Professional Documents

Culture Documents

A Project Report ON: Working Capital Management at Vodafone

Uploaded by

bhagathnagar0 ratings0% found this document useful (0 votes)

119 views12 pagesjkhhgfuuyyuiujhjhhjuouiop

Original Title

16VV12

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentjkhhgfuuyyuiujhjhhjuouiop

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

119 views12 pagesA Project Report ON: Working Capital Management at Vodafone

Uploaded by

bhagathnagarjkhhgfuuyyuiujhjhhjuouiop

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

A

PROJECT REPORT

ON

WORKING CAPITAL MANAGEMENT AT

VODAFONE

Under the guidance of SUBMITTED BY

Mr.CH. SRINIVAS MR. B. RAJESH

H.T.NO: 7407-16-672-012

INTRODUCTION

Working capital management

forms the inching of every business.

As Gilberth Harold puts the

problems. Unfortunately, there is

so much disagreement among

financiers, accountants, business

men and economists as to the exact

meaning of the term Working

Capital

NEED FOR THE STUDY

The need for working capital to run the day-

to-day business activities cannot be

overemphasized. We will hardly find a

business firm, which does not require any

amount of working capital. We know that a

firm should aim at maximizing the wealth of

its shareholders. In its endeavor to do so, a

firm should earn sufficient return from its

operations.

OBJECTIVES OF THE STUDY

To suggest the steps to be taken to increase the

efficiency in management of working capital.

To understand the conceptual framework relating

to management of working capital.

To know how the company is maintaining its

liquidity position.

To evaluate the working capital requirements of

the organization over the late six years.

RESEARCH METHODOLOGY

The present study will reveal the financial

performance of the company covering purely

financial data supplied by the company’s

financial statements through working capital

management

LIMITATIONS OF THE STUDY

The study is based mainly on secondary data.

The accuracy of the results is subjected to the

accuracy of the data furnished by the annual

reports.

Since the study is confined to only few aspects like

loans and advances, so the overall performance of

the company cannot be measured accurately.

COMPANY PROFILE

Vodafone India is a member of the Vodafone

Group and commenced operations in 1994

when its predecessor Hutchison Telecom

acquired the cellular license for Mumbai. The

company now has operations across the

country with over 150 million customers.

Vodafone India has firmly established a

strong position within the Vodafone Group

too, making it the largest subscriber base

globally. This journey is a strong testimony of

Vodafone’s success in a highly competitive

and price sensitive market

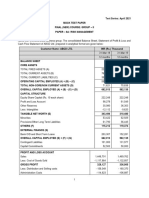

Schedule of changes in working capital statement for the year 2016-2017

Changes in Working capital

2016 2017

Particulars Increase Decrease

Rs In cr Rs. In cr

Rs. In cr Rs. In cr

CURRENT ASSETS

Inventories 441 482 41 -

Taxation recoverable 808 575 - -233

Trade & other receivables 8886 8053 - -833

Other investments 4419 3855 - -564

Cash and bank balances 10134 6882 - -3252

Assets held for sale 34 0 - -34

A. Total Current Assets: 24722 19847 - -4875

CURRENT

LIABILITIES

Short term borrowings 7747 12623 - 4876

Taxation liabilities 873 599 -274 -

Provisions 963 767 -196 -

Trade & other payables 15456 14908 -548 -

B. Total Current

25039 28897 - 3858

Liabilities

Net working Capital (A-

-317 -9050 - -

B)

Decrease in Working

-8733 - - -8733

Capital

Schedule of changes in working capital statement for the year 2015-2016

Changes in Working capital

2015 2016

Particulars Increase Decrease

Rs In cr Rs. In cr

Rs. In cr Rs. In cr

CURRENT ASSETS

Inventories 450 441 - -9

Taxation recoverable 452 808 356 -

Trade & other receivables 9412 8886 - -526

Other investments 5350 4419 - -931

Cash and bank balances 7623 10134 2511 -

Assets held for sale 0 34 34 -

A. Total Current Assets: 23287 24722 1435 -

CURRENT

LIABILITIES

Short term borrowings 12289 7747 -4542 -

Taxation liabilities 1919 873 -1046 -

Provisions 818 963 - 145

Trade & other payables 16918 15456 -1462 -

B. Total Current

31224 25039 -6185 -

Liabilities

Net working Capital (A-

-7937 -317 7620 -

B)

Increase in Working

- 7620 7620 -

Capital

Schedule of changes in working capital statement for the year 2014-2015

Changes in Working capital

2014 2015

Particulars Increase Decrease

Rs In cr Rs. In cr

Rs. In cr Rs. In cr

CURRENT ASSETS

Inventories 486 450 - -36

Taxation recoverable 334 452 118 -

Trade & other receivables 10744 9412 - -1332

Other investments 1323 5350 4027 -

Cash and bank balances 7138 7623 485 -

Assets held for sale 20025 23287 3262 -

A. Total Current Assets:

CURRENT

6258 12289 - 6031

LIABILITIES

Short term borrowings 1898 1919 - 21

Taxation liabilities 633 818 - 185

Provisions 15236 16918 - 1682

Trade & other payables 24025 31224 - 7199

B. Total Current

-4000 -7937 -

Liabilities

Net working Capital (A-

-3937 - -3937

B)

Decrease in Working

486 450 - -36

Capital

FINDINGS

Taxation recoverable is decreased from `.808 Crs in the year

2016 to `. 575 Crs in the year 2017.

Cash and bank balances is decreased from `. 10134 crs in the

year 2016 to `.6882 Crs in the year 2017.

Other investments is decreased from `. 5350 Crs in the year

2015 to `. 4419 Crs in the year 2016.

Short term borrowings is increased from `. 6258 crs in the

year 2014 to `.12289 Crs in the year 2015.

There is a increase net working Capital in the year 2014 `.

6072 Crs.

Taxation liabilities is decreased from `. 2874 crs in the year

2012 to `. 1912 Crs in the year 2013.

Thank You

You might also like

- Financial Due Diligence ReportDocument18 pagesFinancial Due Diligence ReportbiswajeetNo ratings yet

- 2016 Nestle ExtratedDocument7 pages2016 Nestle ExtratednesanNo ratings yet

- SBS 19 20Document12 pagesSBS 19 20Arslan ShafqatNo ratings yet

- Tesco PLC (Group 7)Document23 pagesTesco PLC (Group 7)Jingquan (Adele) ZhaoNo ratings yet

- SOFP HartaDocument1 pageSOFP Hartaワンピ ースNo ratings yet

- LACER - FS and Notes 2018 PDFDocument13 pagesLACER - FS and Notes 2018 PDFErben ReyesNo ratings yet

- Accounting Examples of International TypeDocument6 pagesAccounting Examples of International TypeGLORIA GUINDOS BRETONESNo ratings yet

- Cash Flow Statement - Amith PanickerDocument5 pagesCash Flow Statement - Amith PanickerAmith PanickerNo ratings yet

- Dr. Mannam Sreedevi - IMT - CeresDocument5 pagesDr. Mannam Sreedevi - IMT - CeresSreedevi MannamNo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- 2go FSDocument45 pages2go FSHafsah Amod DisomangcopNo ratings yet

- Carabao Ar 2014Document64 pagesCarabao Ar 2014Egao Mayukko Dina MizushimaNo ratings yet

- Dialog Axiata PLCDocument15 pagesDialog Axiata PLCgirihellNo ratings yet

- Financial Statement Analysis Report of For The Years 2017 & 2018Document15 pagesFinancial Statement Analysis Report of For The Years 2017 & 2018Lawrence Joshua ManzoNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- New Model of NetflixDocument17 pagesNew Model of NetflixPencil ArtistNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- 2016 Management AccountsDocument6 pages2016 Management AccountsJcaldas AponteNo ratings yet

- National College of Business Administration & Economics Front Lane Campus (FLC)Document7 pagesNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanNo ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- Data Analysis Penna Cement 1 NEWDocument22 pagesData Analysis Penna Cement 1 NEWShanmuka SreenivasNo ratings yet

- Discounted Cash FlowDocument9 pagesDiscounted Cash FlowAditya JandialNo ratings yet

- Quatar ShippingDocument42 pagesQuatar Shippingben BenmezdadNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument5 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AhbyhNo ratings yet

- 2019 Annual Audited Financial StatementDocument135 pages2019 Annual Audited Financial StatementAlexis Kaye DayagNo ratings yet

- BA Financial RatiosDocument7 pagesBA Financial RatiosRegen Mae OfiazaNo ratings yet

- Mahadev Medicine Suppliers Audit Report 2079-80Document9 pagesMahadev Medicine Suppliers Audit Report 2079-80sureshthakurclkNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperDocument10 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperBijay AgrawalNo ratings yet

- Cash Flow Analysis: Anandam Manufacturing CompanyDocument13 pagesCash Flow Analysis: Anandam Manufacturing CompanyANANTHA BHAIRAVI MNo ratings yet

- PE01 1logix With CommentsDocument5 pagesPE01 1logix With CommentsVuyoNo ratings yet

- Analysis of WCMDocument47 pagesAnalysis of WCMRATNA KUMARNo ratings yet

- Submitted By: Syeda Fatima Usman (65236) HUNAIN IMRAN (65368) HANIYA BATOOL (65282) Huraibah Batool (65283)Document24 pagesSubmitted By: Syeda Fatima Usman (65236) HUNAIN IMRAN (65368) HANIYA BATOOL (65282) Huraibah Batool (65283)Syeda Fatima UsmanNo ratings yet

- Financial Statements December 31, 2010 and 2009Document48 pagesFinancial Statements December 31, 2010 and 2009b21t3chNo ratings yet

- AMARILODocument8 pagesAMARILOIngrid Molina GarciaNo ratings yet

- Apex QE2012 Paper 1 Suggested Solution Question 2 CleanDocument2 pagesApex QE2012 Paper 1 Suggested Solution Question 2 CleanNicolasNo ratings yet

- QNFS31Dec2013 25 2 14 400pm2Document60 pagesQNFS31Dec2013 25 2 14 400pm2AamirKhanNo ratings yet

- Complete Spreadsheet - From 2020Document233 pagesComplete Spreadsheet - From 2020cpacpacpaNo ratings yet

- Tesla, Inc. (TSLA) : Cash FlowDocument239 pagesTesla, Inc. (TSLA) : Cash FlowAngelllaNo ratings yet

- Rangpur Foundry Limited 105-Middle Badda, Dhaka-1212Document4 pagesRangpur Foundry Limited 105-Middle Badda, Dhaka-1212anup dasNo ratings yet

- 5 6120493211875018431Document62 pages5 6120493211875018431Hafsah Amod DisomangcopNo ratings yet

- La-1l:,zru, I LL Raka LL Raka: AccountantsDocument4 pagesLa-1l:,zru, I LL Raka LL Raka: AccountantsSayeedMdAzaharulIslamNo ratings yet

- Hel Cash FlowDocument1 pageHel Cash Flowravibhartia1978No ratings yet

- The Hanuman Estates Limited: Adjutments ForDocument1 pageThe Hanuman Estates Limited: Adjutments Forravibhartia1978No ratings yet

- Economatica Actividad 6Document17 pagesEconomatica Actividad 6Jenny Zulay SUAREZ SOLANONo ratings yet

- Directors' Report: For The Period Ended 31 March 2018Document24 pagesDirectors' Report: For The Period Ended 31 March 2018Asma RehmanNo ratings yet

- Larsen Dec 2021 SaudiDocument41 pagesLarsen Dec 2021 SaudiLalit TilwaniNo ratings yet

- Anagerial Ccounting: June 2019Document16 pagesAnagerial Ccounting: June 2019aniudhNo ratings yet

- 2022 09 30 Biofish First Half Year 2022 Report and PresentationDocument24 pages2022 09 30 Biofish First Half Year 2022 Report and PresentationMaria PolyuhanychNo ratings yet

- Intl Business Machines Corp Com in Dollar US in ThousandsDocument6 pagesIntl Business Machines Corp Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- A04 T86uxmwsyll4x6ve.1Document44 pagesA04 T86uxmwsyll4x6ve.1citybizlist11No ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- New Data Provided - : Millions of US DollarsDocument1 pageNew Data Provided - : Millions of US DollarsEngr ShahzadNo ratings yet

- Activity 1 - Ratio Template and Financial StatementsDocument9 pagesActivity 1 - Ratio Template and Financial StatementsSiddhant AggarwalNo ratings yet

- Taliworks - Q4FY23Document31 pagesTaliworks - Q4FY23seeme55runNo ratings yet

- Bahl Annual 2013 PDFDocument98 pagesBahl Annual 2013 PDFnasir mehmoodNo ratings yet

- Test and Exam Qs Topic 2 QuestionsDocument15 pagesTest and Exam Qs Topic 2 QuestionsAsadvirkNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- EPCRDocument71 pagesEPCRYinka JosephNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Application 1319159893Document2 pagesApplication 1319159893bhagathnagarNo ratings yet

- DocDocument1 pageDocbhagathnagarNo ratings yet

- Mini Part1Document8 pagesMini Part1bhagathnagarNo ratings yet

- Plagiarism - ReportDocument31 pagesPlagiarism - ReportbhagathnagarNo ratings yet

- Sneha HasthamDocument1 pageSneha HasthambhagathnagarNo ratings yet

- Financial Statement Analysis: SRM PG CollegeDocument3 pagesFinancial Statement Analysis: SRM PG CollegebhagathnagarNo ratings yet

- DrdaDocument48 pagesDrdabhagathnagarNo ratings yet

- PDFDocument11 pagesPDFbhagathnagarNo ratings yet

- S, N.O Custamor Name Mobile Noumer Ariea Wats No Suresh Goud 9059417547 995966826Document2 pagesS, N.O Custamor Name Mobile Noumer Ariea Wats No Suresh Goud 9059417547 995966826bhagathnagarNo ratings yet

- Speech To Text and Text To Speech Coversion Using Raspberry PiDocument2 pagesSpeech To Text and Text To Speech Coversion Using Raspberry PibhagathnagarNo ratings yet

- TGB Annual Report 2014-15 Eng and HindiDocument116 pagesTGB Annual Report 2014-15 Eng and HindibhagathnagarNo ratings yet

- Profile PDFDocument5 pagesProfile PDFbhagathnagarNo ratings yet

- File ServeDocument5 pagesFile ServebhagathnagarNo ratings yet

- MEOsDocument72 pagesMEOsbhagathnagar67% (3)

- Notice of 15th AGMDocument2 pagesNotice of 15th AGMbhagathnagarNo ratings yet

- Correlation Based Character RecognitionDocument2 pagesCorrelation Based Character RecognitionbhagathnagarNo ratings yet

- TGB Annual Report Hindi-2015-16Document56 pagesTGB Annual Report Hindi-2015-16bhagathnagarNo ratings yet

- Construction of Residential Building (2Bhk) : A Project Report OnDocument28 pagesConstruction of Residential Building (2Bhk) : A Project Report Onbhagathnagar0% (1)

- SW 16mar2018 by TEBDocument71 pagesSW 16mar2018 by TEBbhagathnagarNo ratings yet

- Oct 18th PhoneDocument6 pagesOct 18th PhonebhagathnagarNo ratings yet

- 20180207054053Document2 pages20180207054053bhagathnagarNo ratings yet

- Code of ConductDocument18 pagesCode of ConductbhagathnagarNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentbhagathnagarNo ratings yet

- TSSPDCL English Model Question Papers PDFDocument12 pagesTSSPDCL English Model Question Papers PDFbhagathnagarNo ratings yet

- Ticket Printer - CleartripDocument1 pageTicket Printer - CleartripbhagathnagarNo ratings yet

- 9788184489323Document1 page9788184489323bhagathnagarNo ratings yet

- Monetary Management Is That Administrative Movement Which Is Worried About The Arranging and Controlling of The Organizations Budgetary AssetsDocument35 pagesMonetary Management Is That Administrative Movement Which Is Worried About The Arranging and Controlling of The Organizations Budgetary AssetsbhagathnagarNo ratings yet

- Chapter 1Document8 pagesChapter 1bhagathnagarNo ratings yet

- JyothiDocument48 pagesJyothibhagathnagarNo ratings yet

- Assessing Apical PulseDocument5 pagesAssessing Apical PulseMatthew Ryan100% (1)

- Power System Protection (Vol 3 - Application) PDFDocument479 pagesPower System Protection (Vol 3 - Application) PDFAdetunji TaiwoNo ratings yet

- Properties of WaterDocument23 pagesProperties of WaterNiken Rumani100% (1)

- Communicating Value - PatamilkaDocument12 pagesCommunicating Value - PatamilkaNeha ArumallaNo ratings yet

- Legrand Price List-01 ST April-2014Document144 pagesLegrand Price List-01 ST April-2014Umesh SutharNo ratings yet

- Flipkart Labels 06 Jul 2022 09 52Document37 pagesFlipkart Labels 06 Jul 2022 09 52Dharmesh ManiyaNo ratings yet

- TechBridge TCP ServiceNow Business Case - Group 6Document9 pagesTechBridge TCP ServiceNow Business Case - Group 6Takiyah Shealy100% (1)

- Army Aviation Digest - Apr 1971Document68 pagesArmy Aviation Digest - Apr 1971Aviation/Space History LibraryNo ratings yet

- Vq40de Service ManualDocument257 pagesVq40de Service Manualjaumegus100% (4)

- OB and Attendance PolicyDocument2 pagesOB and Attendance PolicyAshna MeiNo ratings yet

- PM 50 Service ManualDocument60 pagesPM 50 Service ManualLeoni AnjosNo ratings yet

- Writ Petition 21992 of 2019 FinalDocument22 pagesWrit Petition 21992 of 2019 FinalNANDANI kumariNo ratings yet

- What Is The PCB Shelf Life Extending The Life of PCBsDocument9 pagesWhat Is The PCB Shelf Life Extending The Life of PCBsjackNo ratings yet

- Springs: All India Distributer of NienhuisDocument35 pagesSprings: All India Distributer of NienhuisIrina DroliaNo ratings yet

- Our Story Needs No Filter by Nagarkar SudeepDocument153 pagesOur Story Needs No Filter by Nagarkar SudeepKavya SunderNo ratings yet

- Payment of Wages 1936Document4 pagesPayment of Wages 1936Anand ReddyNo ratings yet

- Vanguard 44 - Anti Tank Helicopters PDFDocument48 pagesVanguard 44 - Anti Tank Helicopters PDFsoljenitsin250% (2)

- The Marriage of Figaro LibrettoDocument64 pagesThe Marriage of Figaro LibrettoTristan BartonNo ratings yet

- Consumer Protection ActDocument34 pagesConsumer Protection ActshikhroxNo ratings yet

- Study Notes - Google Project Management Professional CertificateDocument4 pagesStudy Notes - Google Project Management Professional CertificateSWAPNIL100% (1)

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Traffic Survey, Analysis, and ForecastDocument91 pagesTraffic Survey, Analysis, and Forecastsanthosh rajNo ratings yet

- Electronics 11 02566Document13 pagesElectronics 11 02566卓七越No ratings yet

- Porter's 5-Force Analysis of ToyotaDocument9 pagesPorter's 5-Force Analysis of ToyotaBiju MathewsNo ratings yet

- Final - Anarchy One-Sheet Sell SheetDocument2 pagesFinal - Anarchy One-Sheet Sell SheetMaddanie WijayaNo ratings yet

- Solutions DPP 2Document3 pagesSolutions DPP 2Tech. VideciousNo ratings yet

- E-CRM Analytics The Role of Data Integra PDFDocument310 pagesE-CRM Analytics The Role of Data Integra PDFJohn JiménezNo ratings yet

- Tec066 6700 PDFDocument2 pagesTec066 6700 PDFExclusivo VIPNo ratings yet

- Acceptable Use Policy 08 19 13 Tia HadleyDocument2 pagesAcceptable Use Policy 08 19 13 Tia Hadleyapi-238178689No ratings yet

- Clinical Skills TrainingDocument12 pagesClinical Skills TrainingSri Wahyuni SahirNo ratings yet