Professional Documents

Culture Documents

Capital Budgeting 1

Uploaded by

Tahir AshrafOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting 1

Uploaded by

Tahir AshrafCopyright:

Available Formats

Slide 6-1

26

Capital Budgeting and Managerial Decisions

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-2

Capital Budgeting

Outcome

is uncertain.

Large amounts of

money are usually involved.

Capital budgeting: Analyzing alternative longterm investments and deciding which assets to acquire or sell.

Decision may be

difficult or impossible to reverse.

Investment involves a

long-term commitment.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

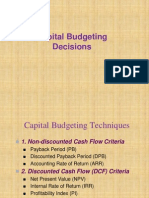

Slide 6-3

Payback Period

Exh. 26-2

The payback period of an investment The payback period of an investment is the time expected to recover is the time expected to recover the initial investment amount. the initial investment amount.

Payback Cost of Investment = period Annual Net Cash Flow

Managers prefer investing in projects with shorter payback periods.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-4

Payback Period Even Cash Flows

FasTrac is considering buying a new machine that will be used in its manufacturing operations. The machine costs $16,000 and is expected to produce annual net cash flows of $4,100. The machine is expected to have an 8-year useful life with no salvage value.

Calculate the payback period.

Payback Cost of Investment = period Annual Net Cash Flow Payback = period $16,000 $4,100 = 3.9 years

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-5

Payback Period Uneven Cash Flows

In the previous example, we assumed that the increase in cash flows would be the same each year. Now, lets look at an example where the cash flows vary each year.

$5,000 $4,100

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-6

Payback Period Uneven Cash Flows

FasTrac wants to install a machine that costs $16,000 and has an 8-year useful life with zero salvage value. Annual net cash flows are:

Year 0 1 2 3 4 5 6 7 8 Annual Net Cash Flows $ (16,000) 3,000 4,000 4,000 4,000 5,000 3,000 2,000 2,000

Exh. 26-3

Cumulative Net Cash Flows $ (16,000) (13,000) (9,000) (5,000) (1,000) 4,000 7,000 9,000 11,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-7

Payback Period Uneven Cash Flows

Year 0 1 2 3 4 4.2 5 6 7 8 Annual Net Cash Flows $ (16,000) 3,000 4,000 4,000 4,000 5,000 3,000 2,000 2,000

Exh. 26-3

We recover the $16,000 purchase price between years 4 and 5, about 4.2 years for the payback period.

Cumulative Net Cash Flows $ (16,000) (13,000) (9,000) (5,000) (1,000) 4,000 7,000 9,000 11,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-8

Using the Payback Period

Ignores the time value of money.

Unacceptable for projects with long lives where time value of money effects are major.

Ignores cash flows after the payback period.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-9

Using the Payback Period

Consider two projects, each with a five-year life and each costing $6,000.

Project One Net Cash Inflows $ 2,000 2,000 2,000 2,000 2,000 Project Two Net Cash Inflows $ 1,000 1,000 1,000 1,000 1,000,000

Year 1 2 3 4 5

Would you invest in Project One just because it has a shorter payback period?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-10

Accounting Rate of Return

The accounting rate of return focuses on annual income instead of cash flows.

Exh. 26-5,6

Accounting Accounting rate of return rate of return

Annual after-tax net income Annual after-tax net income Annual average investment Annual average investment

Beginning book value + Ending book value 2

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-11

Accounting Rate of Return

Reconsider the $16,000 investment being considered by FasTrac. The annual after-tax net income is $2,100. Compute the accounting rate of return.

Exh. 26-5,6

Accounting Accounting rate of return rate of return

Annual after-tax net income Annual after-tax net income Annual average investment Annual average investment

Beginning book value + Ending book value 2

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-12

Accounting Rate of Return

Reconsider the $16,000 investment being considered by FasTrac. The annual after-tax net income is $2,100. Compute the accounting rate of return.

Cash flow Depreciation Income

$ 4,100 2,000 $ 2,100

Exh. 26-5,6

Depreciation = ($16,000 - 0) 8 years

Accounting Accounting rate of return rate of return

Annual after-tax net income Annual after-tax net income Annual average investment Annual average investment

Beginning book value + Ending book value 2

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-13

Accounting Rate of Return

Exh. 26-5,6

Reconsider the $16,000 investment being considered by FasTrac. The annual after-tax net income is $2,100. Compute the accounting rate of return.

Accounting Accounting rate of return rate of return

$2,100 $2,100 $8,000 $8,000

26.25%

$16,000 + $0 2

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-14

Using Accounting Rate of Return

Depreciation may be

calculated several ways.

Income may vary from

year to year.

Time value of

So why would I ever want to use this method anyway?

money is ignored.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-15

Net Present Value

Now lets look at a capital budgeting model that considers the time value of cash flows.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-16

Net Present Value

Discount the future net cash flows from the investment at the required rate of return. Subtract the initial amount invested from sum of the discounted cash flows.

FasTrac is considering the purchase of a conveyor costing $16,000 with an 8-year useful life with zero salvage value that promises annual net cash flows of $4,100. FasTrac requires a 12 percent compounded annual return on its investments.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-17

Net Present Value with Even Cash Flows

Present Present Annual Net Value of $1 Value of Year Cash Flows Factor Cash Flows 1 $ 4,100 0.8929 $ 3,661 2 4,100 0.7972 3,269 3 4,100 0.7118 2,918 4 4,100 0.6355 2,606 5 4,100 0.5674 2,326 6 4,100 0.5066 2,077 7 4,100 0.4523 1,854 8 4,100 0.4039 1,656 Total $ 32,800 $ 20,367 Amount to be invested (16,000) Net present value of investment $ 4,367

Exh. 26-7

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-18

Net Present Value with Even Cash Flows

Present Present value factors Annual Net Value of $1 for 12 percent Year Cash Flows Factor 1 $ 4,100 0.8929 2 4,100 0.7972 3 4,100 0.7118 4 4,100 0.6355 5 4,100 0.5674 6 4,100 0.5066 7 4,100 0.4523 8 4,100 0.4039 Total $ 32,800 Amount to be invested Net present value of investment Present Value of Cash Flows $ 3,661 3,269 2,918 2,606 2,326 2,077 1,854 1,656 $ 20,367 (16,000) $ 4,367

Exh. 26-7

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-19

Net Present Value with Even Cash Flows

Present Present Annual Net Value of $1 Value of Year Cash Flows Factor Cash Flows 1 $ 4,100 0.8929 $ 3,661 2 4,100 0.7972 3,269 3 4,100 0.7118 2,918 4 4,100 0.6355 2,606 5 4,100 0.5674 2,326 6 4,100 0.5066 2,077 A positive net present value indicates that this 7 4,100 0.4523 1,854 8 4,100 0.4039 1,656 project earns more than 12 percent on the investment. Total $ 32,800 $ 20,367 Amount to be invested (16,000) Net present value of investment $ 4,367

Exh. 26-7

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-20

Using Net Present Value

General decision rule . . .

If the Net Present Value is . . . Positive . . . Then the Project is . . . Acceptable, since it promises a return greater than the required rate of return. Acceptable, since it promises a return equal to the required rate of return. Not acceptable, since it promises a return less than the required rate of return.

Zero . . .

Negative . . .

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-21

Net Present Value with Uneven Cash Flows

Present Value of $1 Factor at 10% 0.9091 0.8264 0.7513

Exh. 26-8

Net Cash Flows Year A B C 1 $ 5,000 $ 8,000 $ 1,000 2 5,000 5,000 5,000 3 5,000 2,000 9,000 Total $ 15,000 $ 15,000 $ 15,000 Amount invested Net Present Value

PV of Net Cash Flows A B C $ 4,546 $ 7,273 $ 909 4,132 4,132 4,132 3,757 1,503 6,762 $ 12,435 $ 12,908 $ 11,803 (12,000) (12,000) (12,000) $ 435 $ 908 $ (197)

Although all projects require the same investment and have the same total net cash flows, project B has a higher net present value because of a larger net cash flow in year 1.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-22

Internal Rate of Return (IRR)

The interest rate that makes . . .

Present

value of cash inflows

Present value of cash outflows

The net present value equal zero.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-23

Internal Rate of Return

Projects with even annual cash flows Project life = 3 years Initial cost = $12,000 Annual net cash inflows = $5,000 Determine the IRR for this project.

Exh. 26-9

1.

Compute present value factor.

2. Using present value of annuity table . . .

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-24

Internal Rate of Return

Projects with even annual cash flows Project life = 3 years Initial cost = $12,000 Annual net cash inflows = $5,000 Determine the IRR for this project.

Exh. 26-9

1.

Compute present value factor. $12,000 $5,000 per year = 2.4000

2. Using present value of annuity table . . .

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-25

Internal Rate of Return

1. Determine the present value factor. $12,000 $5,000 per year = 2.4000 2. Using present value of annuity table . . .

Periods 1 2 3 4 5 10% 0.90909 1.73554 2.48685 3.16987 3.79079 12% 0.89286 1.69005 2.40183 3.03735 3.60478

Exh. 26-9

Locate the row whose number equals the periods in the projects life.

14% 0.87719 1.64666 2.32163 2.91371 3.43308

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-26

Internal Rate of Return

1. Determine the present value factor. $12,000 $5,000 per year = 2.4000 2. Using present value of annuity table . . .

Periods 1 2 3 4 5 10% 0.90909 1.73554 2.48685 3.16987 3.79079 12% 0.89286 1.69005 2.40183 3.03735 3.60478

Exh. 26-9

In that row, locate the interest factor closest in amount to the present value factor.

14% 0.87719 1.64666 2.32163 2.91371 3.43308

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-27

Internal Rate of Return

1. Determine the present value factor. $12,000 $5,000 per year = 2.4000 2. Using present value of annuity table . . .

Periods 1 2 3 4 5 10% 0.90909 1.73554 2.48685 3.16987 3.79079 12% 0.89286 1.69005 2.40183 3.03735 3.60478

Exh. 26-9

IRR is approximately 12%.

14% 0.87719 1.64666 2.32163 2.91371 3.43308

IRR is the interest rate of the column in which the present value factor is found.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-28

Internal Rate of Return Uneven Cash Flows

If cash inflows are unequal, trial and error solution will result if present value tables are used. Sophisticated business calculators and electronic spreadsheets can be used to easily solve these problems.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-29

Using Internal Rate of Return

Internal Rate of Return

q Compare the internal rate

of return on a project to a predetermined hurdle rate (cost of capital).

q To be acceptable, a

projects rate of return cannot be less than the cost of capital.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-30

Comparing Methods

Basis of measurement Measure expressed as Payback period Cash flows Number of years Easy to Understand Allows comparison across projects Accounting rate of return Accrual income Percent Easy to Understand

Exh. 26-10

Net present Internal rate value of return Cash flows Cash flows Profitability Profitability Dollar Percent Amount Considers time Considers time value of money value of money

Strengths

Limitations

Allows Accommodates Allows comparison different risk comparisons across projects levels over of dissimilar a project's life projects Doesn't Doesn't Difficult to Doesn't reflect consider time consider time compare varying risk value of money value of money dissimilar levels over the projects project's life Doesn't consider cash flows after payback period Doesn't give annual rates over the life of a project

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-31

Managerial Decisions

Lets change topics.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-32

Decision Making

Decision making involves five steps: Define the problem. Identify alternatives. Collect relevant information on alternatives. Select the preferred alternative. Analyze decisions made.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-33

Relevant Costs

Costs

that are applicable to a particular decision. Costs that should have a bearing on which alternative a manager selects. Costs that are avoidable. Future costs that differ between alternatives.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-34

Classification by Relevance: Sunk Costs

All costs incurred in the past that cannot be changed All costs incurred in the past that cannot be changed by any decision made now or in the future. by any decision made now or in the future. Sunk costs should not be considered in decisions. Sunk costs should not be considered in decisions.

Example: You bought an automobile that cost $10,000 two years ago. The $10,000 cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the $10,000 cost.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-35

Classification by Relevance: Out-of-Pocket Costs

Future outlays of cash associated Future outlays of cash associated with a particular decision. with a particular decision. Example: Considering the decision to take a vacation or stay at home, you will have travel costs (out-of-pocket costs) only if you choose a vacation.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-36

Classification by Relevance: Opportunity Costs

The potential benefit that is given up when one alternative is selected over another.

Example: If you were not attending college, you could be earning $20,000 per year. Your opportunity cost of attending college for one year is $20,000.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-37

Managerial Decision Tasks We will now examine several different types of managerial decisions.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-38

Accepting Additional Business

The decision to accept additional business should be based on incremental costs and incremental revenues. Incremental amounts are those that occur if the company decides to accept the new business.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-39

Accepting Additional Business

Exh. 26-12

FasTrac currently sells 100,000 units of its product. The company has revenue and costs as shown below:

Per Unit $ 10.00 3.50 2.20 1.10 1.40 0.80 $ 9.00 $ 1.00 Total 1,000,000 350,000 220,000 110,000 140,000 80,000 900,000 100,000

Sales Direct materials Direct labor Factory overhead Selling expenses Administrative expenses Total expenses Operating income

$ $

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-40

Accepting Additional Business

FasTrac is approached by an overseas company that offers to purchase 10,000 units at $8.50 per unit. If FasTrac accepts the offer, total factory overhead will increase by $5,000; total selling expenses will increase by $2,000; and total administrative expenses will increase by $1,000. Should FasTrac accept the offer?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-41

Accepting Additional Business

First lets look at incorrect reasoning First lets look at incorrect reasoning that leads to an incorrect decision. that leads to an incorrect decision.

Our cost is $9.00 per unit. I cant sell for $8.50 per unit.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-42

Accepting Additional Business

Current Business $ 1,000,000 $ 350,000 220,000 110,000 140,000 80,000 $ 900,000 $ 100,000 Additional Business $ 85,000 $ 35,000 22,000 5,000 2,000 1,000 $ 65,000 $ 20,000

Exh. 26-14

Sales Direct materials Direct labor Factory overhead Selling expenses Admin. expenses Total expenses Operating income

Combined $ 1,085,000 $ 385,000 242,000 115,000 142,000 81,000 $ 965,000 $ 120,000

This analysis leads to the correct decision.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-43

Accepting Additional Business

Current Business $ 1,000,000 $ 350,000 220,000 110,000 140,000 80,000 $ 900,000 $ 100,000 Additional Business $ 85,000 $ 35,000 22,000 5,000 2,000 1,000 $ 65,000 $ 20,000

Exh. 26-14

Sales Direct materials Direct labor Factory overhead Selling expenses Admin. expenses Total expenses Operating income

Combined $ 1,085,000 $ 385,000 242,000 115,000 142,000 81,000 $ 965,000 $ 120,000

10,000 new units $8.50 selling price = $85,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-44

Accepting Additional Business

Current Business $ 1,000,000 $ 350,000 220,000 110,000 140,000 80,000 $ 900,000 $ 100,000 Additional Business $ 85,000 $ 35,000 22,000 5,000 2,000 1,000 $ 65,000 $ 20,000

Exh. 26-14

Sales Direct materials Direct labor Factory overhead Selling expenses Admin. expenses Total expenses Operating income

Combined $ 1,085,000 $ 385,000 242,000 115,000 142,000 81,000 $ 965,000 $ 120,000

10,000 new units $3.50 = $35,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-45

Accepting Additional Business

Current Business $ 1,000,000 $ 350,000 220,000 110,000 140,000 80,000 $ 900,000 $ 100,000 Additional Business $ 85,000 $ 35,000 22,000 5,000 2,000 1,000 $ 65,000 $ 20,000

Exh. 26-14

Sales Direct materials Direct labor Factory overhead Selling expenses Admin. expenses Total expenses Operating income

Combined $ 1,085,000 $ 385,000 242,000 115,000 142,000 81,000 $ 965,000 $ 120,000

10,000 new units $2.20 = $22,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-46

Accepting Additional Business

Exh. 26-14

Current Additional Business Business Combined Sales $ 1,000,000 $ 85,000 $ 1,085,000 Even though $8.50 selling price 35,000 than the is less $ 385,000 Direct materials the$ 350,000 $ normal Direct labor $10 selling price, FasTrac should accept the 220,000 22,000 242,000 offer because Factory overhead net income will increase by $20,000. 110,000 5,000 115,000 Selling expenses 140,000 2,000 142,000 Admin. expenses 80,000 1,000 81,000 Total expenses $ 900,000 $ 65,000 $ 965,000 Operating income $ 100,000 $ 20,000 $ 120,000

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-47

Make or Buy Decisions

Incremental costs also are important in the

decision to make a product or purchase it from a supplier. The cost to produce an item must include (1) direct materials, (2) direct labor and (3) incremental overhead. We should not use the predetermined overhead rate to determine product cost.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-48

Make or Buy Decisions

FasTrac currently makes part #417, assigning overhead at 100 percent of direct labor cost, with the following unit cost:

Cost to Make Part #417 Direct materials Direct labor Factory overhead Total cost to make Make $ 0.45 0.50 0.50 $ 1.45

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-49

Make or Buy Decisions

Exh. 26-15

FasTrac can buy part #417 from a supplier for $1.20. How much overhead do we have to eliminate before we can continue to make this part?

Make vs. Buy Analysis Direct materials Direct labor Factory overhead Purchase price Total incremental costs Make $ 0.45 0.50 ? ---? Buy ---------$ 1.20 $ 1.20

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-50

Make or Buy Decisions

Exh. 26-15

FasTrac can buy part #417 from a supplier for $1.20. How much overhead do we have to eliminate before we can continue to make this part?

We must eliminate $.25 per unit of overhead, leaving aMake vs. Buyof $0.25 per unit. maximum Analysis

Direct materials Direct labor Factory overhead Purchase price Total incremental costs Make $ 0.45 0.50 0.25 ---1.20 Buy ---------$ 1.20 $ 1.20

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-51

Scrap or Rework Defects

Costs incurred in manufacturing units of product that do not meet quality standards are sunk costs and cannot be recovered. As long as rework costs are recovered through sale of the product, and rework does not interfere with normal production, we should rework rather than scrap.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-52

Scrap or Rework Defects

FasTrac has 10,000 defective units that cost $1.00 each to make. The units can be scrapped now for $.40 each or reworked at an additional cost of $.80 per unit. If reworked, the units can be sold for the normal selling price of $1.50 each. Reworking the defective units will prevent the production of 10,000 new units that would also sell for $1.50. Should FasTrac scrap or rework?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-53

Scrap or Rework Defects

Exh. 26-16

Sale of Defects Less rework costs Less opportunity cost Net return

Scrap Now $ 4,000 $ 4,000

Rework $ 15,000

10,000 units $0.40 per unit 10,000 units $1.50 per unit

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-54

Scrap or Rework Defects

10,000 units $0.80 per unit

Scrap Now $ 4,000 $ 4,000 Rework $ 15,000 (8,000) (5,000) 2,000

Exh. 26-16

Sale of Defects Less rework costs Less opportunity cost Net return

10,000 units ($1.50 - $1.00) per unit

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-55

Scrap or Rework Defects

FasTrac should scrap the units now.

Scrap Now $ 4,000 $ 4,000 Rework $ 15,000 (8,000) (5,000) 2,000

Exh. 26-16

Sale of Defects Less rework costs Less opportunity cost Net return

If FasTrac fails to include the opportunity cost, the rework option would show a return of $7,000, mistakenly making rework appear more favorable.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-56

Sell or Process

q Businesses are often faced with the decision to

sell partially completed products or to process them to completion. q As a general rule, we process further only if incremental revenues exceed incremental costs.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-57

Sell or Process

FasTrac has 40,000 units of partially finished product Q. Processing costs to date are $30,000. The 40,000 unfinished units can be sold as is for $50,000 or they can be processed further to produce finished products X, Y, and Z. The additional processing will cost $80,000 and result in the following revenues:

Continue

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-58

Sell or Process

Product X Y Z Spoilage Total $ Price 4.00 6.00 8.00 Units 10,000 22,000 6,000 2,000 40,000 Revenue $ 40,000 132,000 48,000 $ 220,000

Exh. 26-17

Should FasTrac sell product Q or continue processing into products X, Y, and Z?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-59

Sell or Process

Product X Y Z Spoilage Total $ Price 4.00 6.00 8.00 Units 10,000 22,000 6,000 2,000 40,000 Revenue $ 40,000 132,000 48,000 $ 220,000 (50,000) $ 170,000 (80,000) $ 90,000

Exh. 26-17,18

Revenue, if sold as Q Incremental revenue Cost to process X, Y, and Z Incremental income

FasTrac should continue processing. Note that the earlier $30,000 cost for product Q is sunk and therefore irrelevant to the decision.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-60

Selecting Sales Mix

When a company sells a variety of products,

some are likely to be more profitable than others. must consider . . .

To make an informed decision, management

The contribution margin of each product, The facilities required to produce each product and any constraints on the facilities, and The demand for each product.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-61

Selecting Sales Mix

Consider the following data for two products made and sold by FasTrac.

Per unit amounts Selling price Variable costs Contribution margin Product A $ 5.00 3.50 $ 1.50 Product B $ 7.50 5.50 $ 2.00

Exh. 26-19

If each product requires the same time to make, and the demand is unlimited, FasTrac should produce only Product B.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-62

Selecting Sales Mix

Consider the following data for two products made and sold by FasTrac.

Per unit amounts Selling price Variable costs Contribution margin Machine hours required to produce one unit Contribution per machine hour Product A $ 5.00 3.50 $ 1.50 1.0 1.50 Product B $ 7.50 5.50 $ 2.00 2.0 1.00

Exh. 26-19

Consider this additional information.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-63

Selecting Sales Mix

Consider the following data for two products Product B has a greater made and sold by FasTrac.

Product A $ 5.00 3.50 $ 1.50 1.0 1.50 Product B $ 7.50 5.50 $ 2.00 2.0 1.00

Exh. 26-19

contribution margin than Product A, but it Per unit amounts requires more machine Selling price hours per unit to produce.

Variable costs Contribution margin Machine hours required to produce one unit Contribution per machine hour

With unlimited demand for A and B, produce as many units of A as possible since A provides more dollars per hour worked.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-64

Selecting Sales Mix

Consider the following data for two products made and sold by FasTrac.

Per unit amounts Selling price Variable costs Contribution margin Machine hours required to produce one unit Contribution per machine hour Product A $ 5.00 3.50 $ 1.50 1.0 1.50 Product B $ 7.50 5.50 $ 2.00 2.0 1.00

Exh. 26-19

If demand for A is limited, produce to meet that demand, then use the remaining facilities to produce B.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-65

Eliminating a Segment

A segment is a candidate for elimination if its revenues are less than its avoidable expenses. FasTrac is considering eliminating its Treadmill Division because total expenses of $48,300 are greater than its sales of $47,800. Continue

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-66

Analysis of Divisional Operating Expenses

Cost of goods sold Direct expenses: Salaries Equipment depreciation Indirect expenses: Rent and utilities Advertising Insurance Service department costs: Departmental office Purchasing Total Total Expenses $ 30,200 7,900 200 3,150 200 400 3,060 3,190 $ 48,300

Exh. 26-20

Lets identify avoidable expenses.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-67

Analysis of Divisional Operating Expenses

Cost of goods sold Direct expenses: Salaries Equipment depreciation Indirect expenses: Rent and utilities Advertising Insurance Service department costs: Departmental office Purchasing Total Total Expenses $ 30,200 7,900 200 3,150 200 400 3,060 3,190 $ 48,300 Avoidable Expenses $ 30,200 7,900 $

Exh. 26-20

Unavoidable Expenses

200 3,150

200 300 2,200 1,000 $ 41,800

100 860 2,190 6,500

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-68

Eliminating a Segment

Sales Sales Avoidable expenses Avoidable expenses Decrease in income Decrease in income

$ 47,800 $ 47,800 41,800 41,800 $ 6,000 $ 6,000

Do not eliminate the Treadmill Division!

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-69

Qualitative Factors in Decisions

Qualitative factors are involved in most all managerial decisions. For example: Quality. Delivery schedule. Supplier reputation. Employee morale. Customer opinions.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-70

Break-Even Time

Break-even time incorporates time value Break-even time incorporates time value of money into the payback period method of money into the payback period method of evaluating capital investments. of evaluating capital investments.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

Slide 6-71

End of Chapter 26

Thats All.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 200

You might also like

- Solutions - Capital BudgetingDocument6 pagesSolutions - Capital BudgetingFarzan Yahya Habib100% (1)

- Introduction To Managerial AccountingDocument19 pagesIntroduction To Managerial Accountingdubbs21100% (2)

- Ps 6Document19 pagesPs 6Da Harlequin GalNo ratings yet

- Asservation For NativityDocument27 pagesAsservation For Nativityjohnadams552266No ratings yet

- Capital Budgeting and Decision MakingDocument71 pagesCapital Budgeting and Decision MakingNEERAJ GUPTANo ratings yet

- FIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemDocument7 pagesFIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemRambo GantNo ratings yet

- 4 Capital Investment Nov 2020Document76 pages4 Capital Investment Nov 2020Gabriel Alva AnkrahNo ratings yet

- b11 Capital BudgetDocument65 pagesb11 Capital BudgetGaesaEldiNo ratings yet

- Payback Period QuestionsDocument2 pagesPayback Period Questionspareekrishika34No ratings yet

- ch12 2Document3 pagesch12 2ghsoub777100% (1)

- Chapter Ten: Planning For Capital InvestmentsDocument42 pagesChapter Ten: Planning For Capital InvestmentsGab BautistaNo ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- Abm 460 Chapter Four (4) Capital BudgetingDocument33 pagesAbm 460 Chapter Four (4) Capital BudgetingphaniezaongoNo ratings yet

- Chapter - 7 - Pay Back PeriodDocument15 pagesChapter - 7 - Pay Back PeriodAhmed freshekNo ratings yet

- Chap 025Document42 pagesChap 025Eslam SamyNo ratings yet

- Lecture 2 Ch9Document66 pagesLecture 2 Ch9Linda VoNo ratings yet

- Capital Expenditure - ReportDocument8 pagesCapital Expenditure - Reportmagoimoi100% (1)

- Non-Discounted Capital Budgeting TechniquesDocument4 pagesNon-Discounted Capital Budgeting TechniquesLloyd ReglosNo ratings yet

- 2-4 2005 Dec ADocument14 pages2-4 2005 Dec AnsarahnNo ratings yet

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_No ratings yet

- Tute 6 PDFDocument4 pagesTute 6 PDFRony RahmanNo ratings yet

- FIN370 Week 4 Team PaperDocument7 pagesFIN370 Week 4 Team PaperWellThisIsDifferentNo ratings yet

- Non-Discounted Capital Budgeting Techniques: ExampleDocument2 pagesNon-Discounted Capital Budgeting Techniques: ExampleKristineTwo CorporalNo ratings yet

- MBA 504 Ch9 SolutionsDocument24 pagesMBA 504 Ch9 Solutionspheeyona100% (1)

- Investment Appraisal LectureDocument19 pagesInvestment Appraisal Lectureviettuan91No ratings yet

- Powerpoint MasDocument25 pagesPowerpoint MasMatthew TiuNo ratings yet

- Arr 2Document5 pagesArr 2Rohit GandhiNo ratings yet

- ch6 IM 1EDocument20 pagesch6 IM 1Erachel4eva100% (1)

- CH 6Document29 pagesCH 6Kasahun MekonnenNo ratings yet

- Ch12 Planning For Capital InvestmentsDocument62 pagesCh12 Planning For Capital Investmentsعبدالله ماجد المطارنهNo ratings yet

- Investment AppraisalDocument24 pagesInvestment AppraisalDeepankumar AthiyannanNo ratings yet

- Chapter 26Document26 pagesChapter 26sumesh1980No ratings yet

- SolutionDocument6 pagesSolutionaskdgasNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- Lecture7 PDFDocument7 pagesLecture7 PDFJeannette VillenaNo ratings yet

- Capital Investment Appraisal For Long-Term DecisionsDocument39 pagesCapital Investment Appraisal For Long-Term DecisionsDevon PhamNo ratings yet

- An Introduction To Investment Appraisal - Payback and ARRDocument18 pagesAn Introduction To Investment Appraisal - Payback and ARRKate DrajneanuNo ratings yet

- How To Analyze Investment Projects: Instructor's ManualDocument28 pagesHow To Analyze Investment Projects: Instructor's ManualJim Briggs100% (1)

- New Investment and Project AppraisalDocument23 pagesNew Investment and Project AppraisalRunaway ShujiNo ratings yet

- Investment AppraisalDocument23 pagesInvestment AppraisalHuzaifa Abdullah100% (2)

- Planning and Evaluationl English 2Document38 pagesPlanning and Evaluationl English 2Absa TraderNo ratings yet

- CH 26Document9 pagesCH 26MohitNo ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingAshenafi AbdurkadirNo ratings yet

- Chapter 7 The Analysis of Investment ProjectsDocument41 pagesChapter 7 The Analysis of Investment ProjectsHùng PhanNo ratings yet

- Capital Budgeting SlidesDocument57 pagesCapital Budgeting SlidesCatherine SelladoNo ratings yet

- Investment Appraisal V2Document69 pagesInvestment Appraisal V2Eben KatewaNo ratings yet

- Investment Appraisal Full SlidesDocument84 pagesInvestment Appraisal Full SlidesEben KatewaNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Capital Budgeting DecisionDocument10 pagesCapital Budgeting DecisionrajjoNo ratings yet

- Caledonia Products FIN370Document8 pagesCaledonia Products FIN370huskergirlNo ratings yet

- Present-Worth Analysis: Chapter Learning ObjectivesDocument30 pagesPresent-Worth Analysis: Chapter Learning ObjectivesRoman AliNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- MC AnswerDocument24 pagesMC AnswerMiss MegzzNo ratings yet

- DP 2 Lecture 3.8 and Onwards (Delievered 26th Sep 2022)Document14 pagesDP 2 Lecture 3.8 and Onwards (Delievered 26th Sep 2022)MMN LegendNo ratings yet

- 3 Annual Worth MethodDocument29 pages3 Annual Worth MethodAngel NaldoNo ratings yet

- Capital Budgeting Problems PDFDocument23 pagesCapital Budgeting Problems PDFJitendra SharmaNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- WAPDA Book of Financial Powers (May 2016)Document113 pagesWAPDA Book of Financial Powers (May 2016)waqar67% (3)

- Will Benjamin FranklinDocument9 pagesWill Benjamin FranklinMichael KovachNo ratings yet

- CA Power of Attorney FORM & Info 87-68.200Document29 pagesCA Power of Attorney FORM & Info 87-68.200JugyNo ratings yet

- Reporte Dibella Group Alineada A #Iso26000Document32 pagesReporte Dibella Group Alineada A #Iso26000ALBERTO GUAJARDO MENESESNo ratings yet

- Val Quiz 1 ReviewDocument20 pagesVal Quiz 1 Reviewshafkat rezaNo ratings yet

- Financial MArket in BangladeshDocument2 pagesFinancial MArket in BangladeshSaj Jad33% (3)

- Hotel Financial AnalysisDocument15 pagesHotel Financial AnalysisFayez AssalyNo ratings yet

- 2015 2020 CTRM Market OutlookDocument17 pages2015 2020 CTRM Market OutlookCTRM CenterNo ratings yet

- BCG, IE & Grand MatrxDocument2 pagesBCG, IE & Grand MatrxlionalleeNo ratings yet

- CE Board Problems in Engineering EconomyDocument6 pagesCE Board Problems in Engineering EconomyFritz Fatiga100% (3)

- Enriquez v. de VeraDocument2 pagesEnriquez v. de Veralaurana amataNo ratings yet

- Kedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanDocument15 pagesKedudukan Hukum Kreditur Yang Tidak Terverifikasi Dalam Undang Undang KepailitanVictor TumbelNo ratings yet

- Presentation - Sources - of - Finance - BST SEMINARDocument16 pagesPresentation - Sources - of - Finance - BST SEMINARManav MohantyNo ratings yet

- Unit - 4.4 Hawtrey's Theory.Document3 pagesUnit - 4.4 Hawtrey's Theory.Mahima guptaNo ratings yet

- FS PT Acset 31 Maret 2023Document79 pagesFS PT Acset 31 Maret 2023Nanda WulanNo ratings yet

- Understanding Vietnam: The Rising Star: Economics & StrategyDocument11 pagesUnderstanding Vietnam: The Rising Star: Economics & StrategyHandy HarisNo ratings yet

- FDA POTOSI v-2104 PBL 05-05-2020 Blue Marlin - Xls - CompressedDocument69 pagesFDA POTOSI v-2104 PBL 05-05-2020 Blue Marlin - Xls - CompressedSade Park MaddoxNo ratings yet

- Digest RR 12-2018Document5 pagesDigest RR 12-2018Jesi CarlosNo ratings yet

- Motion To Lift Order of Default With Position PaperDocument3 pagesMotion To Lift Order of Default With Position PaperAtty. Dahn UyNo ratings yet

- GOI Department and MinistriesDocument7 pagesGOI Department and MinistriesgaderameshNo ratings yet

- PT Temas TBK Dan Entitas Anaknya/: and Its SubsidiariesDocument121 pagesPT Temas TBK Dan Entitas Anaknya/: and Its SubsidiariesHammad Muqtadirul ImadNo ratings yet

- Chapter 7Document45 pagesChapter 7Chitose HarukiNo ratings yet

- Initiative of National Housing PolicyDocument4 pagesInitiative of National Housing PolicyMuhaimin RohizanNo ratings yet

- Maynard Case 3 1 PDFDocument2 pagesMaynard Case 3 1 PDFTating Bootan Kaayo YangNo ratings yet

- EconomicsDocument50 pagesEconomicshiteshrao810No ratings yet

- Zed Pay Full PlanDocument36 pagesZed Pay Full Plankukaramp349No ratings yet

- Barclays Municipal Research Detroit - Chapter 9 BeginsDocument22 pagesBarclays Municipal Research Detroit - Chapter 9 Beginsabcabc123123xyzxyxNo ratings yet

- Sol2 Receivables 1 9Document5 pagesSol2 Receivables 1 9Shaira CastorNo ratings yet

- 14 Cession or AssignmentDocument8 pages14 Cession or AssignmentJong PerrarenNo ratings yet