Professional Documents

Culture Documents

Mutual Funds

Uploaded by

rupesh_nair14Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Funds

Uploaded by

rupesh_nair14Copyright:

Available Formats

Mutual Funds : Introduction

A mutual Iund is a Iinancial intermediary that pools the savings oI investors Ior collective

Investment in a diversiIied portIolio oI securities. A Iund is 'mutual as all its returns, minus

its expenses, are shared by the Iund`s investors.

Mutual Iunds pool the Iunds Irom small investors and invest in shares and bonds oI

companies. The income earned through these investments and the capital appreciation

realized are shared by its unit holders in proportion to the number oI units owned by them.

Thus a Mutual Iund is the most suitable investment Ior the common man as its oIIers an

opportunity to invest in a diversiIied , proIessional managed basket oI securities at a

relatively low cost.

The Securities and Exchange Board oI India ( Mutual Funds) Regulations, 1996 deIines

a mutual Iund as a ' a Iund established in the Iorm oI a trust to raise money through the

Sale oI units to the public or a section oI the public under one or more schemes Ior

Investing in securities , including money market instruments.

Mutual Iund is akin to PortIolio management services (PMS).Although , both are

conceptually same , they are diIIerent Irom each other. PMS are oIIered to high net worth

Individuals ; taking into account their risk proIile ,their investments are managed

separately. In the case oI mutual Iunds, savings oI small investors are pooled under

a scheme and the returns are distributed in the same proportion in which the investments

are made.

0n01its o1 Mutual Funds:

By investing in various Mutual Fund Schemes, small investors or middle investors seek

the Iollowing advantages compared to other types oI investment.

1 Pro10ssional Manag020nt: An average investor lacks the knowledge oI capital

market operations and does not have large resources to reap the beneIits oI investment.

. Hence , he requires the help oI an expert. Mutual Iunds are managed by proIessional

managers who have the requisite skills and experience to analyse the perIormance

and prospects oI companies.

They make possible an organised investment strategy , which is hardly possible Ior

an individual investor.

2 ortfo||o d|vers|f|cat|on An lnvesLor underLakes rlsk lf he lnvesLs all hls funds ln a slngle

scrlp MuLual funds lnvesL ln a number of companles across varlous lndusLrles and

secLors 1hls dlverslflcaLlon reduces Lhe rlsklness of Lhe lnvesLmenLs

3 keduct|on |n transact|on costs Compared Lo dlrecL lnvesLlng ln Lhe caplLal markeL

lnvesLlng Lhrough Lhe funds ls relaLlvely less expenslve as Lhe beneflL of economles of

scale ls passed on Lo Lhe lnvesLor

4 L|qu|d|ty ln case of muLual funds Lhey can easlly encash Lhelr lnvesLmenL by selllng

Lhelr unlLs Lo Lhe fund lf lL ls openended scheme or selllng Lhem on a sLock

exchange lf lL ls a closeended scheme

S Conven|ence lnvesLlng ln muLual fund reduces paperwork saves Llme and makes

lnvesLmenL easy

6 I|ex|b|||ty MuLual funds offer a famlly of schemes and lnvesLors have Lhe opLlon of

Lransferrlng Lhelr holdlng s from one scheme or selllng Lhem on a sLock exchange

lf lL a closeended scheme

7 Cho|ce of Schemes

%ax b0n01its: Mutual Iund investors now enjoy income-tax beneIits.Dividends

received Irom mutual Iund`s debt schemes are tax exempt to the overall

limit oI Rs. 10,000 alllowed under section 80L oI the Income Tax Act.

9 %ranspar0ncy: Mutual Iunds transparently declare their portIolio every month.

Thus an investor knows where his/ her money is being deployed and in case

They are not happy with the portIolio they can withdraw at a short notice.

10 Stability to th0 Stock Mark0t: Mutual Iunds have a large amount oI Iunds which

provide them economies oI scale by which they can absorb losses in the stock

market and continue investing in the stock market.

11 Equity r0s0arch: Mutual Iunds can aIIord inIormation and data required Ior

investments as they have large amounts oI Iunds and equity research available

with them.

12 W0ll R0gulat0d.

%yp0s o1 Mutual Funds:

Mutual Iunds could be classiIied in many ways based on structure, objectives oI

Investment, pattern oI investments and returns, etc.

A Functional Classi1ication o1 Mutual Funds: 3 Types

1 Op0n-End0d Funds: Under open-ended scheme, the mutual Iund will

continuously oIIers to sell and repurchase its unit at net asset value(NAV) or we

can say daily purchase and sale price oI the units oI the scheme. II you want to

buy the units today, you can buy the same at the sale price. May be aIter, six months

, iI you decide to sell the units, you can sell at the purchase price announced by

the mutual Iund on that date.

The key Ieature oI open-ended Iunds is liquidity. They increase liquidity oI the

Investors as the units can be continuously bought and sold.

Unlike close-ended schemes, open-ended ones do not have to be listed on the

Stock exchange and can also oIIer repurchase soon aIter allotment.

There is no Iixed redemption period in open-ended schemes, which can be

terminated whenever the need arises at redemption price. Besides, an investors

can enter the Iund again by buying units Irom the Iund at its oIIer price.

Clos0 -0nd0d Sch020s: There is no repurchase Iacility and a Iixed maturity

period ranging between 2 to 10 years. Investors can invest in the scheme when

it is launched. Investors in close-ended schemes can buy units only Irom the

market, , once initial subscriptions are over and thereaIter the units are listed

on the stock exchanges where they can be bought and sold.

The Iund has no interaction with investors till redemption except Ior paying

Dividend/bonus. The close-ended scheme can be converted into an open-ended

one.

3. Int0rval Sch020: Interval scheme combines the Ieatures oI open-ended and

close-ended schemes. They are open Ior sale or redemption during predetermined

intervals at NAV-related prices.

Port1olio Classi1ication or basis o1 inv0st20nt obj0ctiv0:

1 Income Funds: The aim of income funds is to provide safety of investments

and regular income to investors. Such schemes invest predominantly in

income-bearing instruments like bonds, debentures, government securities

and commercial paper. The return as well as the risk are lower in income funds

as compared to growth funds.

7owth Funds: The main objective of growth funds is capital appreciation

over the medium-to-long-term. They invest most of the corpus in equity shares

with significant growth potential and they offer higher return to investors in the

Long-term.There is no guarantee or assurance of returns.

3 BaIanced Funds: The aim of balanced scheme is to provide both capital

Appreciation and regular income. They divide their investment between equity

Shares with significant growth potential and they offer higher return to investors

in the long-term.

oney ma7et mutuaI funds: They specialise in investing in short-term

money market instruments like treasury bills and certificates of deposits.

The objective of such funds is high liquidity with low rate of return.

Othe7s

1 Secto7aI: These funds invest in specific core sectors like energy, tele-commun

-ications , T, construction, transportation and financial services. These new sectors

Offer good investment potential.

%ax saving schemes: Tax-saving schemes are designed on the basis of tax

policy with special tax incentives to investors. These are close-ended schemes

And investments are made for 10 years,although can avail encashment facilities

after 3 years.The latest scheme is the Systematic Withdrawl Plan(SWP) which

enables investors to reduce their tax incidence on dividends from as high as

30 percent to as low as 3 to 4 per cent.

3 Equity-link0d savings sch020 (ELSS) : In order to encourage investors to invest

in equity market, the government has given tax-concessions through special

Schemes. Investment in these schemes entitles the investor to claim on income-

tax rebate , but these schemes carry a lock-in period beIore the end oI which

Iunds cannot be withdrawn.

4 Load 1unds: A load Iund is one that charges a commission Ior entry or exit.

That is , each time you buy or sell units in the Iund, a commission will be payable..

Load range Irom 1 to 2..Load means incur certain expenses such as

Brokerage, marketing expenses and communication expenses.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

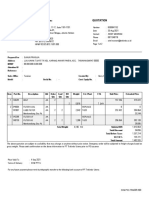

- PT Trakindo Utama: QuotationDocument2 pagesPT Trakindo Utama: QuotationHuda HudaNo ratings yet

- Corporate FinanceDocument310 pagesCorporate Financeaditya.c122No ratings yet

- Abans Finance Pvt. Ltd. October 2020Document19 pagesAbans Finance Pvt. Ltd. October 2020Supreeth SANo ratings yet

- Musharaka by Muhammad Zubair UsmaniDocument48 pagesMusharaka by Muhammad Zubair UsmaniGoharYasinNo ratings yet

- Credit Report: Shannon CoxDocument60 pagesCredit Report: Shannon CoxShanNo ratings yet

- 13 Sources of FinanceDocument26 pages13 Sources of FinanceNikhil GargNo ratings yet

- Application - Loan Overdraft Against DepositDocument5 pagesApplication - Loan Overdraft Against DepositUday Kiran0% (1)

- Now, PLI and RPLI Customers Can Pay Their Premium Online Through Debit/Credit Card, Net Banking, Wallet & UPIDocument1 pageNow, PLI and RPLI Customers Can Pay Their Premium Online Through Debit/Credit Card, Net Banking, Wallet & UPISurya kiranNo ratings yet

- HjjjejdjsjsDocument1 pageHjjjejdjsjsRey CortesNo ratings yet

- 1204-05282 Forest - Dyer V Wheeler Et Al PDFDocument49 pages1204-05282 Forest - Dyer V Wheeler Et Al PDFStatesman Journal100% (1)

- Name: Firda Arfianti NIM: 2301949596 Class: LA53 GSLC 1 Assignment Chapter 4 - Preventing FraudDocument2 pagesName: Firda Arfianti NIM: 2301949596 Class: LA53 GSLC 1 Assignment Chapter 4 - Preventing FraudFirdaNo ratings yet

- Nippon India Gold Savings Fund - Direct Plan - GrowthDocument1 pageNippon India Gold Savings Fund - Direct Plan - GrowthKeval ShahNo ratings yet

- CH 9 Accounting PracticeDocument29 pagesCH 9 Accounting PracticeGernalyn RebanalNo ratings yet

- ACC - ACF1200 Topic 3 SOLUTIONS To Questions For Self-StudyDocument3 pagesACC - ACF1200 Topic 3 SOLUTIONS To Questions For Self-StudyChuangjia MaNo ratings yet

- Profitability Practice ProblemsDocument5 pagesProfitability Practice ProblemsmikeNo ratings yet

- Chapter 11Document45 pagesChapter 11Nada YoussefNo ratings yet

- Stock - Book Debt Statement FormsDocument5 pagesStock - Book Debt Statement Formsjaseer0% (1)

- PE Assignment 15Document4 pagesPE Assignment 15Wei Jiang HoNo ratings yet

- Policy Amendment FormDocument8 pagesPolicy Amendment FormN V Sumanth VallabhaneniNo ratings yet

- GovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Document74 pagesGovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Hazel Morada100% (1)

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- March 2020 Insight Part IDocument88 pagesMarch 2020 Insight Part INifezNo ratings yet

- Letter of CreditDocument4 pagesLetter of CreditMdAlam100% (2)

- Student Activity Packet SC-6.1Document3 pagesStudent Activity Packet SC-6.1Chassidy AberdeenNo ratings yet

- Instruction: Telegraphic TransferDocument4 pagesInstruction: Telegraphic TransferBokulNo ratings yet

- 46 BanksDocument2 pages46 BanksYna Herrera's VlogNo ratings yet

- Practice Questions A1Document11 pagesPractice Questions A1rishalNo ratings yet

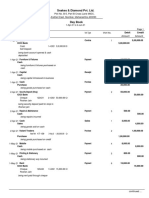

- Day BookDocument3 pagesDay BookPreeti GargNo ratings yet

- Group 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariDocument26 pagesGroup 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariABHISHEK GOYALNo ratings yet

- Capital Structure Decisions NIDocument34 pagesCapital Structure Decisions NIHari chandanaNo ratings yet