 FM007 - Rev.00 - Problem Investigation and Countermeasure ReportroxetteNo ratings yet

- HboDocument19 pagesHboroxetteNo ratings yet

- Reflection 8Document1 pageReflection 8roxetteNo ratings yet

- Standard Application Form v1Document3 pagesStandard Application Form v1roxetteNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginroxetteNo ratings yet

- Outreach 1 g4Document3 pagesOutreach 1 g4roxetteNo ratings yet

- Compression andDocument4 pagesCompression androxetteNo ratings yet

- Research II RevisedDocument45 pagesResearch II RevisedroxetteNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginroxetteNo ratings yet

- Reflection PaperDocument3 pagesReflection PaperroxetteNo ratings yet

- Seminar 1 AarDocument6 pagesSeminar 1 AarroxetteNo ratings yet

- Reflection-Testimonial and Pv1Document6 pagesReflection-Testimonial and Pv1roxetteNo ratings yet

- Shell Petroleum Plant Visit Request for Chemical Engineering StudentsDocument2 pagesShell Petroleum Plant Visit Request for Chemical Engineering StudentsroxetteNo ratings yet

- Questions and AnswersDocument6 pagesQuestions and AnswersroxetteNo ratings yet

- ReporterDocument1 pageReporterroxetteNo ratings yet

- Time Response AnalysisDocument16 pagesTime Response AnalysisroxetteNo ratings yet

- Temp AlteDocument2 pagesTemp AlteroxetteNo ratings yet

- 4 Lab ExerciseDocument6 pages4 Lab ExerciseroxetteNo ratings yet

- Particle Characterization and Size Reduction TechniquesDocument32 pagesParticle Characterization and Size Reduction Techniquesroxette100% (1)

- Distillation 2Document3 pagesDistillation 2roxetteNo ratings yet

- 1LabExercise DoceditedDocument20 pages1LabExercise DoceditedroxetteNo ratings yet

- Safety Ass. 1Document3 pagesSafety Ass. 1roxetteNo ratings yet

- 8 9Document4 pages8 9roxetteNo ratings yet

- Esteron-Malicdem Wedding Program and ChecklistDocument2 pagesEsteron-Malicdem Wedding Program and ChecklistroxetteNo ratings yet

- 5 Introduction ToDocument39 pages5 Introduction ToroxetteNo ratings yet

- ABC Corporation: Statement of Financial Position 2015 AssetsDocument5 pagesABC Corporation: Statement of Financial Position 2015 AssetsroxetteNo ratings yet

- PS#6 KeyDocument4 pagesPS#6 KeyroxetteNo ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- Harvesting The Business Venture Investment FocusDocument31 pagesHarvesting The Business Venture Investment FocusMuhammad Qasim A20D047F100% (1)

- Intangibles PDFDocument5 pagesIntangibles PDFJer RamaNo ratings yet

- 3.0 Final Project - InternationalCorporateTax - EditedDocument17 pages3.0 Final Project - InternationalCorporateTax - Editedkevin kipkemoiNo ratings yet

- Merger & Amalgamtion PresentationDocument38 pagesMerger & Amalgamtion Presentationpravin963No ratings yet

- Merchandising (Part 14) "Normal Operating Cycle"Document2 pagesMerchandising (Part 14) "Normal Operating Cycle"Kyla CelebreNo ratings yet

- Week 2 Live Lecture NotesDocument37 pagesWeek 2 Live Lecture NotesSakura HayashiNo ratings yet

- B. Woods Chapter 15Document42 pagesB. Woods Chapter 15Ludia Daniel100% (1)

- Impairment of Long-Lived Assets: Balance SheetDocument2 pagesImpairment of Long-Lived Assets: Balance SheetJuan MatiasNo ratings yet

- HRM & Finance-Jivraj TeaDocument88 pagesHRM & Finance-Jivraj TeaYash KothariNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- Kelompok 8 - Kelas o - Week 8Document7 pagesKelompok 8 - Kelas o - Week 8Yefinia OpianaNo ratings yet

- Balance Sheet of InfosysDocument2 pagesBalance Sheet of InfosysSamta SukhdeveNo ratings yet

- Finance MNGT (Tejas Sir New)Document29 pagesFinance MNGT (Tejas Sir New)niraliNo ratings yet

- Transaction AssumptionsDocument21 pagesTransaction AssumptionsSuresh PandaNo ratings yet

- ACC 124 - Assignment 2 - TabanaoDocument3 pagesACC 124 - Assignment 2 - TabanaoRuzuiNo ratings yet

- Answer Key Is Available Only On Grewal Conceptual Learning App' (Available On Playstore and Appstore)Document28 pagesAnswer Key Is Available Only On Grewal Conceptual Learning App' (Available On Playstore and Appstore)urviNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- International Financial ManagementDocument9 pagesInternational Financial ManagementKrishna Prince M MNo ratings yet

- Mayes 8e CH03 SolutionsDocument37 pagesMayes 8e CH03 SolutionsKHANJNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- Solved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SDocument1 pageSolved Pitt Reported The Following Information For 2018 and 2019 Required Compute Pitt SAnbu jaromiaNo ratings yet

- Intangible AssetsDocument9 pagesIntangible AssetsDaniellaNo ratings yet

- Fin 1 Module Midterm CoverageDocument67 pagesFin 1 Module Midterm CoverageRomea NuevaNo ratings yet