Professional Documents

Culture Documents

AFAR Part 2 Chapter 23 Translation Gain

Uploaded by

Marvel Keg-ay PolledOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR Part 2 Chapter 23 Translation Gain

Uploaded by

Marvel Keg-ay PolledCopyright:

Available Formats

(Advanced Financial

Accounting and Reporting

Part 2)

LECTURE AID

2017

ZEUS VERNON B. MILLAN

AFAR PART 2: Zeus Vernon B. Millan

Chapter 23 The Effects of Changes in Foreign

Exchange Rates

Learning Objectives

• Define an entity’s functional currency.

• Account for foreign currency transactions.

• Translate the financial statements of a

foreign operation.

AFAR PART 2: Zeus Vernon B. Millan

Two ways of conducting foreign activities

1. Foreign currency transactions – individual

entities often enter into transactions in a foreign

currency.

2. Foreign operations – groups often include overseas

entities.

AFAR PART 2: Zeus Vernon B. Millan

Two main accounting issues

• Exchange rates are constantly changing. Therefore, the

principal issues in accounting for foreign activities are

determining:

1. Which exchange rate(s) to use; and

2. How to report the effects of changes in exchange rates

in the financial statements.

AFAR PART 2: Zeus Vernon B. Millan

Functional currency

• When preparing financial statements, a reporting entity must

identify its functional currency.

• Functional currency is the currency of the primary

economic environment in which the entity operates.

• The primary economic environment in which an entity

operates is normally the one in which it primarily generates

and expends cash.

AFAR PART 2: Zeus Vernon B. Millan

Factors in determining functional currency

Primary factors

An entity’s functional currency is:

1. The currency that mainly influences:

o Sales prices

o Cost of goods sold / Cost of services provided

Secondary factors

2. The currency in which funds from financing activities are

generated.

3. The currency in which receipts from operating activities are

usually retained.

AFAR PART 2: Zeus Vernon B. Millan

Foreign currency transactions

• Initial recognition :

The foreign currency amount is translated at the spot exchange

rate at the date of the transaction.

• Subsequent recognition: At the end of each reporting period:

1. Foreign currency monetary items are re-translated using

the closing rate;

2. Non-monetary items that are measured at historical cost in a

foreign currency shall be translated using the exchange rate at

the date of the transaction; and

3. Non-monetary items that are measured at fair value in a

foreign currency shall be translated using the exchange rates at

the date when the fair value was determined.

AFAR PART 2: Zeus Vernon B. Millan

Monetary items

• Monetary items – are units of currency held and assets

and liabilities to be received or paid in a fixed or

determinable number of units of currency.

AFAR PART 2: Zeus Vernon B. Millan

Recognition of exchange differences

• When a foreign currency transaction occurred in one period and

settled in another period:

a. The exchange difference between the transaction date and the

end of reporting period is recognized in the period of

transaction, while

b. The exchange difference between the end of the previous

reporting period and the date of settlement is recognized in the

period of settlement.

• When a foreign currency transaction occurred and settled in the

same period, all the exchange difference is recognized in that period.

AFAR PART 2: Zeus Vernon B. Millan

Foreign operations

• A foreign operation is an entity that is a subsidiary,

associate, joint venture or branch of a reporting entity,

the activities of which are based or conducted in a

country or currency other than those of the reporting

entity.

AFAR PART 2: Zeus Vernon B. Millan

Translation to the presentation currency

1. Assets and liabilities are translated at the closing rate at the date

of the statement of financial position.

2. Income and expenses, including other comprehensive income, are

translated at spot exchange rates at the dates of the

transactions. For practical reasons, average rates for a period

may be used, if they provide a reasonable approximation of the spot

rates when the transactions took place. However, if exchange rates

fluctuate significantly, the use of the average rate is inappropriate.

3. The resulting exchange difference is recognized in other

comprehensive income.

AFAR PART 2: Zeus Vernon B. Millan

Step 2: Analysis of net assets

Acquisition Consolidation Net

XYZ, Inc. date date change

(in wons) (in wons) (in wons)

Share capital 800,000 800,000

Retained earnings 3,200,000 4,160,000

Totals at carrying amounts 4,000,000 4,960,000

a

FVA at acquisition date 1,600,000 1,600,000

Subsequent depreciation of FVA NIL -

Net assets at fair value (in wons) 5,600,000 6,560,000 960,000

a

The fair value adjustment at acquisition date is determined as follows:

Acquisition-date fair value of XYZ's net assets (in wons) 5,600,000

Acquisition-date carrying amount of XYZ's net assets (in wons) (4,000,000)

FVA - attributable to undervalued land (in wons) 1,600,000

Multiply by: Closing rate ₱0.05

FVA - attributable to undervalued land (in pesos) ₱80,000

No subsequent depreciation of FVA is recognized because the FVA

relates to land, i.e., non-depreciable asset.

AFAR PART 2: Zeus Vernon B. Millan

How much is the goodwill as of December 31, 2001

Formula #1:

Consideration transferred (in wons) 6,000,000

Non-controlling interest in the acquiree (5.6M x 20%) – (Step 2) 1,120,000

Previously held equity interest in the acquiree -

Total 7,120,000

Fair value of net identifiable assets acquired (Step 2) (5,600,000)

Goodwill at acquisition date 1,520,000

Accumulated impairment losses since acquisition date -

Goodwill, net – current year (in wons) 1,520,000

Multiply by: Closing rate ₱0.05

Goodwill, net – current year (in pesos) ₱76,000

AFAR PART 2: Zeus Vernon B. Millan

How much is the non-controlling interest in the net

assets of the subsidiary (NCI) as of December 31, 2001?

XYZ's net assets at fair value – Dec. 31, 20x1 (in wons) (Step 2) 6,560,000

Multiply by: NCI percentage 20%

Total 1,312,000

Add: Goodwill to NCI net of accumulated impairment losses -

NCI in net assets – Dec. 31, 20x1 (in wons) 1,312,000

Multiply by: Closing rate ₱0.05

NCI in net assets – Dec. 31, 20x1 (in pesos) ₱65,600

No goodwill is attributed to NCI because NCI is measured at proportionate share.

AFAR PART 2: Zeus Vernon B. Millan

How much is the consolidated retained earnings as of

December 31, 2001?

ABC's retained earnings – Dec. 31, 20x1 ₱2,580,000

Consolidation adjustments:

ABC's share in the net change in XYZ's net assets (a) ₱30,720

Unamortized deferred gain (Downstream only) -

Gain or loss on extinguishment of bonds -

Impairment loss on goodwill attributable to Parent -

Net consolidation adjustments 30,720

Consol. retained earnings – Dec. 31, 20x1 ₱2,610,720

(a)

ABC’s share in the net change in XYZ’s net assets is computed as:

Net change in XYZ’s net assets (in wons) (Step 2) 960,000

Multiply by: Controlling interest 80%

ABC’s share in the change in XYZ’s net assets (in wons) 768,000

Multiply by: Average exchange rate 0.04

ABC’s share in the net change in XYZ’s net assets (in pesos) ₱30,720

AFAR PART 2: Zeus Vernon B. Millan

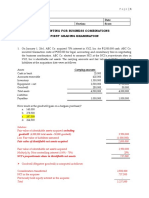

How much is the total translation gain or loss to be

recognized in other comprehensive income in 2001?

Share in translation

difference

ABC Co. XYZ, Inc.

(80%) (20%)

1) Translation of XYZ’s opening net assets

Net assets, Jan. 1 - at opening rate (5.6M x ₱0.03) 168,000

Net assets, Jan. 1 - at closing rate (5.6M x ₱0.05) 280,000

Increase in opening net assets – gain 112,000 89,600 22,400

Cumulative translation difference – Jan. 1 - - -

2) Translation of changes in net assets during the period:

Profit - at average rate (960K x ₱0.04) 38,400

Profit - at closing rate (960K x ₱0.05) 48,000

Increase in profit - FOREX gain 9,600 7,680 1,920

3) Translation of goodwill

Goodwill, Dec. 31 - at opening rate (1.52M x₱0.03) 45,600

Goodwill, Dec. 31 - at closing rate (1.52M x ₱0.05) 76,000

Increase in goodwill - FOREX gain 30,400 30,400 -

Total translation gain – OCI 152,000 127,680 ₱24,320

AFAR PART 2: Zeus Vernon B. Millan

How much is the consolidated profit in 2001?

Parent Subsidiary Consolidated

(a)

Profits before adjustments 1,440,000 38,400 1,478,400

Consolidation adjustments:

Unrealized profits - - -

Unamortized def. loss - - -

Dividend income - N/A -

Net consolidation adjustments - - -

Profits before FVA 1,440,000 38,400 1,478,400

Depreciation of FVA - - -

Impairment of goodwill - - -

Consolidated profit 1,440,000 38,400 1,478,400

Other comprehensive income:

Translation gain - (Step 5A) - - 152,000

Consolidated comp. income 1,440,000 38,400 1,630,400

AFAR PART 2: Zeus Vernon B. Millan

How much is the total consolidated comprehensive

income in 2001?

Owners Consoli-

of parent NCI dated

ABC's profit before FVA - (Step 6) 1,440,000 N/A 1,440,000

(b)

Share in XYZ’s profit before FVA 30,720 7,680 38,400

Depreciation of FVA - - -

Impairment of goodwill - - -

Profit of loss 1,470,720 7,680 1,478,400

Other comprehensive income:

Share in translation gain - (Step 5A) 127,680 24,320 152,000

Comprehensive income 1,598,400 32,000 1,630,400

(b)

Shares in XYZ’s profit before FVA (Step 6): (38,400 x 80%); (38,400 x 20%)

AFAR PART 2: Zeus Vernon B. Millan

Consolidated

ASSETS (pesos)

Investment in subsidiary -

Other assets [1.5M + (140K x 0.54)] 1,575,600

Goodwill (Step 3) 10,260

TOTAL ASSETS 1,585,860

LIABILITIES AND EQUITY

Liabilities [250K + (20K x .54)] 260,800

Share capital (Parent only) 800,000

Retained earnings (Step 5) 514,040

Translation differences (Parent only) - Step 5A 4,540

Equity attributable to owners of the parent 1,318,580

NCI in net assets (Step 4) 6,480

Total equity 1,325,060

TOTAL LIABILITIES AND EQUITY 1,585,860

AFAR PART 2: Zeus Vernon B. Millan

Consolidated

(pesos)

Revenues [1.2M + (150,000 x .52)] 1,278,000

Expenses [500K + (120,000 x .52)] (562,400)

Profit for the year 715,600

Other comprehensive income:

Translation gain (Step 5A) 4,960

Comprehensive income 720,560

AFAR PART 2: Zeus Vernon B. Millan

QUESTIONS????

REACTIONS!!!!!

AFAR PART 2: Zeus Vernon B. Millan

IFA PART 1A: Zeus Vernon B. Millan

END

AFAR PART 2: Zeus Vernon B. Millan

You might also like

- ACC BUS COMB ADV ACCT 2 - MILLANDocument14 pagesACC BUS COMB ADV ACCT 2 - MILLANPrecilla IrosidoNo ratings yet

- Chapter 17 Consolidated FS - Part 1Document29 pagesChapter 17 Consolidated FS - Part 1Erwin Labayog Medina100% (1)

- Chapter 21 - The Effects of Changes in Forex RatesDocument52 pagesChapter 21 - The Effects of Changes in Forex RatesPutmehudgJasd100% (1)

- Chapter 14 Business Combinations Part 1Document23 pagesChapter 14 Business Combinations Part 1Marvel Keg-ay Polled75% (8)

- Accounting for Derivatives and Hedging Transactions (Part 3Document13 pagesAccounting for Derivatives and Hedging Transactions (Part 3Sheed ChiuNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Chapter 22 - Financial Reporing in Hyperinflationary EconomiesDocument19 pagesChapter 22 - Financial Reporing in Hyperinflationary EconomiesErwin Labayog MedinaNo ratings yet

- Effects of Changes in ForEx RatesDocument40 pagesEffects of Changes in ForEx RatesEnrique Paolo Mendoza80% (5)

- Chapter 24 Acctg. For Derivatives & Hedging Transactions - Part 1Document24 pagesChapter 24 Acctg. For Derivatives & Hedging Transactions - Part 1Erwin Labayog MedinaNo ratings yet

- QUIZ 03A ConsolidationDocument5 pagesQUIZ 03A ConsolidationCorpuz Rudica Ken33% (6)

- Advanced Part 2 Solman MillanDocument270 pagesAdvanced Part 2 Solman MillanVenz Lacre80% (25)

- Consolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedDocument11 pagesConsolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedAdam SmithNo ratings yet

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- Quiz 2 Joint ArrangementsDocument4 pagesQuiz 2 Joint ArrangementsJane Gavino100% (2)

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- AFAR - Installment, Customer, ConsignmentDocument3 pagesAFAR - Installment, Customer, ConsignmentJoanna Rose DeciarNo ratings yet

- p2 - Guerrero Ch10Document28 pagesp2 - Guerrero Ch10JerichoPedragosa67% (3)

- Joint Arrangement Accounting (AA1Document16 pagesJoint Arrangement Accounting (AA1Chloe Oberlin0% (2)

- Chapter 11 - Home Agency, Branch and Agency AccountingDocument14 pagesChapter 11 - Home Agency, Branch and Agency Accountingmonica ocureza100% (1)

- Acquiring IMMATURE: Estimating GoodwillDocument1 pageAcquiring IMMATURE: Estimating GoodwillRiselle Ann Sanchez50% (2)

- Foreign Currency TranactionDocument11 pagesForeign Currency TranactionAngelieNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- Introduction To Business Combination - Lesson1Document37 pagesIntroduction To Business Combination - Lesson1Eunice MiloNo ratings yet

- Installment Sales Reviewer. Problems and Solutions.Document43 pagesInstallment Sales Reviewer. Problems and Solutions.Kate Alvarez91% (22)

- Consolidated FS conceptsDocument5 pagesConsolidated FS conceptsChristine Jane RamosNo ratings yet

- Chapter 15 Business Combinations - Part 2Document10 pagesChapter 15 Business Combinations - Part 2Erwin Labayog Medina100% (2)

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- Q1 Hyperinflation PDFDocument12 pagesQ1 Hyperinflation PDF수지No ratings yet

- Test Bank MillanDocument55 pagesTest Bank MillanBusiness MatterNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- Accounting for Business CombinationsDocument4 pagesAccounting for Business CombinationsAbraham Chin67% (3)

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- Module 10 Accounting For Build-Operate-TransferDocument3 pagesModule 10 Accounting For Build-Operate-TransferSunshine Khuletz0% (1)

- p2 Foreign CurrencyDocument4 pagesp2 Foreign CurrencyJustine Goes KaizerNo ratings yet

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Accounting for Business Combinations ExamDocument6 pagesAccounting for Business Combinations ExamCyrine Miwa Rodriguez100% (2)

- ADVACC Corporate LiquidationDocument4 pagesADVACC Corporate LiquidationKim Nicole ReyesNo ratings yet

- PFRS Vs PFRS For SMEsDocument31 pagesPFRS Vs PFRS For SMEsxdoubledutchessNo ratings yet

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- Chapter 7 - Teacher's Manual - Afar Part 1Document24 pagesChapter 7 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Accounting for Business Combinations ExamDocument18 pagesAccounting for Business Combinations Examjoyce77% (13)

- Chapter 8 - Teacher's Manual - Afar Part 1Document7 pagesChapter 8 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Chapter 15 - Bus. Combination Part 3Document8 pagesChapter 15 - Bus. Combination Part 3PutmehudgJasdNo ratings yet

- (Advanced Financial Accounting and Reporting Part 1) : Lecture AidDocument36 pages(Advanced Financial Accounting and Reporting Part 1) : Lecture AidAngelica Curimatmat Roa100% (2)

- Direct Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalDocument14 pagesDirect Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalGwen Sula Lacanilao67% (3)

- Chapter 10 Effects of Changes in Forex RatesDocument16 pagesChapter 10 Effects of Changes in Forex RatesJeeramel TorresNo ratings yet

- Conceptual Framework: & Accounting StandardsDocument62 pagesConceptual Framework: & Accounting StandardsAmie Jane MirandaNo ratings yet

- Shareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizDocument3 pagesShareholders' Equity (Part 2) : Name: Date: Professor: Section: Score: QuizAriesJaved Godinez100% (1)

- Shareholders' Equity QuestionsDocument4 pagesShareholders' Equity QuestionsXienaNo ratings yet

- Pdfcoffee Reviewer Helpful Guide Lecture Notes CompressDocument4 pagesPdfcoffee Reviewer Helpful Guide Lecture Notes CompressElaiza RegaladoNo ratings yet

- Sol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsDocument19 pagesSol. Man. Chapter 10 The Effects of Changes in Foreign Exchange Rates Acctg For Bus. CombinationsJulyca C. LastimosoNo ratings yet

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- 2 - (Accounting For Foreign Currency Transaction)Document25 pages2 - (Accounting For Foreign Currency Transaction)Stephiel SumpNo ratings yet

- Two Ways of Conducting Foreign ActivitiesDocument7 pagesTwo Ways of Conducting Foreign ActivitiesJustine VeralloNo ratings yet

- Introduction To Financial Statements and Other Financial Reporting TopicsDocument26 pagesIntroduction To Financial Statements and Other Financial Reporting TopicsNeil Jasper CorozaNo ratings yet

- Retained Earnings and Dividends ExplainedDocument8 pagesRetained Earnings and Dividends ExplainedLexNo ratings yet

- The Goodwill Attributable To Parent As of December 31, 20x1 IsDocument14 pagesThe Goodwill Attributable To Parent As of December 31, 20x1 IsDenise Jane RoqueNo ratings yet

- CSE Complete Reviewer Philippines 2018Document32 pagesCSE Complete Reviewer Philippines 2018Marvel Keg-ay PolledNo ratings yet

- Civil Service Exam Complete Reviewer Philippines 2017Document46 pagesCivil Service Exam Complete Reviewer Philippines 2017JJ Torres84% (434)

- Swot AnalysisDocument1 pageSwot AnalysisMarvel Keg-ay PolledNo ratings yet

- WD EMAIL Online Application Form NEW NEWDocument3 pagesWD EMAIL Online Application Form NEW NEWMarvel Keg-ay PolledNo ratings yet

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- Private Higher Education Institutions Number of Faculty by Program LevelDocument58 pagesPrivate Higher Education Institutions Number of Faculty by Program LevelMarvel Keg-ay Polled0% (1)

- Civil Service Exam Complete Reviewer Philippines 2017Document46 pagesCivil Service Exam Complete Reviewer Philippines 2017JJ Torres84% (434)

- Auditing Test Bank Ch1Document34 pagesAuditing Test Bank Ch1Rosvel Esquillo95% (21)

- A Ust Law StudentDocument2 pagesA Ust Law StudentMarvel Keg-ay PolledNo ratings yet

- BrochureDocument3 pagesBrochureMarvel Keg-ay PolledNo ratings yet

- ImpressionismDocument4 pagesImpressionismMarvel Keg-ay PolledNo ratings yet

- Cluster 8 - Gqs - 89-102 - Marvel K. Polled 89. Define A Conditional ObligationDocument4 pagesCluster 8 - Gqs - 89-102 - Marvel K. Polled 89. Define A Conditional ObligationMarvel Keg-ay PolledNo ratings yet

- PSYCH 108 Music and BG Color On MemoryDocument6 pagesPSYCH 108 Music and BG Color On MemoryMarvel Keg-ay PolledNo ratings yet

- Mathematics Beliefs and Awareness Survey EDITEDiiDocument4 pagesMathematics Beliefs and Awareness Survey EDITEDiiMarvel Keg-ay PolledNo ratings yet

- Ch10 - Formal SpecificationsDocument41 pagesCh10 - Formal SpecificationsMarvel Keg-ay PolledNo ratings yet

- Philippines Supreme Court Rules on Constitutionality of Executive Order Banning Carabao TransportDocument7 pagesPhilippines Supreme Court Rules on Constitutionality of Executive Order Banning Carabao TransportSheila ManitoNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Soc Sci 14Document3 pagesSoc Sci 14Marvel Keg-ay PolledNo ratings yet

- History of FlorenceDocument8 pagesHistory of FlorenceMarvel Keg-ay PolledNo ratings yet

- Verification and ValidationDocument46 pagesVerification and ValidationMarvel Keg-ay PolledNo ratings yet

- Software EvolutionDocument47 pagesSoftware EvolutionMarvel Keg-ay PolledNo ratings yet

- What Is The Difference Between: Computer Organization and Computer Architecture?Document22 pagesWhat Is The Difference Between: Computer Organization and Computer Architecture?Marvel Keg-ay PolledNo ratings yet

- Logistics Management Lesson 3 Measuring Logistics Costs and PerformanceDocument5 pagesLogistics Management Lesson 3 Measuring Logistics Costs and PerformanceJan Kryz Marfil PalenciaNo ratings yet

- Best Position Sizing in TradingDocument27 pagesBest Position Sizing in TradingSiva No Fear33% (3)

- Case 1-2 - Vanguard International Growth FundDocument2 pagesCase 1-2 - Vanguard International Growth FundlauraNo ratings yet

- Quiz Corporation Law May 11 2020Document2 pagesQuiz Corporation Law May 11 2020Mark Anthony Ruiz DelmoNo ratings yet

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Document11 pagesSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNo ratings yet

- Dynamic Trend Trading The SystemDocument151 pagesDynamic Trend Trading The Systemmangelbel674988% (26)

- Financial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisDocument16 pagesFinancial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisFranciscoNo ratings yet

- Discussion Questions and Problems - 1Document3 pagesDiscussion Questions and Problems - 1qiuNo ratings yet

- Financial Management Chapter - Bond and Stock ValuationDocument6 pagesFinancial Management Chapter - Bond and Stock ValuationNahidul Islam IUNo ratings yet

- Yuri Annisa-Olfa Resha - Int - Class - Financial StatementsDocument16 pagesYuri Annisa-Olfa Resha - Int - Class - Financial StatementsolfareshaaNo ratings yet

- Accenture Global Boom in Fintech InvestmentDocument16 pagesAccenture Global Boom in Fintech InvestmentRachid IdbouzghibaNo ratings yet

- Cheat Sheet - Bloomberg CommodityDocument1 pageCheat Sheet - Bloomberg CommoditybasitNo ratings yet

- Currency Derivatives ExplainedDocument57 pagesCurrency Derivatives ExplainedNagireddy KalluriNo ratings yet

- Chapter - 2 Literature ReviewDocument23 pagesChapter - 2 Literature ReviewMotiram paudelNo ratings yet

- History of Crowdfunding and Its GrowthDocument2 pagesHistory of Crowdfunding and Its GrowthPriyal JainNo ratings yet

- Consumption and Investment Functions ExplainedDocument14 pagesConsumption and Investment Functions Explainedtamilrockers downloadNo ratings yet

- Essentials of Marketing Management by Pride 2019Document4 pagesEssentials of Marketing Management by Pride 2019Cherry Rose VillaruelNo ratings yet

- PPE HandoutsDocument12 pagesPPE HandoutsAries BautistaNo ratings yet

- Chapter Six: Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument32 pagesChapter Six: Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsLeenNo ratings yet

- International Finance - MBA 926Document10 pagesInternational Finance - MBA 926Tinatini BakashviliNo ratings yet

- Redemption FormDocument2 pagesRedemption FormSalman ArshadNo ratings yet

- Activity 1 Finman 1Document6 pagesActivity 1 Finman 1lykaNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- Powers and Functions of CommissionDocument7 pagesPowers and Functions of CommissionAli Akbar100% (1)

- What Is The Philippine Deposit Insurance CorporationDocument5 pagesWhat Is The Philippine Deposit Insurance CorporationHan YanNo ratings yet

- Royalty 7 Investment PlanDocument2 pagesRoyalty 7 Investment PlanAbbas NasirNo ratings yet

- 2007 WFE Annual ReportDocument170 pages2007 WFE Annual ReportPeter NousiosNo ratings yet

- National Highways Infra Trust: and Thus To Raise Further Debt." On Page 36Document1,837 pagesNational Highways Infra Trust: and Thus To Raise Further Debt." On Page 36Someshwar Rao ThakkallapallyNo ratings yet

- 911 BIZ201 Assessment 3 Student WorkbookDocument7 pages911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaNo ratings yet

- AP.3408 Audit of EquityDocument4 pagesAP.3408 Audit of EquityMonica GarciaNo ratings yet