Professional Documents

Culture Documents

Notes Receivable

Uploaded by

Jenny Lariosa0 ratings0% found this document useful (0 votes)

71 views15 pagesNotes receivable are formal promises to pay, usually in the form of negotiable promissory notes which unconditionally promise payment at a future date of a sum certain. When a note matures and is not paid, it is considered dishonored. Notes receivable are initially measured at present value for long-term notes or face value for short-term notes. Interest-bearing long-term notes are measured at face value, while noninterest-bearing long-term notes are measured at present value. Subsequently, all long-term notes receivable are measured at amortized cost using the effective interest method.

Original Description:

Original Title

Notes Receivable.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNotes receivable are formal promises to pay, usually in the form of negotiable promissory notes which unconditionally promise payment at a future date of a sum certain. When a note matures and is not paid, it is considered dishonored. Notes receivable are initially measured at present value for long-term notes or face value for short-term notes. Interest-bearing long-term notes are measured at face value, while noninterest-bearing long-term notes are measured at present value. Subsequently, all long-term notes receivable are measured at amortized cost using the effective interest method.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views15 pagesNotes Receivable

Uploaded by

Jenny LariosaNotes receivable are formal promises to pay, usually in the form of negotiable promissory notes which unconditionally promise payment at a future date of a sum certain. When a note matures and is not paid, it is considered dishonored. Notes receivable are initially measured at present value for long-term notes or face value for short-term notes. Interest-bearing long-term notes are measured at face value, while noninterest-bearing long-term notes are measured at present value. Subsequently, all long-term notes receivable are measured at amortized cost using the effective interest method.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

Notes Receivable

- are claims supported by formal

promises to pay usually in the

form of notes.

Negotiable Promissory Note

- is an unconditional promise in writing made by

one person to another, signed by the maker,

engaging to pay on demand or at a fixed

determinable future time a sum certain in

money to order or to bearer.

Dishonored Notes

- when a promissory notes

matures and is not paid.

Initial measurement of notes receivable

Conceptually, notes receivable shall be measured initially at present

value.

Present Value - is the sum of all future cash flows discounted using

the prevailing market rate of interest for similar notes.

However, short-term notes receivable shall be measured at face

value.

Interest-bearing notes receivable

The initial measurement of long-term notes will

depend on whether the notes are interest-bearing or

noninterest-bearing.

Interest-bearing long term notes are measured at

face value which is actually the present value upon

issuance.

Noninterest-bearing notes receivable

Noninterest long-term notes are measured at

present value whuch is the discounted value of

the future cash flows using the effective interest

rate.

Subsequent measurement

Subsequent to initial recognition, long-

term notes receivable shall be measured at

amortized cost using the effective interest

method.

Meaning of amortized cost

The “amortization cost” is the amount at which the

note receivable is measured initially:

a. Minus principal repayment

b. Plus or minus cumulative amortization of any

difference between the initial carrying amount and

the principal maturity amount

c. Minus reduction for impairment or uncollectibility

For long-term noninterest-bearing notes

receivable, the amortized cost is the

present value plus amortization of the

discount, or the face value minus the

unamortized unearned interest income.

Illustration – Interest bearing note

An entity owned a tract of land costing P800,000

and sold the land for P1,000,000.

The entity received a 3-year note for P1,000,000

plus interesr of 12% compounded annually.

Journal entries

First Year

Note receivable 1,000,000

Land 800,000

Gain on sale of Land 200,00

Accrued interest receivable 120,000

Interest Income 120,000

Journal entries (continuation)

Second Year

Accrued interest receivable 134,400

Interest income 134,400

Face Value 1,000,000

Interest accrued for firsr year 120,000

Total 1,120,000

Interesr for second year 134,400

Journal entries (continuation)

Third Year

Cash 1,404,928

Notes receivable 1,000,000

Accrued interest receivable 254,400

Interest income 150,528

Face Value 1,000,000

Interest accrued:

First year 120,000

Second year 134,400 254,400

Total 1,254,000

Interest for Third year 150,528

Cash received 1,404,928

You might also like

- EquityDocument25 pagesEquityAli Azam Khan100% (11)

- Ia CH 6 & 7 NR LR 2020Document112 pagesIa CH 6 & 7 NR LR 2020Jm Sevalla57% (14)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Jussie Smollett's Emergency MotionDocument393 pagesJussie Smollett's Emergency MotionLouis R. FasulloNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- Receivables Part 2 AsuncionDocument65 pagesReceivables Part 2 AsuncionRica Jane Mariano100% (1)

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- Module 1 Notes and Loans Receivable PDFDocument43 pagesModule 1 Notes and Loans Receivable PDFALEXA GENMARY GULFAN0% (1)

- Materiality in The Audit of Financial StatementsDocument34 pagesMateriality in The Audit of Financial StatementsJenny LariosaNo ratings yet

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Auditing ProblemsDocument67 pagesAuditing ProblemsAngelica Ann Salen100% (1)

- Income Tax Solutions Manual Chapter SummariesDocument60 pagesIncome Tax Solutions Manual Chapter SummariesPaul Justin Sison Mabao88% (32)

- Nelson Mandela's Leadership and Anti-Apartheid StruggleDocument34 pagesNelson Mandela's Leadership and Anti-Apartheid StruggleAmmara Khalid100% (1)

- " Represents Only Claims Arising From Sale ofDocument3 pages" Represents Only Claims Arising From Sale ofprecious2lojaNo ratings yet

- Appellate Handbook 1Document290 pagesAppellate Handbook 1Anqous Cosby100% (1)

- Aac M 2 Cash Flow Prob Answer 1 5Document11 pagesAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- Financial Asset at Amortized CostDocument27 pagesFinancial Asset at Amortized CostRegene May TrinidadNo ratings yet

- Module 5 Loans ReceivablesDocument52 pagesModule 5 Loans ReceivablesMarjorie PalmaNo ratings yet

- PAS 7 Statement of Cash FlowsDocument7 pagesPAS 7 Statement of Cash Flowspanda 1100% (6)

- Cash FlowsDocument15 pagesCash FlowsAkshat DwivediNo ratings yet

- Flexible Benefit Plan - v1.17Document58 pagesFlexible Benefit Plan - v1.17Mukesh SinghNo ratings yet

- 4 in Re of The Admission To The Bar and OathDocument2 pages4 in Re of The Admission To The Bar and OathGenevieve BermudoNo ratings yet

- Notes ReceivableDocument15 pagesNotes ReceivableJenny LariosaNo ratings yet

- Accounting For Notes and Loans ReceivableDocument6 pagesAccounting For Notes and Loans ReceivableBvreanchtz Mantilla CalagingNo ratings yet

- Notes RecievableDocument50 pagesNotes RecievableRyan Abonales BagatuaNo ratings yet

- Derivatives ActivitiesDocument9 pagesDerivatives Activitiesjoong wanNo ratings yet

- Review Financial Instruments Under IFRS 11Document5 pagesReview Financial Instruments Under IFRS 11James Paul SinciocoNo ratings yet

- Notes Payable and Debt RestructuringDocument10 pagesNotes Payable and Debt RestructuringChrisus Joseph SarchezNo ratings yet

- Financial InstrumentDocument5 pagesFinancial InstrumentsadikiNo ratings yet

- Catan Selina Mari Unit 2 Intacc3 099Document12 pagesCatan Selina Mari Unit 2 Intacc3 099Elc Elc ElcNo ratings yet

- Liabilities: Chidelyn Aguado, Marian Andrage, Wincer Alonzaga, Chincel AniDocument57 pagesLiabilities: Chidelyn Aguado, Marian Andrage, Wincer Alonzaga, Chincel AniChincel AniNo ratings yet

- Chapter 6 - Notes ReceivableDocument5 pagesChapter 6 - Notes ReceivableTurks100% (1)

- Integrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesDocument10 pagesIntegrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesKamyll VidadNo ratings yet

- Notes ReceivableDocument9 pagesNotes ReceivableJAPNo ratings yet

- Module 2B. Debt RestructuringDocument17 pagesModule 2B. Debt RestructuringAaron MañacapNo ratings yet

- Notes ReceivableDocument5 pagesNotes ReceivableJustine Carl Nikko NakpilNo ratings yet

- Learn Receivables AccountingDocument46 pagesLearn Receivables AccountingCale Robert RascoNo ratings yet

- Financial Accounting Notes Receivable: Measurement and ExamplesDocument9 pagesFinancial Accounting Notes Receivable: Measurement and ExamplesJAPNo ratings yet

- Audit of ArDocument8 pagesAudit of ArRizzel SubaNo ratings yet

- BONDSDocument8 pagesBONDSCristina MajolasNo ratings yet

- Intermediate Accounting 1 Notes ReceivableDocument17 pagesIntermediate Accounting 1 Notes ReceivablefrostNo ratings yet

- C1 LiabilitiesDocument20 pagesC1 LiabilitiesJomar MarananNo ratings yet

- Week 05 - 03 - Module 12 - Investment in Debt InstrumentsDocument10 pagesWeek 05 - 03 - Module 12 - Investment in Debt Instruments지마리No ratings yet

- Z00330010220164013Installment SalesDocument19 pagesZ00330010220164013Installment SalesLinna GuinarsoNo ratings yet

- Cash Price EquivalentDocument4 pagesCash Price Equivalent밀크milkeuNo ratings yet

- PPE ACQUISITION COSTDocument4 pagesPPE ACQUISITION COSTsabina del monteNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Week 03 - 03 - Module 08 - Accounting For Receivables (Part 3)Document10 pagesWeek 03 - 03 - Module 08 - Accounting For Receivables (Part 3)지마리No ratings yet

- Principles of DeductionsDocument4 pagesPrinciples of DeductionsStanley Renz Obaña Dela CruzNo ratings yet

- Statement of Cash Flows ExplainedDocument6 pagesStatement of Cash Flows ExplainedJmaseNo ratings yet

- Accountancy Term-2 Practical QuestionsDocument3 pagesAccountancy Term-2 Practical QuestionsAnoushka ReddyNo ratings yet

- Current LiabilitiesDocument87 pagesCurrent LiabilitiestheheckwithitNo ratings yet

- Chapter 2 Part 2Document15 pagesChapter 2 Part 2AliansNo ratings yet

- Chapter8 Note PayableDocument24 pagesChapter8 Note PayableKristine Joy Peñaredondo BazarNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- Accounting For InvestmentDocument14 pagesAccounting For Investmentefe davidNo ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- MSU College of Business Administration and Accountancy Accounting 122 LiabilitiesDocument4 pagesMSU College of Business Administration and Accountancy Accounting 122 LiabilitiesJehan CodanteNo ratings yet

- Franchise Accounting FundamentalsDocument24 pagesFranchise Accounting FundamentalsJao FloresNo ratings yet

- C8 Note PayableDocument28 pagesC8 Note PayableJoana RidadNo ratings yet

- Debt Restructure - SIM - 0Document14 pagesDebt Restructure - SIM - 0lilienesieraNo ratings yet

- Chapter 1 - Current LiabilitiesDocument7 pagesChapter 1 - Current LiabilitiesAnton LauretaNo ratings yet

- Financial Stament ReviewDocument8 pagesFinancial Stament Reviewロザリーロザレス ロザリー・マキルNo ratings yet

- Safari - Mar 14, 2024 at 7:26 AMDocument1 pageSafari - Mar 14, 2024 at 7:26 AMMia Jane AcoNo ratings yet

- Financial Statements and Their Analysis - Service and Merchandising BusinessDocument21 pagesFinancial Statements and Their Analysis - Service and Merchandising BusinessJoana Marie DonatoNo ratings yet

- Combinepdf 1 PDFDocument16 pagesCombinepdf 1 PDFandrea arapocNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Visit To Download More Slides, Ebooks, Solution Manuals, and Test BanksDocument1 pageVisit To Download More Slides, Ebooks, Solution Manuals, and Test BanksJenny LariosaNo ratings yet

- VARIABLESDocument42 pagesVARIABLESJenny LariosaNo ratings yet

- Visit To Download More Slides, Ebooks, Solution Manuals, and Test BanksDocument1 pageVisit To Download More Slides, Ebooks, Solution Manuals, and Test BanksJenny LariosaNo ratings yet

- Audit Scores Across SubjectsDocument1 pageAudit Scores Across SubjectsJenny LariosaNo ratings yet

- Visit To Download More Slides, Ebooks, Solution Manuals, and Test BanksDocument1 pageVisit To Download More Slides, Ebooks, Solution Manuals, and Test BanksJenny LariosaNo ratings yet

- Quiz Bee Rules and FormatDocument111 pagesQuiz Bee Rules and FormatJenny LariosaNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Quiz Bee Rules and FormatDocument111 pagesQuiz Bee Rules and FormatJenny LariosaNo ratings yet

- Afar Cpar 1STPB May 2017 PDFDocument17 pagesAfar Cpar 1STPB May 2017 PDFJenny LariosaNo ratings yet

- 4 - Selection StructureDocument5 pages4 - Selection StructureJenny LariosaNo ratings yet

- VARIABLESDocument42 pagesVARIABLESJenny LariosaNo ratings yet

- NFJPIA1718 Safekeeping and Management of Documents IRRDocument15 pagesNFJPIA1718 Safekeeping and Management of Documents IRRJenny LariosaNo ratings yet

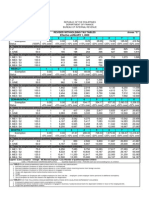

- Revised Withholding Tax TablesDocument1 pageRevised Withholding Tax TablesJonasAblangNo ratings yet

- Þa|awan State Math ReviewDocument3 pagesÞa|awan State Math Reviewkmaxest4No ratings yet

- General Education Mathematics LET Reviewer PDFDocument3 pagesGeneral Education Mathematics LET Reviewer PDFJenny Lariosa100% (1)

- Boa Tos MSDocument3 pagesBoa Tos MSMr. CopernicusNo ratings yet

- Morales Vs Juan Ponce Enrile: Habeas CorpusDocument37 pagesMorales Vs Juan Ponce Enrile: Habeas CorpusBrent TorresNo ratings yet

- Umesh Narain Vs Tobacco Institute of IndiaDocument73 pagesUmesh Narain Vs Tobacco Institute of IndiaThe Quint100% (2)

- J50 Feature Sheet May 2020Document2 pagesJ50 Feature Sheet May 2020victor porrasNo ratings yet

- Examination of Conscience (For Adults) Catholic-Pages - ComDocument4 pagesExamination of Conscience (For Adults) Catholic-Pages - ComrbrunetrrNo ratings yet

- Forticlient Ems 7.2.0 Release NotesDocument25 pagesForticlient Ems 7.2.0 Release NotesHalil DemirNo ratings yet

- RPD Daily Incident Report 1/5/23Document5 pagesRPD Daily Incident Report 1/5/23inforumdocsNo ratings yet

- Financial Accounting 10th Edition Harrison Test Bank 1Document73 pagesFinancial Accounting 10th Edition Harrison Test Bank 1harry100% (35)

- ULAB Midterm Exam Business Communication CourseDocument5 pagesULAB Midterm Exam Business Communication CourseKh SwononNo ratings yet

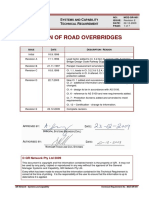

- Design of Road Overbridges: S C T RDocument7 pagesDesign of Road Overbridges: S C T RHe WeiNo ratings yet

- Mini project analysis of top 50 companies in Nifty 50 indexDocument19 pagesMini project analysis of top 50 companies in Nifty 50 indexcharan tejaNo ratings yet

- Answer To Exercises-Capital BudgetingDocument18 pagesAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)

- AKPK Power - Chapter 2 - Borrowing BasicsDocument20 pagesAKPK Power - Chapter 2 - Borrowing BasicsEncik Anif100% (1)

- Arriola vs. SandiganbayanDocument16 pagesArriola vs. SandiganbayanKKCDIALNo ratings yet

- Read, Trace, Write, and Glue: FREE-WinterDocument18 pagesRead, Trace, Write, and Glue: FREE-Winteralana reneNo ratings yet

- Islamic Law of ContractsDocument2 pagesIslamic Law of Contractszaky abdanyNo ratings yet

- LG Eva MSDSDocument8 pagesLG Eva MSDSpbNo ratings yet

- G.R. No. 173227Document6 pagesG.R. No. 173227Maria Lourdes Nacorda GelicameNo ratings yet

- Bharat Dalpat Patel Vs Russi Jal DorabjeeDocument4 pagesBharat Dalpat Patel Vs Russi Jal DorabjeeExtreme TronersNo ratings yet

- Cover Sheet: Month Day Month DayDocument135 pagesCover Sheet: Month Day Month DayMichael MertaNo ratings yet

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- On DFSDocument22 pagesOn DFSAditi pandeyNo ratings yet

- NaOH MSDSDocument4 pagesNaOH MSDSTeguh PambudiNo ratings yet

- Renata FernandaDocument16 pagesRenata FernandaRenata FernandaNo ratings yet

- Dhaka Ashulia Elevated Expressway PDFDocument192 pagesDhaka Ashulia Elevated Expressway PDFEmdad MunnaNo ratings yet