Professional Documents

Culture Documents

ch08 Mish11ge Embfm

Uploaded by

reza halim dana kusuma0 ratings0% found this document useful (0 votes)

29 views19 pagesChapter 8

Original Title

ch08_mish11ge_embfm

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 8

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views19 pagesch08 Mish11ge Embfm

Uploaded by

reza halim dana kusumaChapter 8

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

Chapter 8

An Economic

Analysis of

Financial

Structure

20-1 © 2016 Pearson Education Ltd. All rights reserved.

Preview

• A healthy and vibrant economy requires a

financial system that moves funds from

people who save to people who have

productive investment opportunities.

1-2 © 2016 Pearson Education Ltd. All rights reserved.

Learning Objectives

• Identify eight basic facts about the global

financial system.

• Summarize how transaction costs affect

financial intermediaries.

• Describe why asymmetric information leads

to adverse selection and moral hazard.

• Recognize adverse selection and summarize

the ways in which they can be reduced.

1-3 © 2016 Pearson Education Ltd. All rights reserved.

Learning Objectives

• Recognize the principal-agent problem

arising from moral hazard in equity

contracts and summarize the methods for

reducing it.

• Summarize the methods used to reduce

moral hazard in debt contracts

1-4 © 2016 Pearson Education Ltd. All rights reserved.

Basic Facts about Financial

Structure Throughout the World

• This chapter provides an economic analysis of how

our financial structure is designed to promote

economic efficiency.

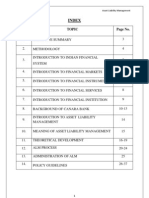

• The bar chart in Figure 1 shows how American

businesses financed their activities using external

funds (those obtained from outside the business

itself) in the period 1970–2000 and compares U.S.

data to those of Germany, Japan, and Canada.

1-5 © 2016 Pearson Education Ltd. All rights reserved.

Figure 1 Sources of External Funds for Nonfinancial

Businesses: A Comparison of the United States with

Germany, Japan, and Canada

Source: Andreas Hackethal and Reinhard H. Schmidt, “Financing Patterns: Measurement Concepts and Empirical Results,” Johann

Wolfgang Goethe-Universitat Working Paper No. 125, January 2004. The data are from 1970–2000 and are gross flows as

percentage of the total, not including trade and other credit data, which are not available.

1-6 © 2016 Pearson Education Ltd. All rights reserved.

Basic Facts about Financial

Structure Throughout the World

1. Stocks are not the most important sources of

external financing for businesses.

2. Issuing marketable debt and equity securities

is not the primary way in which businesses

finance their operations.

3. Indirect finance is many times more important

than direct finance

4. Financial intermediaries, particularly banks,

are the most important source of external

funds used to finance businesses.

1-7 © 2016 Pearson Education Ltd. All rights reserved.

Basic Facts about Financial

Structure Throughout the World

5. The financial system is among the most

heavily regulated sectors of the economy.

6. Only large, well-established corporations

have easy access to securities markets to

finance their activities.

7. Collateral is a prevalent feature of debt

contracts for both households and

businesses.

8. Debt contracts are extremely complicated

legal documents that place substantial

restrictive covenants on borrowers.

1-8 © 2016 Pearson Education Ltd. All rights reserved.

Transaction Costs

• Financial intermediaries have evolved to

reduce transaction costs.

– Economies of scale

– Expertise

1-9 © 2016 Pearson Education Ltd. All rights reserved.

Asymmetric Information: Adverse

Selection and Moral Hazard

• Adverse selection occurs before a

transaction occurs.

• Moral hazard arises after the transaction

has developed.

• Agency theory analyses how asymmetric

information problems affect economic

behavior.

1-10 © 2016 Pearson Education Ltd. All rights reserved.

The Lemons Problem: How Adverse

Selection Influences Financial Structure

• If quality cannot be assessed, the buyer is

willing to pay at most a price that reflects the

average quality.

• Sellers of good quality items will not want to

sell at the price for average quality.

• The buyer will decide not to buy at all

because all that is left in the market is poor

quality items.

• This problem explains fact 2 and partially

explains fact 1.

1-11 © 2016 Pearson Education Ltd. All rights reserved.

Tools to Help Solve Adverse

Selection Problems

• Private production and sale of information

– Free-rider problem

• Government regulation to increase

information

– Not always works to solve the adverse selection

problem, explains Fact 5

• Financial intermediation

– Explains facts 3, 4, & 6

• Collateral and net worth

– Explains fact 7

1-12 © 2016 Pearson Education Ltd. All rights reserved.

How Moral Hazard Affects the Choice

Between Debt and Equity Contracts

• Called the Principal-Agent Problem:

– Principal: less information (stockholder)

– Agent: more information (manager)

• Separation of ownership and control

of the firm

– Managers pursue personal benefits and power

rather than the profitability of the firm.

1-13 © 2016 Pearson Education Ltd. All rights reserved.

Tools to Help Solve the Principal-

Agent Problem

• Monitoring (Costly State Verification)

– Free-rider problem

– Fact 1

• Government regulation to increase information

– Fact 5

• Financial Intermediation

– Fact 3

• Debt Contracts

– Fact 1

1-14 © 2016 Pearson Education Ltd. All rights reserved.

How Moral Hazard Influences Financial

Structure in Debt Markets

• Borrowers have incentives to take on

projects that are riskier than the lenders

would like.

– This prevents the borrower from paying back the

loan.

1-15 © 2016 Pearson Education Ltd. All rights reserved.

Tools to Help Solve Moral Hazard in

Debt Contracts

• Net worth and collateral

– Incentive compatible

• Monitoring and enforcement of restrictive

covenants

– Discourage undesirable behavior

– Encourage desirable behavior

– Keep collateral valuable

– Provide information

• Financial intermediation

– Facts 3 & 4

1-16 © 2016 Pearson Education Ltd. All rights reserved.

Summary Table 1 Asymmetric Information

Problems and Tools to Solve Them

1-17 © 2016 Pearson Education Ltd. All rights reserved.

Application: Financial Development

and Economic Growth

• Financial repression created by an

institutional environment is characterized by:

– Poor system of property rights (unable to use

collateral efficiently)

– Poor legal system (difficult for lenders to enforce

restrictive covenants)

– Weak accounting standards (less access to good

information)

– Government intervention through directed credit

programs and state owned banks (less incentive

to proper channel funds to its most productive

use)

1-18 © 2016 Pearson Education Ltd. All rights reserved.

Application: Financial Development

and Economic Growth

• The financial systems in developing and

transition countries face several difficulties

that keep them from operating efficiently.

• In many developing countries, the system of

property rights (the rule of law, constraints

on government expropriation, absence of

corruption) functions poorly, making it hard

to use these two tools effectively.

1-19 © 2016 Pearson Education Ltd. All rights reserved.

You might also like

- Trs EnrollmentDocument1 pageTrs EnrollmentBrandon MillsNo ratings yet

- 18 - Carvana Is A Bad BoyDocument6 pages18 - Carvana Is A Bad BoyAsishNo ratings yet

- Mishkin PPT Ch08Document21 pagesMishkin PPT Ch08atulkirarNo ratings yet

- 14 Virgines Calvo v. UCPBDocument1 page14 Virgines Calvo v. UCPBEloise Coleen Sulla PerezNo ratings yet

- The ImpactAssets Handbook for Investors: Generating Social and Environmental Value through Capital InvestingFrom EverandThe ImpactAssets Handbook for Investors: Generating Social and Environmental Value through Capital InvestingNo ratings yet

- Solution Manual For Principles of Finance 6th Edition by BesleyDocument5 pagesSolution Manual For Principles of Finance 6th Edition by Besleya8707008010% (1)

- The Essentials of Finance and Accounting for Nonfinancial ManagersFrom EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersNo ratings yet

- Jaiib Indian Financial System Module A Paper 1 PDFDocument95 pagesJaiib Indian Financial System Module A Paper 1 PDFbuddy sepNo ratings yet

- Slides FimDocument203 pagesSlides FimHuzaifa TariqueNo ratings yet

- Oceanic v. CIRDocument1 pageOceanic v. CIRSarah Tarala MoscosaNo ratings yet

- M07 MishkinEakins3427056 08 FMI C07Document58 pagesM07 MishkinEakins3427056 08 FMI C07habiba ahmedNo ratings yet

- As 2252.4-2010 Controlled Environments Biological Safety Cabinets Classes I and II - Installation and Use (BSDocument7 pagesAs 2252.4-2010 Controlled Environments Biological Safety Cabinets Classes I and II - Installation and Use (BSSAI Global - APACNo ratings yet

- Financial Markets and Institutions: Ninth EditionDocument59 pagesFinancial Markets and Institutions: Ninth EditionShahmeer KamranNo ratings yet

- Toles Higher SampleDocument13 pagesToles Higher SampleKarl Fazekas50% (2)

- Schnittke - The Old Style Suite - Wind Quintet PDFDocument16 pagesSchnittke - The Old Style Suite - Wind Quintet PDFciccio100% (1)

- CIS Union Access Update 2021Document6 pagesCIS Union Access Update 2021Fernando Manholér100% (3)

- Chapter 8 An Economic Alaysis of Financiaal StructureDocument14 pagesChapter 8 An Economic Alaysis of Financiaal StructureSamanthaHandNo ratings yet

- 8 - An Economic Analysis On Financial StructureDocument18 pages8 - An Economic Analysis On Financial StructurecihtanbioNo ratings yet

- An Economic Analysis of Financial StructureDocument16 pagesAn Economic Analysis of Financial StructureAdnan NaeemNo ratings yet

- Transaction costs, asymmetric information and financial structureDocument20 pagesTransaction costs, asymmetric information and financial structureMichelle Ngan DaoNo ratings yet

- CH10 Mish11ge EMBFMDocument23 pagesCH10 Mish11ge EMBFMZeeruanNo ratings yet

- Why Do Financial Institutions ExistDocument39 pagesWhy Do Financial Institutions Existkafi100% (1)

- Slides1 - FIMDocument62 pagesSlides1 - FIMHuzaifa TariqueNo ratings yet

- M07 MishkinEakins3427056 08 FMI C07Document58 pagesM07 MishkinEakins3427056 08 FMI C07Declan ShuitNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document29 pagesWhy Study Money, Banking, and Financial Markets?Lazaros KarapouNo ratings yet

- II.1 Economic Analysis of Financial Institutions: Money, Banking and Financial MarketsDocument21 pagesII.1 Economic Analysis of Financial Institutions: Money, Banking and Financial MarketsclementNo ratings yet

- Analysis of Financial Structure Chapter 8 (AFC8Document15 pagesAnalysis of Financial Structure Chapter 8 (AFC8superzttNo ratings yet

- CH 7Document29 pagesCH 7shubhmalhotra93No ratings yet

- An Overview of The Financial SystemDocument20 pagesAn Overview of The Financial SystemLazaros Karapou100% (1)

- An Overview of The Financial SystemDocument20 pagesAn Overview of The Financial Systembb kkkNo ratings yet

- Mishkin Fmi09 PPT 18Document69 pagesMishkin Fmi09 PPT 18lashia.williams69No ratings yet

- Why Study Money, Banking, and Financial Markets?Document28 pagesWhy Study Money, Banking, and Financial Markets?Joe PatrickNo ratings yet

- Why Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Document33 pagesWhy Study Financial Market: Course: FINC6019 Introduction To Money and Capital Market Effective Period: September 2019Ikhsan Uiandra Putra SitorusNo ratings yet

- Financial Management - Chapter 01Document26 pagesFinancial Management - Chapter 01Joe HizulNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument30 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinDaireen ShahrinNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document30 pagesWhy Study Money, Banking, and Financial Markets?Zəfər CabbarovNo ratings yet

- Why Financial Institutions ExistDocument54 pagesWhy Financial Institutions ExistKareen WellingtonNo ratings yet

- Ch01 ME For BlackboardDocument17 pagesCh01 ME For BlackboardIlqar SəlimovNo ratings yet

- An Economic Analysis of Financial StructureDocument15 pagesAn Economic Analysis of Financial Structurevetushi123No ratings yet

- Chapter 2Document16 pagesChapter 2Jinnath JumurNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document12 pagesWhy Study Money, Banking, and Financial Markets?وائل مصطفىNo ratings yet

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDocument5 pagesContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANo ratings yet

- Role of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2)Document31 pagesRole of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2)Shashwat MadanNo ratings yet

- Lectures 3-4 (Chapter 8)Document22 pagesLectures 3-4 (Chapter 8)LuisLoNo ratings yet

- The Role of Managerial FinanceDocument40 pagesThe Role of Managerial FinanceJackBelmandoNo ratings yet

- An Economic Analysis of Financial StructureDocument27 pagesAn Economic Analysis of Financial StructureAlejandroArnoldoFritzRuenesNo ratings yet

- Chapter 5 - Overview of The Financial SystemDocument12 pagesChapter 5 - Overview of The Financial SystemMerge MergeNo ratings yet

- Economics 330: Money and BankingDocument23 pagesEconomics 330: Money and BankinglkjflksdfsdfNo ratings yet

- An Overview of The Financial SystemDocument20 pagesAn Overview of The Financial SystemZəfər CabbarovNo ratings yet

- The Role of Managerial FinanceDocument50 pagesThe Role of Managerial FinanceYudha LampeNo ratings yet

- Activity 1Document2 pagesActivity 1Daisys TindogNo ratings yet

- 01 Fisher Account 5e v1 PPT ch01Document29 pages01 Fisher Account 5e v1 PPT ch01yuqi liuNo ratings yet

- Solved Paper FSD-2010Document11 pagesSolved Paper FSD-2010Kiran SoniNo ratings yet

- The Role of Managerial FinanceDocument46 pagesThe Role of Managerial FinancedhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Career'S in Finance: Presented by Group No7Document18 pagesCareer'S in Finance: Presented by Group No7Afsha RatansiNo ratings yet

- The Role of Managerial FinanceDocument37 pagesThe Role of Managerial Financelayan123456No ratings yet

- Chap 3Document66 pagesChap 3Thùy Vân NguyễnNo ratings yet

- Why Study Financial Markets and Institutions?: All Rights ReservedDocument23 pagesWhy Study Financial Markets and Institutions?: All Rights ReservedДарьяNo ratings yet

- LN01Brooks671956 02 LN01Document22 pagesLN01Brooks671956 02 LN01nightdazeNo ratings yet

- Banking Industry: Structure and CompetitionDocument37 pagesBanking Industry: Structure and CompetitionZeeruanNo ratings yet

- Financial SystemDocument66 pagesFinancial Systemjimoh kamiludeenNo ratings yet

- Chapter 1 - Financial ManagementDocument32 pagesChapter 1 - Financial ManagementtheputeriizzahNo ratings yet

- Financial System in Ethiopia: 4 Institutional Finance: Advantages and Limitations of Institutional FinanceDocument12 pagesFinancial System in Ethiopia: 4 Institutional Finance: Advantages and Limitations of Institutional FinanceRas DawitNo ratings yet

- The Role of Managerial FinanceDocument42 pagesThe Role of Managerial Financemild incNo ratings yet

- Management Accounting Concepts and TechniquesDocument277 pagesManagement Accounting Concepts and TechniquesCalvince OumaNo ratings yet

- Landscape of Financial Services: Section - ADocument12 pagesLandscape of Financial Services: Section - Aanjney050592No ratings yet

- Financial MNGT Module1Document39 pagesFinancial MNGT Module1Stephanie FrescoNo ratings yet

- Ganeshan VanamamalaiDocument57 pagesGaneshan Vanamamalaisweetlingeethu_kannanNo ratings yet

- Financial Crises in Advanced EconomiesDocument29 pagesFinancial Crises in Advanced EconomiesZeeruanNo ratings yet

- Banking Industry: Structure and CompetitionDocument37 pagesBanking Industry: Structure and CompetitionZeeruanNo ratings yet

- ch03 Mish11ge EmbfmDocument18 pagesch03 Mish11ge EmbfmLazaros KarapouNo ratings yet

- The Money Supply ProcessDocument34 pagesThe Money Supply ProcessLazaros KarapouNo ratings yet

- CH02 Mish11ge EMBFMDocument20 pagesCH02 Mish11ge EMBFMZeeruan100% (2)

- CH13 Mish11ge EMBFMDocument12 pagesCH13 Mish11ge EMBFMZeeruanNo ratings yet

- CH09 Mish11ge EMBFMDocument33 pagesCH09 Mish11ge EMBFMZeeruan100% (1)

- CH04 Mish11ge EMBFMDocument23 pagesCH04 Mish11ge EMBFMZeeruanNo ratings yet

- 26 VANGUARDIA, Cedric F. - COVID Essay PDFDocument1 page26 VANGUARDIA, Cedric F. - COVID Essay PDFEstrell VanguardiaNo ratings yet

- Succession 092418Document37 pagesSuccession 092418Hyuga NejiNo ratings yet

- Income Statement and Related Information: Intermediate AccountingDocument64 pagesIncome Statement and Related Information: Intermediate AccountingAdnan AbirNo ratings yet

- Unit 6 LessonsDocument25 pagesUnit 6 Lessonsapi-300955269No ratings yet

- CH7 Lecture SlidesDocument30 pagesCH7 Lecture SlidesRomeo BalingaoNo ratings yet

- English 7 AnnexeDocument4 pagesEnglish 7 AnnexeTASOEUR1234567890No ratings yet

- Evidence Case List 1 STDocument1 pageEvidence Case List 1 STEmmanuel Gomez de Peralta Jr.No ratings yet

- The Queen of The Pirate Isle by Harte, Bret, 1836-1902Document18 pagesThe Queen of The Pirate Isle by Harte, Bret, 1836-1902Gutenberg.orgNo ratings yet

- Sap S/4Hana: Frequently Asked Questions (Faqs)Document6 pagesSap S/4Hana: Frequently Asked Questions (Faqs)kcvaka123No ratings yet

- Co-Operative Act (No. 14 of 2005)Document45 pagesCo-Operative Act (No. 14 of 2005)MozitomNo ratings yet

- Criminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodeDocument27 pagesCriminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodePrabhash ChandNo ratings yet

- School EOEDocument1 pageSchool EOEMark James S. SaliringNo ratings yet

- Bank StatementDocument2 pagesBank StatementZakaria EL MAMOUNNo ratings yet

- Interpretation of TreatyDocument21 pagesInterpretation of TreatyTania KansalNo ratings yet

- Administrative rulemaking and adjudication explainedDocument5 pagesAdministrative rulemaking and adjudication explainedShailvi RajNo ratings yet

- Q. Write A Short Note On Redressal Agencies in Consumer Protection Act?Document4 pagesQ. Write A Short Note On Redressal Agencies in Consumer Protection Act?Siddharth SharmaNo ratings yet

- AttachmentDocument60 pagesAttachmentTahseen banuNo ratings yet

- Dissertation On BrexitDocument37 pagesDissertation On BrexitChristopher P MurasiNo ratings yet

- Institutional Framework FOR International Business: Business R. M. JoshiDocument45 pagesInstitutional Framework FOR International Business: Business R. M. JoshiIshrat SonuNo ratings yet

- Ordinary Use and Enjoyment " of LandDocument4 pagesOrdinary Use and Enjoyment " of LandlkndgknfskNo ratings yet

- NaMo Case StudyDocument4 pagesNaMo Case StudyManish ShawNo ratings yet