Professional Documents

Culture Documents

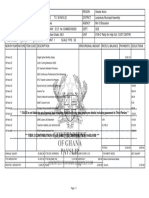

Chapter 14 Personnel and Payroll

Uploaded by

shara guiaman0 ratings0% found this document useful (0 votes)

54 views23 pagesOriginal Title

chap14-lesson2-personnel-and-payroll.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

54 views23 pagesChapter 14 Personnel and Payroll

Uploaded by

shara guiamanCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 23

Chapter 14 Personnel and Payroll

Major topics discussed in this chapter

• The nature of the personnel management and

payroll functions within the expenditure

/disbursement cycle.

• Controls over personnel and payroll.

• The auditor’s consideration of controls over

personnel and payroll.

• Substantive tests applicable to payroll accounts.

• Earnings manipulation in accounting for payroll

costs and post- retirement health care benefits.

Outline

• The expenditure/disbursement cycle

– Personnel & payroll

• Personnel

• Payroll preparation & distribution

– Internal control objectives and potential errors or

fraud

• Transaction authorization

• Execution

• Recording

• Access to assets

• Segregation of duties

• Independent verification

Outline

• Considering internal control

– Obtaining an understanding

• Preliminary review

• System documentation

• Transaction walkthrough

• Identification of control procedures

– Tests of controls: Personnel & Payroll

• Personnel & payroll

• Distribution of employee paychecks

• Assess control risk

• Analytical procedures: payroll and accruals

Internal Control Objectives and

Potential Errors or Fraud

• The following focuses on internal control over

– transaction authorization

– Execution

– Recording

– access to assets for personnel and payroll.

– Segregation of duties

– Independent verification

• The discussion identifies

– control objectives

– examples of errors or frauds that may arise if objectives are not

achieved

– examples of control procedures designed to prevent or detect

errors or frauds.

Transaction Authorization

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

Hiring: Unqualified •Establish clear

Employees employees may be statements of hiring

should be hired, potentially policies and procedures.

hired resulting in excessive •Maintain updated

according to training costs, personnel records for all

criteria unnecessary employees.

authorized by relocation costs, or •Verify employment

management. penalties for violating applications.

equal opportunity

laws.

Transaction Authorization

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

Deductions: •Employees may be paid •Maintain updated listings of

Compensation unauthorized amounts, authorized pay rates and

and payroll potentially resulting in deductions.

deductions excessive labor costs or •Establish procedures for

should be made violation of union reviewing and approving pay

in accordance contracts. rates and deductions.

with •Accruals for pensions,

management’s vacations, or bonuses may

authorization. be calculated from

inaccurate information

potentially resulting in

misstated accruals.

Transaction Authorization

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

Adjustments to Unauthorized Establish clear statements of

payroll or adjustments may be adjustment policies and

personnel processed to increase an procedures.

records should employee’s pay,

be made in potentially

accordance with misappropriating cash

management’s and overstating labor

authorization. costs.

Transaction Authorization

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

Valid employees: A form of payroll fraud The personnel action form helps

Ensure that only involves submitting time payroll keep the employee

the time cards of cards for employees who no records current.

current and valid longer work for the firm.

employees are

processed.

Execution

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

Payroll and Employees could process •Establish personnel and

personnel paychecks for terminated payroll procedures manuals.

procedures or fictitious employees, •Periodically verify employee

should be potentially resulting in reassignments and personnel

established in misappropriated cash. action reports.

accordance with

management’s

authorization.

Execution

OBJECTIVES FRAUDS OR ERRORS PREVENTIVE CONTROLS

IF OBJECTIVE NOT OR DETECTIVE

MET CONTROLS

All payroll cash Cash may be disbursed for •Prenumber and control time

disbursements services not performed, records, paychecks, and

should be based potentially resulting in adjustment forms.

upon a misappropriated cash and •Require manual dual

recognized overstated labor costs. signatories for all pay over a

liability. prespecified peso amount.

Recording

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE

OBJECTIVE NOT MET CONTROLS OR

DETECTIVE CONTROLS

Payroll: •Payroll costs, labor costs, •Establish and document

Amounts due to and related liabilities (e.g., account distribution

employees withholding tax) may be procedures.

should be inaccurate, potentially •Reconcile appropriate

recorded at the resulting in misstated ledgers and journals.

proper expense and liabilities. •Establish physical barriers

amounts, be •Summaries of detail records over unused documents

recorded in the (e.g., payroll register and and forms.

proper period, summary of labor costs) may

and be properly not agree, potentially

classified. resulting in miscalculated

labor costs.

Access to Assets

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE

OBJECTIVE NOT MET CONTROLS OR

DETECTIVE CONTROLS

Access to •Records, forms, or •Prenumber and control

personnel and documents may be misused forms and documents.

payroll records by unauthorized personnel, •Segregate responsibilities

and to forms potentially resulting in for authorizing, executing,

and documents misapplied cash or and recording payroll and

should be unauthorized labor costs. personnel transactions.

restricted to •A dishonest individual can •Maintain listings and

personnel misrepresent the number of samples of authorized

authorized by hours worked on the time cards signatories.

and thus embezzle cash.

management.

Segregation of Duties

• The time-keeping function and the personnel

function should be separated.

• The personnel function provides payroll with pay

rate information for authorized hourly

employees.

– Typically, an organization will offer a range of valid pay

rates based on experience, job classification, seniority,

and merit.

– If the production (time-keeping) department provided

this information, an employee might submit a higher

rate and perpetrate a fraud.

Segregation of Duties

• The time-keeping function and the personnel

function should be separated.

• Payroll function - Segregating key aspects of

the payroll transaction between AP and cash

disbursement functions.

– AP reviews the work done by payroll (payroll

register) and approves payment.

– Cash disbursements then writes the check to

cover the total payroll.

Independent Verification

1. Verification of time: Before sending time cards to payroll,

the supervisor must verify their accuracy and sign them.

2. Paymaster: The use of an independent paymaster to

distribute checks (rather than the normal supervisor)

helps verify the existence of the employees. The

supervisor may be party to a payroll fraud by pretending

to distribute paychecks to nonexistent employees.

3. Accounts payable: The AP clerk verifies the accuracy of

the payroll register before creating a disbursement

voucher that transfers funds to the imprest account.

4. General ledger: The general ledger department provides

verification of the overall process by reconciling the labor

distribution summary and the payroll disbursement

voucher.

Personnel

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE CONTROLS OR

OBJECTIVE NOT MET DETECTIVE CONTROLS

Hiring/termination, •Misunderstanding of •Hiring criteria based on policy and

determination of instructions. approval.

compensation package, •Misappropriation of •Compensation rates and payroll

deductions should be approved in

changes in salary rates, cash by making

writing.

and payroll deductions unauthorized changes •Selected payroll amounts should be

should be authorized in to payroll data. compared with predetermined

writing. •Erroneous payroll control totals to ensure that

deductions. authorized payroll data are accurately

processed.

•Adequate written personnel

procedures manual.

Payroll Processing

OBJECTIVES FRAUDS OR PREVENTIVE CONTROLS OR

ERRORS IF DETECTIVE CONTROLS

OBJECTIVE NOT

MET

•All services performed by •Misappropriation •Use of time records, output

employees should be of payroll cash. records, or other means to

reported. monitor time and attendance.

•All amounts due to •Review and approval by

employees should be responsible supervisors of time or

recognized as liabilities and output records, including overtime

accurately recorded in the for fixed salary employees.

books. •Comparison of totals per time or

•Amounts due to employees output records with payroll

should be based on actual register totals, labor cost allocation

hours worked and should be reports, and supporting

accurately and promptly documentation of hours worked.

reported, computed,

summarized, and recorded.

Payroll Processing

OBJECTIVES FRAUDS OR PREVENTIVE CONTROLS OR DETECTIVE

ERRORS IF CONTROLS

OBJECTIVE NOT

MET

•There should be periodic •For salaried employees, comparison of

verification of the payroll register totals with predetermined

validity, completeness, control totals.

and accuracy of recorded •Reconciliation of payroll register totals to

balances of accounts totals posted to the GL accounts

related to payroll. •Use of prenumber journal vouchers and

•There should be periodic accounting for its completeness.

evaluation of recorded •Checking the accuracy of payroll

balances of payroll- calculations (gross pay, deductions, and

related accruals. net pay) by persons other than the

payroll prepares.

•Review and approval of the payroll by a

designated official not involved in payroll

preparation activities.

Payroll Processing

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE CONTROLS OR

OBJECTIVE NOT MET DETECTIVE CONTROLS

•Checking the propriety oof labor

cost distribution.

•Periodic comparison of recorded

balances of payroll-related

accounts with budgeted amounts.

•Periodic reconciliation of control

account balances with year-to-date

earnings records.

•Periodic review of the method

used to determine accruals (e.g.,

pension and retirement benefits).

Comparison of recorded amounts

with budget and prior period.

•Adequate written procedures for

payroll processing activities.

Payroll Disbursement Distribution

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE CONTROLS OR

OBJECTIVE NOT MET DETECTIVE CONTROLS

•All payroll •Misappropriation of •Preparation of payroll checks

disbursements should be payroll cash by making based on approved payroll

properly authorized, unauthorized payroll summary or register.

should be based on disbursement. •Examining supporting

recognized liabilities, documentation before signing

should be accurately payroll checks. Check signers

prepared, and should be should be other than those who

accurately and promptly prepare or approve payroll.

recorded in the book. •Cancellation of supporting

•Custody of payroll cash documentation to prevent re-use.

should be limited to •Performing bank reconciliation

authorized personnel. procedures.

Payroll Disbursement Distribution

OBJECTIVES FRAUDS OR ERRORS IF PREVENTIVE CONTROLS OR

OBJECTIVE NOT MET DETECTIVE CONTROLS

•All payroll •Misappropriation of •Limiting access to check-signing

disbursements should be payroll cash by making equipment and signature plates to

properly authorized, unauthorized payroll authorized personnel.

should be based on disbursement. •Distribution of pay envelopes

recognized liabilities, should be assigned to a paymaster

should be accurately who is not involved in payroll

prepared, and should be preparation.

accurately and promptly •Control and prompt recording of

recorded in the book. unclaimed salaries and wages by

•Custody of payroll cash persons other than the payroll

should be limited to preparer.

authorized personnel. •Adequate written procedures for

the payroll distribution.

You might also like

- IT Concepts & Systems AnalysisDocument9 pagesIT Concepts & Systems AnalysisAisah ReemNo ratings yet

- Unit IV PDFDocument36 pagesUnit IV PDFRahul Singh Rajput100% (1)

- Family Dollar Paystub 24-04-2020 PDFDocument1 pageFamily Dollar Paystub 24-04-2020 PDFLuis MartinezNo ratings yet

- Expenditure Cycle Part II: Payroll & Fixed Asset ProceduresDocument14 pagesExpenditure Cycle Part II: Payroll & Fixed Asset ProceduresJessalyn DaneNo ratings yet

- Dave Banking Direct Deposit Enrollment FormDocument1 pageDave Banking Direct Deposit Enrollment FormDavid HannaganNo ratings yet

- Payroll DocumentDocument23 pagesPayroll Documentkarthiksainath100% (3)

- CVIOG Payroll Internal ControlsDocument34 pagesCVIOG Payroll Internal ControlsTony MorganNo ratings yet

- HRD Theory & LearningDocument29 pagesHRD Theory & Learningnurus syarifahNo ratings yet

- Auditing The Payroll CycleDocument14 pagesAuditing The Payroll CycleWei Xian100% (1)

- Ex 1Document13 pagesEx 1Raghu RamanNo ratings yet

- Chapter 1 Test BankDocument13 pagesChapter 1 Test BankDoo86% (7)

- AOracle Fusion HRMS For SA Payroll Setup White Paper Rel13 FINAL PDFDocument200 pagesAOracle Fusion HRMS For SA Payroll Setup White Paper Rel13 FINAL PDFMaqbulhusenNo ratings yet

- Payroll audit focuses on salaries, wages and terminationsDocument3 pagesPayroll audit focuses on salaries, wages and terminationsallenchi100% (1)

- Payroll Audit Template IDocument2 pagesPayroll Audit Template IJennifer ScottNo ratings yet

- FY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFDocument16 pagesFY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFTony MorganNo ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamirNo ratings yet

- Ceklist SA 8000 Indonesia (Draft Sample) PDFDocument19 pagesCeklist SA 8000 Indonesia (Draft Sample) PDFRenaldo MoontriNo ratings yet

- Auditing Payroll CycleDocument14 pagesAuditing Payroll CycleVernadette De GuzmanNo ratings yet

- Auditing PayrollDocument45 pagesAuditing PayrollRowena AlidonNo ratings yet

- Study CaseDocument13 pagesStudy CaseMutiara WahyuniNo ratings yet

- Template For IDA ProjectDocument25 pagesTemplate For IDA ProjectQuang NhatNo ratings yet

- Budgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDocument5 pagesBudgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDineshNo ratings yet

- Strategic Cost Management (SCM) FrameworkDocument11 pagesStrategic Cost Management (SCM) FrameworkcallmeasthaNo ratings yet

- Boynton SM Ch.12Document25 pagesBoynton SM Ch.12Eza RNo ratings yet

- BudgetingDocument3 pagesBudgetingSwati RathourNo ratings yet

- Gibson 11e Ch08Document24 pagesGibson 11e Ch08Keval KamaniNo ratings yet

- Certified HR and business training programsDocument52 pagesCertified HR and business training programszaidi10No ratings yet

- Chapter 14Document19 pagesChapter 14Anonymous Yo03tioNo ratings yet

- Slide AKT 405 Teori Akuntansi 8 GodfreyDocument30 pagesSlide AKT 405 Teori Akuntansi 8 GodfreypietysantaNo ratings yet

- Chapter 5 Internal Control Payroll CycleDocument103 pagesChapter 5 Internal Control Payroll Cycletrangalc123No ratings yet

- Accounting System and Control ActivitiesDocument28 pagesAccounting System and Control ActivitiesAmira QasrinaNo ratings yet

- Employee Costs - BIG PictureDocument5 pagesEmployee Costs - BIG PictureShahid MahmudNo ratings yet

- Audit II Ch3Document39 pagesAudit II Ch3tame kibruNo ratings yet

- Blue and White Modern Budgeting in Business PresentationDocument40 pagesBlue and White Modern Budgeting in Business PresentationMaryjoy Benitez 12 ABM-4No ratings yet

- Itec Chapter 5 and 6 Expenditure CycleDocument6 pagesItec Chapter 5 and 6 Expenditure CycleSohfia Jesse VergaraNo ratings yet

- The Audit of Wages - Students - ACCA - ACCA GlobalDocument9 pagesThe Audit of Wages - Students - ACCA - ACCA Globaldesk.back.recovNo ratings yet

- Auditing Payroll Records and ProceduresDocument7 pagesAuditing Payroll Records and ProceduresSafira KhairaniNo ratings yet

- Group 4: Module 12: Errors and Irregularities in The Transaction Cycles of The Business EntityDocument35 pagesGroup 4: Module 12: Errors and Irregularities in The Transaction Cycles of The Business EntityApril Joy ObedozaNo ratings yet

- Makwana Prashant DB8Document5 pagesMakwana Prashant DB8Prashant MakwanaNo ratings yet

- The Audit of WagesDocument7 pagesThe Audit of WagesAhmadzaiNo ratings yet

- CH 06Document18 pagesCH 06ewaidaebaaNo ratings yet

- Chapter11 SM-newDocument2 pagesChapter11 SM-newNazirul HazwanNo ratings yet

- Auditing Payroll and Personnel CycleDocument20 pagesAuditing Payroll and Personnel CycleObey KamutsamombeNo ratings yet

- PayrollDocument2 pagesPayrollBình NGuyễn CôngNo ratings yet

- AUD589 Tutorial PYQ CASE STUDY Sales Acquisition PayrollDocument6 pagesAUD589 Tutorial PYQ CASE STUDY Sales Acquisition PayrollRABIATULNAZIHAH NAZRINo ratings yet

- Gathering and Evaluating EvidenceDocument73 pagesGathering and Evaluating EvidenceHanna BayotNo ratings yet

- The Audit of WagesDocument5 pagesThe Audit of Wagesshahzad arshadNo ratings yet

- Lesson 15, Week 15: Auditing Payroll: TopicsDocument5 pagesLesson 15, Week 15: Auditing Payroll: TopicsChrista LenzNo ratings yet

- Auditing of Payroll CycleDocument33 pagesAuditing of Payroll CycleShi Yan LNo ratings yet

- ControlDocument44 pagesControl5mh8cyfgt4No ratings yet

- Summary Note of Assurance - Chap 8 - 10Document6 pagesSummary Note of Assurance - Chap 8 - 10Đông VyNo ratings yet

- F8uk 2011 Dec ADocument14 pagesF8uk 2011 Dec AElle YeungNo ratings yet

- Chapter 12 AuditingDocument2 pagesChapter 12 AuditingWilly DariusNo ratings yet

- FraudDocument31 pagesFraudewaidaebaaNo ratings yet

- Governanace Chapter 15Document4 pagesGovernanace Chapter 15Loreen TonettNo ratings yet

- AIS-Expenditure Cycle 2-2022-23Document25 pagesAIS-Expenditure Cycle 2-2022-23CenNo ratings yet

- The Control ProcessDocument4 pagesThe Control ProcessYana WatanabeNo ratings yet

- The Auditor - S Responsibilities - Chapter 3Document38 pagesThe Auditor - S Responsibilities - Chapter 3bajaocherylNo ratings yet

- Day 28Document14 pagesDay 28Reem JavedNo ratings yet

- Task-6: Apply The Controls Procedures and Test of Control For Cash System of B-StarDocument11 pagesTask-6: Apply The Controls Procedures and Test of Control For Cash System of B-Startearofda_godNo ratings yet

- Risk Assessment Matrix - Payroll System Objectives Accept Avoid ReduceDocument2 pagesRisk Assessment Matrix - Payroll System Objectives Accept Avoid ReduceAkita PepitoNo ratings yet

- SpecialExercise-5-2Document7 pagesSpecialExercise-5-2akmalilham1508No ratings yet

- Slides - Chapter 8Document8 pagesSlides - Chapter 8Thu TrangNo ratings yet

- HRM/Payroll Cycle Activities & ControlsDocument51 pagesHRM/Payroll Cycle Activities & ControlsRedNo ratings yet

- Chapter 2Document8 pagesChapter 2Karin NafilaNo ratings yet

- Key ControlsDocument3 pagesKey ControlsJiya RajputNo ratings yet

- Module 14Document3 pagesModule 14AstxilNo ratings yet

- In The Name of Allah, The Most Beneficent, The Most MercifulDocument40 pagesIn The Name of Allah, The Most Beneficent, The Most MercifulMuhammad SaadNo ratings yet

- Aeb SM CH20 1 PDFDocument22 pagesAeb SM CH20 1 PDFFebrian Tri IrawanNo ratings yet

- All in One TrackerDocument6 pagesAll in One Trackershara guiamanNo ratings yet

- CORE CV Template 2Document91 pagesCORE CV Template 2Cedric MercadoNo ratings yet

- WaccDocument33 pagesWaccTammy YahNo ratings yet

- Chapter 14Document20 pagesChapter 14Kim Joshua Bolo100% (1)

- Chapter 12Document24 pagesChapter 12Kim Joshua BoloNo ratings yet

- Auditing Expenditure CycleDocument56 pagesAuditing Expenditure CycleRico, Jalaica B.No ratings yet

- Home Health Auto Enrolment - General NoticeDocument4 pagesHome Health Auto Enrolment - General NoticeViorel OpreaNo ratings yet

- FY20 QBO Clients Course 5 Expanding UsabilityDocument47 pagesFY20 QBO Clients Course 5 Expanding UsabilityWinnieNo ratings yet

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresDocument27 pagesThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset Procedureshassan nassereddineNo ratings yet

- Payslip 1 2024-1Document1 pagePayslip 1 2024-1shabbeerbaig5No ratings yet

- 03 Ge DFD EddittedDocument65 pages03 Ge DFD EddittedحسينالربابعهNo ratings yet

- Payroll CycleDocument8 pagesPayroll CyclePauline Keith Paz ManuelNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- April Pay SlipDocument1 pageApril Pay SlipBandari GoverdhanNo ratings yet

- November 2022 PayslipDocument1 pageNovember 2022 PayslipAnthony LarbiNo ratings yet

- Cost Accounting Unit 2 BBA (B&I) GGSIPUDocument30 pagesCost Accounting Unit 2 BBA (B&I) GGSIPUAkshansh Singh ChaudharyNo ratings yet

- Concentrix Services India Private Limited Payslip For The Month of March - 2022Document1 pageConcentrix Services India Private Limited Payslip For The Month of March - 2022Farhin Laskar100% (1)

- OOPS Lab AnswersDocument16 pagesOOPS Lab Answers3004 Anil Kumar.DNo ratings yet

- Swissport_-_Payslip_GuideDocument4 pagesSwissport_-_Payslip_Guideazaan2005No ratings yet

- Hris ProposalDocument3 pagesHris Proposaljebdelrosario25No ratings yet

- Chapter 15Document22 pagesChapter 15Ivan BliminseNo ratings yet

- Pay SlipDocument1 pagePay Slipgopal venuNo ratings yet

- PayslipDocument1 pagePayslipSathish kumarNo ratings yet

- Disability Allowance: Application Form ForDocument36 pagesDisability Allowance: Application Form ForVlad BelovNo ratings yet

- Payroll PPT FinalDocument39 pagesPayroll PPT FinalKarla MeiNo ratings yet

- Adecco Handbook Feb09Document38 pagesAdecco Handbook Feb09Jaz CiceroSantana BoyceNo ratings yet