Professional Documents

Culture Documents

Corporate Finance: Capital Budgeting For The Levered Firm

Uploaded by

Ankit ThakurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Finance: Capital Budgeting For The Levered Firm

Uploaded by

Ankit ThakurCopyright:

Available Formats

17-1

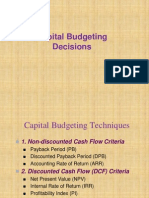

Chapter Seventeen

Capital Budgeting

forFinance

the

Corporate

Ross Westerfield Jaffe

Levered Firm

17

Sixth Edition

Prepared by

Gady Jacoby

University of Manitoba

and

Sebouh Aintablian

American University of

Beirut

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-2

Prospectus

Recall that there are three questions in corporate

finance.

The first regards what long-term investments the

firm should make (the capital budgeting question).

The second regards the use of debt (the capital

structure question).

This chapter is the nexus of these questions.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-3

Chapter Outline

17.1 Adjusted Present Value Approach

17.2 Flows to Equity Approach

17.3 Weighted Average Cost of Capital Method

17.4 A Comparison of the APV, FTE, and WACC

Approaches

17.5 Capital Budgeting for Projects that are Not ScaleEnhancing

17.6 APV Example

17.7 Beta and Leverage

17.8 Summary and Conclusions

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-4

17.1 Adjusted Present Value Approach

APV NPV NPVF

The value of a project to the firm can be thought of as the

value of the project to an unlevered firm (NPV) plus the

present value of the financing side effects (NPVF):

There are four side effects of financing:

The Tax Subsidy to Debt

The Costs of Issuing New Securities

The Costs of Financial Distress

Subsidies to Debt Financing

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-5

APV Example

Consider a project of the Pearson Company, the timing and

size of the incremental after-tax cash flows for an allequity firm are:

-$1,000

0

$125

$250

$375

$500

The unlevered cost of equity is r0 = 10%:

NPV10%

NPV10%

$125

$250

$375

$500

$1,000

2

3

(1.10) (1.10) (1.10) (1.10) 4

$56.50

The project would be rejected by an all-equity firm: NPV < 0.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-6

APV Example (continued)

Now, imagine that the firm finances the project with

$600 of debt at rB = 8%.

Pearsons tax rate is 40%, so they have an interest

tax shield worth TCBrB = .40$600.08 = $19.20

each year.

The net present value of the project under leverage is:

APV NPV NPVF

4

$19.20

APV $56.50

t

(

1

.

08

)

t 1

APV $56.50 63.59 $7.09

So, Pearson should accept the project with debt.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-7

APV Example (continued)

Note that there are two ways to calculate the NPV

of the loan. Previously, we calculated the PV of the

interest tax shields. Now, lets calculate the actual

NPV of the loan: 4

$600 .08 (1 .4) $600

NPVloan $600

t

4

(

1

.

08

)

(

1

.

08

)

t 1

NPVloan $63.59

APV NPV NPVF

APV $56.50 63.59 $7.09

Which is the same answer as before.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-8

17.2 Flows to Equity Approach

Discount the cash flow from the project to the

equity holders of the levered firm at the cost of

levered equity capital, rS.

There are three steps in the FTE Approach:

Step One: Calculate the levered cash flows

Step Two: Calculate rS.

Step Three: Valuation of the levered cash flows at rS.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-9

Step One: Levered Cash Flows for Pearson

Since the firm is using $600 of debt, the equity holders only have to

come up with $400 of the initial $1,000.

Thus, CF0 = -$400

Each period, the equity holders must pay interest expense. The after-tax

cost of the interest is BrB(1-TC) = $600.08(1-.40) = $28.80

CF3 = $375 -28.80

CF2 = $250 -28.80

CF1 = $125-28.80

-$400

0

McGraw-Hill Ryerson

CF4 = $500 -28.80 -600

$96.20

$221.20

$346.20

-$128.80

2003 McGrawHill Ryerson Limited

17-10

Step Two: Calculate rS for Pearson

B

rS r0 (1 TC )(r0 rB )

S

To calculate the debt-to-equity ratio, B/S, start with the debt

to value ratio. Note that the value of the project is

4

$125

$250

$375

$500

19.20

PV

2

3

4

t

(1.10) (1.10) (1.10) (1.10)

(

1

.

08

)

t 1

PV $943.50 63.59 $1,007.09

B = $600 when V = $1,007.09 so S = $407.09.

$600

rS .10

(1 .40)(.10 .08) 11.77%

$407.09

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-11

Step Three: Valuation for Pearson

Discount the cash flows to equity holders at rS = 11.77%

-$400

0

$96.20

1

$221.20

2

$346.20

3

-$128.80

4

$96.20

$221.20

$346.20

$128.80

PV $400

2

3

(1.1177 ) (1.1177 ) (1.1177 ) (1.1177 ) 4

PV $28.56

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-12

17.3 WACC Method for Pearson

rWACC

S

B

rS

rB (1 TC )

SB

SB

To find the value of the project, discount the unlevered cash

flows at the weighted average cost of capital.

Suppose Pearson Inc. target debt to equity ratio is 1.50.

B

1.5S B

1.50

S

B

1 .5 S

1 .5

S

0.60

1 0.60 0.40

S B S 1 .5 S 2 .5

SB

rWACC (0.40) (11.77%) (0.60) (8%) (1 .40)

rWACC 7.58%

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-13

Valuation for Pearson using WACC

To find the value of the project, discount the

unlevered cash flows at the weighted average cost

of capital

$125

$250

$375

$500

NPV $1,000

2

3

(1.0758) (1.0758) (1.0758) (1.0758) 4

NPV6.88% $6.68

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-14

17.4 A Comparison of the APV, FTE, and

WACC Approaches

All three approaches attempt the same task:

valuation in the presence of debt financing.

Guidelines:

Use WACC or FTE if the firms target debt-to-value ratio

applies to the project over the life of the project.

Use the APV if the projects level of debt is known over

the life of the project.

In the real world, the WACC is the most widely used

approach by far.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-15

Summary: APV, FTE, and WACC

Initial Investment

Cash Flows

Discount Rates

APV

WACC FTE

All

UCF

r0

All

UCF

rWACC

Equity Portion

LCF

rS

No

No

PV of financing effects Yes

Which approach is best?

Use APV when the level of debt is constant

Use WACC and FTE when the debt ratio is constant

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-16

17.5 Capital Budgeting for Projects that

are Not Scale-Enhancing

A scale-enhancing project is one where the project

is similar to those of the existing firm.

In the real world, executives would make the

assumption that the business risk of the non-scaleenhancing project would be about equal to the

business risk of firms already in the business.

No exact formula exists for this. Some executives

might select a discount rate slightly higher on the

assumption that the new project is somewhat riskier

since it is a new entrant.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-17

17.5 Capital Budgeting for Projects that are

Not Scale-Enhancing: An example

World-Wide Enterprises (WWE) is planning to enter into a

new line of business (widget industry)

American Widgets (AW) is a firm in the widget industry.

WWE has a D/E of 1/3, AW has a D/E of 2/3.

Borrowing rate for WWE is10 %

Borrowing rate for AW is 8 %

Given: Market risk premium = 8.5 %, Rf = 8%, Tc= 40%

What is the appropriate discount rate for WWE to use for its

widget venture?

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-18

17.5 Capital Budgeting for Projects that are

Not Scale-Enhancing: An example

A four step procedure to calculate discount rates:

1. Determining AWs cost of Equity Capital (rs)

2. Determining AWs Hypothetical All-Equity Cost of

Capital. (r0)

3. Determining rs for WWEs Widget Venture

4. Determining rWACC for WWEs Widget Venture.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-19

STEP 1:Determining AWs cost of Equity

Capital (rs)

r R ( R R )

s

r 8% 1.5 8.5 %

s

r 20.75 %

s

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-20

STEP 2 :Determining AWs Hypothetical AllEquity Cost of Capital. (r0)

B

rS r0

(1 TC )( r0 rB )

S

2

0.2075 r (0.6)(r 0.12)

3

0

r 0.1825

0

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-21

STEP 3 :Determining rs for WWEs Widget

Venture

Assuming that the business risk of WWE and AW

are the same,

B

rS r0

(1 TC )( r0 rB )

S

1

r 0.1825 (0.6)(0.1825 0.10)

3

s

r 0.199

s

NOTE : rs (WWE) < rs (AW)

McGraw-Hill Ryerson

because D/E (WWE) < D/E (AW)

2003 McGrawHill Ryerson Limited

17-22

STEP 4: Determining rWACC for WWEs Widget

Venture.

rWACC

WACC

WACC

S

B

rS

rB (1 TC )

SB

SB

3

1

0.199 0.10(0.6)

4

4

0.16425 16.425%

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-23

17.6 APV Example:

Worldwide Trousers, Inc. is considering a $5 million expansion of

their existing business.

The initial expense will be depreciated straight-line over five

years to zero salvage value

The pretax salvage value in year 5 will be $500,000.

The project will generate pretax earnings of $1,500,000 per year,

and not change the risk level of the firm.

The firm can obtain a five-year $3,000,000 loan at 12.5% to

partially finance the project.

If the project were financed with all equity, the cost of capital

would be 18%. The corporate tax rate is 34%, and the risk-free

rate is 4%.

The project will require a $100,000 investment in net working

capital.

Calculate the APV.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-24

17.6 APV Example: Cost

Lets work our way through the four terms in this equation:

APV Cost PVunlevered PVdepreciation PV interest

project

tax shield

tax shield

The cost of the project is not $5,000,000.

We must include the round trip in and out of net working

capital and the after-tax salvage value.

NWC is riskless, so

we discount it at rf.

Salvage value should Cost $5.1m 100,000 500,000(1 .34)

5

5

(

1

r

)

(

1

r

)

have the same risk as

f

0

the rest of the firms $4,873.561.25

assets, so we use r0.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-25

17.6 APV Example: PV unlevered project

Turning our attention to the second term,

APV $4,873.561.25 PVunlevered PVdepreciation PV interest

project

tax shield

tax shield

The PV unlevered project is the present value of the unlevered cash

flows discounted at the unlevered cost of capital, 18%.

PVunlevered

project

5

UCFt

$1.5m (1 .34)

t

t

(

1

r

)

(

1

.

18

)

t 1

t 1

o

5

PVunlevered $3,095,899

project

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-26

17.6 APV Example: PV depreciation tax shield

Turning our attention to the third term,

APV $4,873.561.25 $3,095,899 PVdepreciation PV interest

tax shield

tax shield

The PV depreciation tax shield is the present value of the tax savings

due to depreciation discounted at the risk free rate, at rf = 4%

PVdepreciation

tax shield

D TC

t

(

1

r

)

t 1

f

5

$1m .34

$1,513,619

t

t 1 (1.04)

5

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-27

17.6 APV Example: PV interest tax shield

Turning our attention to the last term,

APV $4,873.561.25 $3,095,899 $1,513,619 PV interest

tax shield

The PV interest tax shield is the present value of the tax savings due

to interest expense discounted at the firms debt rate, at rD =

12.5%

5

5

TC rD $3m

0.34 0.125 $3m

PV interest

t

t

(

1

r

)

(

1

.

125

)

t 1

t 1

D

tax shield

PV interest

tax shield

McGraw-Hill Ryerson

127,500

453,972.46

t

t 1 (1.125)

2003 McGrawHill Ryerson Limited

17-28

17.6 APV Example: Adding it all up

Lets add the four terms in this equation:

APV $4,873.561.25 3,095,899 1,513,619 453,972.46

APV $189,930

Since the project has a positive APV, it looks like a go.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-29

17.7 Beta and Leverage

Recall that an asset beta would be of the form:

Asset

McGraw-Hill Ryerson

Cov(UCF , Market )

2Market

2003 McGrawHill Ryerson Limited

17-30

17.7 Beta and Leverage: No Corp.Taxes

In a world without corporate taxes, and with riskless

corporate debt, it can be shown that the relationship

between the beta of the unlevered firm and the beta of

levered equity is:

Asset

Equity

Equity

Asset

In a world without corporate taxes, and with risky

corporate debt, it can be shown that the relationship

between the beta of the unlevered firm and the beta of

levered equity is:

Asset

McGraw-Hill Ryerson

Debt

Equity

Debt

Equity

Asset

Asset

2003 McGrawHill Ryerson Limited

17-31

17.7 Beta and Leverage: with Corp. Taxes

In a world with corporate taxes, and riskless debt, it can

be shown that the relationship between the beta of the

unlevered firm and the beta of levered equity is:

Equity

Since

Debt

1

(1 TC ) Unlevered firm

Equity

Debt

1

(1 TC )

Equity

must be more than 1 for a

levered firm, it follows that

McGraw-Hill Ryerson

Equity Unlevered firm

2003 McGrawHill Ryerson Limited

17-32

17.7 Beta and Leverage: with Corp. Taxes

If the beta of the debt is non-zero, then:

Equity

McGraw-Hill Ryerson

B

Unlevered firm (1 TC )( Unlevered firm Debt )

SL

2003 McGrawHill Ryerson Limited

17-33

17.8 Summary and Conclusions

1. The APV formula can be written as:

Additional

Initial

UCFt

APV

effects of

t

investment

t 1 (1 r0 )

debt

2. The FTE formula can be written as:

Amount

Initial

LCFt

APV

t

t 1 (1 rS )

investment borrowed

3. The WACC formula can be written as

Initial

UCFt

t

investment

t 1 (1 rWACC )

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-34

17.8 Summary and Conclusions (cont.)

4 Use the WACC or FTE if the firm's target debt to

value ratio applies to the project over its life.

5 The APV method is used if the level of debt is

known over the projects life.

6 The beta of the equity of the firm is positively

related to the leverage of the firm.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-35

Appendix 17-A:The APV approach to

Valuing Leveraged Buyouts (LBOs)

An LBO is the acquisition by a small group of investors of a

public or private company financed primarily with debt.

In an LBO, the equity investors are expected to pay off

outstanding principal according to a specific timetable.

The owners know that the firms debt-to-equity ratio will fall

and can forecast the dollar amount of debt needed to finance

future operations.

Under these circumstances, the APV approach is more

practical than the WACC approach because the capital

structure is changing.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-36

The APV Approach to Valuing LBOs:

The RJR Nabisco Buyout

In 1988, the CEO of the firm announced a bid of $75 per

share to take the firm private in a management buyout.

Another bid of $90 per share by Kohlberg Kravis and

Roberts (KKR) was followed.

At the end, KKR emerged from the bidding process with an

offer of $109 a share, totalling $25 billion.

We use the APV technique to analyze KKRs winning

strategy.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-37

The RJR Nabisco Buyout (cont.)

KKR planned a significant increase in leverage with

accompanying tax benefits.

The firm issued almost $24 billion of new debt to complete

the buyout with annual interest costs of $3 billion.

4 Steps for RJR LBO valuation

Step1: Calculating the PV of UCF for 1989-93:

PV

1988

PV

1988

$5.404 $4.311 $2.173 $2.336 $2.536

(1.14) (1.14) (1.14) (1.14) (1.14)

2

$12.224 billion

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-38

The RJR Nabisco Buyout (cont.)

Step1: Calculating the PV of UCF beyond 1993:

Assume :UCF grow at 3 % after 1993

PV

1993

PV

1988

$2.536(1.03)

$23.746 billion

0.14 0.03

$23.746 billion

$12.333 billion

(1.14)

5

TOTAL UNLEVERED VALUE = 12.224 +12.333 = $24.557 b

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-39

The RJR Nabisco Buyout (cont.)

Step3: Calculating the PV of interest tax shields 1989-93:

Given: average cost of debt (pretax) = 13.5 %

$1.151 $1.021 $1.058 $1.120 $1.184

PV

$3.877 b

(1.135) (1.135) (1.135) (1.135) (1.135)

1988

Step4: Calculating the PV of interest tax shields beyond 1993:

Assume: debt/assets ratio will be maintained at 25 %.

The WACC method will be appropriate to find terminal value.

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-40

The RJR Nabisco Buyout (cont.)

1

r 0.14 (1 0.34)(0.14 0.135) 0.141

3

s

WACC

3

1

(0.141) 0.135(1 0.34) 0.128 12.8%

4

4

PV

1993

McGraw-Hill Ryerson

$2.536(1.03)

$26.654 billion

0.128 0.03

2003 McGrawHill Ryerson Limited

17-41

The RJR Nabisco Buyout (cont.)

We know that: VL= VU + PVTS

PVTS = VL (1993)-VU(1993)

VL (1993)(from Step4) and Vu (1993)(from Step1)

PVTS = $26.654 23.746 = $2.908 billion

$2.908 billion

PV

$1.544 billion

(1.135)

1988

Total value of interest tax shields = 1.544 + 3.877 (from Step3)

= $5.421

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

17-42

The RJR Nabisco Buyout (cont.)

Total value of RJR = Total unlevered value +

Total value of interest tax shields

= $24.557 (Step1) + 5.421 (Step 4)

= $29.978 billion

McGraw-Hill Ryerson

2003 McGrawHill Ryerson Limited

You might also like

- Fin322 Week6Document6 pagesFin322 Week6chi_nguyen_100No ratings yet

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocument12 pagesShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Document13 pagesMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuNo ratings yet

- Economic SlidesDocument38 pagesEconomic SlidesThamer AlzahraniNo ratings yet

- Masan Group CorporationDocument31 pagesMasan Group Corporationhồ nam longNo ratings yet

- Diebold Case StudyDocument2 pagesDiebold Case StudySagnik Debnath67% (3)

- 8508Document10 pages8508Danyal ChaudharyNo ratings yet

- Fundraising Blueprint Plan TemplateDocument3 pagesFundraising Blueprint Plan Templateoxade21No ratings yet

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Appendix 8 - Instructions - RAPALDocument1 pageAppendix 8 - Instructions - RAPALTesa GDNo ratings yet

- ValuationDocument85 pagesValuationsamNo ratings yet

- Capital Budgeting Practice Questions QueDocument9 pagesCapital Budgeting Practice Questions QuemawandeNo ratings yet

- Ross Corporate 13e PPT CH18 AccessibleDocument26 pagesRoss Corporate 13e PPT CH18 AccessibleAbdulkareem AlharbiNo ratings yet

- Mcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocument44 pagesMcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedMohammad Ilham FawwazNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingmoosanipppNo ratings yet

- Chapter 5 - Investment Rules-1Document32 pagesChapter 5 - Investment Rules-1Ibrahim ManshaNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- L8-Valuations and Capital Budgeting For The LeveredDocument25 pagesL8-Valuations and Capital Budgeting For The LeveredtyraNo ratings yet

- CH 08Document12 pagesCH 08AlJabir KpNo ratings yet

- Chap 018Document27 pagesChap 018Nazifah100% (1)

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- PSB Tutorial Solutions Week 2Document14 pagesPSB Tutorial Solutions Week 2Iqtidar KhanNo ratings yet

- CapitalexpredecnsDocument25 pagesCapitalexpredecnsIamTinuNo ratings yet

- Present Worth Analysis: Engineering Economy With AccountingDocument21 pagesPresent Worth Analysis: Engineering Economy With AccountingCamilo Dela Cruz Jr.No ratings yet

- Fin 612 Managerial Finance Week Six Assignment Your Assignment - CompressDocument3 pagesFin 612 Managerial Finance Week Six Assignment Your Assignment - CompressBala GNo ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Capital RationingDocument24 pagesCapital RationingNeelesh GaneshNo ratings yet

- Capital Budgeting For The Levered FirmDocument15 pagesCapital Budgeting For The Levered FirmAnkur ChughNo ratings yet

- EBF 2054 Capital BudgetingDocument48 pagesEBF 2054 Capital BudgetingizzatiNo ratings yet

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Capital RationingDocument24 pagesCapital RationingKhalid MahmoodNo ratings yet

- Samplepractice Exam Questions and AnswersDocument57 pagesSamplepractice Exam Questions and AnswersShobhitNo ratings yet

- Project Appraisal and Selection: Time Preference For MoneyDocument16 pagesProject Appraisal and Selection: Time Preference For MoneynathnaelNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Document31 pagesCapital Budgeting Decision Rules: What Real Investments Should Firms Make?Adolfo SnyderNo ratings yet

- CH 13b BASICS OF CAPITAL BUDGETINGDocument2 pagesCH 13b BASICS OF CAPITAL BUDGETINGSadia YasmeenNo ratings yet

- Acf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IDocument43 pagesAcf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IXue Meng LuNo ratings yet

- Cost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Document27 pagesCost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Nirjon BhowmicNo ratings yet

- Chapter 5Document46 pagesChapter 5xffbdgngfNo ratings yet

- Topic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsDocument7 pagesTopic 9 - Advanced Valuation and Capital Budgeting - Practice SolutionsSelina LiNo ratings yet

- Finance Mini CaseDocument59 pagesFinance Mini Caseaudy100% (1)

- Capital Budgeting and Cash FlowsDocument49 pagesCapital Budgeting and Cash FlowsArun S BharadwajNo ratings yet

- Chapter 5 - Evaluating A Single ProjectDocument19 pagesChapter 5 - Evaluating A Single Projectmouhammad mouhammadNo ratings yet

- Valuation and Capital Budgeting For The Levered Firm: Mcgraw-Hill/IrwinDocument34 pagesValuation and Capital Budgeting For The Levered Firm: Mcgraw-Hill/IrwinThanh ThanhNo ratings yet

- Cash Flow & TaxesDocument11 pagesCash Flow & TaxesPartha ChakaravartiNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- Finance Management-Week 8Document12 pagesFinance Management-Week 8arwa_mukadam03No ratings yet

- Investment Analysis and Lockheed Tri Star: V C KGDocument6 pagesInvestment Analysis and Lockheed Tri Star: V C KGKrishna Prasad NNo ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Cap 5Document21 pagesCap 5IvanaNo ratings yet

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Sampa VideoDocument18 pagesSampa Videomilan979No ratings yet

- Topic 4 AdditionalDocument15 pagesTopic 4 AdditionalBaby KhorNo ratings yet

- Corporate Finance-CH.5-Section - Mazy MohamedDocument27 pagesCorporate Finance-CH.5-Section - Mazy MohamedMalak EltonyNo ratings yet

- Chapter 18Document25 pagesChapter 18fyoonNo ratings yet

- IM Chapter 6 and 7Document48 pagesIM Chapter 6 and 7Kasahun MekonnenNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- INDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 5: Evaluating A Single ProjectDocument38 pagesINDE/EGRM 6617-02 Engineering Economy and Cost Estimating: Chapter 5: Evaluating A Single Projectfahad noumanNo ratings yet

- Tutorial & Computer Lab Solutions - Week 8Document11 pagesTutorial & Computer Lab Solutions - Week 8yida chenNo ratings yet

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Corporate Value Creation: An Operations Framework for Nonfinancial ManagersFrom EverandCorporate Value Creation: An Operations Framework for Nonfinancial ManagersRating: 4 out of 5 stars4/5 (4)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Closure in Valuation: Estimating Terminal Value: Problem 1Document3 pagesClosure in Valuation: Estimating Terminal Value: Problem 1Silviu TrebuianNo ratings yet

- Chapter 7Document18 pagesChapter 7dheerajm88No ratings yet

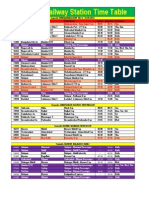

- Solapur Railway Station Time TableDocument2 pagesSolapur Railway Station Time TableAndrea Lopez33% (3)

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating ActivitiesIrfan MansoorNo ratings yet

- 5-Minute Chocolate Balls PDFDocument10 pages5-Minute Chocolate Balls PDFDiana ArunNo ratings yet

- Ticket PDFDocument1 pageTicket PDFVenkatesh VakamulluNo ratings yet

- Agriculture Subsidies and DevelopmentDocument2 pagesAgriculture Subsidies and Developmentbluerockwalla100% (2)

- VisuSon - Business Stress TestingDocument7 pagesVisuSon - Business Stress TestingAmira Nur Afiqah Agus SalimNo ratings yet

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocument24 pagesPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidNo ratings yet

- Putting English Unit14Document13 pagesPutting English Unit14Dung LeNo ratings yet

- Donner Company 2Document6 pagesDonner Company 2Nuno Saraiva0% (1)

- Brand Licensing PDFDocument3 pagesBrand Licensing PDFalberto micheliniNo ratings yet

- Indifference CurveDocument16 pagesIndifference Curveএস. এম. তানজিলুল ইসলামNo ratings yet

- Accounting For NotesDocument3 pagesAccounting For NotesRaffay MaqboolNo ratings yet

- Logistics AccountingDocument131 pagesLogistics AccountingCA Rekha Ashok PillaiNo ratings yet

- Gat PreparationDocument21 pagesGat PreparationHAFIZ IMRAN AKHTERNo ratings yet

- Tennis Ball Activity - Diminishing Returns - Notes - 3Document1 pageTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaNo ratings yet

- Business Level StrategyDocument28 pagesBusiness Level StrategyMohammad Raihanul HasanNo ratings yet

- Magazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheDocument5 pagesMagazine Still Holds True With Its Mission Statement-Dedicated To The Growth of TheRush YuviencoNo ratings yet

- StartUp India - Case AnalysisDocument3 pagesStartUp India - Case AnalysisIrshad AzeezNo ratings yet

- EnglishtoMath##1Document8 pagesEnglishtoMath##1zubairNo ratings yet

- Break Even Point ExplanationDocument2 pagesBreak Even Point ExplanationEdgar IbarraNo ratings yet

- Introduction To Business - 5Document11 pagesIntroduction To Business - 5Md. Rayhanul IslamNo ratings yet

- Market Share AnalysisDocument3 pagesMarket Share AnalysisLawal Musibaudeem ObafemiNo ratings yet