Professional Documents

Culture Documents

Gcse Bus Revised Support 9697

Uploaded by

ubaid0 ratings0% found this document useful (0 votes)

29 views15 pagesgcse report

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgcse report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views15 pagesGcse Bus Revised Support 9697

Uploaded by

ubaidgcse report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

Types of Business Ownership

GCSE Business Studies

Mixed Economy

• The United Kingdom and Ireland has a Mixed

Economy

• A Mixed Economy has:

– Private ownership of business/organisations and

– Public control of business/organisations

• Private ownership involves individuals and

groups of people who set up and run a business

• Public control involves the government running

organisations on behalf of the general public

Types of

Business Ownership

Private Sector Public Sector

• Sole Trader • Public Corporations

• Partnerships • Municipal

• Private Limited Undertakings

Company (Ltd) • Trusts

• Public Limited

Company (plc)

• Franchise

Sole Trader

Key Features

A Sole Trader has:

• 1 owner

• 0 to any number of employees

A Sole Trader is in the Private Sector

Sole Trader

Advantages Disadvantages

• Own boss • Unlimited liability

• Total control • No one to share

decision making

• Greater opportunity • Lack of specialisation

for flexible working

• No continuity of

• Keep all profits existence

• Easy to set up – few • Time off/holidays

legal requirements • Limited finance

Partnership

Key Features

A Partnership can have:

• 2 - 20 owners

• 0 to any number of employees

• A Sleeping Partner - someone who invests

money but takes no part in the day to day

running

• A Deed of Partnership - lays out rules for

running and dissolution of the Partnership eg

sharing of profits

A Partnership is in the Private Sector

Partnership

Advantages Disadvantages

• Shared decision • Unlimited liability

making • Profits have to be

shared between

• Increased capital

partners

invested

• No continuity of

• Increased existence

specialisation • Partners may have

• Easy to set up – few disagreements

legal requirements • Limited finance

Private Limited Company (Ltd)

Key Features

A Private Limited Company has the following key features:

• Ltd after it’s name

• Owners called shareholders

• A separate legal existence from owners

• Shareholders who are family and friends

• Governed by two legal documents:

– Memorandum of Association

– Articles of Association

• Controlled by a Board of Directors

• Run by a Managing Director

A Private Limited Company is in the Private Sector

Private Limited

Company (Ltd)

Advantages Disadvantages

• Limited liability • More complicated

• Greater availability to set up - legal

of finance formalities

• Specialisation can • Loss of individual

occur control

Public Limited Company (plc)

Key Features

A Public Limited Company has the following key features:

• plc after it’s name

• Owners called shareholders

• A separate legal existence from owners

• Shareholders who are members of the general public

• Governed by two legal documents:

– Memorandum of Association

– Articles of Association

• Controlled by a Board of Directors

• Run by a Managing Director

A Public Limited Company is in the Private Sector

Public Limited

Company (plc)

Advantages Disadvantages

• Limited liability • More complicated to

• Greater availability of set up - legal

finance formalities

• Specialisation can • Loss of individual

occur control

• Greater threat of

takeover

Franchise Key Features

A Franchise is:

• Where a business (the Franchiser) allows another business

(Franchisee) to trade under their name

• Also a method of business growth

• Some examples of franchises:

– McDonalds

– Pizza Hut

– Kwik Fit

– Thorntons

• Also going to have another type of business ownership eg

sole trader etc

A Franchise is in the Private Sector

Franchising

Advantages Disadvantages

For Franchisee For Franchisee

• Established name • Lack of total control

• Support of

Franchiser For Franchiser

For Franchiser • Risk of reputation

• Quick way to grow from unsuitable

• Royalties from franchisee

Franchisee

Comparison Business Ownership

FEATURES SOLE TRADER PARTNERSHIP LTD PLC FRANCHISE

Number of 1 2 - 20 Unlimited Unlimited Franchisor owns

owners: number of number of the name.

shareholders shareholders Franchisee owns

the premises

Liability of Unlimited Unlimited Limited Limited Depends on set

owners: sleeping partner up - may be a

- limited liability sole trader, Ltd

Capital Owner Partners Shareholders Shareholders Franchisee

provided

Who gets Owner Partners – may Shareholders Shareholders Franchisee

profits? be split Franchisor paid

according to royalties - % of

amount invested profits

Risks: High High Low Low Low

Legal None None Registration under Companies Act - Depends on set

Requirements: Memorandum and Articles of up of business

Association. Then receive a (eg sole trader

Certificate of Incorporation set up – no legal

PLC also receives Certificate of requirements

Trading etc)

Public Sector

• Business and organisations controlled by the

government

• Main aim of organisations in the Public Sector is

to provide a service for members of the general

public

• Examples include:

– BBC – British Broadcasting Corporation

– NHS - National Health Service

– DENI – Department of Education for Northern Ireland

– Defence – Army, Royal Navy, Royal Air force, PSNI

– Local Councils

You might also like

- Flavor and Fragrance AnalysisDocument1 pageFlavor and Fragrance AnalysisubaidNo ratings yet

- Complying With ISO 17025 A Practical GuidebookDocument122 pagesComplying With ISO 17025 A Practical Guidebookyes17025100% (8)

- A Food Coloring Guide: All About ColorsDocument4 pagesA Food Coloring Guide: All About ColorsubaidNo ratings yet

- Tem-290 Process Validation Protocol Template SampleDocument5 pagesTem-290 Process Validation Protocol Template SampleJonatan Dominguez Perez100% (2)

- Tem-290 Process Validation Protocol Template SampleDocument5 pagesTem-290 Process Validation Protocol Template SampleJonatan Dominguez Perez100% (2)

- Adamjee Insurance Company Limited: Health Insurance - In-Patient Claim FormDocument2 pagesAdamjee Insurance Company Limited: Health Insurance - In-Patient Claim FormubaidNo ratings yet

- 582 1749 1 PBDocument5 pages582 1749 1 PBamerican_guy10No ratings yet

- Fundamentals of Macroeconomics - Mcqs With Answers - Part IDocument4 pagesFundamentals of Macroeconomics - Mcqs With Answers - Part IubaidNo ratings yet

- Cefixime and Palpitations - From FDA ReportsDocument3 pagesCefixime and Palpitations - From FDA ReportsMuhammad UbaidNo ratings yet

- 582 1749 1 PBDocument5 pages582 1749 1 PBamerican_guy10No ratings yet

- Multiple Choice Questions ECONOMICSDocument3 pagesMultiple Choice Questions ECONOMICSubaidNo ratings yet

- PF 32 11 034 06Document6 pagesPF 32 11 034 06ubaidNo ratings yet

- God Made Man and Tailor Made GentlemanDocument1 pageGod Made Man and Tailor Made GentlemanubaidNo ratings yet

- The Complete List of Emulsifier CodesDocument8 pagesThe Complete List of Emulsifier CodesubaidNo ratings yet

- MannitolDocument1 pageMannitolubaidNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounting For Companies I: Learning ObjectivesDocument11 pagesAccounting For Companies I: Learning ObjectivesHongWei TeoNo ratings yet

- Types of Business Ownership in MalaysiaDocument3 pagesTypes of Business Ownership in MalaysiaMardhiah Ramlan0% (1)

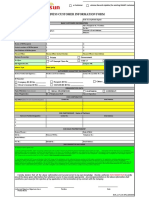

- Application Form Professional & Builder & Developer & GTLDocument15 pagesApplication Form Professional & Builder & Developer & GTLsmazNo ratings yet

- Business Studies 3F Activities Types of OrganizationsDocument4 pagesBusiness Studies 3F Activities Types of OrganizationsSamantha CranieyNo ratings yet

- Forms of Business OwnershipDocument30 pagesForms of Business OwnershipByun Boy50% (2)

- 11am Small Business Tax WorkshopDocument86 pages11am Small Business Tax WorkshopnowayNo ratings yet

- Full Corporate Finance Ross 10Th Edition Test Bank PDF Docx Full Chapter ChapterDocument36 pagesFull Corporate Finance Ross 10Th Edition Test Bank PDF Docx Full Chapter Chapterdrainerdetort.wa8n100% (17)

- Multiple Choice Questions: Top of FormDocument96 pagesMultiple Choice Questions: Top of Formchanfa3851No ratings yet

- z2OrgMgmt FinalSummativeTest LearnersDocument3 pagesz2OrgMgmt FinalSummativeTest LearnersJade ivan parrochaNo ratings yet

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameDocument2 pagesBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade Namelhuk banaag100% (2)

- Business Organizations Grade 8: Private SectorDocument14 pagesBusiness Organizations Grade 8: Private SectorPrinceyoon22No ratings yet

- Sole TraderDocument3 pagesSole TraderMichael Jawahar Babu RavuriNo ratings yet

- KYC Form Individual BOB 28 09 20020Document1 pageKYC Form Individual BOB 28 09 20020Rishu GiriNo ratings yet

- (Source: Board of Investments) : WWW - Boi.gov - PHDocument17 pages(Source: Board of Investments) : WWW - Boi.gov - PHazuremangoNo ratings yet

- A Project On Funds Flow Ststements 2016 in HeritageDocument48 pagesA Project On Funds Flow Ststements 2016 in HeritagevishnupriyaNo ratings yet

- 7-2 Final Project Submission Case Study AnalysesDocument13 pages7-2 Final Project Submission Case Study AnalysesTrish Franks50% (2)

- IB Business and Management Unit 1 DefinitionsDocument3 pagesIB Business and Management Unit 1 DefinitionsNatashaNo ratings yet

- Bmbe CompleteDocument61 pagesBmbe Completedarla1008No ratings yet

- Malaysia Company LawDocument30 pagesMalaysia Company LawTan Cheng Ying100% (4)

- Long Test PrepDocument9 pagesLong Test PrepMyles Ninon LazoNo ratings yet

- The Lahore Chamber of Commerce & Industry: Subject: Application For LCCI MembershipDocument3 pagesThe Lahore Chamber of Commerce & Industry: Subject: Application For LCCI MembershipSultan Mehmood56% (9)

- Forms of Business OrganisationDocument11 pagesForms of Business Organisationuche0% (1)

- Topic 1: The Concept of Business Organization in Nigeria: Nigerian Business Environment BAM 218Document14 pagesTopic 1: The Concept of Business Organization in Nigeria: Nigerian Business Environment BAM 218James Ishaku100% (2)

- SME On Kondapalli ToysDocument55 pagesSME On Kondapalli Toysmanasa vangetiNo ratings yet

- RFQ 758-20-06067 Design-Build North Res HallDocument35 pagesRFQ 758-20-06067 Design-Build North Res HallJAGUAR GAMINGNo ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementMuhammad KashifNo ratings yet

- Enpiii Notes PDFDocument88 pagesEnpiii Notes PDFNGOUEKO TIAKO GEOVANNYNo ratings yet

- Forms of OwnershipDocument2 pagesForms of OwnershipChelcey PascuaNo ratings yet

- C. RevisionDocument3 pagesC. RevisionmaciekNo ratings yet

- Demo Teaching SHS ABMDocument30 pagesDemo Teaching SHS ABMPhil-Wave Boat Builder Co. Ltd.No ratings yet