Professional Documents

Culture Documents

Accounts

Uploaded by

Tapassya GiriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts

Uploaded by

Tapassya GiriCopyright:

Available Formats

Venture of Apollo Global Management and Stone Tower Capital

Presented to: Presented by: Team Members: Prof. Amar Karkhanis Team 3 Tapassya Giri Manali Gaonkar Bushra Chishty Akash Halankar Aditya Jadhav Varad Pitale Saurabh Naik Nitesh Salunke

About Apollo Global Management LLC

y It is an alternative investment management

firm, founded in 1990 by former Drexel Burnham Lambert banker Leon Black. y The firm specializes in leveraged buyout transactions and purchases of securities involving corporate restructuring, and industry consolidations. y Apollo is headquartered in New York City, and also has in many countries y The firm has invested over $16 billion in companies. y As of September 2011, Apollo managed over US$65 billion of investor commitments across its private equity, capital markets and real estate funds and other investment vehicles making it one of the largest alternative investment management firms globally

About Stone Tower Capital LLC

y It is a leading independent alternative credit asset manager with approximately $17 y y y

y y

billion in assets under management. The firm, founded in 2001. It specializes in a variety of corporate and structured credit and credit-related products. Stone Tower has a global investor base that includes state and county pension funds, superannuation funds, corporate pension funds, insurance companies, family offices, university endowments, and high-net-worth individuals. The firm is headquartered in New York with offices in Los Angeles and Dublin. Stone Tower operates through its advisory affiliates which are registered with the Securities and Exchange Commission as investment advisers under the Investment Advisers Act of 1940.

Case study: Apollo Global Management to Acquire Stone Tower Capital

y Apollo Global Management, LLC and its subsidiaries as agreed to merge y

y y

Stone Tower Capital LLC and its related management companies. Stone Tower, is a leading alternative credit manager with approximately $17 billion of assets under management (AUM), into Apollos capital markets business. The transaction will substantially increase Apollos capital markets AUM to approximately $39 billion1, making capital markets Apollos largest business segment upon closing on an AUM basis. Total AUM for Apollo will increase to approximately $82 billion after giving effect to the transaction. The deal will bolster Apollos position as one of the worlds largest and most diverse credit managers by adding significant scale and several new credit product capabilities. The Stone Tower transaction is consistent with Apollos strategy to expand the depth and breadth of its global integrated investment platform and meet the growing secular demand for comprehensive alternative investment solutions.

Case study Continued..

y Stone Tower currently manages approximately $17 billion of alternative

credit assets across a variety of corporate credit funds through separately managed accounts, credit opportunity funds, and 12 Collateralized Loan Obligations (CLOs), as well as structured credit funds. y Stone Towers investment expertise spans a variety of alternative asset classes and strategies including senior loans, high yield bonds, long/short credit, private debt solutions, CLO liabilities, CLO equity, RMBS, CMBS and other asset-backed securities. y Terms of the transaction were not disclosed. Subject to certain conditions, the transaction is expected to close by the end of the first quarter of 2012

Motive of Apollo

y To raise Apollos position as one of the worlds largest and most diverse credit

managers

y Increase Apollos capital markets AUM to approximately $39 billion y Total AUM for Apollo will increase to approximately $82 billion after giving

effect to the transaction.

y The Stone Tower transaction is consistent with Apollos strategy to expand the

depth and breadth of its global integrated investment platform

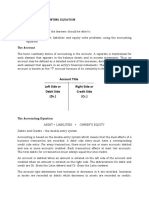

Earnings Per Share

y Earnings Per Share represents the portion of a company's profit allocated to each outstanding

share of common stock. The net income (reported or estimated) for a period divided by the total number of shares outstanding (TSO) during that period.

You might also like

- Ratios and Formulas in Customer Financial AnalysisDocument9 pagesRatios and Formulas in Customer Financial Analysisanon-198630No ratings yet

- Presentation ON Industrial Policy, 1991: Master of Social Works-Ii YRDocument11 pagesPresentation ON Industrial Policy, 1991: Master of Social Works-Ii YRTapassya GiriNo ratings yet

- Questionnaire For Stress Management in An OrganizationDocument8 pagesQuestionnaire For Stress Management in An OrganizationTapassya Giri33% (3)

- HUMANRESOURCEDEVELOPMENTfinalDocument53 pagesHUMANRESOURCEDEVELOPMENTfinalilansakthiNo ratings yet

- Entrepreneurial Development Programe (EDP)Document15 pagesEntrepreneurial Development Programe (EDP)Tapassya GiriNo ratings yet

- Cash and Marketable Securities ManagementDocument6 pagesCash and Marketable Securities ManagementRoshan DarekarNo ratings yet

- Questionnaire Role StressDocument4 pagesQuestionnaire Role StressTapassya Giri100% (1)

- The Impact of Adulterated Food On HealthDocument4 pagesThe Impact of Adulterated Food On HealthTapassya GiriNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Jeremy Paradise V Andrew ParadiseDocument55 pagesJeremy Paradise V Andrew ParadiseNo Skills100% (1)

- Investment Tutorials (Master Invest) - 2018Document332 pagesInvestment Tutorials (Master Invest) - 2018hams100% (3)

- Financial Management Live Project: A Study of Ratio Analysis of Axis BankDocument14 pagesFinancial Management Live Project: A Study of Ratio Analysis of Axis BankKreator's BlogNo ratings yet

- Chapter 7 StudentDocument61 pagesChapter 7 StudentLinh HoangNo ratings yet

- Crowdfunding in FintechDocument6 pagesCrowdfunding in FintechhukaNo ratings yet

- Avon Case: Week 12 - April 6, 2006Document14 pagesAvon Case: Week 12 - April 6, 2006Giridhar GaneshNo ratings yet

- Running Head: PORTFOLIO ANALYSIS: Woolworths Group LTD Name InstitutionDocument6 pagesRunning Head: PORTFOLIO ANALYSIS: Woolworths Group LTD Name InstitutionPrinciNo ratings yet

- 3 Explosive Stocks Riding UP TO 5,629% Gains: FirecrackersDocument6 pages3 Explosive Stocks Riding UP TO 5,629% Gains: FirecrackersSteve WellerNo ratings yet

- P10-3 Choosing Between Two Projects With Acceptable Payback Periods Conad, An ItalianDocument3 pagesP10-3 Choosing Between Two Projects With Acceptable Payback Periods Conad, An ItalianSakibul Islam SifatNo ratings yet

- Satyam FinalDocument25 pagesSatyam FinalSam RenuNo ratings yet

- Strategy Implementation - Anne MulcahyDocument61 pagesStrategy Implementation - Anne Mulcahynknishant100% (10)

- 17 & 18 & 19 Revised Sharpe SimplificationDocument44 pages17 & 18 & 19 Revised Sharpe SimplificationHalimah SheikhNo ratings yet

- Mini Project On NseDocument19 pagesMini Project On Nsecharan tejaNo ratings yet

- 1 - Cfa-2018-Quest-Bank-R21-Financial-Statement-Analysis-An-Introduction-Q-BankDocument7 pages1 - Cfa-2018-Quest-Bank-R21-Financial-Statement-Analysis-An-Introduction-Q-BankQuyen Thanh NguyenNo ratings yet

- Financial Managers Play An Important Role in The Development of Modern CompanyDocument11 pagesFinancial Managers Play An Important Role in The Development of Modern CompanyHadie Aria JayaNo ratings yet

- Reliance Industries LTD: Corporate ActionsDocument8 pagesReliance Industries LTD: Corporate ActionsPrashant PatilNo ratings yet

- Dela Investment ContractDocument3 pagesDela Investment ContractTin GomezNo ratings yet

- Nestle Annual Report 2010Document112 pagesNestle Annual Report 2010Sindhu Qasim0% (1)

- Baron Partners Fund 12.31.22Document6 pagesBaron Partners Fund 12.31.22Vinci ChanNo ratings yet

- Share Khan BrochureDocument30 pagesShare Khan BrochuremhussainNo ratings yet

- M02 Berk994437 04 CF C02Document87 pagesM02 Berk994437 04 CF C02Anh NguyenNo ratings yet

- Almarai Company: Consolidated Income StatementDocument11 pagesAlmarai Company: Consolidated Income Statementabdulla mohammadNo ratings yet

- 38 Hanlon V Haussermann and BeamDocument2 pages38 Hanlon V Haussermann and BeamNichole LanuzaNo ratings yet

- Commercial BankingDocument14 pagesCommercial BankingSudheer Kumar SNo ratings yet

- LESSON 7 The Accounting EquationDocument3 pagesLESSON 7 The Accounting EquationUnamadable UnleomarableNo ratings yet

- Property Transactions Tax ReturnDocument10 pagesProperty Transactions Tax ReturnSn Carbonel33% (3)

- Finance Project ReportDocument7 pagesFinance Project Reporthamzaa mazharNo ratings yet

- 2020visuals - Briefer On KAPA As of 07242020Document22 pages2020visuals - Briefer On KAPA As of 07242020michelleNo ratings yet

- Comparative Analysis of Stock BrokersDocument75 pagesComparative Analysis of Stock Brokersvijayrana0389% (19)

- FINAL REPORT HDFC LifeDocument53 pagesFINAL REPORT HDFC LifeDarshan ShahNo ratings yet