Professional Documents

Culture Documents

Deeper: India Statutory Requirements and SAP Functionalities

Uploaded by

Sharad SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deeper: India Statutory Requirements and SAP Functionalities

Uploaded by

Sharad SinghCopyright:

Available Formats

India Statutory Requirements and SAP Functionalities

Country India version Overview

deeper

Copyright Corporation 2003

Consulting Services

Introduction to India Statutory Requirements

The modules affected by India statutory requirements are FI, MM & SD

FI

SD

MM

*

2

Financial reporting is supported by the standard SAP package

Copyright

Consulting Services

Introduction to India Statutory Requirements

The following process gets affected due to India Statutory requirements

Purchasing

Sub contracting Stock transfer of goods

Payment to service vendors

Sales

Any Movement of goods between legal entities or payments made or received to/from business partners are affected by India statutory requirements

Copyright

Consulting Services

The MM Module

FI

SD

MM

* *

4

The process affected by India statutory requirements are the Purchase, Subcontracting & Stock transfer in MM. Tax settings are common in nature. Account Determination is handled in FI.

Copyright

Consulting Services

The Purchasing Cycle

Purchase Order

Excise Invoice Capture

Excise duty is a type of manufacturing tax Excise duty rate depends upon on the material type as defined by the authorities CENVAT stands for Central Value added tax

Goods Receipt

CENVAT Credit

Country India version related transactions are depicted in a different font

Invoice Verification

Copyright

Consulting Services

Introduction to Excise Duty

Component Inventory value Rs. 6600 Credit Available :Rs. 0

Component

Rs. Basic Price - 5000 Excise Duty - 1000 LST/CST - 600 Total Price - 6600

Component Inventory value Rs. 5600

If the item purchased is part of a manufactured product that is excisable then the Excise duty paid for this purchase order can be availed as CENVAT credit

Credit Available :Rs. 1000

Copyright

Consulting Services

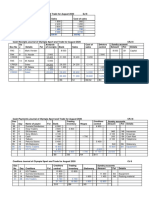

The Purchasing Cycle - Domestic

Purchase Order

Vendor Excise Invoice

Local / Central sales tax is determined upon the location of the sale & the Ship-to-party region Sample Pricing is as below :

Description Basic Price Excise Duty (20% of A) Total Excise Duty Sub Total (A + C) Local Sales Tax (10% of D) Grand Total INR 5000.00 1000.00 1000.00 6000.00 600.00 6600.00

Goods receipt

A B C D E F

CENVAT credit

Either Local sales tax or central sales tax is applicable on any one item.

Invoice Verification

Copyright

Consulting Services

The Purchasing Cycle

Purchase Order

Vendor Excise Invoice

Goods receipt

The following data is captured referring to the Vendors excise invoice Purchase order number Material number Quantity Excise rate Excise amount

CENVAT credit

Invoice Verification

The information captured in this transaction forms the basis for availing the CENVAT Credit as well as for maintaining statutory registers

Copyright

Consulting Services

The Purchasing Cycle - Domestic

Purchase Order

Vendor Excise Invoice

Goods receipt

Goods receipt transaction captures the following data, referring to the vendor excise number Purchase order number Material number Quantity Inventory Valuation is carried out in this transaction based on purchase order

CENVAT credit

The information captured in this transaction forms the basis for updating the statutory records regarding quantity related information

Invoice Verification

10

Copyright

Consulting Services

The Purchasing Cycle - Domestic

Purchase Order

Vendor Excise Invoice

Data captured referring to the Vendors excise invoice are posted No Inventory Valuation is carried out in this transaction Accounting entries are made in the clearing account for excise

Goods receipt

CENVAT credit

The information captured in this transaction forms the basis for updating the statutory records regarding value related information

Invoice Verification

11

Copyright

Consulting Services

The Purchasing Cycle - Domestic

Purchase Order

Vendor Excise Invoice

Corrections to Inventory Valuation is carried out in case of corrections to excise invoice Accounting entries in the clearing account for excise are nullified by making the payment to the vendor

Goods receipt

CENVAT credit

Inventory re-valuation takes place in case of corrections to excise invoice amount

Invoice Verification

12

Copyright

Consulting Services

Purchasing from Overseas Sources

Create purchase requisition Purchase requisition Request for quotation Invoice verification

Create Request for quotation

Analysis of purchase order values Enter invoice

Quotation

Maintain quotation

Goods receipt Goods receipt for purchase order Clearance from Port, LC Activities, Customs Assessment Shipping notification

Purchase order Order Acknowledge ment Create order acknowledgement

Create purchase order reference to request for quotation

Create shipping notification

13

Copyright

Consulting Services

The Purchasing Cycle - Imported

Purchase Order

Counter veiling duty depends upon on the material type as

defined by the authorities All other steps are similar to domestic procurement Sample Pricing is as below :

A B C D E F G H Description Basic Price Customs Duty Basic (20% of A) Special Customs (5% of A) Total Customs Sub Total (A + D) Counter Vailing Duty CVD (13% of E) Sub Total (E + F) Special Additional Duty (4% of G) Grand Total INR 5000.00 1000.00 250.00 1250.00 6250.00 812.50 7062.50 282.50 7345.00

Vendor Excise Invoice

Goods receipt

CENVAT credit

Invoice Verification

In an imported purchase order, the CVD component is used for availing CENVAT credit. rates.

Copyright

The other components vary based on prevailing .

14

Consulting Services

The Purchasing Cycle - Capital Goods

CENVAT credit availment is possible on Capital goods procured for manufacturing or for enhancing existing capacities. Some of the Types for which credit can be availed are : Consumables Tools Assets

CENVAT credit for capital goods are applicable for manufacturing companies only & not for a trading company

Copyright

Consulting Services

The Purchasing Cycle - Consumables

Purchase Order

Intimation

Excise Invoice Capture

CENVAT Credit Availment

Goods Receipt

CENVAT Credit on hold

Invoice Verification

16

Copyright

Consulting Services

The Purchasing Cycle - Tools

Purchase Order

Intimation

Excise Invoice Capture

Goods Issue

Goods Receipt

CENVAT Credit Availment

CENVAT Credit on hold

Invoice Verification

17

Copyright

Consulting Services

External Sub Contract Cycle

Purchase Order

Sample Pricing is as below :

A Description Processing Charges Grand Total INR 5000.00 5000.00

Transfer Posting

57f4 Document Generation

Goods Receipt

57f4 Completion

Purchase order is generated for the Processed Item, to be received from the sub contractor. It also contains information about the input components required for processing.

19

Copyright

Consulting Services

External Sub Contract Cycle

Purchase Order

Based on the component requirement and availability, the same are transferred to the sub contractors site.

Transfer Posting

57f4 Document Generation

Goods Receipt

57f4 Completion

The transferred stock are shown as part of the valuated stock of the enterprise, but lying with the sub contractor

20

Copyright

Consulting Services

External Sub Contract Cycle

Purchase Order

Transfer Posting

57f4 Document Generation

A statutory document called 57f4 is generated which captures the following details Sub contractor details Material description Batch details Quantity Value Expected date of return (within 180 days)

Goods Receipt

On generation of the document, CENVAT account needs to be debited by 10% of the value of components sent for processing, the same can be reversed only if the processed components are received with in 180 days

57f4 Completion

21

Copyright

Consulting Services

External Sub Contract Cycle

Purchase Order

Transfer Posting

57f4 Document Generation

Goods receipt transaction captures the following data, referring to the 57f4 document number Purchase order number Material number Quantity Statutory register related data Inventory Valuation is carried out in this transaction based on confirmation of components consumed during processing

Goods Receipt

57f4 Completion

CENVAT account can be credited only after complete receipt of the purchase order items (processed items)

22

Copyright

Consulting Services

External Sub Contract Cycle

Purchase Order

Transfer Posting

On complete receipt of goods from the sub contractor, the 57f4 document is closed In case of short closure of purchase order, CENVAT credit can be taken only for those items that have been received, and rest needs to be forfeited

57f4 Document Generation

Goods Receipt

Receipt of processed goods within 180 days is crucial

57f4 Completion

23

Copyright

Consulting Services

External Sub Contract Cycle

Inventory valuation

Component Credit reversed : Rs.500

Component

Rs. Basic Price 5000 Excise Duty 500 Total Price 5500 Credit Available :Rs. 1000 Credit Debited :Rs. 500 (when the component is sent to the job worker) Component CENVAT debited : Rs.1000

24

Copyright

Consulting Services

The FI Module

FI

SD

MM

*

25

The process affected by India statutory requirements is the Withholding tax known as the tax deducted at source

Copyright

Consulting Services

Tax Deductions at Source

Down Payment to Vendor TDS Payments

Invoice Verification

Challan Updation

Down Payment Clearing

TDS Certificate Printing

TDS Entry on balance amount

Annual Returns

*

Vendor payment

TDS liability is set up at the time of provision or payment whichever is earlier

26

Copyright

Consulting Services

Vendor Down Payment

Down Payment to Vendor

Invoice Verification

Down Payment Clearing

TDS Entry on balance amount

TDS Rates are maintained for various sections under the Income Tax Act. The rates are attached to vendor master and transactions (down payments and invoices) (e.g.) A contractor is classified under the relevant section & is subject to say 20% TDS. An amount of Rs.40,000 is paid as advance & the entries passed are Dr. Vendor Advance 40000 Cr. Bank 32000 Cr. TDS Payable 8000

Vendor payment

27

Copyright

Consulting Services

Invoice Verification

Down Payment to Vendor

Invoice Verification

For Example : A contractor is classified under the relevant section & is subject to 20% TDS. An invoice of Rs 70000 is verified, and the entries passed are Dr. Expense / Stock 70000 Cr. Vendor 70000

Down Payment Clearing

TDS Entry on balance amount

Vendor payment

28

Copyright

Consulting Services

Down Payment Clearing

Down Payment to Vendor

Invoice Verification

For Example : A contractor is classified under the relevant section & is subject to 20% TDS. The down payment of Rs 40000 was fully cleared against the invoice Dr. Vendor 40000 Cr. Vendor Advance 40000

Down Payment Clearing

TDS Entry on balance amount

Vendor payment

29

Copyright

Consulting Services

TDS Entry

Down Payment to Vendor

Invoice Verification

For Example : A contractor is classified under the relevant section & is subject to 20% TDS. TDS is computed on the invoice, after clearing the down payment with the invoice Dr. Vendor 6000 Cr. TDS payable 6000

Down Payment Clearing

(20% on Rs. 30000)

TDS Entry on balance amount

Vendor payment

30

Copyright

Consulting Services

Vendor Payment

Down Payment to Vendor

Invoice Verification

For Example : A contractor is classified under the relevant section & is subject to 20% TDS. Vendor is paid the amount net of TDS Dr. Vendor 24000 Cr. Bank 24000

Down Payment Clearing

TDS Entry on balance amount

Vendor payment

31

Copyright

Consulting Services

TDS payments

TDS Payments

Challan Updation

For Example : A contractor is classified under the relevant section & is subject to 20% TDS. At the period end the TDS is paid to the government against the liability Dr. TDS payable 14000 Cr. Bank 14000

TDS Certificate Printing

(Rs.14000 composed of Rs. 8000 provided during advance and Rs. 6000 provided during the invoice)

Annual Returns

32

Copyright

Consulting Services

Other TDS Activities

TDS Payments

Challan Updation

On payment to government, a document called Challan is filled up, this Challan number is updated in the system The vendors are issued TDS certificates at the period end The company has to file annual returns to the government which gives details of TDS deducted by various tax sections

TDS Certificate Printing

Annual Returns

33

Copyright

Consulting Services

Tax Deductions at Source

CIN uses SAPs standard withholding tax functionalities to address TDS requirements. Extended withholding functionality is currently followed. CIN supports TDS payments on invoice or payment which ever is earlier

34

Copyright

Consulting Services

The SD Module

FI

SD

MM

*

35

The process affected by India statutory requirements is the pricing procedure for Sales tax & CENVAT credit utilization

Copyright

Consulting Services

The Sales Cycle

Sales Order

Creation of Delivery

The pricing elements of a sales order should contain the following Basic price less all discounts Excise duty Sales tax Entry tax

CENVAT Utilization

Excise Invoice

Commercial Invoice

The pricing structure is similar to that of the vendor pricing.

36

Copyright

Consulting Services

Tax Element in Sales Cycle

Sales Tax

Customer within the same state as the delivering plant

Manufacturing Plant / Sales Depot Customer outside the state of the delivering plant

Sales tax is calculated on (Base Price + Excise duty)

37

Copyright

Consulting Services

The Sales Cycle

Sales Order

The delivery of a sales order includes Picking & Packing of goods as per the Sales order

Creation of Delivery

CENVAT Utilization

Excise Invoice

There is no change in functionality of Delivery due to India statutory requirements

Commercial Invoice

38

Copyright

Consulting Services

The Sales Cycle

Sales Order

Creation of Delivery

The excise duty payable is to be paid before the goods leave the factory premises The credit available in the statutory records can be utilized for paying the excise duty. The amount payable can be netted off from these records

CENVAT Utilization

Excise Invoice

If credit is not available, then duty amount is to be deposited to the government

Commercial Invoice

39

Copyright

Consulting Services

The Sales Cycle

Sales Order

Creation of Delivery

CENVAT Utilization

An excise invoice needs to be generated which would be audited by Excise authorities The invoice should contain the following details The Excise duty percentage The Excise duty amount The Excise duty payment details The sales order details

Excise Invoice

An excise invoice can be combined with the commercial invoice if required

Commercial Invoice

40

Copyright

Consulting Services

The Sales Cycle

Sales Order

Creation of Delivery

The commercial invoice is sent to the customer with the amount payable to the organization with the break up of the pricing components If the excise & commercial invoice is combined then the details required are still the same

CENVAT Utilization

Excise Invoice

* The invoice needs to move along with the goods

Commercial Invoice

41

Copyright

Consulting Services

Summary of the India statutory requirements

The main statutory requirements of India are CENVAT credit availment & utilization Tax deducted on source Sales tax

All records maintained for statutory requirements are subject to audit by the authorities

42

Copyright

Consulting Services

Introduction of VAT

All States in India are yet to move towards VAT regime. VAT has come into force in many States already. Excise, CST and Service tax to remain and other taxes to go. All declared goods to come under VAT and VAT credit available to both manufactures and traders. Tax credit can be carried forward every month till the end of next fiscal year. Export / SEZ input tax paid will be refunded in full. Capital goods credit number of installments to be decided by each state.

43

Copyright

Consulting Services

Implication of VAT in SAP

Jurisdiction codes would be scrapped. One business place needs to be defined for each TIN no. Each plant would be assigned to a business place. While more than one plant can exist in one registration, one plant cannot have two registrations. Alternate GL accounts can be assigned for Tax code at business place. Master Note 818732 to be followed closely to monitor various changes.

44

Copyright

Question & Answers

deeper

Copyright Corporation 2003

Thank You

deeper

Copyright Corporation 2003

You might also like

- Deeper: India Statutory Requirements and SAP FunctionalitiesDocument44 pagesDeeper: India Statutory Requirements and SAP Functionalitiesmksingh_24No ratings yet

- Introduction To India Statutory RequirementsDocument4 pagesIntroduction To India Statutory Requirementsmksingh_24No ratings yet

- Finance DepartmentDocument16 pagesFinance DepartmentAkriti SrivastavaNo ratings yet

- IS-Utilities: Manish KumarDocument23 pagesIS-Utilities: Manish Kumarsuman_yarlagaddaNo ratings yet

- Implementing AP Positive PaymentDocument25 pagesImplementing AP Positive PaymentJacob YeboaNo ratings yet

- Project Procurement Management: Lecture-7Document31 pagesProject Procurement Management: Lecture-7fahadfadi48No ratings yet

- Recognition and MeasurementDocument44 pagesRecognition and MeasurementRabiq Muradi DjamalullailNo ratings yet

- Unit 5 - Procurement of Dsbsdfsafexternal ServicesDocument10 pagesUnit 5 - Procurement of Dsbsdfsafexternal ServicesbalavenakatarajuNo ratings yet

- Revenue ProcessDocument17 pagesRevenue ProcessDaniel TadejaNo ratings yet

- 10 Naw To Be Material AccountingDocument24 pages10 Naw To Be Material AccountingsivasivasapNo ratings yet

- Edp 19.02.2014Document15 pagesEdp 19.02.2014nayearNo ratings yet

- Sap MM Im WM Slides Class FourDocument31 pagesSap MM Im WM Slides Class FourMd Saif100% (1)

- Procurement Process Cycle - Procure To Pay ProcessDocument2 pagesProcurement Process Cycle - Procure To Pay Processamaya100100No ratings yet

- Final AccountDocument10 pagesFinal AccountSaket AgarwalNo ratings yet

- Accounts Payable: Oracle Fusion FinancialsDocument20 pagesAccounts Payable: Oracle Fusion Financialsmaha AhmedNo ratings yet

- Country Version India: A Solution That Addresses Statutory RequirementsDocument28 pagesCountry Version India: A Solution That Addresses Statutory RequirementsvaibhavnuNo ratings yet

- P2P CycleDocument22 pagesP2P Cyclemrsreekanthreddy83% (6)

- Topic 4 - Lecture Slides - Part IDocument25 pagesTopic 4 - Lecture Slides - Part INeha LalNo ratings yet

- Solution PKP TutorialDocument6 pagesSolution PKP TutorialMohd HairiNo ratings yet

- Finance Projection 1Document20 pagesFinance Projection 1api-3741610100% (2)

- ADB Guidelines and Procurement ProcessDocument25 pagesADB Guidelines and Procurement ProcessGautamNo ratings yet

- Sales and Collection CycleDocument4 pagesSales and Collection Cycleimpurespirit0% (1)

- AFARevenue RecognitionDocument34 pagesAFARevenue RecognitionRameen ShehzadNo ratings yet

- Finance Department - Accounts Payable - SOPDocument49 pagesFinance Department - Accounts Payable - SOPnitanth80% (20)

- Atlas Accounts Payable User Guide - Day 1Document158 pagesAtlas Accounts Payable User Guide - Day 1Bhupendra KumarNo ratings yet

- Country India LocalizationDocument19 pagesCountry India Localizationmksingh_24No ratings yet

- Purchase To Be Document v.01 16-Dec-13 FinalDocument23 pagesPurchase To Be Document v.01 16-Dec-13 FinalTharmaraj MuralikrishnanNo ratings yet

- Ind-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniDocument42 pagesInd-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniBijay ShresthaNo ratings yet

- Cenvat Credit ConceptsDocument6 pagesCenvat Credit ConceptsVibhor BhatnagarNo ratings yet

- Financial AccountingDocument12 pagesFinancial AccountingValeria MaldonadoNo ratings yet

- Advanced Financial Reporting: RevisionDocument44 pagesAdvanced Financial Reporting: Revisionmy VinayNo ratings yet

- GeM PresentationDocument50 pagesGeM Presentationmahisoftsol1100% (1)

- E ProcurementDocument25 pagesE ProcurementGurpreet BansalNo ratings yet

- Factoring, Bill Discounting, ForfeitingDocument70 pagesFactoring, Bill Discounting, ForfeitingMadhavi Reddy80% (5)

- P2P CycleDocument22 pagesP2P Cyclethiru_oracleNo ratings yet

- Procure To Pay Best PracticesDocument51 pagesProcure To Pay Best PracticesDmitry Borisov100% (1)

- Rev Rec Construction Contracts p35Document37 pagesRev Rec Construction Contracts p35varadu1963No ratings yet

- Chapter 9, 11: Assignment Questions (Ch9) P9-16 (Document2 pagesChapter 9, 11: Assignment Questions (Ch9) P9-16 (Cheung HarveyNo ratings yet

- Procurement Process CycleDocument3 pagesProcurement Process CycleKARISHMAATA2No ratings yet

- The Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Document37 pagesThe Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Shaina Shanee CuevasNo ratings yet

- Sap p2p MM FicoDocument5 pagesSap p2p MM FicoAdaikalam Alexander Rayappa100% (1)

- The Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresDocument40 pagesThe Expenditure Cycle: Part I: Purchases and Cash Disbursements ProceduresstudentresearchonlyNo ratings yet

- FIAPDocument87 pagesFIAPAravind GangaiahNo ratings yet

- Internal Audit: How To Perform Internal Audit of Manufacturing CompaniesDocument19 pagesInternal Audit: How To Perform Internal Audit of Manufacturing CompaniesNilesh MandlikNo ratings yet

- Procure To PayDocument20 pagesProcure To Payfelixdecruz23No ratings yet

- SAP Loans ManagementDocument20 pagesSAP Loans ManagementNyawira Gichuki Mwithi100% (2)

- Nternal Audit of Manufacturing CompaniesDocument3 pagesNternal Audit of Manufacturing CompaniesCanice OkereaforNo ratings yet

- Lecture 15 Vouching of Income and ExpensesDocument26 pagesLecture 15 Vouching of Income and ExpensesHarjot SinghNo ratings yet

- Procurement Process Consists The Following ProcessesDocument3 pagesProcurement Process Consists The Following ProcessesNaresh BabuNo ratings yet

- Cash Flow Statement ReportDocument26 pagesCash Flow Statement ReportasquarerabbitNo ratings yet

- FactoringDocument22 pagesFactoringRaju MahatoNo ratings yet

- ADM3349 - Nov10 2021 Class 8 PayableDocument65 pagesADM3349 - Nov10 2021 Class 8 PayableSnow NguyễnNo ratings yet

- Lease MGMTDocument31 pagesLease MGMTsen2985100% (1)

- Dubai Economy Tourism Business Complaints B2B ServiceDocument4 pagesDubai Economy Tourism Business Complaints B2B Servicelionel ROYALCLUB UAENo ratings yet

- AP Slide DownloadDocument87 pagesAP Slide DownloadNguyen HoaNo ratings yet

- It Explains Various Processes Excise Master: You Can Download Sample 15 Page Document HereDocument3 pagesIt Explains Various Processes Excise Master: You Can Download Sample 15 Page Document Herenbhaskar bhaskarNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Accounting For Share Capital - Minakshi Sahu - 15-RollDocument9 pagesAccounting For Share Capital - Minakshi Sahu - 15-Rollminakshi sahuNo ratings yet

- Jawaban P5-5aDocument2 pagesJawaban P5-5arezky100% (1)

- Accountancy AdjustmentsDocument17 pagesAccountancy AdjustmentsKRISHNA KUMARNo ratings yet

- PCMRP Manual 790Document541 pagesPCMRP Manual 790Diiee Fürstin JojoNo ratings yet

- Notes On Daily TransactionsDocument51 pagesNotes On Daily TransactionsCyndy NgwenNo ratings yet

- Solution To Assign - Prob 3 Home Office, Branch and Agency AccountingDocument4 pagesSolution To Assign - Prob 3 Home Office, Branch and Agency Accountingmhikeedelantar100% (1)

- Home Office and Branch Accounting: Investment in BR (IIB) / Branch Current Account (BCA)Document10 pagesHome Office and Branch Accounting: Investment in BR (IIB) / Branch Current Account (BCA)Jeallaine Llena BautistaNo ratings yet

- Summer Internship Project: Academic Year: 2021-22Document40 pagesSummer Internship Project: Academic Year: 2021-22yashpal PatilNo ratings yet

- Training - Term LoanDocument33 pagesTraining - Term Loancric6688No ratings yet

- Trial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksDocument5 pagesTrial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksPriyanka SharmaNo ratings yet

- Fin622 McqsDocument25 pagesFin622 McqsShrgeel HussainNo ratings yet

- Account Transactions: Rey Fernan RefozarDocument13 pagesAccount Transactions: Rey Fernan RefozarPaula Bautista75% (4)

- ING Format Description MT.940 Customer Statement Message: Usage GuidelineDocument33 pagesING Format Description MT.940 Customer Statement Message: Usage GuidelineTestspotyfireal EsyNo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Ledger Is The Main Book of Accounts. It Is TheDocument9 pagesLedger Is The Main Book of Accounts. It Is Thesmithsahay0% (1)

- Marikina City Audit ReportDocument55 pagesMarikina City Audit ReportArvin F. VillodresNo ratings yet

- Acctg 11-1 Gbs For Week 11Document5 pagesAcctg 11-1 Gbs For Week 11Ynna Gesite0% (1)

- Charge Back BasicsDocument30 pagesCharge Back BasicsBui Xuan PhongNo ratings yet

- CAF1 IntorductiontoAccounting2016 QBDocument173 pagesCAF1 IntorductiontoAccounting2016 QBMuhammad Talha0% (1)

- Financial Accounting 5th Edition Spiceland Solutions ManualDocument35 pagesFinancial Accounting 5th Edition Spiceland Solutions Manualchaseleekftdqeyjgr100% (12)

- Lecture 6 Cash BookDocument9 pagesLecture 6 Cash BookChaudhry F MasoodNo ratings yet

- MBA Accounting For Managers MBA 201 Assignment 2Document2 pagesMBA Accounting For Managers MBA 201 Assignment 2AMIT JANGIR83% (6)

- Financial Accounting CIA-1 (B)Document24 pagesFinancial Accounting CIA-1 (B)EKANSH DANGAYACH 20212619No ratings yet

- Worksheet Dasar-Dasar AkuntansiDocument50 pagesWorksheet Dasar-Dasar AkuntansiSun dusiyahNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- Bidvest Grow Account FeesDocument2 pagesBidvest Grow Account FeesBusinessTechNo ratings yet

- Accounting For Issue of Debentures: M. C. SharmaDocument30 pagesAccounting For Issue of Debentures: M. C. Sharmadivya kalyaniNo ratings yet

- Vision Bank Ada Oklahoma Verifying Debt They Can't HMMDocument18 pagesVision Bank Ada Oklahoma Verifying Debt They Can't HMMJAKEBRAUNING86100% (1)

- Debtors Journal of Olympia Sport and Trade For August 2020DJ 8Document7 pagesDebtors Journal of Olympia Sport and Trade For August 2020DJ 8thokoanebokang00No ratings yet

- Suspense Accounts and Error CorrectionDocument5 pagesSuspense Accounts and Error Correctionludin00No ratings yet