Professional Documents

Culture Documents

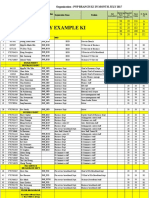

Cash Flow Analysis

Uploaded by

tejoseph20030 ratings0% found this document useful (0 votes)

47 views28 pagesOut of 351 projects each costing over Rs. Crores 56 % had cost overruns (totalling 20% costs) 49 % faced a time overrun from 1 to 157 months. Cash flow management means meeting all three goals (scope, time, and cost) and satisIying the proiects sponsor.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOut of 351 projects each costing over Rs. Crores 56 % had cost overruns (totalling 20% costs) 49 % faced a time overrun from 1 to 157 months. Cash flow management means meeting all three goals (scope, time, and cost) and satisIying the proiects sponsor.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views28 pagesCash Flow Analysis

Uploaded by

tejoseph2003Out of 351 projects each costing over Rs. Crores 56 % had cost overruns (totalling 20% costs) 49 % faced a time overrun from 1 to 157 months. Cash flow management means meeting all three goals (scope, time, and cost) and satisIying the proiects sponsor.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 28

Introduction to

Cash Flow Analysis and

Management oI Billing

by

T.E.Joseph

#eal Estate Does Provide Many

Opportunities Including

Adding Value Through:

#eal estate acquisition

Development

Financing

Site Analysis

Controlling Operating Costs

Innovative Marketing

Innovative Management

No Secret Way To Attain

Success

Only hard work with good

research and systematic

analysis

Main Causes of Project Failure

Data shows that hardly few projects get

completed within specified costs and within

original time duration.

Out of the 351 projects each costing over Rs.20

crores

56 % had cost overruns (totalling 20% costs)

49 % faced a time overrun from 1 to 157

months.

Normally,the factors contributing to these

overruns are :

1. nadequate project formulation This

included poor field investigation, inadequate

project information, bad cost estimates etc.

2. Poor Resources Planning Both Men, Material

and Equipment, inter-linking never anticipated.

3. Lack of Proper contract planning and

management such as improper contract

conditions, poor post award contracts

management.

4. Lack of Proper Resources Management during

Execution thus leading to non-fulfillment of

objectives.

5. This itself highlights the role of a Quantity

Surveyor who is an integral part of the system

and if he does not do his job properly, the project

is bound to suffer.

The Triple Constraint oI Cash Flow

Management

SuccessIul Cash

Flow management

means meeting all

three goals (scope,

time, and cost) and

satisIying the

proiect`s sponsor!

Cash Flow Analysis

Cash fIow management is the process of monitoring,

analyzing, and adjusting your projects' cash flows.

For small projects, the most important aspect of cash flow

management is avoiding extended cash shortages, caused by

having too great a gap between cash inflows and outflows. You

won't be able to stay in business if you can't pay your bills for

any extended length of time!

Therefore, you need to perform a cash flow analysis on a

regular basis, and use cash flow forecasting so you can take the

steps necessary to head off cash flow problems. Many software

accounting programs have built-in reporting features that make

cash flow analysis easy. This is the first step of cash flow

management.

The second step of cash flow management is to develop and

use strategies that will maintain an adequate cash flow for your

project.

Factors eIIecting cost (post

contract)/cash Ilow

Delays (In terms oI time)

Escallation

#ework/ Quality

#esource Utilization

Idling

Wastages

Material Management

#unning

Elements contributing to the cost

(cash Ilow) oI the Proiect

Direct Costs

Costs associated with actual execution

Costs oI #esources like material, labour, machinery etc.

Wastage, escallation,

#ework and #ectiIication

Cost oI Subcontracting

Indirect Costs

Costs oI oIIice and its staII

Computers and communication

Watch and ward

Transportation

Insurance

Other miscellaneous expenses

Bank Finances ???????

Three Views of Cost

N0ll0fl0 8 00lf0lll0 0880 N0ll0fl0 8 00lf0lll0 0880

fl0N 0f00088 l8 08808 0 . fl0N 0f00088 l8 08808 0 .

l98l08ll0 Ff00f088 l98l08ll0 Ff00f088

000f00 0l l0lllllM0l 0l l00 00l00ll908 000f00 0l l0lllllM0l 0l l00 00l00ll908

8l9Il0 l00 8l8l08 0l l00 0f0l00l 8l9Il0 l00 8l8l08 0l l00 0f0l00l

80M08l8l M0880f08lf0 80M08l8l M0880f08lf0 0l8 0l8

Earned Value Management

The earned value cost management report is a

valuable management tool Ior cot control

managers.

Earned value, or the budgeted cost oI work

perIormed, is a key perIormance metric on the

report. It is the basis Ior determining cost and

schedule variances, and is oIten used as part oI a

Iormula to help estimate the Iinal cost oI the

contract, termed the estimate at completion

(EAC). The proiect manager oIten perceived the it

as a Iinancial rather than a management report,

and did not use it as eIIectively as possible.

Earned Value Management

Overall responsibility Ior earned value management was

moved Irom Iinance to proiect management in 1989. In

particular, three ways to evaluate the reasonableness oI the

.ontra.tors EAC are described. Two oI these involve

comparing the proiect`s cumulative cost perIormance with

its predicted Iuture perIormance. The other technique

involves comparing a range oI estimates Iound to be

accurate on a large number oI completed proiects with the

predicted Iinal cost oI the ongoing proiect.

In recent years, earned value management

systems and the resulting data Irom those

systems have been used to manage

commercial proiects in the India and abroad

including United States.

THE TE#MINOLOGY OF EA#NED

VALUE MANAGEMENT #EPO#TS

Terminology used in earned value management reports can be

conIusing. The acronyms alone number in the dozens.

#egardless oI the kind oI proiect (deIense, space,

construction, etc.), however, only three basic data elements

listed on the earned value management report are central to

proper planning, measurement, and analysis: budgeted cost

Ior work scheduled (BCWS), budgeted cost Ior work

perIormed (BCWP), and actual cost oI work perIormed

(ACWP).

The BCWS is the budget Ior work scheduled to be completed. It

can be either monthly or cumulative. As a monthly amount, it

represents the amount oI work scheduled to be completed Ior

that month. As a cumulative amount, it represents the amount

oI work scheduled to be completed to date. BCWS is also

known as 'planned value.

The BCWP is the budget Ior the completed work. It also

can be either monthly or cumulative. Monthly BCWP

represents the amount oI work completed during a month;

cumulative BCWP represents the amount oI work

completed to date. BCWP is also known as 'earned value.

The ACWP is the actual cost incurred in accomplishing the

work within a given period. Like the budgets, both direct

and indirect costs are included. To permit meaningIul

comparisons, the ACWP should be recorded in the same

time period as BCWP Ior a given piece oI work.

Cost and Schedule Variance

ost and S.hedule varian.e are the two primarv

measures of the Proie.t Progress. Thev .an be

determined bv.

ost Jarian.e (J)

J BP AP

S.hedule Jarian.e (SJ)

SJ BP-BS

W f J/SJ 0, then proie.t is right on tra.

W f J/SJ , then the proie.t is under budget and

ahead of time

W f J/SJ -, then the proie.t is over budget and

behind s.hedule

The variance at completion (VAC) is the diIIerence

between the total budget oI the proiect, termed the

budget at completion (BAC), and the estimated total

cost oI the proiect, termed the estimate at completion

(EAC).

When these variances are signiIicant they are

immediately investigated by managers who are

empowered to take appropriate corrective action. The

cost management report summarizes the monthly cost

and schedule status oI the proiect by listing the three

data elements, the related variances, the BAC, and the

revised EAC Ior all oI the maior pieces oI work on

the proiect.

The proiect`s PMB includes indirect cost as well as

direct cost. In addition, ACWP includes indirect

costs, and contractors must investigate all signiIicant

cost variances, including indirect cost variances.

Contractors periodically develop 'comprehensive

EACs by estimating and aggregating the costs oI

incomplete work and planning packages remaining on

the contract. In addition, the c o n t r a c t o r `s EAC

is examined monthly Ior accuracy and revised as

necessary to ensure that resource requirements are

realistic and properly phased.

The second comparison uses two perIormance

indices: the cost perIormance index (CPI)

and the to-complete perIormance index

(TCPI). The CPI measures the budgeted

cost oI completed work against the actual

cost.

II the CPI is less than one, an unIavorable cost

variance is indicated.

Cost and Schedule PerIormance

Indices

Two Indices that are useIul Ior communicating progress status are the

Cost PerIormance Index and the Schedule PerIormance Index. They

are determined by :

Cost PerIormance Index: The cost eIIiciency Iactor representing the

relationship between the actual costs expended and the value oI the

physical work perIormed.

CPI BCWP/ACWP

Schedule PerIormance Index: The planned schedule eIIiciency Iactor

representing the relationship between the value oI the initial planned

schedule and the value oI the physical work perIormed.

SPI BCWP/BCWS

II CPI and SPI 1, then the proiect is on budget and on schedule

1, then the proiect is over budget and behind schedule

~ 1, then the proiect is under budget and ahead oI

schedule.

80800f00 ll008ll0 80800f00 ll008ll0

l0f 00ll0f 0880 fl0N l0f 00ll0f 0880 fl0N

N8800M0l N8800M0l

l80lll9l0 l00 l9008 0l f0800f008 l80lll9l0 l00 l9008 0l f0800f008

008lll9 0l f0800f008 008lll9 0l f0800f008

00f8ll0 0l 0ll9ll9 00f8ll0 0l 0ll9ll9

00lf0lll0 00lf0lll0

l98l08ll0 Ff00f088 l98l08ll0 Ff00f088

000f00 0l l0lllllM0l 0l l00 000f00 0l l0lllllM0l 0l l00

00l00ll908 00l00ll908

8l9Il0 l00 8l8l08 0l l00 8l9Il0 l00 8l8l08 0l l00

0f0l00l 0f0l00l

80M08l8l M0880f08lf0 80M08l8l M0880f08lf0 0l8 0l8

Management oI Billing

Billing Periods

Practices Iollowed Lumpsum, Labour

Procedures Adopted

Contractors Categorised

Payment Period/ Mode oI Payment

#etention Money in Bills

Claims

#econciliation /Periodic

W Like the song in the sound of music says :

limb everv mountain.

ross everv stream.

Stop vou not.

Till vou a.hieve vour dream

Have this attitude towards managing your

cash flows and and you will see you have

successfully executed a project.

A little thought.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Brahms Symphony No 4Document2 pagesBrahms Symphony No 4KlausNo ratings yet

- EX200Document7 pagesEX200shubbyNo ratings yet

- Enrico Fermi Pioneer of The at Ted GottfriedDocument156 pagesEnrico Fermi Pioneer of The at Ted GottfriedRobert Pérez MartinezNo ratings yet

- BSH 7005-15Document129 pagesBSH 7005-15Mark InnesNo ratings yet

- DR S GurusamyDocument15 pagesDR S Gurusamybhanu.chanduNo ratings yet

- LLM Letter Short LogoDocument1 pageLLM Letter Short LogoKidMonkey2299No ratings yet

- Construction Safety MangementDocument11 pagesConstruction Safety Mangementtejoseph2003No ratings yet

- Current Trends and Issues in Nursing ManagementDocument8 pagesCurrent Trends and Issues in Nursing ManagementMadhu Bala81% (21)

- Toshiba MotorsDocument16 pagesToshiba MotorsSergio Cabrera100% (1)

- EP001 LifeCoachSchoolTranscriptDocument13 pagesEP001 LifeCoachSchoolTranscriptVan GuedesNo ratings yet

- Resource LevellingDocument11 pagesResource Levellingtejoseph2003No ratings yet

- Rate Analisys DataDocument1 pageRate Analisys Datatejoseph2003No ratings yet

- Cost PlanDocument12 pagesCost Plantejoseph2003No ratings yet

- On Animal Language in The Medieval Classification of Signs PDFDocument24 pagesOn Animal Language in The Medieval Classification of Signs PDFDearNoodlesNo ratings yet

- PNP Ki in July-2017 AdminDocument21 pagesPNP Ki in July-2017 AdminSina NeouNo ratings yet

- Bubble Test Direct Pressure InserviceDocument3 pagesBubble Test Direct Pressure InserviceEdAlmNo ratings yet

- SDN Van NotesDocument26 pagesSDN Van Notesmjsmith11No ratings yet

- Cpar Characteristics and Functions Week 3Document128 pagesCpar Characteristics and Functions Week 3christianwood0117No ratings yet

- Caradol sc48 08Document2 pagesCaradol sc48 08GİZEM DEMİRNo ratings yet

- Lancru hzj105 DieselDocument2 pagesLancru hzj105 DieselMuhammad MasdukiNo ratings yet

- IQAc 04-05Document10 pagesIQAc 04-05ymcacollegewebsiteNo ratings yet

- Principles of Supply Chain Management A Balanced Approach 4th Edition Wisner Solutions ManualDocument36 pagesPrinciples of Supply Chain Management A Balanced Approach 4th Edition Wisner Solutions Manualoutlying.pedantry.85yc100% (28)

- Nescom Test For AM (Electrical) ImpDocument5 pagesNescom Test For AM (Electrical) Impشاہد یونسNo ratings yet

- Liquitex Soft Body BookletDocument12 pagesLiquitex Soft Body Booklethello belloNo ratings yet

- CRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEADocument21 pagesCRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEAcristian colceriu100% (2)

- Spring 2010 - CS604 - 1 - SolutionDocument2 pagesSpring 2010 - CS604 - 1 - SolutionPower GirlsNo ratings yet

- Possessive Determiners: A. 1. A) B) C) 2. A) B) C) 3. A) B) C) 4. A) B) C) 5. A) B) C) 6. A) B) C) 7. A) B) C)Document1 pagePossessive Determiners: A. 1. A) B) C) 2. A) B) C) 3. A) B) C) 4. A) B) C) 5. A) B) C) 6. A) B) C) 7. A) B) C)Manuela Marques100% (1)

- GLOBE2Document7 pagesGLOBE2mba departmentNo ratings yet

- Presenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoDocument23 pagesPresenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoHorace EstrellaNo ratings yet

- Advocacy Firm Business Plan by SlidesgoDocument40 pagesAdvocacy Firm Business Plan by SlidesgoirinaNo ratings yet

- 1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Document2 pages1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Mario FloresNo ratings yet

- Cultural Sensitivity BPIDocument25 pagesCultural Sensitivity BPIEmmel Solaiman AkmadNo ratings yet

- Omnitron CatalogDocument180 pagesOmnitron Catalogjamal AlawsuNo ratings yet

- ইসলাম ও আধুনিকতা – মুফতি মুহম্মদ তকী উসমানীDocument118 pagesইসলাম ও আধুনিকতা – মুফতি মুহম্মদ তকী উসমানীMd SallauddinNo ratings yet