Professional Documents

Culture Documents

Why Do Interest Rates Change?

Uploaded by

UMAIR AHMED0 ratings0% found this document useful (0 votes)

39 views19 pagesJLJLJKLJLJK

Original Title

chapter 4

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJLJLJKLJLJK

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views19 pagesWhy Do Interest Rates Change?

Uploaded by

UMAIR AHMEDJLJLJKLJLJK

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

Chapter 4

Why Do Interest Rates Change?

Determinants of asset demand

• Demand for an assets is influenced by the

following factors:

1. Wealth

• When our wealth increases, we have more

resources available with which we can

purchase assets,

• Thus holding everything constant, an increase

in wealth raises the quantity demand of an

asset

Determinants of asset demand

2. Expected return =∑RiPi

• When expected return on asset rises relative to

expected returns on alternative assets, holding

everything else constant, demand for that asset will

also rise

3. Risk = Standard deviation of returns

• Investors are usually risk averse and want to reduce the

uncertainty with the returns on an asset

• Hence, holding everything constant, if an asset’s risk

rises relative to that of alternative assets, its quantity

demanded will fall

Determinants of asset demand

4. Liquidity

• Liquidity means how quickly an asset can be

converted into cash at low cost

• The more liquid an asset is to alternative

assets, holding everything else unchanged,

the more desirable it is, and the greater will

be the quantity demand.

Determinants of Asset Demand (3)

Copyright © 2009 Pearson

Prentice Hall. All rights 4-5

reserved.

Supply and demand in the bond

market

• Supply of and demand for bonds determine

interest rates

• Remember the following relationships:

• Interest rates and bond prices have inverse

relationships

• When interest rates rise, quantity demanded

of bonds rises and quantity supplied falls

Derivation of Demand Curve

F P

iR e

P

Point A: if the bond was selling for $950.

P $950

$1000 $950

i .053 5.3%

$950

Bd 100

Point B: if the bond was selling for $900.

P $900

$1000 $900

i .111 11.1%

$900

Bd 200

Copyright © 2009 Pearson

Prentice Hall. All rights 4-7

reserved.

Derivation of Demand Curve

To continue …

• Point C: P = $850 i = 17.6% Bd = 300

• Point D: P = $800 i = 25.0% Bd = 400

• Point E: P = $750 i = 33.0% Bd = 500

• Demand Curve is Bd in Figure 1 which

connects points A, B, C, D, E.

– Has usual downward slope

Copyright © 2009 Pearson

Prentice Hall. All rights 4-8

reserved.

Derivation of Supply Curve

• Point F: P = $750 i = 33.0% Bs = 100

• Point G: P = $800 i = 25.0% Bs = 200

• Point C: P = $850 i = 17.6% Bs = 300

• Point H: P = $900 i = 11.1% Bs = 400

• Point I: P = $950 i = 5.3% Bs = 500

• Supply Curve is Bs that connects points F, G, C,

H, I, and has upward slope

Market Conditions

Market equilibrium occurs when the amount that people are

willing to buy (demand) equals the amount that people are

willing to sell (supply) at a given price

Excess supply occurs when the amount that people are willing to

sell (supply) is greater than the amount people are willing to buy

(demand) at a given price

Excess demand occurs when the amount that people are willing

to buy (demand) is greater than the amount that people are

willing to sell (supply) at a given price

Loanable Funds Framework

• If we drop the prices data from the previous

graph, we can draw demand and supply

curves for bonds that look like demand and

supply curves for commodities

• Note that demand for bond is the same thing

as supply of loanable funds

• And supply of bonds is the same thing as

demand for loanable funds

Factors

That Shift

Demand Curve

Summary of Shifts

in the Demand for Bonds

1. Wealth: in a business cycle expansion with growing

wealth, the demand for bonds rises, conversely, in a

recession, when income and wealth are falling, the

demand for bonds falls

2. Expected returns: higher expected interest rates in

the future decrease the demand for long-term

bonds, conversely, lower expected interest rates in

the future increase the demand for long-term

bonds

Copyright © 2009 Pearson

Prentice Hall. All rights 4-14

reserved.

Summary of Shifts

in the Demand for Bonds (2)

3. Risk: an increase in the riskiness of bonds causes

the demand for bonds to fall, conversely, an

increase in the riskiness of alternative assets (like

stocks) causes the demand for bonds

to rise

4. Liquidity: increased liquidity of the bond market

results in an increased demand for bonds,

conversely, increased liquidity of alternative asset

markets (like the stock market) lowers the demand

for bonds

Copyright © 2009 Pearson

Prentice Hall. All rights 4-15

reserved.

Factors That Shift Supply Curve

We now turn to the

supply curve.

We summarize the

effects in this table:

Summary of Shifts

in the Supply of Bonds

1. Expected Profitability of Investment Opportunities: in a

business cycle expansion, the supply of bonds increases,

conversely, in a recession, when there are far fewer

expected profitable investment opportunities, the supply of

bonds falls

2. Expected Inflation: an increase in expected inflation causes

the supply of bonds to increase

3. Government Activities: higher government deficits increase

the supply of bonds, conversely, government surpluses

decrease the supply of bonds

Copyright © 2009 Pearson

Prentice Hall. All rights 4-17

reserved.

Changes in πe: The Fisher Effect

• If πe

1. Relative Re ,

Bd shifts

in to left

2. Bs , Bs shifts

out to right

3. P , i

Copyright © 2009 Pearson

Prentice Hall. All rights 4-18

reserved.

Business Cycle Expansion

1. Wealth , Bd , Bd

shifts out to right

2. Investment , Bs ,

Bs shifts right

3. If Bs shifts

more than Bd

then P , i

Copyright © 2009 Pearson

Prentice Hall. All rights 4-19

reserved.

You might also like

- The Complete Guide to Real Estate Finance for Investment Properties: How to Analyze Any Single-Family, Multifamily, or Commercial PropertyFrom EverandThe Complete Guide to Real Estate Finance for Investment Properties: How to Analyze Any Single-Family, Multifamily, or Commercial PropertyRating: 3.5 out of 5 stars3.5/5 (2)

- Lecture 6 Behavior of Interest RatesDocument33 pagesLecture 6 Behavior of Interest RatesAman Ullah BalochNo ratings yet

- Why Do Interest Rates Change?Document33 pagesWhy Do Interest Rates Change?Ahmad RahhalNo ratings yet

- CH 2Document28 pagesCH 2shubhmalhotra93No ratings yet

- Why Do Interest Rates Change?Document57 pagesWhy Do Interest Rates Change?Manoj KumarNo ratings yet

- Why Do Interest Rates Change?Document41 pagesWhy Do Interest Rates Change?YSLHKHKHKNo ratings yet

- The Behavior of Interest RatesDocument32 pagesThe Behavior of Interest RatesSafaNo ratings yet

- Money and Banking Week 1 CH 5Document5 pagesMoney and Banking Week 1 CH 5Pradipta NarendraNo ratings yet

- Why Do Interest Rates Change?Document38 pagesWhy Do Interest Rates Change?Ahmad RahhalNo ratings yet

- Bic T Big Concepts: Money and Banking Money and BankingDocument9 pagesBic T Big Concepts: Money and Banking Money and Bankingselsel139No ratings yet

- M05 Mishkin599853 09 C05Document30 pagesM05 Mishkin599853 09 C05K59 Ngo Yen NhiNo ratings yet

- Mishkin Fmi07 Ppt04Document58 pagesMishkin Fmi07 Ppt04Wahbeeah MohtiNo ratings yet

- The Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionDocument38 pagesThe Economics of Money, Banking, and Financial Markets: Twelfth Edition, Global EditionHiền NguyễnNo ratings yet

- Chapter Preview: Why Do Interest Rates Change?Document6 pagesChapter Preview: Why Do Interest Rates Change?shahid faridNo ratings yet

- C04Document50 pagesC04Silvery DoeNo ratings yet

- ch05 Mish11ge EmbfmDocument33 pagesch05 Mish11ge EmbfmRakib HasanNo ratings yet

- M05 Mishkin599853 09 C05Document30 pagesM05 Mishkin599853 09 C05Hikmət RüstəmovNo ratings yet

- Behavior of Interest RateDocument30 pagesBehavior of Interest RateTho ThoNo ratings yet

- Chapter 13 - Saving, Investment, and The Financial SystemDocument29 pagesChapter 13 - Saving, Investment, and The Financial SystemHoang Ngoc Ha (K16HCM)No ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesAhmad RahhalNo ratings yet

- The Behavior of Interest Rates: Cecchetti, Chapter 7Document41 pagesThe Behavior of Interest Rates: Cecchetti, Chapter 7Trúc Ly Cáp thịNo ratings yet

- FIM Lecture V VI: Why Do Interest Rates Change?Document15 pagesFIM Lecture V VI: Why Do Interest Rates Change?Aniket GuptaNo ratings yet

- The Level of Interest RatesDocument42 pagesThe Level of Interest RatesMarwa HassanNo ratings yet

- 5 - The Behavior of Interest RatesDocument31 pages5 - The Behavior of Interest RatescihtanbioNo ratings yet

- CH 5-Behavior of The Interest RateDocument34 pagesCH 5-Behavior of The Interest RateCarolFun AndosNo ratings yet

- Behavior of Interest RatesDocument43 pagesBehavior of Interest RatesSewel CastanedaNo ratings yet

- The Behavior Of Interest Rates: Group 9: 1/ Huỳnh Nguyễn Hạ Vy 2/ Đoàn Duy Khánh 3/ Nguyễn Đường Phương NgọcDocument40 pagesThe Behavior Of Interest Rates: Group 9: 1/ Huỳnh Nguyễn Hạ Vy 2/ Đoàn Duy Khánh 3/ Nguyễn Đường Phương NgọcNguyễn Đường Phương NgọcNo ratings yet

- Chapter 2Document19 pagesChapter 2ebaaNo ratings yet

- Chap 2 - NoteDocument6 pagesChap 2 - NotePeo PaoNo ratings yet

- Money & Banking: Week 3: The Behavior of Interest RatesDocument33 pagesMoney & Banking: Week 3: The Behavior of Interest RatesAhmad RahhalNo ratings yet

- Financial Institutions and Market: Introduction To Indian Financial SystemDocument41 pagesFinancial Institutions and Market: Introduction To Indian Financial SystemDiksha NatarajanNo ratings yet

- Chapter 4 Interest RatesDocument31 pagesChapter 4 Interest RatesnoorabogamiNo ratings yet

- Savings and InvestmentsDocument19 pagesSavings and InvestmentsSonali GuptaNo ratings yet

- THE BOND and FOREIGN EXCHANGE MARKETSDocument11 pagesTHE BOND and FOREIGN EXCHANGE MARKETSmonster_newinNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesRhazes Zy100% (1)

- Financial Market-Lecture 2-2Document23 pagesFinancial Market-Lecture 2-2Krish ShettyNo ratings yet

- Fin 616Document7 pagesFin 616Boby PodderNo ratings yet

- 7 Saving, Investment, and The Financial SystemDocument38 pages7 Saving, Investment, and The Financial SystemMUHAMMAD AWAIS100% (1)

- CH 4 PDFDocument11 pagesCH 4 PDFWasim Hyder100% (1)

- Mishkin PPT Ch17Document22 pagesMishkin PPT Ch17atulkirarNo ratings yet

- Determinants of Interest RateDocument40 pagesDeterminants of Interest Ratesbb anbwNo ratings yet

- Lecture5 WhyInterestrateschangeDocument6 pagesLecture5 WhyInterestrateschangeAbdul RafayNo ratings yet

- Chapter 5 Summary - Group 6Document10 pagesChapter 5 Summary - Group 6Phương Anh NguyễnNo ratings yet

- Lecture 4: The Behaviour of Interest Rates: WealthDocument10 pagesLecture 4: The Behaviour of Interest Rates: WealthLeung Shing HeiNo ratings yet

- Determination of Interest RateDocument35 pagesDetermination of Interest Rateznz17_78248No ratings yet

- Lecture No 2 Fundamentals of Financial Markets Interest RateDocument41 pagesLecture No 2 Fundamentals of Financial Markets Interest RateNimco CumarNo ratings yet

- Mishkin - Chapter 5Document35 pagesMishkin - Chapter 5Jeet JainNo ratings yet

- Chapter 4 Saving, Investment and Financial System: Mentor Pham Xuan Truong Truongpx@ftu - Edu.vnDocument21 pagesChapter 4 Saving, Investment and Financial System: Mentor Pham Xuan Truong Truongpx@ftu - Edu.vnchu binhNo ratings yet

- Macro-Economics BBC1023: InflationDocument33 pagesMacro-Economics BBC1023: InflationNayama NayamaNo ratings yet

- Tutorial - 3 FMTDocument9 pagesTutorial - 3 FMTNguyễn Vĩnh TháiNo ratings yet

- 14 Monetary and Fiscal PoliciesDocument26 pages14 Monetary and Fiscal PoliciesMichael BonadonnaNo ratings yet

- Macroeconomics AD:ASDocument13 pagesMacroeconomics AD:ASSoumya RanaNo ratings yet

- Money and Banking SS 2021: Lecture Four: Bond MarketDocument21 pagesMoney and Banking SS 2021: Lecture Four: Bond MarketMourad El ShafieNo ratings yet

- Chapter 4Document109 pagesChapter 4Manan AgrawalNo ratings yet

- The Behavior of Interest RatesDocument35 pagesThe Behavior of Interest RatesBradley RayNo ratings yet

- Welcome To The Session On Interest Rate Determination, YTM and Yield CurveDocument45 pagesWelcome To The Session On Interest Rate Determination, YTM and Yield CurveZakaria SakibNo ratings yet

- C4-Factors Affecting IRDocument24 pagesC4-Factors Affecting IRDuong Ha ThuyNo ratings yet

- Interest RatesDocument48 pagesInterest RatesSakshi SharmaNo ratings yet

- Macro Economic Variables: Income Consumption Saving Investment Saving - Investment Equality EmploymentDocument32 pagesMacro Economic Variables: Income Consumption Saving Investment Saving - Investment Equality EmploymentFG Degree College Peshawar CanttNo ratings yet

- Department/ Vision & Mission Department B.SC Engineering Program B.SC Engineering Technology ProgramDocument2 pagesDepartment/ Vision & Mission Department B.SC Engineering Program B.SC Engineering Technology ProgramUMAIR AHMEDNo ratings yet

- MCQ HRMDocument13 pagesMCQ HRMUMAIR AHMEDNo ratings yet

- SubmissionDocument1 pageSubmissionUMAIR AHMEDNo ratings yet

- Bank Excess Return Over Benchm Ark (%) Excess Return Over Risk Free (%) Cooff. of Variatio N (%)Document5 pagesBank Excess Return Over Benchm Ark (%) Excess Return Over Risk Free (%) Cooff. of Variatio N (%)UMAIR AHMEDNo ratings yet

- Spring 2021Document2 pagesSpring 2021UMAIR AHMEDNo ratings yet

- Proposal Updated (8-3-22)Document15 pagesProposal Updated (8-3-22)UMAIR AHMEDNo ratings yet

- 3 MarksDocument1 page3 MarksUMAIR AHMEDNo ratings yet

- Cultural and Religious Identities in Bapsi Sidhwa'S Ice CandymanDocument20 pagesCultural and Religious Identities in Bapsi Sidhwa'S Ice CandymanUMAIR AHMEDNo ratings yet

- My Favorite Animal Is CowDocument1 pageMy Favorite Animal Is CowUMAIR AHMEDNo ratings yet

- InstructionsDocument2 pagesInstructionsUMAIR AHMEDNo ratings yet

- Primary Financial StatementsDocument18 pagesPrimary Financial StatementsUMAIR AHMEDNo ratings yet

- The Foreign Exchange MarketDocument39 pagesThe Foreign Exchange MarketUMAIR AHMEDNo ratings yet

- Digital Logic and Design CS-103 Assignment 01 For Spring 2021Document1 pageDigital Logic and Design CS-103 Assignment 01 For Spring 2021UMAIR AHMEDNo ratings yet

- All QuestionsDocument11 pagesAll QuestionsUMAIR AHMEDNo ratings yet

- Chapter 3Document36 pagesChapter 3UMAIR AHMEDNo ratings yet

- Q1Document1 pageQ1UMAIR AHMEDNo ratings yet

- (3 Marks) (4 Marks) (2 Marks)Document1 page(3 Marks) (4 Marks) (2 Marks)UMAIR AHMEDNo ratings yet

- Course Outline Strategic Management MGT-603Document4 pagesCourse Outline Strategic Management MGT-603UMAIR AHMEDNo ratings yet

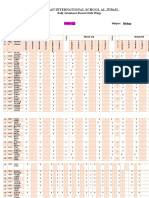

- Pakistan International School Al - Jubail.: Daily Attendance Record (Girls Wing)Document3 pagesPakistan International School Al - Jubail.: Daily Attendance Record (Girls Wing)UMAIR AHMEDNo ratings yet

- 2021 Corporate FinanceDocument3 pages2021 Corporate FinanceUMAIR AHMEDNo ratings yet

- Vertebrates Specimens Invertebrates Species Slides + Specimens Ecto and Endo Parasites Slides Specimens of Pests Fish Specimen Mitosis Meiosis SlidesDocument1 pageVertebrates Specimens Invertebrates Species Slides + Specimens Ecto and Endo Parasites Slides Specimens of Pests Fish Specimen Mitosis Meiosis SlidesUMAIR AHMEDNo ratings yet

- PIFRA Project To Improve Financial Reporting and Auditing' in PakistanDocument3 pagesPIFRA Project To Improve Financial Reporting and Auditing' in PakistanUMAIR AHMEDNo ratings yet

- Course Outline Strategic Management MGT-505Document4 pagesCourse Outline Strategic Management MGT-505UMAIR AHMEDNo ratings yet

- MA MSC Previouse (For Private Candidate) - 1Document2 pagesMA MSC Previouse (For Private Candidate) - 1Faisal RahimNo ratings yet

- Ipm Final Model Paper Spring 15Document12 pagesIpm Final Model Paper Spring 15UMAIR AHMEDNo ratings yet

- New Microsoft Office Word DocumentDocument10 pagesNew Microsoft Office Word DocumentUMAIR AHMEDNo ratings yet

- Naveed Shahzad: Assistant Professor Management SciDocument1 pageNaveed Shahzad: Assistant Professor Management SciUMAIR AHMEDNo ratings yet

- Events After The Reporting Period: International Accounting Standard 10Document5 pagesEvents After The Reporting Period: International Accounting Standard 10Quinnie EscotaNo ratings yet

- PhdibfDocument17 pagesPhdibfUMAIR AHMEDNo ratings yet

- Form - Cancellation, Transfer and NCD Withdrawal-1 PDFDocument1 pageForm - Cancellation, Transfer and NCD Withdrawal-1 PDFGambar Gambar0% (1)

- MPC MPS MultipliersDocument14 pagesMPC MPS MultipliersAmanda BrownNo ratings yet

- Biological AssetsDocument2 pagesBiological AssetsMjhayeNo ratings yet

- 3 MDocument26 pages3 MSneha Daswani100% (1)

- Interdependence of Functional AreasDocument1 pageInterdependence of Functional AreasAnil KulkarniNo ratings yet

- Marriott-Corporation - HBR CaseDocument4 pagesMarriott-Corporation - HBR CaseAsif RahmanNo ratings yet

- Venture Capital Q2 2016Document1 pageVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- Tariq Ali 1Document62 pagesTariq Ali 1Hafeezullah ShareefNo ratings yet

- Reviewability of Reinsurance Rates - FinalDocument24 pagesReviewability of Reinsurance Rates - FinalShubham MehtaNo ratings yet

- Warren Buffet by Mohd Irfan RizviDocument12 pagesWarren Buffet by Mohd Irfan Rizvitushit0005No ratings yet

- Continental Carriers IncDocument7 pagesContinental Carriers IncYetunde JamesNo ratings yet

- Settlement Order in Respect of Dasharath S. Mahadevia and Others in The Matter of M/s Tak Machinery & Leasing Ltd. (Now Known As "M/s Mangal Credit and Fincorp Limited)Document5 pagesSettlement Order in Respect of Dasharath S. Mahadevia and Others in The Matter of M/s Tak Machinery & Leasing Ltd. (Now Known As "M/s Mangal Credit and Fincorp Limited)Shyam SunderNo ratings yet

- John Gokongwei Success StoryDocument11 pagesJohn Gokongwei Success StoryGershNo ratings yet

- Chapter 13 HW SolutionDocument5 pagesChapter 13 HW SolutionZarifah Fasihah67% (3)

- Mumbai MetroDocument23 pagesMumbai MetroTarun AnandNo ratings yet

- Disaster Risk ReductionDocument86 pagesDisaster Risk ReductionliemorixNo ratings yet

- FDIC Continental Illinois ResolutionDocument22 pagesFDIC Continental Illinois ResolutionБоби ПетровNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- The Size of The Tradable and Non-Tradable Sector - Evidence From Input-Output Tables For 25 CountriesDocument15 pagesThe Size of The Tradable and Non-Tradable Sector - Evidence From Input-Output Tables For 25 CountrieskeyyongparkNo ratings yet

- Mutual FundDocument75 pagesMutual FundpopNo ratings yet

- Triple Screen Trading SystemDocument22 pagesTriple Screen Trading Systemalrog2000No ratings yet

- Skills Training Proposal For Eden District Municipality by Zaid NordienDocument9 pagesSkills Training Proposal For Eden District Municipality by Zaid NordienZaid NordienNo ratings yet

- MATH1510 Financial Mathematics I: Jitse Niesen University of Leeds January - May 2012Document20 pagesMATH1510 Financial Mathematics I: Jitse Niesen University of Leeds January - May 2012YoungJamesNo ratings yet

- Ijara-Based Financing: Definition of Ijara (Leasing)Document13 pagesIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuNo ratings yet

- BitAuto IPO Prospectus 2010Document291 pagesBitAuto IPO Prospectus 2010ryanmaruiNo ratings yet

- Theoretical FrameworkDocument3 pagesTheoretical Frameworkm_ihamNo ratings yet

- Arpico Insurance IPO - Capital TRUST Research PDFDocument5 pagesArpico Insurance IPO - Capital TRUST Research PDFRandora LkNo ratings yet

- Financial & Managerial Accounting: The Basis For Business DecisionsDocument20 pagesFinancial & Managerial Accounting: The Basis For Business Decisionsaqeelkhan7942No ratings yet

- THFJ Europe 50 2011Document15 pagesTHFJ Europe 50 2011nickmontNo ratings yet

- Minor Project Report On Bajaj Automobiles IndiaDocument55 pagesMinor Project Report On Bajaj Automobiles IndiaAmit Jain71% (7)