Professional Documents

Culture Documents

6.presentation 7 - Afm

Uploaded by

Saloni AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6.presentation 7 - Afm

Uploaded by

Saloni AggarwalCopyright:

Available Formats

Amity Business School

TRIAL BALANCE

When posting of all the transactions into the Ledger is

completed and the accounts are balanced off, it

becomes necessary to check the arithmetical accuracy

of the accounting work. For this purpose the balance of

each and every account in the Ledger is put on a list.

The list so prepared is called a trial balance..

Trial Balance may be defined as a statement which

contains balances of all ledger accounts on a particular

date.

Amity Business School

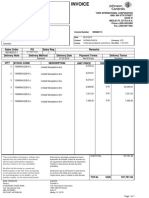

FORMAT

Particulars

Trial Balance

As on March 31, 2009

L.F

Dr Balance

(in Rs)

Cr.

Cr Balance

(in Rs)

Amity Business School

OBJECTIVES OF PREPARING A TRIAL

BALANCE

Following are the objectives of preparing Trial Balance

(i) To check arithmetical accuracy

(ii) To help in preparing Financial Statements

(iii) Helps in locating errors

(iv) Helps in comparison

(v) Helps in making adjustments

Trial Balance is generally prepared at the end of the year.

However it can be prepared at any time during the

accounting year to check the accuracy of the posting.

Amity Business School

METHODS OF PREPARATION OF

TRIAL BALANCE

A) Total Method : In this method , after totaling each side of

the ledger account, the respective debit and credit totals

of the ledger accounts are transferred to the respective

sides of the Trial Balance

Particulars

Cash A/c

Capital A/c

Purchases A/c

Total

Trial Balance

As on March 31, 2009

Cr.

Dr Balance Cr Balance

L.F (in Rs)

(in Rs)

25,000

12,000

7,000

20,000

4

Amity Business School

METHODS OF PREPARATION OF TRIAL

BALANCE

b) Balance Method: According to this method, every ledger

account is balanced and only the balance of the ledger

account is carried forward to the trial balance.

Particulars

Cash A/c

Capital A/c

Purchases A/c

Total

Trial Balance

As on March 31, 2009

Cr.

Dr Balance Cr Balance

L.F (in Rs)

(in Rs)

18,000

12,000

20,000

5

Amity Business School

TYPES OF ERRORS

The errors can be broadly classified as

Amity Business School

ERRORS of PRINCIPLE

When a transaction is recorded in contravention of

accounting principles.

For example: Purchase of machinery debited to

purchases account.

Effect: In this case, there will be no effect on Trial

Balance as these amounts are correctly placed on the

correct side though in the wrong account.

Amity Business School

CLERICAL ERRORS

These errors arise because of mistakes committed in the

ordinary course of accounting work. These are of three

types:

Amity Business School

Errors of Omission

If the transaction is completely or partially omitted in the

books of accounts. Errors of Omission can be complete or

partial.

Examples:

Complete: Purchased goods for Rs 5000. Entry not

recorded. In this case trial balance will match

Partial: Purchased goods on credit for RS 2000 from Ram

In this

case trial balance will not match.

Amity Business School

Errors of Commission

If while making an entry, the wrong amount is written

either in Journal or in the ledger, or entry is made in the

wrong side of the account, the error will be an error of

commission.

Examples:

a) Errors in posting as to amount Rs 400 posted as Rs 40

b) Wrong totaling of accounts

c) Wrong balancing of accounts

d)

Posting the same amount twice to an account.

10

Amity Business School

Compensating errors

If the effect of the errors committed cancels out, the

errors will be called compensating errors.

The trial balance will agree.

For example: X account debited with Rs 150 instead of

Rs 120 and Y account with Rs 200 instead of Rs 230

11

Amity Business School

SUSPENSE ACCOUNT

A suspense account is an account in which the amount

of difference in the trial balance is put till such time that

errors are located and rectified.

When the errors affecting Suspense account are

located, they are rectified with the help of the suspense

account

12

You might also like

- C) LIFO - Last in First OutDocument16 pagesC) LIFO - Last in First OutSaloni AggarwalNo ratings yet

- 9.cash Flow StatementDocument15 pages9.cash Flow StatementSaloni AggarwalNo ratings yet

- 12.ffinal Accounts 11 - AfmDocument23 pages12.ffinal Accounts 11 - AfmSaloni AggarwalNo ratings yet

- 11.final Accounts 10 - AfmDocument19 pages11.final Accounts 10 - AfmSaloni AggarwalNo ratings yet

- 10.costing 1 - AfmDocument13 pages10.costing 1 - AfmSaloni AggarwalNo ratings yet

- 11.final Accounts 10 - AfmDocument19 pages11.final Accounts 10 - AfmSaloni AggarwalNo ratings yet

- 10.costing 1 - AfmDocument13 pages10.costing 1 - AfmSaloni AggarwalNo ratings yet

- 8.fund Flow Statement 1Document17 pages8.fund Flow Statement 1Saloni AggarwalNo ratings yet

- 5.presentation 6 - AfmDocument12 pages5.presentation 6 - AfmSaloni AggarwalNo ratings yet

- Amity Business School: MBA Class of 2012, Semester IDocument21 pagesAmity Business School: MBA Class of 2012, Semester IMayank TiwariNo ratings yet

- 7presentation Financial Analysis - AfmDocument24 pages7presentation Financial Analysis - AfmSaloni AggarwalNo ratings yet

- 8.final Accounts 9 - AfmDocument13 pages8.final Accounts 9 - AfmSaloni AggarwalNo ratings yet

- 5.final AccountsDocument12 pages5.final AccountsSaloni AggarwalNo ratings yet

- Amity Business School: MBA Class of 2012, Semester IDocument21 pagesAmity Business School: MBA Class of 2012, Semester IMayank TiwariNo ratings yet

- Accounting For ManangementDocument2 pagesAccounting For ManangementSaloni AggarwalNo ratings yet

- 2.presentation 3 (II) - AfmDocument12 pages2.presentation 3 (II) - AfmSaloni AggarwalNo ratings yet

- 3.presentation 5 - AfmDocument10 pages3.presentation 5 - AfmSaloni AggarwalNo ratings yet

- 0fcd5bank Reconciliation StatementDocument8 pages0fcd5bank Reconciliation StatementAnjali PaulNo ratings yet

- 3.presentation 5 - AfmDocument10 pages3.presentation 5 - AfmSaloni AggarwalNo ratings yet

- Account: Amity Business SchoolDocument9 pagesAccount: Amity Business SchoolSaloni AggarwalNo ratings yet

- Presentation 2 - AfmDocument10 pagesPresentation 2 - AfmSaloni AggarwalNo ratings yet

- Accounting Principles: Amity Business SchoolDocument11 pagesAccounting Principles: Amity Business SchoolSaloni AggarwalNo ratings yet

- For Management: Common Issues and Recent Trends in AccountingDocument1 pageFor Management: Common Issues and Recent Trends in AccountingSaloni AggarwalNo ratings yet

- AFM Module 1Document30 pagesAFM Module 1Saloni AggarwalNo ratings yet

- CH 02Document18 pagesCH 02mayanksarin23No ratings yet

- Amity Business School: MBA Class of 2012, Semester IDocument10 pagesAmity Business School: MBA Class of 2012, Semester ISaloni AggarwalNo ratings yet

- Global Human Resource ManagementDocument7 pagesGlobal Human Resource ManagementSaloni AggarwalNo ratings yet

- Organizational Culture Critical TheoryDocument17 pagesOrganizational Culture Critical TheoryKunal BhardwajNo ratings yet

- Organizational Culture Critical TheoryDocument17 pagesOrganizational Culture Critical TheoryKunal BhardwajNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bo Dincer - New York City - Fixed Income Trader - Baris Dincer - Maritime CapitalDocument1 pageBo Dincer - New York City - Fixed Income Trader - Baris Dincer - Maritime CapitalBONDTRADER100% (3)

- Should You Buy or Sell Tail Risk Hedges? A Filtered Bootstrap ApproachDocument33 pagesShould You Buy or Sell Tail Risk Hedges? A Filtered Bootstrap ApproachRahul SheorainNo ratings yet

- CtviyhbkjDocument4 pagesCtviyhbkjRon MagnoNo ratings yet

- 2 - BK City Union Bank - 3QFY20Document8 pages2 - BK City Union Bank - 3QFY20Girish Raj SankunnyNo ratings yet

- Acct 2113Document5 pagesAcct 2113Nhon HoaiNo ratings yet

- 46712bosfnd p4 Part2 Cp6Document26 pages46712bosfnd p4 Part2 Cp6RushikeshNo ratings yet

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- Aditya Birla Mutual Funds SIDocument14 pagesAditya Birla Mutual Funds SIABHISHEK SINGHNo ratings yet

- Ch02HullOFOD9thEdition - EditedDocument31 pagesCh02HullOFOD9thEdition - EditedHarshvardhan MohataNo ratings yet

- Annualised Coste Ee 05-05-1Document2 pagesAnnualised Coste Ee 05-05-1jj0% (1)

- Scope of DerivativesDocument14 pagesScope of DerivativesAbhinav Roy0% (1)

- Corporation Law Course Syllabus Part I - General ProvisionsDocument11 pagesCorporation Law Course Syllabus Part I - General ProvisionsJani MisterioNo ratings yet

- FR Additional Questions For Practice - Dec 21 ExamsDocument59 pagesFR Additional Questions For Practice - Dec 21 ExamsmNo ratings yet

- Vanishing CompaniesDocument7 pagesVanishing CompaniesVinay Artwani100% (1)

- Need of Financial Advisor For Mutual Fund InvestorsDocument19 pagesNeed of Financial Advisor For Mutual Fund InvestorsNavjot SinghNo ratings yet

- Final Placements Students ListDocument4 pagesFinal Placements Students ListRahul MishraNo ratings yet

- Double Top and Double BottomDocument3 pagesDouble Top and Double BottomJimmy ChowNo ratings yet

- Ibo 06 PDFDocument4 pagesIbo 06 PDFKunal SharmaNo ratings yet

- G.R. No. 188146, February 01, 2017 Pilipinas Shell Petroleum Corporation, Petitioner, V. Royal Ferry Services, INC., Respondent. (LEONEN)Document1 pageG.R. No. 188146, February 01, 2017 Pilipinas Shell Petroleum Corporation, Petitioner, V. Royal Ferry Services, INC., Respondent. (LEONEN)GeorginaNo ratings yet

- First Screen: Part 1: Strength of Business IdeaDocument6 pagesFirst Screen: Part 1: Strength of Business IdeaArif ShanNo ratings yet

- Asistensi Pertemuan 9Document2 pagesAsistensi Pertemuan 9kerang ajaibNo ratings yet

- War22e Ch13Document77 pagesWar22e Ch13tamparddNo ratings yet

- Plaint - Crusader Redeemer V HighlandDocument62 pagesPlaint - Crusader Redeemer V HighlandSeth BrumbyNo ratings yet

- Solution AP Test Bank 1Document8 pagesSolution AP Test Bank 1ima100% (1)

- Crystal ReportsDocument1 pageCrystal ReportsFrancisco Riascos GomezNo ratings yet

- Accounting CheatsheetDocument1 pageAccounting Cheatsheetalbatross868973No ratings yet

- Major Components of The Travel BusinessDocument20 pagesMajor Components of The Travel BusinesskyenachiNo ratings yet

- Mutual Fund Investment InternshipDocument69 pagesMutual Fund Investment InternshipSv KhanNo ratings yet

- How To Develop The Ultimate Trading PlanDocument32 pagesHow To Develop The Ultimate Trading Planfrlax100% (2)

- Final Copy of Conso FS - FEUDocument133 pagesFinal Copy of Conso FS - FEUjoachimjackNo ratings yet