Professional Documents

Culture Documents

Introduction To International Business & Finance

Uploaded by

Bilal Raja0 ratings0% found this document useful (0 votes)

104 views10 pagesOriginal Title

Introduction to International Business & Finance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views10 pagesIntroduction To International Business & Finance

Uploaded by

Bilal RajaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 10

INTERNATIONAL

BUSINESS & FINANCE

BC-613

B.Com (Hons) 8th Semester

Compulsory Course

INTERNATIONAL

FINANCE

Meaning & Definition

International finance is the branch of

economics that studies the dynamics of

exchange rates,foreign investment and how

these affect international trade. It also studies

international projects, international investments and

capital flows, and trade deficits. It includes the

study of futures, options and currency swaps.

Together with international trade theory,

international finance is also a branch of

international economics.

Explanation

• Linkage of domestic finance activities with IF

focusing on problems arise in IF such as

exchange rate complications, opportunities

and risk involved in overseas borrowing and

investment such as inflation, discount rate etc

• IF is a subfield of Finance and all finance is

going to be ‘international’ (international financial

crises in USA effected whole the world)

The benefits of studying IF

IF helps in two ways

• Helps FM to decide how international events will

affect a firm and which steps can be taken to

exploit positive developments and insulate the

firm from harmful ones

• Helps managers to anticipate events and make

profitable decisions before the events occur.

Among in exchange rates, as well as in interest

rates, inflation rates and asset values.

It is difficult to think of any firm or

individual that is not affected in some way

or other by the international environment.

Jobs, bond and stock prices, food prices,

government revenuers and other important

economic variables are all tied to

exchange rates and other development in

the global financial environment.

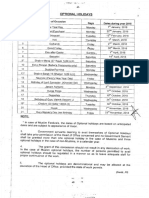

Demonstration of some effects

of change in exchange rate

December 2008

Exchange Rate US $ 1 = Pak Rupee 60

International Price in Pakistan

price (US $) (PKR)

Imported Commodity (per

2 120

unit)

Raw Material 100 6000

Foreign Loans 40 billion 2400 billion

FDI 10 billion 600 billion

February 2010

Exchange Rate US $ 1 = Pak Rupee 88

International Price in Pakistan

price (US $) (PKR)

Imported Commodity (per

2 176

unit)

Raw Material 100 8800

Foreign Loans 40 billion 3520 billion

FDI 10 billion ?

Change

Internati Change

Price I Pakistan (PKR)

onal

December February 2010

price

2008

(US $)

Imported 2 120 176 56

Commodity

(per unit)

Raw Material 100 6000 8800 2800

Foreign Loans 40 2400 b. 3520 b. 1120 b.

billion

FDI 10 600 b. ? ?

billion

Some questions for you

Consequences to

• Public finance

• Tax matters

• Govt negotiation power to foreign & local

businessmen

• Debt servicing

• Foreign & economic policies

You might also like

- Devaluation of Pakistan RupeeDocument28 pagesDevaluation of Pakistan Rupeemuhammad irfanNo ratings yet

- Devaluation of Pakistan RupeeDocument28 pagesDevaluation of Pakistan Rupeehameed.mba055336100% (12)

- Difference Between The Balance of Payments CA and FADocument2 pagesDifference Between The Balance of Payments CA and FAIrfan AhmedNo ratings yet

- International Financial Management PgapteDocument24 pagesInternational Financial Management PgapteAdison Growar SatyeNo ratings yet

- Macroeconomic Interaction with World EconomyDocument31 pagesMacroeconomic Interaction with World EconomyIQBAL NASEEM IQBAL NASEEMNo ratings yet

- Pakistan 719Document46 pagesPakistan 719Abdul MajeedNo ratings yet

- AssignmentDocument7 pagesAssignmentNurul IzzatyNo ratings yet

- FDI in Pakistan: Trends, Challenges, and ProspectsDocument21 pagesFDI in Pakistan: Trends, Challenges, and ProspectsJ lodhiNo ratings yet

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- Done By, Rounak Gupta: Management Joint-Venture Transfer of Technology ExpertiseDocument5 pagesDone By, Rounak Gupta: Management Joint-Venture Transfer of Technology Expertisekirti11No ratings yet

- Balance of PaymentDocument29 pagesBalance of Paymentprincesssneha128281No ratings yet

- Unit 3: Foreign Direct Investment: ECON 401 The Changing Global EconomyDocument52 pagesUnit 3: Foreign Direct Investment: ECON 401 The Changing Global Economyjacklee1918No ratings yet

- Notes On Foreign TranslationDocument3 pagesNotes On Foreign TranslationcpacpacpaNo ratings yet

- Impact of Fiis On National Stock Exchange of IndiaDocument6 pagesImpact of Fiis On National Stock Exchange of IndiaVamshi KrishnaNo ratings yet

- Economic Comparison of Pakistan 1999-2009: Indicator 1999 2007 2008 2009Document4 pagesEconomic Comparison of Pakistan 1999-2009: Indicator 1999 2007 2008 2009Fahad HassanNo ratings yet

- Currency Fluctuation: Accountancy Project - SMBA 12 (2010 - 2012)Document13 pagesCurrency Fluctuation: Accountancy Project - SMBA 12 (2010 - 2012)itsme_gossip60% (5)

- Economic Indicators - India: Gross Domestic Product, 2000Document6 pagesEconomic Indicators - India: Gross Domestic Product, 2000Divya PuriNo ratings yet

- Introduction of International FinanceDocument29 pagesIntroduction of International FinanceZubair13260% (1)

- Presented By: Vaishali Sharma Lecturer MBA-IBEDocument26 pagesPresented By: Vaishali Sharma Lecturer MBA-IBEKartikNo ratings yet

- Balance of P WKSTDocument2 pagesBalance of P WKSTjayshree D Y PATIL INTERNATIONAL SCHOOL PUNE0% (1)

- Unit 2 Till Exposure 8Document22 pagesUnit 2 Till Exposure 820je0426HritikGuptaNo ratings yet

- Economic Indicators - Pakistan: Gross Domestic Product, 2000Document6 pagesEconomic Indicators - Pakistan: Gross Domestic Product, 2000Taimur ShanNo ratings yet

- PAS 21 EFFECTS OF FOREIGN EXCHANGE RATESDocument7 pagesPAS 21 EFFECTS OF FOREIGN EXCHANGE RATESElizabeth DumawalNo ratings yet

- If Cheat SheetDocument6 pagesIf Cheat Sheetdamtuan11012000No ratings yet

- ITC by Country: JapanDocument43 pagesITC by Country: Japanthinh duongNo ratings yet

- Ie FinalDocument3 pagesIe FinalMỹ Hoa LêNo ratings yet

- Market Size Subsaharan AfricaDocument21 pagesMarket Size Subsaharan AfricaJehangir IftikharNo ratings yet

- Performance of Inward and Outward U.S. Foreign Direct Investment During Recent Financial CrisesDocument31 pagesPerformance of Inward and Outward U.S. Foreign Direct Investment During Recent Financial CrisesBalanuța IanaNo ratings yet

- Core 2 Financial Risk ManagementDocument99 pagesCore 2 Financial Risk ManagementShailjaNo ratings yet

- Mail Notes After Midterm - MacroDocument14 pagesMail Notes After Midterm - MacroPRITEENo ratings yet

- Study of Singapore Financial Market and Monetary AuthorityDocument21 pagesStudy of Singapore Financial Market and Monetary AuthorityrohanNo ratings yet

- Open EconomyDocument56 pagesOpen Economy4111220078shelsiNo ratings yet

- Foreign Exchange Risk Exposure (1)Document13 pagesForeign Exchange Risk Exposure (1)mansi dhimanNo ratings yet

- Liberalized Remittance SchemeDocument5 pagesLiberalized Remittance SchemePuneet NandaNo ratings yet

- Balance of Payments As A Leading Indicator: DR Rupal ChowdharyDocument11 pagesBalance of Payments As A Leading Indicator: DR Rupal ChowdharyGrishma JainNo ratings yet

- Pre Feasibility SPC FloorDocument6 pagesPre Feasibility SPC Floorashenafii100% (1)

- International Finance: and Foreign ExchangeDocument37 pagesInternational Finance: and Foreign ExchangeskvgcribdNo ratings yet

- Ec 038Document4 pagesEc 038suman subediNo ratings yet

- International EconomicsDocument349 pagesInternational EconomicsMr. Chan BonnivoitNo ratings yet

- Midterm - MGT003Document6 pagesMidterm - MGT003GIGI BODONo ratings yet

- Fdi in IndiaDocument21 pagesFdi in IndiaYash MehraNo ratings yet

- Foreign Investment: Benefit & RiskDocument23 pagesForeign Investment: Benefit & RiskAvayant Kumar SinghNo ratings yet

- Session 15Document23 pagesSession 15Sid Tushaar SiddharthNo ratings yet

- SUSA - United States Fact SheetDocument2 pagesSUSA - United States Fact SheetscribdcurioushNo ratings yet

- Unit 12 Balance of PaymentsDocument13 pagesUnit 12 Balance of PaymentsVivek AdateNo ratings yet

- Ef3a PPT Bop1 Current Account Pcb7 UlDocument137 pagesEf3a PPT Bop1 Current Account Pcb7 UlHarmeet SinghNo ratings yet

- Foreign Currency ConversionDocument39 pagesForeign Currency ConversionRutuja KulkarniNo ratings yet

- Unit 17 PDFDocument9 pagesUnit 17 PDFnitikanehiNo ratings yet

- (Group 5) - Balance of PaymentsDocument49 pages(Group 5) - Balance of Paymentshoangminh01122019No ratings yet

- Chapter 10 Blades CaseDocument2 pagesChapter 10 Blades CaseJanka SiposNo ratings yet

- 01 INBU 4200 Fall 2012 Lecture 1 Valuation Model For MNC and Global InvestorsDocument27 pages01 INBU 4200 Fall 2012 Lecture 1 Valuation Model For MNC and Global InvestorsChauhan ShivangiNo ratings yet

- P1 - 2 - International Monetary SystemDocument18 pagesP1 - 2 - International Monetary SystemMario KabosuNo ratings yet

- ITC by Country - PeruDocument37 pagesITC by Country - PeruThiago Rios PolarNo ratings yet

- Lecture - Open Economy - Exchange Rate DynamicsDocument21 pagesLecture - Open Economy - Exchange Rate DynamicsParth BhatiaNo ratings yet

- Managerial EconomicsDocument13 pagesManagerial Economics20me23No ratings yet

- ECON Chapter 7Document8 pagesECON Chapter 7Mushaisano MudauNo ratings yet

- FULL CONVERTIBILITY OF INDIAN RUPEEDocument18 pagesFULL CONVERTIBILITY OF INDIAN RUPEEankur jaiswalNo ratings yet

- Foreign Exchange Aka FOREXDocument53 pagesForeign Exchange Aka FOREXVinit RokdeNo ratings yet

- Exports To Dollars For Invisible PaymentsDocument7 pagesExports To Dollars For Invisible PaymentsandrewNo ratings yet

- PTA Annual Report 2017Document72 pagesPTA Annual Report 2017Bilal RajaNo ratings yet

- Public and Optional Holidays-2018Document3 pagesPublic and Optional Holidays-2018Aisha ShahidNo ratings yet

- Work Force Diversity, Globalization, Technological Innovation & Human Resource PracticesDocument15 pagesWork Force Diversity, Globalization, Technological Innovation & Human Resource PracticesBilal RajaNo ratings yet

- Success of O2 in The UK Mobile Phone CategoryDocument3 pagesSuccess of O2 in The UK Mobile Phone CategoryBilal RajaNo ratings yet

- Project On LenovoDocument25 pagesProject On LenovoHelpdesk100% (1)

- Water CrisesDocument12 pagesWater CrisesBilal RajaNo ratings yet

- NationalismDocument9 pagesNationalismBilal RajaNo ratings yet

- Trade On Price at Your Peril1Document2 pagesTrade On Price at Your Peril1Bilal RajaNo ratings yet

- Pakistan Government AgendaDocument2 pagesPakistan Government AgendaBilal RajaNo ratings yet

- Yuvanah Chyawanprash New Product LaunchDocument24 pagesYuvanah Chyawanprash New Product LaunchBilal RajaNo ratings yet

- Ocean Park CaseDocument40 pagesOcean Park CaseBilal RajaNo ratings yet

- PMLN Document 20 January 2011 10-Point-AgendaDocument2 pagesPMLN Document 20 January 2011 10-Point-AgendaBilal RajaNo ratings yet

- CASE #1. Food For The Children-Or Bribes For The Minister of Education?Document4 pagesCASE #1. Food For The Children-Or Bribes For The Minister of Education?Bilal RajaNo ratings yet

- Consumers Behaviour TowardsDocument9 pagesConsumers Behaviour TowardsBilal RajaNo ratings yet

- Project On Impact of Celebrity EndormentDocument20 pagesProject On Impact of Celebrity EndormentHelpdesk0% (1)

- How The Bailouts DwarfDocument18 pagesHow The Bailouts DwarfBilal RajaNo ratings yet

- Digital Media AirlinesDocument4 pagesDigital Media AirlinesdivzkNo ratings yet

- CBL ChocobiteDocument52 pagesCBL ChocobiteBilal Raja100% (1)

- The Debt Crisis in Greece and The Euro ZoneDocument5 pagesThe Debt Crisis in Greece and The Euro ZoneBilal RajaNo ratings yet

- What Should Be The Agenda of Pakistan.. 2 Main IssuesDocument2 pagesWhat Should Be The Agenda of Pakistan.. 2 Main IssuesBilal RajaNo ratings yet

- Exchange Rate DeterminationDocument22 pagesExchange Rate DeterminationBilal Raja0% (1)

- Brandz Apple 01 06Document4 pagesBrandz Apple 01 06Bilal RajaNo ratings yet

- Currency DerivativesDocument40 pagesCurrency DerivativesBilal RajaNo ratings yet

- Is Greece The Next LehmansDocument2 pagesIs Greece The Next LehmansBilal RajaNo ratings yet

- Country Risk AnalysisDocument29 pagesCountry Risk AnalysisBilal Raja100% (2)

- Greece's Debt Crisis - Its Implications ForDocument2 pagesGreece's Debt Crisis - Its Implications ForBilal RajaNo ratings yet

- The College Cafe Is A Student-To-student Internet MarketplaceDocument29 pagesThe College Cafe Is A Student-To-student Internet MarketplaceBilal RajaNo ratings yet

- Exiting The Economic Crisis TogetherDocument2 pagesExiting The Economic Crisis TogetherBilal RajaNo ratings yet

- CH-21-Tapping Into Global MarketsDocument14 pagesCH-21-Tapping Into Global MarketsBilal Raja100% (4)

- Agexmark Top1Document6 pagesAgexmark Top1Waren LlorenNo ratings yet

- Lesson 3 GLOBAL ECONOMYDocument3 pagesLesson 3 GLOBAL ECONOMYRosemarie BacallanNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDBala KumarNo ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 3 PDFDocument10 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 3 PDFAlans TechnicalNo ratings yet

- Full Download Better Business 4th Edition Solomon Test BankDocument36 pagesFull Download Better Business 4th Edition Solomon Test Bankmaf0dlwood100% (24)

- Chapter 9 Investments QuizDocument5 pagesChapter 9 Investments QuizMs Vampire100% (1)

- Bearish Bets 3 Stocks You Really Should Think About Shorting This WeekDocument6 pagesBearish Bets 3 Stocks You Really Should Think About Shorting This WeekhanvwbNo ratings yet

- Accounting Test BankDocument32 pagesAccounting Test Bankleah_may6No ratings yet

- PWC A4 Data Governance ResultsDocument36 pagesPWC A4 Data Governance ResultsHoangdhNo ratings yet

- PPT5-Allocation and Depreciation of Differences Between Implied and Book ValuesDocument51 pagesPPT5-Allocation and Depreciation of Differences Between Implied and Book ValuesRifdah SaphiraNo ratings yet

- The Myth of Asia's Miracle Paul Krugman: A Cautionary FableDocument17 pagesThe Myth of Asia's Miracle Paul Krugman: A Cautionary Fable0shaka0No ratings yet

- Foundations of Financial Management 16th Edition Block Test Bank 1Document27 pagesFoundations of Financial Management 16th Edition Block Test Bank 1john100% (33)

- EIU Asia Outlook 2023Document8 pagesEIU Asia Outlook 2023Lan HươngNo ratings yet

- Lowy Institute 2023 Asia Power Index Key Findings ReportDocument36 pagesLowy Institute 2023 Asia Power Index Key Findings ReportDimitris VgNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- The Media and Financial CrisesDocument339 pagesThe Media and Financial CrisesKaan SaracogluNo ratings yet

- Theory of National IncomeDocument72 pagesTheory of National IncomeAlex RockNo ratings yet

- Introduction&Lec 1Document45 pagesIntroduction&Lec 1JayHatNo ratings yet

- Ps 4Document4 pagesPs 4Tuấn KiệtNo ratings yet

- Carchedi, Guglielmo - RemarxDocument15 pagesCarchedi, Guglielmo - RemarxTom CookNo ratings yet

- The Economist 2312Document385 pagesThe Economist 2312Ramos PresleyNo ratings yet

- Defining The Diasporic CaribbeanDocument2 pagesDefining The Diasporic CaribbeanLatoya Toya Ebanks88% (8)

- 07 - Chapter 2Document39 pages07 - Chapter 2tapanamoriaNo ratings yet

- Delhi Metro Plan 2020-25Document9 pagesDelhi Metro Plan 2020-25Kamal NegiNo ratings yet

- Financial Challenges of Ambulant Kakanin Vendors: Basis For Continuity Plan QuestionnaireDocument4 pagesFinancial Challenges of Ambulant Kakanin Vendors: Basis For Continuity Plan QuestionnaireLeslie Ann Elazegui UntalanNo ratings yet

- 06 Road WriteUp 2022Document30 pages06 Road WriteUp 2022Yvette MislangNo ratings yet

- Eun8e Chapter06 TB AnswerkeyDocument28 pagesEun8e Chapter06 TB AnswerkeyshouqNo ratings yet

- Infyom Technologies Account FeesDocument66 pagesInfyom Technologies Account FeesMD DNNo ratings yet

- Types of Elasticity of DemandDocument3 pagesTypes of Elasticity of Demandapi-372734986% (7)

- Insurance & Risk ManagementDocument4 pagesInsurance & Risk ManagementTeju PaputejNo ratings yet