Professional Documents

Culture Documents

Theories of Capital Structure: Net Income and Net Operating Income Approach

Uploaded by

Livanshu Garg0 ratings0% found this document useful (0 votes)

38 views10 pagesOriginal Title

Livanshu FM copy.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views10 pagesTheories of Capital Structure: Net Income and Net Operating Income Approach

Uploaded by

Livanshu GargCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

Submitted By:

Livanshu Garg

152/14

B.Com.LL.B. - Section

C

THEORIES OF

CAPITAL

NET

INCOME

AND

NET

OPERATING

STRUCTURE

INCOME APPROACH

THEORIES OF CAPITAL STRUCTURE

MEANING OF CAPITAL STRUCTURE

Capital structure can be defined as the mix of owned capital (equity,

reserves & surplus) and borrowed capital (debentures, loans from

banks, financial institutions)

Maximisation of shareholders wealth is prime objective of a financial

manager. The same may be achieved if an optimal capital structure is

designed for the company.

Planning a capital structure is a highly psychological, complex and

qualitative process.

It involves balancing the shareholders expectations (risk & returns)

and capital requirements of the firm.

THEORIES OF CAPITAL STRUCTURE

THEORIES OF CAPITAL STRUCTURE

A number of theories explain the relationship between cost of capital,

Capital Structure and value of the firm. They are:

Net income approach (NIA)

Net operating income approach (NOIA)

Traditional approach (TA)

Modigliani-Miller approach (MMA)

THEORIES OF CAPITAL STRUCTURE

NET INCOME APPROACH

Net Income approach proposes that there is a definite relationship

between capital structure and value of the firm.

The capital structure of a firm influences its cost of capital (WACC),

and thus directly affects the value of the firm.

As per NI approach, higher use of debt capital will result in reduction

of WACC. As a consequence, value of firm will be increased.

THEORIES OF CAPITAL STRUCTURE

Value of firm = Earnings/WACC

Earnings (EBIT) being constant and WACC is reduced, the value of a

firm will always increase.

Thus, as per NI approach, a firm will have maximum value at a point

where WACC is minimum, i.e. when the firm is almost debt-financed.

THEORIES OF CAPITAL STRUCTURE

Assumptions:

1. NI approach assumes that a continuous increase in debt does not

affect the risk perception of investors.

2. Cost of debt (Kd) is less than cost of equity (Ke) [i.e. Kd < Ke ]

3. Corporate income taxes do not exist.

THEORIES OF CAPITAL STRUCTURE

NET OPERATING INCOME APPROACH

Net Operating Income (NOI) approach is the exact opposite of the Net Income

(NI) approach.

As per NOI approach, value of a firm is not dependent upon its capital

structure.

Assumptions

1. WACC is always constant, and it depends on the business risk.

2. Value of the firm is calculated using the overall cost of capital i.e. the

WACC only.

3. The cost of debt (Kd) is constant.

4. Corporate income taxes do not exist.

THEORIES OF CAPITAL STRUCTURE

NOI propositions (i.e. school of thought)

1. The use of higher debt component (borrowing) in the capital

structure increases the risk of shareholders.

2. Increase in shareholders risk causes the equity capitalisation rate

to increase, i.e. higher cost of equity (Ke)

3. A higher cost of equity (Ke) nullifies the advantages gained due to

cheaper cost of debt (Kd )

4. In other words, the finance mix is irrelevant and does not affect

the value of the firm.

THEORIES OF CAPITAL STRUCTURE

Cost

of

capital

(Ko)

is

constant.

As the proportion of debt increases, (Ke)

increases.

No effect on total cost of capital (WACC)

You might also like

- Doctrine of Fair Use Under The Copyright LawDocument14 pagesDoctrine of Fair Use Under The Copyright LawLAW MANTRA100% (5)

- Sexual Harrasment at Workplace ActDocument17 pagesSexual Harrasment at Workplace ActLivanshu Garg67% (3)

- Advance Financial ManagementDocument62 pagesAdvance Financial ManagementKaneNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Advanced Financial ManagementDocument23 pagesAdvanced Financial ManagementDhaval Lagwankar75% (4)

- Capital Structure TheoriesDocument25 pagesCapital Structure TheoriesLalit ShahNo ratings yet

- Net Income ApproachDocument6 pagesNet Income ApproachDisha Ganatra80% (5)

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Capital Structure Theories ExplainedDocument10 pagesCapital Structure Theories ExplainedMd. Nazmul Kabir100% (1)

- Capital StructureDocument33 pagesCapital StructurezewdieNo ratings yet

- EnvironmentalDocument24 pagesEnvironmentalLivanshu Garg100% (1)

- Chapter Four: Capital StructureDocument28 pagesChapter Four: Capital StructureFantayNo ratings yet

- Capital StructureDocument28 pagesCapital Structureyaatin dawarNo ratings yet

- FM AssignmentDocument16 pagesFM AssignmentSarvagya GuptaNo ratings yet

- By Dr. B. Krishna ReddyDocument24 pagesBy Dr. B. Krishna ReddyhafizNo ratings yet

- Capital Structure: Presented by Prof. P. Basatin Arockia Raj Dept. of BBA ST - Joseph's College TrichyDocument25 pagesCapital Structure: Presented by Prof. P. Basatin Arockia Raj Dept. of BBA ST - Joseph's College TrichyAyeesha K.s.No ratings yet

- Capital Structure Theories Summary (40Document25 pagesCapital Structure Theories Summary (40Ayeesha K.s.No ratings yet

- Capital Structure TheoriesDocument13 pagesCapital Structure TheoriesShruti AshokNo ratings yet

- Optimal Capital Structure for Maximum Firm ValueDocument26 pagesOptimal Capital Structure for Maximum Firm ValueHimani DubeyNo ratings yet

- Capital Structure Unit 3Document9 pagesCapital Structure Unit 3Hardita DhameliaNo ratings yet

- Capital StructureDocument38 pagesCapital StructureShil ShambharkarNo ratings yet

- Unit 5 Capital Structure - TheoriesDocument39 pagesUnit 5 Capital Structure - Theoriesvishal kumarNo ratings yet

- Fertig Project Von IDBIDocument49 pagesFertig Project Von IDBIShiva Punter BhaskerNo ratings yet

- Understand Capital Structure Theories with the Net Income ApproachDocument18 pagesUnderstand Capital Structure Theories with the Net Income ApproachKiran BabuNo ratings yet

- Capital StructureDocument55 pagesCapital Structurekartik avhadNo ratings yet

- Financial Management I Sem 4Document60 pagesFinancial Management I Sem 4trashbin.dump123No ratings yet

- Unit II.2 Capital Structure MainDocument52 pagesUnit II.2 Capital Structure MainDhruv singhNo ratings yet

- Capital StructureDocument3 pagesCapital StructureManjushaNo ratings yet

- Capital Structure: By: Anuja RastogiDocument19 pagesCapital Structure: By: Anuja RastogiMansi SainiNo ratings yet

- Mba NotesDocument12 pagesMba NotesSrishtiNo ratings yet

- RelianceDocument9 pagesRelianceIshpreet SinghNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Captial StructureDocument51 pagesCaptial Structurepragyaan classesNo ratings yet

- QLesson 3 Capital StructureDocument63 pagesQLesson 3 Capital StructureSay SayNo ratings yet

- Financial Management-Module 2 NewDocument29 pagesFinancial Management-Module 2 New727822TPMB005 ARAVINTHAN.SNo ratings yet

- 8779 - AssignmentDocument7 pages8779 - AssignmentOmkar BhujbalNo ratings yet

- Wacc Approach To Capital StructureDocument18 pagesWacc Approach To Capital StructureAnkit NeupaneNo ratings yet

- Capital Budgeting: A Mini Project Submitted in Fulfillment of The Requirement of The Internal AssessmentDocument28 pagesCapital Budgeting: A Mini Project Submitted in Fulfillment of The Requirement of The Internal AssessmentAarthi SivarajNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Capital Budgeting Presentation Part 1Document38 pagesCapital Budgeting Presentation Part 1eiaNo ratings yet

- Financial Decision MakingDocument14 pagesFinancial Decision Makingfa22-rba-003No ratings yet

- Capital Structure TheoryDocument20 pagesCapital Structure TheoryPrerna tayalNo ratings yet

- Capital Structure NotesDocument56 pagesCapital Structure NotesChanchal Chawla100% (1)

- F D C S: Inancing Ecisions Apital TructureDocument54 pagesF D C S: Inancing Ecisions Apital TructurePrabhatiNo ratings yet

- Capital Structure Theories Explained in 40 CharactersDocument23 pagesCapital Structure Theories Explained in 40 CharactersAshutosh MohantyNo ratings yet

- Lesson 22 Capital Structure TheoriesDocument6 pagesLesson 22 Capital Structure TheoriesSana Ur Rehman100% (1)

- Capital Structure TheoriesDocument9 pagesCapital Structure TheoriesMahesh HadapadNo ratings yet

- MB0045Document10 pagesMB0045Dinesh Reghunath RNo ratings yet

- CF Assignment - Capital Structure - FreshDocument3 pagesCF Assignment - Capital Structure - Freshganesh gowthamNo ratings yet

- Answers MS 42Document13 pagesAnswers MS 42SHRIYA TEWARINo ratings yet

- Capital StructuresDocument19 pagesCapital StructuresSaibelle LeeNo ratings yet

- Module 4 - The Cost of CapitalDocument10 pagesModule 4 - The Cost of CapitalMarjon DimafilisNo ratings yet

- Capital StructureDocument25 pagesCapital Structure2203037No ratings yet

- Financial Management Chapter 5Document60 pagesFinancial Management Chapter 5CA Uma KrishnaNo ratings yet

- Corporate FinanceDocument140 pagesCorporate FinanceGerald NjugunaNo ratings yet

- ACCOUNTING 223n - Terminal OutputDocument6 pagesACCOUNTING 223n - Terminal OutputAys KopiNo ratings yet

- Overview of WaccDocument19 pagesOverview of Waccসুজয় দত্তNo ratings yet

- Capital Structure 2Document51 pagesCapital Structure 2moydozukkuNo ratings yet

- Finance Compendium PartI DMS IIT DelhiDocument29 pagesFinance Compendium PartI DMS IIT Delhinikhilkp9718No ratings yet

- AFM Theory SNDocument18 pagesAFM Theory SNshubhamatilkar04No ratings yet

- Mba Corporate FinanceDocument13 pagesMba Corporate FinanceAbhishek chandegraNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- EthicsDocument2 pagesEthicsLivanshu Garg0% (1)

- C. K. DAPHTARY & ORS. v. O. P. GUPTA & ORS.Document30 pagesC. K. DAPHTARY & ORS. v. O. P. GUPTA & ORS.Livanshu GargNo ratings yet

- Livanshu WorkoutDocument1 pageLivanshu WorkoutLivanshu GargNo ratings yet

- Forensic Identification Through Personal ClothingDocument12 pagesForensic Identification Through Personal ClothingLivanshu GargNo ratings yet

- Workout Level 2Document2 pagesWorkout Level 2Livanshu GargNo ratings yet

- (2018-2019) Semester: X Name of Subject: Paper No: P-IDocument11 pages(2018-2019) Semester: X Name of Subject: Paper No: P-ILivanshu GargNo ratings yet

- Science-Tech Issues 2018Document69 pagesScience-Tech Issues 2018Livanshu GargNo ratings yet

- Workout Level 2Document2 pagesWorkout Level 2Livanshu GargNo ratings yet

- Lie Detector TestDocument6 pagesLie Detector TestLivanshu GargNo ratings yet

- Reporting Judicial ProceedingsDocument4 pagesReporting Judicial ProceedingsLivanshu GargNo ratings yet

- (Crtmtnal) : Propositton /RDocument2 pages(Crtmtnal) : Propositton /RLivanshu GargNo ratings yet

- Abs Level 1Document1 pageAbs Level 1Livanshu GargNo ratings yet

- Workout Level 2Document2 pagesWorkout Level 2Livanshu GargNo ratings yet

- Lawctopus Model CVDocument4 pagesLawctopus Model CVTulip DeNo ratings yet

- Livanshu WorkoutDocument1 pageLivanshu WorkoutLivanshu GargNo ratings yet

- Pu Holidays 2017Document3 pagesPu Holidays 2017Anonymous ey6J2bNo ratings yet

- Crash 1Document88 pagesCrash 1Livanshu GargNo ratings yet

- Reporting Judicial ProceedingsDocument4 pagesReporting Judicial ProceedingsLivanshu GargNo ratings yet

- Announcement On Modified Training Structure From 1st April2014Document5 pagesAnnouncement On Modified Training Structure From 1st April2014GR VenkatesanNo ratings yet

- List of Papers: SESSION 2014-2015Document46 pagesList of Papers: SESSION 2014-2015Livanshu GargNo ratings yet

- 7 JpegDocument1 page7 JpegLivanshu GargNo ratings yet

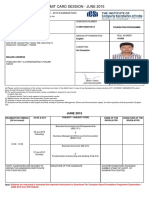

- Admit Card Session - June 2015: Admission Certificate For June - 2015 ExaminationDocument1 pageAdmit Card Session - June 2015: Admission Certificate For June - 2015 ExaminationLivanshu GargNo ratings yet

- Child WitnessDocument13 pagesChild WitnessMayank PradhanNo ratings yet

- Pu Holidays 2016Document2 pagesPu Holidays 2016Anonymous ey6J2bNo ratings yet

- Theories of Capital Structure: Net Income and Net Operating Income ApproachDocument10 pagesTheories of Capital Structure: Net Income and Net Operating Income ApproachLivanshu GargNo ratings yet

- Theories of Capital Structure: Net Income and Net Operating Income ApproachDocument10 pagesTheories of Capital Structure: Net Income and Net Operating Income ApproachLivanshu GargNo ratings yet