Professional Documents

Culture Documents

The Cash Book

Uploaded by

arun2311870 ratings0% found this document useful (0 votes)

33 views24 pagescash

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcash

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views24 pagesThe Cash Book

Uploaded by

arun231187cash

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

The Cash Book

The cash book is:

a book of prime entry

part of the double-entry system

the cash and bank accounts brought together

© Hodder Education 2008

The two-column

cash book

The cash book is set out so that the:

debit columns for cash and bank are side by side

credit columns for cash and bank are also side by

side

© Hodder Education 2008

The folio column

This column is used to identify the name of the

ledger and account number where the

corresponding part of the double entry has been

entered.

Using a folio column speeds up the process of

finding the opposite entry in the ledgers.

© Hodder Education 2008

Two-column cash

book

The layout

Cash book

Date Details Folio Cash Bank Date Details Folio Cash Bank

© Hodder Education 2008

Example

Complete the two-column cash book for the following:

1 March Balance brought down from last month:

cash £325; bank £8,640.

2 March Paid insurance £2,000 by cheque.

3 March Cash sales £600.

4 March Purchases by cheque £3,250.

5 March R Hodge paid us £4,250 by cheque.

6 March Bought stationery £40, paying by cash.

7 March Paid wages by cheque £1,350.

8 March P Wilson paid us £600 for goods previously

bought on credit.

9 March Received £2,000 owing from A Sumner.

10 March Paid rent £300 by cash.

© Hodder Education 2008

Cash book

Date Details Folio Cash Bank Date Details Folio Cash Bank

01/03 Balance b/d 325 8,640 02/03 Insurance GL 6 2,000

03/03 Sales GL 1 600 04/03 Purchases PL 2 3,250

05/03 R Hodge SL 2 4,250 06/03 Stationery GL 4 40

08/03 P Wilson SL 3 600 07/03 Wages GL 9 1,350

09/03 A Sumner SL 5 2,000 10/03 Rent GL 3 300

11/03 Balance c/d 585 8,890

925 15,490 925 15,490

© Hodder Education 2008

Tasks

Complete Question 1 on task sheet.

Complete Questions 1–14 from text book,

Chapter 10.

© Hodder Education 2008

Three-column cash

book

The three-column cash book incorporates an

additional column at each side for discounts.

There are two types of discounts but only one kind

are entered in the double-entry system.

© Hodder Education 2008

Discounts

1. Trade discounts

These are discounts given to companies who

trade in the same area or for bulk buying.

They are not recorded in the double-

entry system.

© Hodder Education 2008

Example: trade

discount

Goods normally sell at retail price of £250 each.

The manufacturer sells them to the retailer at a

20% trade discount for buying 10.

The discount is recorded on the invoice

£250 × 10 = 2,500 – 20% (£500) = £2000.

£2,000 is the figure that is used in the double-

entry books.

© Hodder Education 2008

Discounts

2. Cash discounts

These are discounts given for early settlement of

an invoice.

They are given to encourage early payment.

© Hodder Education 2008

These discounts are

recorded in the double-

entry system as:

Discounts allowed – discounts given to debtors

when they pay their accounts early.

Discounts received – discounts received by a

business from its suppliers when they pay their

accounts quickly.

© Hodder Education 2008

Discounts

The discount columns in the cash book are

memorandum columns.

At the end of the period they are totalled and the

total is transferred into the discounts allowed

account and discounts received account in the

general ledger.

© Hodder Education 2008

The three-column

cash book

Discount columns = memorandum columns.

The discount columns are not part of the double-

entry system.

These columns are totalled and transferred to the

discounts allowed account and discounts received

accounts in the general ledger.

© Hodder Education 2008

Contra

A transaction that appears on both the debit and

credit sides of the account is called a contra entry.

For example, when cash is taken out of the cash

account and put into the bank account, then both

entries will be in the cash book.

© Hodder Education 2008

Three-column cash

book

Cash Book

Date Details Folio Disc Allowed Cash Bank Date Details Folio Disc Received Cash Bank

© Hodder Education 2008

Enter the following transactions in the three-column cash book of

William Buck. Balance off the cash book and show the discounts

accounts in the general ledger.

1 July Balances brought forward: Cash £230; Bank 4,560.

2 July Cash sales £450.

3 July The following debtors paid their accounts by cheque each

deducting a 5% cash discount: R Jenn £460, S Benny £620 and

J Hacker £540.

4 July Paid rent by cheque £700.

5 July Paid wages by cheque £1,300.

6 July We paid the following accounts by cheque, in each case

deducting a 2% cash discount: F Jepson £300, D Hudson £400,

E Butler £600.

7 July Transferred £500 cash to the bank account.

8 July Bought stationery £60, paying cash.

© Hodder Education 2008

Cash Book

Disc Disc

Date Details Folio Allow Cash Bank Date Details Folio Rec’d Cash Bank

1/7 Balances b/d 230 4,560 4/7 Rent GL 2 700

2/7 Sales GL 1 450 5/7 Wages GL3 1,300

3/7 R Jenn SL3 23 437 6/7 F Jepson PL2 6 294

3/7 S Benny SL4 31 589 6/7 D Hudson PL5 8 392

3/7 J Hacker SL8 42 498 6/7 E Butler PL6 12 588

7/7 Cash C 500 7/7 Bank C 500

8/7 Stationery GL8 60

9/7 balance c/d 620 2,810

96 1,180 6,084 26 1,180 6,084

© Hodder Education 2008

Discounts allowed

9/7 Cash book 96

Discounts received

9/7 Cash book 26

© Hodder Education 2008

Bank overdraft

A bank overdraft is when a business has taken

more money out of its bank account than it has

deposited.

If this has occurred then the balance b/d will be

shown on the credit side of the account.

© Hodder Education 2008

For example, if a business on 1 November has a

bank overdraft of £1,200, and a cash balance of

£330, then the opening balances in the cash book

would appear as follows:

Cash Book

Date Details Folio Cash Bank Date Details Folio Cash Bank

1/11 balance b/d 330 1/11 balance b/d 1,200

© Hodder Education 2008

Tips

If the balance b/d on the bank is a credit then it is

a bank overdraft.

You can never have a balance b/d on the credit

side of the cash account (it is impossible to

physically spend more cash than you have).

Take care with discounts: trade discounts do not

appear in the cash book or double-entry accounts.

Cash discounts do appear in the cash book: these

are discounts given for early settlement, not

necessarily for cash payments.

© Hodder Education 2008

Tasks

Complete Question 2 from task sheet.

Complete Questions 1–6, Chapter 11 of text

book.

© Hodder Education 2008

You might also like

- Paperchromatographybharmsud 151012115319 Lva1 App6891 PDFDocument34 pagesPaperchromatographybharmsud 151012115319 Lva1 App6891 PDFarun231187No ratings yet

- XRDDocument27 pagesXRDHardik PrajapatiNo ratings yet

- PhysiologicalrolesofmineralsDocument46 pagesPhysiologicalrolesofmineralsarun231187No ratings yet

- Ureacycle ConversionDocument31 pagesUreacycle Conversionarun231187No ratings yet

- Adsorption PresentationDocument23 pagesAdsorption Presentationarun231187100% (1)

- Composition and FunctionsDocument13 pagesComposition and Functionsarun231187No ratings yet

- Specific Immune System: T - LymphocytesDocument18 pagesSpecific Immune System: T - Lymphocytesarun231187No ratings yet

- Effective Communication Between Physician and Pharmacist: Dr. G Praveen KumarDocument50 pagesEffective Communication Between Physician and Pharmacist: Dr. G Praveen Kumararun231187No ratings yet

- PUB210 HemeAtlas SampleDocument6 pagesPUB210 HemeAtlas Samplearun231187No ratings yet

- ChromatographyDocument31 pagesChromatographyarun231187No ratings yet

- International University of Africa Faculty of Pharmacy Medicinal Chemistry MCHM 311 Siddieg Omer Elsiddieg, M. SC, B. SC (Honors)Document47 pagesInternational University of Africa Faculty of Pharmacy Medicinal Chemistry MCHM 311 Siddieg Omer Elsiddieg, M. SC, B. SC (Honors)arun231187No ratings yet

- Vogel ExtractDocument17 pagesVogel Extractarun231187No ratings yet

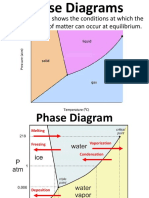

- A Phase Diagram Shows The Conditions at Which The Distinct Phases of Matter Can Occur at EquilibriumDocument9 pagesA Phase Diagram Shows The Conditions at Which The Distinct Phases of Matter Can Occur at Equilibriumarun231187No ratings yet

- High Energy Compouds: Anjali.H.S BCH.10.05.10Document66 pagesHigh Energy Compouds: Anjali.H.S BCH.10.05.10arun231187No ratings yet

- Conductometry Titrations PDFDocument4 pagesConductometry Titrations PDFkomalseemi97No ratings yet

- CARBOHYDRATESDocument38 pagesCARBOHYDRATESgulrukh100% (3)

- Calibracion MicropipetasDocument4 pagesCalibracion MicropipetasAnonymous 58LGc3No ratings yet

- Introduction to Biochemistry FundamentalsDocument34 pagesIntroduction to Biochemistry Fundamentalsarun231187No ratings yet

- Nutrition 1101-Lecture 21Document21 pagesNutrition 1101-Lecture 21arun231187No ratings yet

- ThephaseruleDocument48 pagesThephaserulearun231187No ratings yet

- Pipette CalibrationDocument79 pagesPipette Calibrationarun231187No ratings yet

- TwocomponentsystemDocument28 pagesTwocomponentsystemarun231187No ratings yet

- Carpalbonefractures 150330093618 Conversion Gate01Document136 pagesCarpalbonefractures 150330093618 Conversion Gate01arun231187No ratings yet

- Carbohydrates 131204014552 Phpapp02 PDFDocument27 pagesCarbohydrates 131204014552 Phpapp02 PDFTweenie Dalumpines100% (4)

- StalagmometerDocument4 pagesStalagmometerRamesh KumarNo ratings yet

- Titrasi PresipitasiDocument85 pagesTitrasi PresipitasiayukiwaNo ratings yet

- Pipette CalibrationDocument4 pagesPipette CalibrationbalajivangaruNo ratings yet

- Qualitative Carbohydrate Tests GuideDocument52 pagesQualitative Carbohydrate Tests Guidearun231187No ratings yet

- 4 ImportanceofbiochemistryDocument18 pages4 Importanceofbiochemistryarun231187No ratings yet

- 4 ImportanceofbiochemistryDocument18 pages4 Importanceofbiochemistryarun231187No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Calculating Depreciation and Average Rate of Return for Equipment InvestmentDocument9 pagesCalculating Depreciation and Average Rate of Return for Equipment Investmentpeter mulilaNo ratings yet

- Mean Vs Median Vs ModeDocument12 pagesMean Vs Median Vs ModekomalmongaNo ratings yet

- AprilDocument4 pagesAprilTerry WinegarNo ratings yet

- Lo Vs KJS Dacion en Pago. Existing CreditDocument1 pageLo Vs KJS Dacion en Pago. Existing CreditVen BuenaobraNo ratings yet

- AR PresentationDocument32 pagesAR PresentationSaq IbNo ratings yet

- EFU Life Insurance Group ReportDocument20 pagesEFU Life Insurance Group ReportZawar Afzal Khan0% (1)

- Analysis of Common Business TransactionsDocument18 pagesAnalysis of Common Business TransactionsClarisse RosalNo ratings yet

- Statement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Document4 pagesStatement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Kirti Kant SrivastavaNo ratings yet

- Hotel FranchiseDocument10 pagesHotel FranchiseTariku HailuNo ratings yet

- GST Aftab 2.0Document76 pagesGST Aftab 2.0AFTAB PIRJADENo ratings yet

- Audit Planning and Materiality: Concept Checks P. 209Document37 pagesAudit Planning and Materiality: Concept Checks P. 209hsingting yuNo ratings yet

- Introduction To XRPDocument15 pagesIntroduction To XRPiwan.herisetiadi6833No ratings yet

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDocument3 pagesQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzNo ratings yet

- DD Rules V 4 19 Rulebook Nov 2011 FinalDocument68 pagesDD Rules V 4 19 Rulebook Nov 2011 Finalimesimaging100% (1)

- CrowdForce - Pitch Deck 22.04.21Document22 pagesCrowdForce - Pitch Deck 22.04.21thiwa karanNo ratings yet

- Authority To Sell FORMDocument2 pagesAuthority To Sell FORMSuzi Garcia-RufinoNo ratings yet

- TerraPower Case PDFDocument7 pagesTerraPower Case PDFKaustav DeyNo ratings yet

- PERE - Mar24 22 29Document8 pagesPERE - Mar24 22 29simblante.nl166No ratings yet

- Table of Contents - Chapter 12: Accounts ReceivableDocument43 pagesTable of Contents - Chapter 12: Accounts Receivabletgbyhn111No ratings yet

- M4 Assignment 1Document4 pagesM4 Assignment 1Lorraine CaliwanNo ratings yet

- Corporate Mission: To Maximize The Value Shareholder's WealthDocument14 pagesCorporate Mission: To Maximize The Value Shareholder's WealthCamille GrandeNo ratings yet

- Practice Set For ACC 111Document6 pagesPractice Set For ACC 111Irahq Yarte TorrejosNo ratings yet

- Transaction Details PayPalDocument1 pageTransaction Details PayPalChristine Eunice RaymondeNo ratings yet

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- Capitalized Cost Eng Econo As1Document8 pagesCapitalized Cost Eng Econo As1Francis Valdez LopezNo ratings yet

- Fixed Assets ManagementDocument62 pagesFixed Assets ManagementBâlãjï BālûNo ratings yet

- 101 Bir FormDocument3 pages101 Bir Formmijareschabelita2No ratings yet

- Latest Jurisprudence and Landmark Doctrines On DepreciationDocument2 pagesLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanNo ratings yet

- Stamp Duty Rules ExplainedDocument3 pagesStamp Duty Rules ExplainedSausan SaniaNo ratings yet

- Notes Payable Are Obligations Accompanied by A Written Promise To Pay A Certain Amount of Money To TheDocument5 pagesNotes Payable Are Obligations Accompanied by A Written Promise To Pay A Certain Amount of Money To TheMelchie RepospoloNo ratings yet