Professional Documents

Culture Documents

6 Financial Reports

Uploaded by

Saddamix AL OmariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Financial Reports

Uploaded by

Saddamix AL OmariCopyright:

Available Formats

Qais Alefan

B.Pharm, R.Ph., M.Pharm, PhD

Accounting is a service activity, whose function is to provide quantitative information, primarily financial in nature, about economic entities that is intended to be useful in making economic decisions Accounting provides the framework for critical decisionmaking processes essential for the organization success Accounting is the dynamic process which determine and report how corporations and individuals finance their activities and use their money

A major use of accounting is to track the flow of money (cash or credit) between financing and investing activities

Understanding financial reports is essential to understanding the flow of money

If your goal is to operate a taxicab, you need to obtain a car. The car is an asset

Assets are things that a business owns & used to generate income Obtaining the money needed to acquire an asset requires financing Financing may come from a combination of personal savings, gifts, a bank loan, or even money borrowed from friends and relatives These sources of financing can be further classified as liabilities (money owed to others) and owners equity (owners own funds)

If you paid $25,000 for the car, the value of your asset is recorded as $25,000 Now lets say that you financed this asset by putting up $10,000 of your own money and getting a $15,000 from your bank

In accounting language, this investment in the asset ($25,000 for the car) is financed by owners equity ($10,000) and a liability ($15,000)

This brings us to the most important rule in accounting, often referred to as the accounting equation: Assets = owners equity + liabilities

Accounting principles are essential tools that can be applied in all areas of pharmacy practice This is so because any pharmacy engages in three fundamental activities:

Obtaining financing Making investments Conducting a profitable operation

To start a business, one needs to acquire assets Financing activities to acquire assets involve obtaining funds from owners and creditors When owners fund the activities of a corporation, they become shareholders Shareholders have a claim on the companys assets, and their investments in the company are rewarded by either:

regular distributions from the company to the owners (also known as dividends) an increase in the value of companys total assets owing to profitable operations

Creditors provide funds to the company but do not receive dividends They require the company to repay the funds with interest over a period of time

The types of investments a company makes depend on the type of business it is conducting In pharmacy settings, funds are invested in acquisition of inventory, computer software and hardware, robotics, buildings, and land Acquiring the resources necessary to employ the appropriate number of pharmacists, pharmacy technicians, and other staff also can be viewed as an investment activity

The operating activities of pharmacy settings include:

Purchasing distribution (i.e., prescription-filling activities) clinical activities administration

In many pharmacies, marketing is also a significant operation activity, in that it is required so that others can learn of the goods and services that the pharmacy offers

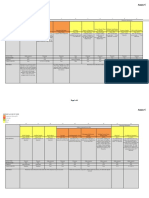

There are three types of financial statements that are essential to the operations of any organization The fiscal year is a unit of time -a year- that businesses use to record their financial interactions A fiscal year can start on January 1 and end on December 31, or on other date and end 1 year later The three financial reports that are essential to the operation of any organization are

the balance sheet the income statement the statement of cash flows

Provides a snapshot of an organizations assets, liabilities, and shareholder equity at any particular point in time Organizations generally prepare a balance sheet at the end of a fiscal year, or at any point in time The balance sheets total assets must equal the total liabilities plus shareholders equity at all times

Provides information about money coming into an organization (income) and money necessary to obtain that income (expenses) The difference between income and expenses is referred to as net income, net profit, or earnings Tells what happens to an organization over a period of time

Records the inflows and outflows of cash throughout the fiscal year These recorded values generally fall into three categories: operating, investing, and financing

The last line in the statement of cash flows, indicating the amount of cash available at the end of a fiscal year, is always the same as the amount of cash recorded on the balance sheet for the beginning of the following fiscal year

Examine an organizations financial performance & success Net income/average total assets, provide useful information on the profitability Data are taken from the balance sheet and income statement for calculating most ratios

Measure the overall financial success of a company

The most commonly used are the gross profit margin and the net profit margin

Gross profit margin = (sales - cost of goods sold) total sales

Provides information on the companys ability to generate gross profits

Higher gross profit margin ratios are desirable because they indicate the availability of funds for the companys other expenses

Net profit margin = net income (after taxes) total sales Indicates the fraction of net profit that is generated for every dollar of sales Return on assets (ROA) = net income average total assets Provides information on the companys ability to generate profits using the companys assets

Effective use of assets results in a high ROA ratio

Return on equity (ROE) = net income average owners equity Also known as return on investment (ROI), is a measure of how well the company can make profits from funds provided by owners or investors High ROE levels are desirable because investors are interested in maximizing their profits

Assess the businesss ability to meet its short-term financial obligations Current ratio = current assets current liabilities A high current ratio means fewer risks in meeting financial obligations

An alternative ratio is the quick ratio (known as the acid test)

Quick assets: assets that are easily converted to cash Provides a better picture of a companys liquidity and its ability to meet its financial obligations Quick ratio = (current assets - inventories - prepaid expenses) current liabilities

Measure the efficiency with which an organization uses its assets Inventory turnover ratio = cost of goods sold average inventory Measures how quickly an organizations inventories are sold The data for this ratio come from two different financial statements Cost of goods sold (COGS) is found on the income statement, and the average inventory comes from the balance sheet Remember that one can achieve a high inventory ratio by keeping a very small inventory

Receivables turnover ratio = credit sales average accounts receivable Measures how quickly receivables (money owed to the organization by others) are turned into cash If you divide the receivable turnover ratio by 365, you will have a ratio known as the average collection period The average collection period indicates the number of days (on average) that credit sales remain in accounts receivable before they are collected

Familiarity with basic accounting concepts and preparation of financial reports is essential knowledge for every pharmacist The financial success of any organization depends on proper management of its funds Those who understand how organizations finance operations, generate revenue, and allocate financial resources will have easier task understanding many of the factors that affect their success

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Violation of The Truth Lending Act, Sample ComplaintDocument12 pagesViolation of The Truth Lending Act, Sample ComplaintShan KhingNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- UCC-House Joint Resolution 192, Chapter 49 - 05.06.1933Document2 pagesUCC-House Joint Resolution 192, Chapter 49 - 05.06.1933Bálint FodorNo ratings yet

- LU3 Applications of Linear FunctionsDocument28 pagesLU3 Applications of Linear Functionssuethui lauNo ratings yet

- Rakesh Jhunjhunwala Latest Portfolio HoldingsDocument3 pagesRakesh Jhunjhunwala Latest Portfolio HoldingsAshish YadavNo ratings yet

- A History of Interest and DebtDocument152 pagesA History of Interest and DebtM Alif IchsanNo ratings yet

- 8 Risk Management in Contemporary Pharmacy PracticeDocument36 pages8 Risk Management in Contemporary Pharmacy PracticeSaddamix AL Omari75% (16)

- CARDTEK Ocean Payment Processing SolutionDocument39 pagesCARDTEK Ocean Payment Processing SolutionDaud SuleimanNo ratings yet

- Chapter 16, Online Banking and Investing: OutlineDocument42 pagesChapter 16, Online Banking and Investing: Outlinemanojbhatia1220No ratings yet

- Performing Key Bookkeeping TasksDocument15 pagesPerforming Key Bookkeeping TasksNicole Ann Blando BaroniaNo ratings yet

- Peptic Ulcer Disease: Mashehabat@just - Edu.joDocument46 pagesPeptic Ulcer Disease: Mashehabat@just - Edu.joSaddamix AL Omari100% (1)

- Adrenal Cortex: - Divided Into Three Zones - Zona Glomerulosa (Outer Layer) ProducesDocument25 pagesAdrenal Cortex: - Divided Into Three Zones - Zona Glomerulosa (Outer Layer) ProducesSaddamix AL OmariNo ratings yet

- Renal PathologyDocument31 pagesRenal PathologySaddamix AL OmariNo ratings yet

- Disorders of The Thyroid1Document22 pagesDisorders of The Thyroid1Saddamix AL OmariNo ratings yet

- The Gonadal Hormones & InhibitorsDocument41 pagesThe Gonadal Hormones & InhibitorsSaddamix AL OmariNo ratings yet

- Pancreatic Hormones & Antidiabetic DrugsDocument41 pagesPancreatic Hormones & Antidiabetic DrugsSaddamix AL OmariNo ratings yet

- Adrenocorticosteroids & Adrenocortical AntagonistsDocument34 pagesAdrenocorticosteroids & Adrenocortical AntagonistsSaddamix AL OmariNo ratings yet

- The Basal Ganglia Mashehabat@just - Edu.joDocument62 pagesThe Basal Ganglia Mashehabat@just - Edu.joSaddamix AL OmariNo ratings yet

- Endocrine SystemDocument39 pagesEndocrine SystemSaddamix AL OmariNo ratings yet

- Antiparasitic Medications: Dr. Meera Ababneh, Pharm.D, PHDDocument39 pagesAntiparasitic Medications: Dr. Meera Ababneh, Pharm.D, PHDSaddamix AL OmariNo ratings yet

- Hypertension: Prepared by DR - Mustafa AlshehabatDocument25 pagesHypertension: Prepared by DR - Mustafa AlshehabatSaddamix AL OmariNo ratings yet

- Drugs Affecting The Cardiovascular System: Mashehabat@just - Edu.joDocument24 pagesDrugs Affecting The Cardiovascular System: Mashehabat@just - Edu.joSaddamix AL OmariNo ratings yet

- Epilepsy in Adults A Basic IntroductionDocument40 pagesEpilepsy in Adults A Basic IntroductionSaddamix AL OmariNo ratings yet

- Diabetes Mellitus: Dr. Othman Al-Shboul Department of PhysiologyDocument28 pagesDiabetes Mellitus: Dr. Othman Al-Shboul Department of PhysiologySaddamix AL OmariNo ratings yet

- 4 Human Resources Management FunctionsDocument45 pages4 Human Resources Management FunctionsSaddamix AL Omari60% (5)

- Principles of Healthcare EthicsDocument15 pagesPrinciples of Healthcare EthicsSaddamix AL OmariNo ratings yet

- Pharmaceutical Care: Qais AlefanDocument18 pagesPharmaceutical Care: Qais AlefanSaddamix AL OmariNo ratings yet

- Winter 2007 Midterm With SolutionsDocument13 pagesWinter 2007 Midterm With Solutionsupload55No ratings yet

- Review Questions - Corporate Finance 58.51Document17 pagesReview Questions - Corporate Finance 58.51Đỗ Tuấn An100% (1)

- Pdic Ri 2021-01 Annex CDocument4 pagesPdic Ri 2021-01 Annex ChohoDanielleXDXSNo ratings yet

- Payroll PDFDocument7 pagesPayroll PDFtylerNo ratings yet

- Sicure: Use Font Devlys 010Document8 pagesSicure: Use Font Devlys 010jay3377No ratings yet

- Rudra Vahini FoundationDocument14 pagesRudra Vahini FoundationBhim BhardwajNo ratings yet

- Cma Data 2Document16 pagesCma Data 2rubhakarNo ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- GmailDocument4 pagesGmailmoNo ratings yet

- Money Vocabulary: Term MeaningDocument6 pagesMoney Vocabulary: Term MeaningNadiaKasimNo ratings yet

- Gold Investment Guide Gold Investment Guide: CollectionDocument4 pagesGold Investment Guide Gold Investment Guide: Collectiondanish_kabeerNo ratings yet

- 31 Life Cycle of A TradeDocument45 pages31 Life Cycle of A TradeSaurabh SumanNo ratings yet

- STMT Sfa BookDocument1 pageSTMT Sfa BookTinayeshe TshumahmutingwendeNo ratings yet

- Public Prosecutor V Phua Keng TongDocument2 pagesPublic Prosecutor V Phua Keng TongPhilip TanNo ratings yet

- Summer Internship Project ReportDocument42 pagesSummer Internship Project ReportTarun Bhatia50% (2)

- Robert Campbell and Carol Morris Are Senior Vice Presidents ofDocument2 pagesRobert Campbell and Carol Morris Are Senior Vice Presidents ofAmit PandeyNo ratings yet

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- Axis Two Pager FormatDocument4 pagesAxis Two Pager FormatBhupender AswalNo ratings yet

- Uniwersytet Jagielloński Jagiellońskie Centrum JęzykoweDocument9 pagesUniwersytet Jagielloński Jagiellońskie Centrum JęzykoweVân TrầnNo ratings yet

- APL Prospectus 20160620Document100 pagesAPL Prospectus 20160620Anonymous FiAN6MiuNo ratings yet

- Interpretation and Analysis of Financial Statement: CA N Maheswara RaoDocument62 pagesInterpretation and Analysis of Financial Statement: CA N Maheswara RaoRavikiran Bapatla100% (1)

- Introduction To Fixed Income MarketsDocument12 pagesIntroduction To Fixed Income MarketsJeremy PageNo ratings yet