Professional Documents

Culture Documents

Islamic Banking Services

Uploaded by

Omer SaeedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islamic Banking Services

Uploaded by

Omer SaeedCopyright:

Available Formats

Over view

Introduction Emergence of Islamic banking Definition of Islamic banking Modes of finance Services Other Notes

Modern banking system was introduced into the Muslim countries at a time when they were politically and economically at a low ebb, in the late 19th century. The main banks in the home countries of the imperial powers established local branches in the capitals of the subject countries and they catered mainly to the import export requirements of the foreign businesses.

The banks were generally confined to the capital cities and the local population remained largely untouched by the banking system. The local trading community avoided the foreign banks both for nationalistic as well as religious reasons. However, as time went on it became difficult to engage in trade and other activities without making use of commercial banks. Even then many confined their involvement to transaction activities such as current accounts and money transfers.

Borrowing from the banks and depositing their savings with the bank were strictly avoided in order to keep away from dealing in interest which is prohibited by religion. With the passage of time, however, and other socioeconomic forces demanding more involvement in national economic and financial activities, avoiding the interaction with the banks became impossible. Local banks were established on the same lines as the interest-based foreign banks for want of another system and they began to expand within the country bringing the banking system to more local people.

As countries became independent the need to engage in banking activities became unavoidable and urgent. Governments, businesses and individuals began to transact business with the banks, with or without liking it. This state of affairs drew the attention and concern of Muslim intellectuals. The story of interest-free or Islamic banking begins here. In the following paragraphs we will trace this story to date and examine how far and how successfully their concerns have been addressed

Historical development It seems that the history of interest-free banking could be divided into two parts. First, when it still remained an idea; second, when it became a reality -- by private initiative in some countries and by law in others. We will discuss the two periods separately

The last decade has seen a marked decline in the establishment of new Islamic banks and the established banks seem to have failed to live up to the expectations. The literature of the period begins with evaluations and ends with attempts at finding ways and means of correcting and overcoming the problems encountered by the existing banks

What is Islamic Banking? Islamic banking is the conduct of banking based on Shariah principles (Islamic rules on transactions) and does not allow the paying and receiving of interest while promoting profit sharing.

It has exactly the same purpose as conventional banking except that it operates under the rules of Shariah, the law of Islam that covers every aspect of life, based on the holy Quran.

Islamic banks and financial institutions that offer Islamic banking products are required to establish a Shariah advisory committee to advise them on the rules of the Shariah and to ensure that they operate in accordance with the Shariah principles

Modes of financing and services Banks adopt several modes of acquiring assets or financing projects. But they can be broadly categorized into three areas: investment trade and lending.

This is done in the following modes : A. Musharaka where a bank may join another entity to set up a joint venture, both parties participating in the various aspects of the project in varying degrees. Profit and loss are shared in a pre-arranged fashion. This is not very different from the joint venture concept The venture is an independent legal entity and the bank may withdraw gradually after an initial period

B : Mudarabha where the bank contributes the finance and the client provides the expertise, management and labour. Profits are shared by both the partners in a pre-arranged proportion, but when a loss occurs the total loss is borne by the bank.

D: Financing on the basis of an estimated rate of return. Under this scheme, the bank estimates the expected rate of return on the specific project it is asked to finance and provides financing on the understanding that at least that rate is payable to the bank. (Perhaps this rate is negotiable.) If the project ends up in a profit more than the estimated rate the excess goes to the client. If the profit is less than the estimate the bank will accept the lower rate. In case a loss is suffered the bank will take a share in it.

This is also done in several ways. The main ones are: a) Mark-up where the bank buys an item for a client and the client agrees to repay the bank the price and an agreed profit later on. b) Leasing where the bank buys an item for a client and leases it to him for an agreed period and at the end of that period the lessee pays the balance on the price agreed at the beginning an becomes the owner of the item. c) Hire-purchase

where the bank buys an item for the client and hires it to him for an agreed rent and period, and at the end of that period the client automatically becomes the owner of the item. d) Sell-and-buyback where a client sells one of his properties to the bank for an agreed price payable now on condition that he will buy the property back after certain time for an agreed price. e) Letters of credit where the bank guarantees the import of an item using its own funds for a client, on the basis of sharing the profit from the sale of this item or on a mark-up basis.

Main forms of Lending are: A) Loans with a service charge where the bank lends money without interest but they cover their expenses by levying a service charge. This charge may be subject to a maximum set by the authorities. B) No-cost loans where each bank is expected to set aside a part of their funds to grant no-cost loans to needy persons such as small farmers, entrepreneurs, producers, etc. and to needy consumers. c) Overdrafts also are to be provided, subject to a certain maximum, free of charge.

Wadiah (Safekeeping) In Wadiah, a bank is deemed as a keeper and trustee of funds. You deposit your funds in the bank and the bank guarantees refund of the whole amount or any part of the amount when you demand it. The bank may also reward you with hibah (gift) in appreciation for allowing the bank to use your deposited funds. Under conventional banking, Wadiah is applicable to your savings or current account while hibah would be the interest earned on these accounts.

Mudharabah (Profit Sharing) Mudharabah is an agreement between you and the bank where the bank allows you to mobilize its funds for your business activities. If there is any profit resulting from the venture, it is shared with the bank while any losses are borne by you. Under conventional banking, Mudharabah is applicable to your savings, current or investment accounts as well as deposit instruments, share and unit trust financing.

Musharakah (Joint Venture) Musharakah is a joint venture agreement between you and the bank where profits and losses are both shared in accordance with the terms of the agreement. Under conventional banking, it is applicable to share or unit trust financing and letters of credit.

According to this concept, a financier and his client participate either in the joint ownership of a property or an equipment, or in a joint commercial enterprise. The share of the financier is further divided into a number of units and it is understood that the client will purchase the units of the share of the financier one by one periodically, thus increasing his own share till all the units of the financier are purchased by him so as to make him the sole owner of the property, or the commercial enterprise, as the case may be.

Murabahah (Cost Plus) Murabahah is the selling of goods at an agreed price and at an agreed profit margin between the bank and you Under conventional banking, it is applicable to a cash line facility, working capital financing, letters of credit and accepted bills.

Salam is a sales contract in which the price is paid in advance at the time of contracting ,against delivery of the purchased goods/services at a specified future date. Note every commodity is suitable for a salam contract. It is usually applied only to fungible commodities

Al- Istisna a contract in which a party orders another to manufacture and provide a commodity , the description of which , delivery date, price and payment date are all set in the contract . According to a decision of the OIC fiqh Academy, this type of contract is of a binding nature , and the payment of price could be deferred.

Bai Bithaman Ajil (Deferred Payment Sale) This is the selling of goods on a deferred payment basis at a price which includes a profit margin agreed to by the bank and you. Under conventional banking, Bai Bithaman Ajil is applicable to a negotiable debt certificate, home or property financing, share or unit trust financing, Umrah (Muslim pilgrimage to Mecca) and visitation financing.

Wakalah (Agency) Wakalah is when you appoint your bank to undertake transactions on your behalf just as your bank acts for you when issuing letters of credit in trade financing.

Qardhul Hassan (Benvolent Loan) Qardhul Hassan is when your bank extends you a loan based on goodwill and you are only required to repay the amount borrowed. However, you may at your discretion pay more to your bank as a token of appreciation.

The subject matter in leasing contract is the usufruct generated over time by an asset, such as machinery, air planes, ships or trains. This usufruct is sold to the lessee at a predetermined price. The lessor retains the owner ship of the asset with all the rights and as well as the responsibilities that go with owner ship .

Ijarah Thumma Al Bai (Hire Purchase) There are two contracts under this hire purchase principle. The first is the Ijarah contract (leasing/renting) when you enter into an agreement with your bank to lease the car from the bank at an agreed rental and time frame. When the leasing period ends, the Bai (purchase) contract takes effect which enables you to purchase the car at an agreed price

Hibah (Gift) A token given voluntarily in return for a loan received or benefit obtained.

Ujr (Fee) All other banking services are based on the Ijr principle which are fee-based services such as stockbroking, telegraphic transfers, travelers checks, ATM services and telebanking. Islamic Banking Rates For savings, current and deposit accounts hibah (gift) is paid at the discretion of the banks should there be any profit from utilization of your deposited funds

Finance asset-backed interest-free bond in Islamic financing, the equivalent of a bond, which represents undivided shares in ownership of tangible assets. Under Islamic law it cannot earn interest.

Generally the approximate rate for savings and deposit accounts is 2.2% while for current accounts it is1%. For fixed deposit accounts it ranges from about 2.6% for one month to about 4.2% for 60 months. Home financing rates would depend on whether yours is a new or completed house.

For a new house the financing rate ranges from about 2.8% in the first year to about 7.75% after the fifth year. For a completed house the financing rate ranges from about 3.8% in the first year to about 7.75% after the fifth year.

Some key services offered by Islamic banks are: money transfers and remittance of funds via(Telegraphic transfer) lending and borrowing trade in foreign currencies at spot rate provision of intermediation facilities bill of exchange letter of credit Accepting of deposits

Issuance of credit and debit cards Issuance of guarantees, securities etc. Issuance of cheques or travel cheques ATM(Aatomated Teller Machine) Provision of researches, sustainability studies, consultations and advices Mail Telephone banking Online banking

Mobile banking Video banking Safekeeping of documents and other items in safe deposit boxes. where the banks own money is not involved are provided on a commission or charges basis.

In the previous section we listed the current practices under three categories: deposits, modes of financing (or acquiring assets) and services. There seems to be no problems as far as banking services are concerned

Islamic banks are able to provide nearly all the services that are available in the conventional banks. The only exception seems to be in the case of letters of credit where there is a possibility for interest involvement. However some solutions have been found for this problem -- mainly by having excess liquidity with the foreign bank.

On the deposit side, judging by the volume of deposits both in the countries where both systems are available and in countries where law prohibits any dealing in interest, the nonpayment of interest on deposit accounts seems to be no serious problem. Customers still seem to deposit their money with interest-free banks.

The main problem, both for the banks and for the customers, seem to be in the area of financing. Bank lending is still practised but that is limited to either no-cost loans (mainly consumer loans) including overdrafts, or loans with service charges only. Both these types of loans bring no income to the banks and therefore naturally they are not that keen to engage in this activity much

That leaves us with investment financing and trade financing. Islamic banks are expected to engage in these activities only on a profit and loss sharing (PLS) basis. This is where the banks main income is to come from and this is also from where the investment account holders are expected to derive their profits from.

And the latter is supposed to be the incentive for people to deposit their money with the Islamic banks. And it is precisely in this PLS scheme that the main problems of the Islamic banks lie. Therefore we will look at this system more carefully in the following section.

This body (AAOIFI )was established after an agreement signed by various Islamic financial institutions on 26 February 1990 and was registered in Bahrain as an international autonomous non-profit making corporate body on 27 March 1991. At that time local country accounting standards were not well established in the Middle East and a need was clearly felt for the establishment of accounting standards for Islamic financial institutions that would be harmonized across countries. AAOIFI has also established a Shariah Board which is highly respected, and is probably the leading global setter of Islamic finance Shariah standards. However the organization's name clearly indicates

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hypothetical Development Approach CalculationDocument6 pagesHypothetical Development Approach CalculationVernon BacangNo ratings yet

- ECO AssignmentDocument2 pagesECO AssignmentChin-Chin AbejarNo ratings yet

- NINJA Notes - Individual TaxationDocument26 pagesNINJA Notes - Individual TaxationMahesh Toppae100% (1)

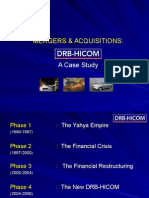

- M&a - DrbhicomDocument68 pagesM&a - DrbhicomOkay325No ratings yet

- Module 5Document3 pagesModule 5RyuddaenNo ratings yet

- Generic Attorney Demand LetterDocument5 pagesGeneric Attorney Demand Letterresearcher3No ratings yet

- ProjectDocument11 pagesProjectKrizia Mae LoricaNo ratings yet

- Marriot Corp. - Cost of CapitalDocument6 pagesMarriot Corp. - Cost of Capitalone990scribdNo ratings yet

- A Report On Indian Infrastructure SectorDocument16 pagesA Report On Indian Infrastructure SectorhsinghaNo ratings yet

- Extra Problems On BondsDocument1 pageExtra Problems On BondsTausique SheikhNo ratings yet

- Fiscal Risks: Sources, Disclosure and ManagemenDocument35 pagesFiscal Risks: Sources, Disclosure and ManagemenInternational Consortium on Governmental Financial ManagementNo ratings yet

- Inv Lectures FinalsDocument5 pagesInv Lectures FinalsShiela Mae Gabrielle AladoNo ratings yet

- Reliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment PlanDocument24 pagesReliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment Planpuneetk20No ratings yet

- Case Studies On Financial MarketsDocument7 pagesCase Studies On Financial Marketsibscdc67% (3)

- Kisan Credit CardDocument6 pagesKisan Credit CardAshok RathodNo ratings yet

- Unit 3-Financial Statement AnalysisDocument55 pagesUnit 3-Financial Statement AnalysisGizaw BelayNo ratings yet

- Sample For Solution Manual Economics Global Edition by Daron Acemoglu & David LaibsonDocument14 pagesSample For Solution Manual Economics Global Edition by Daron Acemoglu & David LaibsonmunamboutiqueNo ratings yet

- Description: Tags: 03session11Document74 pagesDescription: Tags: 03session11anon-535931No ratings yet

- Cost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Document42 pagesCost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Yugapreetha R100% (1)

- Chapter 10 1Document40 pagesChapter 10 1William Masterson Shah0% (1)

- Spontaneous FinancingDocument3 pagesSpontaneous Financingmohi80% (1)

- Simple Loan Amortization TemplateDocument5 pagesSimple Loan Amortization TemplateGíRì BháRàťNo ratings yet

- Partnership Calculator and Answer 23 - 24Document6 pagesPartnership Calculator and Answer 23 - 24Sheikh NaumanNo ratings yet

- Summary of Account Activity Payment Information: TD Cash Visa Secured CardDocument4 pagesSummary of Account Activity Payment Information: TD Cash Visa Secured CardSaphyrusNo ratings yet

- CFP Quation PaperDocument3 pagesCFP Quation PaperHassan AliNo ratings yet

- Sample Financial PlanDocument45 pagesSample Financial PlanAmit Kumar Gupta100% (1)

- Tax Deducted at SourceDocument37 pagesTax Deducted at SourceasanjeevaNo ratings yet

- Vehicle Loan ProjectDocument99 pagesVehicle Loan ProjectAnkit Vardhan68% (37)

- Mcq-Fundamental of Partnership (Part 6)Document12 pagesMcq-Fundamental of Partnership (Part 6)Sanchit GargNo ratings yet

- Data InterpretationDocument11 pagesData InterpretationJan Ellard CruzNo ratings yet