Professional Documents

Culture Documents

Lascona Land Co. Inc. vs. Commission of Internal Revenue: Facts

Uploaded by

JoVic2020Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lascona Land Co. Inc. vs. Commission of Internal Revenue: Facts

Uploaded by

JoVic2020Copyright:

Available Formats

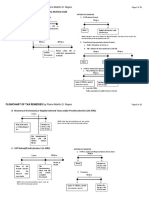

Lascona Land Co. Inc. vs.

Commission of Internal Revenue

FACTS:

March 27, 1998

April 20, 1998

- CIR issued an assessment

- Lascona Filed a

notice for the year 1993

protest.

amounting to P 753K.

March 3, 1999

NO DECISION in the -Notwithstanding the inaction of the CIR.

lapsed of 180 days: The The Regional Director of BIR send a letter

CIR did not act on the to petitioner that in the lapse of 180 days

matter of the protest. petitioner must file within 30 days a

petition for review with the CTA, failure

to do so, will render the assessment final

and executory .

• Lascona Land Co. Inc. vs. Commission of Internal Revenue

FACTS: April, 12 1999 Jan 4, 2000

-Petitioner filed a petition for -CTA Ruled in Favor of Lascona.

review with the Court of Tax

appeals.

CTA held that in cases of inaction by the CIR

on the protested assessment, Section 228 of

the NIRC provided two options for the

taxpayer: (1) appeal to the CTA within thirty Dissatisfied, the CIR filed an

(30) days from the lapse of the one hundred appeal before the CA.

eighty (180)-day period, or (2) wait until the

Commissioner decides on his protest before

he elevates the case.

• Lascona Land Co. Inc. vs. Commission of Internal Revenue

FACTS:

October 25, 2005

-Court of Appeals granted the CIR’s

petition and set aside the Decision

dated January 4, 2000 of the CTA

• Lascona Land Co. Inc. vs. Commission of Internal Revenue

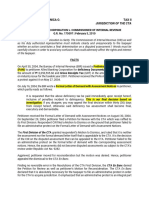

ISSUE: Whether or not the subject assessment has become final and executory due to

failure of petitioner to file an appeal before the CTA within Thirty(30) days from the

lapse of One hundred eight (180) day period pursuant to Sec 228 of NIRC?

RULING:

NO. The Supreme court cited its own ruling in the case of RCBC v. CIR, 522 SCRA 144

(2007), the Court has held that in case the Commissioner failed to act on the disputed

assessment within the 180-day period from date of submission of documents, a

taxpayer can either:

(1) file a petition for review with the Court of Tax Appeals within 30 days after

the expiration of the 180-day period; or

(2) await the final decision of the Commissioner on the disputed assessments and

appeal such final decision to the Court of Tax Appeals within 30 days after receipt

of a copy of such

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Lascona Land Co. Inc. vs. Commission of Internal Revenue: FactsDocument4 pagesLascona Land Co. Inc. vs. Commission of Internal Revenue: FactsJoVic2020No ratings yet

- Lascona Land Co., Inc. v. CIR (667 SCRA 455)Document2 pagesLascona Land Co., Inc. v. CIR (667 SCRA 455)Karl MinglanaNo ratings yet

- Lascona Land Co vs. CIRDocument2 pagesLascona Land Co vs. CIRAnneNo ratings yet

- 1.rizal Commercial Banking Corporation vs. Commissioner of INTERNAL REVENUE-Protest Tax AssessmentsDocument9 pages1.rizal Commercial Banking Corporation vs. Commissioner of INTERNAL REVENUE-Protest Tax AssessmentsSheena Jean Krystle LabaoNo ratings yet

- Lascona Land Co., Inc. v. CIRDocument5 pagesLascona Land Co., Inc. v. CIRL.A. ManlangitNo ratings yet

- Lascona Vs CIR - Case DigestDocument1 pageLascona Vs CIR - Case DigestKaren Mae ServanNo ratings yet

- CIR Wins Tax Remedies CasesDocument37 pagesCIR Wins Tax Remedies CasesLanz OlivesNo ratings yet

- 166919-2012-Lascona Land Co. Inc. v. Commissioner ofDocument7 pages166919-2012-Lascona Land Co. Inc. v. Commissioner ofBeatrice AquinoNo ratings yet

- Lascona Land vs CIR Tax Assessment AppealDocument2 pagesLascona Land vs CIR Tax Assessment AppealJesstonieCastañaresDamayo100% (1)

- G.R. No. 171251 March 5, 2012 LASCONA LAND CO., INC., Petitioner, Commissioner of Internal Revenue, RespondentDocument5 pagesG.R. No. 171251 March 5, 2012 LASCONA LAND CO., INC., Petitioner, Commissioner of Internal Revenue, RespondentWayne ViernesNo ratings yet

- CIR Assessment Not Final Due to Failure to Decide Protest Within 180 DaysDocument2 pagesCIR Assessment Not Final Due to Failure to Decide Protest Within 180 DaysYoan Baclig BuenoNo ratings yet

- Lascona vs. CIR - Appeal - ProtestDocument20 pagesLascona vs. CIR - Appeal - ProtestVictoria aytonaNo ratings yet

- Lacsona Land Co., Inc. v. CIRDocument11 pagesLacsona Land Co., Inc. v. CIRMingNo ratings yet

- Lascona Land CoDocument2 pagesLascona Land CoLawrence PiNo ratings yet

- Lascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineDocument1 pageLascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineHoreb FelixNo ratings yet

- Lascona Land Vs CirDocument15 pagesLascona Land Vs Circode4saleNo ratings yet

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSNo ratings yet

- 03 Lascona Land Co., Inc. vs. CIRDocument1 page03 Lascona Land Co., Inc. vs. CIRKristie Renz Anne PanesNo ratings yet

- Lascona Land Co. Inc. v. CIR, G.R. No., 171251, March 5, 2012Document5 pagesLascona Land Co. Inc. v. CIR, G.R. No., 171251, March 5, 2012Francis Leo TianeroNo ratings yet

- Lascona Land Vs CIRDocument3 pagesLascona Land Vs CIRKM MacNo ratings yet

- CIR vs. San RoqueDocument1 pageCIR vs. San Roquekatsura_hinagik4657No ratings yet

- Lascona vs. CIR (TAX)Document4 pagesLascona vs. CIR (TAX)Teff QuibodNo ratings yet

- Nueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weDocument3 pagesNueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weReynaldo GasparNo ratings yet

- Lascona Land, Inc. vs. CIRDocument12 pagesLascona Land, Inc. vs. CIRraiza_andresNo ratings yet

- Lascona Land Co., Inc. v. CIRDocument2 pagesLascona Land Co., Inc. v. CIRAron Lobo100% (1)

- 08 - Lascona Land V CIRDocument13 pages08 - Lascona Land V CIRParis LisonNo ratings yet

- Remedies of Taxpayer Contesting Amount For Local Taxes, Fees, and Charges: A. AdministrativeDocument2 pagesRemedies of Taxpayer Contesting Amount For Local Taxes, Fees, and Charges: A. AdministrativeJose Emmanuel DolorNo ratings yet

- TAX 2 REVIEW - REMEDIESDocument24 pagesTAX 2 REVIEW - REMEDIESManuel VillanuevaNo ratings yet

- Case Digest in Tax Review-Income TaxDocument7 pagesCase Digest in Tax Review-Income TaxMaria Salee MoraNo ratings yet

- Lascona Vs CIR DigestDocument2 pagesLascona Vs CIR Digestminri721No ratings yet

- Two-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsDocument3 pagesTwo-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsBeryl Joyce BarbaNo ratings yet

- Tax Cases 2Document8 pagesTax Cases 2Jerald-Edz Tam AbonNo ratings yet

- Lascona Land CoDocument2 pagesLascona Land CoTheodore0176No ratings yet

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Fishwealth Canning Corp. vs. CIR (GR No. 179343 Dated January 21, 2010)Document3 pagesFishwealth Canning Corp. vs. CIR (GR No. 179343 Dated January 21, 2010)anaNo ratings yet

- Tax Chair - S DigestsDocument18 pagesTax Chair - S Digestsruth sab-itNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument3 pagesPetitioner Vs Vs Respondent: First DivisionNika RojasNo ratings yet

- Finals Personal Study Guide Tax2Document116 pagesFinals Personal Study Guide Tax2TeacherEliNo ratings yet

- Marubeni Vs CIRDocument9 pagesMarubeni Vs CIRSteph AnyNo ratings yet

- Case 10. Oceanic Wireless Network Inc Vs CIRDocument2 pagesCase 10. Oceanic Wireless Network Inc Vs CIRAl-MakkiHasanNo ratings yet

- Week 10Document8 pagesWeek 10Victor LimNo ratings yet

- Tax Remedies Comparison NIRC, TCC, Local Tax, Real Property TaxDocument3 pagesTax Remedies Comparison NIRC, TCC, Local Tax, Real Property Taxares_aguilarNo ratings yet

- Tax Remedies Comparison Table NIRC, TCC, LGC, RPTDocument3 pagesTax Remedies Comparison Table NIRC, TCC, LGC, RPTStacy Liong BloggerAccountNo ratings yet

- Lascona vs. CIRDocument8 pagesLascona vs. CIRCarla EspinoNo ratings yet

- Taxation-2-Power-Point-part-2Document32 pagesTaxation-2-Power-Point-part-2Vince Q. MatutinaNo ratings yet

- Allied Bank v. CIR Case DigestDocument4 pagesAllied Bank v. CIR Case DigestCareenNo ratings yet

- Capitol Steel v. CIRDocument32 pagesCapitol Steel v. CIRaudreydql5No ratings yet

- Lascona Vs CIR Case Digest GR 171251 March 5 2012Document10 pagesLascona Vs CIR Case Digest GR 171251 March 5 2012Henry LNo ratings yet

- 05 CIR vs. Isabela Cultural CorporationDocument2 pages05 CIR vs. Isabela Cultural CorporationKristie Renz Anne PanesNo ratings yet

- Cir V Fitness by DesignDocument9 pagesCir V Fitness by DesigndNo ratings yet

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionButch MaatNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- 139 Lascona Land Co. - vs. CIRDocument12 pages139 Lascona Land Co. - vs. CIRKriszan ManiponNo ratings yet

- REmedies Procedure Lecture 1Document5 pagesREmedies Procedure Lecture 1Susannie AcainNo ratings yet

- Tax Rev Digest Mindanao II Geothermal Partnership V CirDocument4 pagesTax Rev Digest Mindanao II Geothermal Partnership V CirCalypso75% (4)

- CTA Ruling on Final Decision of CIR in Tax AssessmentDocument5 pagesCTA Ruling on Final Decision of CIR in Tax AssessmentAndrina Binogwal TocgongnaNo ratings yet

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1972.From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1972.No ratings yet

- Preweek - Remedial Law - Vice Dean Cheska Senga - Senga Remedial Law Preweek 2022Document75 pagesPreweek - Remedial Law - Vice Dean Cheska Senga - Senga Remedial Law Preweek 2022JoVic2020No ratings yet

- Supreme Court Reports Annotated Volume 555.PsDocument23 pagesSupreme Court Reports Annotated Volume 555.PsJoVic2020No ratings yet

- Pestilos vs. GenerosoDocument68 pagesPestilos vs. GenerosoJoVic2020No ratings yet

- Perez vs. PeopleDocument44 pagesPerez vs. PeopleJoVic2020No ratings yet

- Supreme Court Reports Annotated Volume 559Document30 pagesSupreme Court Reports Annotated Volume 559JoVic2020No ratings yet

- People vs. MagatDocument19 pagesPeople vs. MagatJoVic2020No ratings yet

- Suero vs. PeopleDocument16 pagesSuero vs. PeopleJoVic2020No ratings yet

- Trillanes IV vs. Pimentel, Sr.Document23 pagesTrillanes IV vs. Pimentel, Sr.JoVic2020No ratings yet

- Torres, Jr. vs. AguinaldoDocument21 pagesTorres, Jr. vs. AguinaldoJoVic2020No ratings yet

- San Miguel vs. MacedaDocument16 pagesSan Miguel vs. MacedaJoVic2020No ratings yet

- People vs. TorresDocument23 pagesPeople vs. TorresJoVic2020No ratings yet

- People vs. UlitDocument42 pagesPeople vs. UlitJoVic2020No ratings yet

- People vs. AlundayDocument19 pagesPeople vs. AlundayJoVic2020No ratings yet

- People vs. TevesDocument21 pagesPeople vs. TevesJoVic2020No ratings yet

- Heirs of Jane Honrales vs. HonralesDocument16 pagesHeirs of Jane Honrales vs. HonralesJoVic2020No ratings yet

- Ivler vs. Modesto-San PedroDocument39 pagesIvler vs. Modesto-San PedroJoVic2020No ratings yet

- Labides Vs CADocument16 pagesLabides Vs CAEunice NavarroNo ratings yet

- Los Baños vs. PedroDocument24 pagesLos Baños vs. PedroJoVic2020No ratings yet

- Enrile Vs SBDocument84 pagesEnrile Vs SBLarssen IbarraNo ratings yet

- Esteban vs. AlhambraDocument7 pagesEsteban vs. AlhambraJoVic2020No ratings yet

- Andres vs. BeltranDocument13 pagesAndres vs. BeltranJoVic2020No ratings yet

- Daan vs. Sandiganbayan (Fourth Division)Document20 pagesDaan vs. Sandiganbayan (Fourth Division)JoVic2020No ratings yet

- Torres, Jr. vs. AguinaldoDocument21 pagesTorres, Jr. vs. AguinaldoJoVic2020No ratings yet

- Benares vs. LimDocument12 pagesBenares vs. LimJoVic2020No ratings yet

- Labor LawDocument4 pagesLabor LawBenn DegusmanNo ratings yet

- Pestilos vs. GenerosoDocument68 pagesPestilos vs. GenerosoJoVic2020No ratings yet

- Aquino vs. PaisteDocument23 pagesAquino vs. PaisteJoVic2020No ratings yet

- Supreme Court Reports Annotated Volume 555.PsDocument23 pagesSupreme Court Reports Annotated Volume 555.PsJoVic2020No ratings yet

- Supreme Court Reports Annotated Volume 559Document30 pagesSupreme Court Reports Annotated Volume 559JoVic2020No ratings yet

- San Miguel vs. MacedaDocument16 pagesSan Miguel vs. MacedaJoVic2020No ratings yet

- Banking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Document5 pagesBanking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Adrianne JulianNo ratings yet

- 6,1 Manajemen Modal Kerja PDFDocument14 pages6,1 Manajemen Modal Kerja PDFIronaYurieNo ratings yet

- Investment Analyst Cevian Capital 2017Document1 pageInvestment Analyst Cevian Capital 2017Miguel Couto RamosNo ratings yet

- Aavas FinanciersDocument8 pagesAavas FinanciersSirish GopalanNo ratings yet

- Accounting and FinanceDocument5 pagesAccounting and FinanceHtoo Wai Lin AungNo ratings yet

- KOMALDocument50 pagesKOMALanand kumarNo ratings yet

- Sanraa Annual Report 08 09Document49 pagesSanraa Annual Report 08 09chip_blueNo ratings yet

- Salient Features of The Companies Act, 2013Document6 pagesSalient Features of The Companies Act, 2013SuduNo ratings yet

- Fundamental Analysis Project.Document82 pagesFundamental Analysis Project.Ajay Rockson100% (1)

- Vajiram & Ravi Civil Services Exam Details for Sept 2022-23Document3 pagesVajiram & Ravi Civil Services Exam Details for Sept 2022-23Appu MansaNo ratings yet

- National Open University of Nigeria: Prepared byDocument17 pagesNational Open University of Nigeria: Prepared byMAVERICK MONROENo ratings yet

- CVP - Quiz 1Document7 pagesCVP - Quiz 1Jane ValenciaNo ratings yet

- Cashback Redemption FormDocument1 pageCashback Redemption FormPapuKaliyaNo ratings yet

- Regional Trial Court counter affidavit disputes estafa chargesDocument8 pagesRegional Trial Court counter affidavit disputes estafa chargesHabib SimbanNo ratings yet

- Personal Finance PowerPointDocument15 pagesPersonal Finance PowerPointKishan KNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- Teaching Market Making with a Game SimulationDocument4 pagesTeaching Market Making with a Game SimulationRamkrishna LanjewarNo ratings yet

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDocument5 pagesSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- Scotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedDocument2 pagesScotia Aria Progressive Defend Portfolio - Premium Series: Global Equity BalancedChrisNo ratings yet

- SAS® Financial Management 5.5 Formula GuideDocument202 pagesSAS® Financial Management 5.5 Formula Guidejohannadiaz87No ratings yet

- Yodlee User Guide PDFDocument211 pagesYodlee User Guide PDFy2kmvrNo ratings yet

- Model ByeLaws of Housing Cooperative SocietiesDocument65 pagesModel ByeLaws of Housing Cooperative SocietiesbluedremzNo ratings yet

- Pimentel v. Aguirre, Et. Al. - G.R. No. 132988Document15 pagesPimentel v. Aguirre, Et. Al. - G.R. No. 132988sejinmaNo ratings yet

- Mechanics of Futures MarketsDocument42 pagesMechanics of Futures MarketsSidharth ChoudharyNo ratings yet

- Nava Bharat-2013-2014Document180 pagesNava Bharat-2013-2014SUKHSAGAR1969No ratings yet

- BPI's Opposition to Sarabia Manor's Rehabilitation PlanDocument2 pagesBPI's Opposition to Sarabia Manor's Rehabilitation PlanJean Mary AutoNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementinspectorsufiNo ratings yet

- Reauthorization of The National Flood Insurance ProgramDocument137 pagesReauthorization of The National Flood Insurance ProgramScribd Government DocsNo ratings yet

- Notes To FS - Part 1Document24 pagesNotes To FS - Part 1Precious Jireh100% (1)