Professional Documents

Culture Documents

PPT

Uploaded by

Ishika PathakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPT

Uploaded by

Ishika PathakCopyright:

Available Formats

By surbhi Pathak MBA (G)

To

study the currency market in detail and factor affecting currency market in India. To study various hedging strategies. To analyse and study the performance of various currencies in currency market. To suggest the investors of religare on their investment in the currency market and also to suggest the investors about the future prospects.

Religare is India's leading retail financial services company with over 250 share shops across 115 cities in India. They have over 750 Client Relationship Managers that are dedicated to serving clients unique needs. They have class Infrastructure that provides clients with real-time service & 24/7 access to all information and products. Services provided by the RELIGARE:- 1. Equities & Derivatives :--Comprehensive services for independent investors, active traders & Non-Resident Indians. 2. Religare equity analysis :--Premium research on 401+ companies updated daily. 3. Depository Services :--Value added services for seamless delivery.

Derivatives are financial contracts whose value/price is independent on the behaviour of the price of one or more basic underlying assets. These contracts are legally binding agreements, made on the trading screen of stock exchanges, to buy or sell an asset in future. These assets can be a share, index, interest rate, bond, rupee dollar exchange rate, sugar, crude oil, soybeans, cotton, coffee and what you have.

DERIVATIVES

Financials

Basics 1. Forwards 2. Futures Complex

Commodities

1. Swaps

2.Exotics

3. Options 4. Warrants and Convertibles

Future: A currency future contract is a standardized contract between two parties to buy or sell a particular currency at a specified future date on a price agreed today. Forward: A currency forward contract is almost similar to future contract but it is the customized contract between two parties where contract matures on a specified date on a price agreed today. Option: It is a contract between two parties for future transactions on a financial instrument at a specified price. There are two types of options: call option and put option.

Swaps: swaps are the portfolio of forward contract between two parties to exchange cash flows in the future according to a pre arranged formula. There are 2 types of swaps: Interest rate swaps Currency swaps

The various strategies in Currency futures are Hedging Speculation Arbitrage Trading in Spreads 1. Hedging: Hedging means taking a position in the future market that is opposite to a position in the physical market with a view to reduce or limit risk associated with unpredictable changes in exchange rate.

Arbitrage means locking in a profit by simultaneously entering into transactions in two or more markets. If the relation between forward prices (OTC market) and futures prices (exchange market) differs, it gives rise to arbitrage opportunities. Difference in the equilibrium prices determined by the demand and supply at two different markets also gives opportunities to arbitrage. Speculators means Based on the forecast, a speculator would like to make gains by taking long /short positions in derivatives. Speculators, or traders, assume the price risk that hedgers attempt to lay off in the markets

The

Euro The Japanese Yen The British Pound US Dollar

RESEARCH DESIGN The project uses both exploratory and descriptive research. An intensive primary research is conducted to gain insights in the currency market. SAMPLING UNIT Every person who is the active client of Religare Securities is the sampling unit. The survey has been conducted on sample size of 40. In nature of data, it was both primary and secondary.

Most of the people are aware about the currency market. Most of the people invest in the currency market. Risk is the most considerable factor by the respondent while trading in currency derivative compare to the price, return, volatility and status of the countries.

Lack of fund is the main cause which hold respondent back to invest in cash market and trade in currency derivative market.

Out of total respondents most of them think that the advantages of currency market over Commodity and Equity Market is Low investment cost, Lesser Volatility, Lesser risk and Comparatively low manipulation.

The investors are not fully aware about the currency market as this is the upcoming market so the company needs to make such awareness campaign to provide the awareness amongst the investors. As far as the investors are concern they only prefer investing in the US Dollar because they only know about US Dollar so the company needs to educate them about the other currencies also i.e Pound Sterling, Euro, Japanese Yen. For some investors Brokerage cost, Brand of the broking firm, Regular tips from the broking firm, Opening Demat account charges, Allocated account/relationship manager is important so the company needs to make plans and policies accordingly.

Their is a sense of unpopularity amongst the investors regarding the currency market reasons being Lack of knowledge, complexity, time delays and unlimited risks. The currency market has a bright future in the near upcoming market trends due to its easy to understand the market, Commission-free Trading and Low Transaction Cost, low investment cost, lesser risk and the most importantly Comparatively Low manipulations.

Level of accuracy of the results of research is restricted to the accuracy level with which the customers have given their answers and the accuracy level of the answers cannot be predicted. The currency future is new concept so only few topic related book are available in library and market. Observations and Interactions were also the limiting factors in the proper conclusion of the study. Since segment wise investors is not available in RCL this means consumers are not only investing in commodities they also investing in equity ,insurance, mutual funds, wealth management & investment Banking . Hence overall concept is taken for the study.

Information is partly based on secondary data and hence the authenticity of the study can be visualized and is measurable.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Structure and Composition of Foreign Exchange Management SystemDocument28 pagesStructure and Composition of Foreign Exchange Management SystemParthadeep SharmaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Mba Finance Syllabus Nagpur UniversityDocument6 pagesMba Finance Syllabus Nagpur UniversityAniketsingh KatreNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Numismatic News March 01 2022Document98 pagesNumismatic News March 01 2022Rick WilsonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- FTMO-Trader Contract SampleDocument4 pagesFTMO-Trader Contract SampleMatvii NockamNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fund5e Chap05 PbmsDocument44 pagesFund5e Chap05 PbmsLêViệtPhươngNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Learnforexdouble Trouble Dual Candlestick PatternsDocument7 pagesLearnforexdouble Trouble Dual Candlestick Patternslewgraves33No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Enhanced 05Document48 pagesEnhanced 05Abu SufyanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Treasury and Fund Management in Bank123Document29 pagesTreasury and Fund Management in Bank123Ravi SuchakNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Organisational Study of Hedge Equities LtdDocument56 pagesOrganisational Study of Hedge Equities LtdAju K Raju67% (6)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Banking and Financial InstitutionDocument2 pagesBanking and Financial InstitutionMaricar TabadaNo ratings yet

- Documentary Credit MessageDocument4 pagesDocumentary Credit MessageEdy CahyonoNo ratings yet

- Research Bulletin Volume 5 - FINAL MinDocument121 pagesResearch Bulletin Volume 5 - FINAL MinMbongeni ShongweNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Exchange Summary Volume and Open Interest Energy Futures: PreliminaryDocument9 pagesExchange Summary Volume and Open Interest Energy Futures: PreliminaryavadcsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Learnforexmargin Vs LeverageDocument9 pagesLearnforexmargin Vs Leveragelewgraves33No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- An Overview of Bangladesh Banking Industry and Financial Performance Evaluation of Mercantile Bank LimitedDocument51 pagesAn Overview of Bangladesh Banking Industry and Financial Performance Evaluation of Mercantile Bank LimitedSADAF BIN HOSSAINNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- EBCL Analysis Sheet June'23Document25 pagesEBCL Analysis Sheet June'23ParitoshNo ratings yet

- Group7 MacroeconomicsDocument21 pagesGroup7 MacroeconomicsAashay JainNo ratings yet

- India's Growing Edible Oil Imports and Business OpportunitiesDocument19 pagesIndia's Growing Edible Oil Imports and Business Opportunitiessreeramchellappa100% (1)

- 31-The Forex GambitDocument6 pages31-The Forex Gambitlowtarhk100% (1)

- Technopreneurship CEE 504: Coin CounterDocument11 pagesTechnopreneurship CEE 504: Coin CounterRomark Pasia TorejaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Syllabus 6th Sem TYBMSDocument9 pagesSyllabus 6th Sem TYBMSVinay RaghavendranNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystsDocument82 pagesThe Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystskessbrokerNo ratings yet

- Merged Sample QuestionsDocument55 pagesMerged Sample QuestionsAlaye OgbeniNo ratings yet

- ForexTradingStrategy PDFDocument39 pagesForexTradingStrategy PDFshyam91% (11)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Scrim Sessions v2Document28 pagesScrim Sessions v2Khandaker Tanvir RahmanNo ratings yet

- What Are The Six Key Differences Between Multinational and Domestic Financial Management?Document5 pagesWhat Are The Six Key Differences Between Multinational and Domestic Financial Management?susanta87No ratings yet

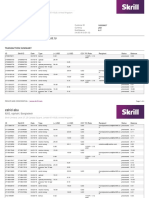

- Transaction Report: Zahid AbuDocument4 pagesTransaction Report: Zahid AbuSãbbìŕ Ràhmâñ0% (1)

- Chapter 6 - International TradeDocument31 pagesChapter 6 - International TradeWilliam DC RiveraNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- TDI Trading Strategies Very GoodDocument20 pagesTDI Trading Strategies Very GoodNitesh Mistry100% (5)

- Treasury Handbook 5-26-2014Document200 pagesTreasury Handbook 5-26-2014Marius Angara100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)