Professional Documents

Culture Documents

Lec 2

Uploaded by

charlie simoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lec 2

Uploaded by

charlie simoCopyright:

Available Formats

Financial Reporting

and Analysis

CHAPTER

2-1

2-2

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

Nature & Purpose

of

Accounting

Accruals

Cornerstones of

Accounting

Fair

value

Accounting

Accounting

Analysis

2-3

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

2-4

GAAP

Types

Typesof

ofAccounting

Accountingrules

rulesand

andguidelines

guidelines

USA

USA

o Statements of Financial Accounting Standards

o Statements of Financial Accounting Standards

o APB Opinions.

o APB Opinions.

o Accounting Research Bulletins (ARB).

o Accounting Research Bulletins (ARB).

o AICPA pronouncements.

o AICPA pronouncements.

o EITF Bulletins.

o EITF Bulletins.

o Industry practices.

o Industry practices.

Malaysia

Malaysia

o Company Act 1967

o Company Act 1967

o MASBs ?

o MASBs ?

o IAS

o IAS

o FRS

o FRS

2-5

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

2-6

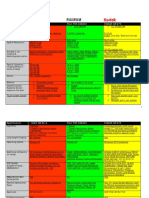

Environmental Factors

2-7

Environmental Factors

Parties Involved (Malaysia)

oo MIA (Malaysia Institute of Accountant)

MIA (Malaysia Institute of Accountant)

oo SC (Securities Commission)

SC (Securities Commission)

oo Professional Bodies (ACCA, CPA, ICAEW..)

Professional Bodies (ACCA, CPA, ICAEW..)

oo Government / Politician

Government / Politician

oo Investors

Investors

oo Association ?

Association ?

2-8

Environmental Factors

Managers of Companies

oo Primary responsibility for fair & accurate

Primary responsibility for fair & accurate

reports

reports

oo Accounting reporting to reflect business

Accounting reporting to reflect business

activities

activities

oo Managerial discretion is necessary in

Managerial discretion is necessary in

accounting

accounting

2-9

Auditing

1Investors

2Shareholders/owners

3

Appoint

Appoint

Shares

Auditors

Sell

Check

Financial

Statements

Directors

$$

Management

Prepare

2-10

Environmental Factors : Auditing

o SEC (USA)/ MROC, KLSE, SC requires Audit Report

o SEC (USA)/ MROC, KLSE, SC requires Audit Report

o Audit opinion can be:

o Audit opinion can be:

1)

1)clean

clean(fairly

(fairlypresented):

presented):

Standard

StandardUnqualified

UnqualifiedReport

ReportStandard

Standardwordings

wordings

2)

2)qualified

qualified(Overall

(Overallconsidered

consideredfairly

fairlypresented,

presented,except

except

for

forcertain

certainmatter)

matter)

Qualified

QualifiedReport

ReportExcept

Exceptfor

for

3)

3)disclaimer

disclaimer(no

(noopinion)

opinion)

Disclaimer

Disclaimerreport

reportno

noopinion

opinion

4)

4)adverse

adverse(no

(notruth

truthand

andfair)

fair)

Adverse

Adversereport

reportno

notruth

truthand

andfair

fair

o Check Auditor quality & independence

o Check Auditor quality & independence

2-11

Environmental Factors

Corporate Governance

oo Board of directors oversight

Board of directors oversight

oo Audit committee of the board

Audit committee of the board

oo oversee accounting process

oversee accounting process

oo oversee internal control

oversee internal control

oo oversee internal/external audit

oversee internal/external audit

oo Internal Auditor

Internal Auditor

2-12

BOD (Insider/outsider)

Inside/outside mix:

Insider/Executive Directors: Sit at the board & manage the company

Outsider/NEDS: Sit at the board only

BOD

Chairman

EDs

Management

Monitor

NEDs

Via

Audit committee, Risk committee, etc

2-13

Environmental Factors

Internal Users

External Users

2-14

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

Nature & Purpose

of

Accounting

2-15

Desirable Qualities of Accounting

Information

2-16

Financial Accounting

Relevance

Relevanceof

ofAccounting

AccountingInformation

Information

Relation

Relationbetween

betweenAccounting

AccountingNumbers

Numbersand

andStock

StockPrices

Prices

2-17

Financial Accounting

Important Accounting Principles

o Historical Cost - fair & objective values from arms-length

o Historical Cost - fair & objective values from arms-length

bargaining

bargaining

o Accrual Accounting - recognize revenues when earned,

o Accrual Accounting - recognize revenues when earned,

expenses

expenseswhen

whenincurred

incurred

o Materiality - threshold when information impacts decision

o Materiality - threshold when information impacts decision

making

making

o Conservatism - reporting or disclosing the least optimistic

o Conservatism - reporting or disclosing the least optimistic

information

informationabout

aboutuncertain

uncertainevents

eventsand

andtransactions

transactions

2-18

Financial Accounting

Limitations of Accounting Information

ooTimeliness - periodic disclosure, not real-time

Timeliness - periodic disclosure, not real-time

basis

basis

ooFrequency - quarterly and annually

Frequency - quarterly and annually

ooForward Looking - limited prospective

Forward Looking - limited prospective

information

information

2-19

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

Nature & Purpose

of

Accounting

Accruals

Cornerstones of

Accounting

2-20

Accruals-The Cornerstone

Illustration - Case Facts

ooEstablish company and invest $700 equity

Establish company and invest $700 equity

ooPurchase plain 100T-shirts for $5 each

Purchase plain 100T-shirts for $5 each

ooFixed screen cost of $100

Fixed screen cost of $100

ooVariable print cost of $0.75 per T-shirt

Variable print cost of $0.75 per T-shirt

ooSold 25 T-shirts at $10 each for cash

Sold 25 T-shirts at $10 each for cash

ooSold 25 T-shirts at $10 each on credit

Sold 25 T-shirts at $10 each on credit

2-21

Accruals- The Cornerstone

Case Illustration Cash Accounting

Statement of Cash Flows

Receipts

T-Shirt sales

Assets

$250

Payments

T-Shirt purchases $500

Screen purchase

100

Printing charges

75

Total payments

Net cash outflow

Cash

Balance Sheet (Cash basis)

$275

Equity

Beginning Equity

$700

Less net cash outflow (425)

$(675)

Total equity

$275

$(425)

2-22

Accruals-The Cornerstone

Case Illustration Accrual Accounting

Income Statement

Revenues

T-Shirt sales

Balance Sheet (Accrual basis)

$500.00

337.50

Expenses

T-Shirts costs

$250.00

Screen depreciation 50.00

Printing charges

37.50

Total expenses

(337.50)

Net income

$162.50

Assets

Cash

$275.00

T-Shirt inventory$337.50

Receivables

Total assets

250.00

$862.50

Equity

Beginning equity

Add net income

Total equity

$700.00

162.50

$862.50

2-23

Accruals-The Cornerstone

2-24

Accruals-The Cornerstone

Foundations of Accrual Accounting

Revenue

RevenueRecognition

Recognitionrecognize

recognizerevenues

revenueswhen

when

(1)

(1) Earned

Earned

(2)

(2) Realized

Realizedor

orRealizable

Realizable

Expense

ExpenseMatching

Matchingmatch

matchwith

withcorresponding

correspondingrevenues

revenues

- -Product

Productcosts

costs

- -Period

Periodcosts

costs

2-25

Accruals-The Cornerstone

Accruals and Cash Flows - Myths

ooMyth: Since company value depends on future cash

Myth: Since company value depends on future cash

flows,

flows,only

onlycurrent

currentcash

cashflows

flowsare

arerelevant

relevantfor

for

valuation.

valuation.

ooMyth: All cash flows are value relevant.

Myth: All cash flows are value relevant.

ooMyth: Cash flows cannot be manipulated.

Myth: Cash flows cannot be manipulated.

ooMyth: All income is manipulated.

Myth: All income is manipulated.

2-26

Accruals-The Cornerstone

Accruals and Cash Flows - Truths

ooTruth: Accrual accounting (income) is more

Truth: Accrual accounting (income) is more

relevant

relevantthan

thancash

cashflow.

flow.

ooTruth: Cash flows are more reliable than

Truth: Cash flows are more reliable than

accruals.

accruals.

ooTruth: Accrual accounting numbers are subject

Truth: Accrual accounting numbers are subject

to

toaccounting

accountingdistortions.

distortions.

2-27

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

Nature & Purpose

of

Accounting

Accruals

Cornerstones of

Accounting

Fair

value

Accounting

2-28

Fair value accounting

Asset

Assetand

andliability

liabilityvalues

valuesare

aredetermined

determinedon

onthe

the

basis

basisof

oftheir

theirfair

fairvalues

values(typically

(typicallymarket

marketprices)

prices)

on

onthe

themeasurement

measurementdate

date(i.e.,

(i.e.,approximately

approximately

the

thedate

dateof

ofthe

thefinancial

financialstatements).

statements).

2-29

Historical cost Vs Fair value

2-30

Advantages & Disadvantages

Advantages

Advantages

o

o

o

o

o

o

o

o

o

o

Reflects

Reflectscurrent

currentinformation.

information.

Consistent

Consistentmeasurement

measurementcriteria.

criteria.

Comparability

Comparability

No

Noconservative

conservativebias

bias

More

Moreuseful

usefulfor

forequity

equityanalysis

analysis

Disadvantages

Disadvantages

o

o

o

o

o

o

o

o

Lower

Lowerobjectivity

objectivity

Susceptibility

Susceptibilitytotomanipulation.

manipulation.

Lack

Lackofofconservatism.

conservatism.

Excessive

Excessiveincome

incomevolatility.

volatility.

2-31

Financial Reporting

And Analysis

Accounting

Rules &

Guidelines

Parties involved

In

Financial Reporting

Nature & Purpose

of

Accounting

Accruals

Cornerstones of

Accounting

Fair

value

Accounting

Accounting

Analysis

2-32

Accounting Analysis

Demand for Accounting Analysis

oo Adjust for accounting distortions/misstatement

Adjust for accounting distortions/misstatement

so

sofinancial

financialreports

reportsbetter

betterreflect

reflecteconomic

economic

reality

reality

oo Adjust general-purpose financial statements to

Adjust general-purpose financial statements to

meet

meetspecific

specificanalysis

analysisobjectives

objectivesof

ofaaparticular

particular

user

user

2-33

Accounting Analysis

Sources of Accounting Distortions/misstatement

Accounting

AccountingStandards

Standardsattributed

attributedtoto

1)

accounting

1)

accountingprinciples

principlesand

andassumptions,

assumptions,and

and

2)

conservatism

2)

conservatism

o Estimation Errors attributed to estimation errors inherent in accrual

o Estimation Errors attributed to estimation errors inherent in accrual

accounting

accounting

o Reliability vs Relevance attributed to over-emphasis on reliability at

o Reliability vs Relevance attributed to over-emphasis on reliability at

the

theloss

lossofofrelevance

relevance

o Earnings Management attributed to window-dressing of financial

o Earnings Management attributed to window-dressing of financial

statements

statementsby

bymanagers

managerstotoachieve

achievepersonal

personalbenefits

benefits

o

2-34

Accounting Analysis

Earnings Management Frequent Source of Distortion

Earning

EarningManagement

Managementstrategies:

strategies:

Increasing

IncreasingIncome

Incomemanagers

managersadjust

adjustaccruals

accrualstotoincrease

increase

reported

reportedincome

income

o Big Bath managers record huge write-offs in one period to

o Big Bath managers record huge write-offs in one period to

relieve

relieveother

otherperiods

periodsofofexpenses

expenses

o Income Smoothing managers decrease or increase reported

o Income Smoothing managers decrease or increase reported

income

incometotoreduce

reduceits

itsvolatility

volatility

o

o

2-35

Accounting Analysis

Earnings Management Motivations

Contracting

ContractingIncentives

Incentives- - managers

managersadjust

adjustnumbers

numbersused

usedinin

contracts

contractsthat

thataffect

affecttheir

theirwealth

wealth(e.g.,

(e.g.,compensation

compensationcontracts)

contracts)

o Stock Prices managers adjust numbers to influence stock

o Stock Prices managers adjust numbers to influence stock

prices

pricesfor

forpersonal

personalbenefits

benefits(e.g.,

(e.g.,mergers,

mergers,option

optionororstock

stock

offering)

offering)

o

o

2-36

Accounting Analysis

Process of Accounting Analysis

Accounting

Accountinganalysis

analysisinvolves

involvesseveral

severalinter-related

inter-relatedprocesses

processesand

and

tasks

tasksthat

thatcan

canbe

begrouped

groupedinto

intotwo

twobroad

broadareas:

areas:

ooEvaluating Earning Quality: Steps

Evaluating Earning Quality: Steps

1)

1)

2)

2)

3)

3)

4)

4)

Identify

Identifyand

andassess

assesskey

keyaccounting

accountingpolicies

policies

Evaluate

Evaluateextent

extentofofaccounting

accountingflexibility

flexibility

Determine

Determinethe

thereporting

reportingstrategy

strategy

Identify

Identifyand

andassess

assessred

redflags

flags

oAdjusting

AdjustingFinancial

FinancialStatements:

Statements:

Identify,

Identify,measure,

measure,and

andmake

makenecessary

necessaryadjustments

adjustmentstotofinancial

financial

statements

to

better

serve

ones

analysis

objectives;

statements to better serve ones analysis objectives;

Chapters

Chapters3-6

3-6focus

focuson

onadjusting

adjusting(recasting)

(recasting)the

thestatements

statements

2-37

Questions (10

th

pages 122-123) (11th pages 118-119)

2-7

2-8

2-11

2-12

2-17

2-18

2-45

2-47

Calculation Question

Establish company and invest $800 equity

Purchase plain 100T-shirts for $8 each

Fixed screen cost of $200

Variable print cost of $0.90 per T-shirt

Sold 20 T-shirts at $15 each for cash

Sold 30 T-shirts at $15 each on credit

Request: Prepare Statement under Cash and Accrual Accounting

Prepare and discuss at least 4 type of auditor report from listed companies

You might also like

- Chapter 02 Financial Reporting and AnalysisDocument40 pagesChapter 02 Financial Reporting and Analysisshabrina r56% (9)

- Financial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter02Document40 pagesFinancial Statement Analysis - 10e by K. R. Am & John J. Wild Chapter02Salem FirstNo ratings yet

- HSBC in A Nut ShellDocument190 pagesHSBC in A Nut Shelllanpham19842003No ratings yet

- Financial Statement Analysis - Chapter 02Document40 pagesFinancial Statement Analysis - Chapter 02Muthia KhairaniNo ratings yet

- Assessment-2 FMDocument12 pagesAssessment-2 FMMarcela PassosNo ratings yet

- State Immunity Cases With Case DigestsDocument37 pagesState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- Ch02 - Financial Reporting AnalysisDocument44 pagesCh02 - Financial Reporting AnalysisDialog AntaraNo ratings yet

- Lec 2Document35 pagesLec 2KS YamunaNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildAgus TinaNo ratings yet

- Session 03Document30 pagesSession 03amanthi gunarathna95No ratings yet

- Chapter 1Document43 pagesChapter 1Shah NidaNo ratings yet

- Chapter 2Document18 pagesChapter 2vithyaNo ratings yet

- ALK Kelompok 2 Finale DAY 2Document44 pagesALK Kelompok 2 Finale DAY 2IrmaRenatariaSiregarNo ratings yet

- CH 01Document65 pagesCH 01Obeit TrianangNo ratings yet

- Financial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument37 pagesFinancial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- Financial ParametersDocument43 pagesFinancial ParametersJivaansha SinhaNo ratings yet

- Basics of Accounting Level IIDocument63 pagesBasics of Accounting Level IIjustvicky1000No ratings yet

- Chapter 2 - Accounting Analysis - SVDocument23 pagesChapter 2 - Accounting Analysis - SVK59 Le Nhat ThanhNo ratings yet

- Power Notes: Statement of Cash FlowsDocument63 pagesPower Notes: Statement of Cash FlowsRon ManNo ratings yet

- Accounting 301 Lecture Notes: Autumn 2013 Paul Febry, CPADocument16 pagesAccounting 301 Lecture Notes: Autumn 2013 Paul Febry, CPABella EveNo ratings yet

- Financial RatiosDocument44 pagesFinancial RatiosOmaidNo ratings yet

- Financial Accounting - NotesDocument28 pagesFinancial Accounting - NotesKathrinaRodriguezNo ratings yet

- Cima c02 - NotesDocument112 pagesCima c02 - Notesrenny2064775% (4)

- 1f9b0008-a5aa-48b6-923f-33607527d48bDocument2 pages1f9b0008-a5aa-48b6-923f-33607527d48bNihad ƏhmədovNo ratings yet

- Chapter 2 - Accounting Analysis - SVDocument23 pagesChapter 2 - Accounting Analysis - SVNguyen LienNo ratings yet

- Deffgh Fill inDocument5 pagesDeffgh Fill inaleah de jesusNo ratings yet

- Ratio AnalysisDocument25 pagesRatio Analysisdeba1644No ratings yet

- AN Introduction To Financial StatmentsDocument67 pagesAN Introduction To Financial StatmentsirquadriNo ratings yet

- ACCOUNTING (Nizam Sir) Syllabus Overview: Profitability RatiosDocument2 pagesACCOUNTING (Nizam Sir) Syllabus Overview: Profitability Ratiosanon_926636748No ratings yet

- Introduction To Accounting and Financial StatementDocument15 pagesIntroduction To Accounting and Financial StatementSubhra DasNo ratings yet

- Finance Primer - 2016Document26 pagesFinance Primer - 2016Gurram Sarath KumarNo ratings yet

- Chapter 10Document85 pagesChapter 10sherrybanoNo ratings yet

- ACC Lecture 1Document58 pagesACC Lecture 1Tinashe ChikwenhereNo ratings yet

- Chapter 2 of Fundamentals of Corporate FinanceDocument25 pagesChapter 2 of Fundamentals of Corporate FinanceDdsfalkdfjs100% (1)

- Chapter 2 Corporate FinanceDocument37 pagesChapter 2 Corporate FinancediaNo ratings yet

- Lec 2Document35 pagesLec 2Ahmad FauzanNo ratings yet

- How To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCDocument70 pagesHow To Take Charge of Your Farm's Financial Management: Terry Betker P.Ag., CAC, CMCTurner McKayNo ratings yet

- Financial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinDocument24 pagesFinancial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinMd Musa PatoaryNo ratings yet

- Note 2Document7 pagesNote 2faizoolNo ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- Accounting Information ValueDocument16 pagesAccounting Information ValuefarhanuddinsiddiquiNo ratings yet

- FCFChap 002Document24 pagesFCFChap 002istiNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw Hill/IrwinPasti JadiNo ratings yet

- Annual Report 2012Document416 pagesAnnual Report 2012rafey201No ratings yet

- Creating A Successful Financial PlanDocument29 pagesCreating A Successful Financial PlanNaveed Mughal AcmaNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinabilNo ratings yet

- Financial Statements, Taxes, and Cash Flows: Mcgraw-Hill/IrwinDocument27 pagesFinancial Statements, Taxes, and Cash Flows: Mcgraw-Hill/Irwinwahid_040No ratings yet

- Chap 002Document25 pagesChap 002Nishelle JeffreyNo ratings yet

- Chap-02-Lecture-Summer - 16 - Ross - 10 India YuDocument34 pagesChap-02-Lecture-Summer - 16 - Ross - 10 India YuAbinaya SathyaNo ratings yet

- Accruals-The Cornerstone: Illustration - Case FactsDocument12 pagesAccruals-The Cornerstone: Illustration - Case Factssri athiyatinNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinMutyaraNo ratings yet

- AFIN102 Notes Pack 1Document40 pagesAFIN102 Notes Pack 1boy.poo90No ratings yet

- Financial Accounting 1Document306 pagesFinancial Accounting 1Dimpal RabadiaNo ratings yet

- AnswerDocument8 pagesAnswerShamik SenghaniNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDani Yustiardi MunarsoNo ratings yet

- Financial PresentDocument19 pagesFinancial PresentTrung HậuNo ratings yet

- Difference Between COST and FINANCIAL AccountingDocument2 pagesDifference Between COST and FINANCIAL Accountingfaris_baba100% (2)

- Financial Accounting For ManagersDocument127 pagesFinancial Accounting For ManagerssowmtinaNo ratings yet

- Accountancy & Financial ManagementDocument38 pagesAccountancy & Financial ManagementUsman AyyubNo ratings yet

- Business Analysis and Valuation - Financial AnalysisDocument86 pagesBusiness Analysis and Valuation - Financial AnalysiscapassoaNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- TUTOR 9 CH22 The Short-Run Trade Off Between Inflation and UnemploymentDocument6 pagesTUTOR 9 CH22 The Short-Run Trade Off Between Inflation and Unemploymentcharlie simoNo ratings yet

- Problem Session-1 02.03.2012Document12 pagesProblem Session-1 02.03.2012charlie simoNo ratings yet

- Problem Session-1 - 02.03.2012Document72 pagesProblem Session-1 - 02.03.2012dewiNo ratings yet

- PLEDGE: I Have Neither Given Nor Received Unauthorized Help On This Quiz. SIGNED - PRINT NAMEDocument2 pagesPLEDGE: I Have Neither Given Nor Received Unauthorized Help On This Quiz. SIGNED - PRINT NAMEcharlie simoNo ratings yet

- AP Macro Practice MC Chapts 35Document22 pagesAP Macro Practice MC Chapts 35charlie simoNo ratings yet

- Chapter 21 Answersmultiple ChoicesDocument5 pagesChapter 21 Answersmultiple Choicescharlie simoNo ratings yet

- CH21Document4 pagesCH21charlie simoNo ratings yet

- Lecture 07n FullDocument40 pagesLecture 07n Fullcharlie simoNo ratings yet

- © 2007 Thomson South-WesternDocument44 pages© 2007 Thomson South-Westerncharlie simoNo ratings yet

- AP Macro Practice MC Chapts 35Document22 pagesAP Macro Practice MC Chapts 35charlie simoNo ratings yet

- 12 - Revising Sentences and ParagraphsDocument19 pages12 - Revising Sentences and Paragraphscharlie simoNo ratings yet

- BAE1044 English For Business Communication Syllabus Updated May 2014Document4 pagesBAE1044 English For Business Communication Syllabus Updated May 2014charlie simoNo ratings yet

- Lecture Plan Tri 2 1415 - BAE1044 - English For Business Communication 14oct2014Document3 pagesLecture Plan Tri 2 1415 - BAE1044 - English For Business Communication 14oct2014charlie simoNo ratings yet

- 06-Apache SparkDocument75 pages06-Apache SparkTarike ZewudeNo ratings yet

- Transparency Documentation EN 2019Document23 pagesTransparency Documentation EN 2019shani ChahalNo ratings yet

- JAZEL Resume-2-1-2-1-3-1Document2 pagesJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoNo ratings yet

- Maths PDFDocument3 pagesMaths PDFChristina HemsworthNo ratings yet

- Javascript Applications Nodejs React MongodbDocument452 pagesJavascript Applications Nodejs React MongodbFrancisco Miguel Estrada PastorNo ratings yet

- Departmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedDocument37 pagesDepartmental Costing and Cost Allocation: Costs-The Relationship Between Costs and The Department Being AnalyzedGeorgina AlpertNo ratings yet

- Job Description For QAQC EngineerDocument2 pagesJob Description For QAQC EngineerSafriza ZaidiNo ratings yet

- CV Ovais MushtaqDocument4 pagesCV Ovais MushtaqiftiniaziNo ratings yet

- Binary File MCQ Question Bank For Class 12 - CBSE PythonDocument51 pagesBinary File MCQ Question Bank For Class 12 - CBSE Python09whitedevil90No ratings yet

- Oracle FND User APIsDocument4 pagesOracle FND User APIsBick KyyNo ratings yet

- TLE - IA - Carpentry Grades 7-10 CG 04.06.2014Document14 pagesTLE - IA - Carpentry Grades 7-10 CG 04.06.2014RickyJeciel100% (2)

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoDocument17 pagesSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoNo ratings yet

- PC210 8M0Document8 pagesPC210 8M0Vamshidhar Reddy KundurNo ratings yet

- Unit Process 009Document15 pagesUnit Process 009Talha ImtiazNo ratings yet

- Dialog Suntel MergerDocument8 pagesDialog Suntel MergerPrasad DilrukshanaNo ratings yet

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Document3 pagesAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNo ratings yet

- MMC Pipe Inspection RobotDocument2 pagesMMC Pipe Inspection RobotSharad Agrawal0% (1)

- EnerconDocument7 pagesEnerconAlex MarquezNo ratings yet

- Assignment - 2: Fundamentals of Management Science For Built EnvironmentDocument23 pagesAssignment - 2: Fundamentals of Management Science For Built EnvironmentVarma LakkamrajuNo ratings yet

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaNo ratings yet

- 4 Bar LinkDocument4 pages4 Bar LinkConstance Lynn'da GNo ratings yet

- 3125 Vitalogic 4000 PDFDocument444 pages3125 Vitalogic 4000 PDFvlaimirNo ratings yet

- Rating SheetDocument3 pagesRating SheetShirwin OliverioNo ratings yet

- Hager Pricelist May 2014Document64 pagesHager Pricelist May 2014rajinipre-1No ratings yet

- Wendi C. Lassiter, Raleigh NC ResumeDocument2 pagesWendi C. Lassiter, Raleigh NC ResumewendilassiterNo ratings yet

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument58 pagesSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNo ratings yet

- Tivoli Performance ViewerDocument4 pagesTivoli Performance ViewernaveedshakurNo ratings yet

- Sample Annual BudgetDocument4 pagesSample Annual BudgetMary Ann B. GabucanNo ratings yet