Professional Documents

Culture Documents

Bull & Bear Spread Strategy

Uploaded by

dexter80880 ratings0% found this document useful (0 votes)

338 views6 pagesThis document outlines four spread strategies:

1) Bull call spread involves buying an ITM call and selling an OTM call on the same underlying asset.

2) Bull put spread involves buying a lower strike put and selling a higher strike put, generating a credit.

3) Bear call spread involves buying an OTM call and selling an ITM call, creating a net debit.

4) Bear put spread involves buying a higher strike put and selling a lower strike put, also resulting in a net debit.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines four spread strategies:

1) Bull call spread involves buying an ITM call and selling an OTM call on the same underlying asset.

2) Bull put spread involves buying a lower strike put and selling a higher strike put, generating a credit.

3) Bear call spread involves buying an OTM call and selling an ITM call, creating a net debit.

4) Bear put spread involves buying a higher strike put and selling a lower strike put, also resulting in a net debit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

338 views6 pagesBull & Bear Spread Strategy

Uploaded by

dexter8088This document outlines four spread strategies:

1) Bull call spread involves buying an ITM call and selling an OTM call on the same underlying asset.

2) Bull put spread involves buying a lower strike put and selling a higher strike put, generating a credit.

3) Bear call spread involves buying an OTM call and selling an ITM call, creating a net debit.

4) Bear put spread involves buying a higher strike put and selling a lower strike put, also resulting in a net debit.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

BULL SPREAD STRATEGY

BULL CALL SPREAD STRATEGY

A bull call spread is constructed by buying an in-the-money (ITM) call option, and selling another out-of-the-money (OTM) call option. Often the call with the lower strike price will be in-the-money while the Call with the higher strike price is out-of-the-money. Both calls must have the same underlying security and expiration month.

BULL PUT SPREAD STRATEGY

A bull put spread can be profitable when the stock / index is either range bound or rising. The concept is to protect the downside of a Put sold by buying a lower strike Put, which acts as an insurance for the Put sold. The lower strike Put purchased is further OTM than the higher strike Put sold ensuring that the investor receives a net credit, because the Put purchased (further OTM) is cheaper than the Put sold. This strategy is equivalent to the Bull Call Spread but is done to earn a net credit (premium) and collect an income.

BEAR SPREAD STRATEGY

BEAR CALL SPREAD STRATEGY

The strategy requires the investor to buy out-of-the-money (OTM) call options while simultaneously selling in-the-money (ITM) call options on the same underlying stock index. This strategy can also be done with both OTM calls with the Call purchased being higher OTM strike than the Call sold.

BEAR PUT SPREAD STRATEGY

This strategy requires the investor to buy an in-the-money (higher) put option and sell an out-of-the-money (lower) put option on the same stock with the same expiration date. This strategy creates a net debit for the investor.

Bull Call Spread Strategy

Buy ITM Call Option & Sell OTM Call Option

Nifty Bank Buy ITM Call Option Premium Current Value (02/01/2012) Strike Price Paid 8009 7800 414.40 8200 194.85 219.55 9856.6 4511.25

Sell OTM Call Option Strike Price Premium Receive Net Premium Paid Option expire Net Profit 25/01/2012 180.45*25

Bull Put Spread Strategy

Buy Put Option (At Low Strike) & Sell Put Option (At High Strike)

Nifty Bank Buy Put Option Premium Sell Put Option Premium Current Value (02/01/2012) Strike Price Paid Strike Price Receive Net Premium Receive Option expire Net Profit 25/01/2012 51.15*25 8009 7600 150 7800 201.15 51.15 9856.6 1278.75

Bear Call Spread Strategy

Buy ITM Call Option & Sell OTM Call Option

Nifty Bank Current Value (21/02/2012) 11170.4 11300 419.35 11000 556.55 137.2 9927.65 3430

Buy OTM Call Option Strike Price Premium Sell ITM Call Option Premium Paid Strike Price Receive Net Premium Receive Option expire Net Profit 29/03/2012 137.2*25

Bear Put Spread Strategy

Buy Put Option (At High Strike) & Sell Put Option (At Low Strike)

Nifty Bank Buy Put Option Premium Sell Put Option Premium Current Value (21/02/2012) Strike Price Paid Strike Price Receive Net Premium Paid Option expire Net Profit 29/03/2012 63.65*25 11170.4 11300 431.50 11200 395.15 36.35 9927.65 1591.25

You might also like

- Bullish (Green) Candle Bearish (RED) Candle Upper Shadow Real BodyDocument20 pagesBullish (Green) Candle Bearish (RED) Candle Upper Shadow Real Bodysantosh kumariNo ratings yet

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument19 pagesCall OI Strike Put OI Call Value Put Value Total StrikejitendrasutarNo ratings yet

- Piyush PPT of ZRAMDocument16 pagesPiyush PPT of ZRAMPiyush SharmaNo ratings yet

- Risk Management & Journal For Options Trading - 021726Document9 pagesRisk Management & Journal For Options Trading - 021726Aanindya ChoudhuryNo ratings yet

- A19 NotesDocument1 pageA19 NotesRavi SinghNo ratings yet

- Nifty Options (Positional) Delta HedgingDocument4 pagesNifty Options (Positional) Delta HedgingsachinNo ratings yet

- Option Chain-27-01-2022Document11 pagesOption Chain-27-01-2022vpritNo ratings yet

- Trade Like A Pro 3.0Document10 pagesTrade Like A Pro 3.0suryasahoo2024No ratings yet

- How To Catch BlockbusterstocksDocument12 pagesHow To Catch Blockbusterstocksdr.kabirdev100% (1)

- Technical Webinar 6 - Analyst Rajendra - (23-Aug-2020)Document46 pagesTechnical Webinar 6 - Analyst Rajendra - (23-Aug-2020)RajanmanuVarada0% (1)

- A Trading System Which Mostly Works!!Document2 pagesA Trading System Which Mostly Works!!SPIMYSNo ratings yet

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083No ratings yet

- OptionTradingStrategy-July 31 BankNiftyDocument3 pagesOptionTradingStrategy-July 31 BankNiftyShekharNo ratings yet

- Understanding Forwards & OptionsDocument39 pagesUnderstanding Forwards & OptionsSameerNo ratings yet

- Put Call RatioDocument3 pagesPut Call Ratiobhavnesh_muthaNo ratings yet

- Derivative StrategyDocument1 pageDerivative StrategyvadlapatisNo ratings yet

- WINNING Option Trading Strategies For Volatile MarketDocument4 pagesWINNING Option Trading Strategies For Volatile MarketDaknik CutieTVNo ratings yet

- Finc361 - Lecture - 05 - Stock Valuation - Continued PDFDocument38 pagesFinc361 - Lecture - 05 - Stock Valuation - Continued PDFLondonFencer2012No ratings yet

- Master Speci C Skills: Ironed Collar Options Strategy (With Recorded Q&A)Document3 pagesMaster Speci C Skills: Ironed Collar Options Strategy (With Recorded Q&A)AKASH MUKHERJEE0% (1)

- Analysis of Implied Volatility With Changes in Option PriceDocument31 pagesAnalysis of Implied Volatility With Changes in Option PricePrathmesh HiremathNo ratings yet

- Upper Circuit Technical Indicator WarfareDocument16 pagesUpper Circuit Technical Indicator WarfareBiswambhar Ghosh100% (1)

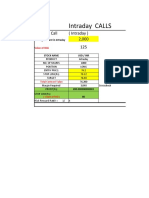

- Intraday CALLS: For Long Call (Intraday) 2,000 125Document12 pagesIntraday CALLS: For Long Call (Intraday) 2,000 125DNYANESH MASKENo ratings yet

- COMM 308 OptionsDocument8 pagesCOMM 308 Optionsadcyechicon123No ratings yet

- Student Trading Guide - IntroductionDocument39 pagesStudent Trading Guide - IntroductionB.R SinghNo ratings yet

- Forward: Muhammad The Prophet of IslamDocument17 pagesForward: Muhammad The Prophet of IslamSajid QureshiNo ratings yet

- Akshay Padman: Career ProfileDocument2 pagesAkshay Padman: Career ProfileakshayNo ratings yet

- Central Pivot Range (CPR)Document10 pagesCentral Pivot Range (CPR)Jaideep PoddarNo ratings yet

- Banknifty StrategyDocument3 pagesBanknifty Strategyashish10mca93940% (1)

- Stocks: Fundamental Analysis: Sample Investing PlanDocument5 pagesStocks: Fundamental Analysis: Sample Investing PlanNakibNo ratings yet

- FMI - Module IV On Derivatives (Options)Document85 pagesFMI - Module IV On Derivatives (Options)Utkrisht SethiNo ratings yet

- Day 1Document28 pagesDay 1CHENAB WEST100% (1)

- Ema TradingDocument16 pagesEma TradingMR. INDIAN VILLAINNo ratings yet

- Value Hunt - 07 May 2009Document3 pagesValue Hunt - 07 May 2009dhanan12No ratings yet

- DAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFDocument4 pagesDAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFtummalaajaybabuNo ratings yet

- Introduction To Currency Markets: by DVKDocument74 pagesIntroduction To Currency Markets: by DVKSaubhagya Suri100% (1)

- 2 Hedging With FUTURESDocument27 pages2 Hedging With FUTURESAlexandra-Nicoleta MateescuNo ratings yet

- Hedging Breakeven CalculatorDocument11 pagesHedging Breakeven CalculatorjitendrasutarNo ratings yet

- TTC Workshop Brochure With FeeDocument4 pagesTTC Workshop Brochure With Feesiddheshpatole153No ratings yet

- 16.volatility Calculation (Historical) - Zerodha VarsityDocument24 pages16.volatility Calculation (Historical) - Zerodha Varsityravi4paperNo ratings yet

- Free Investor CampDocument31 pagesFree Investor CampRudramurthy Bv0% (1)

- ShShort Straddle StrategyDocument6 pagesShShort Straddle StrategyDeepak RanaNo ratings yet

- Limit Order Books: Ren e CarmonaDocument38 pagesLimit Order Books: Ren e Carmonadheeraj8rNo ratings yet

- Nifty Put Call Ratio Nifty Option Chain NiftyDocument1 pageNifty Put Call Ratio Nifty Option Chain NiftySwapnil JadhavNo ratings yet

- What To Expect From 9th MentoringDocument27 pagesWhat To Expect From 9th Mentoringgurukarthick_dbaNo ratings yet

- Chapter Eighteen Technical AnalysisDocument19 pagesChapter Eighteen Technical Analysisfaisalshaikh34No ratings yet

- Options Stratergies Payoff ChartDocument2 pagesOptions Stratergies Payoff ChartAbhijit ButalaNo ratings yet

- Trading ManualDocument12 pagesTrading ManualMatthew MalliaNo ratings yet

- IT CircularDocument65 pagesIT Circularnavdeepsingh.india8849100% (2)

- Day2 1Document111 pagesDay2 1Antariksh ShahwalNo ratings yet

- Nifty MasterDocument35 pagesNifty MasterAshok Singh BhatiNo ratings yet

- Bollinger Bands and 200 EMA - StradegyDocument1 pageBollinger Bands and 200 EMA - StradegyccnxcessNo ratings yet

- Vijay ThakkarDocument41 pagesVijay Thakkarfixemi0% (1)

- Trading Course DetailsDocument3 pagesTrading Course DetailsBotiyo0% (1)

- Trend Equation: Investopedia SaysDocument3 pagesTrend Equation: Investopedia SaysMahesh SavaliyaNo ratings yet

- Face 2 Face V2.1Document35 pagesFace 2 Face V2.1Srinivas RNo ratings yet

- Derivatives ISFMDocument126 pagesDerivatives ISFMISFM, Stock Market SchoolNo ratings yet

- Option Trading Staretegy PDFDocument73 pagesOption Trading Staretegy PDFAtul JainNo ratings yet

- Option SpreadsDocument28 pagesOption Spreadsjim12567% (3)

- Video 12 - Bull Call Spread Strategy - UsefulDocument4 pagesVideo 12 - Bull Call Spread Strategy - Usefulshalomhanyane9No ratings yet

- Option Strategies: By: Prashant Sharma Vasu KannaDocument39 pagesOption Strategies: By: Prashant Sharma Vasu KannaNihar ShahNo ratings yet

- 9 Final Quiz 2 Comprehensive Prob SpecialjournalDocument3 pages9 Final Quiz 2 Comprehensive Prob SpecialjournalPalma, Dalton John A.No ratings yet

- Creating and Measuring Shareholder WealthDocument4 pagesCreating and Measuring Shareholder WealthMANSINo ratings yet

- Entrep (Banana Cake Business)Document4 pagesEntrep (Banana Cake Business)Marjhon Maniego MascardoNo ratings yet

- Anasco, Act6 EcoDocument6 pagesAnasco, Act6 EcoDolph Allyn AñascoNo ratings yet

- Konkan RailwayDocument20 pagesKonkan Railwayashutosh1202No ratings yet

- Macroeconomics & National IncomeDocument20 pagesMacroeconomics & National Incomesd0324No ratings yet

- 2 MarksDocument49 pages2 MarksPadmini SelvarajNo ratings yet

- PWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFDocument16 pagesPWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFSanath Fernando100% (1)

- Exercise-5 - Genta Yusuf Madhani - 1201174352 PDFDocument17 pagesExercise-5 - Genta Yusuf Madhani - 1201174352 PDFGentaYusufMadhaniNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- NEW - English MarketPeak Presentation 2021 + DeFiDocument43 pagesNEW - English MarketPeak Presentation 2021 + DeFiClaudiuNo ratings yet

- Badla (Stock Trading)Document2 pagesBadla (Stock Trading)BOBBY212No ratings yet

- #Pvofguaranteedpaymentof10,000In5Years: PV PVDocument7 pages#Pvofguaranteedpaymentof10,000In5Years: PV PVL.E.O.ZNo ratings yet

- HC 4.3: Financial Services: Merchant Banking and UnderwritingDocument14 pagesHC 4.3: Financial Services: Merchant Banking and UnderwritingAishwaryaNo ratings yet

- AdaDocument8 pagesAdaperapericprcasNo ratings yet

- Olympus 1Document22 pagesOlympus 1Preemnath KatareNo ratings yet

- Consensus Global GovaernanceDocument18 pagesConsensus Global GovaernancepalestallarNo ratings yet

- MasDocument3 pagesMaschowchow123No ratings yet

- Final PROJECT REPORT On MF 1Document62 pagesFinal PROJECT REPORT On MF 1SSONI2No ratings yet

- Specialty Packages To Super Bowl XLVDocument4 pagesSpecialty Packages To Super Bowl XLVsblaskovichNo ratings yet

- Module 2 - Slide PresentationDocument10 pagesModule 2 - Slide PresentationJovan SsenkandwaNo ratings yet

- L&T Finance HoldingsDocument302 pagesL&T Finance HoldingsReTHINK INDIANo ratings yet

- CSC-AE10-GBERMIC-Module 2Document6 pagesCSC-AE10-GBERMIC-Module 2Marjorie Rose GuarinoNo ratings yet

- Demand and Supply in Relation To The Prices of Basic CommoditiesDocument21 pagesDemand and Supply in Relation To The Prices of Basic CommoditiesSheilaMarieAnnMagcalasNo ratings yet

- Electracash's BankruptcyDocument70 pagesElectracash's BankruptcyhyenadogNo ratings yet

- (Leland Yeager) The Fluttering VeilDocument465 pages(Leland Yeager) The Fluttering Veilvkozaeva100% (1)

- Accenture CFO Research Global PDFDocument47 pagesAccenture CFO Research Global PDFDeepak SharmaNo ratings yet

- Test 1 Review ProblemsDocument3 pagesTest 1 Review ProblemsYesen HangNo ratings yet

- Module 3 EXTRA SolutionsDocument17 pagesModule 3 EXTRA SolutionsJeff MercerNo ratings yet

- Audit 2 - Concept Map For InvestmentsDocument4 pagesAudit 2 - Concept Map For InvestmentsPrecious Recede100% (1)