Professional Documents

Culture Documents

Securitization and Hire Purchase Explained

Uploaded by

sumit_mehta120 ratings0% found this document useful (0 votes)

129 views19 pagesSecuritization involves pooling and repackaging of homogeneous financial assets into marketable securities that can be sold to investors. The main parties are the originator, special purpose vehicle (SPV), and investors. Assets are transferred from the originator to the SPV, which then issues securities to investors. Securities are structured and rated to match the maturity of the underlying assets. The process benefits originators through additional liquidity and investors through safer, higher returning investments. However, securitization remains unpopular in India due to factors such as heavy taxes, a lack of standardization and guidelines, and inadequate credit rating facilities. Hire purchase allows buyers to obtain goods through installment payments, with ownership transferring upon final payment. It provides

Original Description:

Original Title

securitization and hire purchase

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSecuritization involves pooling and repackaging of homogeneous financial assets into marketable securities that can be sold to investors. The main parties are the originator, special purpose vehicle (SPV), and investors. Assets are transferred from the originator to the SPV, which then issues securities to investors. Securities are structured and rated to match the maturity of the underlying assets. The process benefits originators through additional liquidity and investors through safer, higher returning investments. However, securitization remains unpopular in India due to factors such as heavy taxes, a lack of standardization and guidelines, and inadequate credit rating facilities. Hire purchase allows buyers to obtain goods through installment payments, with ownership transferring upon final payment. It provides

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

129 views19 pagesSecuritization and Hire Purchase Explained

Uploaded by

sumit_mehta12Securitization involves pooling and repackaging of homogeneous financial assets into marketable securities that can be sold to investors. The main parties are the originator, special purpose vehicle (SPV), and investors. Assets are transferred from the originator to the SPV, which then issues securities to investors. Securities are structured and rated to match the maturity of the underlying assets. The process benefits originators through additional liquidity and investors through safer, higher returning investments. However, securitization remains unpopular in India due to factors such as heavy taxes, a lack of standardization and guidelines, and inadequate credit rating facilities. Hire purchase allows buyers to obtain goods through installment payments, with ownership transferring upon final payment. It provides

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 19

SECURITIZATION AND

HIRE PURCHASE

By: Raman Deep Kaur

SECURITIZATION

Pooling and Repackaging of Homogeneous

liquid Financial Assets into Marketable

Securities that can be sold to Investors, is

known as Securitization.

Parties in Securitization

Generally 3 parties, namely-

1. Originator: any financial institution or

other entity, which has decided to adopt

securitization and sell its assets.

2. Special Purpose Vehicle: usually a trust

which converts receivables into securities.

3. The Investor: MF, pension fund,

insurance company, PF, etc buying

securities from SPV.

Other Parties:

4.The Obligor: original borrower on whose

integrity success of securitization depends.

5. Credit Rating Agency: rates originator and

underlying assets of securities.

6. Administrator: receiving and paying agent

who receives payments from obligor and gives

to SPV.

7. Trustee: ensure that all parties meet their

obligations

8. Structurer: works with originator to comply

with all legal, taxation, procedural

requirements and structuring whole deal.

Process of Securitization

Mainly includes transfer of assets, issue of

securities, servicing of securities.

1. Transfer of Assets: to SPV thru any of the

following methods-

Assignment (statutory with legal & beneficial rights or

equitable with beneficial rights)

Sub-participation- (not a transfer of loan, payments

received from borrower are transferred to buyer by the

lender or originator)

Documentation: rights and obligations of all parties are

defined.

2. Issue of Securities: maturity of securities is

matched with securitized loans, rated or

guaranteed or underwritten by some agency.

3. Servicing of Securities: repayment of

securitized loan passed on to SPV, which then

pays to investors on maturity.

Structure of Securities

1. Pass through certificates: issued to investors,

against pooled assets and undivided interest and

cash flows received from underlying assets are

‘passed through’ to investors. Tenure of PTCs is

matched with life of securitized assets. Investors

have no charge against underlying assets.

2. Pay through certificates: SPV issues secured

debt instruments of different maturity in

response to investors’ demand. Offered at a

discount to face value. Like deep discount

bonds.

3. Preferred stock certificates: issued by subsidiary

company against trade debts/ consumer receivables of

parent company. Subsidiary company issues S.T.

securities against them with guarantee from merchant

banker.

4.Stripped structures: structured as ‘interest only’ or

principal only securities. Borrowers make early payment

if market interest falls. Investors in ‘principle only’ gain

by getting early payment, but ‘interest only’ investors

lose interest.

5. Asset based commercial paper: SPV purchases portfolio

of mortgages from lending institutions, combine into

single group on the basis of interest rate, maturity and

underlying collateral. Then transfers them to trust which,

in turn, issues mortgaged backed papers (CPs) of S.T.

duration. Investors participate in cash flows from

underlying mortgages to the extent of investment in

certificates.

Benefits of Securitization

1. Additional source of fund/liquidity for originator.

2. Greater profitability due to high liquidity and fees when

originator acts as receiving and paying agent.

3.Enhancement in capital adequacy ratio by removal of

assets from balance sheet.

4.Spreading of credit risk by sharing responsibility with

several parties.

5. Lower cost of funding due to higher credit

rating of asset backed securities than the rating

of company as a whole.

6. Provision of Multiple instruments for

investors.

7. Safer investment and higher return to

investors.

8. Capital formation by preventing idle capital.

Causes of Unpopularity in

India

1. New concept, benefits not much known

2. Heavy stamp duty and registration fees on

assignment of illiquid& non performing assets

to SPVs.

3. Cumbersome transfer procedure to SPVs.

Difficulty in assignment of debt to third party.

Transfer of Property Act needs amendment.

4. Lack of standardised loan document creates

pooling difficult for SPVs.

5. Inadequate credit rating facilities.

6. Absence of proper accounting procedure for

securitized assets.

7. Absence of proper guidelines for securitization.

HIRE PURCHASE

Hire purchase means a transaction where

goods are purchased and sold on the terms

that:

(1) payment will be made in installments,

(2) the possession of the goods is given to the buyer

immediately,

(3) the property in the goods remains with the vendor

till the last installment is paid,

(4) the seller can repossess the goods in case of default

in payment of any installment, and

(5) each installment is treated as hire charges till the

last installment is paid.

Characteristics of Hire Purchase

Agreement

1. Payment is made by hirer (buyer) to the hiree, usually vendor, in

installments over a specified period of time.

2. The possession of the goods is transferred to buyer immediately.

3. The property in goods remains with vendor (hiree) till last

installment is paid. The ownership passes to buyer (hirer) when he

pays all installments.

4. Hiree or vendor can repossess the goods in case of default and treat

the amount received by way of installments as hire charged for that

period.

5. The installments in hire purchase include interest as well as

repayments of principal.

6. Usually, hiree charges interest on flat rate.

Legal Position of Hire

Purchase

A. Possession of goods is delivered by owner

there of to a person on a condition that such

person pays the agreed amount in periodic

payments, and

B. The property in the goods is to pass to such

person on the payment of the last of such

installments, and

C. Such person has a right to terminate the

agreement at any time before the property

so passes.

ANY QUERY???

THANKS!!!

You might also like

- SecuritizationDocument22 pagesSecuritizationNishant_g90% (1)

- Securitisation Process and Key PartiesDocument32 pagesSecuritisation Process and Key PartiesAmit SinghNo ratings yet

- Unit 3 BFSDocument69 pagesUnit 3 BFSCHANDAN CHANDUNo ratings yet

- Financial Services - Unit 1Document72 pagesFinancial Services - Unit 1Darshini Thummar-ppmNo ratings yet

- The Concept of SecuritisationDocument36 pagesThe Concept of Securitisationsunny singhania99No ratings yet

- BNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityDocument36 pagesBNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityaliaNo ratings yet

- Debentures and ChargesDocument2 pagesDebentures and ChargesAnshuman ChakrabortyNo ratings yet

- Mfs Unit 2 FinalDocument12 pagesMfs Unit 2 FinalRama SardesaiNo ratings yet

- Convertible Debentures: Convert Debt Into EquityDocument4 pagesConvertible Debentures: Convert Debt Into EquityPrateek MishraNo ratings yet

- Lapse and Irregularities in Selection PDFDocument15 pagesLapse and Irregularities in Selection PDFtareqNo ratings yet

- Kodigs 1Document6 pagesKodigs 1froelanangusatiNo ratings yet

- 13.specialised Financial ServicesDocument31 pages13.specialised Financial ServicesffbugbuggerNo ratings yet

- Securities Regulation CodeDocument118 pagesSecurities Regulation CodedasdsadsadasdasdNo ratings yet

- Banking Products & Services IIDocument39 pagesBanking Products & Services IIAinnur HaziqahNo ratings yet

- Modes of Charging SecuritiesDocument11 pagesModes of Charging SecuritiesKopal Agarwal50% (4)

- Understanding Credit InstrumentsDocument43 pagesUnderstanding Credit InstrumentskatlicNo ratings yet

- SecuritisationDocument45 pagesSecuritisationSaravanan SnrNo ratings yet

- Ijara-Based Financing: Definition of Ijara (Leasing)Document13 pagesIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuNo ratings yet

- International Trade Financing OptionsDocument22 pagesInternational Trade Financing Optionssyahiir syauqiiNo ratings yet

- SecuritizationDocument31 pagesSecuritizationSaravanan SnrNo ratings yet

- Negotiation and EndorsementDocument23 pagesNegotiation and EndorsementpatriciaNo ratings yet

- Securitization of assets: An SEO-optimized titleDocument24 pagesSecuritization of assets: An SEO-optimized titlekhush preet100% (1)

- SecuritizationDocument34 pagesSecuritizationshubh duggalNo ratings yet

- Business Finance Project - DebenturesDocument16 pagesBusiness Finance Project - DebenturesMuhammad TalhaNo ratings yet

- MerchantileLawReviewer - 2014Document158 pagesMerchantileLawReviewer - 2014Juris Arrest100% (1)

- 19 DebenturesDocument2 pages19 DebenturesTEXTILIONSNo ratings yet

- YOM Part 2 3editedDocument77 pagesYOM Part 2 3editedFeker H. MariamNo ratings yet

- Securitisation of Financial AssetsDocument27 pagesSecuritisation of Financial Assetsvahid100% (3)

- Islamic Finance TermsDocument7 pagesIslamic Finance TermsShahin RahmanNo ratings yet

- Bond and EquityDocument13 pagesBond and EquityDarkknightNo ratings yet

- Do's and Don't While Creating Different Types ofDocument28 pagesDo's and Don't While Creating Different Types ofAnit BiswasNo ratings yet

- MBFS 2 Mark QPDocument14 pagesMBFS 2 Mark QPHarihara PuthiranNo ratings yet

- Learning Material 5Document15 pagesLearning Material 5jdNo ratings yet

- Islamic BankingDocument3 pagesIslamic BankingsallyNo ratings yet

- Short Term and Working Capital Financing OptionsDocument44 pagesShort Term and Working Capital Financing OptionsSarahNo ratings yet

- Relationship Between Banker and CustomerDocument10 pagesRelationship Between Banker and Customerswagat098No ratings yet

- Repurchase Agreements: Ritesh Garg (64) Sunil Kumar MauryaDocument24 pagesRepurchase Agreements: Ritesh Garg (64) Sunil Kumar MauryaArjun KalraNo ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument24 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬No ratings yet

- Securitisation of Debt AssetsDocument24 pagesSecuritisation of Debt AssetsANITTA M. AntonyNo ratings yet

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarNo ratings yet

- LC TerminologiesDocument4 pagesLC Terminologiesapi-3802032100% (5)

- SecuritizationDocument4 pagesSecuritizationshweta jaiswalNo ratings yet

- Track Change FileDocument5 pagesTrack Change Filejajaja hfieieNo ratings yet

- DEBENTURESDocument9 pagesDEBENTURESKajal RaiNo ratings yet

- Basic Concepts of Islamic FinanceDocument5 pagesBasic Concepts of Islamic FinanceSaifullahMakenNo ratings yet

- Securities Regulation Code ReviewerDocument12 pagesSecurities Regulation Code ReviewerJose LacasNo ratings yet

- SYBBA Unit 4.PptxDocument40 pagesSYBBA Unit 4.Pptxidea8433No ratings yet

- Processing and Operation of Cash Credit1 FinalDocument42 pagesProcessing and Operation of Cash Credit1 Finalrajin_rammsteinNo ratings yet

- Securities For AdvancesDocument3 pagesSecurities For AdvancesWaqas TariqNo ratings yet

- Financial InstrumentDocument4 pagesFinancial InstrumentFrances Bea WaguisNo ratings yet

- Securitization and Foreclosure by Robert RamersDocument8 pagesSecuritization and Foreclosure by Robert RamersBob Ramers100% (2)

- Sources of Intermediate and Long-Term Financing: Debt and EquityDocument4 pagesSources of Intermediate and Long-Term Financing: Debt and EquityborgszxcNo ratings yet

- Fund Based Financial ServicesDocument45 pagesFund Based Financial Servicesamitsingla19No ratings yet

- Circular No. 424 - Modified Guidelines On Extrajudicial Foreclosure of Real and Estate MortgageDocument10 pagesCircular No. 424 - Modified Guidelines On Extrajudicial Foreclosure of Real and Estate MortgageZia Mae Davis LaureNo ratings yet

- Introduction To CreditDocument34 pagesIntroduction To CreditElle RaineNo ratings yet

- Everything You Need to Know About SecuritisationDocument26 pagesEverything You Need to Know About SecuritisationPuneet GargNo ratings yet

- UntitledDocument23 pagesUntitledMANSI JOSHINo ratings yet

- Customer Credit Agreement Yellow Finance LTD v2023 - 09 - 28Document4 pagesCustomer Credit Agreement Yellow Finance LTD v2023 - 09 - 28victoriaNo ratings yet

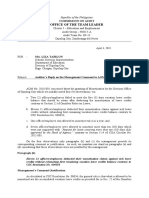

- Office of The Team Leader: Commission On AuditDocument4 pagesOffice of The Team Leader: Commission On Auditrussel1435100% (1)

- Generic - Introduction To Financial Management (20 Credits)Document178 pagesGeneric - Introduction To Financial Management (20 Credits)thabosimonnkosi.940No ratings yet

- Topic 5: International Lending and Portfolio ManagementDocument29 pagesTopic 5: International Lending and Portfolio ManagementSanthiya MogenNo ratings yet

- Financial Literacy PowerPoint Presentations PPT PowerPoint Presentation SampleDocument13 pagesFinancial Literacy PowerPoint Presentations PPT PowerPoint Presentation SampleDeanne Lorraine V. GuintoNo ratings yet

- Math-1050-Credit-Card-Debt 1Document3 pagesMath-1050-Credit-Card-Debt 1api-323413222No ratings yet

- PL BPB J18 WebDocument9 pagesPL BPB J18 WebIssa BoyNo ratings yet

- US Credit Cards - McKinsey & CompanyDocument9 pagesUS Credit Cards - McKinsey & Companystevtan01No ratings yet

- Section 609 of The Fair Credit Reporting Act LoopholeDocument7 pagesSection 609 of The Fair Credit Reporting Act LoopholeFreedomofMind97% (39)

- The Belgian Macroprudential Policy Framework in The Banking SectorDocument20 pagesThe Belgian Macroprudential Policy Framework in The Banking SectorVictoria PostolacheNo ratings yet

- Tyco Form10K 2002 3Document10 pagesTyco Form10K 2002 3TranNo ratings yet

- How To Kick Your Debt To The Curb: Get Our of DebtDocument4 pagesHow To Kick Your Debt To The Curb: Get Our of DebtAnu PrakashNo ratings yet

- Coop Society GuideDocument5 pagesCoop Society GuideKavita SinghNo ratings yet

- Q 4 PolicyDocument5 pagesQ 4 PolicyGK ARUNACHALAMNo ratings yet

- Business Finance ConceptDocument55 pagesBusiness Finance ConceptBir MallaNo ratings yet

- The Impact of Credit Policy On Improving Vietnamese Household Living Standards in The Time of Covid 19 Pandemic - 20230228 - 020555Document49 pagesThe Impact of Credit Policy On Improving Vietnamese Household Living Standards in The Time of Covid 19 Pandemic - 20230228 - 020555Phương ThảoNo ratings yet

- Loan Int RatesDocument4 pagesLoan Int RatesSteve WozniakNo ratings yet

- Intermediate Accounting 1 - Loans Receivable ProblemsDocument1 pageIntermediate Accounting 1 - Loans Receivable ProblemsJanidelle Swiftie67% (3)

- (ENG Ver) POJK 35.POJK.05.2018 Tentang Penyelenggaraan Usaha Perusahaan Pembiayaan PDFDocument75 pages(ENG Ver) POJK 35.POJK.05.2018 Tentang Penyelenggaraan Usaha Perusahaan Pembiayaan PDFIndira S. Setyobudi25% (4)

- SaundersChap016 FinalDocument24 pagesSaundersChap016 FinalPrincess AdaleaNo ratings yet

- Radian Default Claims Servicing GuideDocument42 pagesRadian Default Claims Servicing GuidelostvikingNo ratings yet

- Social, Economical and Financial Consequences of Financial ExclusionDocument12 pagesSocial, Economical and Financial Consequences of Financial ExclusionTinasheNo ratings yet

- Credit Bureau Knowledge GuideDocument82 pagesCredit Bureau Knowledge GuideIFC Access to Finance and Financial Markets100% (1)

- Federal Bank Process ImprovementDocument13 pagesFederal Bank Process ImprovementSujayRawatNo ratings yet

- CTOS Credit Sample Score PDFDocument29 pagesCTOS Credit Sample Score PDFsubrascNo ratings yet

- Court upholds liability for lost bulls loaned by govtDocument42 pagesCourt upholds liability for lost bulls loaned by govtAnonymous bMJQuUO8nNo ratings yet

- Vice Ch11petition DeclarationDocument92 pagesVice Ch11petition DeclarationTHRNo ratings yet

- IFDocument12 pagesIFVikas ShegalNo ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- Credit Risk Management For EXIM Bank FinalDocument69 pagesCredit Risk Management For EXIM Bank Finalkhansha ComputersNo ratings yet

- Training Manual on SAC ManagementDocument19 pagesTraining Manual on SAC ManagementLambadyna100% (1)